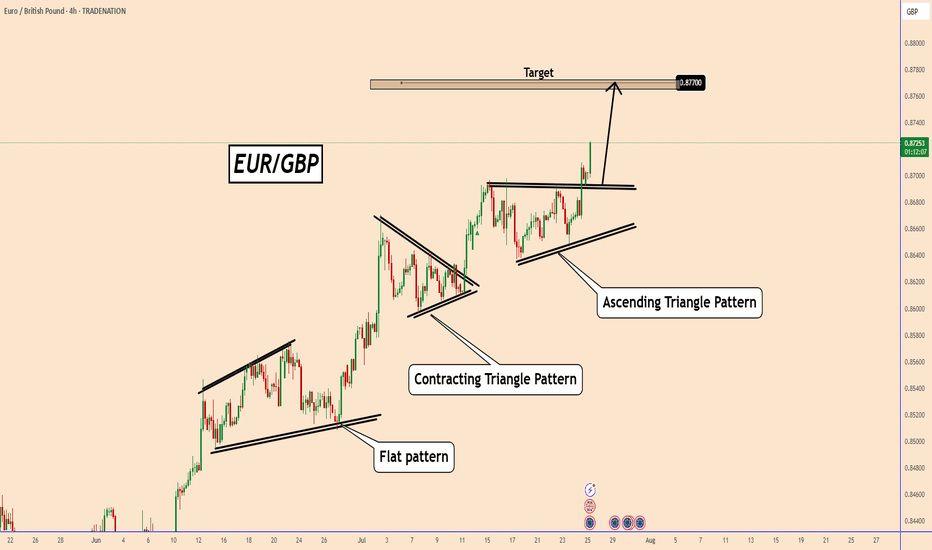

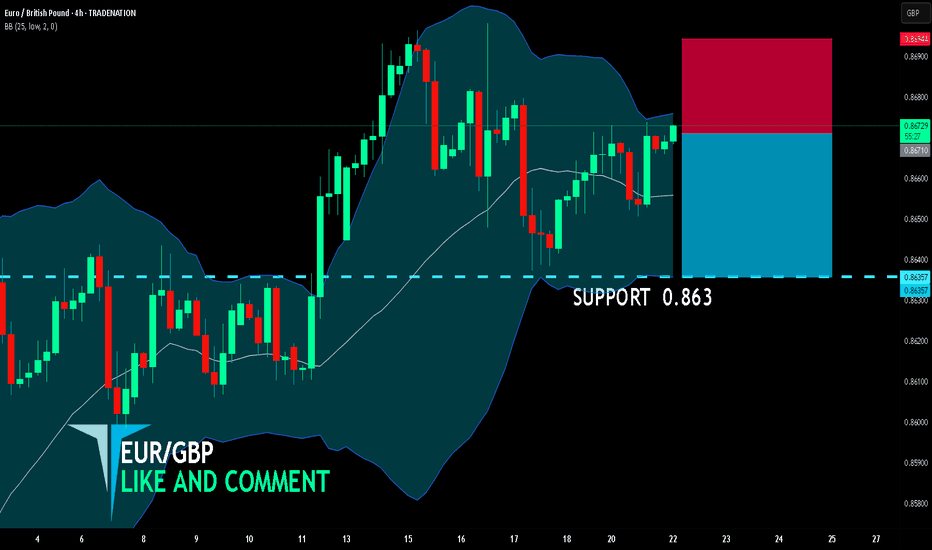

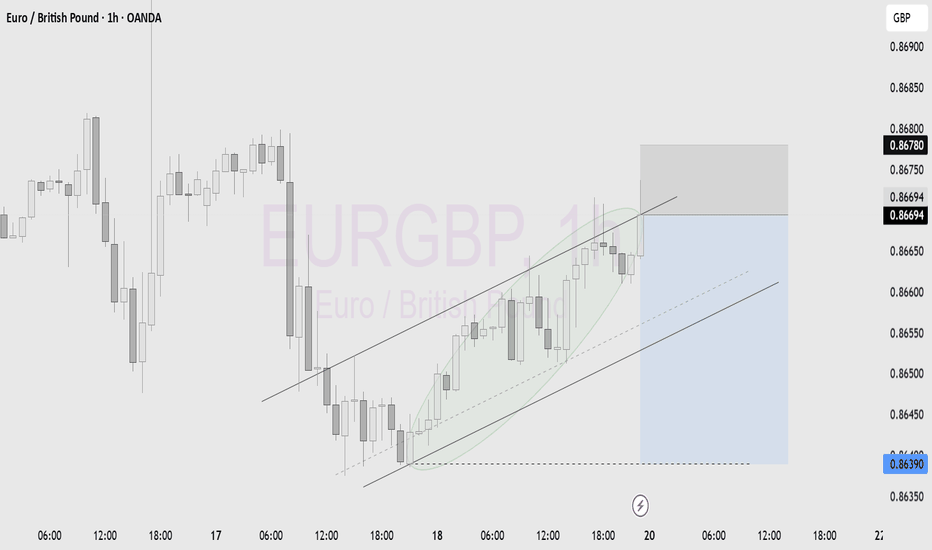

EURGBP Is Rising Further After UK Retail Sales missed estimatesEURGBP Is Rising Further After UK Retail Sales missed estimates

EURGBP already broke out from an Ascending Triangle pattern after it spent some time in accumulation and without direction the price is rising today.

