EURCHF: Likely pullback at resistanceI am watching for a reversal EURCHF, expecting a rejection with a target at around 0.93550.

This area is where it can become a decision point: either price bounces, or it breaks above and the move can start to go higher.

I'll be watching for confirmation: not just in candlestick structure, but also in volume behavior.

EURCHF trade ideas

EURCHF: Intraday Bearish Move?! 🇪🇺🇨🇭

EURCHF reached a key horizontal resistance level.

I think that there is a high probability that the price

will retrace from that.

The closest intraday support is 0.93825,

it will be the goal for the sellers.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCHF - Low risk High Probability IdeaIn higher time frames EURCHF is in a downtrend, but for some time including the daily and intra day timeframes we have been in an uptrend (higher time frame counter trend).

Currently prices being at a strong monthly level, we are expecting a shift of the current intraday uptrend situation.

We are capitalizing the opportunity without forgetting to be risk cautious.

DISCAIMER: This is meant for educational purpose and not a financial advice.

Regards, relentlessforex.

EURCHF too?In the higher timeframes (monthly) prices have traced a confirmed uptrend.

This is also confirmed in the daily timeframe.

But prices being in a strong structural and psychological level, we are expecting a significant counter trend, which happens to have been confirmed in the lower time frames.

We are risking 13 pips on this trade aiming a potential 1:10+, but still proper trade management is always needed to make sure profits are secured incase targets are not reached.

DISCLAIMER: This is not a financial advice, always trade with caution.

EURCHF – DAILY FORECAST Q3 | W32 | D8 | Y25📊 EURCHF – DAILY FORECAST

Q3 | W32 | D8 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURCHF

Bullish bounce off pullback support?EUR/CHF is falling towards the support level which is a pullback support and could bounce from this level to our take profit.

Entry: 0.93625

Why we like it:

There is a pullback support.

Stop loss: 0.93147

Why we like it:

There is a pullback support that aligns with the 61.8% Fibonacci retracement.

Take profit: 0.94279

Why we like it:

There is a swing high resistance that lines up with the 161.8% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURCHF – Buy Trade UpdateEURCHF – Buy Trade Update 📈

Our EURCHF long is in profit ✅ and I’m now trailing my stop-loss to lock it in. Price is still moving higher with steady momentum.

The bullish push started picking up after Trump’s 39% tariffs came into effect on August 7, which weighed on CHF by dampening Swiss trade sentiment 😬. At the same time, the euro is holding firm on the back of better Eurozone data and the view that the ECB will move cautiously on rate cuts.

I’m watching the next resistance around . If price slows down or reverses, I’ll look to take profit. For now, the plan is simple: let it run 🚀 and keep stops tight to protect gains.

EURCHF – DAILY FORECAST Q3 | W33 | D11 | Y25📊 EURCHF – DAILY FORECAST

Q3 | W33 | D11 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

OANDA:EURCHF

EURCHF – DAILY FORECAST Q3 | W33 | D12 | Y25 📊 EURCHF – DAILY FORECAST

Q3 | W33 | D12 | Y25

Daily Forecast 🔍📅

📌 NOTE – Market Context Update

We’ve seen the daily candle close above the weekly 50 EMA, which suggests bullish intent... BUT 🧠⚠️

Let’s stay mindful — price is currently testing a major higher time frame level, and with 4 trading days left in the week, there’s still room for a rejection from the weekly 50 EMA.

🔍 Be smart with longs — don’t get caught chasing. Personally, I’ll be waiting for a 15-min BOS from my initial level to confirm intent. 🎯

📉 If price breaks back below the weekly 50 EMA, I’ll switch bias to shorts — then wait for a pullback to structure for continuation down.

Let the market show its hand. Stay sharp and trade what you see, not what you want to see. 🧘♂️📊

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

OANDA:EURCHF

EURCHF – Waiting for the Signal, Not the MiracleWe are currently in a great area for a potential short, and the marked zone looks ideal for an entry—but only if a valid signal confirms it.

We’re not upset if the level gets broken.

We don’t say “this strategy doesn’t work.”

Why? Because we know the market is not under our control.

If price breaks above and gives a clean pullback, we’ll go long.

Simple. No ego. No bias.

Also, the lower level marked on the chart seems to be a great zone for either taking profit from shorts or initiating fresh longs.

🎯 We follow the market, not fight it.

EURCHF: Bearish Continuation & Short Signal

EURCHF

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell EURCHF

Entry - 0.9419

Stop - 0.9425

Take - 0.9409

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EUR/CHF Bulls Test Range Highs Following Sharp ReboundEUR/CHF sits just beneath the top of the range it’s been trading in over the past three months, providing a variety of potential setups depending on how the near-term price action evolves.

The bullish engulfing candle on the daily chart last Friday set the tone for the price action seen this week, sparking a significant bullish reversal after a false break of .9300 support. The subsequent move saw the price take out resistance at .9363 before stalling at .9429—a level that capped the pair in June.

Given recent price action, traders should be on alert for a potential extension of the bullish move.

