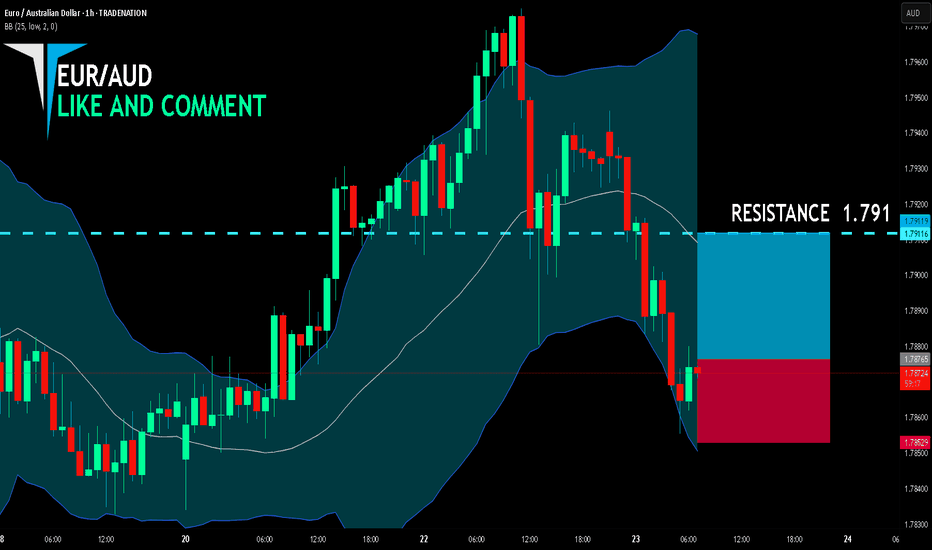

EUR/AUD BUYERS WILL DOMINATE THE MARKET|LONG

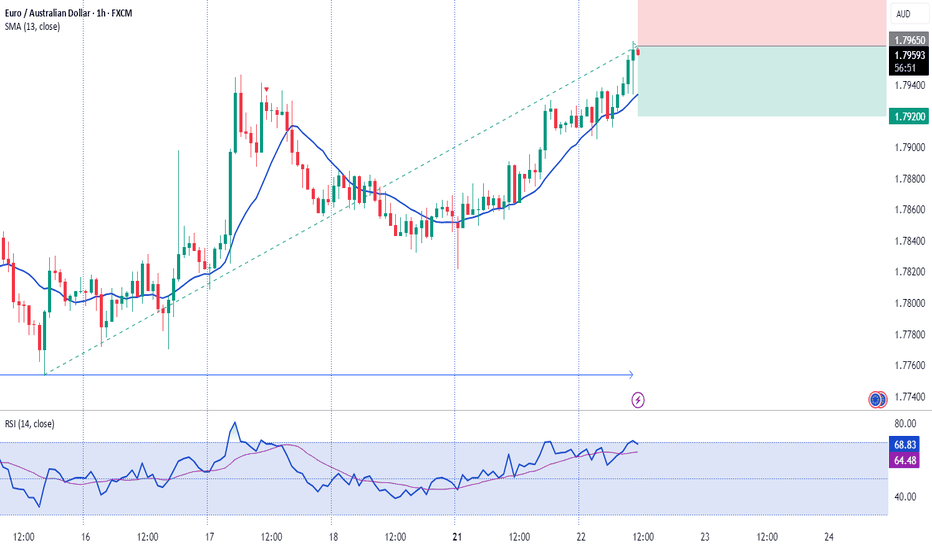

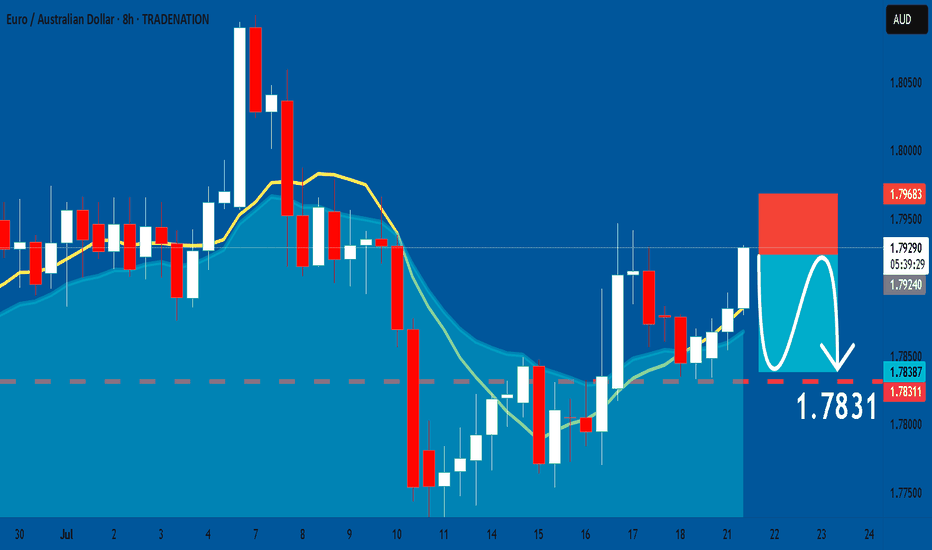

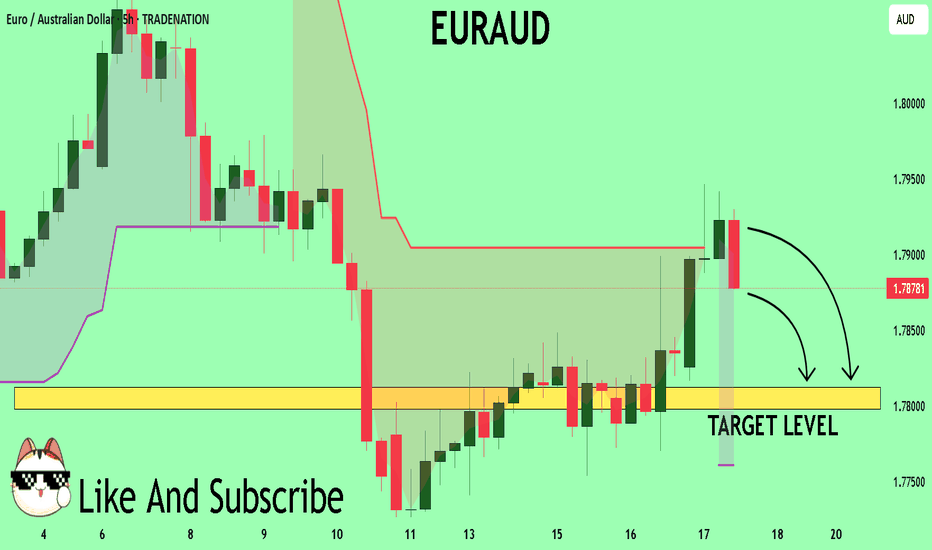

EUR/AUD SIGNAL

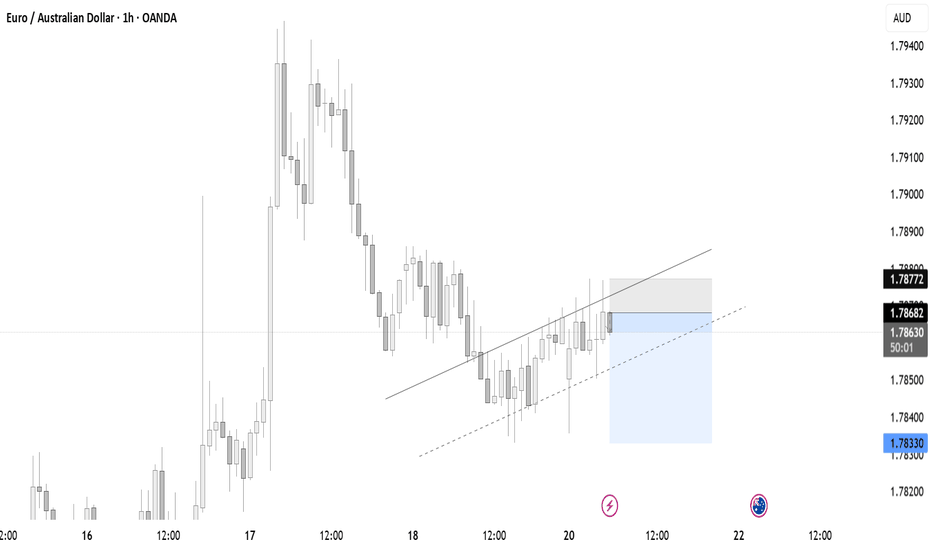

Trade Direction: long

Entry Level: 1.787

Target Level: 1.791

Stop Loss: 1.785

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURAUD trade ideas

EURUAD is in the Buy directionHello Traders

In This Chart EUR/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today EUR/AUD analysis 👆

🟢This Chart includes_ (EUR/AUD market update)

🟢What is The Next Opportunity on EUR/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

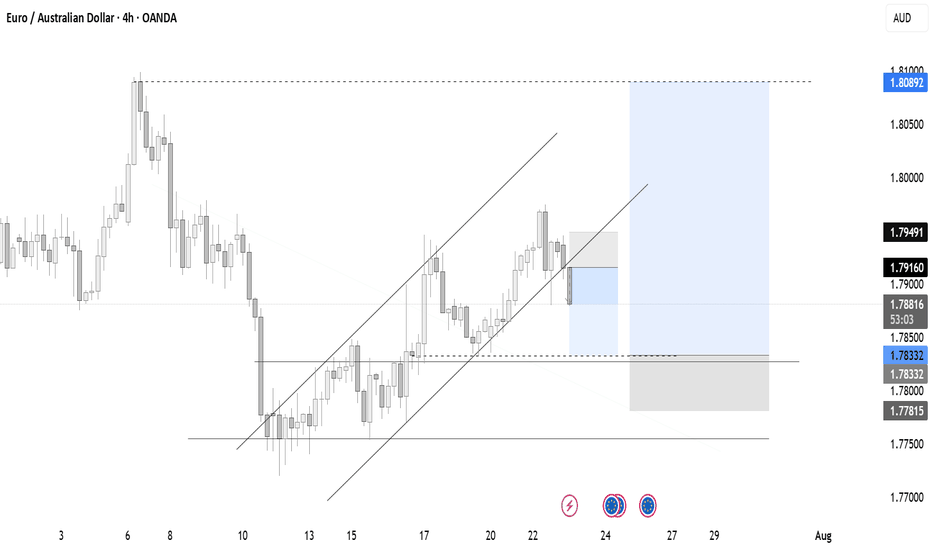

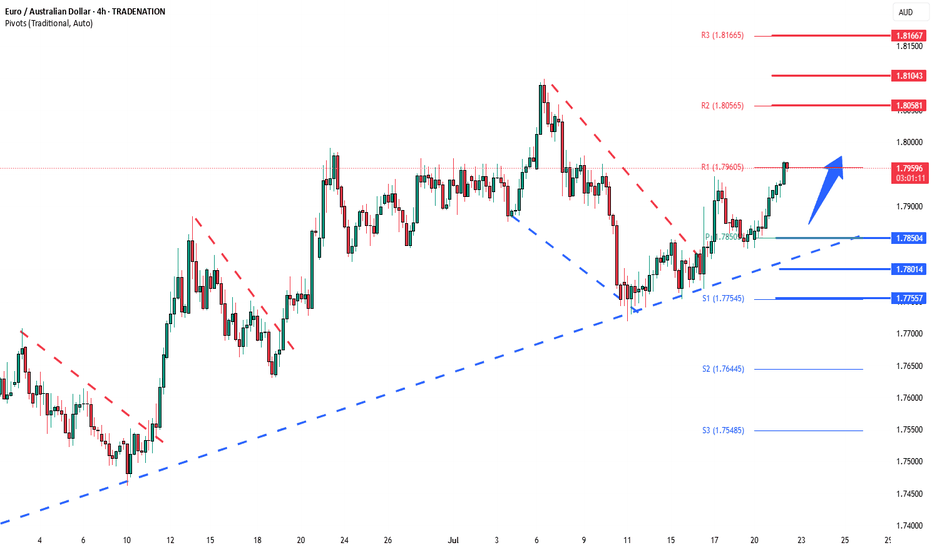

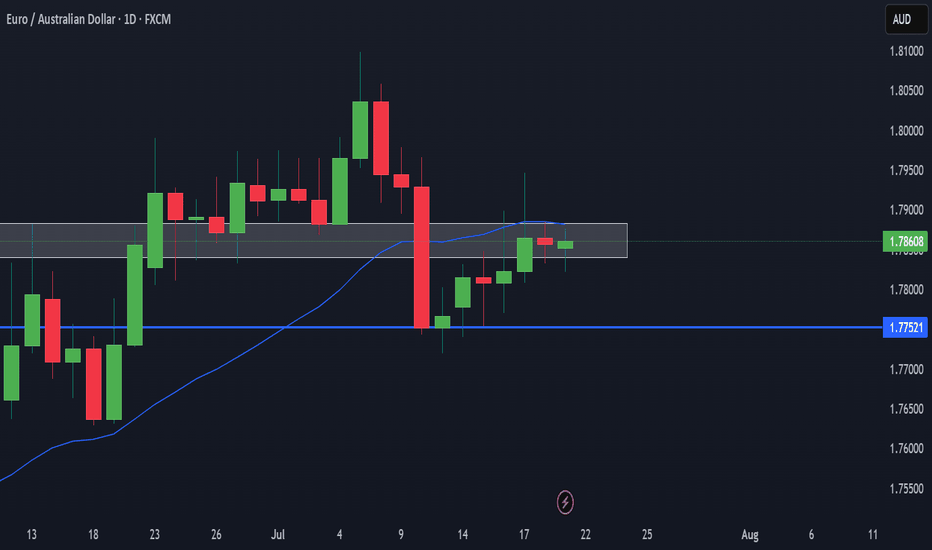

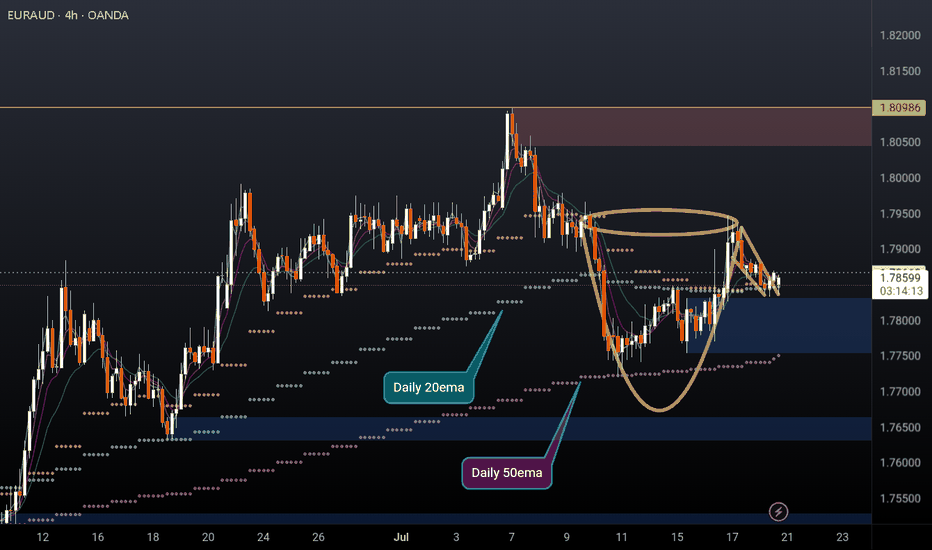

EURAUD Bullish breakout supported at 1.7650The EURAUD remains in a bullish trend, with recent price action indicating a continuation breakout within the broader uptrend.

Support Zone: 1.7850 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.7850 would confirm ongoing upside momentum, with potential targets at:

1.8060 – initial resistance

1.8100 – psychological and structural level

1.8165 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.7850 would weaken the bullish outlook and suggest deeper downside risk toward:

1.7800 – minor support

1.7755 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURAUD holds above 1.7850. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

