EUR/CAD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

EUR/CAD pair is trading in a local downtrend which know by looking at the previous 1W candle which is red. On the 1H timeframe the pair is going up. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 1.542 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURCAD trade ideas

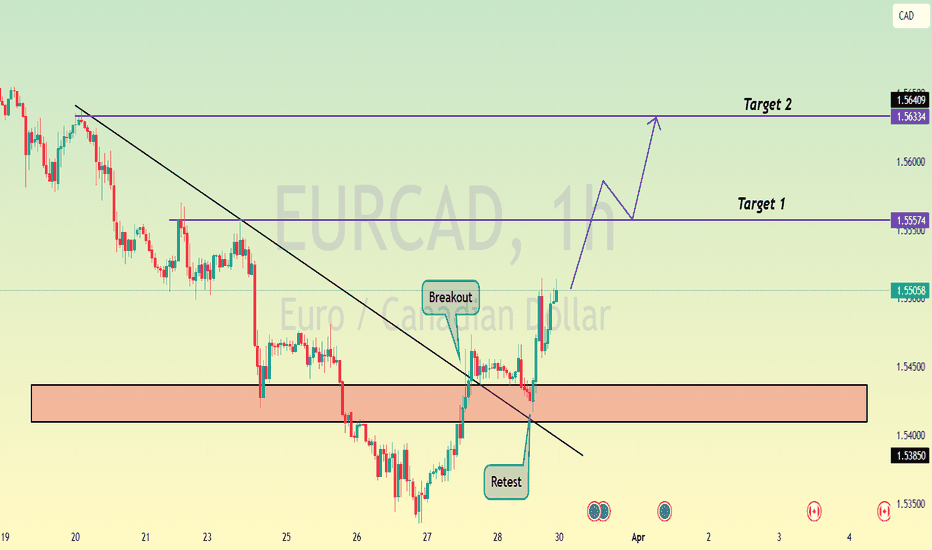

EURCAD , Successful Trendline Break , Ready for BullHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

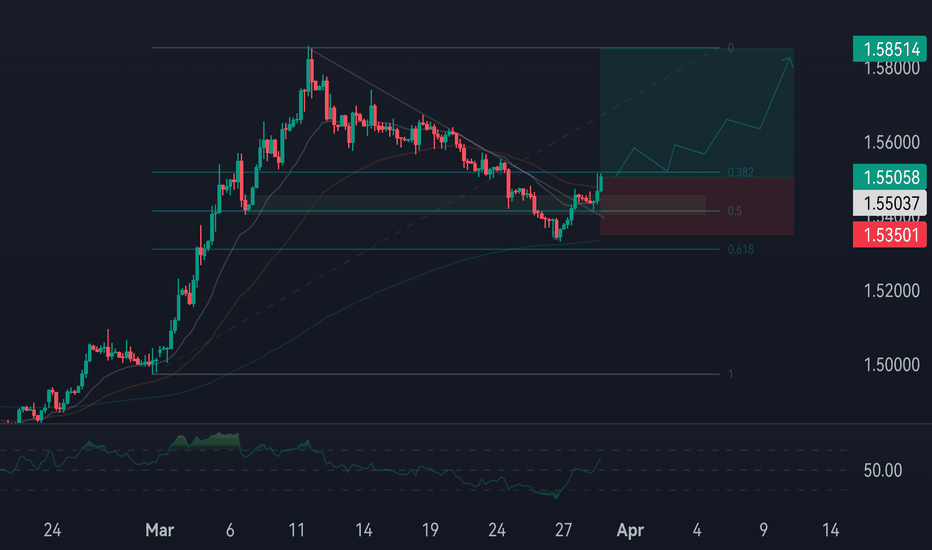

EURCAD Massive Long! BUY!

My dear subscribers,

EURCAD looks like it will make a good move, and here are the details:

The market is trading on 1.5441 pivot level.

