EURCAD - Weekly Resistance Might Shift The Momentum!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURCAD has been overall bullish trading within the rising channel marked in blue. However, it is currently approaching the upper bound of the channel.

Moreover, the red zone is a strong weekly resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper blue trendline and resistance.

📚 As per my trading style:

As #EURCAD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCAD trade ideas

EUR_CAD GROWTH AHEAD|LONG|

✅EUR_CAD went down to retest

A horizontal support of 1.5964

Which makes me locally bullish biased

And I think that a move up

From the level is to be expected

Towards the target above at 1.6040

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCAD MAY RETEST ALL-TIME-HIGH AGAIN If you look at this very closely, you would see that the monthly candle of June 2025 already closed above June 2020 after 5 years exactly. That was very instructive. However, there may be opportunities for sell as counter trade as we are currently seeing some rejections that can be seen more clearly in lower timeframes.

Nevertheless, I am ultimately bullish and would be looking to buy to that 1.75 zone in the near-future, depending on the price action I am seeing on the daily.

Let us see if daily is in perfect alignment with the monthly.

Trade with caution!!!!

EUR/CAD Bears are getting strongerHI Traders.

I think when we develop more LTF correction there is a good chance that we will at least reach the buttom of the structure. I havent entered the posiition yet because i was already envolved in a EUR PAIR. But this is running in profit so i consider to enter one more when the setups plays out.

SELL EURCAD for bullish divergence trend reversal STOP LOSS: 1.6SELL EURCAD for bullish divergence trend reversal STOP LOSS: 1.6048

Regular Bearish Divergence

In case of Regular Bearish Divergence:

* The Indicator shows Lower Highs

* Actual Market Price shows Higher Highs

We can see a strong divergence on the MACD already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this level resistance so we are looking for the trend reversal and correction push from here .....

TAKE PROFIT: take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything

Remember to risk only what you are comfortable with........trading with the trend, patient and good risk management is the key to success here

EURCAD DISCLAIMER: I am not a financial adviser. those videos and posts on my channel are for educational and entertainment purposes ONLY. I'm documenting my trading journey so that you have the potential to take ideas and inspiration from the videos that may help you within your own journey. But remember, trading/investing of any kind involves risk. Your trading/investments are solely your responsibility .

EURCAD Will Grow! Long!

Please, check our technical outlook for EURCAD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 1.603.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 1.623 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

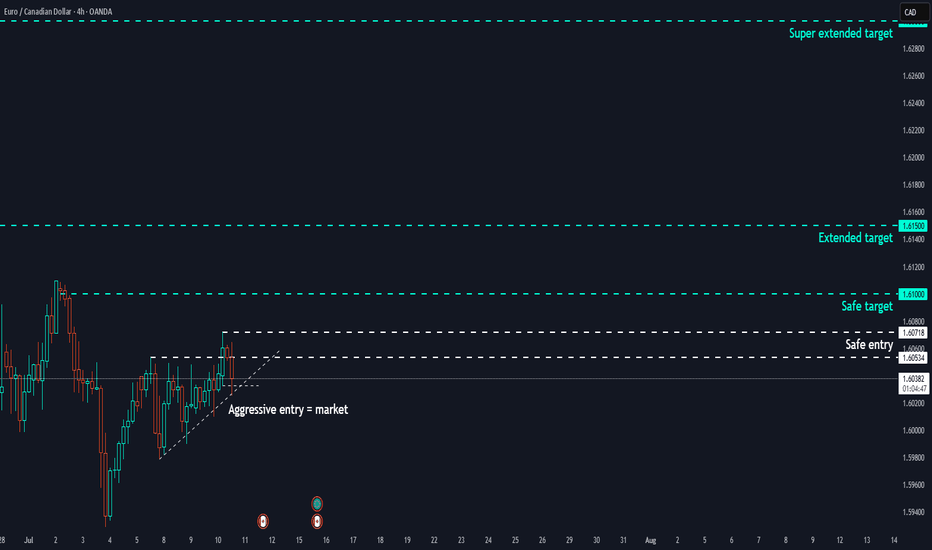

EURCAD - Long Bias explanation and Entry/SL/TP ideasThe main reasons this seems like a very good opportunity to me are :