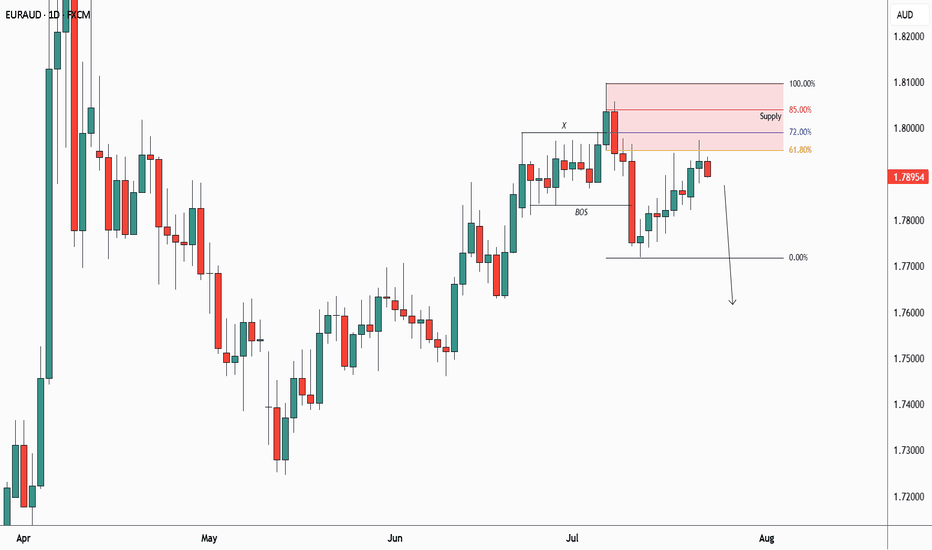

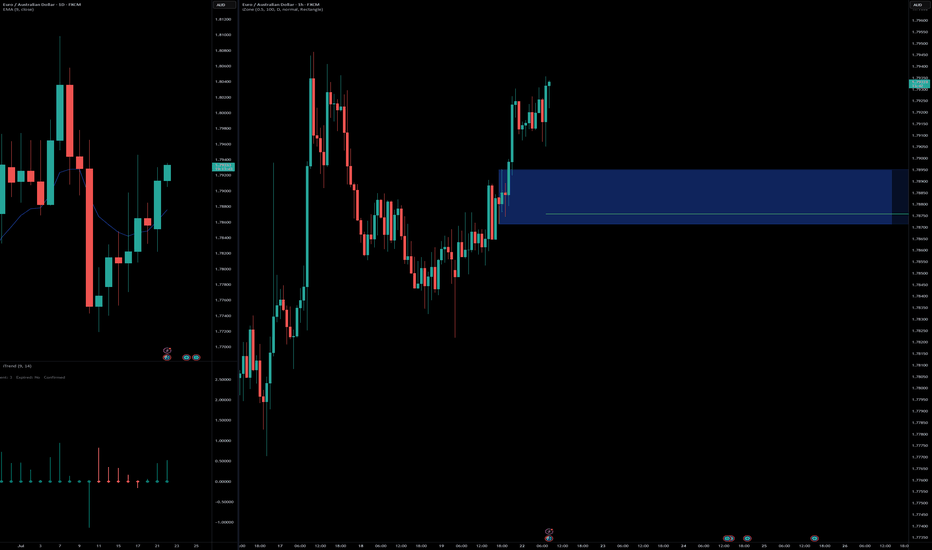

EURAUD: Short Signal Explained

EURAUD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell EURAUD

Entry - 1.7924

Stop - 1.7968

Take - 1.7831

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

The 4 Pillars of PRICE ACTION - Explained!!!!!All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

