ETH/USDT at Critical Decision Point: Breakout or Rejection AheadETH is pressing into a major confluence zone between two key trendlines. Price is currently testing both diagonal resistance and horizontal support, making this a pivotal area to watch 👀

📍 Scenario 1 – Bullish:

If ETH can break above Resistance Zone #1 and hold, there’s clear upside toward $2,900 (Resistance Zone #2). A confirmed breakout could mark the start of a new short-term uptrend.

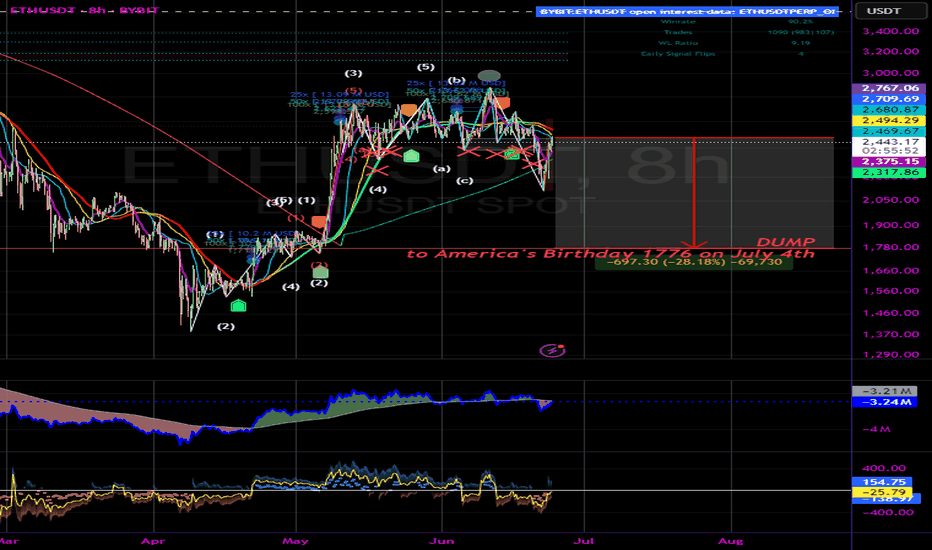

📍 Scenario 2 – Bearish:

Failure to hold Support Zone #1 could send price back into the lower range, with $2,300 and $2,100 in play. Watch for rejection from the descending trendline and a break of the rising channel.

This post is for educational purposes only — not financial advice. Use your own judgment and proper risk management when trading.

#ETH #Ethereum #TechnicalAnalysis #TradingView #BreakoutWatch #SupportResistance #CryptoTA #QuantTradingPro

ETHUST.P trade ideas

Ethereum (ETH): Buyers Took Back Control Over 200EMABuyers are back in control over the 200EMA, so nothing is lost yet. We keep our bullish game plan here. As many know, ETH is still far from its potential...considering the fact that BTC has already outperformed itself.

Time for ETH to shine now!

Swallow Academy

Ethereum (ETH): Good Start, Seeing Buyside DominanceEthereum has done well, where we have established a proper support area near the local buy zone, which should be enough for us to have a proper bounce from here towards our target of $2800.

As long as buyers keep the dominance near the buy area, we are bullish!

Swallow Academy

Weekly trading plan for EthereumBINANCE:ETHUSDT Last week, price mostly traded in a range. For this week, I've updated key levels, marked them on the chart, and modeled several scenarios. We can expect a pullback—possibly a deeper correction—before another push toward resistance levels. If price breaks the local low but then reclaims the weekly pivot point, I'll consider opening long positions without waiting for a deeper pullback.

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

$ETH is showing signs of a potential bullish move!CRYPTOCAP:ETH is showing signs of a potential bullish move.

The recent consolidation looks like it's building up for a strong breakout.

With market sentiment improving and growing interest in ETH-based projects, this could be a good time to accumulate before the next move up.

I’m watching the key resistance levels closely, if they break, we could see a fast rally.

#Ethereum

#ETH Rebounds on Ceasefire News – Eyes Set on $3100 and Beyond!By analyzing the #Ethereum chart on the weekly (logarithmic) timeframe, we can see that after dropping to $2100, ETH started recovering strongly following the ceasefire announcement, and is currently trading around $2430. If Ethereum manages to close above $2700 by the end of the week, we could expect further upside.