Trend : EURCAD is in a strong uptrend at the moment

Retail : Majority have a BEARISH sentiment on this pair

Institutions : More holdings in EUR than CAD

Structures : Equal highs up above that MAY act as a magnet

Price action : Recent breakout of a consolidation and resistance shelf

Targets : levels at round numbers

Stops : Many options to place stops below

Entries : Many options in terms of entry aswell

This is primarily for me as a reference in the future.

For educational purposes only

EURCAD - Long Bias explanation and Entry/SL/TP ideasThe main reasons this seems like a very good opportunity to me are :

Trend : EURCAD is in a strong uptrend at the moment

Retail : Majority have a BEARISH sentiment on this pair

Institutions : More holdings in EUR than CAD

Structures : Equal highs up above that MAY act as a magnet

Price action : Recent breakout of a consolidation and resistance shelf

Targets : levels at round numbers

Stops : Many options to place stops below

Entries : Many options in terms of entry aswell

This is primarily for me as a reference in the future.

For educational purposes only

EURCAD BUY TRADE PLAN ✅ EURCAD TRADE PLAN

📅 **Date**: July 10, 2025

🕐 **Pair**: EUR/CAD

---

### 1️⃣ STRUCTURAL ALIGNMENT

| TF | Structure Status | Key Levels | Market Bias |

| -- | ------------------- | ------------------------------ | ----------------- |

| D1 | Bullish Trend | HH: 1.6108 / HL: 1.5910 | ✅ Bullish |

| H4 | Trend Resumption | Range Break > 1.6060 Confirmed | ✅ Bullish |

| H1 | Micro Bullish Shift | Price > 1.6040 key minor HL | ✅ Bullish (Ready) |

🧠 **Comment**: Market holding higher low structure across all TFs. Compression breakout likely underway.

---

### 2️⃣ ENTRY TRIGGER ZONE

| Parameter | Level / Zone |

| --------------- | ---------------------------------- |

| 🎯 ENTRY | **1.6025–1.6038** (retest pocket) |

| ⛔ STOP LOSS | **1.5975** (below H1 invalidation) |

| 🎯 TP1 | **1.6100** (prev swing high) |

| 🎯 TP2 | **1.6170** (measured extension) |

| 🧠 Optional TP3 | **1.6235** (macro fib proj) |

📌 **Only enter on valid wick or LTF confirmation candle inside zone.**

📉 Avoid mid-candle chases or breakout impulse entries. Let it *pull back*.

---

### 3️⃣ RISK MODEL INTEGRITY

| Metric | Value |

| ------------------- | -------------------------------- |

| SL Distance | ≈ 50-60 pips max |

| Minimum RRR | **1:2.5 to 1:3.5** |

| Break-even Protocol | Lock BE after 1H close > 1.6080 |

| Trade Invalidation | 1H Close < 1.5975 |

⚠️ Risk size calibrated to avoid breach of core portfolio risk ceiling.

---

### 4️⃣ MACRO–FUNDAMENTAL ALIGNMENT

| Macro Driver | Current Stance | Effect |

| ----------------------- | ------------------------------------------------ | ------------------- |

| 🇨🇦 CAD | Weak (Oil pressure + BOC dovish bias) | ✅ CAD Soft |

| 🇪🇺 EUR | Strong (Post-NFP euro demand + ECB hawkish tone) | ✅ EUR Strong |

| Intermarket Correlation | Oil ↓ → CAD ↓ | ✅ Pro-EURCAD |

| Macro Bias | **EUR Strength > CAD Weakness** | ✅ Bullish Alignment |

🧠 No conflict with structural plan = ✅ Macro Confirmed

---

### 5️⃣ EXECUTION PROTOCOL

* 💎 *Type*: **Limit Order** ONLY — no market chasing

* 🎯 Wait for rejection or bullish engulfing on 15M or 30M inside entry zone

* 🔒 Trail after price > 1.6080 with hourly close

* ❌ Do not trade this setup if **1.5980 is breached intraday**

---

🚫 NOT INVESTMENT ADVICE – For institutional execution only under your risk model.

