EURAUD trade ideas

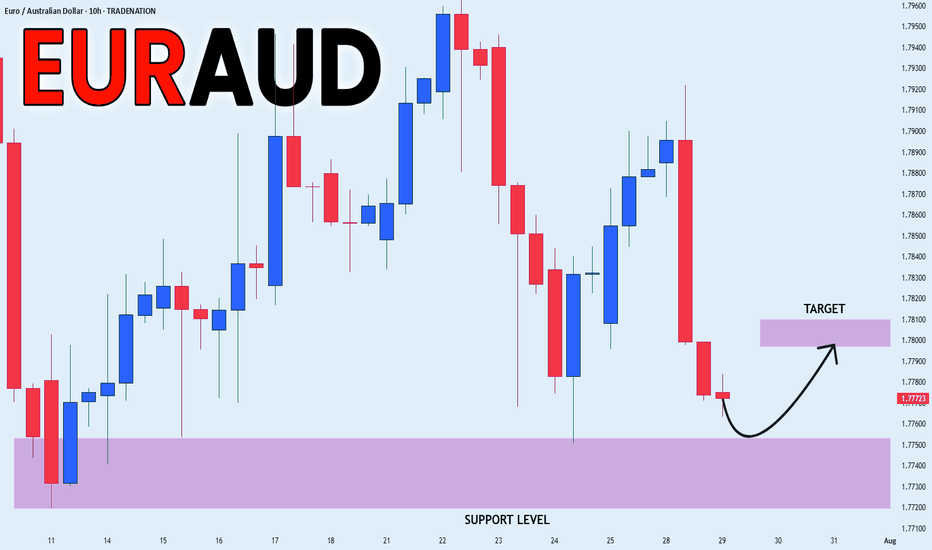

EUR/AUD Testing Support - Drop Incoming?EUR/AUD is sitting on an important support level. So far, the price has been holding, but it's starting to show signs of weakness.

If the price breaks below this support, it could drop further, with the next target around 1.7640.

This level could act as the next area where the price might slow down or bounce.

EURAUD THE CURRENT PRICEACTION OF EURAUD IS WATCHED.

EU10Y=2.689%

ECB RATE 2.0%

AU10Y= 4.348%

RBA RATE =3.85%

RATE AND BOND YIELD DIFFERENTIAL FAVOR AUD .

The recent fluctuations in the EUR/AUD exchange rate are primarily driven by factors including:

Monetary Policy and Interest Rate Differentials:

Decisions and outlooks from the European Central Bank (ECB) and the Reserve Bank of Australia (RBA) strongly impact EUR/AUD. Hawkish (tightening) or dovish (easing) policy stances influence demand for each currency, affecting the exchange rate. For example, higher interest rates or hawkish tones usually strengthen a currency, while easing weakens it. Differences in inflation rates and inflation expectations also play a part, as central banks adjust rates accordingly.

Economic Indicators and Growth Outlooks:

Economic performance disparities between the Eurozone and Australia—such as GDP growth, trade balances, and industrial versus commodity exports—drive currency strength or weakness. The Eurozone’s economy is more industrial and technological, while Australia's economy is strongly commodity-driven, especially by prices of iron ore and gold. Changes in global commodity prices or demand can cause the AUD to fluctuate vs the EUR.

Commodity Prices, Especially Gold:

Since Australia is a major gold producer, AUD tends to correlate positively with gold prices. Rising gold prices support AUD strength, which may lower EUR/AUD rates, and vice versa.

Global Risk Sentiment and Geopolitical Events:

Global market sentiment—whether investors seek risk or safe-haven assets—affects both currencies. The Euro and AUD react differently to geopolitical developments and trade tensions. For instance, increased risk appetite can strengthen AUD vs EUR and vice versa depending on circumstances.

In summary, the recent EUR/AUD fluctuations reflect the interplay of ECB and RBA policies, divergent economic data between Europe and Australia, commodity price movements (notably gold), and shifting global risk sentiment.

