EURJPY trade ideas

EURJPY Massive Long! BUY!

My dear friends,

Please, find my technical outlook for EURJPY below:

The price is coiling around a solid key level - 161.01

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 162.16

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

eurjpy buy signal

Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EUR/JPY SENDS CLEAR BULLISH SIGNALS|LONG

EUR/JPY SIGNAL

Trade Direction: long

Entry Level: 161.131

Target Level: 162.550

Stop Loss: 160.184

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 3h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/JPY Bearish Setup Breakdown (2H Chart)1. Market Structure & Trend Shift

The pair was in a clear uptrend, forming higher highs and higher lows.

However, price broke below the ascending trendline, signaling a potential trend reversal.

A retest of the broken trendline confirms bearish strength, as price rejected from it.

2. Entry Strategies

✅ Break & Retest Entry (Best Option)

Since price already broke and retested the trendline, the best entry point was:

Sell Entry: After price rejected the broken trendline (confirmation candle).

Confirmation: A bearish candle with a long upper wick or strong red close.

Stop Loss (SL): Above the recent high (around 163.3).

Take Profit (TP): Targeting key support zones (159.0, then 156.0).

3. Risk Management

Stop Loss Placement: Above the last high (163.3), ensuring room for market fluctuations.

Take Profit Zones:

First TP: 159.0 (psychological level & previous support).

Final TP: 156.0 (major support & full bearish target).

Risk-to-Reward Ratio (RRR):

If SL = 2.0 pips and TP = 6.0 pips, RRR = 1:3 (ideal for strong trades).

Ensures potential profits outweigh risk.

4. Bearish Confirmation Signs

🔴 Lower Highs & Lower Lows → Trend is shifting down.

🔴 Bearish Engulfing Candles → Strong selling pressure.

🔴 Volume Increase on Down Moves → Sellers are in control.

🔴 Retest Rejection → Confirms trendline break is valid.

5. Potential Trade Outcome

✅ Bearish Scenario (Best Case)

Price continues falling towards 159.0, then 156.0.

The trade follows a clean trendline break & retest pattern.

Successful high RRR trade (1:3 or better).

❌ Invalidation (Worst Case)

If price reclaims 163.3, the bearish setup is invalid.

This could trigger a stop-loss hit or indicate a fake breakout.

Adjust strategy and wait for a stronger confirmation.

Final Trading Plan:

✅ Wait for confirmation before entering (trendline rejection or strong bearish candle).

✅ Manage risk properly (never risk more than 2-3% per trade).

✅ Stick to the plan and avoid emotional decisions.

DeGRAM | EURJPY decline in the channelEURJPY is in a descending channel between the trend lines.

The price is moving from the upper boundary of the channel and dynamic resistance, which has previously acted as a point of decline.

The chart keeps the harmonic pattern relevant, as well as the descending structure.

We expect the decline to continue.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

DeGRAM | EURJPY retest of trend lineEURJPY is above the descending channel between the trend lines.

The price broke the upper boundary of the channel, formed a harmonic pattern and approached the dynamic resistance.

The chart maintains the descending structure.

We expect the decline to continue after consolidation under the nearest support level.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

