EURGBP.P trade ideas

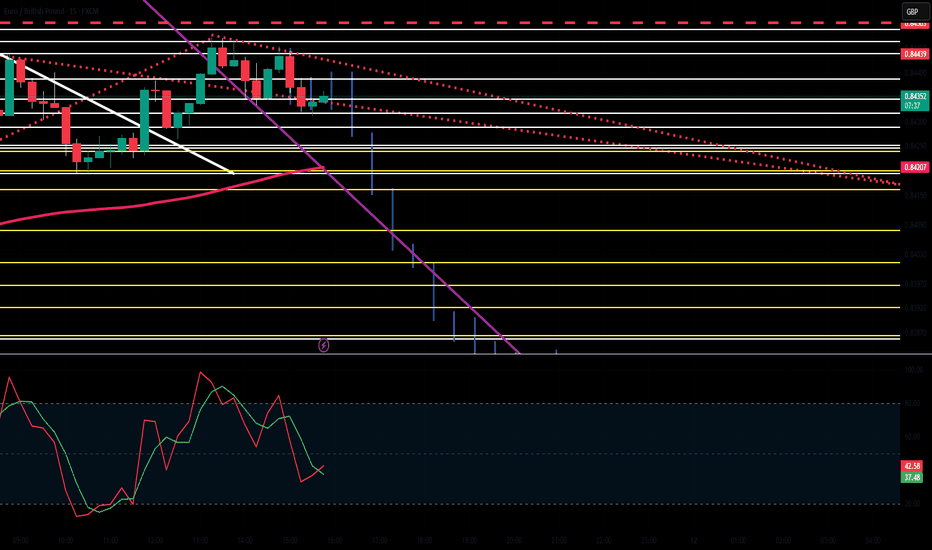

Short trade

30 min TF overview

Sellside tarde

Pair EURGBP

Tue 11th March 25 2.00 pm

LND to NY Session PM

Entry and Structure - 30 min TF

Entry 0.84450

Profit level 0.84219 (0.27%)

Stop level 0.84497 (0.06%)

RR 4.91

Target fib level 0.382

Reason: Observing price action on EURGBP and the narrative of supply and demand, I assumed the price reached a pivotal supply zone indicative of a sellside trade.

Bearish reversal off overlap resistance?EUR/GBP is reacting off the resistance level which is an overlap resistance and could drop from this level to our take profit.

Entry: 0.8441

Why we like it:

There is an overlap resistance level.

Stop loss: 0.8473

Why we like it:

There is a pullback resistance level.

Take profit: 0.8403

Why we like it:

There is an overlap support level that aligns with the 23.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EUR-GBP Resistance Ahead! Sell!

Hello,Traders!

EUR-GBP keeps growing in

A strong uptrend but the pair

Is already overbought so after

It hits a horizontal support

Level of 0.8473 we will be

Expecting a local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Believe or Not follow the blue prediction for the futureEURGBP- It's really highest highs and now headed to the lowest lows. You can see the prediction in blue. Follow me and I will make you a millionaire. Trading is not for the weak and takes a lot patience.

The best way to make money in this industry is to first get a whole life insurance policy from me. Then once it is active drop some money in it. Called paid in advance. The the policy is function in paid in advance bringing the account to cash value. The account will then begin to be your infinite bank. Next 30 days later borrow against your own account and take these funds and place them into your trading account.

So the infinite account will be building 9-15% guaranteed interest each month despite you borrowing from it and the policy provide life insurance in case you get sick or disabled like me. Then trade your balance of $.01 per $100 dollars and copy and paste trades.

If you want to learn how to trade binary first before forex you should join Brandon Boyd and Dr. Josh's class.

EUR/GBP Trade PlanEUR/GBP looks solid with a breakout strategy.

**

EUR/GBP Trade Plan

#### **🔹 Buy Setup (Bullish Breakout)**

- **Entry:** Above **0.84270**

- **Target:** **0.84700**

- **Stop Loss:** Below **0.84150** (to manage risk)

- **Confirmation:** Look for strong bullish candles or increased volume before entry.

