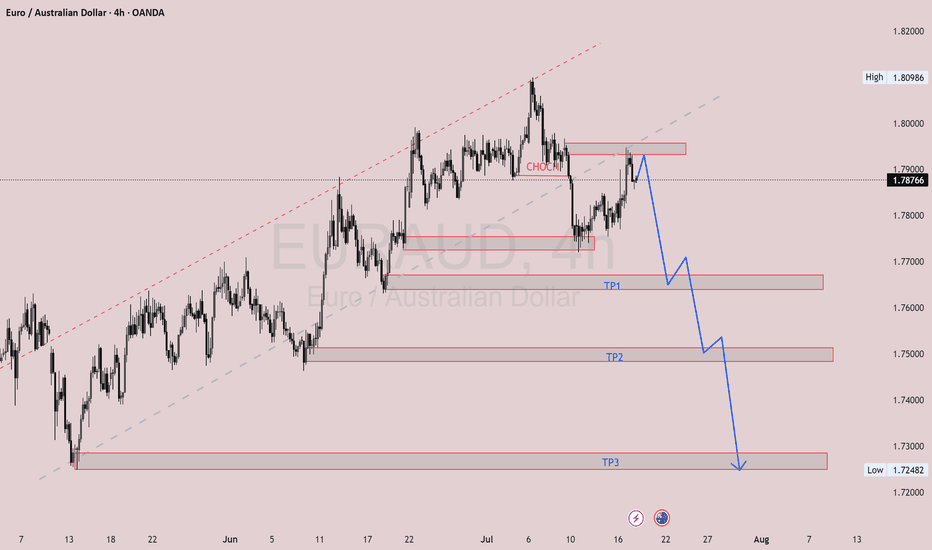

EURNZDThis is a chart of EURNZD on the 4H timeframe. Here's what it shows and what you can post:

Analysis:

- CHoCH (Change of Character) shows a shift from bullish to bearish structure.

- Price retested the supply zone after CHoCH.

- Now it's reacting downwards from that area.

- Two Take Profit zones (TP1 and TP2) are clearly marked as price targets.

What to do:

- Look for sell entries below the retest zone.

- Set your targets at TP1 and TP2.

- Confirm with lower timeframe structure or candlestick patterns before entering.

"EURNZD analysis — Bearish bias confirmed after a clear CHoCH and retest of the supply zone. Watching for sell setups down to TP1 and TP2. Patience and precision is key. 📉🔥 #ForexTrading #SmartMoney #EURNZD #PriceAction"

EURAUD trade ideas

EURNZDThis is a chart of EURNZD on the 4H timeframe. Here's what it shows and what you can post:

Analysis:

- CHoCH (Change of Character) shows a shift from bullish to bearish structure.

- Price retested the supply zone after CHoCH.

- Now it's reacting downwards from that area.

- Two Take Profit zones (TP1 and TP2) are clearly marked as price targets.

What to do:

- Look for sell entries below the retest zone.

- Set your targets at TP1 and TP2.

- Confirm with lower timeframe structure or candlestick patterns before entering.

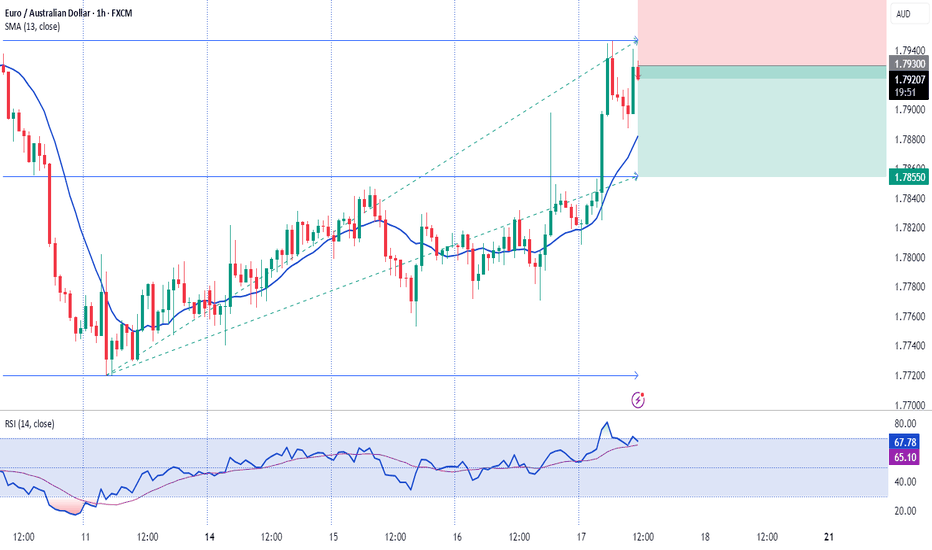

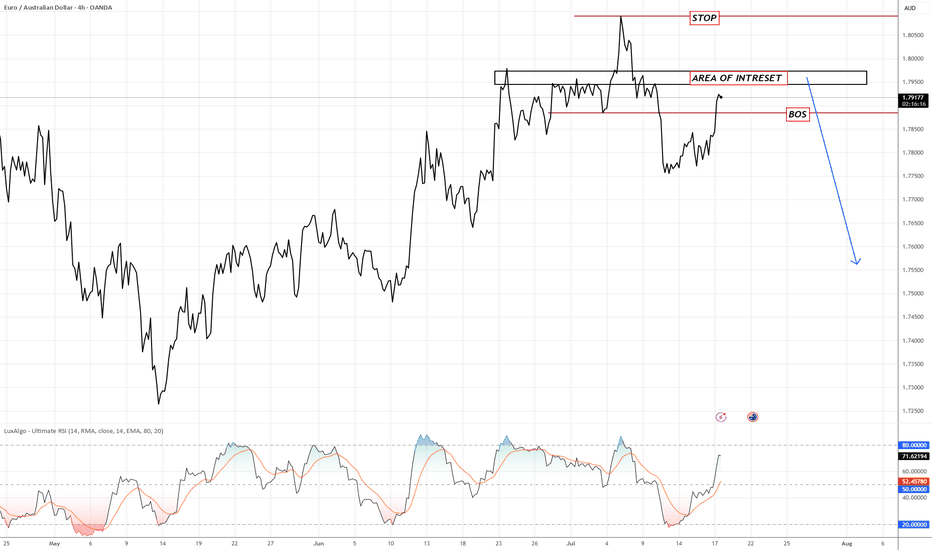

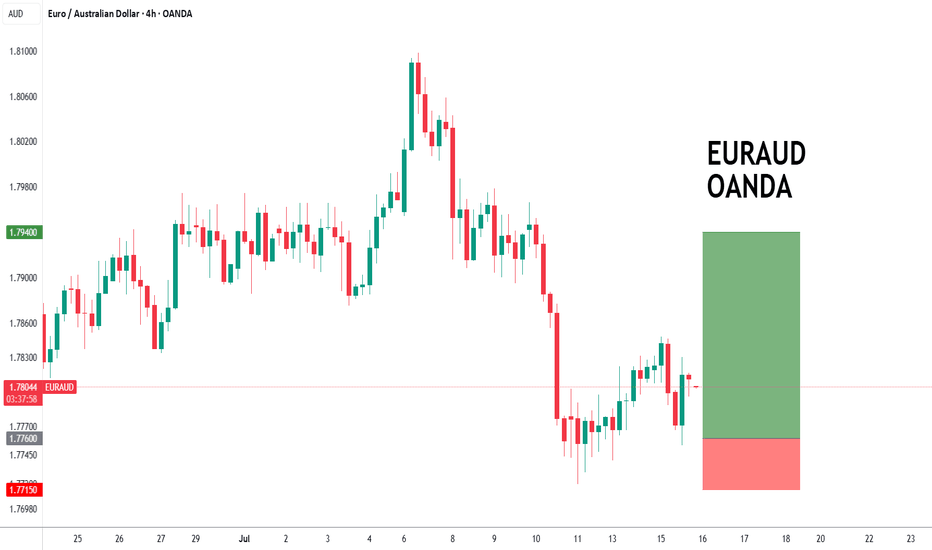

EURAUDWe're approaching a high-probability area of interest just below 1.7950. Price recently created a Break of Structure (BOS) at 1.7870 and is now retesting that broken structure zone.

📌 Key Levels:

Entry Zone (AOI): 1.7920 – 1.7950

Stop Loss: 1.8020 (above recent highs)

Target: 1.7665 – swing low support

💡 Expecting a rejection from the supply zone and continuation of the bearish move.

Confluence:

BOS confirmation

RSI overbought

Weak Euro sentiment fundamentally vs AUD strength from commodities

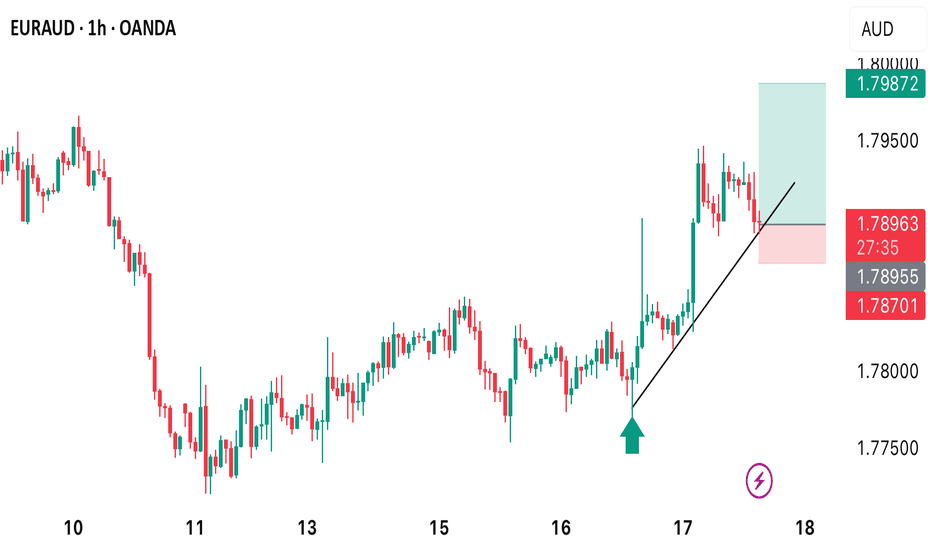

#009: EUR/AUD Long Investment Opportunity

We placed a buy limit order at 1,776, waiting for a bearish spike that would allow us to enter alongside the institutions, not against them.

Why this entry?

🔻 We're waiting for a false breakout at 1,776, a key level where big players are accumulating liquidity with technical stop hunts.

🔐 The SL is below the levels where banking systems have protective orders for the future.

📊 Retailers are still heavily short and aren't exiting, confirming that the upside movement hasn't started yet.

📈 Open interest shows anticipation of an imminent breakout, with progressive loading by large players.

⏳ We're staying out now to avoid being victims of the retracement, but ready to enter on the institutional bearish spike.

A violent expansion toward 1.79, with a directional candlestick that will start as soon as the retail cleanup below 1.776 is completed.

The trade has all the hallmarks of a perfect institutional entry: early positioning, patience, and a defensive stop.

MarketBreakdown | EURAUD, GBPJPY, WTI CRUDE OIL, SILVER

Here are the updates & outlook for multiple instruments in my watch list.

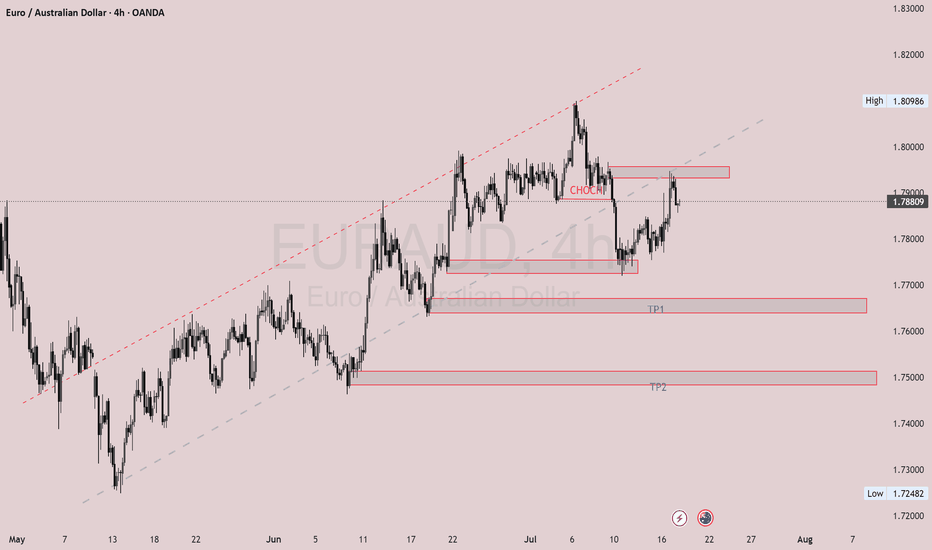

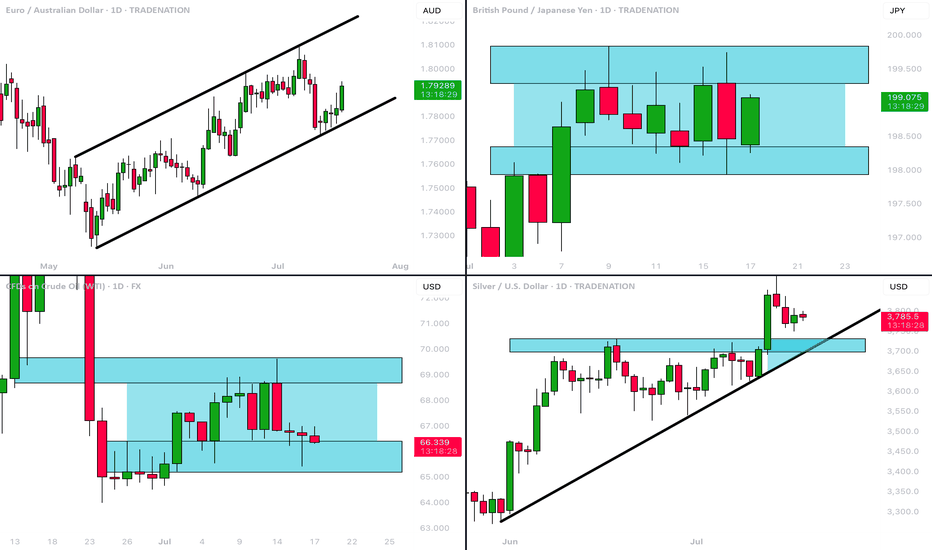

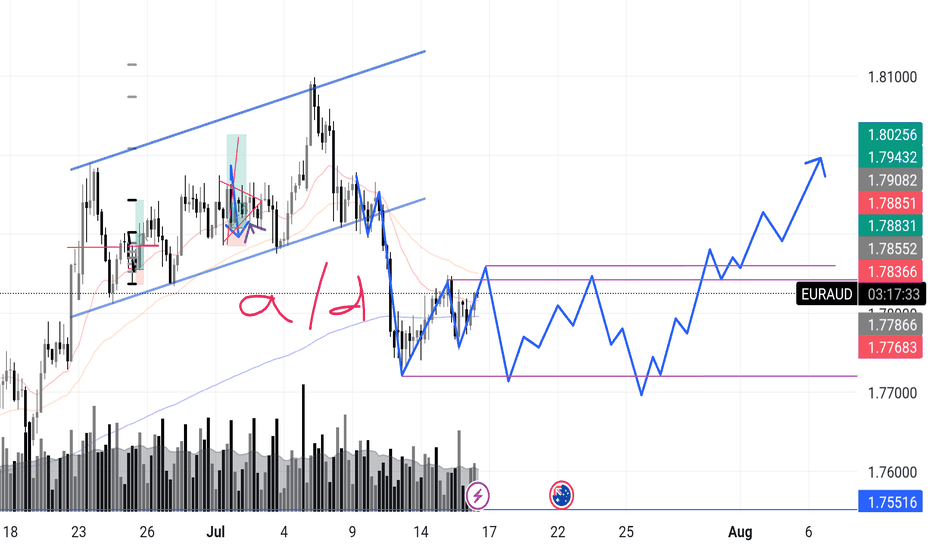

1️⃣ #EURAUD daily time frame 🇪🇺🇦🇺

The market is trading in a bullish trend.

The price is steadily growing within a rising parallel channel.

A recent test of its support triggered a strong bullish reaction.

I think that a rise may continue at least to a current high - 1.8035

2️⃣ #GBPJPY daily time frame 🇬🇧🇯🇵

The market is consolidating within a narrow horizontal

parallel channel.

Consider consolidation, trading within its boundaries.

The next bullish wave will be confirmed with a breakout and a

daily candle close above its resistance.

3️⃣ CRUDE OIL #WTI daily time frame 🛢️

The market remains weak and consolidation continues.

I see a wide horizontal range where the price is now stuck.

I think that we may see a pullback from its support.

4️⃣ #SILVER #XAGUSD daily time frame 🪙

The market is retracing after a formation of a new higher high.

I see a strong demand zone ahead: it is based on a rising trend line

and a recently broken horizontal resistance.

The next trend following movement will most likely initiate from there.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

If confirmed, this could be a strong trigger to enter shortIf the euro is indeed set to weaken — as we anticipate based on the current signs of trend exhaustion — this could be a solid trigger for a short position.

However, if the breakout fails to confirm, it may turn out to be a fakeout, potentially leading to a bullish reversal instead

EURAUD SELL IDEAWe can only anticipate sells if price breaks out of the trendline,there has been rejection already on H4 due to a reaction from breakerblock.

EURAUD still looks bearish internally and if you look closely you will notice price is forming an expansion

But if price keeps keeps the bullish run which I doubt,we can anticipate the bullish move to continue as it has hit the 3rd touch on the trendline

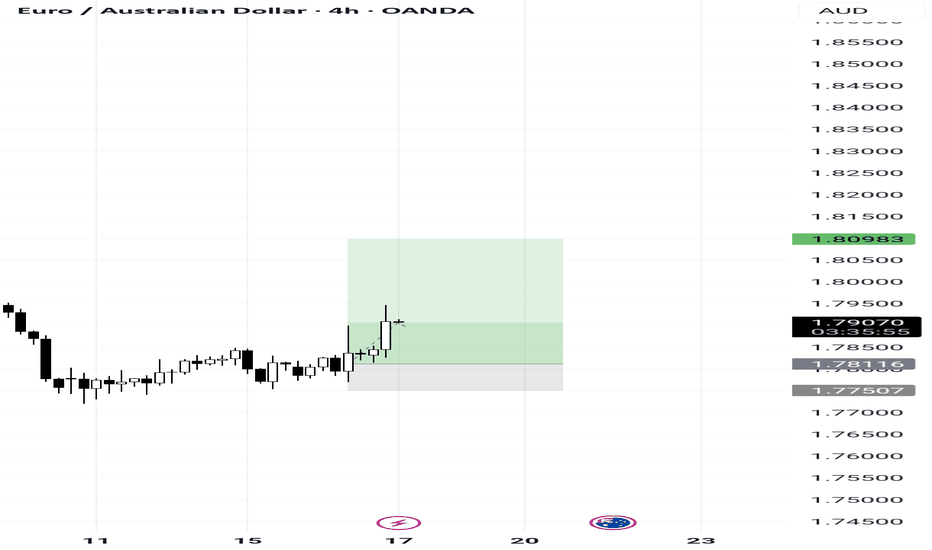

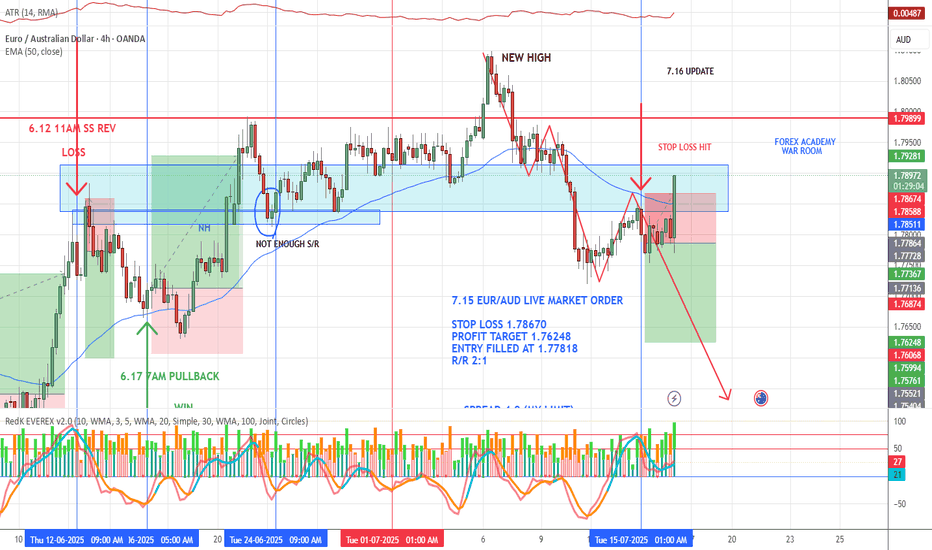

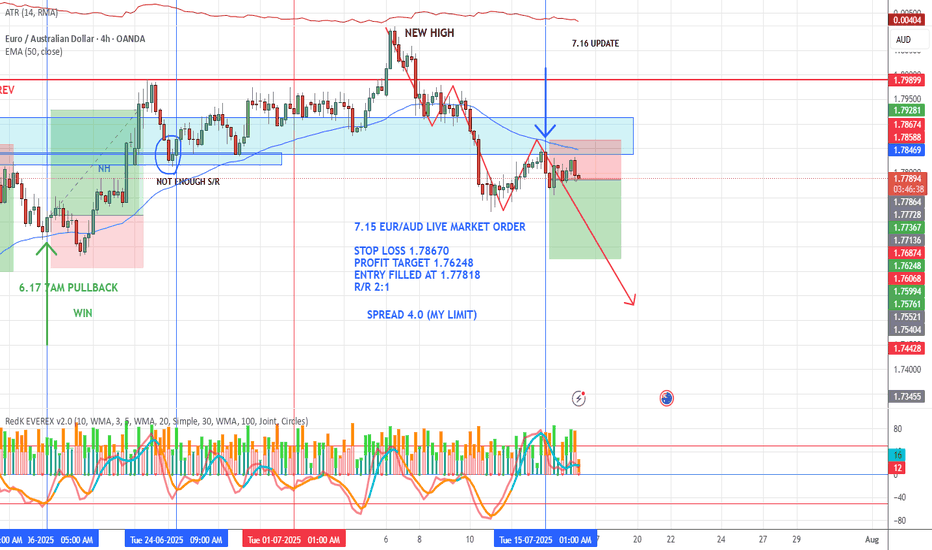

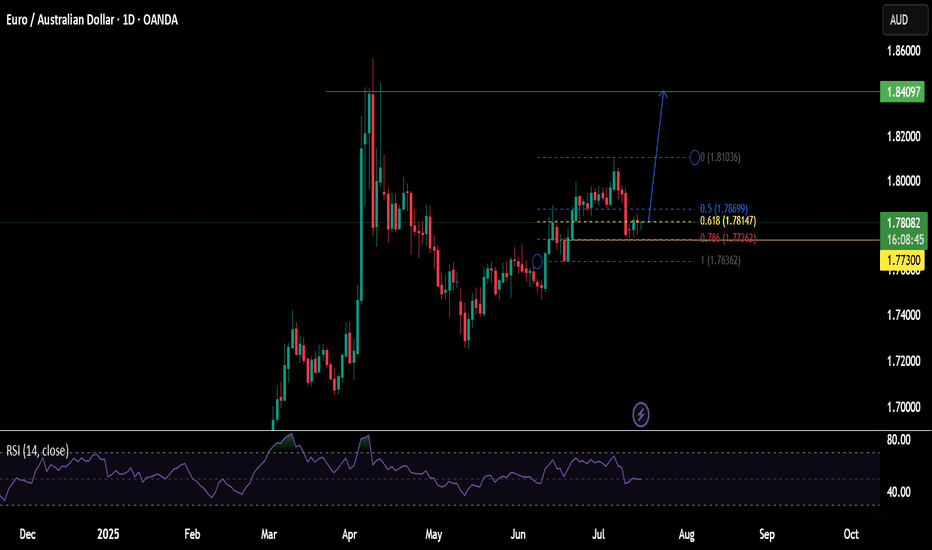

EURAUD 4H Chart DownsideI expect further downside for EURAUD.

Ideally, I´d prefer the current upside correction to reach 50% pullback (at 1.79088).

Intermediate targets are the green zones which served as resistance & support levels during the uptrend, and final target is the blue zone close to the May pivot low.

EUR/AUD – Next impulsive leg in playHello traders,

Fascinating PA over the last few weeks. PA came from in impulsive phase (HTF) and formed currently the corrective phase. PA stagnated for a while before it dropped towards the downside, completed its trend with 3 drives (ending structure). It currently forms the second continuation. PA closed still bullish on the 4H. However. PA wicked with full PA through an area of interest, which could mean that orders are being filled and PA is ready to go towards the downside.

If it commits I'm looking for multiple scale-ins and targeting the 90% - rule of the whole pattern.

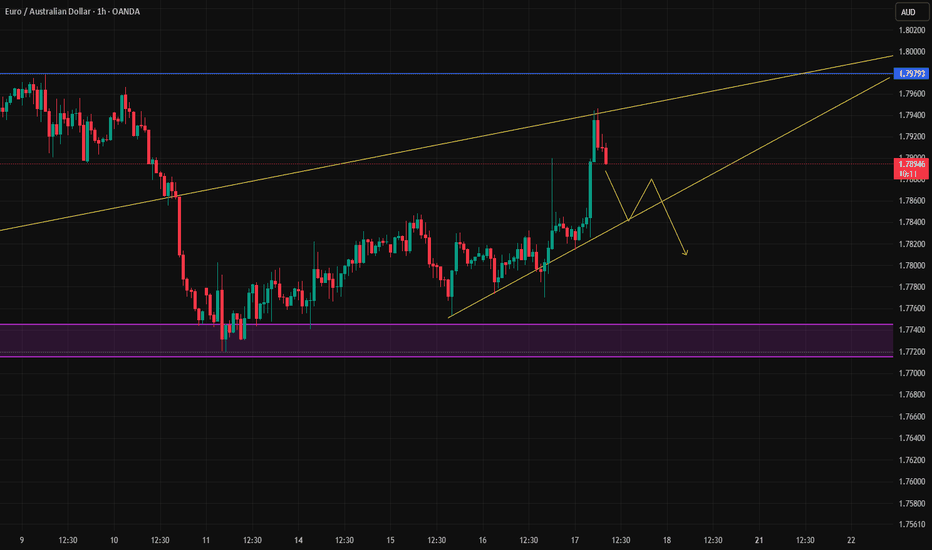

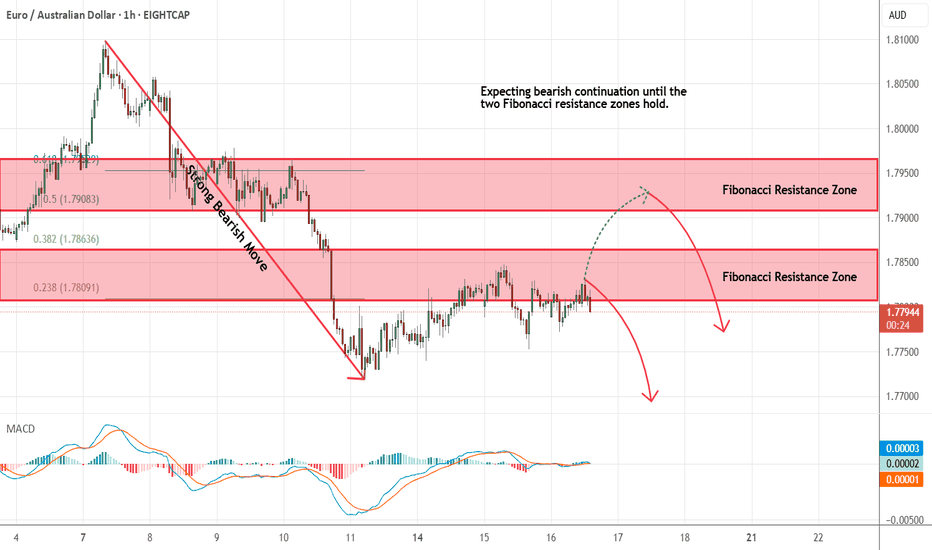

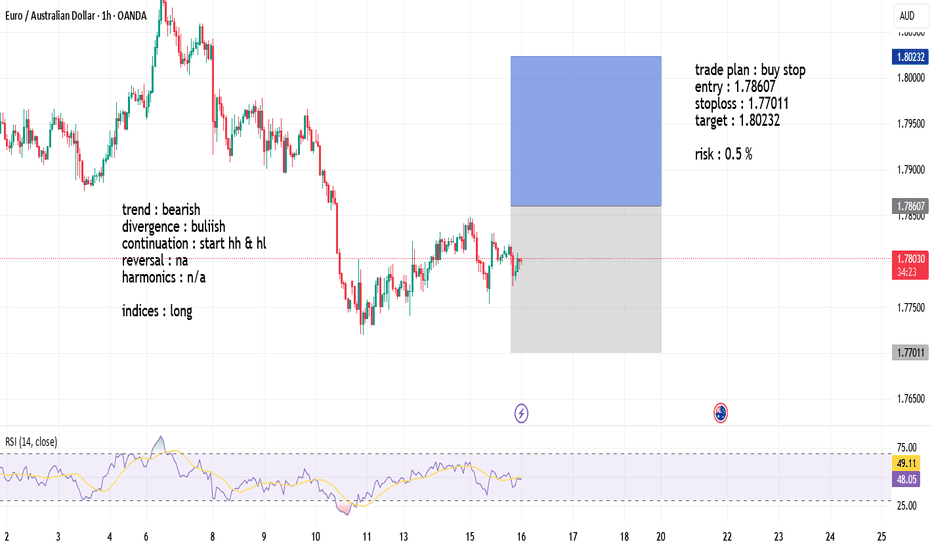

EURAUD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

EURAUD – Incoming Upthrust? Accumulation or Distribution? Chart Context:

EURAUD recently completed a sharp markdown after a textbook rising channel break. What’s interesting now is that price has entered what looks like a potential box range between 1.7768 and 1.7885.

I'm anticipating a possible upthrust move into the 1.788x zone — and what follows will reveal the true intent.

Here’s the internal debate:

Are we looking at reaccumulation — smart money trapping shorts before driving higher in line with broader money flow?

Or is this a distribution — where the market builds a false sense of support before deeper downside?

🔍 What tips the scale for now is this:

>The overall money flow direction (via volume patterns + structure) has leaned bullish, so I’m favoring accumulation with a shakeout scenario.

Signs I’m watching:

✅ Absorption volume near the bottom of the range

✅ Higher lows inside the zone

✅ Fake breakout / upthrust into prior structure

❌ Failure to hold above 1.7855 could flip the bias short-term

📉 Expecting one more dip to test demand, followed by range tightening, and if buyers show up strong — the breakout can get explosive.

What’s your take?

Are we prepping for a markup or will this fakeout and roll over?

"I go long or short as close as I can to the danger point, and if the danger becomes real, I close out and take a small loss"

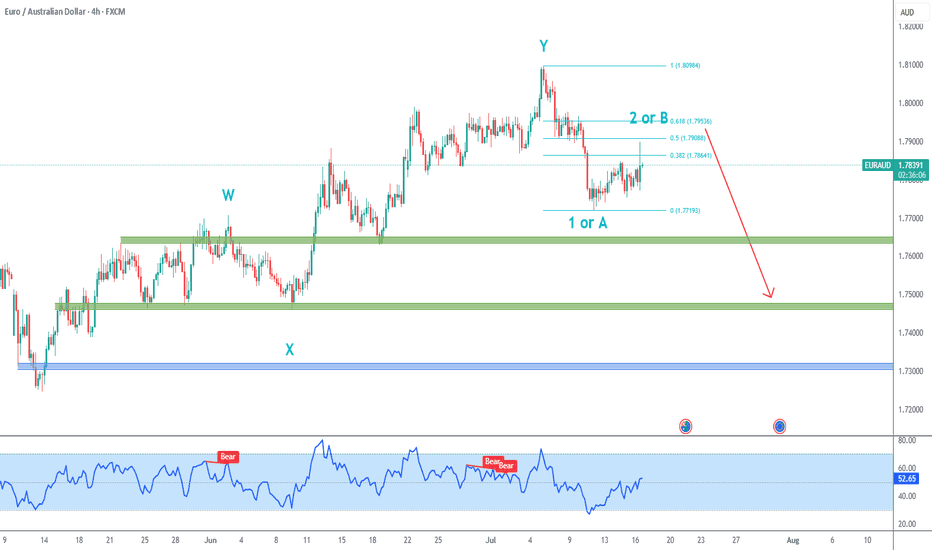

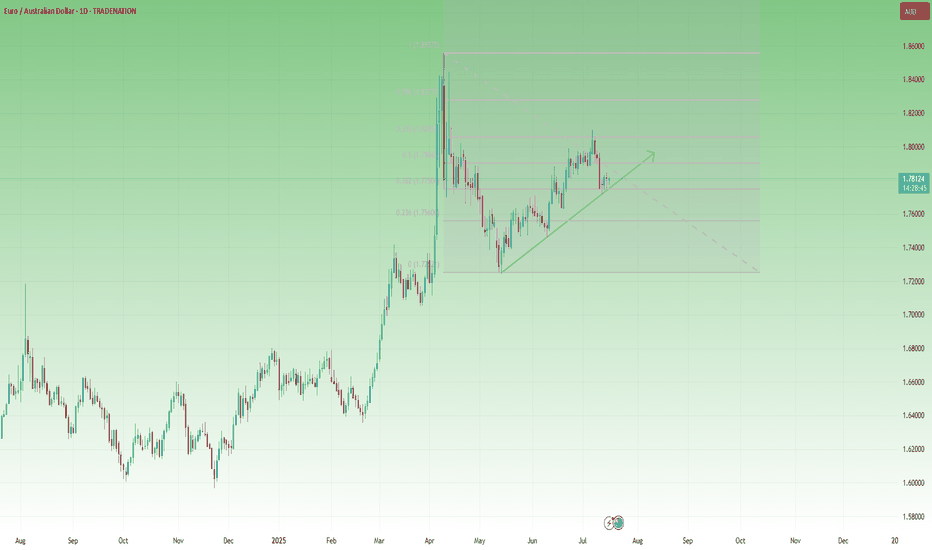

EURAUD Flag Forming Below 1.80 – Time to Sell the Rally?📈 The Big Picture

In mid-February, EURAUD exploded to the upside, gaining over 2000 pips in just two weeks. After peaking near 1.85, the pair corrected sharply, returning to more balanced levels around 1.72.

🕰️ What’s happened since?

The market has resumed its climb and just recently made a new local high at 1.81. On the surface, it looks like bulls are still in control – but a closer look reveals warning signs.

🔍 Key structure observations:

• The current rally appears to be a measured move, topping out near the 61.8% Fibonacci retracement of the previous drop

• Price structure is overlapping, suggesting weak momentum

• A large flag pattern is developing – typically bearish in this context

• The pair still trades above the ascending trendline, but a breakdown is looming

📍 Current price: 1.7805

🎯 Swing Trade Plan

From a swing trading perspective, I’m looking to sell rallies near the 1.80 zone, with:

• Negation: if the price breaks clearly above the recent high

• Target: the recent low around 1.7250 – where the last correction ended

________________________________________

📌 Conclusion:

EURAUD may have exhausted its bullish energy. The technical picture suggests we are in the late stage of the rally, with bearish patterns stacking up. Unless bulls manage a clean breakout above 1.80, this looks like a great place to position for a medium-term reversal. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EURAUD BUY?Market is overall bullish on daily and weekly. Based on 4HR TF, the market is reacting to daily FIB area.

We could see BUYERS coming in strong should the current level hold.

Disclaimer:

Please be advised that the information presented on TradingView is solely intended for educational and informational purposes only.The analysis provided is based on my own view of the market. Please be reminded that you are solely responsible for the trading decisions on your account.

High-Risk Warning

Trading in foreign exchange on margin entails high risk and is not suitable for all investors. Past performance does not guarantee future results. In this case, the high degree of leverage can act both against you and in your favor

EURAUD forming a bottom?EURAUD - 24h expiry

The primary trend remains bullish.

The selloff has posted an exhaustion count on the daily chart.

Preferred trade is to buy on dips.

Risk/Reward would be poor to call a buy from current levels.

Bespoke support is located at 1.7760.

We look to Buy at 1.7760 (stop at 1.7715)

Our profit targets will be 1.7940 and 1.7970

Resistance: 1.7875 / 1.7950 / 1.8000

Support: 1.7750 / 1.7715 / 1.7670

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.