This explains why EUR/AUD rates move as they do: when the Eurozone outlook improves or ECB signals tightening while Australian commodity prices weaken or RBA signals easing, EUR tends to strengthen against AUD, and the pair rises. Conversely, stronger Australian growth, rising commodity prices, or hawkish RBA moves can push the pair lower.

#EURAUD

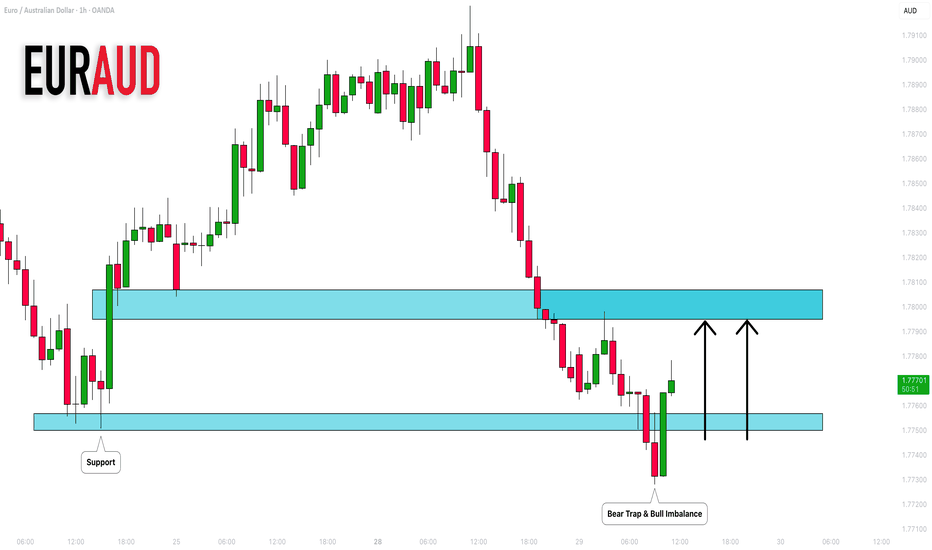

EUR_AUD LOCAL GROWTH AHEAD|LONG|

✅EUR_AUD will soon retest a key support level of 1.7750

So I think that the pair will make a rebound

And go up to retest the supply level above at 1.7800

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURAUD | One Kiss from 1.7906 and I’m In – TP 140 Pips!The big picture of EURAUD is SELL possible up to 1.7750

Spot that H1 BUY range?

Inside it, there is conflict. A sneaky SELL range form inside it after rejection H4 BLUE LINE.

See that top blue line at 1.7916?

It got a gentle kiss from the H4 candle (REJECTION).

Then H1 already whispered, "a sweet breakout"!

📌LONG STORY SHORT, I'M SELL AROUND 1.7888 - 7906

If H4 comes and kisses one of the line (just a touch and wick), I’m SELLING — no more playing hard to get. 😘

Other wise, I’ll quietly cry in the corner

TP? 1.7750 — that’s a sweet 140-candlelit dinner!

WISH ME LUCK...!!!

EUR-AUD Rebound Ahead! Buy!

Hello,Traders!

EUR-AUD is already making

A rebound from the horizontal

Support level of 1.7822

So we are locally bullish

Biased and we will be

Expecting a further

Local move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURAUD Is Bullish! Buy!

Please, check our technical outlook for EURAUD.

Time Frame: 15m

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 1.785.

The above observations make me that the market will inevitably achieve 1.787 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EUR/AUD Analysis – Symmetrical Triangle FormationKey Observations:

Pattern Type: Symmetrical triangle with converging trendlines.

Higher lows show demand stepping in.

Lower highs signal sellers defending resistance.

Volume Profile: Volume is tapering off, aligning with triangle logic → explosive move likely upon breakout.

Liquidity Pool Below: Large liquidity zone marked around 1.68300–1.74000, previously acted as accumulation base and demand zone.

Price Behavior: Currently nearing apex; compression suggests volatility expansion imminent.

EURAUD Bullish Continuation Methodas you can see form my posts i have shared that lst Bullish Setip few days ago now what we are waiting is a contiuation to bullish side, when we look at 4W chart we can see that th prvious 4W candle was a bullish one and we are looking the next 4W candle to bullish and potetioally to raid the high of previous 4H high, so in 1-4H chart we are lookin bullish continuation and clearly what we are seeing now is Bullsuh continuation correction setup Lets just wait.

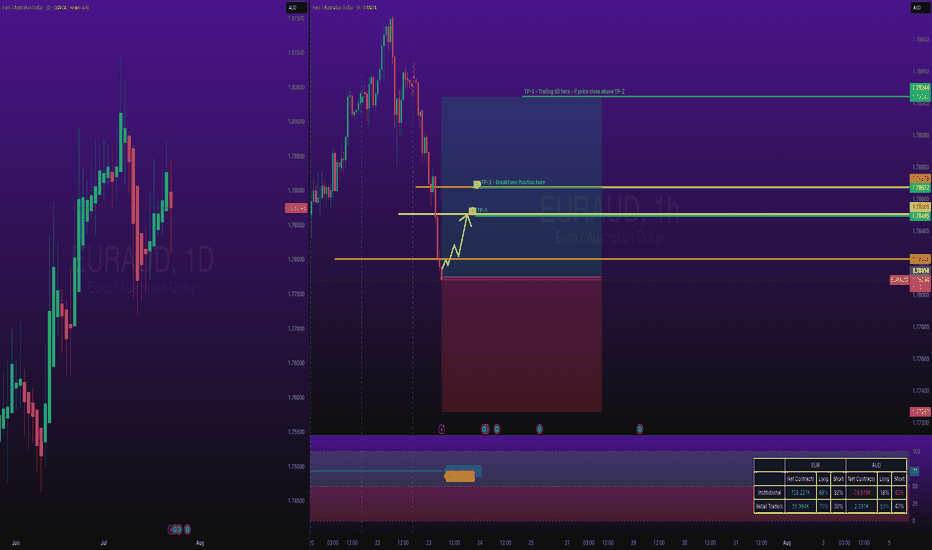

EURAUD 4H: Long Setup from Fresh Demand ZoneOverview:

OANDA:EURAUD retracing into a newly formed 4H demand zone after a bullish Break of Structure (BoS). Eyes on continuation towards a historically significant supply zone at 1.8000.

🧩 Setup Details

• Asset & Timeframe: EURAUD, 4H

• Bias: Bullish

• Entry Zone: 1.77300 – 1.77700 (DEMAND area)

• Targets:

🎯 T1 = 1.7900 (minor reaction level)

🎯 T2 = 1.8000 (historical supply level)

• Stop-Loss: Below 1.77300 (last valid demand)

• Risk-Reward: Approx. 1:6+

🧠 Why Now? (Trade Rationale)

• ✅ Fresh 4H Demand Zone: Price is retracing into a clear demand zone after rejecting lower prices.

• ✅ Break of Structure (BoS): Bullish BoS confirms shift in order flow.

• ✅ Volume Confirmation: Increasing demand near current price levels.

• ✅ Clear Liquidity Sweep: Price likely swept short-term lows before BoS.

• ✅ Target Supply Zone: 1.8000 is a well-respected historical supply/resistance level — clean magnet for price.

⏱ Multi-Timeframe Context

• Daily Chart: Price is reacting off a larger DAILY DEMAND ZONE. Trend bias is bullish.

• 4H Chart: Structure break + demand formation suggest continuation.

• 1H/Entry Level: Monitor price action in the blue zone for lower-timeframe confirmation (e.g. bullish engulfing, flip zones, LQ sweep, etc.) and potentially greater risk-reward.

