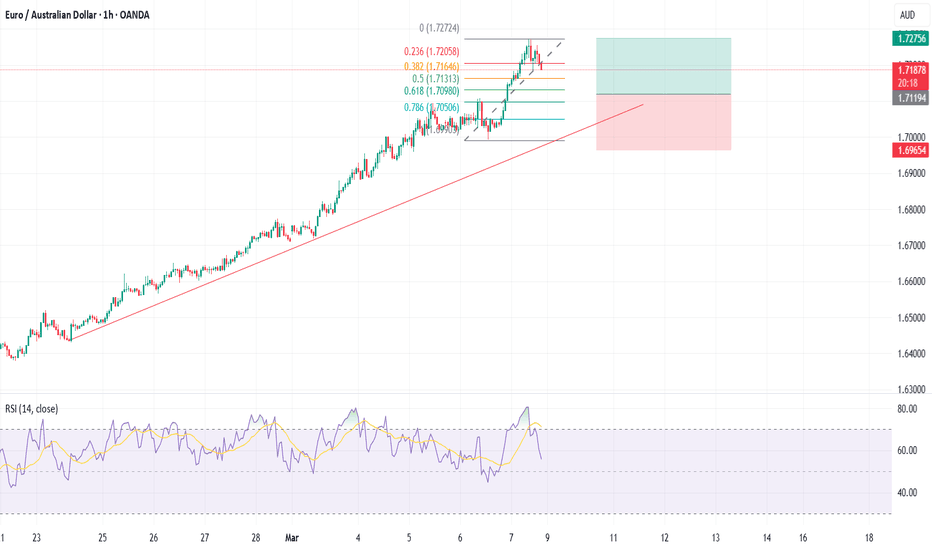

EURAUD looking for value zone to go long ... the week of 10 Mar Weekly – strongly bullish

Daily – strongly bullish

H4 – bullish, now pulling back towards a consolidation zone between 1.7108 and 1.69930 (marked on my chart). 20 ema is also currently located here.

When/If price reaches this zone, I will be monitoring PA on H4 and H1 timeframes with a view to find evidence of a bullish continuation. In the current uncertain US situation, it is vital to establish that control of the market has returned to the bulls, before taking a long trade. Stop can be below the zone (around 1.6930) or a bit lower with the initial target at about 1.7280.

This is not a trade recommendation, merely my own analysis. Trading carries a high level of risk, so only trade with money you can afford to lose and carefully manage your capital and risk. If you like my idea, please give a “boost” and follow me to get even more. Please comment and share your thoughts too!!

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

EURAUD trade ideas

quant levels to get involved in aud recovery/eur pullbackalready in hedging zones to look for upside wicks breakdown

Check out our socials for some nice insights.

Let us know if there're any pair you like to see or if this is something you like.

Do ask if you have any question

Not as refined as our direct trade setups. More for advanced active traders.

information created and published doesn't constitute investment advice!

NOT financial advice

EUR/AUD Short Looking at the chart a correction is in much needed demand. We are coming close to a prior key resistance level and I have started to enter into a short position here on this pair. Wish you all the best and good luck with your trades!

Personally I believe risk at these levels to be low I feel to many will be selling due to fear soon to allow this to climb without correction. This could in turn be the start of a larger upwards move however in the short term bears will need to catch up.

EUR/AUD - Liquidity Sweep & Potential Reversal SetupPrice is approaching a key support level, where a significant liquidity zone exists. Given the current market structure and sentiment data, a break below this level is likely to trigger stop-loss clusters from retail longs, allowing market makers to grab liquidity.

Trade Plan:

If price sweeps below support but fails to sustain lower lows, it may indicate absorption by larger players.

Confirmation will come from order flow signals such as delta divergence, aggressive buy orders stepping in, or a volume shift.

A potential buy entry will be considered only after signs of accumulation appear, ensuring alignment with institutional order flow.

Key Levels:

Support Break Zone: 1.7035 – 1.7040

Liquidity Grab Target: 1.6997 (Below recent lows)

Potential Reversal Confirmation: Above 1.7057

Execution:

Wait for liquidity sweep & failure to continue lower.

Monitor order book dynamics and sentiment shifts before entering.

