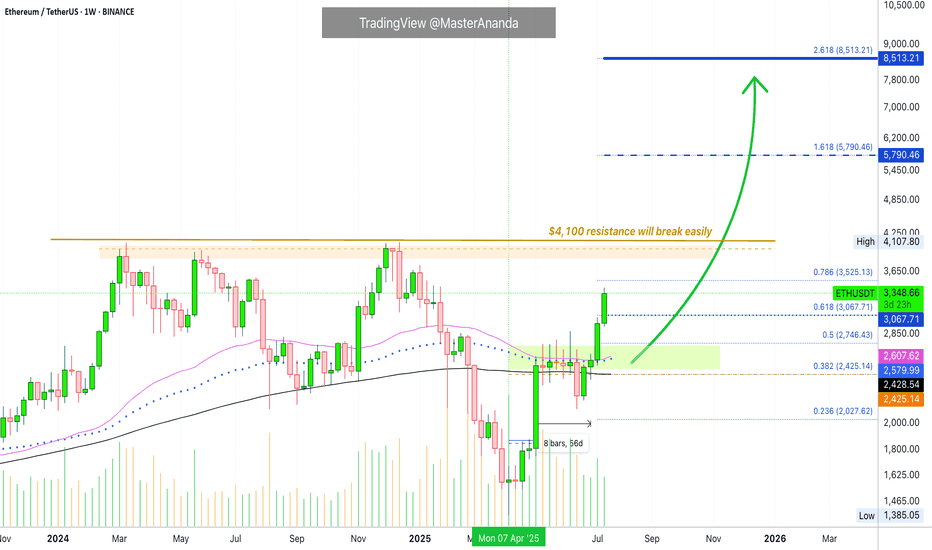

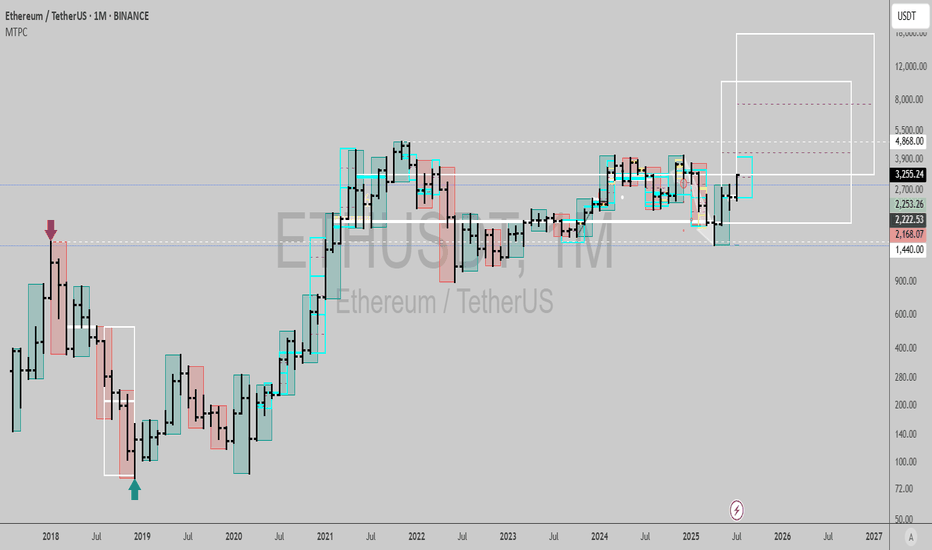

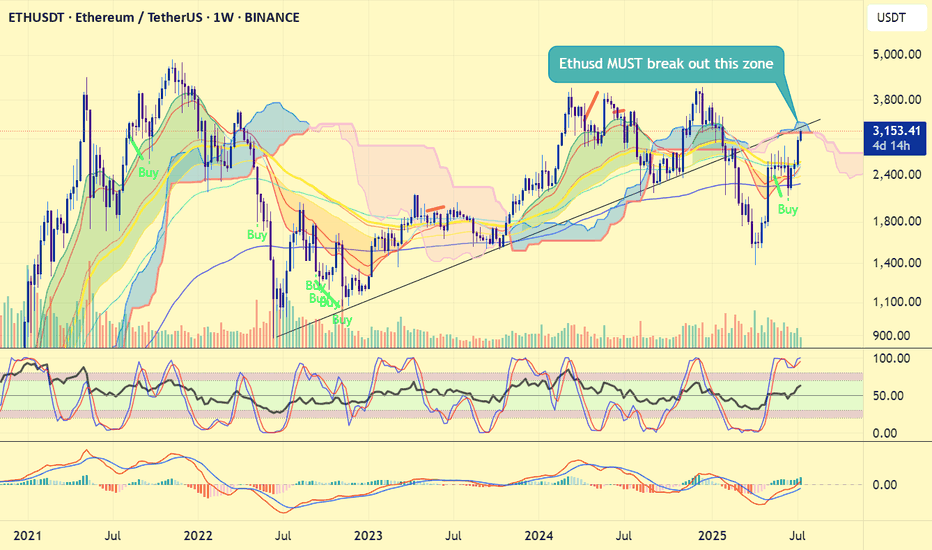

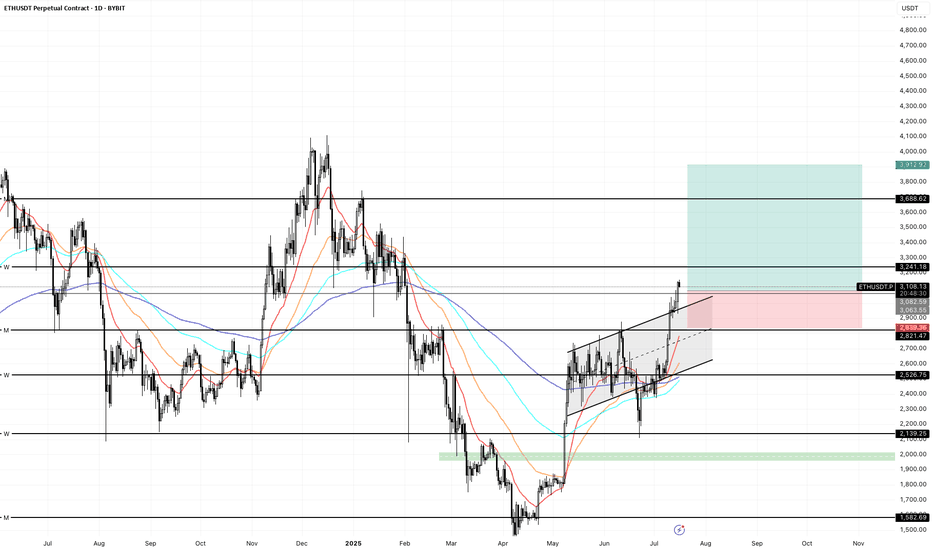

Ethereum · Going beyond $5,790 · $8,513 Next TargetThe eight weeks of consolidation, 56 days, happened as compressed (sandwich style) action right in-between MA200 and EMA55/89.

The EMA55/89 duo worked as resistance while MA200 worked as support.

Before a major move the market always tends to produce a form of shakeout. Sometimes it is call a bear-trap, a shakeout, a liquidity-hunt or stop-loss hunt event, a failed signal, etc.

Here Ether (ETHUSDT) closed below MA200 one week just to recover the next. In this case, we will call it a failed breakdown but we know this is a way to liquidate over leveraged long-traders, also a way to catch unsuspecting bears ready to short. The conclusion is simple, Ether recovered the next week above MA200 and the following week above EMA55/89 which worked as resistance for six weeks. With these levels behind us, the market is full green.

Notice the last two candles, big huge green candle. That is because resistance is no more.

With no resistance to stop prices from rising, Ethereum started to grow and we are now in full blown bullish mode.

The last major high sits at $4,107. This is an easy target, the minimum. Once support is tested the action moves toward resistance and this is where we are headed.

Some people will wonder if resistance will break or hold. Some unsuspecting bears, again, will even short at resistance thinking this is the logical move, they will lose all.

The truth is that this resistance and major high will break easily, we know this based on marketwide action and Bitcoin, Bitcoin is hitting new all-time highs every other day. In this way, we know that Ethereum will soon catch up and do the same.

Many altcoins are moving forward and growing, and some already conquered their December 2024 high price. This is another indication that shows Ether will not stay behind.

Whatever you do when Ethereum goes up, do not short. You can short if you are going to close the short after just a few hours or a few days, but instead of shorting a bullish trend, go LONG and enjoy maximum profits on the way up.

» Ethereum will break $6,000 and move toward $8,500 and beyond in the long-run.

You read it here first.

Thanks a lot for your continued support.

Resistance will break and the altcoins market will continue to grow. Not only for a few months but for a very long time.

When correction time comes, it will last a few months, we will get higher lows and then additional growth. Think of the pattern that came up on Bitcoin but with the altcoins; long-term growth.

Namaste.