This is the third and clear bullish pattern that EURGBP broke out and the chances to rise one more time are high.

K retail sales is supporting this bullish movement because they failed to meet expectations.

Overall, the data was higher compared to the last month, but the fact that it missed expectations suggests that the UK economy is growing in small steps.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP trade ideas

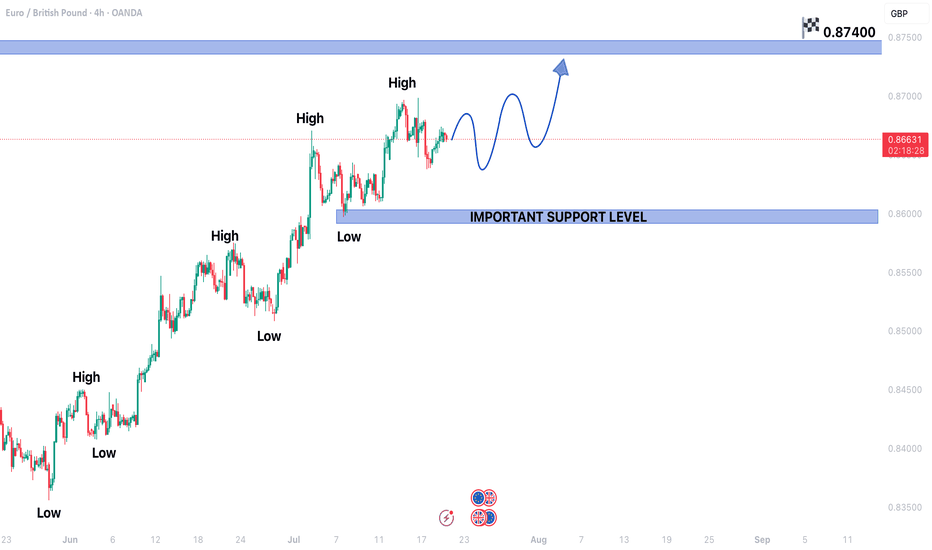

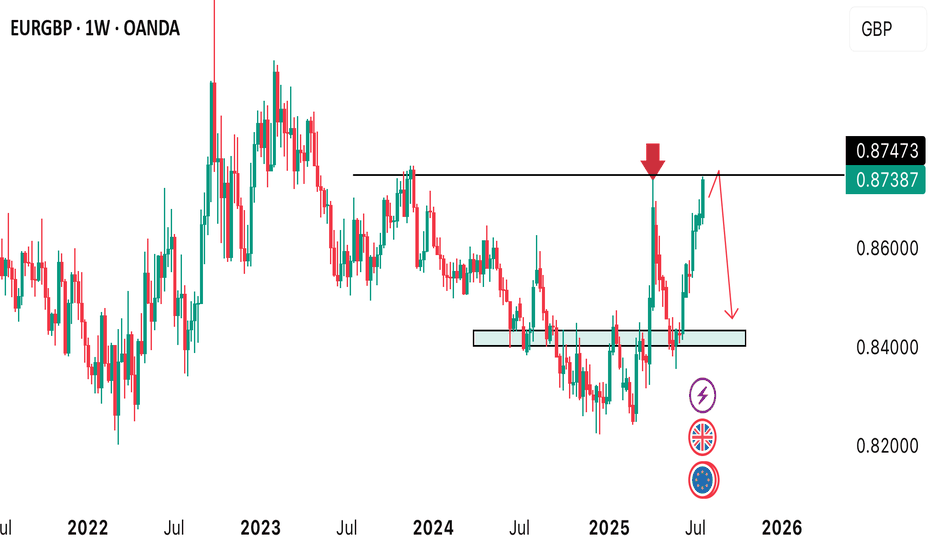

EURGBP CONTINUING BULLISH TREND STRUCTUREEURGBP CONTINUING BULLISH TREND STRUCTURE IN 4H TIME FRAME.

Price is currently in a secondary trend.

Price is expected to end the secondary trend and start primary trend again.

On higher side market may hit the targets of 0.87400

On lower side 0.85950 may act as a key support level.

