EUR/JPY Setup: Retail is 82% Short – Squeeze First, Drop After?🔹 Technical Context

Price reacted with a strong bullish wick in the 169.50–170.30 demand zone, signaling clear buyer defense. The RSI bounced from weakness but remains subdued, showing limited momentum.

📍 Current price action suggests a potential retest of the 172.50–173.30 area, which aligns with a supply zone, before a possible directional decision is made.

🗓️ Seasonality

Historically, August tends to be bearish for EUR/JPY:

5Y average: -0.48%

10Y average: -0.12%

15Y/20Y averages: -1.3% and -1.2%

📉 Seasonality indicates potential weakness, especially in the second half of the month.

🪙 COT Report (EURO & YEN) – July 22

EURO: Strong long accumulation by non-commercials (+6,284) and commercials (+17,575)

JPY: Net decline in both longs (-1,033) and shorts (-4,096), with a drop in total open interest

🧠 The market is heavily positioned on the Euro, while Yen positioning is fading. This creates a divergence between the two currencies, favoring a short-term technical bounce on EUR/JPY, though downside risks remain in the mid-term.

📉 Sentiment

82% of retail traders are short EUR/JPY

Volume: 1,564 lots short vs 352 lots long

📣 This extreme sentiment imbalance suggests a potential short-term squeeze against retail traders.

📊 Market Mood & DPO

Overall mood: Neutral

DPO at -9.0, Wyckoff score below 50

Momentum remains weak, but not showing a clear divergence.

🧩 Operational Summary

Retest of the 172.50–173.30 supply zone

Likely exhaustion in that area

Ideal setup: rejection + bearish confirmation

→ Targets: 170.30, then 169.00

EURJPY trade ideas

demand zone spottedEUR/JPY – Bullish Rejection from Demand Zone | 4H Smart Money Setup

Pair: EUR/JPY

Timeframe: 4H (4-Hour)

Bias: Bullish

Status: Trade Active

Strategy: Demand Zone Rejection / Smart Money Concepts (SMC)

Market Context

EUR/JPY has been in a broader uptrend with higher highs and higher lows throughout July. Recently, the market retraced and tapped into a clearly defined demand zone, showing bullish rejection—a potential opportunity for long entries.

Key Technical Highlights

• Demand Zone marked around 170.65 – 171.30

o Formed by previous accumulation before the last strong impulsive bullish leg.

o This zone acts as institutional support, where large buy orders may reside.

o Price wicked into the zone and printed a bullish candle, suggesting buyer interest.

• Risk-Reward Structure

o Entry: ~171.33 (current price action after bounce)

o Stop Loss: Below demand zone (~170.66)

o Take Profit: 173.38 (previous high / clean traffic zone)

• The position is marked on chart with a clear long setup:

o Green zone = Target

o Red zone = Risk

o Trade offers a favorable Risk:Reward > 2:1

Scenarios

Bullish Continuation

• Price continues upward respecting demand zone.

• Confirmation from bullish price action or break of lower highs (structure shift).

• Clean targets above at 173.00 – 173.40.

•

Bearish Invalidity

• Price closes below 170.65 on a 4H candle.

• Break of demand invalidates the setup.

• Next potential support lies lower near 169.80.

Trade Plan Summary

Component Value

Entry 171.33

Stop Loss 170.66

Take Profit 173.38

R:R Ratio ~2.5:1

Status Active, Waiting for Follow-through

Conclusion

EUR/JPY is showing a clean rejection from a strong 4H demand zone after a healthy pullback. Structure still supports a bullish continuation, and the trade is positioned with tight risk and strong upside potential. Monitoring for confirmation via momentum and market structure.

EURJPY: Short Trade Explained

EURJPY

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short EURJPY

Entry - 171.66

Sl - 172.11

Tp - 170.81

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURJPY Bullish Setup : EURJPY Forecast + Demand Zone🧠 Introduction: What's Happening on the Chart?

Today’s analysis on EURJPY is built on the MMC trading framework, which emphasizes the identification of institutional supply and demand zones, reaction points, QFL patterns, and volume bursts to map out high-probability trading paths.

We are currently observing a market in a corrective phase following a significant bearish drop. However, the presence of a major demand zone, along with a positive bullish pattern, suggests potential upside reversal or at least a short-term retracement.

