Ethereum · No Reason To Stop · Will Continue RisingEthereum will continue rising. Remember Ether is number two and it is awesome, to start, and it follows Bitcoin like darkness follows the light. There is no reason for Ether to move down. There is no necessity for ETH to stop its major advance, in fact, it has been lagging behind and it needs to catch up. Bitcoin is waiting and will continue waiting but it won't wait forever so Ethereum must wake up and is waking up. We are going up.

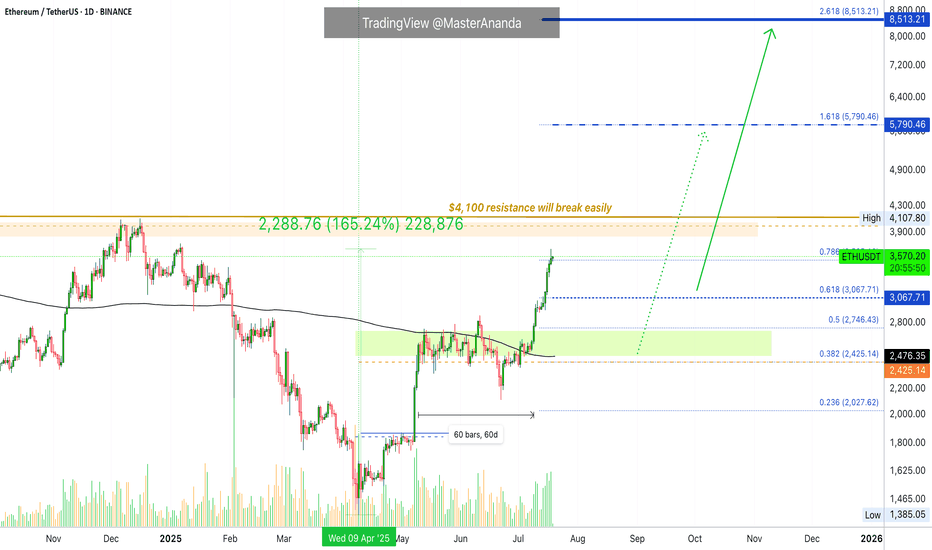

Ethereum has grown 165% since its 7-April low. This is more than XRP and its capital is twice as much. Boom! The best part? Ethereum will continue growing straight up for weeks and months. It needs to be trading at a new all-time high as soon as possible just so that the market can feel at ease and know, once again, that Crypto is here to stay.

What has been suppressed can't stay suppressed forever. Crypto went through a fight but challenges only made us that much stronger. We are now happy and grateful for everything that we went through because we know that we can take anything the world throws at us.

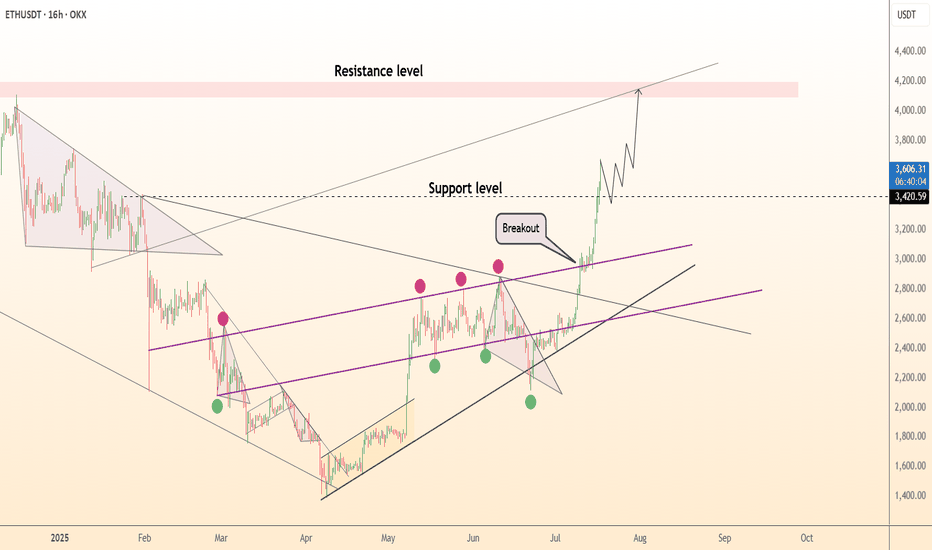

The chart. Green, green, green straight up. Two months of consolidation. That's the key. ETHUSDT went sideways for almost two months and this reveals what comes next. The advance outside the consolidation range has been happening for 8 days. 60 days of sideways can support at least an entire month of growth. When the entire month is consumed, we can expect a retrace, nothing more, followed by additional growth.

In short, Ethereum will continue rising. If you see a shakeout, know that growth will always resume in a matter of days. If you see a drop, know that this is a bear-trap, the bulls now own the game. If you are in doubt, come read my articles and I will publish something that you will understand and agree is right, so you can continue holding until you can reach the big prize.

