EURGBP SHORT – WEEKLY FORECAST Q3 | W29 | Y25💼 EURGBP SHORT – WEEKLY FORECAST

Q3 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

EURGBP is currently reacting from a key higher time frame supply zone, with price action showing weakness at premium levels. Momentum has slowed, and early signs of distribution are appearing. With structure aligning bearishly across multiple timeframes, the pair presents a short bias opportunity.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Price reacted from a high-probability bearish OB.

Rejection wicks and a shift in candle body control point to supply dominance.

Momentum is fading, confirming the presence of smart money sellers.

✅ 4H Order Block

Clear mitigation of 4H OB followed by an internal break of structure (iBoS).

Price is respecting the OB zone, printing lower highs beneath key supply.

Perfect mid-timeframe confirmation of trend transition.

✅ 1H Order Block

1H structure shifted bearish, validating LTF trend alignment.

Price building supply chain with continued lower highs and bearish engulfing patterns.

Ideal zone for entry on pullback or liquidity sweep.

📈 Risk Management Protocols

🔑 Core Principles:

💰 Max 1% risk per trade

📍 Only execute at pre-identified zones

⏰ Set alerts — avoid impulsive trades

📉 Respect RR — minimum 1:2 per position

🧠 You're not paid for frequency. You're paid for discipline and execution quality.

🧠 Weekly FRGNT Insight

“Trade what the market gives, not what your ego wants.”

Stay mechanical, stay focused, and allow the probabilities to play out. Your job is to control risk — not the outcome.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

📌 The confluences are stacked.

📌 The bias is confirmed.

Let your execution reflect your discipline, not your emotions.

❤️ Good luck this week, and as always – I’ll see you at the very top.

EURGBP trade ideas

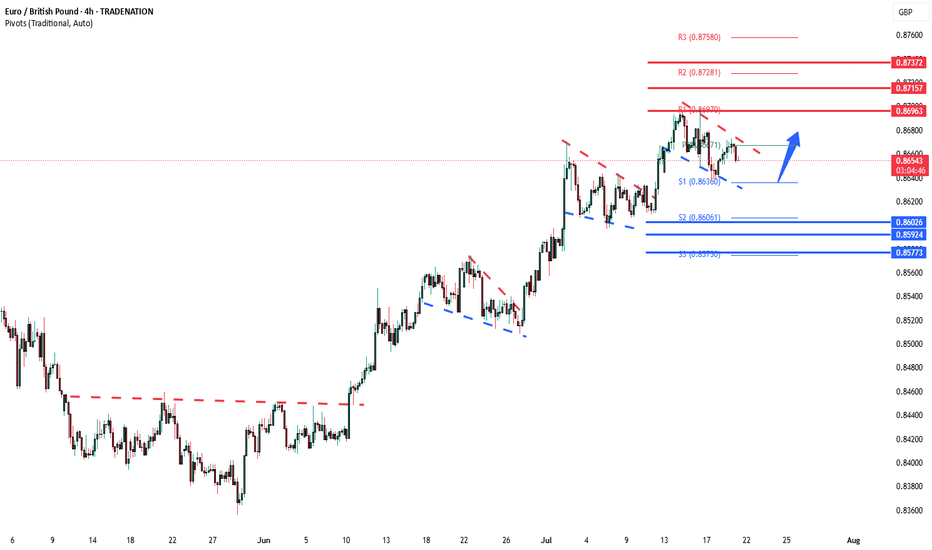

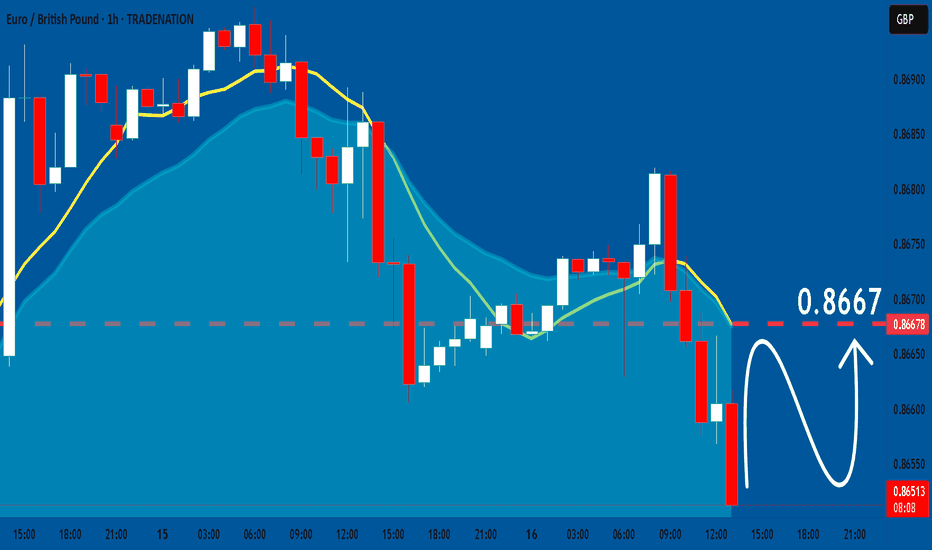

EURGBP - Follow The Bulls!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURGBP has been overall bullish trading within the rising channel marked in blue. And it is currently retesting the lower bound of the channel.

Moreover, the orange zone is a strong daily support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower blue trendline and support.

📚 As per my trading style:

As #EURGBP approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

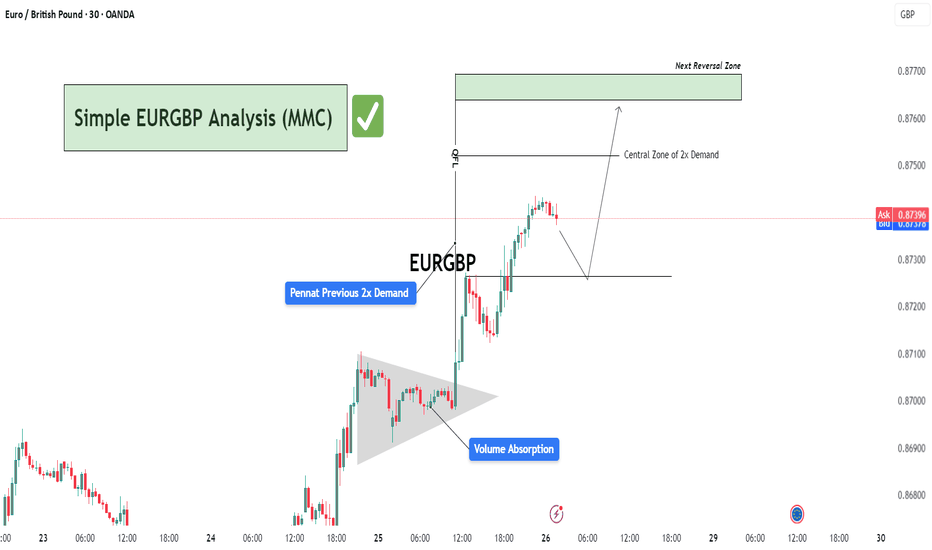

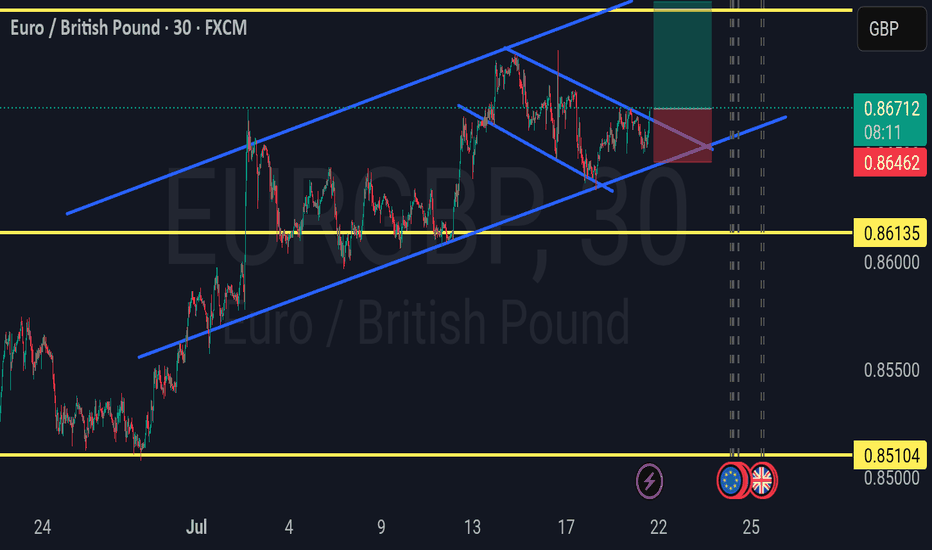

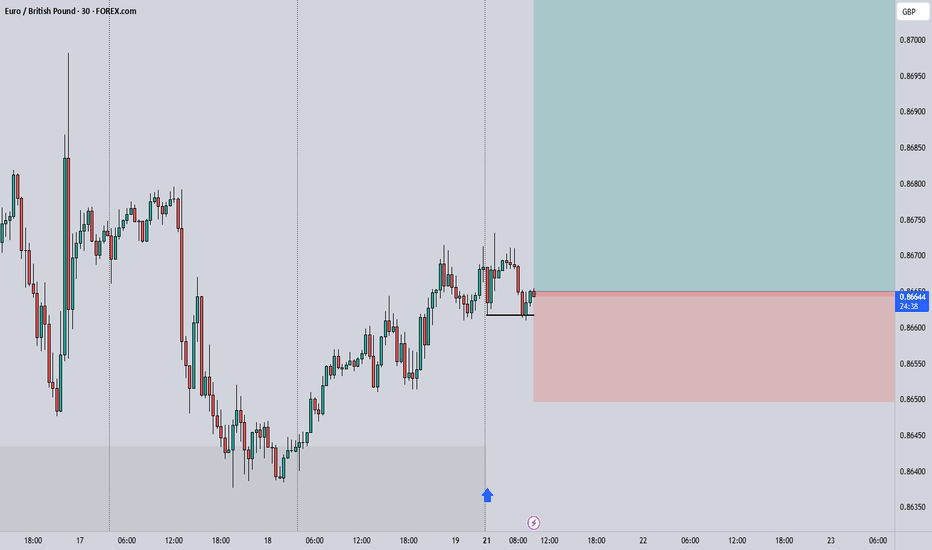

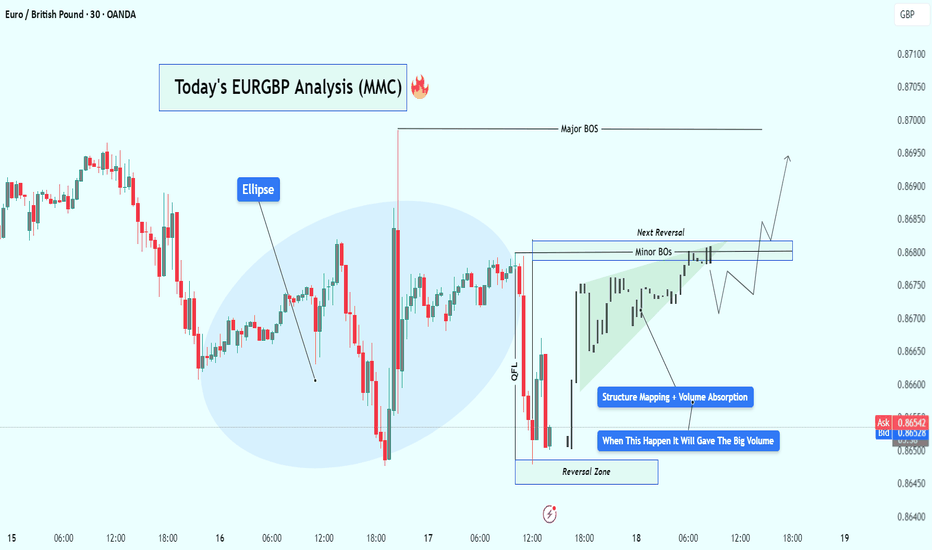

Simple EURGBP Analysis (MMC) – Bullish Continuation or Reversal?🕵️♂️ Chart Overview – 30-Min Timeframe (OANDA)

This EURGBP chart illustrates a classic bullish continuation structure following a volume absorption phase and pennant formation, leading into a vertical price expansion toward a potential reversal zone. The technical flow demonstrates smart money accumulation and re-accumulation before a sharp bullish leg.

🔷 Phase 1: Bullish Accumulation via Pennant Formation

The chart begins with a tight consolidation structure marked as a pennant, typically a continuation pattern.

This area coincides with “Previous 2x Demand”, hinting at a strong institutional buying interest.

The Volume Absorption label suggests that sell-side liquidity was efficiently absorbed—often a precursor to bullish breakouts.

📈 Phase 2: Breakout & Price Expansion

Price breaks out of the pennant aggressively, validating the absorption theory.

The post-breakout rally continues with minimal retracement, showcasing impulsive bullish momentum.

The QFL (Quasimodo Failure Level) is also marked—this serves as a structural footprint left by trapped sellers.

🟩 Next Levels to Watch: Reversal or Re-Entry Zones

As the price approaches the green "Next Reversal Zone" (0.87650–0.87700), watch for potential exhaustion or a reaction.

The Central Zone of 2x Demand (just below 0.87500) could act as a re-entry level for continuation long setups.

Anticipated short-term correction before continuation, as depicted by the projected path.

🧠 Strategic Insight & Trade Planning

Aggressive Bulls: May target breakout pullbacks near the Central Zone of Demand for intraday continuation.

Conservative Traders: Should wait for a clean reaction from the green Reversal Zone. If rejection is confirmed, short opportunities with tight stops become favorable.

Watch the price behavior around 0.87300–0.87500—this will likely dictate whether continuation or correction prevails.

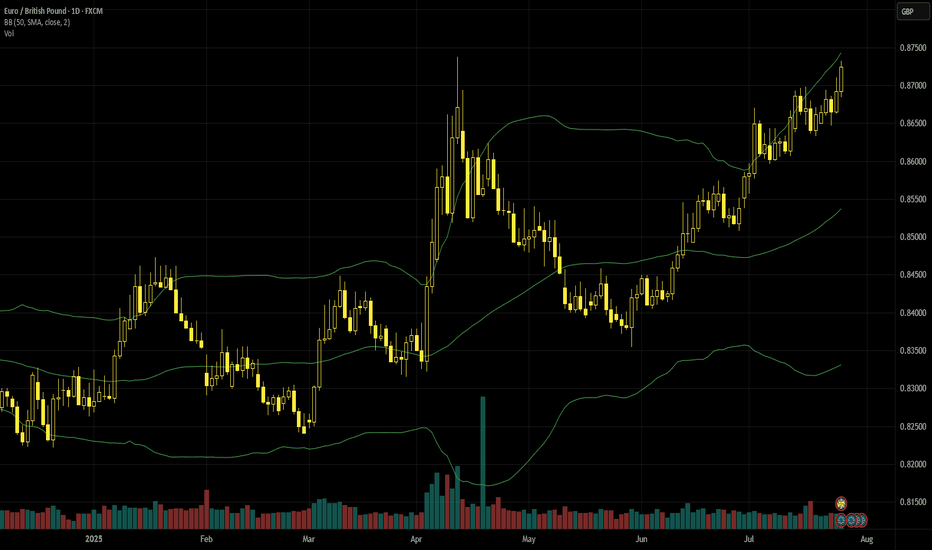

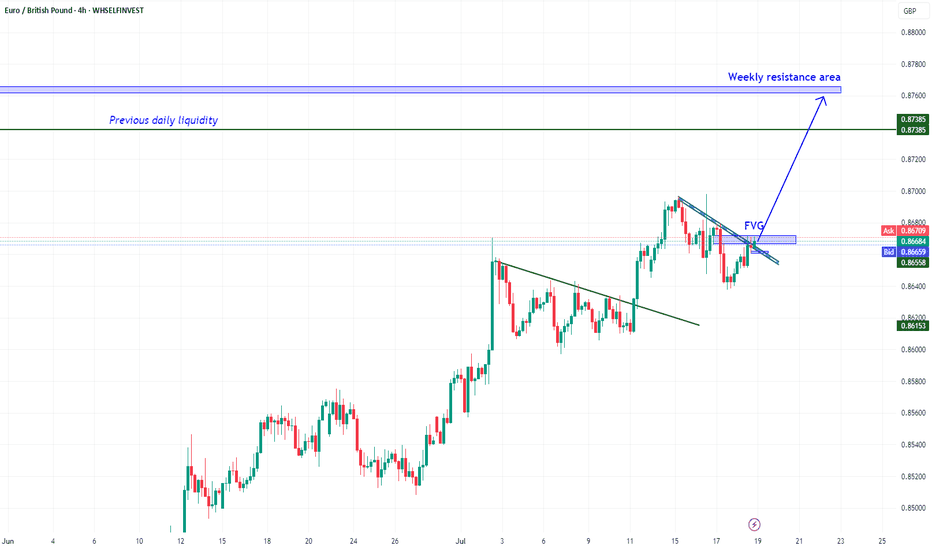

Euro-pound retests April’s highsThe ECB’s relative hawkishness or at least lower dovishness on 24 July seems to have boosted the euro significantly, with euro-pound in particular continuing its uptrend. Here though the generally weaker recent sentiment on British growth and disappointing retail data added fuel to EURGBP’s gains. There’s also some likelihood that the EU will secure a trade deal with the USA in the next few days before the deadline for new tariffs of 1 August.

87p on 24 July was euro-pound’s highest daily close since December 2023 and gains continued intraday the following day with a clear push above the 23.6% monthly Fibonacci retracement. The overall trend since March is upward and these two days might suggest that the latest phase of it isn’t close to exhaustion yet; on the contrary, momentum has increased in recent sessions. However, volume has been significantly lower since late April and now a seasonal further drop might be possible. The slow stochastic signals overbought and ATR hasn’t risen significantly in recent days.

The 20 SMA might be an important dynamic support in the near future, but first it’d be possible to see the 23.6% Fibo flipping to support from resistance previously. Traders are looking ahead to the eurozone’s flash GDP for Q2 on 30 July and inflation on 1 August although the latter might be overshadowed by the NFP the same day.

This is my personal opinion, not the opinion of Exness. This is not a recommendation to trade.

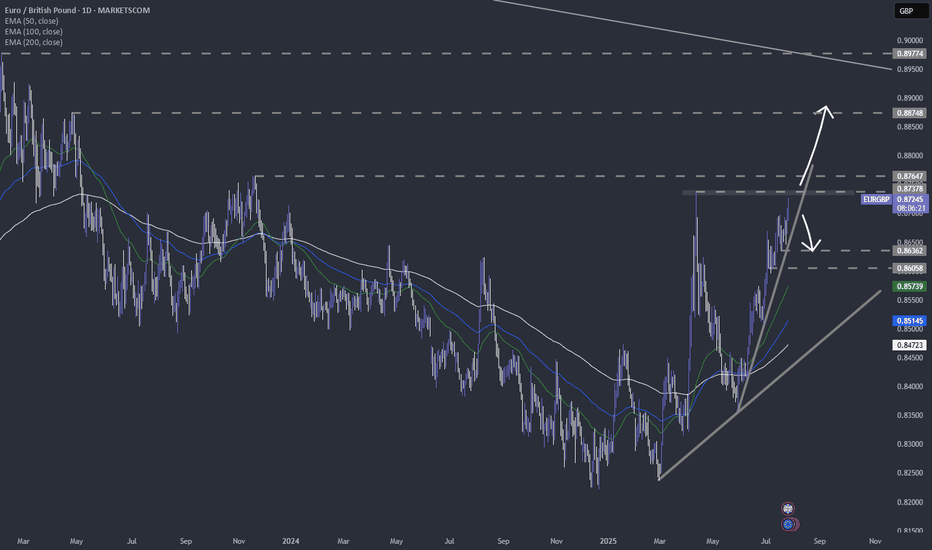

EURGBP near the current highest point of 2025.FX_IDC:EURGBP is slowly approaching a strong area of resistance, which is the current highest point of 2025. Let's dig in...

MARKETSCOM:EURGBP

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

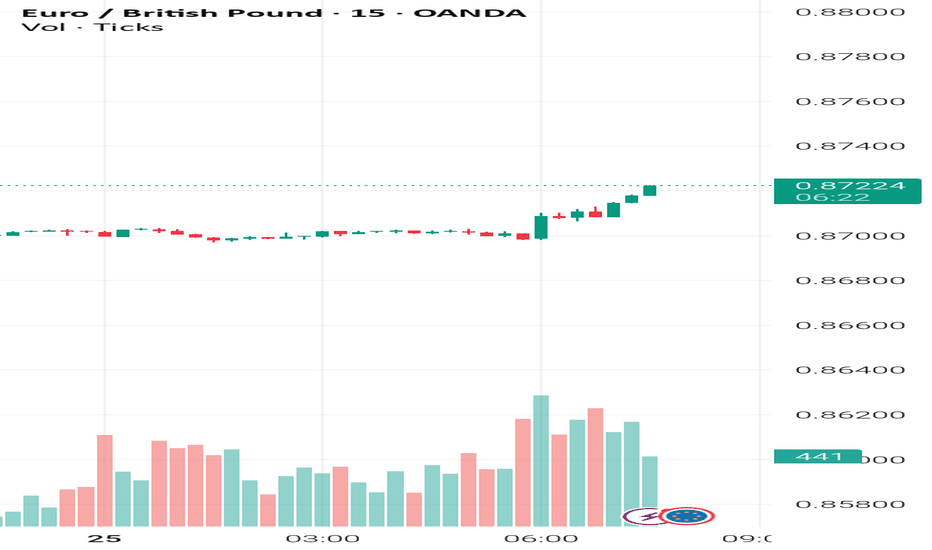

EUR GBP: Long EUR GBP long 'relative fundamental' trade, based on the fairly 'hawkish' ECB and also today's and yesterday's 'soft' UK data. Entry 0.8712

The risk to the trade is the fact the stop loss is not behind a solid 'upswing of note'. But this is the only moment I have to potentially trade today and I think it's worth a go.

I do think a 'risk on' trade is also viable (which is also a risk if the GBP strengthens in a positive environment). But I've chosen to go with the 'freshness' of the UK data.

EUR GBP has a low ATR, the trade has a 10 pip stop loss and 15 pip profit target.

If it's ongoing, I will close the trade before end of day to avoid weekend risk.

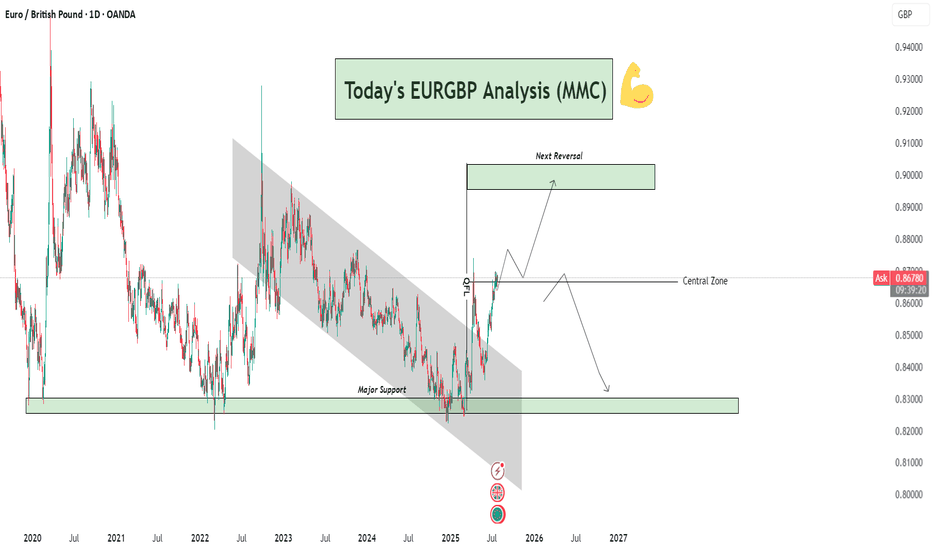

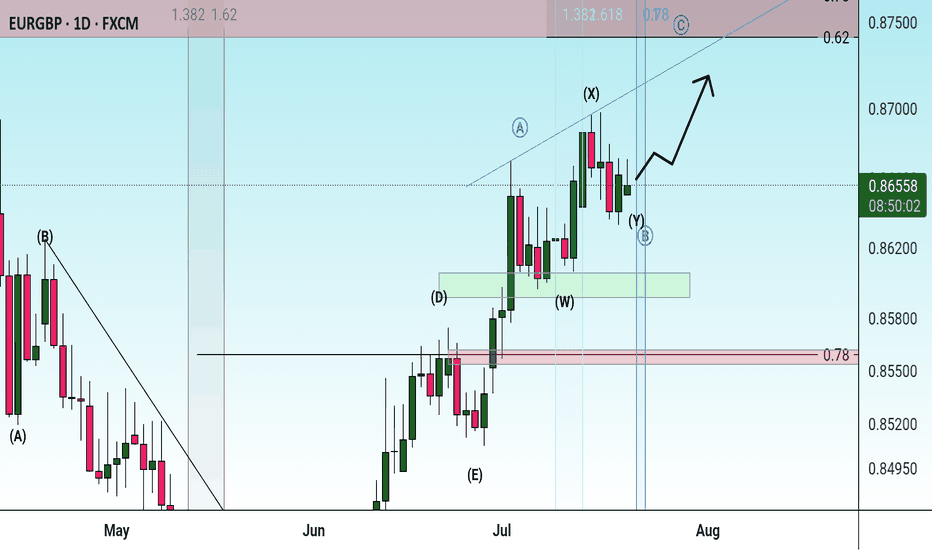

EURGBP Analysis : Breakout, Central Zone Flip & Reversal Target🧠 Overview:

This EURGBP daily chart clearly presents a bullish breakout from a long-term descending channel, a successful reclaim of the central structure zone, and a projection toward a key reversal level. This analysis incorporates Smart Money Concepts (SMC), Market Maker Concepts (MMC), and classic structural behavior.

🔍 Technical Breakdown:

📉 Long-Term Bearish Channel (2021–2025)

For nearly 4 years, EURGBP was trapped in a descending channel, forming consistent lower highs and lower lows.

This long-term bearish phase reflects strong supply-side control and institutional distribution.

The breakout above this structure is significant — marking a potential mid- to long-term trend reversal.

🔁 Major Support Zone (0.8300–0.8350)

Price bounced strongly from this historical demand zone multiple times (in 2021, 2022, and recently in 2025).

This zone is critical and acts as a high-volume accumulation area where smart money has stepped in.

The strong reaction from this level in 2025 triggered the breakout of the bearish structure.

🚀 Break of Structure + Retest

After breaking the descending channel, price retested the upper boundary, confirming a structure shift.

The breakout retest succeeded — marking the transition from a bearish phase to a bullish expansion.

📍 Central Zone Flip

The Central Zone, once a resistance/supply area during the downtrend, has now been reclaimed as support.

This is a powerful MMC concept – where the "central balance" of a structure flips and becomes a base for the next impulse.

Current price is sitting just above this zone, indicating bulls are still in control.

🎯 Next Reversal Zone (Target Area: 0.9000–0.9050)

The chart outlines a projected bullish move toward the Next Reversal Zone marked above.

This is a key supply area, likely to trigger profit-taking or institutional sell orders.

Expect price to range or wick into this zone before showing a possible bearish reversal.

🔄 Future Projection Scenarios:

Scenario 1 – Bullish Continuation:

Price continues to build bullish structure and approaches the 0.90 reversal zone.

Rejection from this zone may trigger consolidation or a minor retracement.

Scenario 2 – Major Reversal:

Upon hitting the next reversal zone, price could reverse and fall back toward the Central Zone or even the Major Support below, especially if macroeconomic fundamentals shift.

🔑 Confluences Supporting This Setup:

✅ Element 🧩 Description

🔹 Major Support Historical demand zone with repeated rejections

🔹 Channel Breakout Structure shift confirming bullish interest

🔹 Retest Success Technical confirmation of breakout validity

🔹 Central Zone Flip Old resistance → new support (MMC principle)

🔹 Reversal Zone Anticipated next profit-taking / supply area

📌 Strategic Insight:

Bias: Bullish short-term to mid-term

Entry Opportunity: Lower timeframe pullbacks into Central Zone (or retest zones)

Target: 0.9000–0.9050 area

Watch for Rejection: In reversal zone for potential bearish shift

⚠️ Risk Note:

Always wait for confirmation at reversal zones. Overextended moves without correction can quickly retrace. Manage your trades with stop-losses below key structural levels and maintain strict risk-reward planning.

🧠 Conclusion:

EURGBP has transitioned from a long bearish cycle into a bullish expansion phase. Smart Money accumulation at the base and a clean breakout with retest confirm a strong directional shift. Keep your focus on the Central Zone retests and the Reversal Zone reaction for optimal entries or exits.

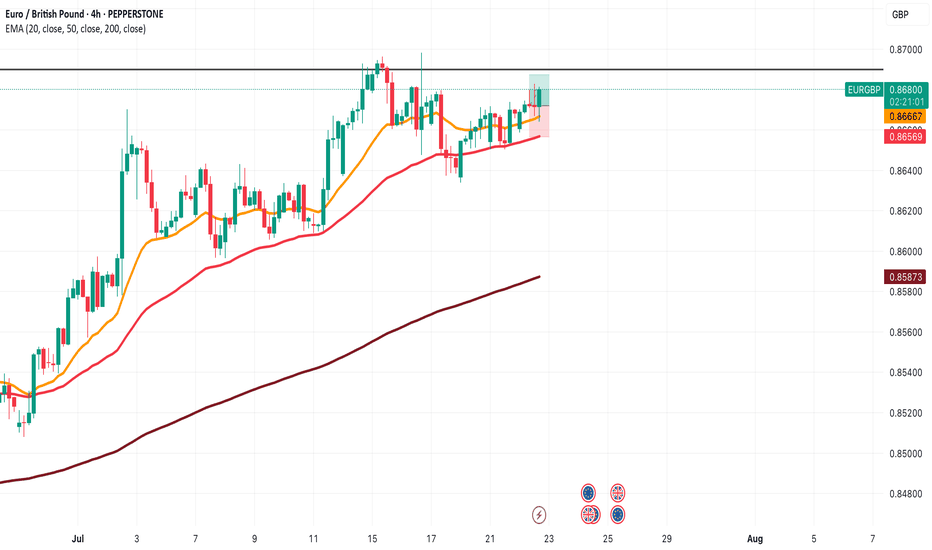

EURGBP Pushing Up about to reach Major Resistance Level!EURGBP has been in a nice uptrend on the 1D and 4H.

Now, it is reaching a major resistance level at 0.86900.

Looking at the strong buying, there is a chance that price may break that level a move above 0.86900, but that is yet to be determined.

I've taken a demo position in this case, aiming 1:1 but possibly aiming for that 0.86900 level.

I saw a nice bounce of the 20 EMA and also that the 20, 50 and 200 EMA are lined very well. The RSI is also pointing upwards suggesting some strength.

It's been a while since the entry has passed by, but I'd like to post this idea to document this trade.

When price comes at the 0.86900 level, we can see what happens at the time and decide whether we are long or short.

It'll be interesting to see how this trade plays out.

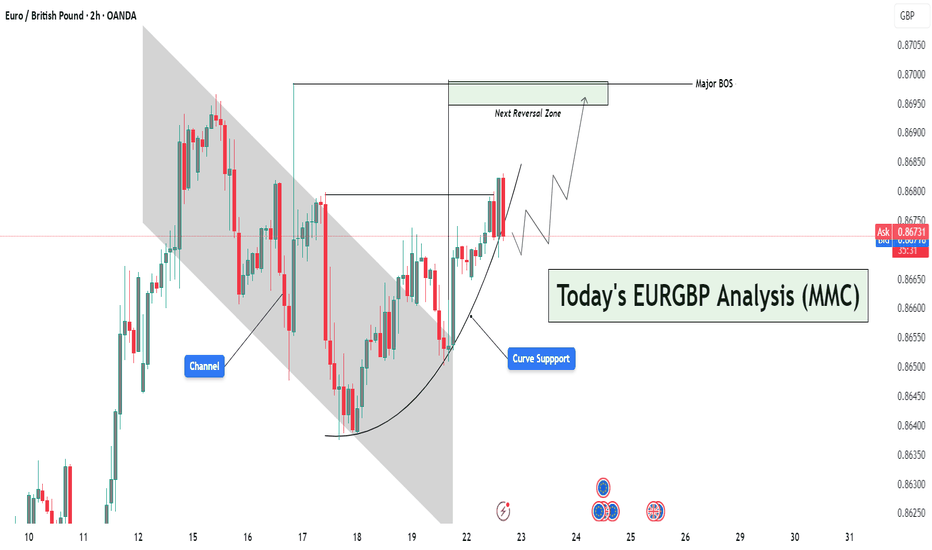

EURGBP Curved Support Breakout – Targeting Reversal Zone🔍 Market Context & Structural Narrative (MMC Style)

The EURGBP pair is currently displaying a textbook MMC structural evolution, transitioning from a bearish trend into a potential bullish leg driven by curve dynamics and trap-break logic.

🔨 Phase 1: Bearish Channel & Trap Formation

The market initially moved within a clearly defined descending channel, which acted as a trap for reactive sellers. Each lower high and lower low within the channel created a perception of sustained bearishness, luring breakout traders and late sellers into short positions.

✅ Key Insight:

This trap zone represents the first step in MMC logic — create a visible structure, generate bias, then prepare for inversion.

🌙 Phase 2: Curve Support – Psychological Accumulation

Around the base of the channel, the market began forming a rounded bottom or curve support. This is a signature MMC accumulation pattern, where market makers gradually absorb sell orders and build long positions without triggering immediate attention.

The curve support has the following implications:

Represents passive accumulation.

Suggests waning bearish pressure.

Builds bullish pressure subtly, often missed by retail traders.

🧠 MMC Mindset Tip:

Curved price action isn't just technical — it's psychological. It represents a controlled shift in sentiment, not an impulsive change, which is what makes it so powerful.

💥 Phase 3: Break of Structure (BOS) – Confirmation of Strength

Price breaks out of both the descending channel and the curved base, leading to a Major Break of Structure (BOS). This BOS is critical, as it confirms the invalidity of the previous bearish narrative and activates a new bullish leg.

📌 This BOS is more than a line — it’s a wall of liquidity getting broken. Price has now closed above key swing highs, which suggests:

Smart money is in control.

Trend shift is validated.

New demand zone created below.

🎯 Projection: The Path to the Next Reversal Zone (NRZ)

Following the breakout, price is projected to:

Possibly retest the breakout level (structure retest) aligned with the curve support — a healthy bullish pullback.

Then move higher towards the Next Reversal Zone (NRZ), which is your defined target area.

📌 NRZ Insight:

This zone is where the market is likely to face:

High liquidity.

Strong previous supply.

Potential profit-taking by early bulls.

Thus, this becomes the make-or-break zone — price either:

Reverses sharply,

Or breaks through and continues the bull rally.

⚠️ Multiple Scenarios Based on MMC Conditions

✅ Scenario 1: Retest & Bounce (Ideal MMC Setup)

Price pulls back to retest the breakout level or the curve support.

Shows bullish confirmation (e.g., pin bar, bullish engulfing).

Targets the NRZ above 0.8700.

❌ Scenario 2: Failed Retest – Fakeout Trap

Price breaks below the curve and structure again.

Suggests that the BOS was a false breakout.

Could re-enter the previous bearish channel structure.

🔄 Scenario 3: Direct Rally Without Retest

Strong momentum buyers push price directly to NRZ.

Wait for reaction at NRZ — could trigger a reversal or continuation depending on price behavior.

🧠 MMC Strategic Takeaways:

Trap → Break → Shift is the psychological framework in play.

The curve is not just support — it's evidence of silent accumulation.

The NRZ isn’t just resistance — it's the battleground where MM logic resolves.

🔐 Trading Insights (Optional Entry Ideas):

Entry: On bullish confirmation near 0.8660–0.8665 (curve/structure support).

SL: Below curve base (e.g., 0.8640).

TP: Near or slightly below NRZ (0.8700–0.8705), partial profits or full exit.

EURGBP bullish flag developing The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8620 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8620 would confirm ongoing upside momentum, with potential targets at:

0.8700 – initial resistance

0.8715 – psychological and structural level

0.8740 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8620 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8600 – minor support

0.8590 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8620. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

I'm currently long on EUR/GBPPrice is currently reacting to a retest of an order block located within the discount zone, following a Shift in Market Structure (SMS).