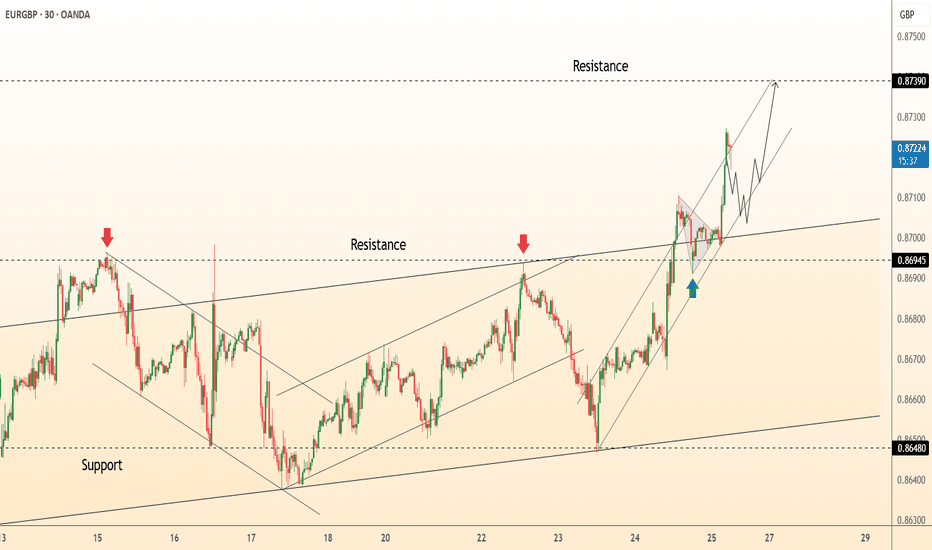

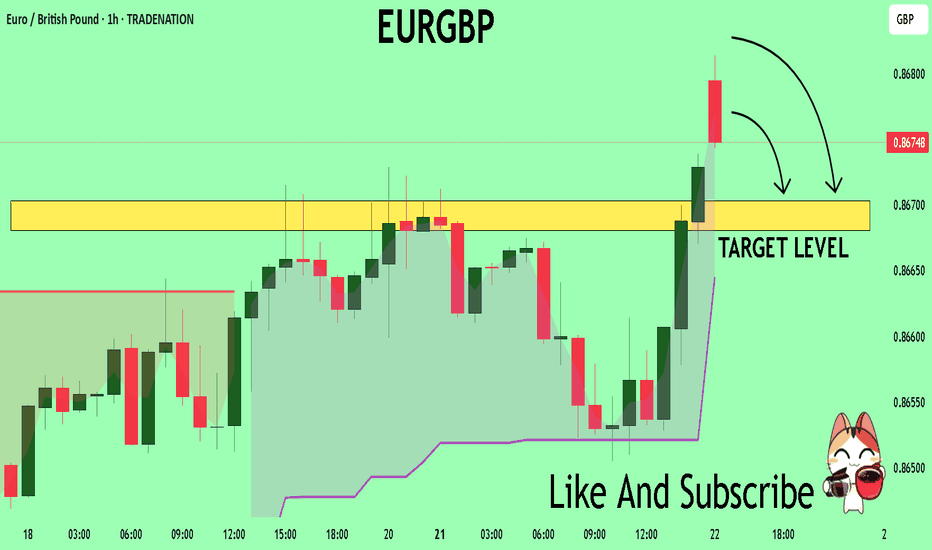

DeGRAM | EURGBP exited the channel📊 Technical Analysis

● Breakout: price burst from the July descending wedge, reclaimed 0.8695 former cap, and is now riding a steep intraday channel of higher-highs; the channel mid-line aligns with the broken wedge roof, adding fresh support.

● A pennant is consolidating just above 0.8695; its measured pole and the outer channel top converge at the next horizontal barrier 0.8739.

💡 Fundamental Analysis

● Softer UK July composite-PMI (47.9 vs 50.2 prior) revived BoE cut bets, while ECB speakers flagged “premature to talk easing,” narrowing the rate gap in the euro’s favour.

✨ Summary

Long 0.8695-0.8705; pennant break targets 0.8739. Bias void on a 30 m close below 0.8648.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