Should we see a break and close above .9429, it would allow for longs to be established with a stop beneath for protection, targeting resistance at .9500. Offers may be encountered just beneath .9450, presenting a potential hurdle for bulls along the way.

Alternatively, if the pair cannot break .9429 meaningfully, the setup could be flipped with shorts established beneath the level with a stop above for protection. Potential targets include .9363 or .9300.

Momentum indicators have skewed bullish over the past week, with RSI (14) trending higher but not yet overbought, while MACD has crossed the signal line and now sits in positive territory. It’s not a roaring endorsement for a bullish bias, but it does favour upside rather than downside in the near term.

EURCHF Wave Analysis – 6 August 2025

- EURCHF rising inside sideways price range

- Likely to test resistance level 0.9420

EURCHF currency pair recently reversed from the support area between the strong support level of 0.9300 (lower border of the sideways price range from April) and the lower daily Bollinger Band.

The upward reversal from this support area created the clear daily Japanese candlesticks reversal pattern Bullish Engulfing – which started active impulse wave 3.

Given the strongly bearish Swiss franc sentiment seen today, EURCHF can be expected to rise to the next resistance level 0.9420 (upper border of the active sideways price range).

Behold the sacred EUR/CHF long positionBehold the sacred EUR/CHF long position, an epic quest powered by the same top-secret pyramidal formula whispered only in the King’s Chamber:

Pharaoh’s Pivot Points

– We align the EUR/CHF swings to the Great Pyramid’s four cardinal chambers. Whenever the pair dips into the “Queen’s Antechamber Zone” (just above 0.9800), legend says the jackal-headed guardian approves—and that’s our golden buy signal.

Helvetic Sphinx Sentiment

– We decode ECB press-conference riddles and SNB policy hints through the Sphinx’s ancient riddle-engine. If the riddle’s answer leans “Euro strength,” we “scale the Alps”; if it winks “Franc fortress,” we hold our shields.

Ra’s Zurich-Hour Candle Filter

– Only candles that close between 09:00 and 17:00 CET count as “true” Swiss-sunlight candles. Any move outside Swiss business hours is treated like a sandstorm—ignored.

Anubis’ FX-Flow Veil

– We measure interbank liquidity flows as if they were pharaoh-ounces of gold. When daily EUR/CHF turnover eclipses “5,000 pharaoh-ounces,” prepare for a breakout ritual—er, breakout rally.

Tomb-Run Trend Confirmation

– Trendlines aren’t drawn from mere swing highs; they trace the three cryptographic glyphs carved into the sarcophagus walls. Connect them, and you unveil the “Tomb-Run Uptrend.”

Divine Entry & Targets:

When all five pillars align, we enter long EUR/CHF at 0.9850, place our mummy-wrapped stop at 0.9800, and aim for the “Obelisk of Olympus” target at 0.9950. May the golden-scaled gryphons guard your P&L!

EUR/CHF Bullish Vault Raid – The Franc Robbery Begins!💣EUR/CHF Bullish Heist: Thief's Franc Escape Plan 🚨💰

🚨Asset: EUR/CHF "Euro-Franc" Forex Market

📈Plan: Bullish

🎯Entry: Any price level (No breakout entry nonsense – we're stealthy robbers)

🛑Stop Loss: 0.93200

🏆Target: 0.94300

👑Thief's Statement:

Hey Money Muggers & Market Marauders! 🥷💰

Today, we strike the Euro-Franc vault with a clean bullish heist plan. No noise, no breakout bait — just silent limit orders stacked like layers on a cake 🍰.

🎭We ain’t chasing price… we let price chase us! Smart thieves wait. Pullbacks? That’s our entry door 🧨🚪.

🔑Gameplan:

📦 Entry:

🕵️♂️Layer up your Buy Limit orders near recent pullbacks or swing lows.

⏳Wait on the 15M or 30M timeframe for the cleanest setups.

📉No breakout entries – thieves don’t chase, we trap.

🛡️Stop Loss (SL):

🧱Set at 0.93200 — hidden just below the thief's last cover zone.

🎲Risk based on your position size & how many orders you layer.

🎯Keep it tactical. One mistake and the vault closes!

🏁Target (TP):

💎0.94300 is the escape tunnel.

💨Exit fast if heat rises before the target hits. Smart thieves know when to run!

👊Scalpers’ Note:

🪝Only ride long waves — don’t swim against the current.

💣Use trailing SL to secure the loot as price climbs.

👑Big pockets? Dive in. Small pockets? Swing with precision.

🧠Why We Rob Here:

EUR/CHF fundamentals align with the bulls. We're riding sentiment, intermarket flow, and positioning from big money. COT, macro signals, and FX momentum all say: Thieves, it's go time! 🚨

📢News Alert:

❌ Avoid entries during high-impact news – it ain’t worth jail time (or stop hunts).

🎯Use a trailing SL to protect gains if caught mid-heist during volatility.