Avoid premature longs until clear absorption is confirmed.

📌 Institutional Play: Let the market take liquidity before positioning with the real momentum.

EURAUD Will Go Lower! Short!

Here is our detailed technical review for EURAUD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 1.705.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 1.695 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

EURAUD to see a turnaround?EURAUD - 24h expiry

We are trading at overbought extremes.

Bearish divergence is expected to cap gains.

The rally is close to a correction count on the daily chart.

We look to Sell a break of 1.6950.

A lower correction is expected.

We look to Sell a break of 1.6950 (stop at 1.7010)

Our profit targets will be 1.6740 and 1.6710

Resistance: 1.7070 / 1.7100 / 1.7250

Support: 1.6950 / 1.6850 / 1.6730

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

EUR-AUD Strong Resistance Ahead! Sell!

Hello,Traders!

EUR-AUD surged up sharply

And the pair is locally overbought

So after it hits a horizontal resistance

Of 1.7190 from where we will

Be expecting a local bearish

Correction and a move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

EURAUD, EURNZD and AUDNZD - Quick technical pieceWe are seeing strong move in the euro just before the ECB rate decision on Thursday. However, let's not forget that we will get some action from the RBA and RBNZ in the first days of April. MARKETSCOM:EURAUD and MARKETSCOM:EURNZD are at key resistance areas, which could be interesting for the sellers. That said, we have not received any reversal signal yet, so the bears need to wait for a bit.

Let's dig into the technicals.

FX_IDC:EURAUD

FX_IDC:EURNZD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

EURAUD UpdateEURAUD Long Position Update

On February 23, 2025, I initiated a long position on EUR/AUD at an entry price of 1.64185. As of March 4, 2025, the pair is trading at 1.6919, reflecting a gain of approximately 500 pips.

ECB.EUROPA.EU

Key Observations:

Trend Analysis: Since the entry date, EUR/AUD has exhibited a consistent upward trend, moving from 1.64185 to 1.6919.

Support Levels: The pair has maintained support above the 1.6600 mark, indicating sustained buying interest.

Resistance Levels: The pair is approaching the psychological resistance at 1.7000, which may present a challenge for further upward movement.

I had previously shared this trade setup before these gains materialized, highlighting the importance of thorough analysis and patience in trading.

Note: All trading activities involve inherent risks. Past performance does not guarantee future results.

EURAUD — Sell Setup at Key Resistance LevelOANDA:EURAUD is approaching a major resistance zone, highlighted by strong selling interest. This area has historically acted as a supply zone, increasing the likelihood of a bearish reversal if sellers step in.

The current price action suggests that if the pair confirms resistance through signals like bearish engulfing candles, long upper wicks, or increased selling volume, we could see a downward move toward 1.68380 — a logical target based on previous price behavior and market structure.

However, if the price breaks above this zone and sustains, the bearish outlook may be invalidated, opening the door for further upside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

EUR/AUD 4H – Bullish Structure with Possible Retest Zones📌 Pair: EUR/AUD

⏳ Timeframe: 4H

📈 Market Overview:

EUR/AUD has been in a strong bullish trend, pushing towards 1.7000+ levels, breaking previous resistance zones. However, we are now approaching a critical area where price could either consolidate or retrace before continuing higher.

🔍 Key Levels to Watch:

1.71825 – Daily Resistance: A major level where sellers may step in.

1.70048 – Recent High: Current price has reached a key psychological level.

1.68461 – Broken Support: Potential retest zone.

Fair Volume Gaps: Gaps indicate possible areas for retracement before a continuation.

Fibonacci Retracement Levels:

0.382 - 1.67569

0.5 - 1.66814

0.618 - 1.66058

📊 Trade Plan:

🔹 Scenario 1 - Bullish Continuation: If price consolidates above 1.68461 and forms a strong rejection, we could see a continuation towards 1.71825.

🔹 Scenario 2 - Pullback & Retest: If price retraces into the Fair Volume Gap zones or Fib levels, we can look for bullish confirmations before entering long positions.

💡 Trade Sentiment:

✅ Bullish Bias remains strong

📍 Watching for a healthy pullback before further upside

📉 Bearish reversal only if price breaks below 1.6600