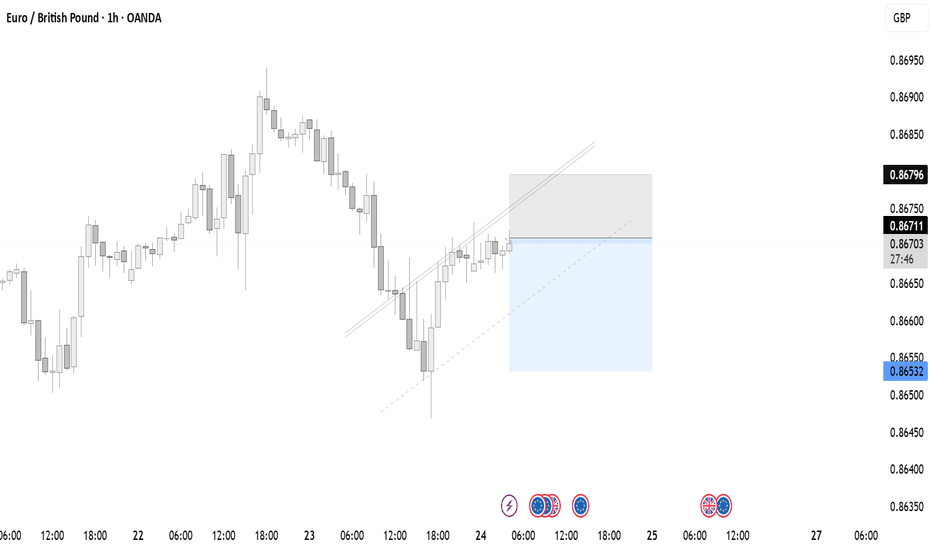

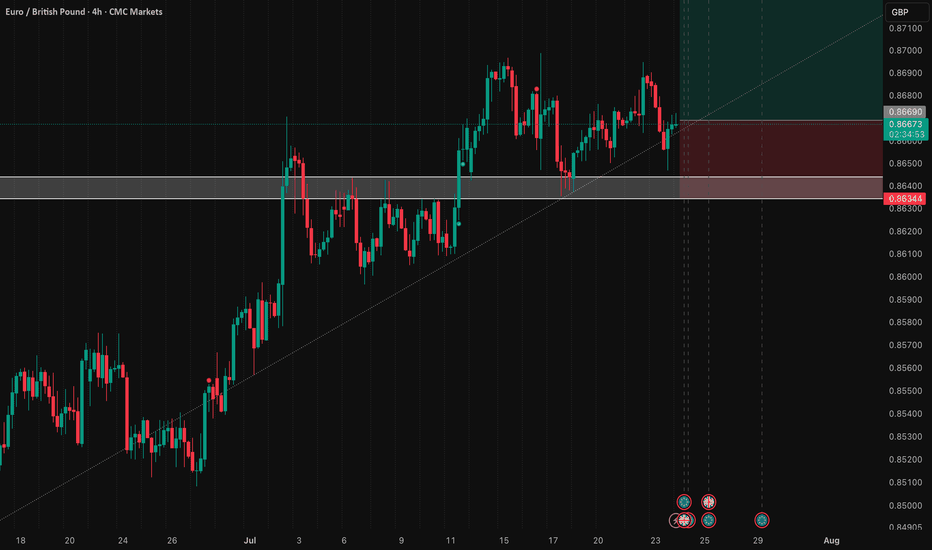

EUR/GBP: Bullish Stance Above 0.8640This signal outlines a tactical long entry on EUR/GBP, positioning for a bullish resolution from today's major fundamental events.

📰 Fundamental Thesis

This position is taken ahead of the two primary market movers: the ECB rate decision and the UK PMI data. The core thesis is that the ECB policy statement will be the dominant catalyst, providing strength to EUR that will outweigh the impact of the UK data release.

📊 Technical Thesis

The trade is defined by a sound technical structure. The stop loss is anchored beneath the critical support zone at 0.8640. The profit target is set to challenge the resistance area just above 0.8722. This setup offers a favorable and clearly defined risk-to-reward profile.

🧠 Risk Management

Execution is timed before extreme event-driven volatility. Adherence to the stop loss is critical to manage the inherent risk of this pre-news strategy.

Trade Parameters

⬆️ Direction: Long (Buy)

➡️ Entry: 0.86690

⛔️ Stop Loss: 0.86344

🎯 Target: 0.87382

✅ Risk/Reward: 1:2

EURGBP Analysis : Bullish Setup + Support & Reversal Zone Ahead🔍 Overview:

This analysis explores a well-developed Mid-Market Cycle (MMC) pattern playing out on the EUR/GBP 8H chart. The price action has transitioned from accumulation to markup, forming a classic cup-shaped recovery structure supported by a parabolic ARC curve. With strong volume contraction, historical interchange zones, and clean breakouts, this setup indicates bullish momentum heading into the next reversal zone.

Let’s walk through each component in detail and build the case for this trade setup.

🧩 1. MMC Cycle Framework

The chart structure aligns with the MMC (Mid-Market Cycle) model:

Phase 1 – Accumulation:

From April to late May, price formed a rounded bottom resembling a "cup" — a known sign of smart money accumulation. The downward momentum stalled, and sellers were gradually absorbed by larger participants.

Phase 2 – Breakout & Expansion:

Early June saw price breaking out of this base, beginning an aggressive uptrend supported by rising structure. This marks the transition to the markup phase of the MMC.

Phase 3 – Pullback & Continuation:

Price pulled back slightly into previous resistance (now turned support), forming a bullish continuation triangle and breaking out again. A textbook MMC continuation.

🧠 2. Technical Confluences

✅ A. ARC Support Curve

The curved support line (ARC) acts as dynamic demand.

Price has bounced multiple times off the curve, reinforcing its strength.

ARC patterns often signal increasing bullish acceleration, reflecting market psychology as traders gain confidence with each higher low.

✅ B. Interchange Zones

The concept of Interchange refers to zones where support becomes resistance or vice versa.