CHECK EURJPY ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

EURJPY trading signals technical analysis satup👇🏼

I think now EURJPY ready for BUY trade EURJPY BUY zone

( TRADE SATUP) 👇🏼

ENTER POINT (161.500) to (161.400) 📊

First tp (161.700)📊

2nd tp (162.000)📊

Last target (162.300) 📊

stop loss (161.000)❌

Tachincal analysis satup

Fallow risk management

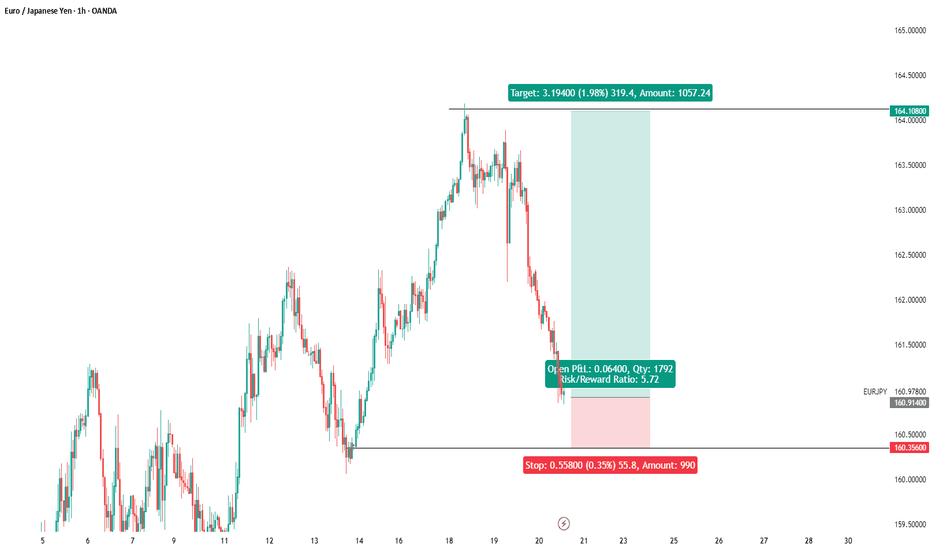

Bearish drop?EUR/JPY is rising towards the pivot which is a pullback resistance and could drop to the 1st support.

Pivot: 162.24

1st Support: 160.36

1st Resistance: 164.02

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURJPY Wave Analysis – 19 March 2025

- EURJPY reversed from resistance zone

- Likely to fall to support level 161.00

EURJPY currency pair recently reversed down from the resistance zone between the resistance level 163.80 (which has been reversing the price from January) and the upper daily Bollinger Band.

The downward reversal from this resistance zone created the daily Japanese candlesticks reversal pattern Shooting Star.

Given the overbought daily Stochastic, EURJPY currency pair can be expected to fall to the next support level 161.00.

EURJPY - Expecting Retraces Before Prior Continuation HigherHi Traders, on March 12th I shared this "EURJPY Short Term Buy Idea"

We expected to see correction prior to the bullish continuation. You can read the full post using the link above.

Price is moving as per the plan!!!

Based on the current scenario my bullish view still remains the same here.

We have bearish divergence in play based on the moving averages and histogram of the MACD and I expect to see retraces now before further continuation higher.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.-

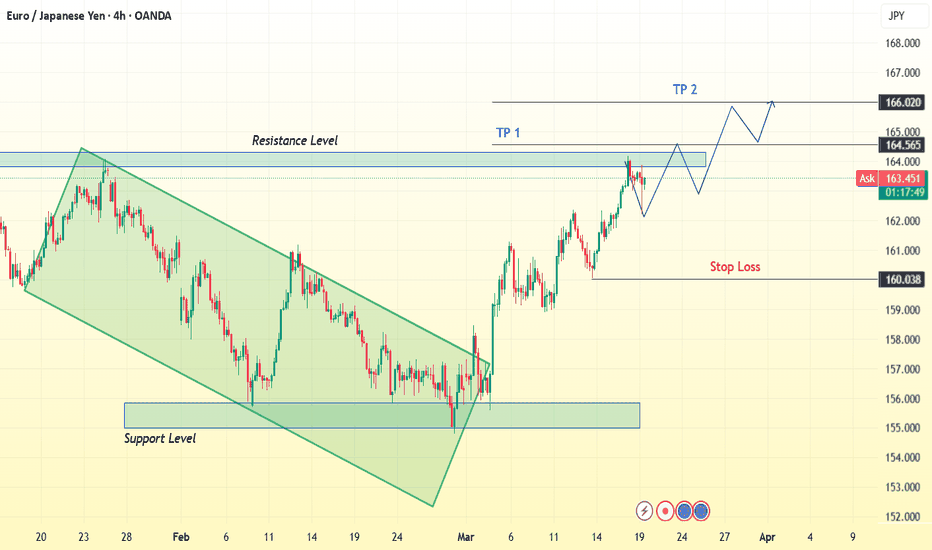

EURJPY 4H | Bullish Breakout & Retest – Next Big Move?The EUR/JPY 4-hour chart presents a compelling bullish breakout setup following a structured downtrend. The market recently broke through a significant resistance zone, indicating potential further upside movement. This analysis outlines key price levels, market structure, and an actionable trading plan.

