EURGBP trade ideas

EURGBP | Ready to Ride Again – Just Say the WordI’ve got a lovely 1H bullish range from 0.8632 to 0.8730 — full of promise and potential.

Then came a little 40-pip pullback to 0.8687 — just a small mood swing, nothing serious. 😒

WHAT AM I GOING TO TO DO NOW?

If a bullish candle closes above my 50EMA,

I’m not overthinking — I’m riding the bull like we never broke up! 🐂💥

SL? Depends on the candle’s vibe:

If it’s a strong Marubozu, I’ll trust it like a loyal partner — SL goes just below it.

If stopped out ......!!!

TP? Straight to 0.8930 — no detours, no drama. 🎯

Wish me luck… and a bullish candle that finally knows what it wants.

EUR-GBP Potential Long! Buy!

Hello,Traders!

EUR-GBP keeps falling down

Towards the horizontal support

Level of 0.8650 and after the

Retest we will be expecting

A local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP – Buy the Dip from Morning Doji Star BaseTrade Idea

Type: Buy Limit

Entry: 0.8695

Target: 0.8757

Stop Loss: 0.8674

Duration: Intraday

Expires: 07/08/2025 06:00

Technical Overview

Morning Doji Star printed at the lows, signalling potential bullish reversal.

Previous resistance at 0.8690 now acts as support; confluence with 20-period 4H EMA at 0.8694.

Short-term bias remains positive; daily signals are bullish.

Structure offers ample risk/reward to buy on a modest pullback toward support.

Key Technical Levels

Resistance: 0.8709 / 0.8731 / 0.8757

Support: 0.8697 / 0.8680 / 0.8660

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

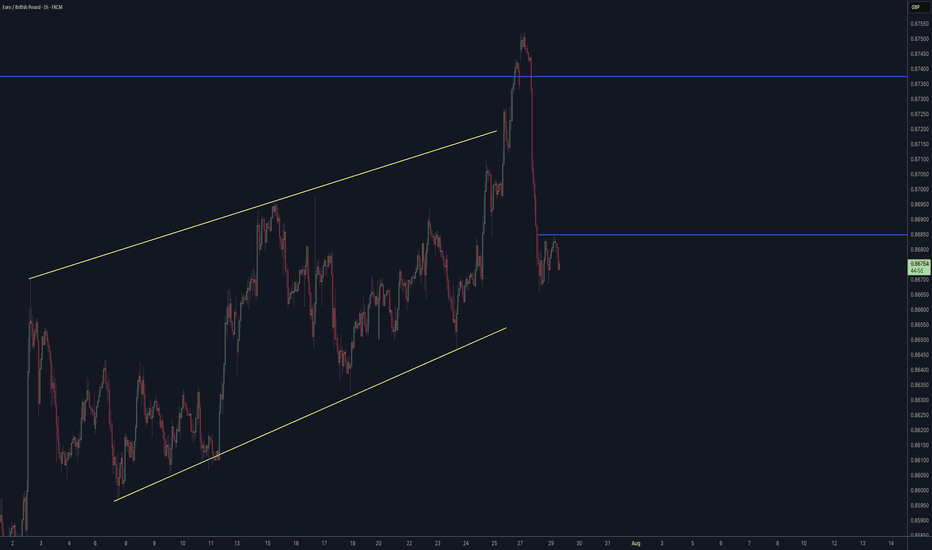

EURGBP Trend Line SupportEURGBP is Bullish and currently at trend line support we can expect a buy movement in EURGBP.

The pair is bullish and also sentiments are suggesting to go long as retails are short heavily short so we can target their SL at top.

Keep GBP Bank Rates are also upcoming and we can expect a 25 bps cuts to 4% from 4.25% which can make EURGBP fall so keep SL tight.

EURGBP Bullish Momentum Trade PlanWatching EUR/GBP closely 🔍 — after an extended bullish trend 🐂 and a sharp corrective pullback 📉, we’re now seeing renewed upside momentum and signs of bullish continuation 📈. My current bias is long ✅. Price has retraced back into equilibrium, and with movement beginning to pick up, I’m actively hunting for an entry 🎯 — aiming for a retest of the previous high, with stops tucked below the most recent low 🛡️. Everything is broken down in the video and should not be taken as financial advice ⚠️.

EURGBP – DAILY FORECAST Q3 | W32 | D8 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W32 | D8 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

EURGBPMajor Break of Structure (BoS) confirmed on the daily, with a clear rejection from recent highs. Price has aggressively sold off and is now preparing for a retracement into a key supply zone.

🔸 Plan:

Waiting for a pullback toward the 0.8715–0.8740 supply zone (area of interest) to look for signs of bearish continuation.

🔸 BoS confirms shift in trend structure

🔸 STOP: Above the previous high ~0.8825

🔸 Target: Lower lows toward ~0.8500 short term — possible extension toward 0.84xx zone

🧠 RSI shows strong bearish divergence and confirms trend shift.

📌 Setup in progress — will monitor lower timeframes (1H/4H) for entry trigger within zone.

EURGBP Long Swing Trade OANDA:EURGBP Long trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

EUR/GBP Thief Trade: Swipe Profits Before Overbought Trap!🦹♂️ EUR/GBP "THE CHUNNEL HEIST" – BULLISH LOOT IN PROGRESS! 🚨💰

(Thief Trading Strategy – Escape Before the Cops Arrive!)

🎯 DEAR MARKET PIRATES & PROFIT SNATCHERS,

Based on our 🔥Thief Trading Style Analysis🔥, we’re executing a bullish heist on EUR/GBP ("The Chunnel"). The vault is wide open—time to swipe the loot before the high-risk resistance police barricade (aka overbought trap) shuts us down!

📜 THE MASTER PLAN:

✔ Entry (📈): "The Bullish Vault is Unlocked!"

Buy Limit Orders (15-30min TF) near recent swing lows/highs.

Thief’s DCA Trick: Layer entries like a pro robber—multiple limit orders for max loot.

✔ Stop Loss (🛑): "Hide Your Stash Wisely!"

SL at nearest 4H candle wick (0.86000)—adjust based on your risk appetite & lot size.

Remember: A good thief always has an escape route!

✔ Target (🎯): 0.88000 (or escape earlier if the cops get suspicious!)

🔎 SCALPERS & SWING BANDITS – LISTEN UP!

Scalpers: Stick to LONG-ONLY heists! Use trailing SL to protect profits.

Swing Thieves: If you’re low on cash, join the slow robbery—DCA & hold!

📡 WHY THIS HEIST IS HOT:

Bullish momentum in play (but BEWARE of overbought traps!).

Fundamental Drivers: Check COT Reports, Macro Data, & Sentiment.

🚨 TRADING ALERT: NEWS = POLICE RAID RISK!

Avoid new trades during high-impact news.

Trailing SL = Your Getaway Car! Lock profits before volatility strikes.

💥 BOOST THIS HEIST – STRENGTHEN THE GANG!

👉 Smash the LIKE & BOOST button to fuel our next market robbery!

👉 Follow for more heists—profit awaits! 🚀💰

🦹♂️ Stay Sharp, Stay Ruthless… See You on the Next Heist!

EURGBP Will Collapse! SELL!

My dear subscribers,

EURGBP looks like it will make a good move, and here are the details:

The market is trading on 0.8667 pivot level.

Bias - Bearish

My Stop Loss - 0.8675

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.8650

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURGBP Steps Into A Correction Within Ongoing RecoveryEURGBP is sharply down after reaching April highs for wave »v« of an impulse into wave A. As expected, the pair is now unfolding a three-wave abc corrective setback within higher-degree wave B. Currently, EURGBP is breaking below the channel support line in a sharp and impulsive projected wave »a«. A corrective recovery in wave »b« may follow, considering that RSI is already at the lower side of its range. Overall, we are still tracking this correction toward the 0.85x support area, which could act as a base before a potential bullish continuation higher into wave C.

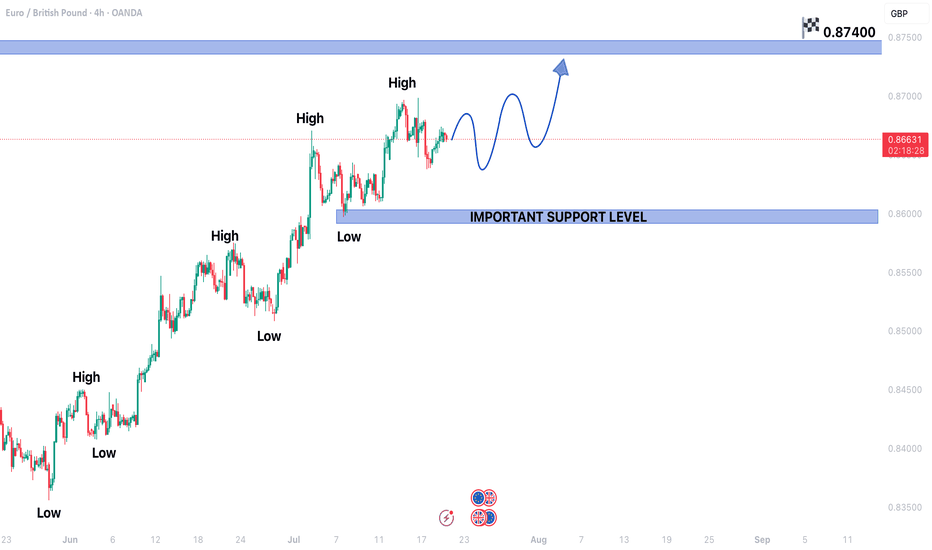

EURGBP CONTINUING BULLISH TREND STRUCTUREEURGBP CONTINUING BULLISH TREND STRUCTURE IN 4H TIME FRAME.

Price is currently in a secondary trend.

Price is expected to end the secondary trend and start primary trend again.

On higher side market may hit the targets of 0.87400

On lower side 0.85950 may act as a key support level.