ETHUSDT trade ideas

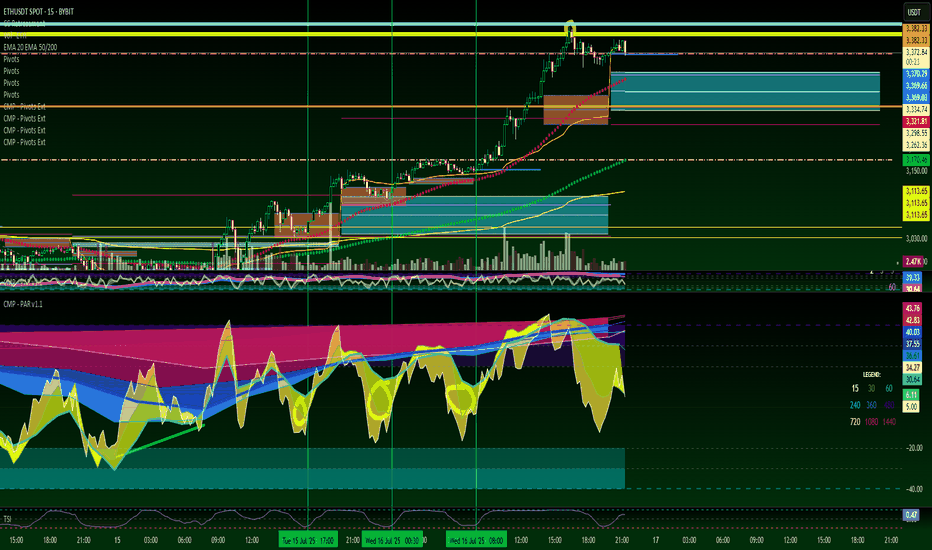

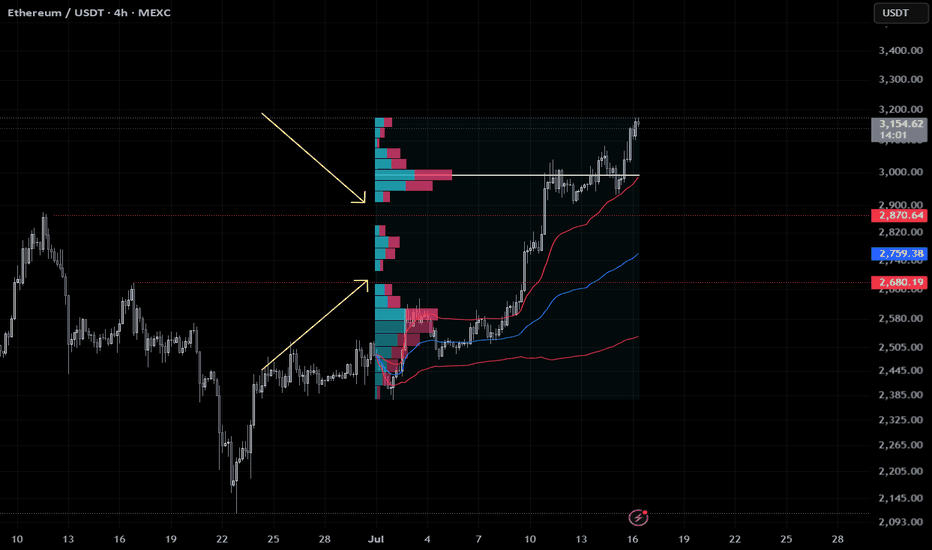

#ETH Update #4 – July 17, 2025#ETH Update #4 – July 17, 2025

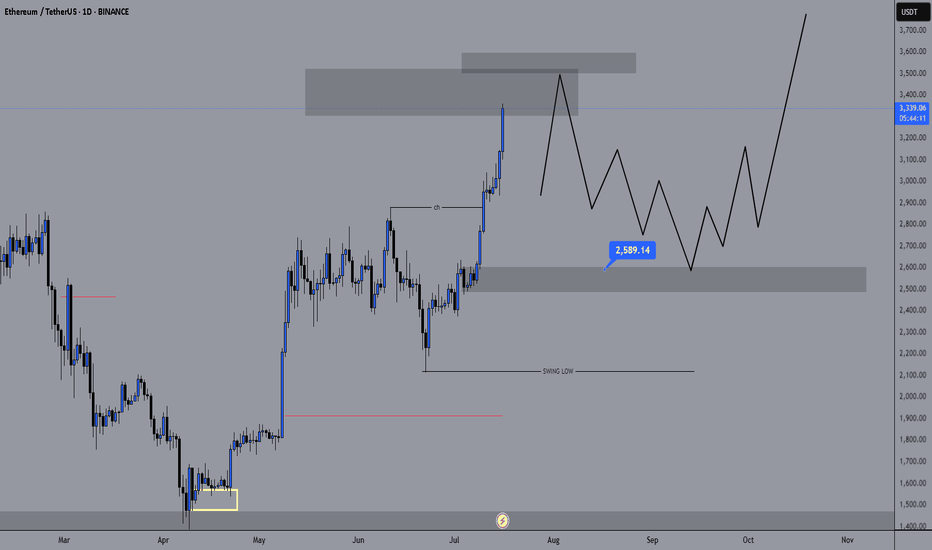

Ethereum is currently facing a significant resistance zone. The recent bullish move has been very steep, which often leads to a correction. If that happens, the first potential retracement level is around $3,010.

If Ethereum continues to rally without correcting, the next upside target is $3,700. However, USDT Dominance has reached a support level. If that support holds, we could see capital rotation into USDT, accelerating a pullback in ETH.

At this point, a slowdown in Ethereum’s momentum is likely. If you're holding altcoins, it might be a good moment to take some profits.

tahlile eth baye in mahHere is the English translation of your analysis:

---

**Comprehensive Analysis of Ethereum**

Ethereum is currently at a critical point and is experiencing significant volatility. It is attempting to break through key resistance levels to continue its upward trend. However, failure to break these levels could lead to a price decline. Various factors, such as whale activity and the break of key resistance levels, can influence Ethereum's future trend.

### **Technical Analysis**

**Current Trend:**

Ethereum is currently trading in a range, fluctuating between support and resistance levels.

**Support Levels:**

Key support levels are at **\$1,750** and **\$1,650**.

**Resistance Levels:**

Key resistance levels are at **\$1,930** and **\$2,100**.

### **Possible Scenarios**

* **Bullish:** If Ethereum can break above the \$1,930 resistance level and hold above it, it could move toward higher targets.

* **Bearish:** If Ethereum fails to break through the resistance levels, it may decline toward lower support levels.

### **Whale Activity**

Whale activity currently has the potential to significantly impact Ethereum's price trend. If whales continue to accumulate Ethereum, it could support a reversal of the bearish trend.

---

### **Fundamental Analysis**

**Correlation with Bitcoin:**

Ethereum remains heavily influenced by Bitcoin, and its price movement is largely dependent on Bitcoin’s trend.

**New Projects:**

The development of new projects within the Ethereum ecosystem can drive demand and increase its price.

**Regulations:**

New regulations in the cryptocurrency space can affect Ethereum’s future.

---

### **Recommendations**

* **Monitor Whale Activity:**

Investors should pay close attention to whale behavior in the Ethereum market.

* **Watch for Resistance Breakouts:**

Breaking through key resistance levels could signal the beginning of a bullish trend.

* **Risk Management:**

Given the high volatility in the crypto market, effective risk management is crucial in investment strategies.

* **Further Research:**

Conducting additional research on Ethereum and the factors influencing it is highly recommended for better decision-making.

> **Note:** This analysis is a general overview of Ethereum’s current status and should not be considered as investment advice.

---

Let me know if you'd like this formatted as a PDF, presentation, or infographic.