The time to sell will come, but it isn't now. Right now is the time to hold strong. Not only Ethereum, but Cardano, XRP, BTC, Dogecoin, Solana and the rest of the altcoins. This is only the start.

I expect Ether will continue rising. $8,000 now looks like such an easy target...

Very good indeed. If you enjoy the content, follow me.

Namaste.

ETHUSDT trade ideas

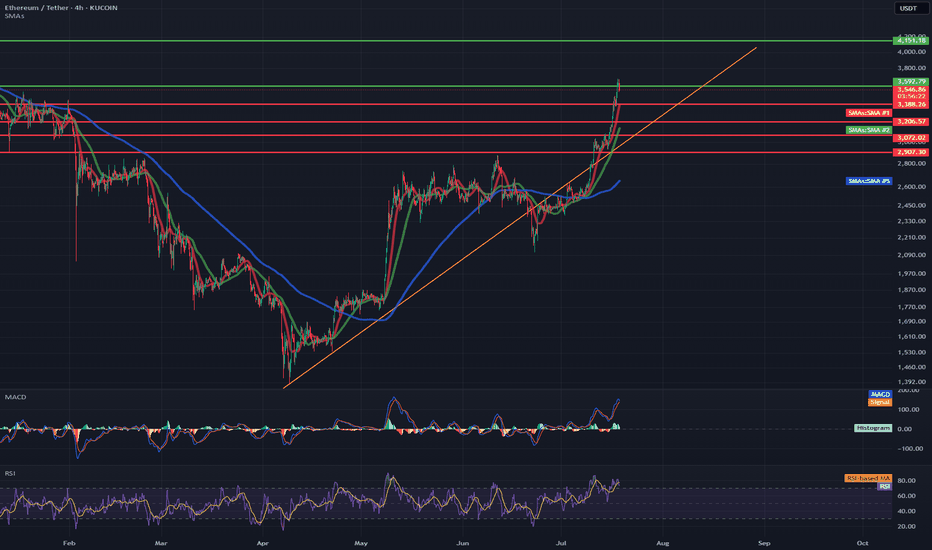

ETH/USDT 4H Chart✅ Market Trend and Structure:

Uptrend: The highlighted orange trend line shows continuous growth since mid-April. The price is trading above the 50- and 200-period moving averages (EMA and SMA), confirming bullish sentiment.

Current price: around 3556 USDT – very close to local highs.

Resistance break in the 3200–3300 USDT area, which now acts as support.

📈 Technical Levels:

Resistance (red horizontal lines):

3600–3650 USDT – local resistance resulting from market reaction.

3888 USDT – next historical resistance level.

4133 USDT – established long-term target (green dashed line at the top).

Support:

3300 USDT – strong support after a previous breakout.

3080 USDT – previous high, now the next support level.

3070 / 2900 USDT – key technical support levels in the event of a larger correction.

📊 Indicators:

MACD:

The MACD is in a strongly bullish zone, but:

The histogram is flattening.

A bearish crossover pattern is possible in the following candles – a signal of weakening momentum.

RSI:

RSI ~74 – is in the overbought zone, which often heralds a correction or at least consolidation.

A value above 70 confirms the bullish trend but may suggest that momentum is overheated.

📌 Conclusions and Scenarios:

🔼 Upside Scenario (trend continuation):

If the price remains above 3300–3350 USDT, it could move towards 3888, and then 4133 USDT.

A break above 3650 USDT on heavy volume will be a strong continuation signal.

🔽 Corrective scenario (short-term pullback):

The RSI and MACD suggest a possible correction.

Potential pullback to:

3300 USDT (retest of previous resistance as support).

SMA 200 (~2600 USDT) with a deeper downward move.

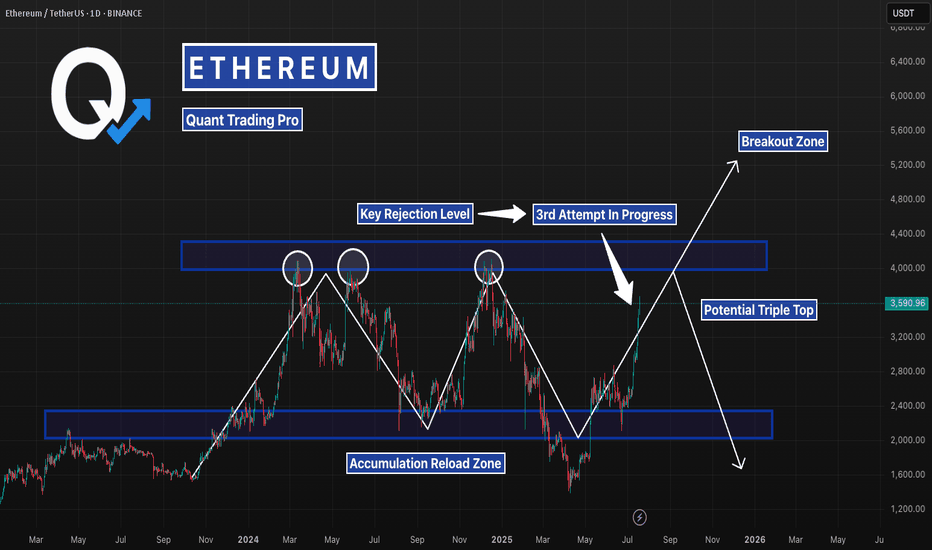

ETH Breaks Key Resistance – $6K Possible if Wedge BreaksETHUSDT has broken out above a key horizontal resistance zone that has historically acted as a strong support and resistance level. This zone, marked in blue, has seen multiple rejections and bounces over the past year, confirming its significance.

