EURJPY trade ideas

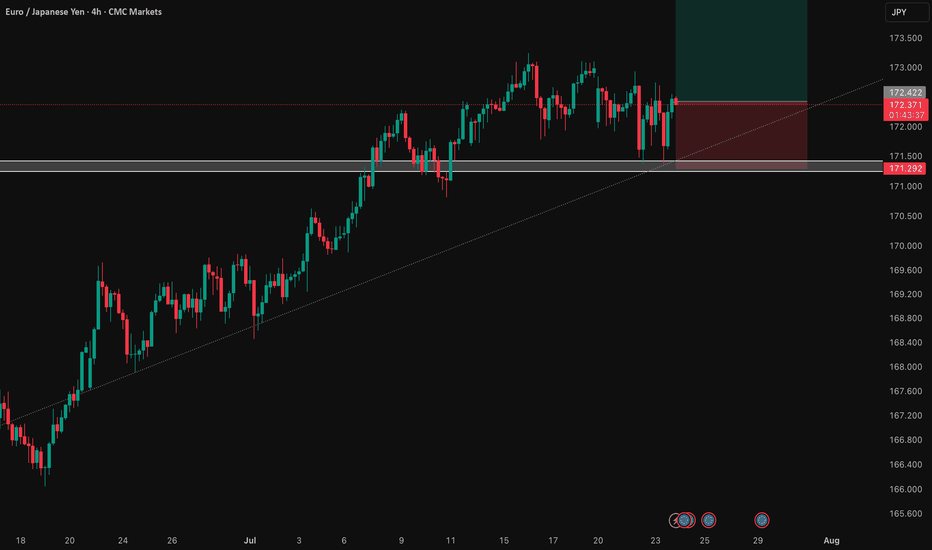

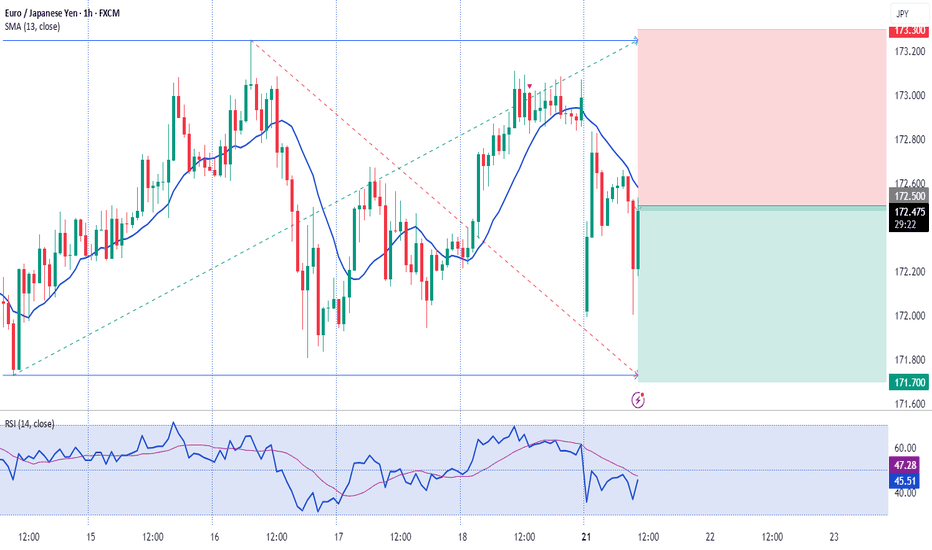

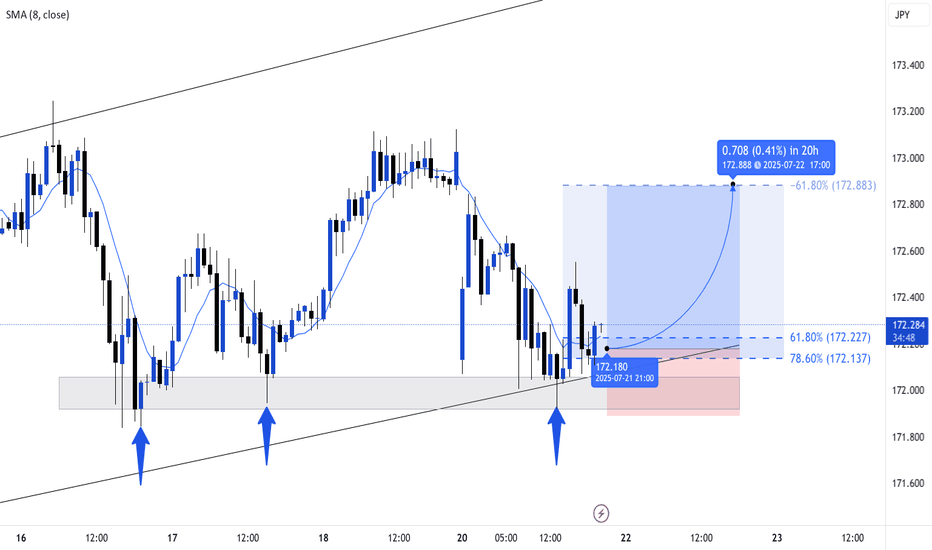

EURJPY will retest yesterday's lowest priceBased on Asian session price action, price broke the 172.00 mark.

due to this, i believed it will continue downtrend at least to test yesterday's lowest price (around 171.37).

I'm instant sell from current market price.

calculate your own risk & reward.

Good Luck.