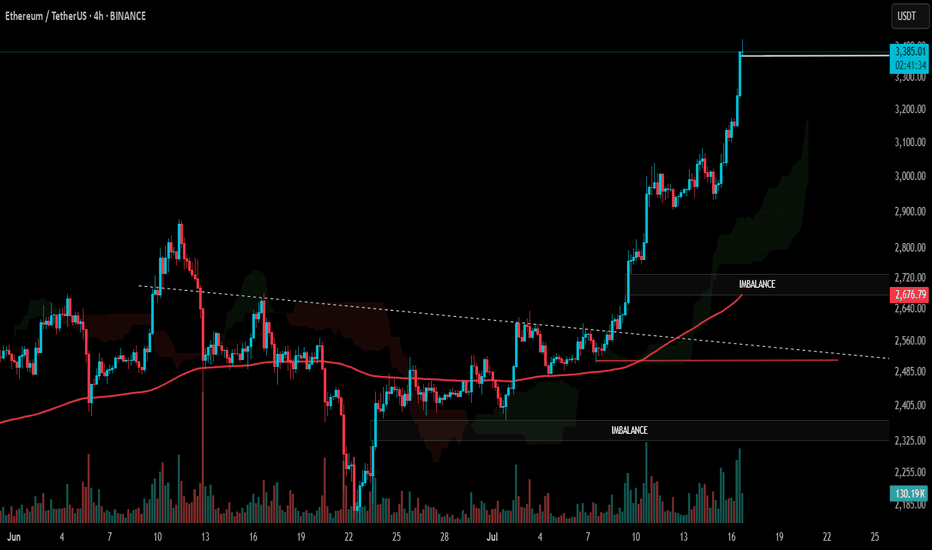

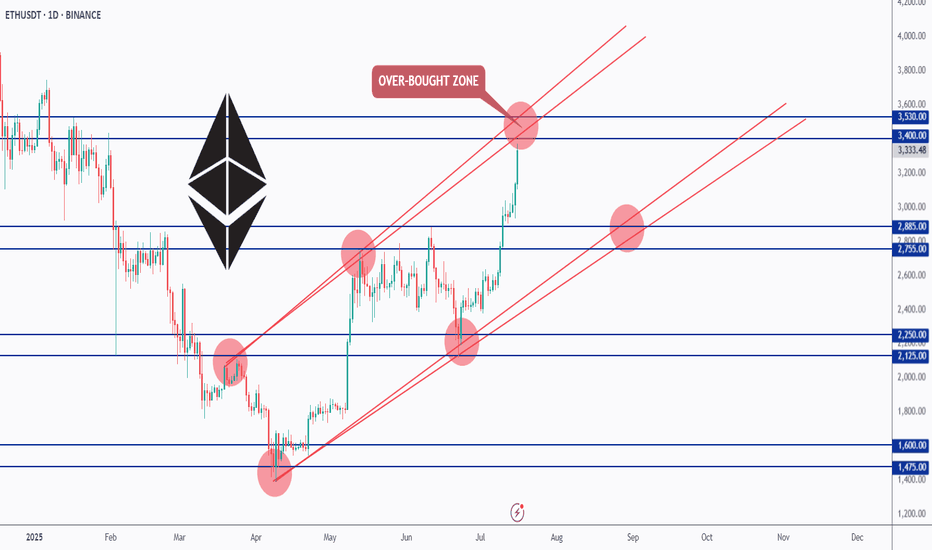

ETH Testing Overbought Zone — What’s Next?📊ETH has been overall bullish, trading inside this rising red channel for months.

After breaking above the $2,885 resistance, bulls took full control, and price is now approaching the upper red trendline — an overbought zone where we’ve seen rejections before.

As long as ETH holds above the $2,885 zone, the bulls remain in control. But since we’re near a strong resistance and the top of the channel, we’ll be waiting for a potential correction or at least a slowdown in momentum before looking for fresh entries.

📌 Key levels to watch:

Resistance: $3,400 – $3,530

Support: $2,885 – $2,755

Let’s stay patient and follow the market’s lead. 🧠

Let me know your thoughts in the comments 👇

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

From now on, be careful!!Hello friends..

We are back with a new analysis of the Ethereum cryptocurrency, from the area I had previously specified, we are currently in profit by about 120%. (We gave a buy signal to the good cryptocurrencies in the market at the peak of market disappointment, you can enter the page to view.)

Now we have reached the resistance area where correction is possible, there is a strong resistance from the $3400 to $3600 area, you can sell 50% of your assets in this area if confirmed and add to your assets if corrected (I will indicate the buy areas in the next analysis).

If you have a cryptocurrency that you want us to analyze for you, you can write the name of the cryptocurrency in the comments, and wait for the analysis post (priority is given to the cryptocurrency that gets the most likes)