📉 Risk Management & Duration

• Stop below 1.76315 keeps you protected from deeper invalidation.

• Trade Duration: Short to mid-term (1–4 days).

• Position Size: Scale based on volatility; ideal for swing trade conditions.

📌 Trade Plan Summary

📍 Watch for bullish PA on re-entry into demand (1.77300–1.77700)

📍 Set SL below 1.76315

📍 TP1 at 1.79000 — partials advised

📍 TP2 at 1.80000 — strong historical level

📍 Adjust SL to BE on momentum breakout

One Sweet Bullish Candle Above 50EMA… and I’m All Yours, 1.7940I’ve got a lovely 1H bullish range from 1.7733 to 1.7940 — pure potential.

Market gave me a 100-pip pullback/retracement from 1.7940 to 1.7840 — just a little mood swing. 😒

Now I’m patiently stalking...

If a bullish candle closes above my 50EMA,

I’m not thinking twice — I’m riding the bull! 🐂💥

SL? Depends on the candle’s vibe:

If it’s a strong Marubozu, I’ll trust it like a loyal partner — SL goes just below it.

TP? Straight to 1.7940 — no detours, no drama. 🎯

Wish me luck… and a Marubozu with commitment issues! 😂📉📈

Lower Timeframe Analysis on EUR/AUDWhen analyzing the pair on lower timeframes, there appears to be a potential opportunity for a long position.

Looking at the broader picture on the daily timeframe, the pair may continue its upward movement following the formation of a strong bullish candle on Friday (August 1st, 2025).

Additionally, it's worth noting that the pair recently reached a low around 1.72476 and may now be aiming to establish a new high near 1.85566.

Given that this analysis is based on the daily timeframe, and following the breakout of the resistance at 1.79311 — which corresponds to the upper boundary of a rectangle marking the current range — a long position is considered valid.

Note: Be mindful of the potential for a GAP at the market open.

It is essential to remember that while technical analysis can provide valuable signals, it is crucial to also monitor economic data, news releases, and other fundamental factors that may affect this pair. This analysis focuses solely on the technical aspect.

The long position tool shown on the chart is meant for illustrative purposes only and should not be considered a definitive entry signal.

Disclaimer: This analysis reflects only my personal view of the market and does not, under any circumstances, constitute investment advice.

The 7 Secrets Of Trading MasteryIn this video we are going to talk about:

Buy Limit Orders

Sell Limit Orders

Reversal Patterns

Double Tops

Double Bottoms

Using The Rocket Booster Strategy

The Power Of Risk Management

Watch this video on CAPITALCOM:EURAUD in order for you to learn more

take care and trade safe.

Rocket Boost This Content To Learn More

Disclaimer;Trading is risky please a simulation ion trading account

before you trade with real money

also learn risk management and profit taking strategies.

EURAUD BULLISH MOVE CONTINUESOur analysis is based on a multi-timeframe top-down approach and fundamental analysis.

Based on our assessment, the price is expected to return to the monthly level.

DISCLAIMER: This analysis may change at any time without notice and is solely intended to assist traders in making independent investment decisions. Please note that this is a prediction, and I have no obligation to act on it, nor should you.

Please support our analysis with a boost or comment!

EUR-AUD Bullish Breakout! Buy!

Hello,Traders!

EUR-AUD made a bullish

Breakout of the falling resistance

And the breakout is confirmed

So we are bullish biased

And we will be expecting

A further bullish move up

On Monday!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURAUD waiting for breakoutWe can see a breakout in upside in EURUAD after this consolidation as EA already tested it's support and swept the sell side liquidity. Targeting 1.78500 Zone Again for Testing and also forming a triangle pattern in 4H.

We can take a buy till that trend line test with tight SL.

EURAUD Long TradeOANDA:EURAUD Long trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

TP-1 is high probability.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice