EURGBP trade ideas

EURGBP: A Potential Short Opportunity Amidst ConsolidationEUR/GBP daily chart reveals a compelling narrative of consolidation followed by a potential bearish reversal. The pair has been trading within a defined range, bounded by key horizontal support and resistance zones (highlighted in blue). The recent price action suggests a rejection from the upper resistance zone, setting the stage for a possible short trade.

Key Observations:

Range-Bound Consolidation: The chart clearly shows EUR/GBP oscillating within a well-defined range. This pattern indicates a period of indecision, where neither buyers nor sellers have established a clear dominant trend.

Resistance Zone Test and Rejection: The price recently revisited the upper resistance zone. The subsequent price action, characterized by a sharp downward move, suggests a strong rejection from this level. This rejection is a critical signal that sellers are stepping in, potentially reversing the recent upward momentum.

Bearish Engulfing/Pin Bar Formation (Possible): While the chart doesn't explicitly highlight a candlestick pattern, the sharp rejection from the resistance zone suggests the formation of a bearish engulfing or a pin bar on a lower timeframe. This pattern reinforces the bearish bias.

Retracement and Entry Opportunity: The price has retraced a portion of the recent decline. This retracement presents a potential opportunity to enter a short position, capitalizing on the anticipated continuation of the bearish move.

Support Zones as Targets: The lower support zone serves as a primary target for the potential short trade. The intermediate support level (around 0.83727) can act as a partial profit-taking zone or a point to trail the stop loss.

Pattern Identification:

The dominant pattern observed is a range-bound consolidation followed by a potential bearish reversal triggered by a rejection from a key resistance zone. Trade Setup:

Entry: A short entry can be considered at the current price level (around 0.85021-0.85129) or on a break below the immediate support level (0.84772). A more conservative approach would be to wait for a clear bearish candlestick pattern confirmation on a lower timeframe (e.g., H4 or H1).

Stop Loss: The stop loss should be placed above the recent swing high (around 0.85867) to protect the trade from unexpected price reversals.

Take Profit: The primary target is the lower support zone (around 0.82537-0.82218). An intermediate target can be set at the 0.83727 level.

Risk-Reward Ratio: The potential trade offers a favorable risk-reward ratio, with a relatively small stop loss and a significant profit target.

EUR/GBP Analysis Double Bottom Breakout Toward TargetOverview of the Chart

This chart displays a EUR/GBP daily timeframe setup, highlighting a Double Bottom Pattern, a well-known bullish reversal formation. The pattern consists of two consecutive lows at a similar price level, followed by a breakout above a key resistance zone. This setup suggests a potential trend reversal from bearish to bullish.

Technical Analysis Breakdown

1. Double Bottom Formation (Reversal Signal)

Bottom 1: The first low was established after a prolonged downtrend, where the price found support and bounced higher.

Bottom 2: Price revisited the same support area but failed to break lower, indicating that sellers are losing strength and buyers are stepping in.

A double bottom pattern signals that the asset is forming a strong base and is likely to move higher after breaking the neckline (resistance level).

2. Support and Resistance Levels

Support Level (~0.8322):

This level acted as a demand zone, preventing further downside.

It marks the price area where buyers accumulated positions, leading to a reversal.

Resistance Level (~0.8500):

This level previously acted as a supply zone, where sellers controlled the price.

A breakout above this level is crucial to confirm the bullish trend continuation.

3. Breakout Confirmation & Retest Expectation

The price successfully broke above the resistance zone, confirming a bullish reversal.

A potential retest of the broken resistance (now turned support) could occur before further upside movement.

Traders often wait for this retest to confirm that the breakout is genuine before entering a position.

4. Price Target Projection

Based on the measured move strategy, the expected target is calculated by measuring the height of the double bottom pattern and projecting it above the breakout zone.

Target Price: 0.8742, aligning with historical resistance levels.

5. Stop Loss Placement

Stop loss at ~0.8322 (below the double bottom support).