The next potential bullish targets are $2890, $3100, and $4100.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

ETHUSDT WEEKLY UPDATE — PART 1

When Conviction Fails: Apex Rejection, Hidden Redistribution, and the Illusion of Demand

Good morning, good afternoon, good evening, wherever you're tapping in from. Now, as always, I’m not here to waste your time with unnecessary waffle. Let’s get straight into it and unpack this mess step-by-step.

THE APEX REJECTION | MORE THAN JUST A WICK

So picking up from last week's update, we find ourselves right at the crossroads, and not the romantic kind either. What we’re looking at right now so far, is a clean yet 100% conclusive rejection from the apex of a key macro structure.

This isn’t just any level. This is the intersection of vertical momentum and horizontal memory, the apex of a triangle that’s been forming for months. This is where bullish intent was supposed to hold, supposed to assert dominance, but instead, what did we get? A strong push into resistance, a failure to fix above it, followed by exhaustion and signs of institutional unloading.

Now, to the untrained eye, this may look like a pullback, or even a healthy correction. But we’re not here to look at charts with retail goggles. We’re here to track the true intent behind the price action, and if you know your schematics, this is screaming redistribution. And not just any redistribution, the kind that happens right before the market changes its personality.

WHERE ARE WE IN THE SCHEMATIC?

If we overlay Wyckoff logic on top of this structure, it's very clear:

We’ve had our PSY (preliminary support).

Followed by a spring, a shakeout, and a fake rally.

Now we’re dancing around what appears to be the UTAD (upthrust after distribution) — but weaker.

This isn’t classic distribution, it’s redistribution masked in macro confusion.

Here’s the thing this range isn’t just price consolidation, it’s behavioural conditioning. This long, choppy sideways movement is designed to wear out both bulls and bears, making them question their bias, mismanage their risk, and either overstay or exit too early.

The market is methodical, not random. These candles aren’t accidents, they are footprints of algorithmic trap setting, and right now, it looks like the net is about to close.

VOLUME TELLS THE TRUTH

Let’s not forget volume. Look at the weekly volume through this recent push:

Decreasing volume on the rallies,

Higher volume on the red closes,

And multiple spikes that failed to carry price past resistance.

That’s your dead giveaway. You don’t need to be a wizard, just follow the clues. Price is being pushed, not lifted. Demand isn’t stepping in, liquidity is being removed. This isn’t smart money accumulation, if confirmed by the endd of this week, this most recent move up cout be doing of smart money unloading, Quietly and Efficiently.

THE MARKDOWN IS PRIMED

Let’s now address the elephant in the room, the range low and point C of the triangle on the 4H.

T hat’s where liquidity is sitting.

That’s where the market’s next objective lies.

We’ve now failed to reclaim the apex, the wick was slapped down, and unless something significant shifts, the next logical move is to sweep that C point, take out the emotional support, and either:

Tap into true demand (if it exists), or

Begin the cascade toward the final green demand zones between 2,150–2,070, which we marked weeks ago.

And don’t forget, this sweep may not be clean. We could get a fakeout bounce mid-range — enough to bait in more longs, only to roll over again.

PSYCHOLOGICAL LAYER

What’s happening here isn’t just technical, it’s emotional warfare. This entire range has been one long gaslight for the average trader. Between the failed breakouts, failed breakdowns, and chaotic intraday behaviour, retail has been turned into liquidity.

And if you’re still trying to long blindly at the top of this, hoping for 3k ETH without a confirmed structure reclaim, then respectfully, you’re the product right now.

Coming next in Part 2:

A full breakdown of the 4H macro setup

Analysis of the internal range mechanics

Recalculated fib zones

Where the liquidity pockets are

What the most probable path is short, medium, and long-term

Stay tuned — I’ll keep the flow coherent, structured, and aggressive. No fluff. No hopium. Just structure, psychology, and execution.

Ethereum Breakdown Ahead? Classic Head & Shoulders Pattern Hello Guys!

Ethereum looks like it’s setting up for a potential drop after forming a textbook Head & Shoulders pattern on the 4H chart.