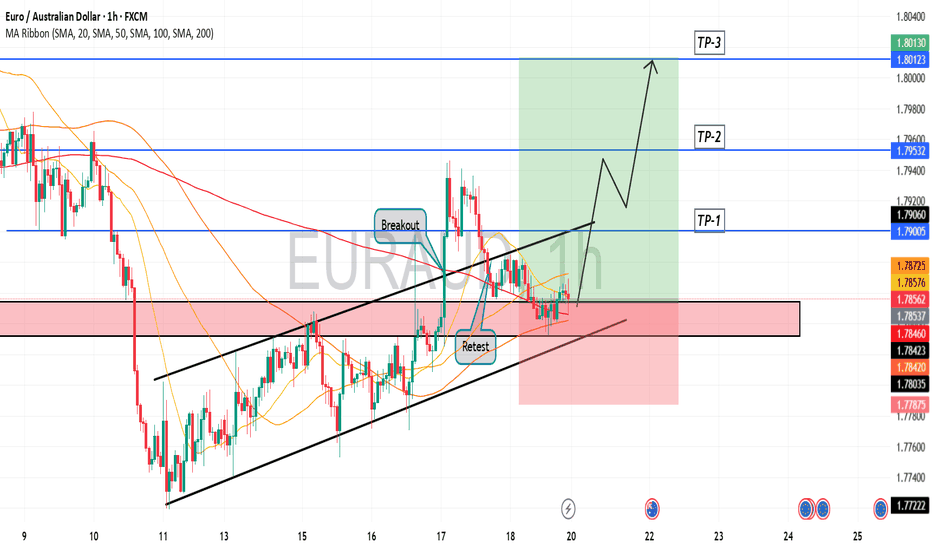

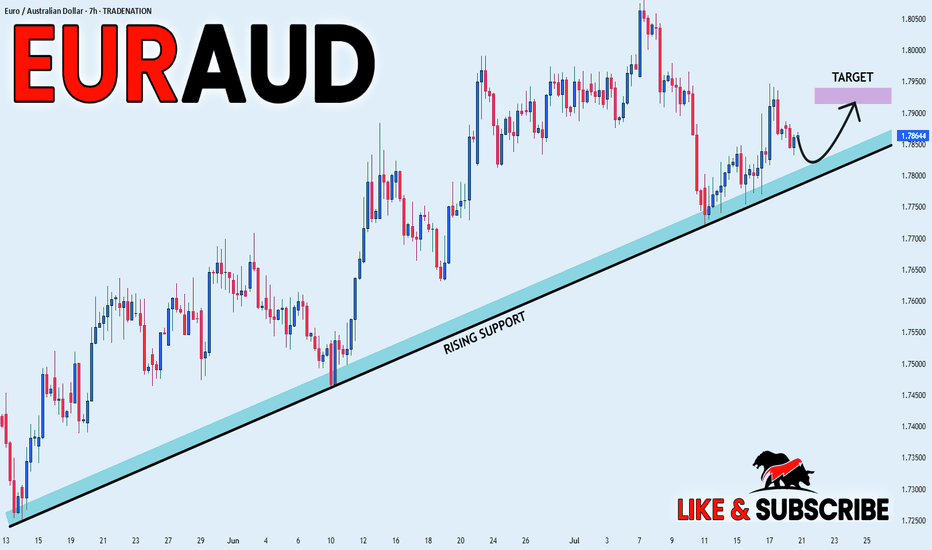

EUR_AUD WILL GROW|LONG|

✅EUR_AUD is trading in an uptrend

With the pair set to retest

The rising support line

From where I think the growth will continue

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-AUD Strong Uptrend! Buy!

Hello, Traders!

EUR-AUD is trading along

The rising support line in a

Strong uptrend so we we are

Bullish biased and as the pair

Is going down to retest the

Support we will be expecting

A rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURAUD Buyers In Panic! SELL!

My dear friends,

Please, find my technical outlook for EURAUD below:

The price is coiling around a solid key level - 1.7893

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.7812

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

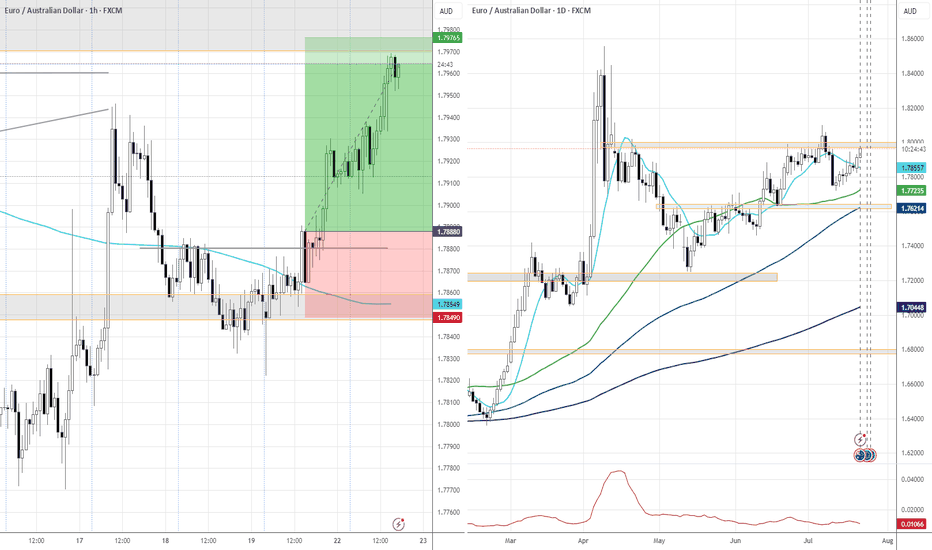

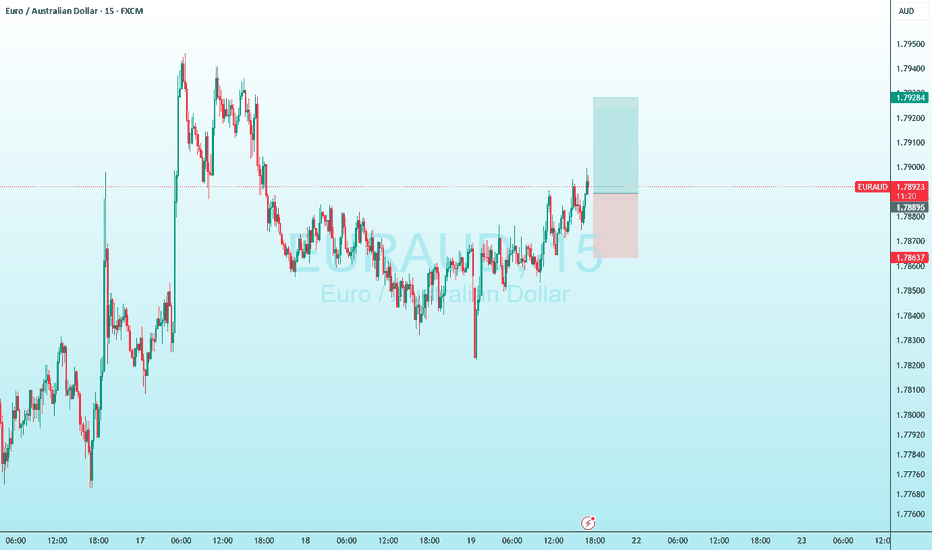

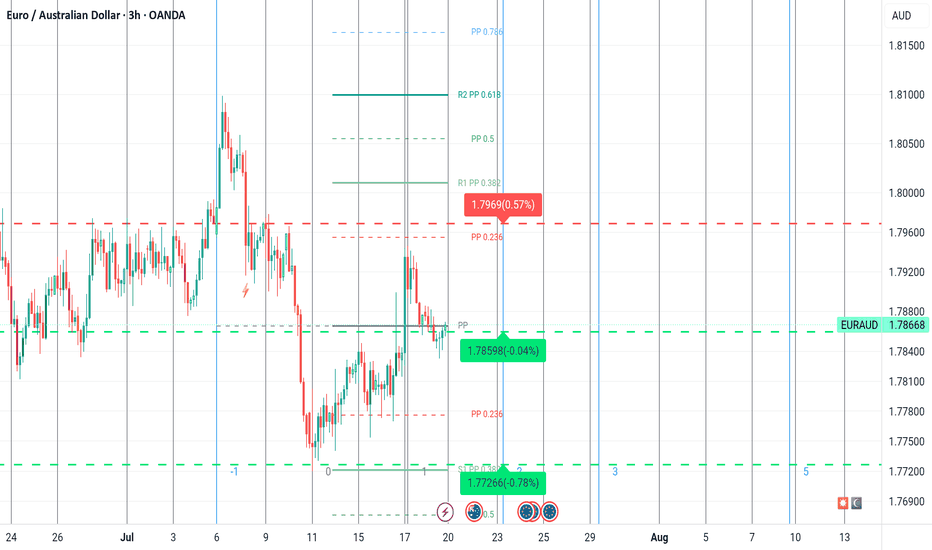

FX Setup of the Day: EURAUD SELL ZONEHey traders 👋

📌 SELL / EURAUD – Technical Breakdown

🟢 Entry: 1.78579

🎯 Target 1: 1.78304

🎯 Target 2: 1.78026

🎯 Target 3: 1.77636

🔴 Stop Loss: 1.79039

📈 Risk/Reward Ratio: 2.00

I’ve carefully validated these levels and crafted a clean, focused analysis for you.

Every like seriously fuels my drive to produce more top-tier content 📈

Your support genuinely means a lot to me.

Thanks from the heart to everyone showing love 💙

🎯 Clear targets, solid strategy.

🤝 Let’s move forward with logic and discipline.

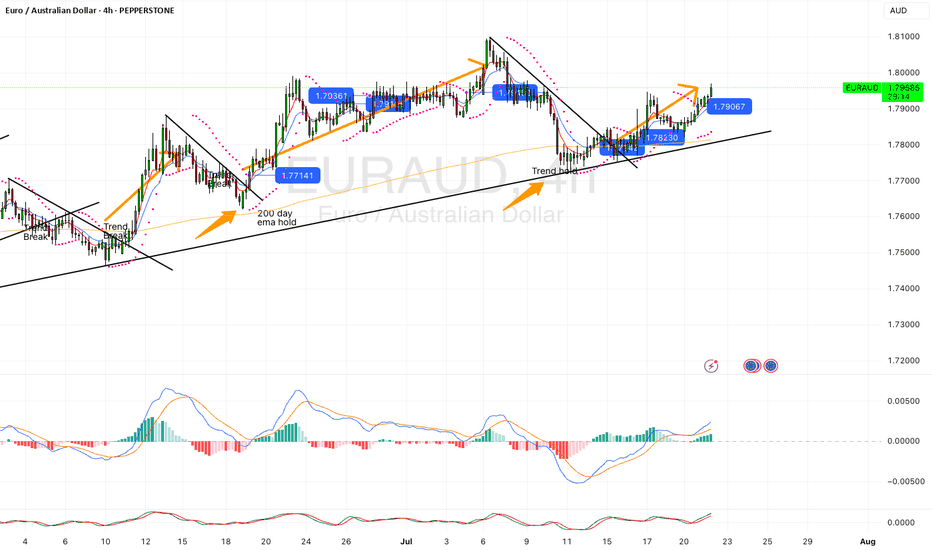

EURAUD → Correction for accumulation before growthFX:EURAUD reaches the zone of interest during a correction and forms a false breakdown of local support. Traders can switch to the buy side to support the trend.

Against the backdrop of a global bullish trend and a correction in the euro, the currency pair is following this movement, the essence of which is to consolidate funds for further growth. Liquidation is forming in relation to the liquidity zones of 1.785, 1.78, and 1.773, and the market imbalance is changing. The current movement is bringing the price to the zone of interest: the liquidity area of 1.773 and the order block. The capture of liquidity relative to 1.773 leads to the formation of a false breakdown and a pullback to the area of interest for buyers. Accordingly, price consolidation above 1.776 and 0.7 Fibonacci could support the main trend and allow the price to strengthen.

Support levels: 1.776, 1.773, 1.763

Resistance levels: 1.786, 1.795

The euro clearly demonstrates an upward trend, the structure of which has not been broken during the correction. Correction is a perfectly healthy movement within a trend, allowing positions to be opened at more favorable prices. If the bulls hold their defense above 1.776, momentum towards the specified targets may form.

Best regards, R. Linda!

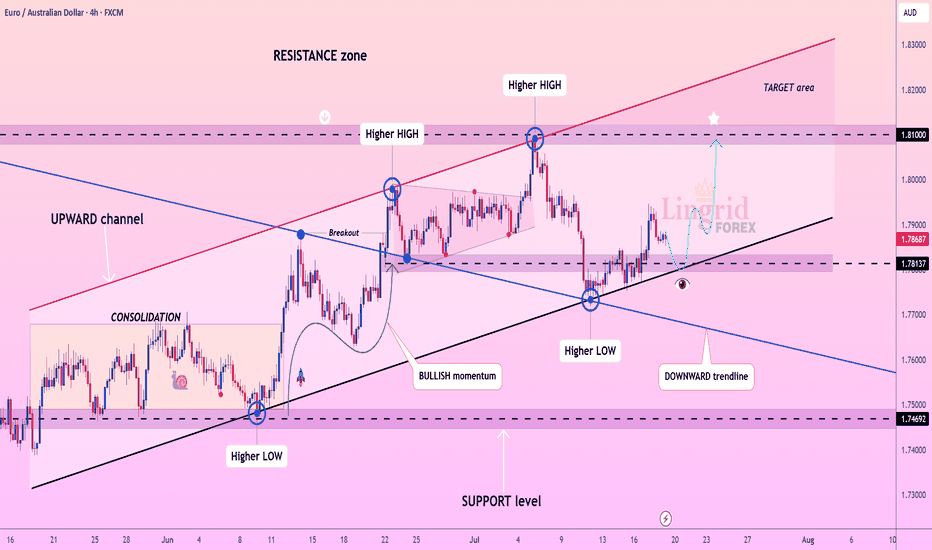

Lingrid | EURAUD Potential Retest of the Key LevelFX:EURAUD is holding firmly above the rising trendline after a successful retest of the support zone at 1.7813. The price has formed consecutive higher lows and remains within a well-defined upward channel, indicating continued bullish structure. A small corrective pullback is expected before a renewed rally toward the 1.8100 resistance level. Momentum is building for a potential breakout continuation toward the upper boundary of the channel.

📉 Key Levels

Buy trigger: Bounce from 1.7813 and reclaim of 1.7900

Buy zone: 1.7820–1.7880

Target: 1.8100

Invalidation: Breakdown below 1.7780 and support trendline

💡 Risks

Failure to hold above the current higher low

False breakout followed by bearish rejection from the mid-range

Weak momentum due to macroeconomic uncertainty

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!