Bias - Bullish

My Stop Loss - 1.5341

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.5603

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

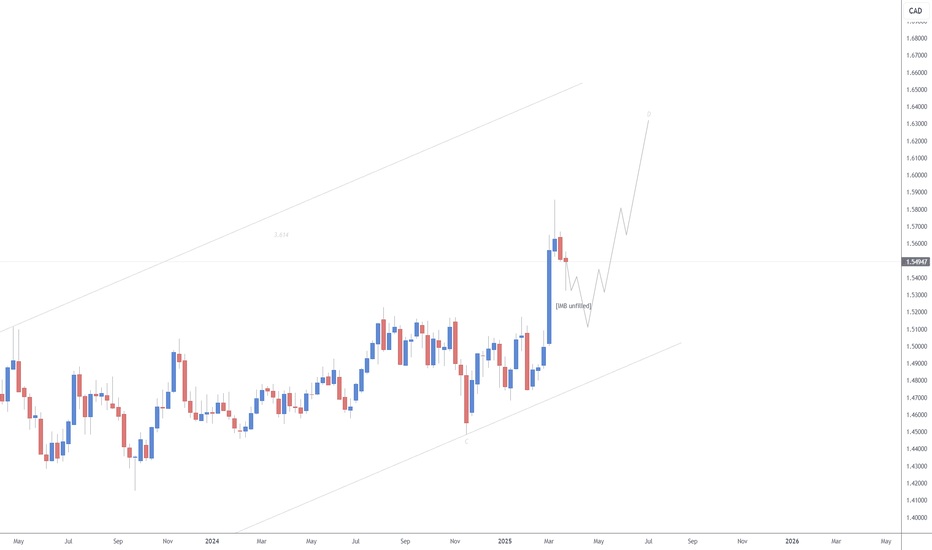

Break of Structure happen on EUR/CADIn 12 March 2025, Bank of Canada announced overnight rate same as forecast result which is 2.75%. While 18 March 2025, Consumer price index seem increase different 0.5% from forecast result. Both also have a good impact to the Canada currency. From the chart, we saw the break of structure happen, currently pending for the reversal and confirmation.

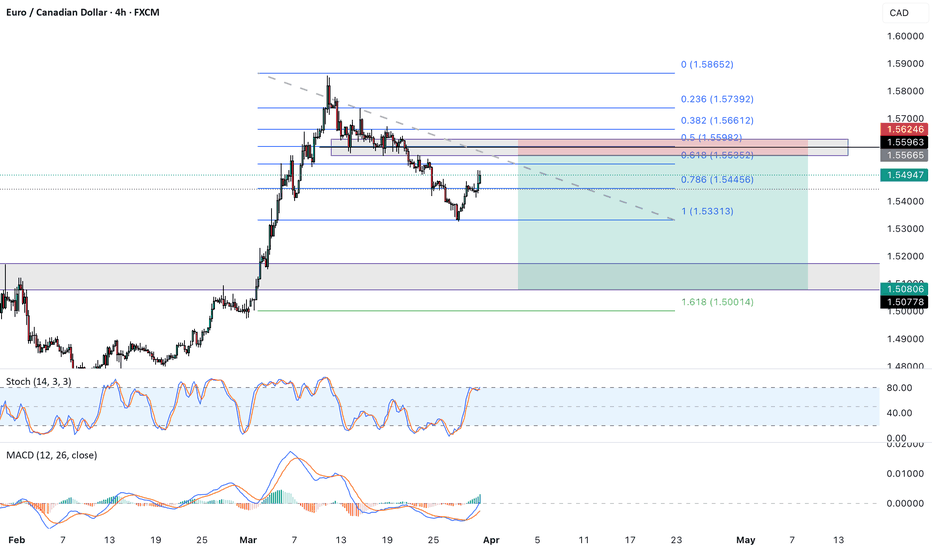

EURCAD Long Bias ! chart shows a potential buy setup after a pullback. Price found support around 1.5350, which lines up with key Fibonacci levels, making it a strong area for a possible bounce. Buyers have stepped in, pushing the price back above 1.5500. The idea here is to target 1.5850 while keeping a stop loss below 1.5350. As long as price stays above 1.5500, the bullish outlook makes sense. But if it drops below 1.5350, the setup could fail, leading to more downside. The overall momentum suggests a good chance of continuation upwards.