🔍 Technical Breakdown – Zone by Zone

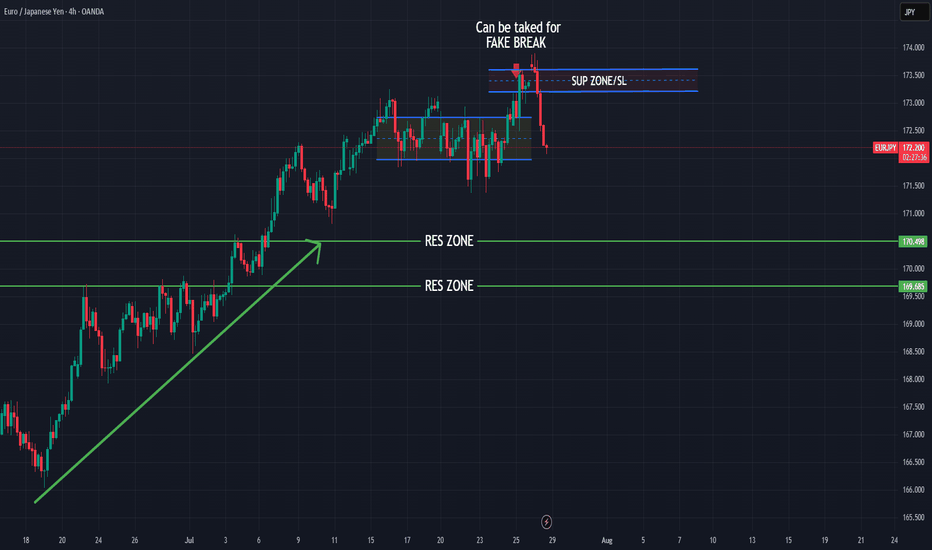

🔻 1. The Drop from 2x Supply Zone

EURJPY experienced a significant decline from the 173.60–174.00 area, which acted as a 2x confirmed supply zone.

Sellers took control with strong bearish candles that broke through previous minor support levels.

This drop was impulsive, showing momentum-driven selling, often linked with institutional activity.

🟩 2. Demand Reaction at Major Zone

Price entered a key demand zone marked in green (170.80–171.00), where historically buyers have stepped in.

A "Volume Burst" is visible here—large volume candles with long wicks to the downside, which typically indicate accumulation.

A positive pattern (possibly engulfing or a pin bar structure) has formed, signaling a potential bullish reversal or relief rally.

🧱 3. QFL Structure (Quantum Flat Line)

The chart highlights a QFL base, where the price consolidates after an initial drop, then continues lower before a sharp bounce.

QFL is often used to identify trap zones where retail traders are shaken out, and smart money enters.

The recent bounce from the QFL base suggests smart money might be accumulating for a reversal move.

📐 Key Levels and Zones

Type Zone/Level Role

🔵 Volume Burst Area ~170.80–171.00 Aggressive buyer entry; accumulation zone

🟢 Major Demand 170.80–171.20 Key structural low supporting bullish bias

🟠 SR Flip Zone 171.80–172.00 Crucial breakout/retest level

🔴 Minor Resistance 172.60–173.00 Short-term pullback zone

🟥 2x Supply 173.60–174.00 Strong reversal point; ideal target

🔁 Scenarios to Watch

📈 Scenario 1: Bullish Breakout and Rally (Blue Box 1)

If price breaks above 172.00, we expect:

A potential retest (bullish confirmation).

Continuation toward minor resistance at 173.00, and possibly the 2x supply zone at 174.00.

This aligns with the positive pattern formed at the base and the idea of a market rotation from bearish to bullish structure.

📉 Scenario 2: Rejection and Retest of Lows (Blue Box 2)

If the price fails to sustain above 172.00, sellers may step in:

Price could revisit the major demand zone again or even break down to 170.50.

This would invalidate the bullish setup in the short term and imply a larger continuation of the bearish trend.

🧠 Strategic Insights (MMC-Based Thinking)

The MMC approach teaches us to mirror the market’s emotion and behavior.

In this case, we see signs of:

Panic selling → smart money accumulation.

Institutional traps (QFL drop) → bullish absorption.

Traders applying MMC would anticipate reactive setups at the SR Flip Zone to determine next directional bias.