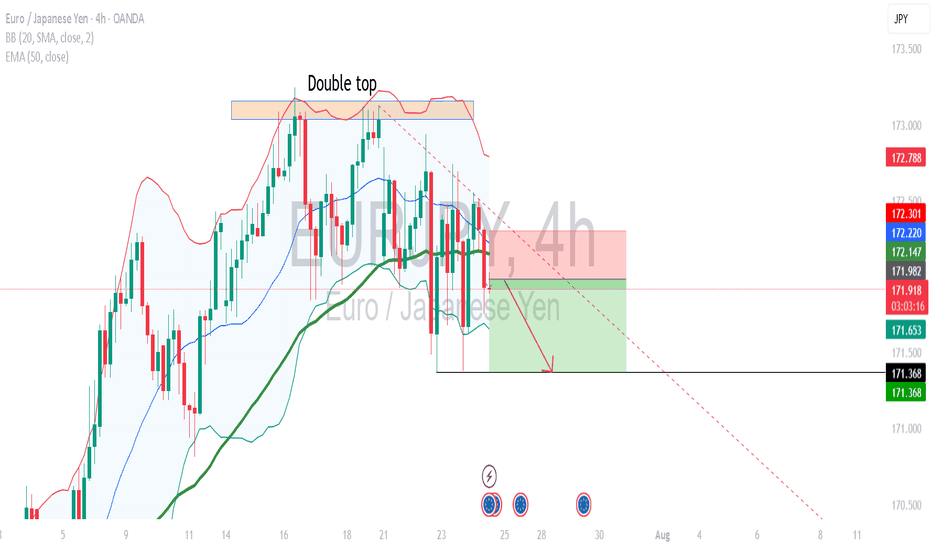

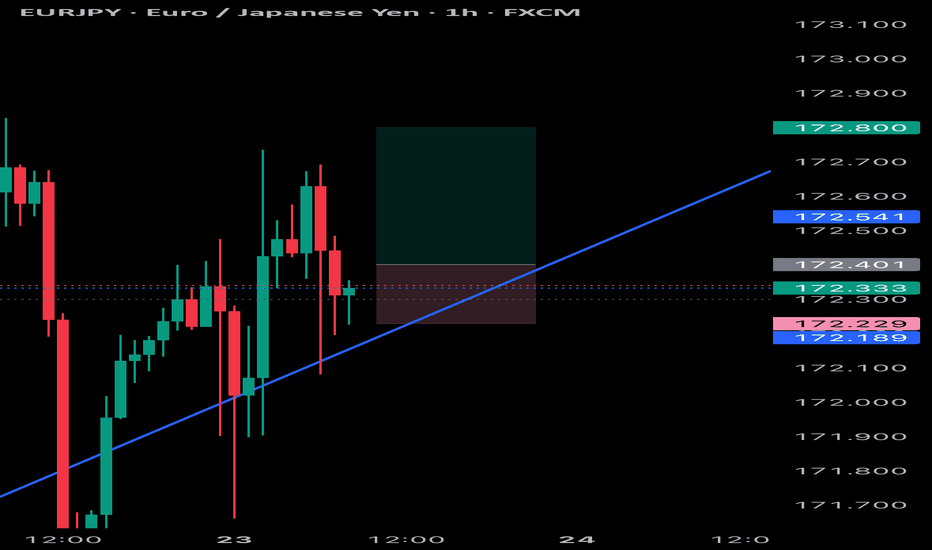