📊 Market Structure Overview

🔸 Downtrend Reversal: The price was previously trading within a descending channel (highlighted in green), forming lower highs and lower lows.

🔸 Support Confirmation : The price bounced from a strong support zone around 158.500 - 160.000, confirming buyers' interest in this region.

🔸 Breakout & Retest : A strong bullish impulse broke through the 164.500 - 165.000 resistance zone, suggesting a shift in market sentiment.

📌 Key Trading Levels

🔹 Support Zone: 158.500 - 160.000

This area previously acted as a demand zone where buyers aggressively pushed the price higher.

It now serves as a safety net for long positions.

🔹 Resistance Zone (Now Potential Support): 164.500 - 165.000

Price has broken above this level, but a retest could provide an ideal entry for confirmation.

🔹 Next Major Resistance (Target Levels):

TP1: 165.000 → A psychological level and previous resistance.

TP2: 166.020 → A higher resistance zone where price may struggle to break through.

📈 Trading Plan – Long Setup

✅ Entry Confirmation:

Wait for price to pull back to the 164.500 - 165.000 zone.

Look for bullish candlestick patterns (e.g., pin bars, engulfing candles) to confirm buyers stepping in.

🎯 Take Profit Targets:

TP1: 165.000 (Initial resistance level)

TP2: 166.020 (Potential extended bullish move)

🛑 Stop Loss Strategy:

Below 160.038 (Previous structure low & key support level)

Ensures protection against potential fakeouts or trend reversals.

📢 Risk-Reward Ratio:

Aiming for 2:1 or better risk-reward ratio for an optimal trade setup.

📝 Market Outlook & Conclusion

📌 The recent breakout above resistance suggests bullish momentum is strong. However, traders should be patient and wait for a pullback to enter at a better risk-reward level. If price successfully retests and holds above 164.500, there is a high probability of continuation towards 166.020.

🚀 Trading Bias: Bullish – Until market structure shifts or a major rejection occurs at resistance.

📢 Final Trading Tip

🔹 Patience is key! Don’t rush into a trade immediately after a breakout. Wait for confirmation, as false breakouts are common in volatile markets. A successful retest of the broken resistance will provide a low-risk, high-reward entry opportunity.