The recent breakout above this zone indicates a shift in market structure and suggests growing bullish momentum. The price action shows a clean move above resistance, with potential for a retest before continuing higher. The market is also forming a long-term broadening wedge pattern. The next target lies near the upper resistance of the wedge, around $4,000. If the price breaks above this broadening wedge, it could open the path toward the $6,000 level.

Regards

Hexa

ETH 3rd Attempt at Resistance — Breakout or Bull Trap?Ethereum is back at a major level that’s rejected it twice already. A breakout here could finally end the range and send price into discovery — but if history repeats, this might be the ultimate fakeout before a sharp reversal. All eyes on the next few candles.

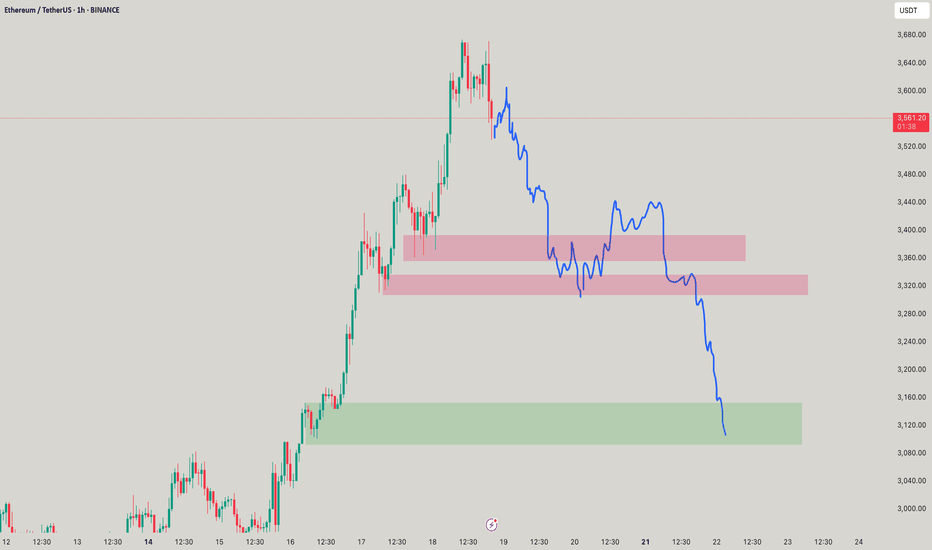

ETHUSDT Analysis – Potential Pullback Before ContinuationAfter a strong bullish rally, ETHUSDT may be ready for a short-term correction. The price has broken a key structure and is now trading well above previous resistance.

I'm expecting a potential pullback into the Fair Value Gap (FVG) area around $3,200, which also aligns with a retest of the previous resistance now turned support. If this level holds, it could act as a springboard for the next bullish leg, possibly targeting the $4,000+ region.

This setup follows a typical market behavior where price fills imbalance zones before resuming its trend.

Key levels:

Support zone: $3,200 – $3,300

Bullish continuation target: $4,000 – $4,400

Let’s see how price reacts at the FVG zone. Patience and discipline are key.

DeGRAM | ETHUSD retest of the support level📊 Technical Analysis

● ETH exploded out of the purple median channel, invalidating March-July lower-highs; retest of 3 210 held as a fresh higher-low, confirming trend acceleration.

● Price is now travelling the channel’s outer parallel; flag pole projected from the 2 430→3 210 thrust aligns with the 4 150-4 250 supply zone shown in pink.

💡 Fundamental Analysis

● CME ether futures OI hit a 14-month high on 17 Jul while exchange balances dropped to a five-year low, signalling strong institutional demand and tight float ahead of expected spot-ETF approvals.