EURCAD trend trading through 12M chart analysis to daily t f EURCAD as shown strong move to the upside by considering higher tf trend EURCAD is much alikely to buy but due to the liquidation move possibly it will start sell at 1.58429 it will depend on buy move and confirmation we will get at such area

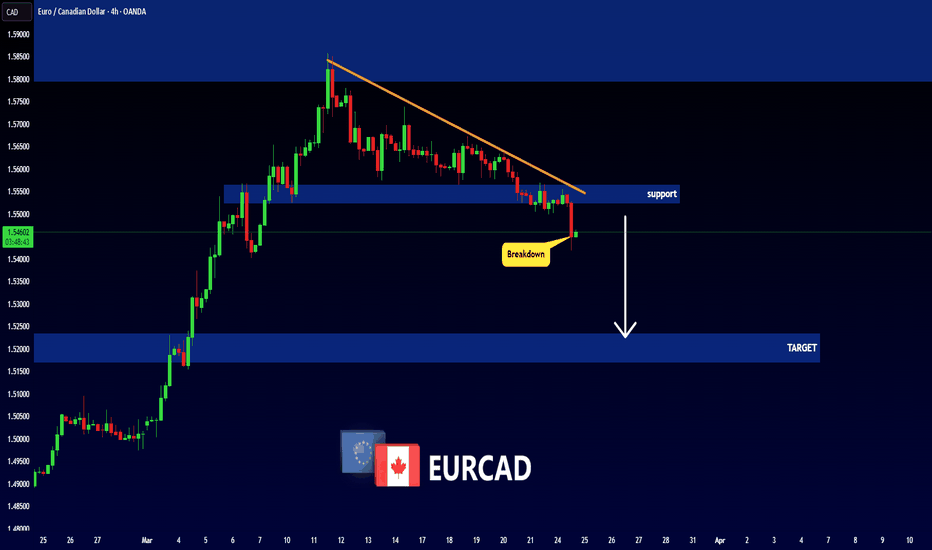

EURCAD Bearish OutlookHere is my Analysis for the EURCAD Outlook for the coming weeks.

Price is approaching correctively to the Lower time frame 0.618-0.500 level or Golden ratio, expecting the price would react on that Sell Zone as illustrates in the chart.

Expecting price to drop from the Sell Zone area towards the Higher time frame 0.618-0.500 level or Golden ratio where we would be expecting a potential Long-term Bullish Outlook.

EURCAD Resistance , All eyes on SellingHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Bearish reversal off pulback resistance?EUR/CAD is rising towards the resistance level which is a pullback resistance that line sup with the 38.2% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.5548

Why we like it:

There is a pullback resistance level that line sup with the 38.2% Fibonacci retracement.

Stop loss: 1.5695

Why we like it:

There is a pullback resistance level that line sup with the 71% Fibonacci retracement.

Take profit: 1.5340

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Downside movement for EURCAD !! The EUR/CAD pair is currently respecting the SBR zone, meaning the price has reached a key resistance level and is struggling to break above it. This suggests that sellers are actively defending this zone, causing the price to either consolidate or potentially reverse downward.