💡 Trade Ideas (For Educational Purposes Only)

Strategy Entry SL TP1 TP2

Aggressive Long 171.30–171.50 170.70 172.50 173.50

Breakout Retest Long 172.10 (after breakout) 171.50 173.00 174.00

Sell on Rejection 172.00 (bearish confirmation) 172.60 171.00 170.40

📌 Conclusion & Final Thoughts

EURJPY is showing a potential bullish reversal setup from a well-defined demand zone, supported by volume bursts and positive price action patterns. However, the SR Zone at 172.00 remains the key pivot—how the price reacts here will determine whether we see a deeper pullback or a continuation to test upper resistance levels.

Stay flexible and responsive. Let the market give confirmation before execution. As always, follow proper risk management and trade the reaction, not the prediction.

SELL EURJPY for bullish trend reversal SELL EURJPY for bullish trend reversal

STOP LOSS : 172.80

Trade trade is based on false breakout and divergence.....

First what is false breakout, A false breakout in Forex occurs when the price breaks through a key level (like support or resistance) but quickly reverses and returns to its original range, often trapping traders who were expecting a continuation of the breakout. It's essentially a false signal, indicating a potential trend reversal or continuation, but the price doesn't follow through....

Secondly what is divergence ,In forex trading, divergence occurs when the price of a currency pair moves in one direction, while a technical indicator (like an oscillator) moves in the opposite direction. This mismatch can signal a potential trend reversal or weakening trend. There are two main types: bullish and bearish divergence.

On this trade we are taking it because we saw regular bearish divergence

Regular Bearish Divergence

In case of Regular Bearish Divergence:

* The Indicator shows Lower Highs

* Actual Market Price shows Higher Highs

We can see a strong divergence on the RSI already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this level resistance so we are looking for the trend reversal and correction push from here .....

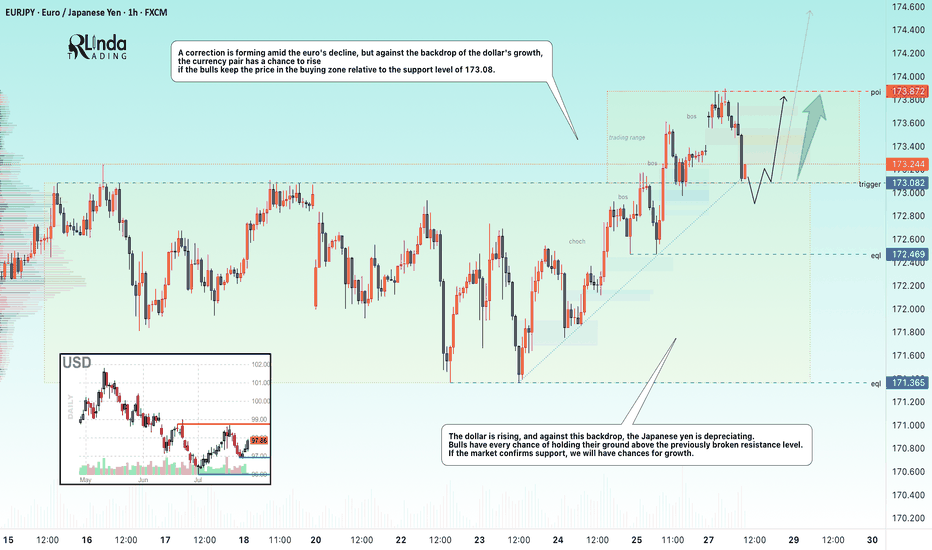

EURJPY POSSIBLE EXPECTED MOVEIn this analysis we're focusing on 1H time frame. Today I'm looking for a potential buy move from my marked key levels. This is a higher time frame analysis. Let's analyze more deeply into smaller timeframe and potential outcomes. Confirmation is very important.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is my analysis.

#EURJPY 1H Technical Analysis Expected Move.

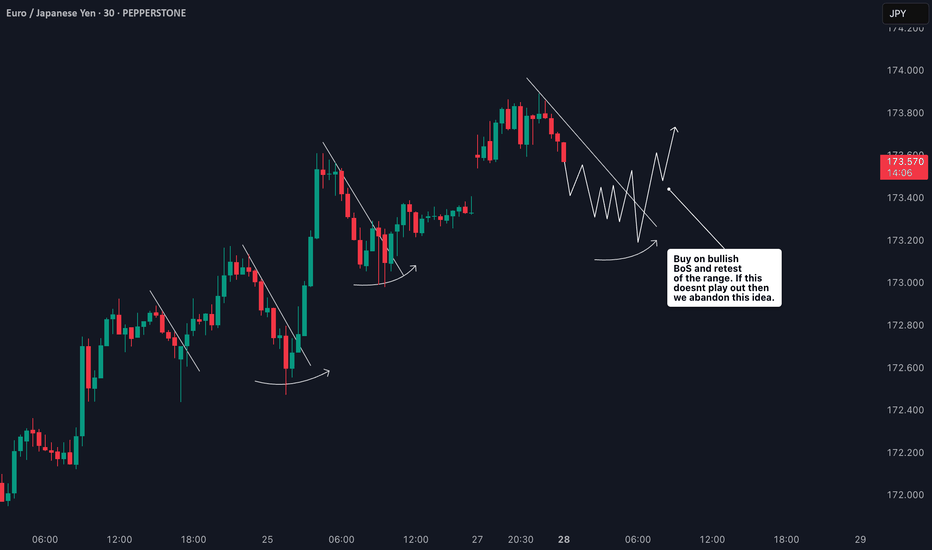

Trading the Pullback on EURJPY My Trade PlanThe EURJPY is clearly in a strong bullish trend 📈, as shown by a consistent pattern of higher highs and higher lows on the 1H timeframe ⏱️. In this video, I’m looking to capitalize on a pullback as a potential buy opportunity 🎯.

We dive into my entry strategy, explore how to align with the prevailing trend, and break down key concepts such as price action, market structure, and smart pullback zones 🧠📊.

⚠️ As always, this is for educational purposes only — not financial advice.

How I’m Trading the EURJPY Break of Structure Setup📈 EURJPY Analysis Update 🔍

I'm currently watching EURJPY closely. On the weekly timeframe, the pair is clearly in a strong bullish trend 🚀. Price has recently tapped into a previous daily bullish order block 🧱 — a key zone of interest.

Now, I’m watching for a break of structure (BoS) 📉 followed by a bullish continuation, especially if price pulls back into the fair value gap (FVG) 📊 near the current low.

As always, this setup — along with all key details and trade considerations — is fully broken down in the 🎥 video.

⚠️ This is for educational purposes only and not financial advice.

EUR/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are now examining the EUR/JPY pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 168.581 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURJPY Wave Analysis – 30 July 2025

- EURJPY reversed from the resistance zone

- Likely fall to support level 169.60

EURJPY currency pair recently reversed down from the resistance zone between the resistance level 174.00, the upper daily Bollinger Band and the resistance trendline of the daily up channel from February.

The downward reversal from this resistance zone created the daily Japanese candlesticks reversal pattern, Bearish Engulfing.

EURJPY currency pair can be expected to fall further to the next round support level 169.60 (former resistance from the end of June).

EURJPY → Retest support before growthFX:EURJPY has been correcting since the opening of the European session. The movement was triggered by yesterday's news related to the trade deal between the US and Europe...

EURJPY is reacting to news related to the deal between the US and Europe. A correction is forming amid the fall of the euro, but against the backdrop of the dollar's growth, the currency pair has a chance to rise if the bulls keep the price in the buying zone relative to the support level of 173.08.

The dollar is rising, and against this backdrop, the Japanese yen is falling. Bulls have every chance of holding their ground above the previously broken resistance. If the market confirms support, we will have chances for growth.

Resistance levels: 173.87

Support levels: 173.082, 172.47

The currency pair may form a liquidity trap relative to the previously broken consolidation resistance. A false breakdown of support and price consolidation in the buying zone (above 173.1) could trigger further growth.

Best regards, R. Linda!

EURJPY Bearish! Short EURJPY

We see a verg bearish weekly BAT!

Long‑term short opportunity on EUR/JPY

Weekly: bearish bat pattern formed

Price fell below daily and 4H lows, breaking support floor

If you missed the 173–174 entry zone, there’s still a short setup today

Entry: 171.9–172.1

Stop loss: above 172.4

Intraday targets:

Target #1: 171.5

Target #2: 170.5

Target #3: 169.9 and below

Medium‑to‑long‑term targets:

Target #1: 166.5

Target #2: 161.7

#institutional order flow #trading

EURJPY – DAILY FORECAST Q3 | W31 | D29 | Y25📊 EURJPY – DAILY FORECAST

Q3 | W31 | D29 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

OANDA:EURJPY

EUR/JPY Bearish Engulf as EUR/USD Sells Off Ahead of the FedA good illustration of FX market structure is on display today. EUR/USD is down sizably after teh announcement of the EU trade deal and this may be a 'buy the rumor, sell the news' kind of event. But, there's also the possibility that this is squaring up ahead of a really big week of drivers with FOMC, Core PCE and NFP all scheduled for later this week. But, there's also the sentiment argument, where a strong bullish move has taken hold of the Euro in the first half of the year as EUR/USD has jumped to fresh three-year highs.