✨ Summary

Long 3 210-3 300; hold above 3 210 targets 3 600 → 4 200. Bull view void on a 16 h close below 3 020.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

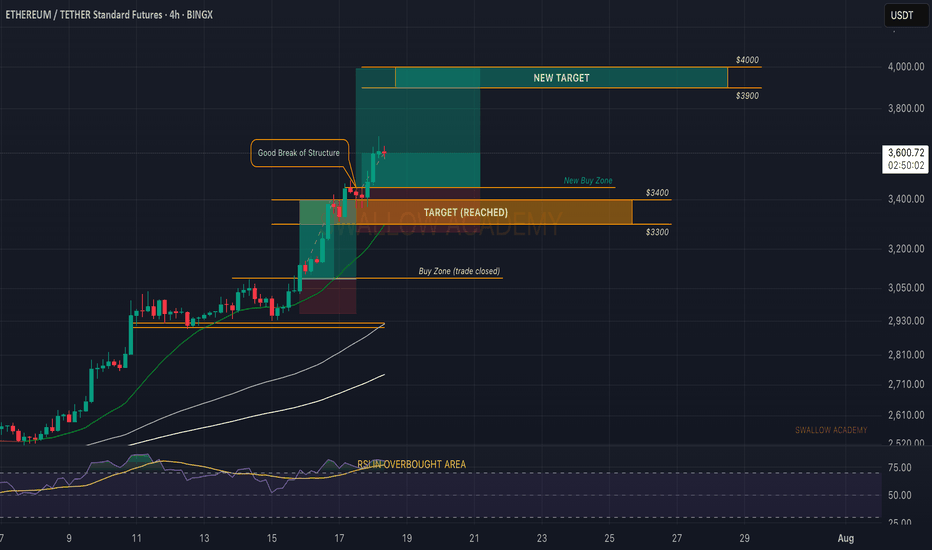

Ethereum (ETH): Looks Good, We Are Going For $3300-3400 EasilyWe are flying; Ethereum seems strong, so we are bullish on it. Our target of $3K was reached and broken easily, and now we are looking for the next resistance area to be reached, which is $3300-3400.

Targets are set; the first one got reached, and now we're heading towards the other 2 targets of ours!

Time for BINGX:ETHUSDT.P to shine.

Swallow Academy

Ethereum (ETH): Time For Ethereum To Shine | $3300-$3400The daily timeframe is showing no remorse to sellers, with buyers strongly dominating the zones after a local resistance area near $2800 was broken.

After that breakout we had a smaller sideways consolidation movement, here we formed a proper BOS and now price is heading towarsd the upper zones. we are tergeting the $3300 to $3400 are as of now, where we might see another sideways movement before a breakout.

Swallow Academy

Ethereum (ETH): Will Overtake The Bitcoin Soon? Ethereum has been moving much better compared to Bitcoin, which confirms our theory that ETH will now head for its ATH, just like Bitcoin did before.

We are looking for further movement to $4000 area, but be careful as we are entering weekends market, we should keep an eye on our entry area.

Volatility can happen but nevertheless, we are very bullish on ETH.

Swallow Academy

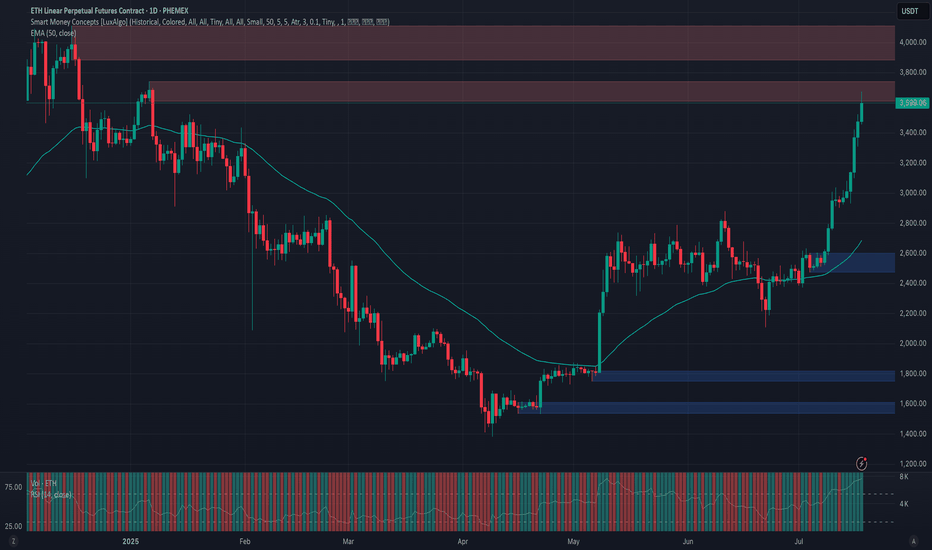

Phemex Analysis #98: ETH Price Explodes— Is $5,000 Finally Next?Ethereum ( PHEMEX:ETHUSDT.P ) has recently shown impressive strength, surging past significant resistance levels and stirring excitement in the crypto market. After an extended consolidation, ETH decisively broke through the crucial $3,300 resistance level, rallying more than 15% in just three days, and is now trading confidently around $3,500.

This renewed bullish momentum has traders and investors eagerly speculating: Could this be the start of Ethereum's next major run? Or should caution prevail amid ongoing market uncertainty? To help navigate this critical period, let's explore several key trading scenarios.

Possible Scenarios

1. Bullish Continuation – Targeting New Highs

Ethereum’s recent breakout above the $3,300 resistance signals strong bullish sentiment. If buying volume continues increasing, ETH could swiftly move towards higher resistance levels at $3,800 and potentially challenge the psychological milestone of $4,100.