This ensures risk is managed in case of an invalid breakout or a false move.

Trading Plan & Execution Strategy

📌 Entry Strategy:

✅ Breakout Entry: Buy after the breakout above resistance.

✅ Retest Entry: Wait for a pullback to the previous resistance (now support) before entering.

📌 Risk Management:

🔹 Stop Loss: Placed below the recent support at 0.8322 to limit downside risk.

🔹 Take Profit: First target at 0.8742 based on the double bottom structure.

📌 Market Outlook:

A successful breakout and bullish momentum could push prices toward the target.

If the price fails to hold above the breakout zone, a deeper retracement could occur before continuing higher.

Conclusion

The EUR/GBP pair has formed a bullish double bottom reversal pattern, signaling a potential uptrend continuation. The key levels to watch include 0.8500 (resistance turned support) and 0.8742 (target projection). Traders should monitor price action around the breakout zone for confirmation and consider risk management strategies before entering a position.

EURGBP is ready to take off ... the week of 07 Apr 2025Weekly chart – strongly bullish, broke above previous structure

Daily chart – strongly bullish, broke above previous structure

H4 chart – bullish, now pulling back towards previous resistance, now turned support.

The formation of a higher low on the daily adds to my confidence that we are headed higher. This is actually a breakout-retest setup. When/If price reaches this zone, I will be monitoring PA on H4 and H1 timeframes with a view to find evidence of a bullish continuation. We could easily have a much deeper retracement too. In the current uncertain world economic situation, it is vital to establish that control of the market has returned to the bulls, before taking a trade.

Stop may be larger than what I would like, but it will need to be below the nearest swing low. Target can be generous too – at 0.8613 or anywhere higher right up to 0.8750.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk, only trade with money you can afford to lose and carefully manage your capital and risk.

If you like my idea, please give a “boost” and follow me to get even more. Please comment and share your thoughts too!!

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

OPPORTUNITY FOR BUY EURGBPWe have the following indicators for a BUY opportunity:

• Low volume suggesting continuation of the current direction.

• Support at a monthly low level.

• Re-test 6M low + 3M low

• Reflection from the bottom of the parallel channel.

• Strong long-term support area.

• Bounce from the trend line.

We define 3 goals:

TP 1 = 40 pips

TP 2 = 100 pips

TP 3 = 200 pips

SL = -200 pips

EURGBPEURGBP Daily chart is in a correction phase. The price has come down to test the support zone again. If the price can stay above 0.82396, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

EURGBP Wave Analysis – 4 April 2025

- EURGBP broke resistance area

- Likely to rise to resistance level 0.8500

EURGBP currency pair recently broke the resistance area located between the resistance level 0.8450 (which has been reversing the price from September), resistance trendline of the daily down channel from November and the 50% Fibonacci correction of the downward impulse from March.

The breakout of this resistance area should strengthen the bullish pressure on this currency pair.

EURGBP currency pair can be expected to rise to the next resistance level 0.8500 (former yearly low from 2023 and strong support from the start of 2024).

EURGBP- Chart of the day (Trend line break out)The pair hits a fresh year high on board-based Euro buying. Intraday bias remains bullish as long as support 0.8380 holds. It hit an intraday high of 0.85014 and is currently trading around 0.85008.

Technical Analysis

The pair is currently trading above the 34- and below 55-EMA on the 4-hour chart.

Bearish Trend Confirmation: Any break below 0.84500 confirms an intraday bearish trend. A drop to 0.8400/0.8380/0.8300 is likely.

Near-Term Resistance: It broke major trend line resistance (trend line joining 0.87564 and 0.86251). A jump to 0.85405 (200 W EMA)/0.8600 is possible.

Indicator Analysis (Daily chart)

CCI (50): Bullish

Average Directional Movement Index: Bullish

Trading Recommendation

It is good to buy on dips around 0.84950-98 with SL around 0.84480 for a TP of0.8600

EURGBP Market Structure Analysis on 4 Hour Timeframe4H swing is bullish => current is pullback

M15 swing is bearish.