EURCAD: Strong Bullish PatternObserve the price movement on 📈EURCAD.

The next buying signal will occur with a bullish breakout above the neckline of an ascending triangle pattern on the 4-hour chart.

A 4-hour candle closing above 1.6056 will confirm this breakout, with the next resistance level at 1.6105.

Second buy entry..BUY EURCAD now for a four hour time frame bulBUY EURCAD now for a four hour time frame bullish trend continuation ...............

STOP LOSS: 1.5969

This buy trade setup is based on hidden bullish divergence trend continuation trading pattern ...

Always remember, the trend is your friend, so whenever you can get a signal that the trend will continue, then good for you to be part of it

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything...

Remember to risk only what you are comfortable with... trading with the trend, patient and good risk management is the key to success here

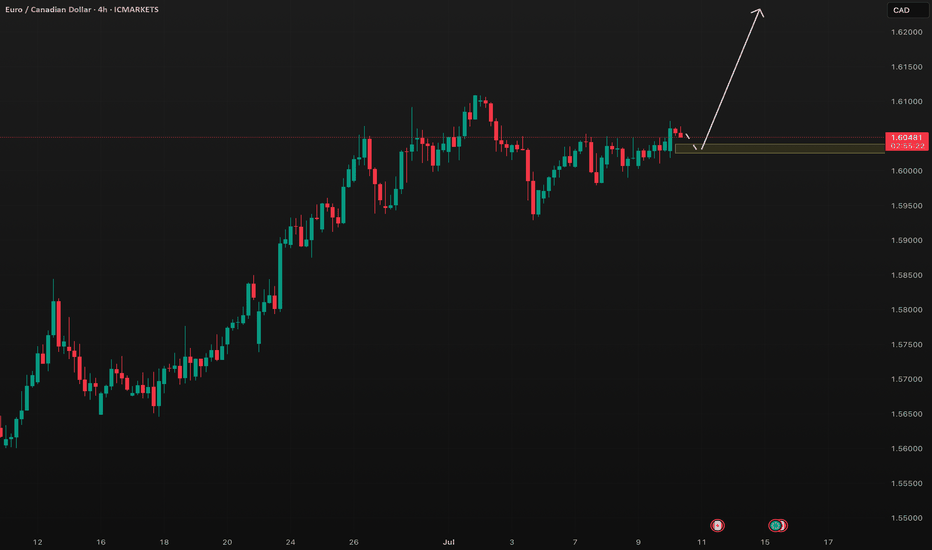

EURCAD positions for a buy! (Intraday opportunity) From what we see in H1 timeframe price is likely to trade bullish from the H1 support Level of 1.60071 technical analysis shows how price made a low at 1.59370 and a recent pullback at 1.59797 connecting the low and recent pullback gives us a nice trendline. a buy opportunity is envisaged from the current market price.

BUY EURCAD now for a four hour time frame bullish trend continuBUY EURCAD now for a four hour time frame bullish trend continuation ...............

STOP LOSS: 1.60037

This buy trade setup is based on hidden bullish divergence trend continuation trading pattern ...

Always remember, the trend is your friend, so whenever you can get a signal that the trend will continue, then good for you to be part of it

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything...