Don't miss our page in these bullish days of the market. (You won't lose

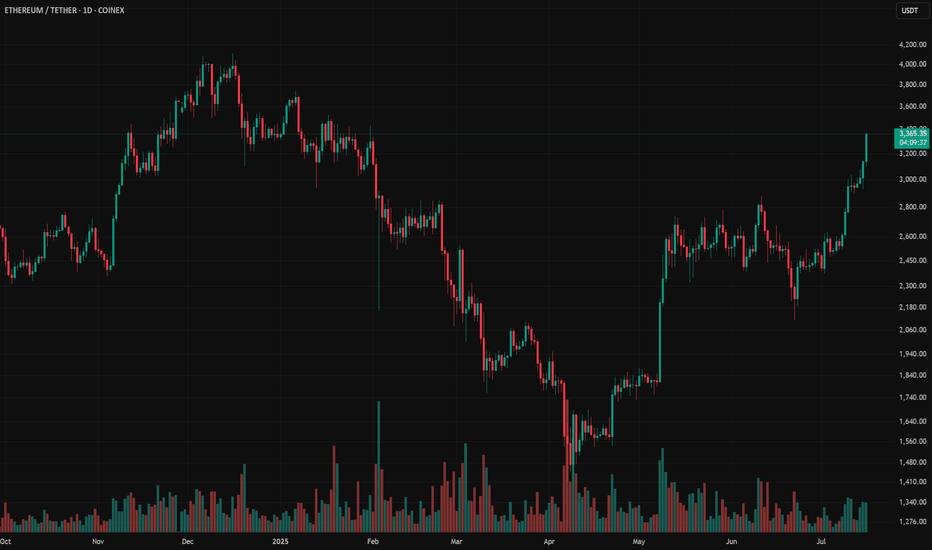

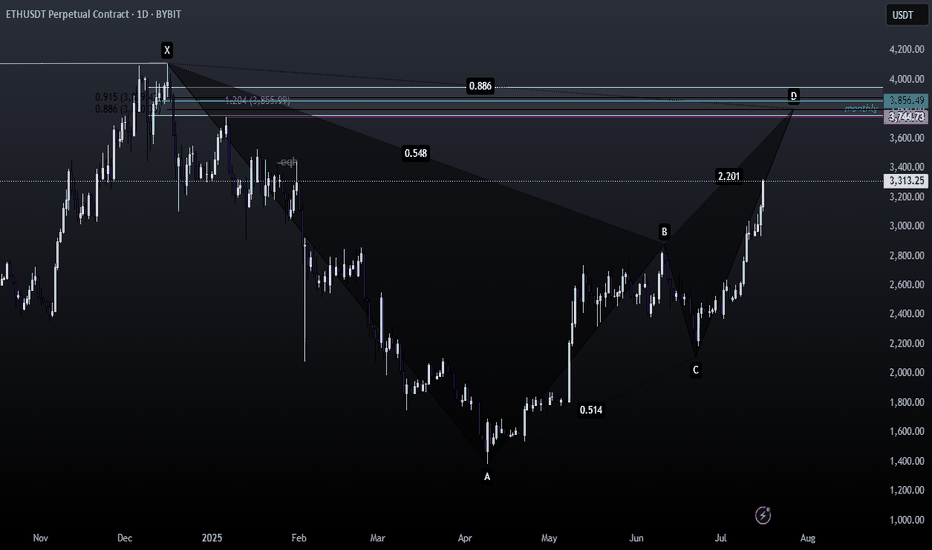

Ethereum Wave Analysis – 16 July 2025

Ethereum: ⬆️ Buy

- Ethereum broke resistance area

- Likely to rise to resistance level 3400.00

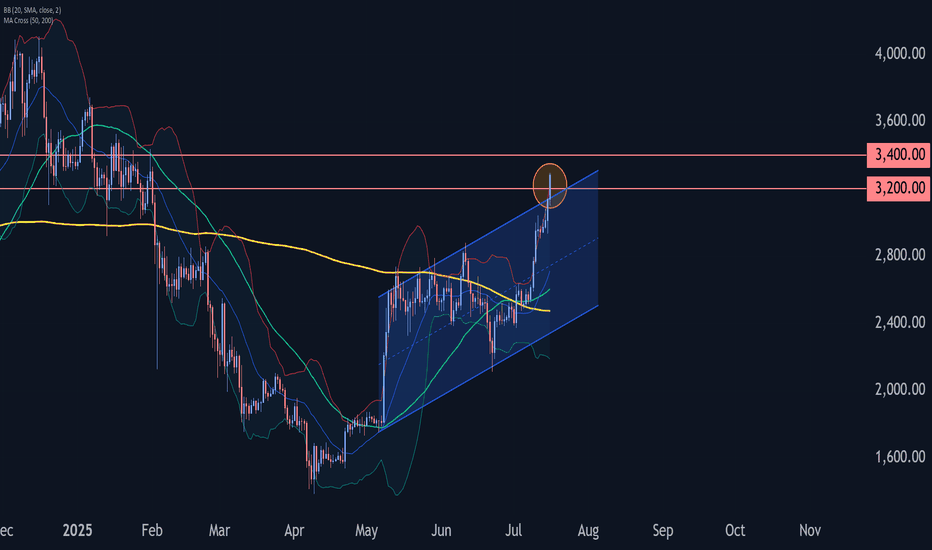

Ethereum cryptocurrency recently broke the resistance area located at the intersection of the resistance level 3200.00 and the resistance trendline of the daily up channel from May.

The breakout of this resistance area should accelerate both of the active impulse waves 3 and (3).

Given the clear daily uptrend, Ethereum cryptocurrency can be expected to rise to the next resistance level 3400.00 (which reversed Ethereum multiple times in January).

Ethereum's Road to $7500 – Strategic Entries & Profit Optimizati🔵 Entry Zone: My first position is placed at $2225.5, aligning with a strong support level, while a secondary entry at $1857.5 serves as an additional safeguard against unexpected market swings—lowering my average purchase price and protecting capital.

💰 Profit-Taking Strategy: For low-risk traders, securing a 40% profit from the first entry is a prudent move to lock in gains early. However, my long-term target remains ambitious.

🚀 Main Target: Based on valuation models and fundamental news, Ethereum’s upside potential points toward $7500. However, I personally plan to secure 90% of my holdings at $6000, ensuring strong profit realization while leaving room for further upside.

This setup balances risk management, smart positioning, and strategic profit optimization. Let’s see how ETH’s trajectory unfolds!

Entry1: 2225.5

Entry 2: 1857.5

If your second entry is successful, you are required to withdraw 50 to 70 percent of your capital to maintain your capital. I will definitely update this setup.

$ETHUSDT: Time at mode trend signalMonthly chart signal gives me a 17,975 United States of America Dollars per Vitalik Coin target🎯, within 19 months from now...

I don't think many people can fathom this but it is entirely possible, and probable now. (few bulls and those bullish mention 10k as a target, but nothing as high as this)

Best of luck!

Cheers,

Ivan Labrie.