Currently giving CHoCH reversal signal.

We can look for buying opportunities in this area.

More carefully, we wait for the price to break the top to confirm the 15-minute reversal frame.

EURGBP: Short Trading Opportunity

EURGBP

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell EURGBP

Entry - 0.8451

Stop - 0.8489

Take - 0.8371

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EUR/GBP (1H) – Rising Wedge Breakdown & Short Trade Setup1. Overview of Market Structure

The EUR/GBP pair is forming a Rising Wedge Pattern, a well-known bearish reversal formation, which suggests that the current uptrend may soon reverse into a downtrend. The price has been moving within a tightening range, making higher highs and higher lows, but the upward momentum appears to be weakening.

A breakdown from this wedge is a strong bearish signal, indicating that sellers are gaining control, and a significant price drop is expected.

2. Chart Pattern: Rising Wedge – Bearish Reversal

A Rising Wedge is a pattern that occurs when price moves upward within a contracting range. This pattern typically forms after an uptrend and suggests that bullish momentum is slowing down.

Characteristics of the Rising Wedge in This Chart:

The price has tested the upper resistance zone multiple times, but each attempt has resulted in a rejection.

The lower support trendline has been tested frequently, showing that buyers are losing strength.

The breakdown of the wedge signals a strong bearish move, with price expected to drop toward key support levels.

This pattern becomes valid once the price breaks below the lower trendline, confirming the bearish outlook.

3. Key Technical Levels & Zones

A. Resistance Zone (0.84853) – Strong Supply Area

Marked as a Resistance Zone, where price has struggled to break through.

Sellers have stepped in around this level multiple times, preventing any further bullish movement.

Acts as a major stop-loss level for bearish trades, as a breakout above this zone could invalidate the setup.

B. Support Zones (Potential Take-Profit Targets)

1st Support Level (TP1) – 0.82539

This level has previously acted as strong support, where buyers have entered the market before.

A short-term pullback or consolidation may occur here.

2nd Support Level (TP2) – 0.81332

This is the final bearish target, marking a key demand zone from where price has bounced in the past.

If bearish momentum continues, price could reach this level, making it an ideal take-profit zone for swing traders.

4. Trading Strategy & Execution

A. Entry Strategy

A short trade is ideal after the price breaks below the rising wedge pattern. There are two possible entries:

Aggressive Entry:

Enter immediately after the breakout of the lower trendline, anticipating strong downside momentum.

Higher risk as price might retest the trendline before moving down.

Conservative Entry:

Wait for a retest of the broken trendline before entering short.

This confirms the breakdown, reducing false breakout risks.

B. Stop-Loss Placement

Stop-loss should be placed just above the resistance zone (0.84853).

This prevents being stopped out by minor pullbacks before the actual move happens.

C. Take-Profit Targets

TP1: 0.82539 (First major support level – potential profit booking area)

TP2: 0.81332 (Final bearish target – strong demand zone)

5. Risk Management & Trade Management

Risk-to-Reward Ratio (RRR)

This trade offers a high RRR, making it an attractive setup.

The stop-loss is small compared to the potential downside move.

Trailing Stop Strategy

A trailing stop can be used to lock in profits as price moves lower.

If price reaches TP1, move stop-loss to breakeven to secure capital.

If price reaches TP2, close the trade for maximum profit.

Exit Strategy

Exit early if price fails to break key support zones.

Monitor price action around TP1 & TP2 for signs of reversal.

6. Sentiment Analysis & Market Context

Bearish Confirmation:

Breakdown from the wedge signals bearish sentiment in the market.

If price fails to sustain above support zones, further downside is likely.

News & Fundamentals:

Major economic events or interest rate decisions could impact EUR/GBP volatility.