Remember to risk only what you are comfortable with... trading with the trend, patient and good risk management is the key to success here

How a Triple Breakout and Daily Reversal Signal Point to a 25%..How a Triple Breakout and Daily Reversal Signal Point to a 25% Bullish Opportunity on EURCAD

Introduction

A strong bullish signal has formed on the EURCAD currency pair, capturing the attention of traders using a combination of

breakout confirmation and daily chart reversal signals. With a clear confluence across the 4-hour, daily, and weekly timeframes,

this technical setup offers a well-supported case for a buy position with an estimated 25% upside, targeting the 1.6100 level.

Whether traded intraday or held for a few days, the structure of this trade offers exceptional technical clarity and reward

potential.

✅ Key Technical Highlights

🔹 4-Hour Breakout Confirmation

The EURCAD pair has broken decisively above a recent range high on the 4-hour chart. This breakout occurred on increased volume,

which validates the move as more than a false spike. Price action shows bullish momentum building as candles close strongly above

the 50-period EMA, indicating short-term strength.

🔹 Weekly Chart Breakout Structure

Zooming out, the weekly chart reveals that EURCAD has cleanly broken through a key resistance zone, which had previously

capped price several times. The breakout aligns with the long-term trend shift, reinforcing the bullish narrative from a macro

perspective. Support now sits firmly below at previous resistance.

🔹 Daily Chart Reversal Signal

The daily chart offers the most critical insight: a strong reversal pattern, potentially a bullish engulfing or morning star, has

formed near the breakout area. This suggests a change in sentiment and invites buying pressure as traders react to the clear

reversal signal after a recent pullback. This reversal provides

timing precision for the trade.

🎯 Take-Profit and Target Projection

The price target is placed at 1.6100, which corresponds to:

A previous structural high

A Fibonacci extension zone

A round psychological number respected historically

The move to this level offers a potential 25% profit window, depending on entry price and lot size. This makes it attractive for both day traders and short-term swing traders.

🕒 Trade Duration Outlook

While this breakout setup is forming across the weekly and daily charts, the 4-hour entry makes it highly suitable for day trading.

Traders who prefer intraday execution can look for a pullback to breakout support for entry, followed by momentum confirmation

from RSI or volume spikes.

Swing traders may hold the position over several days, aiming for the full stretch to the 1.6100 target, while trailing stops to lock in profits.

⚠️ Risk and News Awareness

Traders must remain cautious of:

Oil price movements, which directly impact CAD strength

Economic data from the Eurozone or Canada (GDP, employment, interest rate updates)

Central bank speeches that may introduce volatility

Risk should be limited by placing stop-loss orders just below the 4-hour breakout level or the low of the daily reversal candle.

📌 Why This EURCAD Setup Matters

This setup is more than just a breakout—it combines:

Multi-timeframe confirmation

Momentum breakout on the 4-hour chart

Weekly structure validation

Daily chart reversal timing

These factors build a strong technical case for bullish continuation and provide high confidence for experienced and new traders alike.

Conclusion

EURCAD presents a powerful trading opportunity backed by clear technical signals across major timeframes. With a 25% upside and

precise entry timing from a daily reversal pattern, this is the kind of setup traders seek for both fast profits and well-structured

trades. Whether approached as a day trade or a swing play, the EURCAD breakout is one to watch.

Disclaimer: This content is for educational and informational purposes only. It does not constitute financial advice or a

recommendation to buy or sell any financial instrument. Use a simulation trading account before you trade with real money and learn risk management and profit taking strategies.

EURCAD: Liquidity taken, imbalance left behindPrice swept the liquidity above the previous day’s high and then broke structure to the downside. That’s often a sign that smart money was hunting stops before shifting direction. Now I’m watching for price to come back and fill the imbalance (FVG) it left after the break.

If that happens and price respects the FVG zone, we could see a continuation lower with the next target being the previous day’s low where more liquidity is likely sitting.

I’ve also added the 50 EMA here as confluence. It helps keep me trading in line with the broader market flow and stops me from fighting the trend.

This is one of those spots where patience is key . Let the market return to the zone on its own terms, wait for a reaction, and keep protecting your mindset just as carefully as your capital.