Pro Tips:

Profit Targets: Consider locking in partial profits as ETH approaches strong resistance zones around $3,800 and $4,100.

Risk Management: Place tight stop-loss orders on recent lows, approximately around $2,902 to minimize downside risks.

2. Short-term Retracement – Healthy Pullback

Given ETH’s rapid surge, a short-term pullback to retest the recently broken resistance zone at $3,300 to $3,000 (now acting as strong support zone) is plausible. A successful retest would strengthen the bullish case, signaling healthy consolidation before further upward momentum.

Pro Tips:

Buying the Dip: If ETH holds above $3,000 with declining volume, consider cautiously adding to your positions or initiating new longs.

Volume Confirmation: Closely watch trading volume; lower volume during pullbacks typically indicates a healthy retracement rather than a bearish reversal.

3. Bearish Reversal – Breaking Below Critical Support

If Ethereum’s price experiences heavy selling pressure and breaks below the key support at $3,000, bearish sentiment could escalate, potentially driving ETH towards lower support levels near $2,470 and possibly even $2,110.

Pro Tips:

Short Positions: Experienced traders might consider initiating short positions if ETH decisively breaks below the crucial $3,000 support zone on increasing selling volume.

Long-term Accumulation: Long-term investors may strategically accumulate ETH near stronger support areas at $2,470 and $2,110, after clear signs of price stabilization.

Conclusion

Ethereum (ETH) currently offers attractive opportunities, propelled by recent bullish momentum yet balanced by market uncertainties. Traders must closely observe key resistance at $4,000, critical support around $3,000, and carefully analyze trading volumes for confirmation of market direction. By maintaining disciplined risk management and strategically capitalizing on outlined scenarios, investors can effectively navigate ETH’s price action in the weeks ahead.

🔥 Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

DeGRAM | ETHUSD above the resistance area📊 Technical Analysis

● Price burst through the 12-week compression roof, converting the 2 990 supply into support and printing the strongest close since March.

● The pull-back just retested both the purple trend-fan and the 2 960 flip zone; the active rising channel and flag depth map the next magnet at 3 410.

💡 Fundamental Analysis

● SEC’s 12 Jul request for updated spot-ETH ETF S-1s hints at imminent approval, fuelling fresh inflows.

● Glassnode reports the largest daily net-staking deposit since April, reducing exchange float and adding bid pressure.

✨ Summary

Long 2 960-3 000; holding above 2 990 targets 3 110 → 3 410. Bias void on an H4 close below 2 860.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

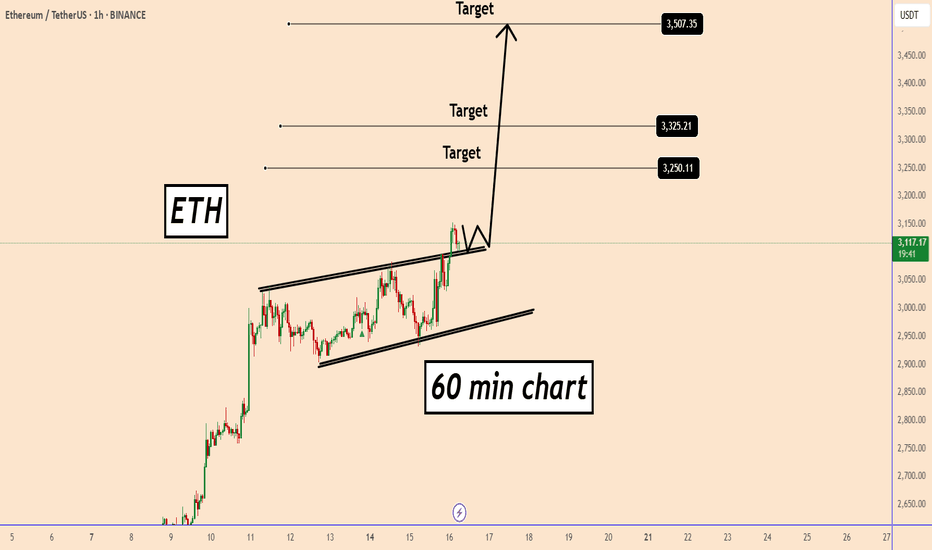

ETH about to reach 3500ETH about to reach 3500

On all time frames ETH is in a clear bullish trend.

Yesterday the price created also a new structure high above the small pattern indicating for a growth on the bullish momentum.

Given that ETH didn't rise for a long time the chances that ETH may start even a bigger bullish movement are higher.

If the price continues this trend ETH may test 3500 soon

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

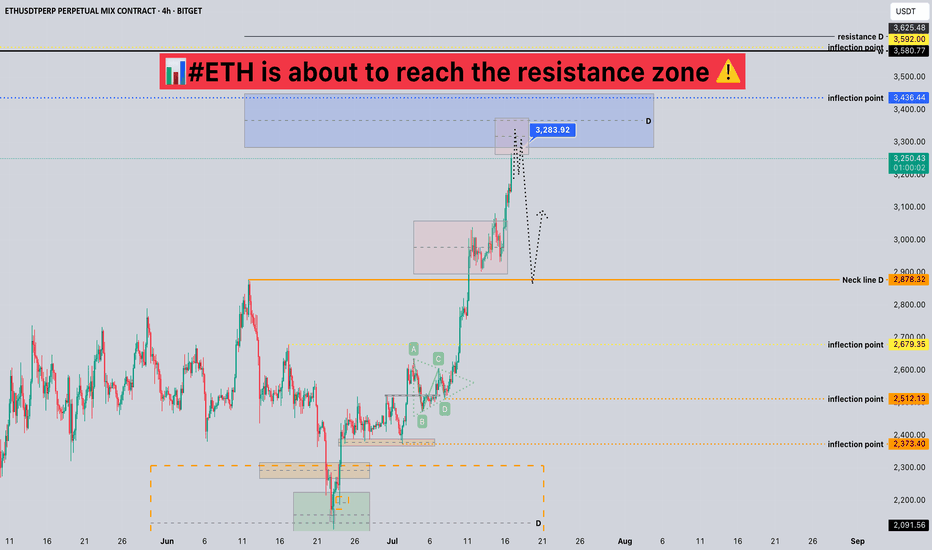

#ETH is about to reach the resistance zone 📊#ETH is about to reach the resistance zone ⚠️

🧠From a structural perspective, we are about to reach the resistance zone at the daily level, so we need to be wary of the risk of a pullback. If your cost price does not have much advantage, then please remember to lock in profits in time.

➡️New long trades need to wait patiently for a pullback to occur before participating, or the trend is relatively strong, and continue to consolidate sideways to form a new long structure to continue the long trend, otherwise we can't chase the rise near the resistance zone.

Will we start a pullback from here? Let's see 👀

🤜If you like my analysis, please like 💖 and share 💬

BITGET:ETHUSDT.P

Short term next target for ETH - 1100$; Market crash in JuneEthereum will be reaching 2808$ in coming days before month May is closed.

ETH almost reached main liquidity zone for this rally and also 200MA. As soon this level is done - expect another market crash in June.

Next crash will be super fast and most of altcoins will drop even lower.

Target for ETH in month of June is between 1100$ and 1300$.

After this crash we will see altcoin season and ETH will lead it.

We are entering last phase of a bull run. There are about 3 months left before we enter a bear market officially.

Here is previous idea from 1300$ to 2808$

#ETHUSDT #4h (Bitget Futures) Ascending channel on resistanceEthereum printed a gravestone doji followed by a shooting star, RSI is overbought, local top seems in.

⚡️⚡️ #ETH/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Short)

Leverage: Isolated (9.0X)

Amount: 5.0%

Entry Zone:

2996.99 - 3050.49

Take-Profit Targets:

1) 2864.25

2) 2744.02

3) 2623.80

Stop Targets:

1) 3157.46

Published By: @Zblaba

CRYPTOCAP:ETH BITGET:ETHUSDT.P #4h #Ethereum #PoS ethereum.org

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +47.5% | +83.3% | +119.0%

Possible Loss= -39.8%

Estimated Gaintime= 1-2 weeks

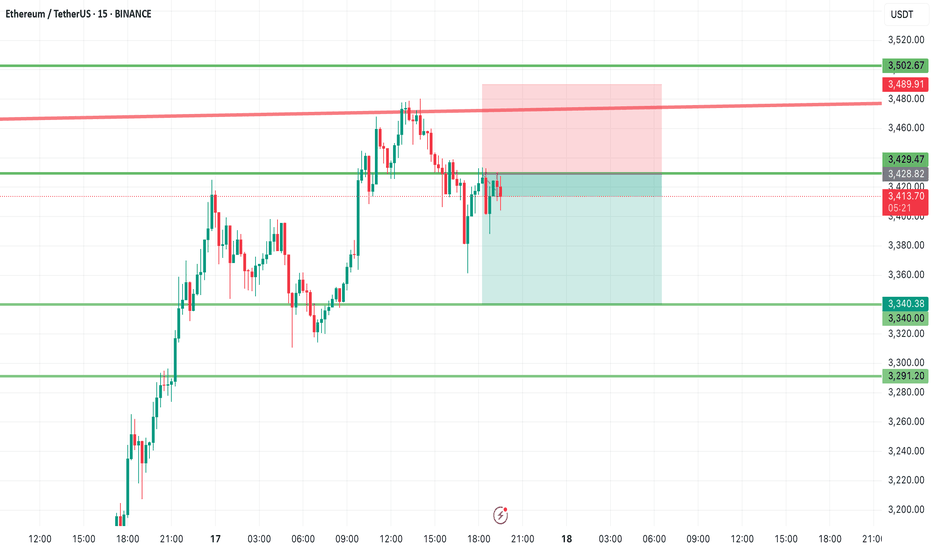

ETH Short OpportunityETH Short Opportunity 🟥 | Watch 3428 Closely

Ethereum is approaching a key resistance at $3428 — this zone could offer a great short setup if confirmed.