Traders should check for UK & Eurozone news before entering the trade.

7. Conclusion – Bearish Outlook

The Rising Wedge breakdown is a strong short-selling opportunity.

Confirmation is key: Enter short after the breakdown, use proper risk management, and aim for TP1 & TP2.

If price invalidates the pattern by breaking above 0.84853, the trade setup should be reconsidered.

This setup provides a high-probability bearish trade with a well-defined stop-loss and risk-to-reward ratio.

EURGBP: A Multi-Time Frame AnalysisEURGBP: Range Trading Opportunity

EUR/GBP recently tested a strong resistance zone near 0.8470, showing for a possible price reaction. The same zone pushed the price downward several times.

We have to be careful as the situation is not that stable from Trump's tariffs but it could be the case for EURGBP to respect the same pattern again. Based on historical price behavior, there is potential for the pair to move downward again.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP → False break of liquidity zone (resistance)FX:EURGBP within the distribution (news background) tests resistance 0.84616 and liquidity zone, but without the possibility of continued growth the price forms a false breakout

The dollar index falls amid Trump's introduction of new tariffs, which generally provokes a rally in the whole market. But before NFP, the market shifts to profit-taking because of the growing risks. There are quite important news ahead, which may provoke high volatility.

Technically, after a strong move, the currency pair forms a false resistance breakout and consolidates in the selling zone. If the bears keep the price below 0.84616, in the short term we should wait for a correction to 0.5 fibo or to the fvg zone.

Resistance levels: 0.84600

Support levels: 0.8427, 0.8396

The situation is quite complicated due to unstable background, but technically we have a classic situation with a false breakout of strong resistance, and as we know, according to statistics, the strongest movements start after it (in relation to the trade of level breakout).

Regards R. Linda!

Why EURGBP Bullish ?? Detailed Analysis EUR/GBP is currently trading around 0.8470, having recently completed a breakout accompanied by increased trading volume. This surge suggests strong bullish momentum, with the pair targeting a potential gain of over 300 pips, aiming for a price level of 0.8700.

Fundamental factors contribute to this bullish outlook. The euro has shown resilience amid recent economic developments in the Eurozone. Notably, Eurozone inflation decreased to 2.2% in March from 2.3% in February, driven by a significant reduction in energy costs and slowing service inflation. Core inflation, which excludes volatile food and fuel prices, also fell to 2.4% from 2.6%, which was below expectations. This easing of inflation is likely to reinforce expectations for another interest rate cut by the European Central Bank (ECB) later in April. The ECB has already reduced rates six times since last June.

Conversely, the British pound has experienced fluctuations due to recent trade developments. On April 3, 2025, the pound surged to a six-month high against the U.S. dollar amid global market concerns following the announcement of new U.S. trade tariffs. Despite facing elevated duties on exports such as cars, steel, and aluminum, optimism surrounding a potential UK-U.S. trade agreement provided a positive outlook for sterling. citeturn0news24 However, ongoing trade negotiations and potential fiscal adjustments by the UK government may introduce volatility, influencing the pound's performance against the euro.

Technical analysis supports the bullish sentiment for EUR/GBP. The pair's breakout above previous resistance levels, coupled with increased volume, indicates strong buying interest. Key resistance levels to monitor include 0.8500 and 0.8600, with a sustained move above these levels potentially paving the way toward the 0.8700 target. Traders should also observe support levels around 0.8400 to manage potential pullbacks effectively.

In summary, the EUR/GBP pair exhibits a bullish trajectory, underpinned by favorable technical patterns and evolving fundamental factors. Traders should implement robust risk management strategies, including setting appropriate stop-loss orders, to navigate potential market volatility. Staying informed about upcoming economic data releases and central bank communications will be crucial in effectively capitalizing on this trading opportunity.

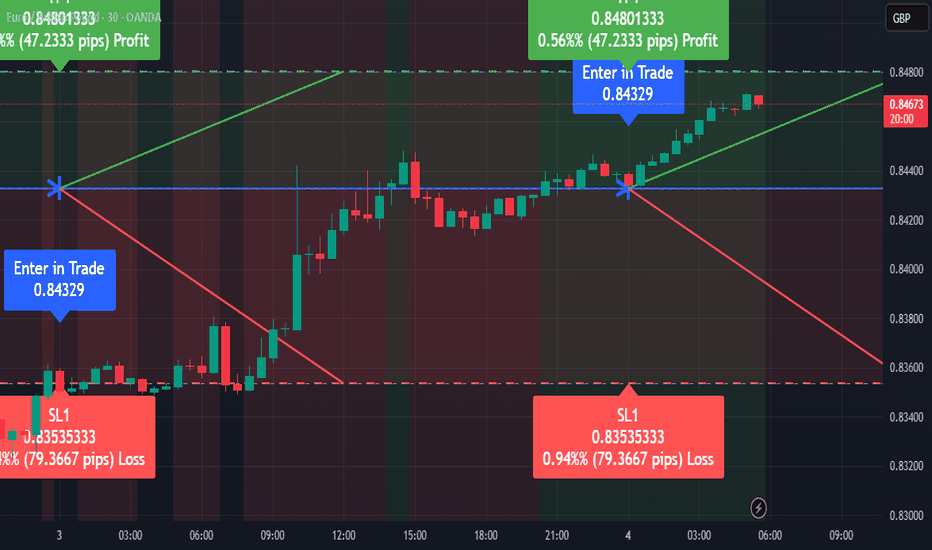

EURGBP Poised for Upward Momentum - Buy Opportunity AheadEURGBP is signaling a bullish scenario according to the EASY Trading AI strategy. Current analysis indicates a strategic entry at 0.84329, aiming for a clear upward potential with a well-defined take profit target at 0.84801333 and protective stop loss level at 0.83535333. The EASY Trading AI identifies this move based on emerging bullish market structure, steady price momentum, and supportive buying volumes at current price levels. Watch for continued buyer strength confirming this anticipated move towards our established upside target.

UPDATE ON EURGBP BUY BIASThis pair took us out once but our buy bias was still the same so we looked for another buy opportunity and lurkingly for us we found one.

The confluences were the same, both normal retail head and shoulders structural patterns and some others. Trade is running about 8:1 RR. What a good catch!!!

EURGBP SELL TRADE PLAN🔥 EUR/GBP TRADE PLAN 🔥

✅ Analysis Timeframe: D1, H4, H1

✅ Market Bias: Bearish 📉

✅ Trade Type: Trend Continuation

📌 ENTRY TYPE: Sell Trade – Pullback Entry

⭐ Confidence Level: ⭐⭐⭐⭐⭐ (90%)

(Structure + OB + EMA Rejection + Momentum + Fundamentals)

📌 STATUS: Waiting for entry confirmation within zone

📍 ENTRY ZONE (SELL):

Primary Zone: 0.8355 – 0.8375

Secondary Zone (Deeper Pullback): 0.8395 – 0.8410

(Rejection zone aligning with bearish OB and EMA dynamic resistance)

📌 STOP LOSS:

Single SL for both entries: Above 0.8425

📌 TAKE PROFIT TARGETS:

🥉 TP1: 0.8300 (Secure partials & move SL to BE)

🥈 TP2: 0.8250

🥇 TP3: 0.8200 (Final swing target)

📌 RISK-REWARD (Approx.):

Primary Zone: ~1:3

Secondary Zone: ~1:4

📌 REASON FOR ENTRY:

Overall bearish market structure on D1/H4

Institutional OB rejection at confluence zone

EMA dynamic resistance aligning with zone

Momentum shift toward GBP strength (EUR weakness in sentiment data)

📌 CONFIRMATION REQUIRED:

H1 Bearish Engulfing or Pin Bar in the zone

Bearish divergence or failure to break recent high

Spike in sell volume at or near OB

📌 RISK MANAGEMENT REMINDER:

💼 Risk 1–2% only. Move SL to breakeven after TP1. Don’t scale in unless confirmation supports continuation.