This chart features two key interchange levels:

First interchange formed after the April high.

Second interchange was retested and held cleanly after the breakout.

These areas indicate institutional interest, and their successful retests confirm trend continuation.

✅ C. Volume Contraction

Volume has been shrinking during the markup, which is counterintuitive but strategic.

In Wyckoff theory, this shows absorption of supply — institutions deliberately suppress volatility to accumulate before the next breakout.

Once the contraction ends, explosive moves often follow.

🎯 3. Target Zone: Next Reversal Area

Price is now heading into a clearly defined resistance zone around 0.87400–0.87500.

This level was respected in prior price history (April peak) and may trigger short-term selling or distribution.

The chart shows a possible liquidity grab scenario at the reversal zone, followed by a corrective move (mini bearish ABC).

📈 4. Price Projection & Scenarios

Bullish Case (High Probability)

Breakout Above 0.87500: Triggers a major leg upward.

Potential extension targets:

0.87850 (Fibonacci projection)

0.88200 (next higher timeframe resistance)

Bearish Case (Short-Term Pullback)

Rejection at Reversal Zone:

A corrective leg toward the ARC or prior interchange.

Ideal re-entry for buyers near:

0.86400–0.86600 zone

Or curve retest near 0.86000

🧭 5. Trade Strategy

🔹 Entry Options:

Breakout Entry: Above 0.87500 on strong candle + volume.

Retest Entry: On dip toward ARC curve or interchange.

🔹 Stop-Loss Ideas:

Below ARC line (~0.86000)

Below last bullish engulfing (~0.86250)

🔹 Targets:

TP1: 0.87500

TP2: 0.87850

TP3: 0.88200 (longer-term swing)

💡 6. Trader Psychology in This Chart

This chart represents a controlled bullish structure — a hallmark of smart money participation. Here’s why:

The rounding base was methodically built without sudden volatility.

Each breakout was followed by healthy retests (no fakeouts).

Volume stayed low during markups, reducing retail confidence and allowing institutional loading.

The ARC curve reflects increasing confidence and participation — buyers consistently stepping in on higher lows.

📌 Conclusion

This EUR/GBP setup is a textbook MMC/ARC structure with multiple confirmations:

Smart accumulation

Curve support respected

Volume and structure aligned

Clear next resistance zone

Whether you’re swing trading or monitoring for breakout scalps, this is a high-quality setup worth tracking. Be ready to act at the reversal zone, as it will either confirm continuation or offer a lucrative retest entry.

🔔 Follow for More:

I post regular MMC, structure-based, and Smart Money trade setups. Drop a like, comment your thoughts, or ask questions below!

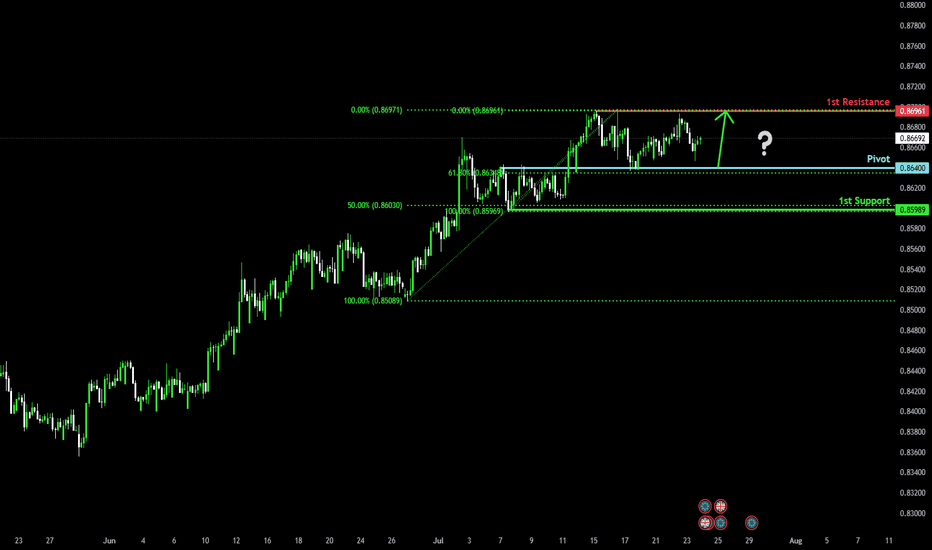

Bullish bounce off overlap support?EUR/GBP is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance, which acts as a swing high resistance.