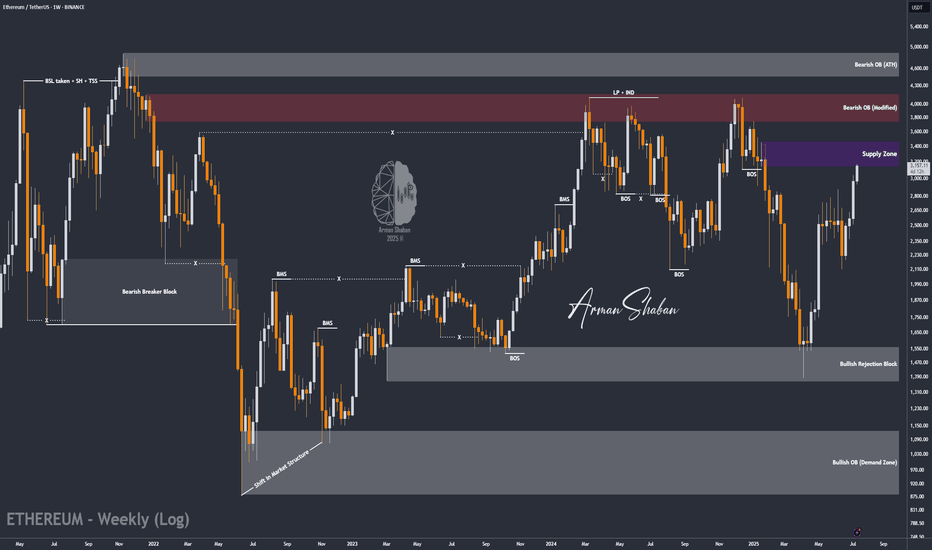

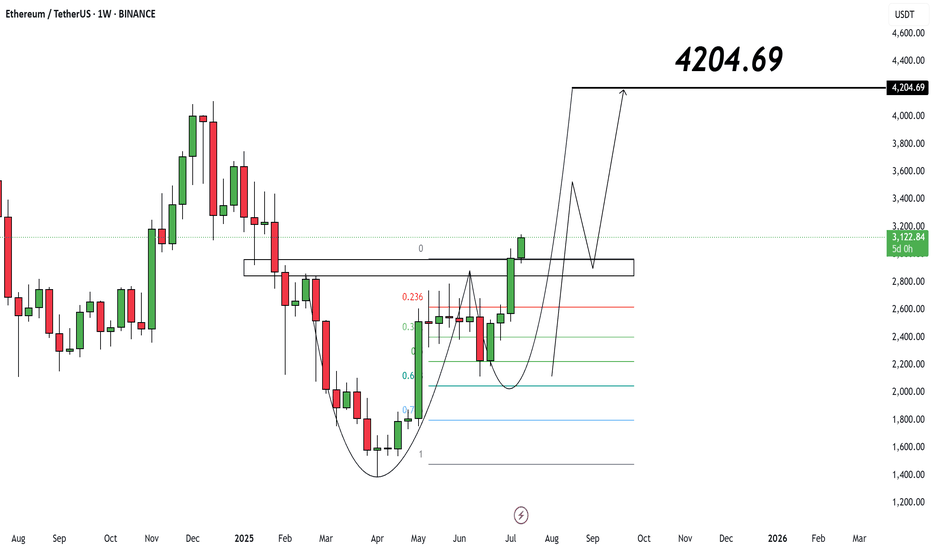

ETH/USDT : $3000 Reached, It's time foe $4000? (READ)By analyzing the Ethereum chart on the weekly timeframe, we can see that the price has finally broken the strong $2700 resistance and pushed toward the next target at $3000! Currently trading around $3150 and now within the $3130–$3440 zone, I expect a short-term rejection from this area. However, given the overall market trend, this level may not hold for long, and we could soon see a breakout toward the next targets at $3500, $3740, $4100, and $4470!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

THE LATEST ANALYSIS :

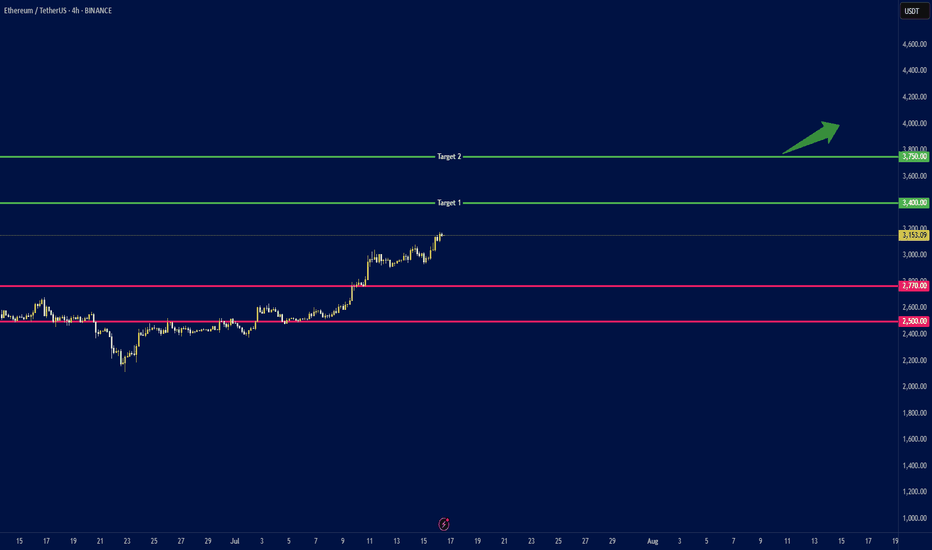

ETH to $4K ? Whales Accumulate as ETFs Break Records🕞 Timeframe: 4H

.

🟢 Bias: Bullish

1. 🧭 Fundamental Overview:

📈 Massive Institutional Inflows:

Ethereum ETFs have recorded over $1.2 billion in net inflows this July, with $908M just in the week ending July 11. This strong demand from institutional players (notably through ETHA and Bitwise) has pushed ETF AUM above $13.5 billion.

🏢 Corporate Accumulation:

Companies such as SharpLink Gaming have begun adding ETH to their balance sheets. SharpLink's 10,000 ETH (~$49M) purchase highlights growing corporate adoption of Ethereum as a store of value and strategic reserve.