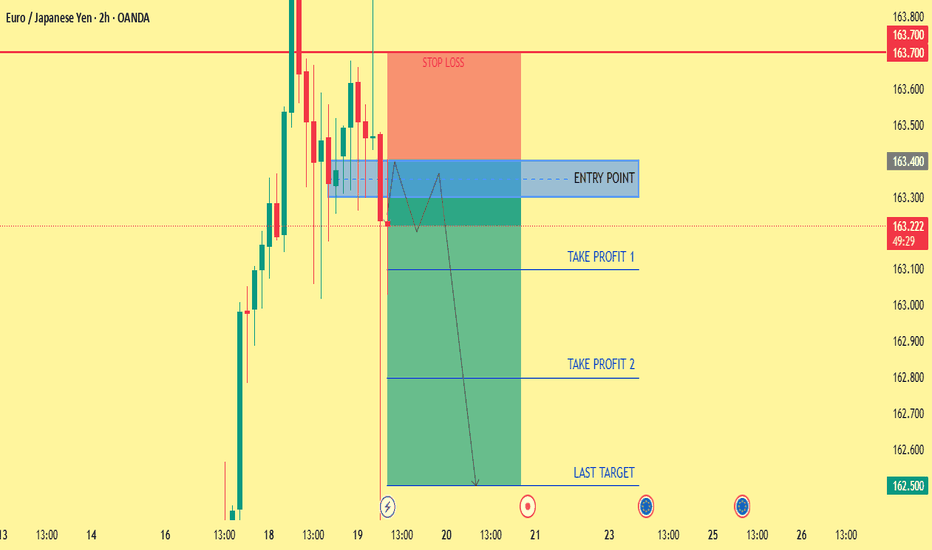

CHECK EURJPY ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

EURJPY trading signals technical analysis satup👇🏼

I think now EURJPY ready for SEEL trade EURJPY SEEL zone

( TRADE SATUP) 👇🏼

ENTER POINT (163.400) to (163.300) 📊

First tp (163.100)📊

2nd tp (162.800)📊

Last target (162.500) 📊

stop loss (163.700)❌

Tachincal analysis satup

Fallow risk management

EURJPY sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EUR/JPY Market Analysis: Potential Reversal at Key Resistance LeThe EUR/JPY pair, on the 4-hour chart, exhibits a strong bullish impulse that recently peaked around 163.64 , aligning with a key Fibonacci extension level (1.618). This area marks a critical resistance zone, where price action has shown signs of rejection.

The Harmonic pattern, such as the b]Crab , suggest potential exhaustion of the uptrend. The latest leg upward reached a 2.618 extension , reinforcing the possibility of a corrective move. Support levels to monitor include ** 162.23 ** (BC) and ** 160.59 ** (T1), which could serve as downside targets if bearish momentum gains traction.

For traders, a decisive break above **163.64** could invalidate the short-term bearish bias, paving the way for further upside. Conversely, sustained rejection from this level may trigger a deeper retracement towards key Fibonacci and harmonic support zones.

Conclusion : The pair is at a critical inflection point, where price action and confirmation of rejection signals will determine the next directional move. Traders should watch for price action at resistance and key support levels to assess trade opportunities.

Bullish momentum to extend?EUR/JPY is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 162.21

1st Support: 160.29

1st Resistance: 164.35

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURJPY BUY TRADE PLAN🔥 BUY TRADE 🔥 | ✅ ✅ ✅ ✅ ✅

🎯 ENTRY TYPE: Trend Continuation

⏳ STATUS: Price Has NOT Tapped Entry Zone Yet – Still Waiting

📍 Entry Zone: 160.800 - 160.500

📍 Deeper Buy Entry (If price drops further): 160.000 - 159.800

🛑 Stop Loss:

Below 159.800 (Standard SL)

Below 159.500 (Safe SL – Final invalidation level)

🏆 Take Profit Targets:

🎯 TP1: 161.800 (First reaction zone)

🎯 TP2: 162.500 (Key liquidity target)

🏆 TP3: 163.200 - 163.500 (Major resistance zone)

📈 Risk-Reward Ratio:

1:3 if targeting 🎯 TP1

1:4+ if targeting 🎯 TP2 or 🏆 TP3

📌 Reason for Entry:

✔ 📈 Bullish trend remains intact, looking for a pullback to enter.

✔ 🔄 H4 bullish structure valid – higher lows forming.

✔ 🏦 Institutional demand zone expected to hold.

✔ 📊 Volume spike shows Smart Money buying dips.

🚨 ⚠️ CONFIRMATION REQUIRED BEFORE BUYING:

🔹 H1/M30 Bullish Rejection Candle (Pin Bar, Engulfing) at Entry Zone.

🔹 LTF (H1/M30) Bullish Divergence = Extra Confirmation.

🔹 Volume Increase at Demand Zone = Smart Money Buying Signal.

❌ DO NOT take the trade if price breaks below 159.800 without reaction.

📌 TRADE VALIDITY & INVALIDATION CONDITIONS

🕒 VALID FOR:

BUY TRADE: 1-3 days (H4-based swing setup).

SELL TRADE: 12-24 hours (H1-based counter-trend setup, ONLY IF REJECTION OCCURS).

🚫 BUY SETUP INVALID IF:

Stop Loss at 159.500 is hit → Trade invalid.

Price breaks below 159.800 and holds = Institutional demand zone fails.

Market structure shifts bearish (Strong BOS to downside).

📌 RISK MANAGEMENT REMINDER

💰 Use 1-2% risk per trade. Move SL to breakeven after TP1 to secure profits.