First target on the downside: $3340 📉

High R/R potential if price rejects this level.

Stay sharp and manage your risk!

🔔 Follow me for more real-time trade ideas and technical insights.

ETH vs 200MA: Another TestETH on the daily has been pushed back so many times by the 200MA. Will price conquer it this time? I guess we’ll just have to wait and see.

Today is Friday, July 4th, so probably a long weekend for most traders. Somehow, price got pushed back again. Just a hunch, but I believe long traders are touching grass this weekend while sellers are grinding.

Anyway, we now have a support zone under price, made up of the 200MA and the 0.5 Fib — which, in theory, should hold against any attempts to push the price lower this weekend.

Always take profits and manage risk.

Interaction is welcome.

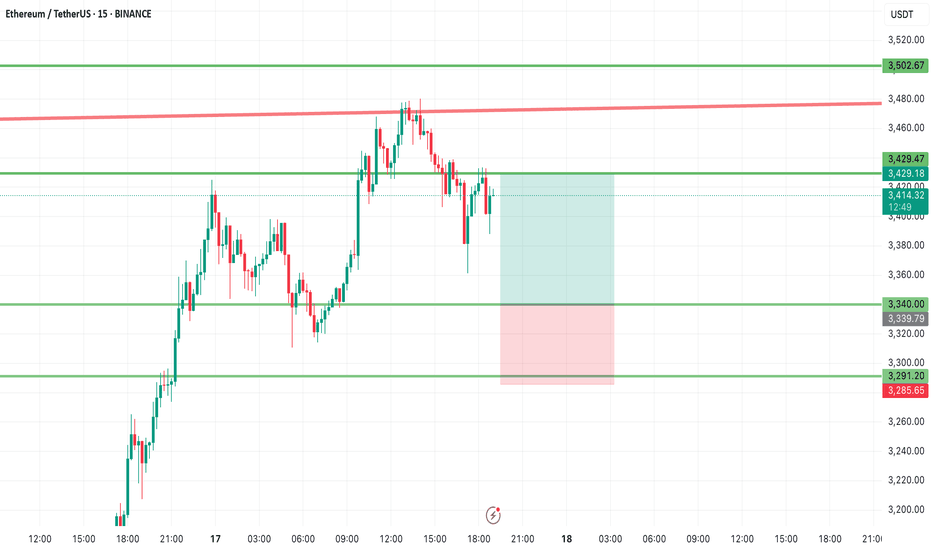

ETH Buy Zone AlertETH Buy Zone Alert 🚨 | Eyes on 3340 & 3291

Ethereum is entering a strong demand zone between $3340 and $3291 — this could be a great long opportunity if price reacts well.

Short-term targets to watch: $3420 and then $3500.

Don’t sleep on this setup — keep it on your radar! 👀

📈 Follow for more actionable trade setups and real-time market updates.

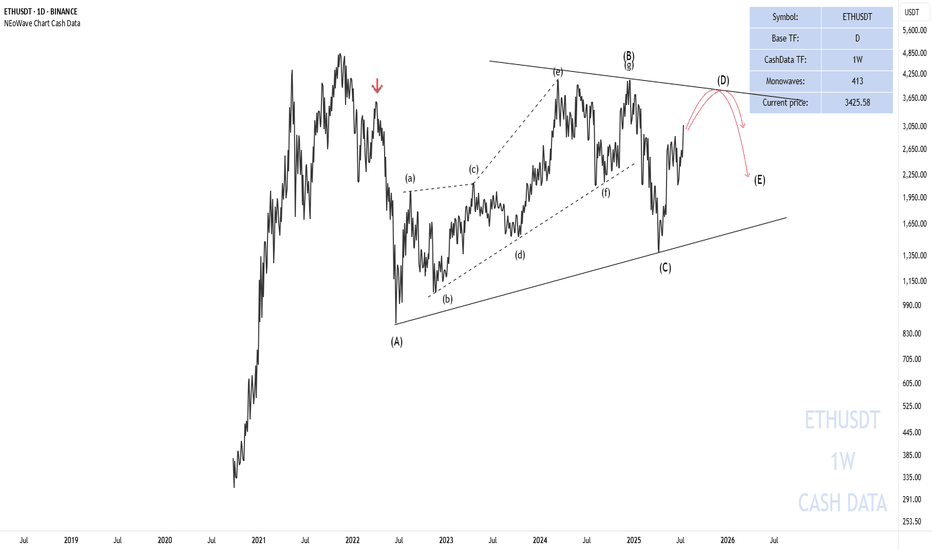

NEoWave Analysis of Ethereum 2025 Cash data chart shows that Ethereum is in a corrective phase and the wave structure from (A) to (C) has been completed. Initially, we expected a flat pattern to form; however, the wave structure-(C) was not an impulse and the flat was not confirmed.