🛠️ Ecosystem Resilience:

Ethereum continues to lead in network upgrades (e.g., Dencun), institutional DeFi, and tokenized assets—strengthening the long-term fundamentals of the chain.

2. 🧠 Sentiment & On‑Chain Metrics

🏦 Institutional Sentiment:

Ethereum ETFs have seen 12 straight weeks of inflows, outperforming Bitcoin in institutional allocation growth (ETH: 1.6%, BTC: 0.8%).

🐋 Whale Activity & Exchange Flows:

Declining ETH balances on exchanges suggest accumulation and reduced sell pressure. Whales and smart money are taking positions.

📊 Public Sentiment:

Bullish expectations remain strong amid price consolidation above key levels and positive ETF momentum.

3. 🔼 Key Levels:

Support: $2,770 and $2,500 (major trendline and psychological level).

4.🎯 Price Targets:

Short‑term (2–4 weeks):

If ETH breaks above $3,150: next targets at $3,400 and $3,750.

Medium‑term (by end of Q3 2025):

ETH could reach $3,500 with potential upside to $4,000.

.

.

.

⚠️ Disclaimer: This analysis is for educational purposes and not financial advice. Please do your own research and risk management.

.

✅ If you like this analysis, don't forget to like 👍, follow 🧠, and share your thoughts below 💬!

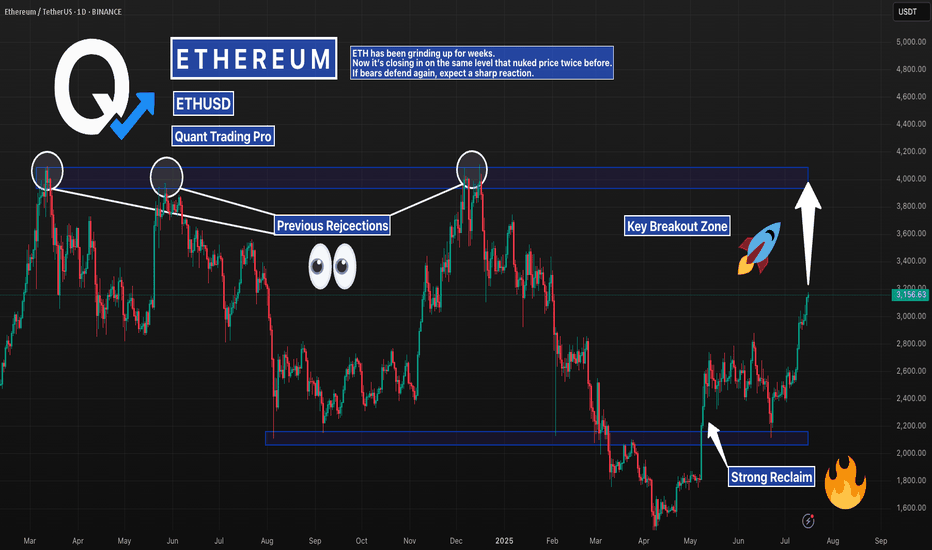

ETHUSD – Final Resistance Test Ahead Ethereum is ripping toward a major historical resistance zone between $4,000–$4,300 — a level that rejected price cleanly in both 2024 and early 2025. With momentum high and sentiment bullish, this area becomes the real test of trend strength.

Failure here could form a triple top.

Breakthrough? Expect fireworks.

#ETHUSD #Ethereum #Crypto #ResistanceZone #SmartMoney #QuantTradingPro #TradingView

ETH Flash Crash Setup – Gaps Below to WatchEthereum broke out fast, too fast. In the process, it left two clear value gaps around $2850 and $2690 — areas where price barely traded. These usually get revisited.

I’m watching those zones for a potential flash crash setup. If we get a sharp wick down, that’s where I want to be a buyer. No chasing.

Limit orders layered in. Plan is simple:

$2850 — first tap

$2690 — full imbalance fill

Stops below $2600 if triggered

Not saying it has to happen, but if it does, I want to be ready. Mark your levels.

—

Trade safe. This is just my setup, not advice.

Ethereum price is critical now#ethereum #eth price is now testing very very important resistance zone now and this also the bearish retest if #ethusd fails to leap over 3500 usd. 4 months ago, #ethusdt breakdown the 3 years of trendline, heavily dumped below 1400 usd and bounced. Now, CRYPTOCAP:ETH is testing this 3 years of trendline resistance zone + weekly ichimoku cloud.

Therefore ETH price has no other chance to at least reclaim 3450 - 3500 usd. True bullrun requires a new ATH. Heavy declination at current zone will not be tasty. This week' s close will determine the things i think.

Not financial advice.

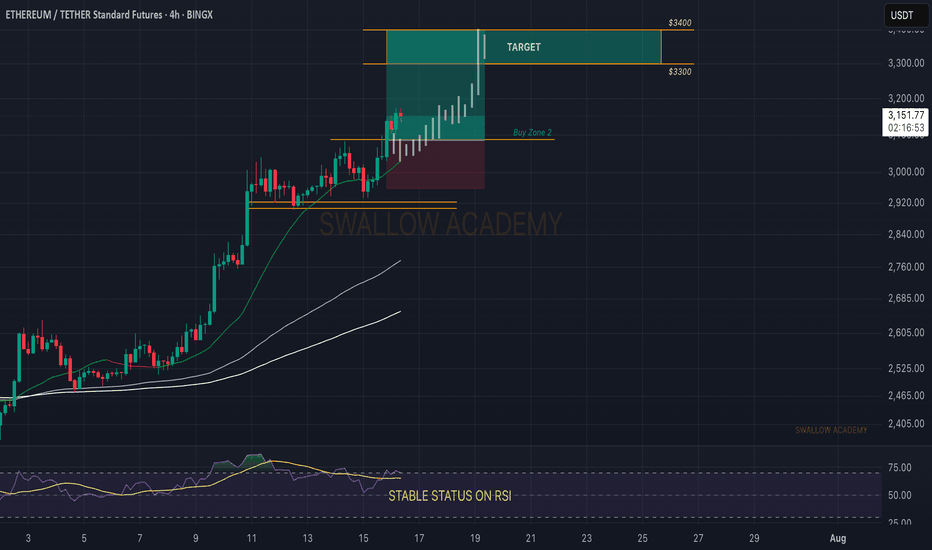

Ethereum (ETH): Buy Entry 2 Reached | $3300-$3400 IncomingNo remorse from buyers on ETH, where the price is pushing further and we are looking now at our new target, the $3300-3400 area, to be reached within this week.