And while USD/JPY is rallying up to the 148.00 level, displaying Yen-weakness, EUR/JPY is down on the daily with a show of JPY-strength. This highlights that the move in EUR/USD is likely driving that sell-off in EUR/JPY as EUR/JPY is currently working on a bearish engulfing candlestick on the daily. And this happens after last week showed overbought RSI on both the daily and weekly charts, with daily RSI diverging from price as EUR/JPY set a fresh yearly high shortly after the open this morning.

This shows that EUR/JPY is very much in-play this week with those US drivers, and there's also the Bank of Japan rate decision to consider. In EUR/JPY, there's possible support tests coming up, around the 170.47 and 170.93 Fibonacci levels, followed by the 170.00 big figure. - js

EURJPY Sellers In Panic! BUY!

My dear friends,

Please, find my technical outlook for EURJPY below:

The price is coiling around a solid key level - 172.51

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 173.00

Safe Stop Loss - 172.29

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURJPY – DAILY FORECAST Q3 | W31 | D28 | Y25📊 EURJPY – DAILY FORECAST

Q3 | W31 | D28 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

OANDA:EURJPY

EURJPY 4Hour TF - July 27th, 2025EURJPY 7/27/2025

EURJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bullish

Daily - Bullish

4hour - Bullish

All timeframes suggest we are bullish and after last week that is clear. We’re expecting a bit of a pullback but let’s get into two potential setups for the week ahead:

Bullish Continuation - If we are to continue with the bullish trend we would like to enter a trade at the next point of structure. In this scenario, the next point of structure would be a higher low as close to 172.250 support & our 61.8% fib level as possible.

Look to target higher toward our -27% fib level if this happens.

Bearish Reversal - For us to consider EJ bearish again we would need to see a strong break below our support at 172.250.

If we see bearish structure below this zone we can say price action will most likely fall lower, potentially down to 170.750.

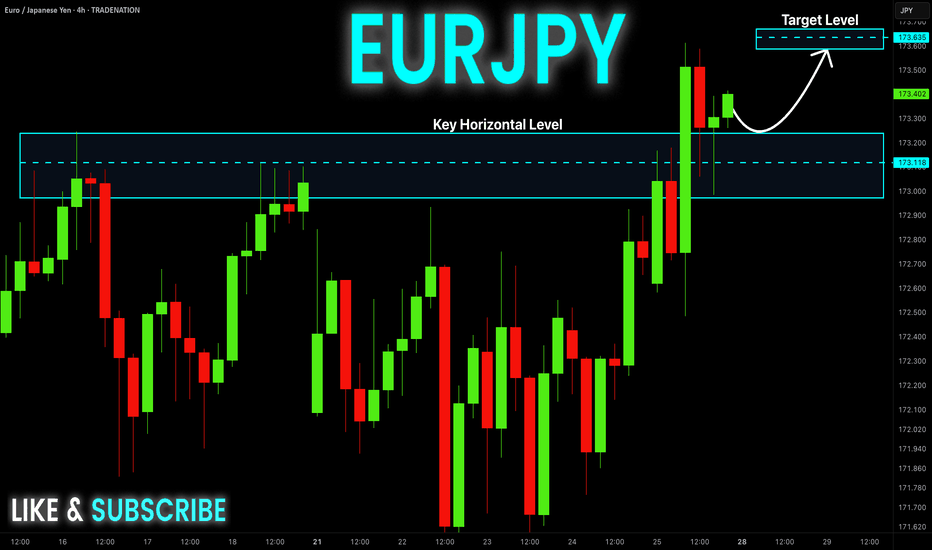

EUR-JPY Local Long! Buy!

Hello,Traders!

EUR-JPY is trading in an

Uptrend and the pair made

A breakout, a retest and

A bullish rebound from the

Horizontal support of 173.200

So we are bullish biased and

We will be expecting a

Further bullish move up

On Monday!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.