Pivot: 0.8640

1st Support: 0.8598

1st Resistance: 0.8696

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

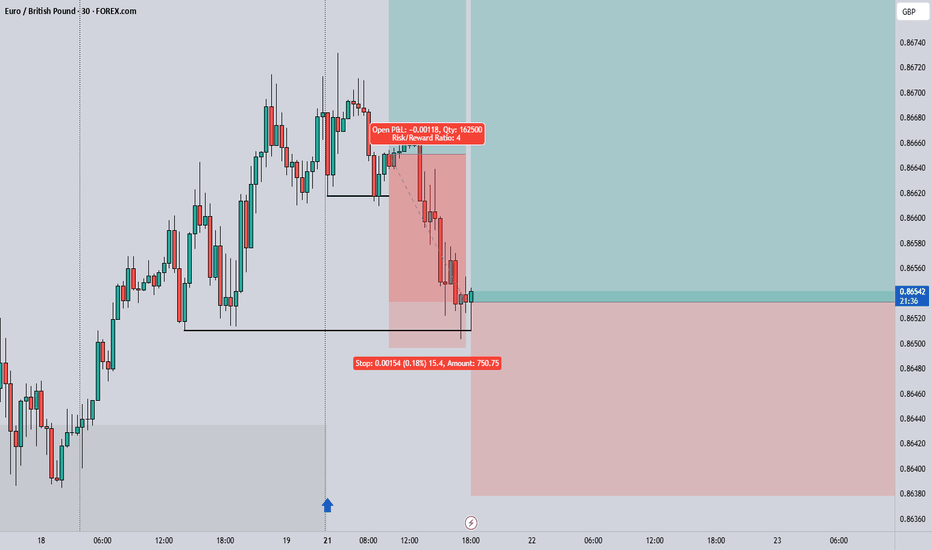

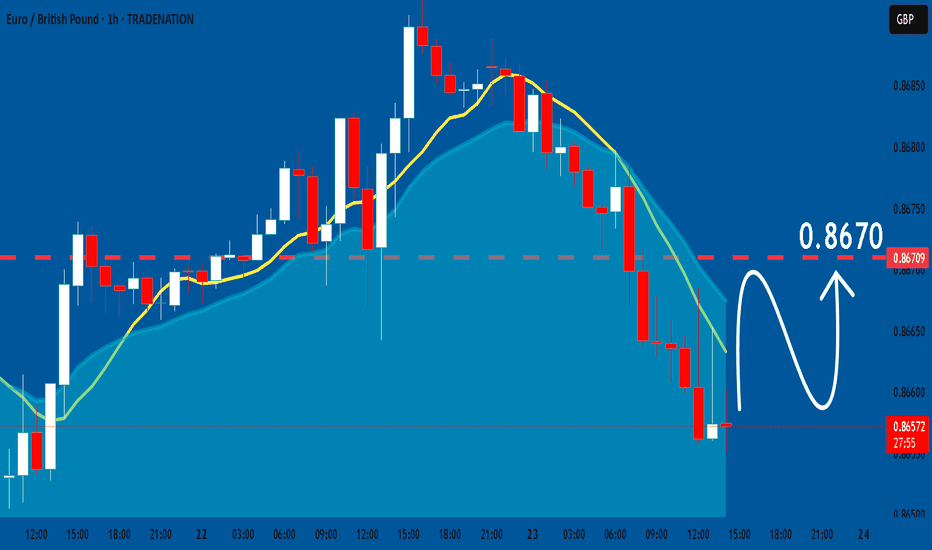

EUR/GBP SHORT FROM RESISTANCE

EUR/GBP SIGNAL

Trade Direction: short

Entry Level: 0.867

Target Level: 0.863

Stop Loss: 0.869

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 4h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

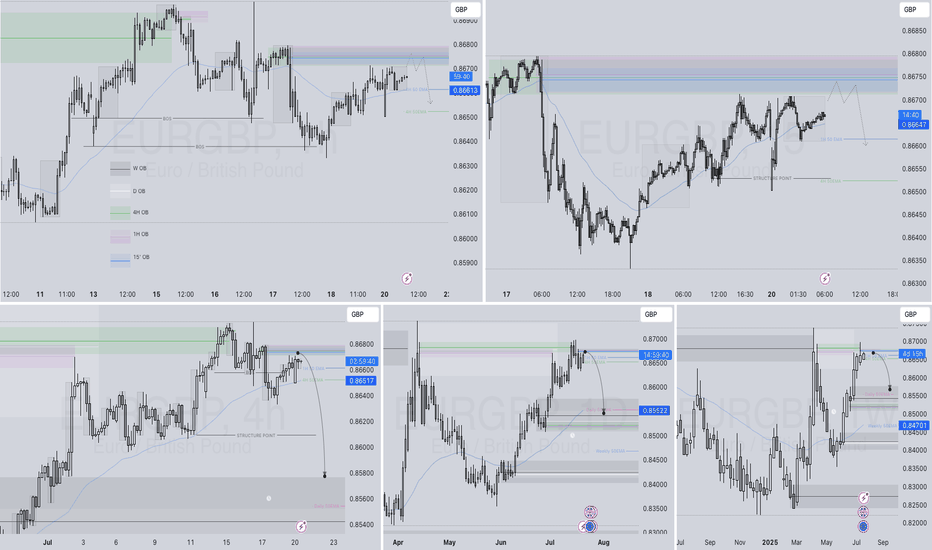

EURGBP Q3 | D21 | W30 | Y25📊EURGBP Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

