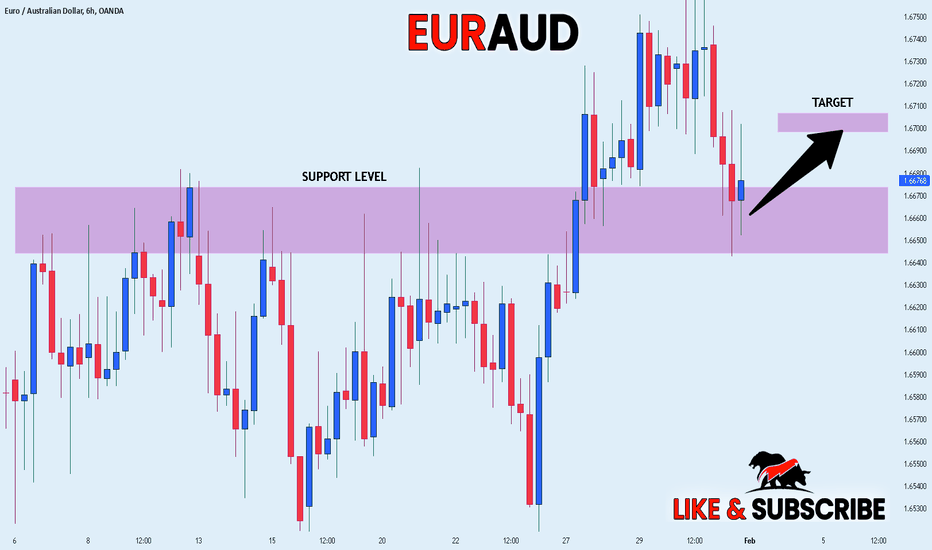

EURAUD: Free Trading Signal

EURAUD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long EURAUD

Entry Point - 1.6579

Stop Loss - 1.6541

Take Profit - 1.6645

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

EURAUD trade ideas

EURAUD short tradethe price after hitting HH on major scale he bounced back breaking that high of the range and keep forming LL/Lh

Judging the 1h tf the price break the last LL on that downtrend and cane back for a restest

after identifying the structure on PullBack phase my entry was after the break of the HH

EUR/AUD BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

EUR/AUD pair is trading in a local uptrend which know by looking at the previous 1W candle which is green. On the 2H timeframe the pair is going down. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 1.665 area.

✅LIKE AND COMMENT MY IDEAS✅

EUR/AUD: Testing Uptrend Support After December High RejectionEUR/AUD has pulled back after failing to clear the December highs, bringing it within touching distance of uptrend support. With the 50-day moving average just below, it provides a bullish setup.

Longs could be initiated above the uptrend with a stop below the 50DMA for protection. It would be preferable to see the price test and hold the uptrend before initiating the trade. 1.6800 screens as a potential target.

Good luck.

DS

EURAUD at Resistance - Will Sellers Step In?OANDA:EURAUD is testing a strong resistance zone, an area where sellers have stepped in before. If price struggles to break through and we see bearish confirmation—such as rejection wicks, bearish engulfing candles, or decreasing buying volume—I anticipate a move toward 1.6600.

A clean rejection from this level could trigger selling momentum, leading to further downside. However, if buyers manage to break above 1.6800 with strong conviction, it could shift the bias bullish and invalidate the short setup.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Please boost this post, every like and comment drives me to bring you more ideas! I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

EURAUD: Intraday Bearish Signal?!It appears that the EURAUD pair could continue to decrease in value.

I have observed a downward breakout of a bearish flag pattern on the hourly chart following a retest of a support level that was recently broken.

My targets for this potential decline are 1.6591 and 1.6559.

idea on a chartWe have a great chart where price could go.One of the biggest reasons the euro has been rallying against the Australian dollar is due to the fact that the Chinese economy has been so sluggish. The Australian economy is highly levered to what’s going on in China, as a huge portion of the commodities in Australia ended up on the Chinese mainland. As long as the Chinese economy is sluggish, it does make a certain amount of sense that the Australian dollar will fall. At this point in time, the 2 economies are so interlocked that it’s essentially a proxy for Chinese economic performance.

EURAUD Will Grow! Long!

Here is our detailed technical review for EURAUD.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 1.667.

Considering the today's price action, probabilities will be high to see a movement to 1.672.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

EURAUD - 28 Jan 2025 SetupEURAUD Market structure are making N pattern on the market structure with strong bullish rally. Spotted demand area (Green Rectangle). its a very good demand area structure after the price creating a higher high.

Entry Position : Long

Profit Target : 1:3 Shown on the chart image (Green Line)

Stop Loss : Slightly below demand area (Red Line)

Follow me if u guys making any gains from this idea.

Thanks

Coffee Trade Team

EUR/AUD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

Bearish trend on EUR/AUD, defined by the red colour of the last week candle combined with the fact the pair is overbought based on the BB upper band proximity, makes me expect a bearish rebound from the resistance line above and a retest of the local target below at 1.648.

✅LIKE AND COMMENT MY IDEAS✅

EURAUD is in The bullish Direction after Triple Bottom FormationHello Traders

In This Chart EUR/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today EUR/AUD analysis 👆

🟢This Chart includes_ (EUR/AUD market update)

🟢What is The Next Opportunity on EUR/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts