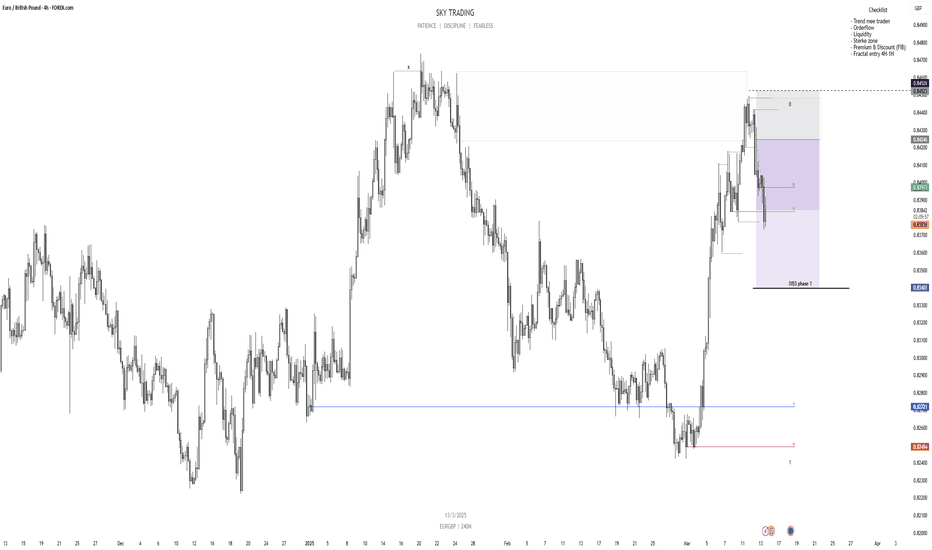

EURGBP continuation ideai have identified a bearish trend which may move until the daily fvg below.. check previous post for the overview. I still have my sell until it hit BE ( i know people will say why didnt u take profit) iam overall 13% this week this if i had taken then id be over 17% but since i am bearish and i have achieved my monthly target this week is amazing lol... however buyside has been cleared + daily fvg has been filled now. either BE or bearish trend will be continued.

1 lesson: ( i am no pro i just share my idea and views) all appreciation to TTrades on his daily bias video man's a gem,,, In a particular time of day i expect downside or upside which i cannot decide overall...

(mistake) knowing friday is reversals but ignored lol u see i am no perfect man.

have a nice weekend guys.

EURGBP trade ideas

EUR-GBP Growth Ahead! Buy!

Hello,Traders!

EUR-GBP made a retest

Of the horizontal support

Level of 0.8370 and we are

Already seeing a bullish

Reaction so we are bullish

Biased and we will be

Expecting a further move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/GBP Short before next leg upEur/Gbp had a big push up and now I expect pullback back to support before price will push back up again.

Looking on weekly chart prices are in clear uptrend. So for longterm trading wait for pullback.

For shortterm trading taking shorts with SL above last high is good place to put a trade today.

TP 0.83360

SL 0.84500

EURGBP Wave Analysis – 13 March 2025

- EURGBP reversed from key resistance level 0.8450

- Likely to fall to support level 0.8340

EURGBP currency pair recently reversed down with the daily Shooting Star from the resistance area between the key resistance level 0.8450 (which has been reversing the price from September) and the upper daily Bollinger Band.

The downward reversal from this resistance area stopped the earlier short-term ABC correction ii from the end of February.

Given the strength of the resistance level 0.8450 and the overbought daily Stochastic, EURGBP currency pair can be expected to fall to the next support level 0.8340.

EURGBP - Approaching Key Resistance: Is 0.8370 the next target?OANDA:EURGBP is nearing a key resistance level that has previously acted as a strong barrier, triggering bearish momentum in the past. This zone also aligns with prior supply areas where sellers have stepped in, making it a potential point of interest for those looking for short opportunities. Given its historical significance, how price reacts here could set the tone for the next move.

If bearish signals emerge, such as rejection wicks, bearish candlestick patterns, or signs of weakening bullish pressure, I anticipate a move toward the 0.83700 level. However, a clear breakout above this resistance could challenge the bearish outlook and open the door for further upside. It's a pivotal area where price action will likely provide clearer clues on the next direction.

Just my take on support and resistance zones, not financial advice. Always confirm your setups and trade with a proper risk management.

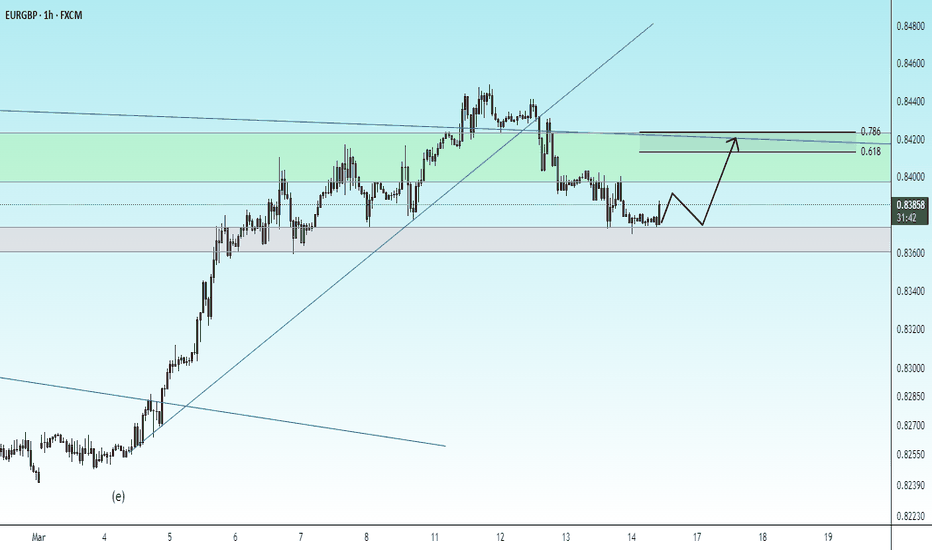

DeGRAM | EURGBP completes the correctionEURGBP is in an ascending channel between the trend lines.

The price has already reached the support level and approached the lower trend line.

Indicators are forming a bullish convergence on the 1H Timeframe.

We expect the growth to resume.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | EURGBP pullback from the retracement levelEURGBP is in an ascending channel between the trend lines.

The price is moving from the dynamic resistance, which has already acted as a pullback point, and 88.6% retracement level.

The chart formed a harmonic pattern after reaching the upper trend line.

Indicators continue to form a bearish divergence on the 4H Timeframe.

We expect a pullback.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURGBP INTRADAY upside capped at 0.8420Bullish Scenario:

The EURGBP pair maintains a bullish intraday sentiment, supported by the longer-term uptrend. The key level to watch is 0.8420, which acts as a critical resistance zone. If the price rallies above 0.8420, the uptrend could resume, targeting 0.8440, with further resistance levels at 0.8460 and 0.8500 over the longer timeframe.

Bearish Scenario:

A confirmed break below 0.8380, especially with a daily close beneath this level, would invalidate the bullish outlook. This could lead to further downside movement, with immediate support at 0.8360, followed by 0.8340 and 0.8327, signaling a deeper corrective pullback.

Conclusion:

The overall intraday trend remains bullish, with 0.8420 as the key pivot level. Holding above this support reinforces the upside potential, while a confirmed breakdown below it could shift momentum toward a deeper retracement. Traders should monitor price action around this critical level for confirmation of the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bullish bounce off overlap support?EUR/GBP is falling towards the support which has been identified as an overlap support and could bounce tot he 1st resistance which is a pullback resistance.

Pivot: 0.8387

1st Support: 0.8355

1st Resistance: 0.8452

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR/GBP - Short Trade IdeaHere we are Respecting the Long Term Liquidity Trend In a Bearish Momentum.

We had a Large Bearish push from this previous supply zone and now I would like to see price move off this Smaller 1H Supply zone and take Sell side Liquidity.

The previous movement has show price reject the Liquidity zone as shown, we have also rejected 71% level which is the Optimal OTE area for price to respond too

Good luck to all traders that follow this. I will also be live in this trade Idea

MY WATCHLIST BIAS MIGHT CHANGE ON EG, however this is my view and not a financial advice to take on same trade. So far this week my eyes has been on Usdchf and 2 trades already delivered 7% which is more than i want for the week as i aim 10% monthly. AU i am bullish once price hit my POI. Feel free to share your analysis on EG and AU. Forgive my background noise this is my first video publish lol.. Have a nice weekend.

EURGBP Buyers In Panic! SELL!

My dear subscribers,

My technical analysis for EURGBP is below:

The price is coiling around a solid key level - 0.8417

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 0.8356

My Stop Loss - 0.8444

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

Market Analysis: EUR/GBP Gains StrengthMarket Analysis: EUR/GBP Gains Strength

EUR/GBP is gaining pace and might extend its upward move above the 0.8445 zone.