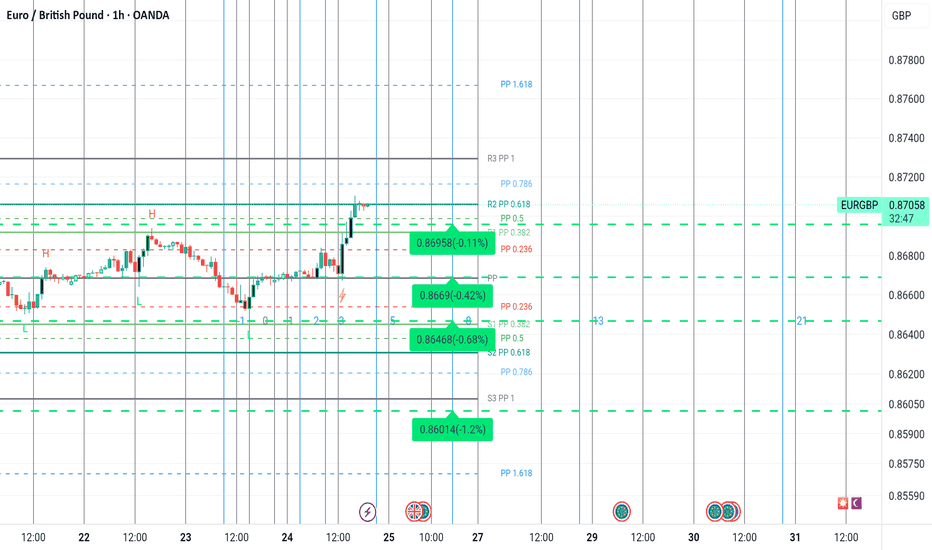

EURGBP The Target Is DOWN! SELL!

My dear friends,

Please, find my technical outlook for EURGBP below:

The price is coiling around a solid key level - 0.8676

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 0.8670

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURGBP: Bearish Forecast & Outlook

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the EURGBP pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURGBP – WEEKLY FORECAST Q3 | W30 | Y25📊 EURGBP – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

EURGBP: Will Keep Growing! Here is Why:

The recent price action on the EURGBP pair was keeping me on the fence, however, my bias is slowly but surely changing into the bullish one and I think we will see the price go up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

