Title: Geopolitical Tempest Navigating the EUR/ILS Currency PairThe EUR/ILS exchange rate is a crucial indicator of Israel's economic and geopolitical stability in relation to the Eurozone. Recently, it has been under substantial pressure due to escalating tensions between Israel and Iran. This dynamic interplay of geopolitical risks and economic factors creates a complex environment for the Israeli shekel (ILS) against the Euro (EUR).

Key Points

1. Geopolitical Background: The conflict between Israel and Iran, fueled by nuclear ambitions, proxy wars, and direct military engagements, has deep historical, religious, and political roots.

2. Economic Implications: Investor confidence, economic sanctions, and increased military expenditures are critical factors influencing the ILS. Geopolitical instability can reduce investor confidence, cause capital flight, and strain Israel's fiscal budget.

3. Impact on EUR/ILS Exchange Rate: Geopolitical risks lead to a flight to safety, with investors seeking stable currencies like the Euro. Inflationary pressures from supply chain disruptions and military spending can erode the ILS, while the Bank of Israel's interventions may be limited by persistent tensions.

Conclusion

The Israel-Iran conflict casts a long shadow over the Israeli economy and the strength of the ILS. As geopolitical tensions persist, the EUR/ILS exchange rate is likely to experience significant volatility. Investors and policymakers must remain vigilant, monitoring developments closely to mitigate risks and capitalize on opportunities in this uncertain environment.

EURILS trade ideas

After a sharp fall, Israeli shekel begins to correct to 3.6/3.7 After a sharp fall, Israeli shekel begins to correct to 3.6/3.7 nis per euro.

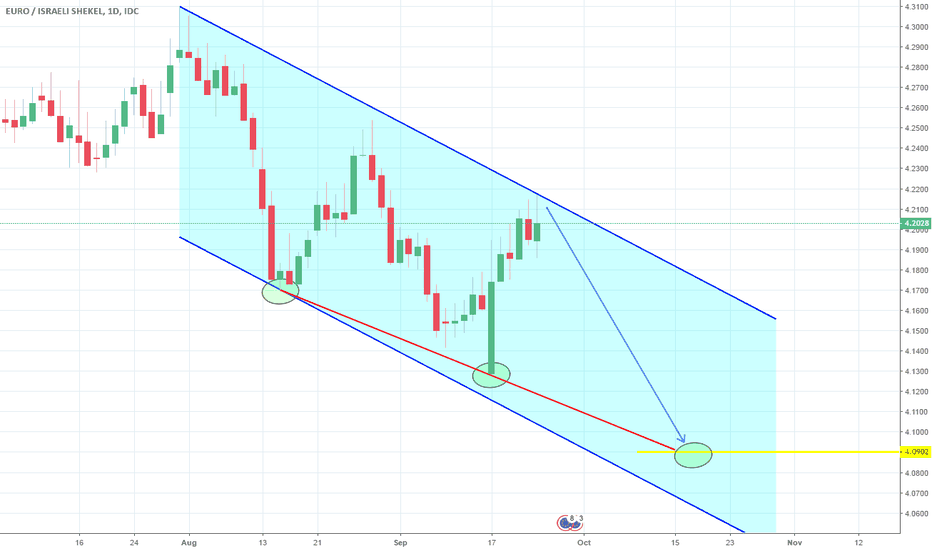

Now we can see an almost ideal Wolfe wave with strong divergence as a confirmation.

Also 4 ils is a round number with a good supply zone in the past.

For my opinion very soon we will see 4 nis per euro

Have a good trades=)

EURO / ISRAEL moneytechnical analysis:

on monthly, bullish divergence, the retesting and retesting of a descending resistance with many fake out breakouts. the more a resistance is tested the more likely it is to break.

some fundamental analysis:

it has a miniscule inflation rate right now at 0.84% in 2021. but on average it is 21.46% this is due to 370% inflation rate around 1985 due to very bad economic conditions.

people that where 20 at the time of huge inflation would be 56 now so people would remember, and a currency is only worth what people assign it, possible run on commodities or other currencies if it starts going bad.

a tiny inflation rate is not always good as it could mean the economy is not doing so well.

to note: it had negative inflation rates in 2015 and 2016.

Israel's GDP has been steadily increasing at a good rate, with growth rate of 5% so far in 2021,

70% of Israel's GDP is the service sector, and with its exceptional vaccine rollout, its looking optimistic.

debt to GDP increased from 58% to 71% in 2020, that is still a lot better than other some other countries. with that around 20% increase being normal in 2020.

the elephant in the room, current conflict, possibility of war. a conflict on a larger scale could mean serious damage to the economy.

regardless if a larger conflict happens i think euro is going up against shekel, with a larger conflict just adding fire to the flames.

the EXY, euro currency index is extremely bullish with a retest of a monthly resistance, i expect big things.

EURILS: Sell entries.EURILS has been trading within a long term Channel Down since December 2018 (RSI = 38.590, MACD = -0.085, ADX = 31.136, Highs/Lows = -0.0915). At the moment it is trading around the 1D MA50 and on the Lower High trend line. We expect the price to be rejected back to the 3.7790 Support. If not, then the June - December 2018 fractal may be played out: rise towards 3.9500 and then rejection.

Previous call within the Channel Down:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

EURILS: Further downside expected.The pair is on a strong 1M Channel Down (RSI = 37.575, MACD = 0.082, Highs/Lows = -0.1355) since the beginning of the year. We are expecting another test of the 3.7870 1D Support. Based on the RSI (despite being a bullish divergence) we are expecting a symmetric low outside the Channel. That should be the 3.7870 contact.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.