This pattern (marked clearly with a left shoulder, head, and right shoulder) is often seen before a price reversal. Right now, ETH has already broken below the neckline (around $2,480), confirming the bearish pattern, and is currently retesting that level from below.

📉 What’s Next?

If the pattern plays out, we could see ETH drop toward the projected target zone around $2,200–$2,250, which is highlighted in blue on the chart. This zone also lines up with a previous area of interest and sits near a broken trendline, adding confluence to the setup.

✅ What I see:

Resistance: ~$2,500 (neckline retest)

Target: ~$2,200 support zone

Broken trendline adds downside pressure

Unless bulls reclaim the neckline quickly and push above the right shoulder (~$2,650), this looks like a bearish continuation setup.

ETH Bullish Update

Ethereum is looking bullish, and is respecting clearly defined support and resistance levels.

In my primary count, we have finished black wave 1. The question is to determine if black 2 is already finished, which could lead to strong upside.

There is no way to know without further price action, and a break of green resistance is a very bullish signal.

ETH/USDT – Symmetrical Triangle Breakout Setup (1H Chart)After a strong bullish impulse, ETH is consolidating in a symmetrical triangle formation — a classic continuation pattern. Price is coiling up near the apex, with higher lows forming against a horizontal resistance line.

Setup Highlights:

Pattern: Symmetrical Triangle (1H)

Trend: Bullish continuation after breakout

Entry Zone: ~2592 USDT

Target: 2679 USDT (upper green box)

Stop Loss: Below 2561 USDT (lower red box)

Risk-Reward: Favorable R:R structure

Watching closely for a decisive breakout above the triangle resistance to confirm bullish momentum continuation.

Let me know what you think — bullish continuation or fakeout risk?

#Ethereum #ETHUSDT #CryptoTrading #TechnicalAnalysis #BreakoutSetup #TradingView

ETH: Deep Retrace or Shallow? Two Key Long Zones into Next Week✅ Two main long setups: Equal Lows @ $2,376, Untapped Demand $2,250–$2,314

✅ Best R/R from deeper demand zone, but will watch both levels

✅ Targets: $2,738 (range high), ~$3,000 (expansion)

✅ Shallow retrace may limit upside to a new local high, not full expansion

Setup 1:

Buy trigger on sweep and reclaim of $2,376 (equal lows)

Target: $2,508, then $2,738

Setup 2:

Preferred: Buy trigger into $2,250–$2,314 untapped demand

Target: $2,738, $3,000

Risk:

Wait for reaction/confirmation at both zones; no FOMO in between

🚨 Risk Warning:

If no strong bounce from these levels, stand aside — don't force the setup.

Ethereum Rebounds from Strong Base – ATH in Sight?Hello traders, here’s the CRYPTOCAP:ETH Monthly Outlook

Ethereum is flashing early signs of a bullish reversal, with a clean Morning Star candlestick pattern forming right above the $1,050–$1,200 support zone, a historically strong base.

After bouncing hard from this level, ETH is now approaching the major resistance area at $3,400–$3,800, the same zone that previously rejected upward moves.

If ETH can break and close above this resistance, we could see the start of a fresh bullish leg. But until then, this zone remains a major hurdle.

Keep an eye on the monthly close, it could confirm a shift in long-term momentum.

DYOR, NFA

Thanks for following along — stay tuned for more updates!

ETH/USDT 1D🔍 ETH/USDT - technical analysis (1D interval):

📉 Price: 2478 USDT (-4.36%)

🔧 Resistance:

• SMA 200 (green): ~ 2589

• Resistance zone: ~ 2715 → 2880 USDT

• SMA 100 (blue): ~ 2500 (just rejected)

🔧 Support:

• SMA 50 (red): ~ 2434 - currently tested

• Strong support: 2373, 2314, 2223 USDT

📊 indicators:

• MacD: freshly intersected, but the momentum is weakening

• RSI: ~ 45 - neutral/weak, under 50 (no bull strength)

• Trend: Still in the downward channel (yellow trend lines)

⸻

⚠️ Conclusions:

• Price rejected from 2500 (SMA 100) and flies down.

• If 2434 falls, a further discount is possible to 2373–2314.

• Lack of bulls with key resistance - the inheritance scenario dominates.

• Watch behavior at 2434 - this is now a key level.