📌 TRADE VALIDITY & INVALIDATION:

✅ Valid for next 24–48 hours while structure holds

❌ Invalidate if price closes above 0.8425 or breaks structure with bullish momentum

📌 FUNDAMENTAL CONFLUENCE:

EUR pressured by recent zone weakness in economic outlook

GBP supported by relatively stable BoE sentiment

No major EU data surprises expected; risk flows favor GBP

📋 FINAL TRADE SUMMARY:

🔻 SELL EUR/GBP on pullback into 0.8355–0.8375

👉 SL: Above 0.8425

🎯 TP: 0.8300 → 0.8250 → 0.8200

⏳ Validity: 24–48h while structure holds

🚨 Execute ONLY on confirmation – institutional precision only.

EUR/GBP Triangle Pattern - Bearish Breakdown SetupProfessional Analysis of the EUR/GBP Chart

This EUR/GBP (Euro/British Pound) daily chart from OANDA, published on April 3, 2025, highlights a key technical setup based on price action analysis, chart patterns, and support/resistance levels.

1. Market Context: Accumulation & Transition to a Triangle Pattern

Curve Zone Formation (Rounded Bottom):

The market initially exhibited a rounded bottom structure (curve zone) from July 2024 to February 2025, indicating a gradual accumulation phase.

This phase often signals a shift in market sentiment, where sellers lose dominance, and buyers start stepping in.

Breakout from Accumulation:

After reaching the support zone (~0.8250 - 0.8300), price rebounded sharply in March 2025, confirming strong buyer interest.

However, it failed to sustain upward momentum near the resistance zone (~0.8470 - 0.8500), leading to consolidation.

2. Formation of a Symmetrical Triangle Pattern

Lower Highs & Higher Lows:

Price action began forming a symmetrical triangle, a classic consolidation pattern that typically precedes a strong breakout.

The market is currently trading near the apex of the triangle, indicating that a breakout is imminent.

Potential Breakout Direction:

Symmetrical triangles are neutral patterns, meaning they can break either upward or downward.

However, the price structure and resistance rejection suggest a higher probability of a bearish breakdown.

3. Key Levels & Trading Setup

Resistance & Support Zones:

🔴 Resistance Zone (~0.8470 - 0.8500):

This area has repeatedly acted as strong resistance, where sellers have consistently pushed prices lower.

A breakout above this zone would indicate a bullish invalidation of the current bearish bias.

🟢 Support Zone (~0.8250 - 0.8300):

This level has held price multiple times, acting as key support.

A break below this zone would confirm bearish momentum, targeting lower price levels.

4. Bearish Trade Setup

📉 Entry Strategy (Short Position):

Wait for a confirmed breakout below the triangle’s lower trendline (~0.8320 - 0.8350).

A retest of the broken support turning into resistance would provide the best short entry.

📌 Stop-Loss Placement (~0.84764):

Positioned above recent highs and the resistance zone to minimize risk.

This ensures the trade is protected against potential false breakouts.

🎯 Profit Target (~0.81190 - 0.81134):

The projected move aligns with historical support levels, making it a logical target.

This level represents a previous market structure where buyers stepped in.

5. Conclusion & Trade Considerations

✅ Bearish Bias: The price action and pattern suggest a higher probability of a downside breakout.

✅ Defined Risk & Reward: A well-structured stop-loss and target level ensures a solid risk management strategy.

✅ Watch for Confirmation: Traders should wait for a confirmed breakout before entering a trade to avoid false moves.

📊 Overall Verdict: A high-probability short setup is forming, with a clear entry, stop-loss, and take-profit strategy. If the market respects the triangle breakdown scenario, this could lead to a significant bearish move toward the 0.81190 target.