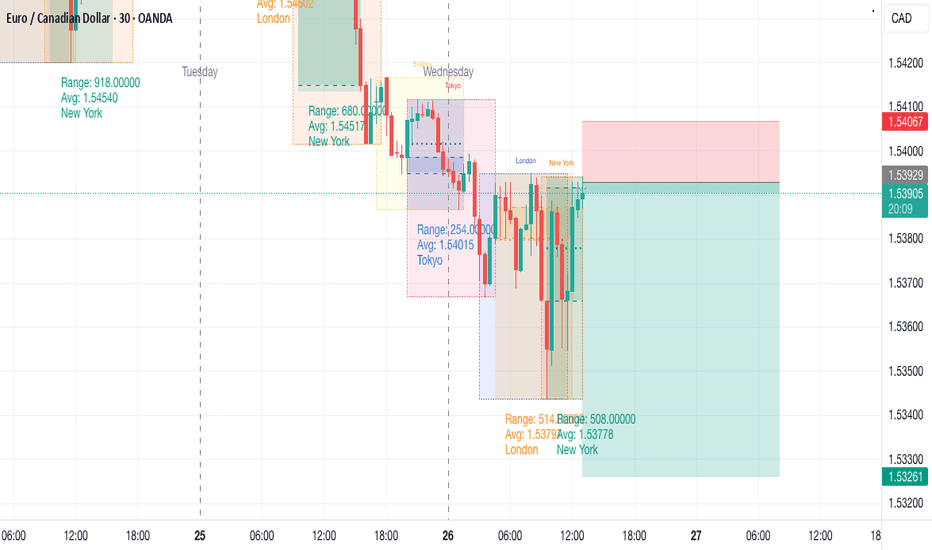

Forex Traders Focus on Trump’s Tariff NewsForex Traders Focus on Trump’s Tariff News

As April 2 approaches—the date when Trump's international trade tariffs are set to take effect—traders are increasingly concentrating on this highly uncertain issue.

Yesterday, the U.S. president stated that:

→ Tariffs on cars would be introduced "soon" (but not all possible tariffs would be imposed);

→ Some countries might receive exemptions;

→ Nations purchasing oil from Venezuela could face 25% tariffs.

Following these remarks:

→ Oil prices rose;

→ U.S. stocks gained as Wall Street (according to Reuters) interpreted the comments as a sign of flexibility in trade negotiations.

Given this backdrop, the EUR/CAD chart is particularly interesting, as both Europe and Canada frequently feature in news related to the White House's trade policies.

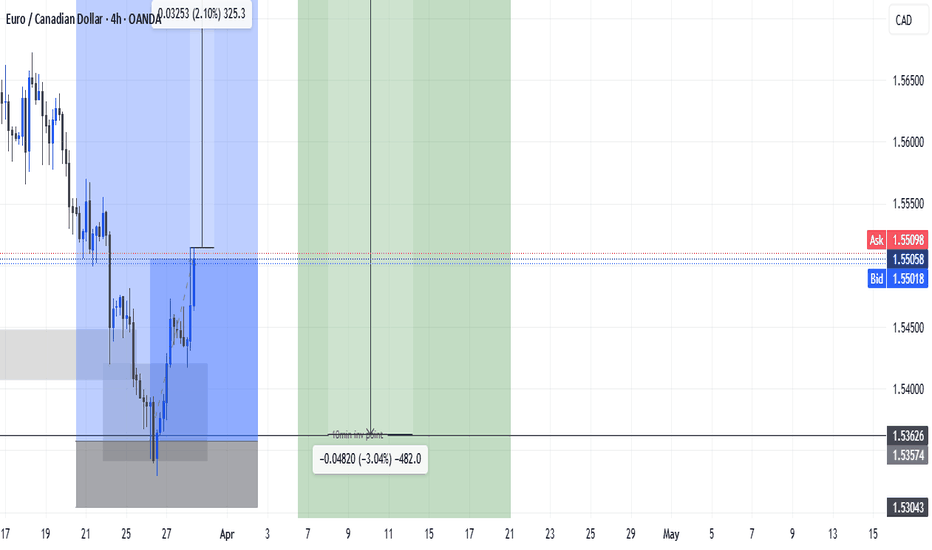

EUR/CAD Exchange Rate Today

As seen on the EUR/CAD chart, the pair has slightly declined at the start of the week, dipping towards 1.54450. However, market volatility remains high:

→ The pair has gained approximately 2.85% since early March;

→ The decline from March’s peak is around 2.6%.

Technical Analysis of EUR/CAD

The pair’s volatile price swings have formed a trend channel (marked in blue).

Notably, the 1.57750 level has shifted from support to resistance, signalling bearish dominance. This is further reflected in the price movement within the red channel. If bears maintain control, EUR/CAD may drop towards a support zone, which includes:

→ The median of the blue channel;

→ The 1.54000 support level, drawn from early March’s local low.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.