As a result, given that the wave structure (A)-(B)-(C) is corrective and the waves differ in time, it seems that a contracting triangle pattern is forming and we are currently in wave-(D) of this triangle. Furthermore, wave-(D) could rise to $3630-3880 and end. Then a price correction in the form of wave-(E) may occur. This correction could end between $2900-3086 and if this range is broken downwards, wave-(E) could decline to $2000-2230, after which the main bullish move for Ethereum is expected to begin.

Good luck

NEoWaveChart

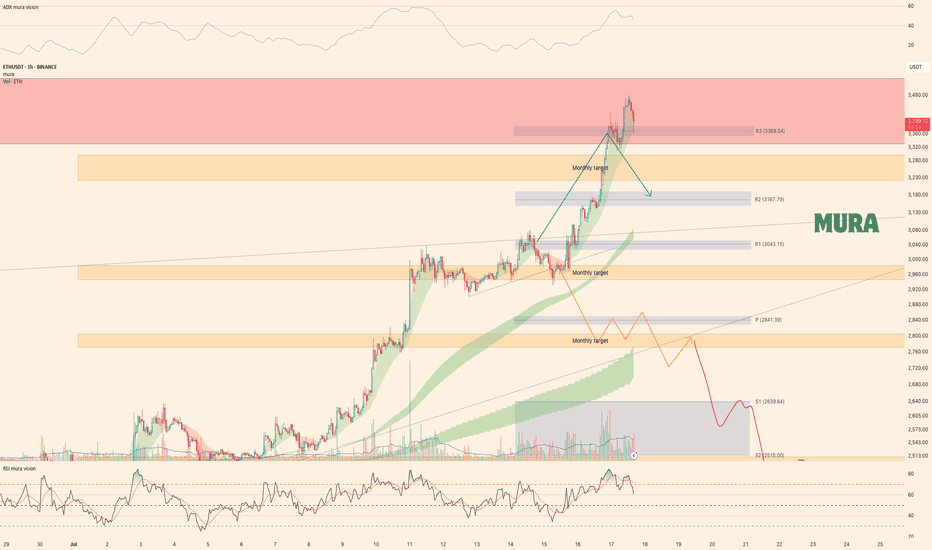

Ethereum Weekly UpdateAs anticipated, Ethereum has achieved all weekly targets, perfectly following our bullish (green) scenario. Price currently tests a key resistance zone after:

Holding critical monthly support at $2,966

Rallying to our projected upside targets

Technical Observations:

Bearish Divergence (4H RSI)

Trend Weakness (H1 & H4 ADX decline)

Seller Reaction at resistance, yet holding above $3,300

Key Levels:

Break above resistance → Continuation likely

Break below $3,300 → Pullback toward $3,000-3,100 expected

Conclusion:

While the trend remains intact, weakening momentum signals potential short-term correction. Trade plan aligns with Monday’s video analysis.

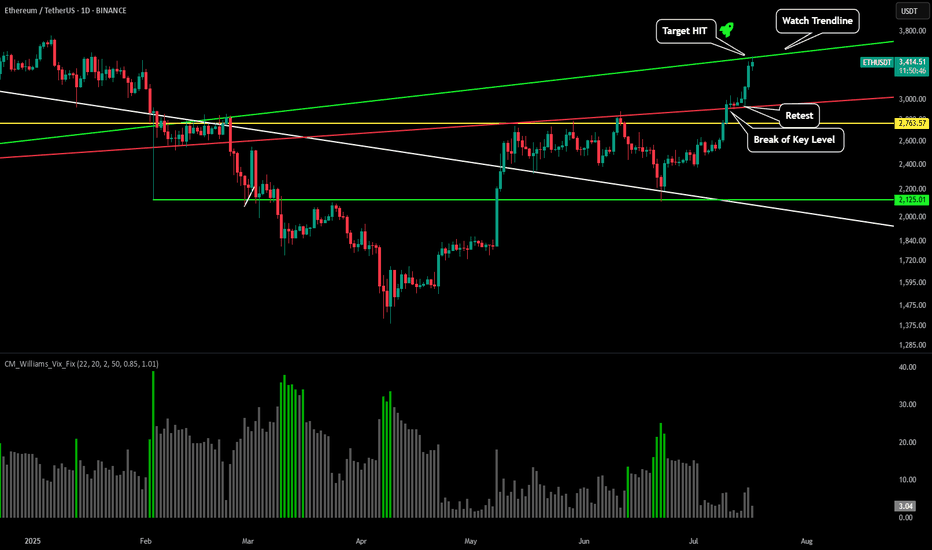

ETH - Charts Don't LiePlease refer to our previous post:

As stated here after breaking our red key trendline our prediction was price would move up swiftly to test the green trendline between between $3,400-$3,500.

After a successful retest of the red trendline it only took price 48 hours to increase 19% and reach our green trendline. This is a major area where we could see some profit taking starting to occur.

Once price is able to break through this level we should see a move to the most important price zone throughout the past couple years around $4k-$4,100.