There is not much more to talk about here, other than that we keep our bullish view (that we shared on a weekly timeframe).

Time for Ethereum to shine.

Swallow Academy

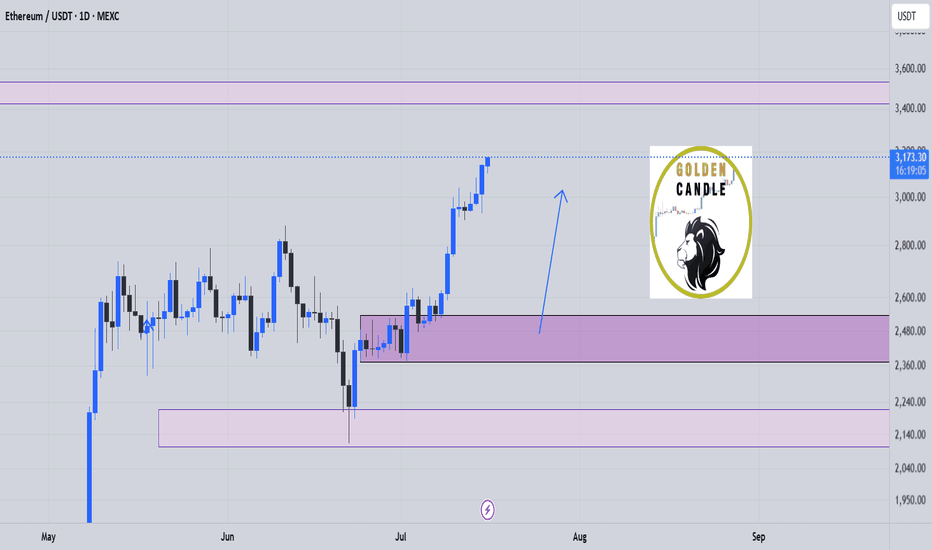

eth buy longterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

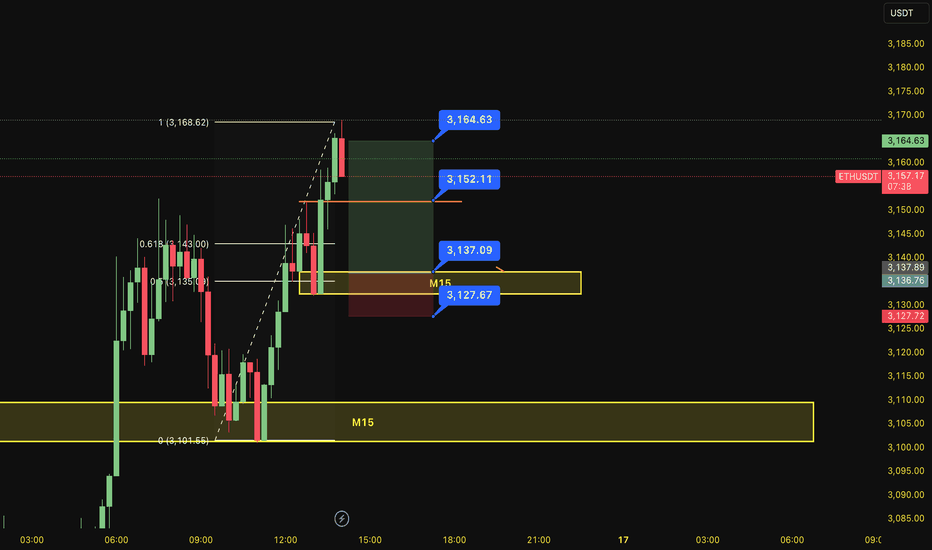

BUY ETHUSDT 16.7.2025Confluence order: BUY at M15

Type of order: Limit order

Reason:

- M15~FIBO 0,5-0,618 (same position)

Note:

- Management of money carefully at the price of sub key M15 (3152)

Set up entry:

- Entry buy at 3137

- SL at 3127

- TP1: 3152

- TP2: 3164

Trading Method: Price action (No indicator, only trend and candles)

Binance Holds 25% of Exchange ETH: Smart Accumulation?According to cryptoonchain’s analysis of on-chain data from CryptoQuant, Binance now holds about 25% of the total Ethereum reserves across all exchanges. This significant figure could be a sign of smart accumulation by major market participants. Notably, Binance’s rising share has occurred while overall ETH reserves on exchanges have remained stable. In a situation where Ethereum’s price is still below its all-time highs—even as Bitcoin has set new records—this accumulation on Binance may signal that large investors are entering and expecting future price growth.

On the weekly chart, Ethereum is showing signs of strength and a possible continuation of its upward trend. If buyers maintain their momentum, the first target lies in the 3,900–4,200 zone, with the second target in the 4,850–4,950 range—close to previous all-time highs.

ETH is testing resistance. False breakout?ETH is gathering liquidity ahead of a possible decline

The gray square is the active buying zone. When the price returned below the 3040 level, a liquidation phase occurred. Against the backdrop of the news, a retest of resistance is forming, but not with the aim of breaking through the level, but with the aim of gathering liquidity for a move to 2960-2913.

A false breakout of resistance could trigger another phase of liquidation (correction) to 2961. A halt should be expected in the 2900 zone.