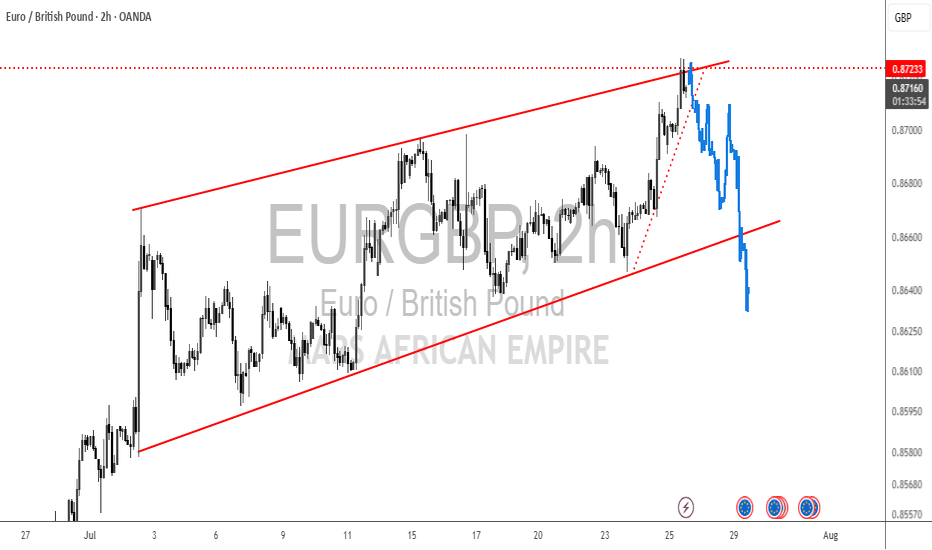

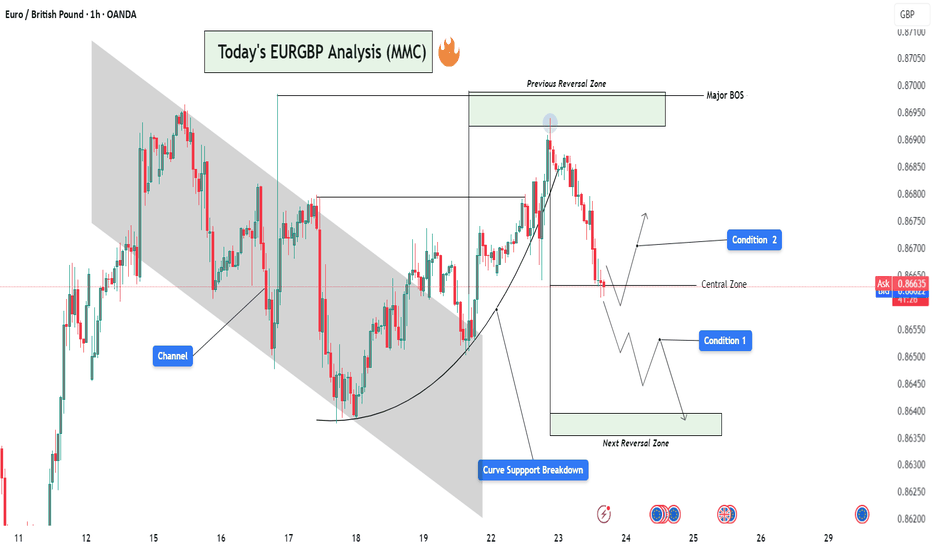

EURGBP Analysis : Curve Breakdown + Directional Setup + Target🧠 Institutional Context & Smart Money Bias

This EURGBP chart offers a masterclass in engineered liquidity and market traps. Institutions have created an illusion of bullish strength through:

A manipulated rounded accumulation curve

A controlled channel phase

A false breakout above the reversal zone

These are textbook signals that the retail crowd is being misled, while smart money is preparing for a deeper move. Let’s dissect it step by step.

📊 Phase-by-Phase Technical Breakdown

🔻 1. Bearish Channel – Sentiment Shaping Phase

From July 11 to July 21, the pair traded within a descending parallel channel, forming a bearish market structure.

This phase was not a genuine trend, but a sentiment builder—to:

Create a belief in continued bearishness

Gather liquidity around the channel boundaries

The upper and lower bounds of the channel were respected precisely, revealing market maker intent.

📈 2. Parabolic Curve Support – Trap Engineered

Price transitioned out of the channel into a rounded bullish curve—a visual cue suggesting accumulation and strength.

This curved trendline often misleads retail traders into thinking a breakout rally is coming.

Price surged aggressively toward the Previous Reversal Zone, further fueling FOMO buys.

But this move was not sustainable. Why?

➡️ Because it lacked a clean base and was built off a manipulated liquidity sweep. The curve was a setup.

🟥 3. Previous Reversal Zone & Major BOS – Institutional Exit Point

Price entered the Previous Reversal Zone, a marked area of prior supply.

This is where institutional orders were likely resting.

After briefly exceeding the previous high, the market instantly reversed with force—evidence of:

Stop hunts

Distribution

Smart money selling into retail breakout buyers

The Major BOS (Break of Structure) confirms the shift: The trend is no longer bullish.

⚠️ 4. Curve Support Breakdown – Structure Shift Triggered

After peaking, the price violated the curve support, confirming the bullish trap.

This breakdown signals a phase transition:

From accumulation illusion → distribution reality

From retail optimism → smart money unloading

🟨 5. Central Zone – Decision Point

Price is now hovering at the Central Zone, a region of equilibrium between buyers and sellers.

This is where market makers may:

Redistribute for another leg down

Fake a pullback before continuing lower

Temporarily rally to trap more longs

This area will determine short-term directional bias. That’s why your setup smartly outlines two conditions from this point.

🔀 Trade Scenarios – MMC Conditions

🔻 Condition 1: Bearish Continuation Toward Next Reversal Zone

If the price rejects the Central Zone and begins forming lower highs and bearish structures:

Expect further downside

This confirms the market is in redistribution mode

Target: Next Reversal Zone at 0.8630–0.8640

💡 Rationale: Institutions are driving price back into demand zones to grab new liquidity or fill leftover buy orders.

🔁 Condition 2: Temporary Recovery & Trap Continuation

If price holds above the Central Zone and breaks short-term highs:

A short-term bullish rally may occur

Likely targets: 0.8675–0.8685

This may act as a fake-out rally, creating more buying interest before a deeper dump

💡 Rationale: Smart money may induce more buyers to create fresh liquidity pockets before dropping toward the next reversal zone.

🔐 Key MMC Zones & Structure Levels

Zone/Level Purpose

0.8695–0.8700 Previous Reversal Zone / Major BOS – Institutional distribution area

0.8660–0.8665 Central Zone – Mid-point equilibrium & battle zone

0.8630–0.8640 Next Reversal Zone – Potential bullish interest area for demand

🧠 Smart Money Summary

This chart showcases a multi-stage smart money plan:

Create channel to shape bias

Form curve to generate false hope

Push into supply and trap late buyers

Break curve support to shift structure

Retest Central Zone to decide next manipulation leg

Deliver price toward true unfilled demand zones

This is how institutions engineer movement while retail gets trapped chasing direction.

EURGBP Long Project1. Price Drivers: higher timeframe demand

2. Current Trend: up

3. Momentum: bullish

Action: Waiting for entry on the intraday timeframe (entry will be published further)

*Disclaimer: I will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.