Additionally, on the weekly timeframe, price is also positioned in the discount zone, aligning with a weekly order block at the same level.

Disclaimer: This is not financial advice—just my personal analysis.

EUR/GBP Maintains Bullish Structure – Key Levels to WatchEUR/GBP Maintains Bullish Structure on 4H Chart – Key Levels to Watch

The EUR/GBP pair continues to exhibit a bullish trend structure on the 4-hour timeframe, with price action currently consolidating in a secondary trend. After a strong upward impulse, the pair has entered a corrective phase, which is expected to conclude before resuming its primary bullish trend.

Key Resistance & Upside Potential

The market remains well-supported, and a breakout above the current consolidation could see prices rally toward the next major target at 0.87400. A sustained move above this level would confirm a continuation of the bullish momentum, potentially opening the door for further upside. Traders should watch for bullish reversal patterns or a strong breakout candle to confirm the resumption of the uptrend.

Critical Support Zone

On the downside, 0.85950 stands as a crucial support level. If the secondary correction extends deeper, this zone could act as a springboard for buyers to re-enter the market. A breakdown below this level, however, could signal a deeper retracement, potentially invalidating the near-term bullish bias.

Market Outlook

Given the prevailing bullish structure, traders should monitor price action around the mentioned levels for potential trading opportunities. A rebound from 0.85950 with strong bullish confirmation (such as a pin bar or engulfing pattern) could present a buying opportunity targeting 0.87400. Conversely, a decisive break below support may require a reassessment of the bullish outlook.

In summary, while the EUR/GBP pair is currently in a corrective phase, the broader trend remains upward. A breakout above resistance or a hold at key support could reignite bullish momentum, making these levels critical for short-to-medium-term trading decisions.

EURFBP still bullish The pair is currently maintaining a bullish structure after breaking above the descending trendline. Price is approaching a Fair Value Gap (FVG) zone, which acts as a short-term resistance.

We are anticipating a bullish continuation, but confirmation is needed. A 4H candle close above the FVG zone will validate the breakout, turning this FVG into an Imbalance Fair Value Gap (IFVG) — indicating strong bullish intent and potential continuation toward the 0.87385 resistance level.

Until then, we remain cautiously bullish, awaiting that decisive breakout confirmation.

EUR-GBP Long From Rising Support! Buy!

Hello,Traders!

EUR-GBP is trading in an

Uptrend along the rising

Support line and the pair

Is going down now so after

The retest we will be

Expecting a bullish rebound

And a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP Bullish Setup Analysis – MMC + Volume Absorption + TargetIn today's EUR/GBP 30-minute chart, we can clearly observe a well-structured Market Maker Cycle (MMC) in play, accompanied by Smart Money concepts such as volume absorption, minor BOS (Break of Structure), and reversal zone identification. Let’s walk through the technical story unfolding:

🧠 Step-by-Step Breakdown:

🟣 1. Reversal Zone & QFL (Quasimodo Failed Level) Formation

The price made a sharp decline, which trapped retail sellers chasing the breakout to the downside.

This drop landed into a key reversal zone — a price pocket where Smart Money often steps in for accumulation.

The QFL structure is evident here, showing a previous demand zone break and then recovery — classic stop-loss hunting behavior followed by institutional positioning.

This is often considered the “Spring” or “Manipulation” phase in Wyckoff or MMC theory.

🟩 2. Volume Absorption & Compression Phase

After tapping into the reversal zone, price action entered a tight compression range, forming a wedge/triangle.

During this phase, volume absorption is clearly visible — large players are absorbing selling pressure without letting price drop further.

This is a signal of re-accumulation. Buyers are loading up while keeping the price suppressed to mislead retail traders.

You’ve rightly labeled this phase as “Structure Mapping + Volume Absorption” — a textbook Smart Money behavior prior to breakout.

🔓 3. Minor Breaks of Structure (BOS)

As price consolidates, we begin to see Minor BOS— subtle shifts in structure where previous highs are taken out.

These BOS levels are confirmation that demand is outweighing supply.

Once we break multiple minor highs, it shows that buyers are now in control — hinting at the transition from Accumulation → Expansion.

📈 4. Projected Next Reversal + Breakout Scenario

The marked Next Reversal Zone above (around 0.8680–0.8695) is where we can expect the first true breakout and major expansion.

If price enters this area with increased volume, it validates that Smart Money is pushing into the Markup Phase of the MMC.

After the breakout, we could see price push toward 0.8710 and above.

📊 5. Market Maker Cycle (MMC) Summary

What we’re seeing here is a full-scale MMC pattern unfolding:

Manipulation (QFL trap ) → Accumulation (Volume absorption) → Structure Shift (Minor BOS) → Expansion (Reversal breakout)

This is the kind of setup that offers high-probability entries for those who understand Smart Money dynamics and wait for confirmation.

🎯 Key Levels to Watch:

Reversal Support Zone: 0.86450 – 0.86500

Breakout Target Zone: 0.86800 – 0.86950

Final Target (Swing): 0.87100+

🧠 Final Thoughts:

This EUR/GBP setup shows everything we love to see:

Liquidity taken ✅

Structure forming ✅

Volume building ✅

BOS confirming ✅

Expansion pending 🔜

Be patient. Let Smart Money reveal their hand through price action and volume confirmation.

EURGBP: Expecting Bullish Movement! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the EURGBP pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️