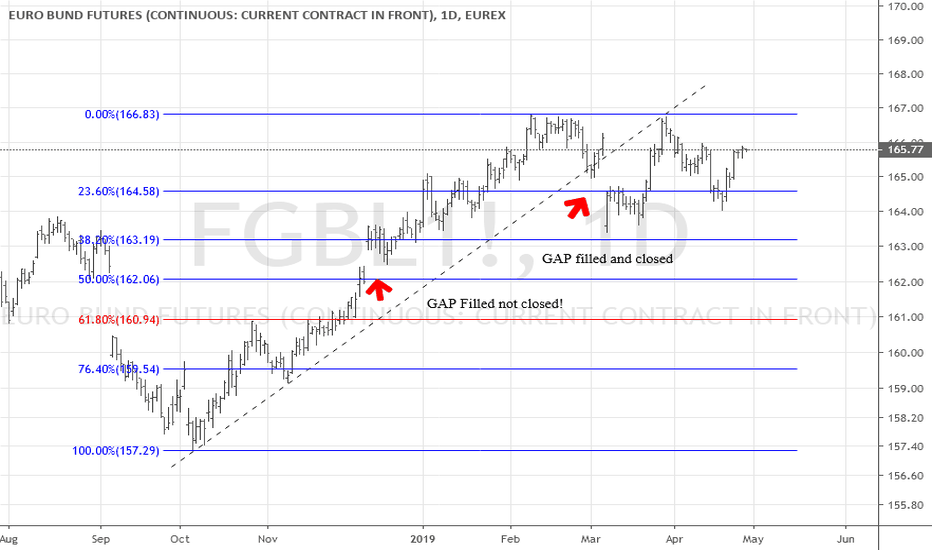

FGBL1! trade ideas

June Bunds lower into 166?Observing an simple abc correction down between 17/4-20/4 followed by an X-wave, terminating close to previous wave b. From there, I'm anticipating another correction, starting with a leading diagonal into ~166.30, then retracing close to the previous 4th wave (from the leading diagonal). This means we should head lower in Bunds in 5 waves.

Wave equality between wave W and Y lies around 166.28, and at 165.81, wave Y is 161.8% of wave W. Inside wave Y, wave c equals wave a at 165.97. So from a short term perspective I'd rather focus on 166.28, and if that level breaks, the range of 165.81-165.97 comes into play.

Wave count becomes doubtful if Bunds break above 166.73. Bear in mind a leading diagonal would ideally retrace back to 61.8%, which lies around 166.82 and one could count the price action since 16h00-21May2019 as a regular flat correction, currently wave C into 166.82. A move above this level makes the analysis invalid for me.