🔥Like the Plan? Hit that Boost Button 💥

Join the Thief Squad and let’s rob the FX banks together 💵💎

Catch you in the next heist drop 🐱👤🚀

EUR/CHF – On Watch for Pullback OpportunityEUR/CHF just broke through resistance and is pushing into new highs. From here, we’re patiently watching for a potential pullback into the newly formed strong support zone.

If price returns to that area and the setup aligns with our VMS criteria — Volume, Momentum, and Structure — we’ll evaluate it as a possible trade opportunity.

No chasing. No forcing. Just preparation and discipline.

Patience is the key to consistency — and consistency is the key to success.

EURCHF - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

EURCHF: Short Signal Explained

EURCHF

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell EURCHF

Entry Level - 0.9350

Sl - 0.9361

Tp - 0.9328

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EUR-CHF Resistance Ahead! Sell!

Hello,Traders!

EUR-CHF went up sharply

And the pair is locally

Overbought so after it

Hits the horizontal resistance

Above at 0.9367 we will be

Expecting a local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

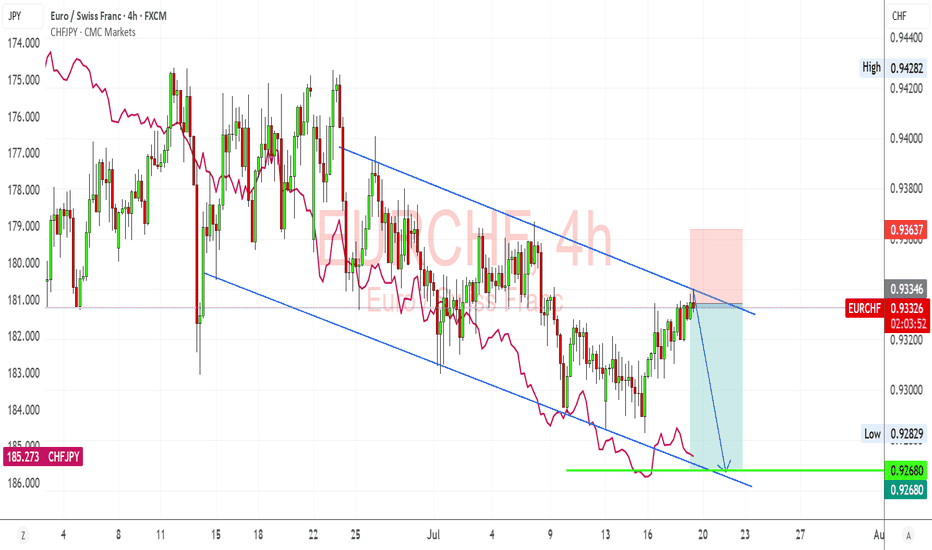

EURCHF – Bearish Channel Holds Firm, CHF Strength Set to ResumeEURCHF just tapped into the descending channel resistance again and is showing signs of rejecting. I'm expecting a bearish continuation here, especially given the strong CHF momentum recently, supported by safe-haven flows and Swiss inflation stability. If the pair fails to break above 0.9340, I’m watching for a downside push back toward 0.9270–0.9265, completing another leg within the structure.

🔍 Technical Setup (4H):

Channel Structure: EURCHF remains firmly within a downward-sloping parallel channel since mid-June.

Resistance Rejection: Price recently tested upper channel resistance (~0.9335–0.9340 zone), aligning with trendline rejection.

Target Support: 0.9270–0.9265 (channel base and key horizontal level).

Confluence: CHFJPY overlay (pink line) is rising again, suggesting renewed CHF strength—this usually weighs on EURCHF.

💡 Fundamental Insight:

EUR Side:

ECB officials remain cautious, but with recent EU data showing weaker growth (especially PMIs and sentiment), euro upside is capped.

The ECB is likely to pause further tightening, while other central banks like SNB remain firm on inflation risks.

CHF Strength:

The Swiss National Bank (SNB) still leans hawkish, with stable inflation giving room to hold rates steady or tighten if needed.

CHF benefits from risk-off flows amid global tariff headlines, China slowdown, and Middle East tensions.

Rising CHFJPY = clear CHF strength across the board.

⚠️ Risks:

If eurozone data surprises to the upside (e.g., inflation rebounds), EURCHF could break out of the channel.

A sudden drop in geopolitical tension or strong risk-on rally could weaken CHF as safe-haven demand falls.

SNB jawboning or FX intervention is always a wildcard.

🧭 Summary:

I’m bearish on EURCHF while it respects this well-defined descending channel. The technicals show consistent lower highs and lower lows, while the fundamentals continue to support CHF strength due to risk aversion, stable inflation, and a resilient SNB. My short bias is valid as long as price remains below 0.9340, with downside targets at 0.9270–0.9265. CHFJPY rising confirms franc leadership across FX markets, and EURCHF is likely a lagger following broader CHF strength.

EUR/CHF SHORT FROM RESISTANCE

Hello, Friends!

EUR/CHF pair is in the uptrend because previous week’s candle is green, while the price is obviously rising on the 5H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 0.926 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