#### **🔻 Sell Setup (Bearish Breakout)**

- **Entry:** Below **0.84100**

- **Target:** **0.83800**

- **Stop Loss:** Above **0.84200**

- **Confirmation:** Strong bearish momentum, possibly after a retest.

### **🛡️ Risk Management Tips:**

✔️ Keep risk per trade **1-2% of capital**.

✔️ Adjust position size based on Stop Loss distance.

✔️ Watch for **fake breakouts** – wait for candle closure before entry.

✔️ Avoid overleveraging; stick to **proper risk-to-reward ratios (RRR ≥ 1:2)**.

Short trade

15min TF overview

Sell side trade

Pair EURBBP

Tue 11th March 25

05.15 am

LND Session AM

Entry and Structure - 30 min TF

Enrty 0.84365

Profit level 0.84151 (0.25%)

Stop level 0.84445 (0.09%)

RR 2.67

Reason: Price reached a pivotal supply zone 30min TF that seemed indicative of a sellside trade along with the narrative of supply and demand for direction bias.

EUR/GBP BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

EUR/GBP pair is in the uptrend because previous week’s candle is green, while the price is obviously rising on the 8H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 0.831 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURGBP: One More Bullish Wave AheadThe EURGBP has shown a significant bullish pattern on the 4-hour chart.

I have identified an ascending triangle, which is a bullish pattern indicating a break above its resistance level.

There is now a contracting demand zone formed by a trend line and a broken horizontal structure.

It is likely that the bulls will continue to drive prices higher in this scenario.

EURGBP H4 | Bearish Drop Based on the H4 chart analysis, we can see that the price is currently at our sell entry at 0.8427, a pullback resistance close to the 78.6% Fibonacci retracement.

Our take profit will be at 0.8386, a pullback support.

The stop loss will be placed at 0.8463, which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (fxcm.com/uk):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Stratos Global LLC (fxcm.com/markets):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

EURGBP 15 Min INTRADAY overbought sideways consolidationBullish Scenario:

The EURGBP pair maintains a bullish intraday sentiment, supported by the longer-term uptrend. The key level to watch is 0.8420, which acts as a critical resistance zone. If the price rallies above 0.8420, the uptrend could resume, targeting 0.8440, with further resistance levels at 0.8460 and 0.8500 over the longer timeframe.

Bearish Scenario:

A confirmed break below 0.8380, especially with a daily close beneath this level, would invalidate the bullish outlook. This could lead to further downside movement, with immediate support at 0.8360, followed by 0.8340 and 0.8327, signaling a deeper corrective pullback.

Conclusion:

The overall intraday trend remains bullish, with 0.8420 as the key pivot level. Holding above this support reinforces the upside potential, while a confirmed breakdown below it could shift momentum toward a deeper retracement. Traders should monitor price action around this critical level for confirmation of the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

The Day Ahead Monday March 10

Data: US February NY Fed 1-yr inflation expectations, Japan February Economy Watchers survey, M2, M3, January household spending, leading index, coincident index, Germany January industrial production, trade balance, Italy January PPI, Sweden January GDP indicator, Denmark and Norway February CPI

Central banks: ECB’s Nagel speaks

Earnings: Oracle

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DeGRAM | EURGBP correction in the channelEURGBP is in an ascending channel between the trend lines.

The price has reached the dynamic resistance.

Indicators have formed a bearish divergence on the 4H Timeframe.

The chart has formed a harmonic pattern.

We expect a correction.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EUR/GBP Trade Analysis & Key LevelsEUR/GBP Trade Analysis & Key Levels

📈 **Current Price:** 0.83800

🔹 **Resistance:** 0.83900

🔹 **Support:** 0.83700

💡 **Market Outlook:**

- Strong **bullish momentum** observed, supported by the **EMA50** trend.

- If the price **breaks resistance**, the next target is **0.84600**.

- If the price **breaks support**, a bearish move may follow.

🎯 **Trade Plan:**

✅ **Entry:** Monitor for breakout confirmation.

✅ **Stop Loss:** 0.83600 (to manage risk effectively).

✅ **Risk Management:** Essential for capital protection.

📊 **Stay updated & trade wisely!** 🚀