Important Takeaways for EUR/GBP Analysis Today

- EUR/GBP started a fresh increase above the 0.8360 resistance zone.

- There is a major bullish trend line forming with support at 0.8402 on the hourly chart at FXOpen.

EUR/GBP Technical Analysis

On the hourly chart of EUR/GBP at FXOpen, the pair started a fresh increase from the 0.8240 zone. The Euro traded above the 0.8360 level to move into a positive zone against the British Pound.

The EUR/GBP chart suggests that the pair settled above the 50-hour simple moving average and 0.8400. Immediate resistance is near 0.8445. The next major resistance for the bulls is near the 0.8460 zone.

A close above the 0.8460 level might accelerate gains. In the stated case, the bulls may perhaps aim for a test of 0.8500. Any more gains might send the pair toward the 0.8550 level in the coming days.

Immediate support sits near the 23.6% Fib retracement level of the upward move from the 0.8359 swing low to the 0.8447 high. The next major support is near a major bullish trend line at 0.8402.

The 61.8% Fib retracement level of the upward move from the 0.8359 swing low to the 0.8447 high is also at 0.8402. A downside break below the 0.8402 support might call for more downsides.

In the stated case, the pair could drop toward the 0.8360 support level. Any more losses might send the pair toward the 0.8265 level in the near term.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Bullish continuation?EUR/GBP is falling towards the pivot which has been identified as an overlap support and could bounce to the 1st resistance.

Pivot: 0.8403

1st Support: 0.8367

1st Resistance: 0.8442

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURGBP uptrend - continuing⭐️Smart investment, Strong finance

⭐️EURGBP INFORMATION:

EUR/GBP extends its winning streak since March 3, hovering around 0.8440 during Tuesday’s European session. The pair gains momentum as the European Union (EU) considers boosting defense spending through joint borrowing, EU funds, and an expanded role for the European Investment Bank (EIB), with crucial decisions anticipated by June.

⭐️Personal comments NOVA:

EURGBP H1 breakout price zone retreats, continuing the uptrend

⭐️SET UP EURGBP PRICE:

🔥BUY eurgbp zone: 0.84200 - 0.84100 SL 0.83800

TP1: 0.84500

TP2: 0.84800

TP3: 0.85200

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

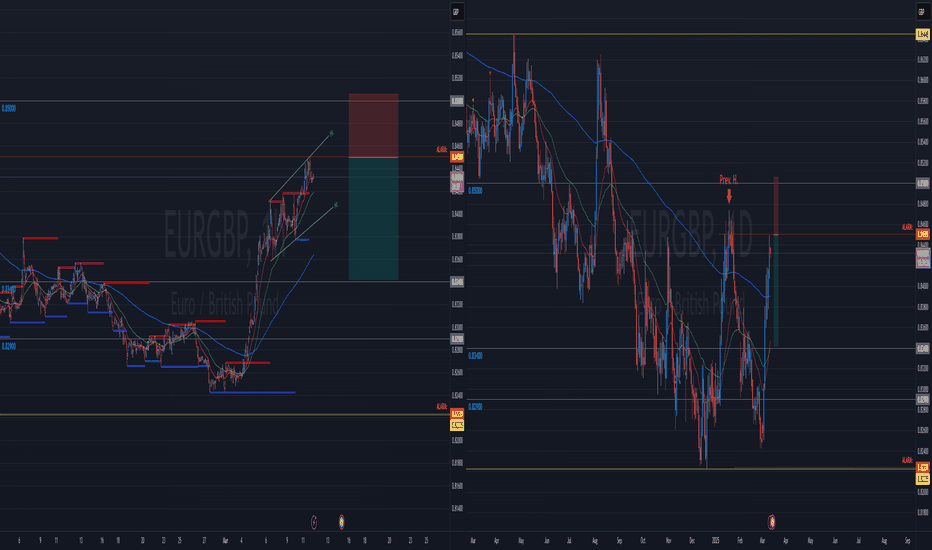

EUR/GBPOn Daily Chart,

Overall it's a bearish move. in the recent Bullish impulsive, it couldn't SO FAR, reach the previous high. this failiur so far, is the sighn of Bearish continuation. It seems it's creating Shooting star.

On 1 Hour chart,

it has created a "Rising Wewdge" which is the sign of reversal from Bullish to Bearish.

Just watch this pair and trade it as you wish. I will look for Bearsih reversal at the lower time frame.