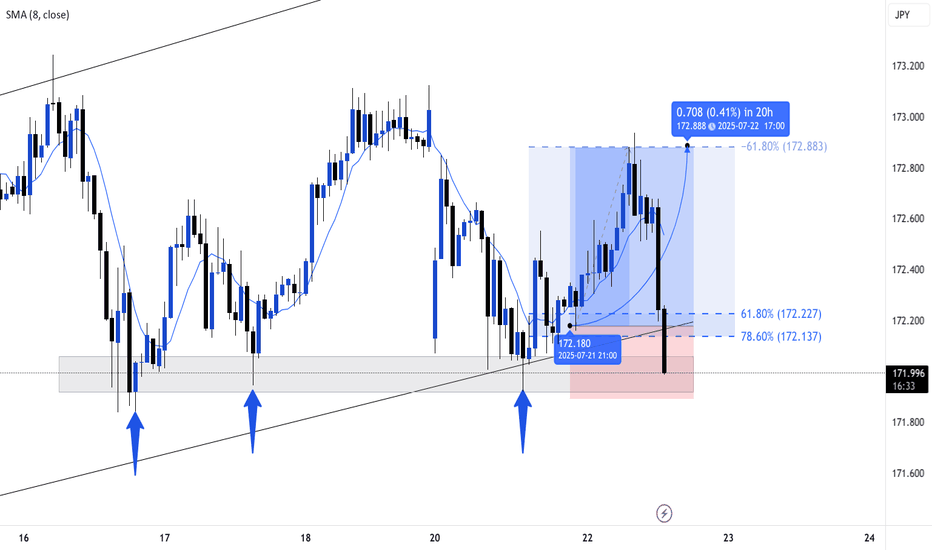

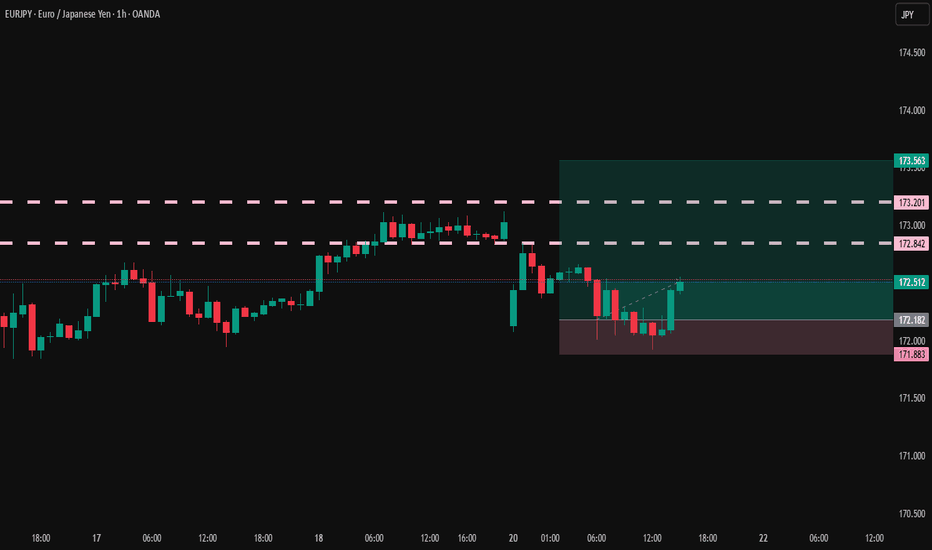

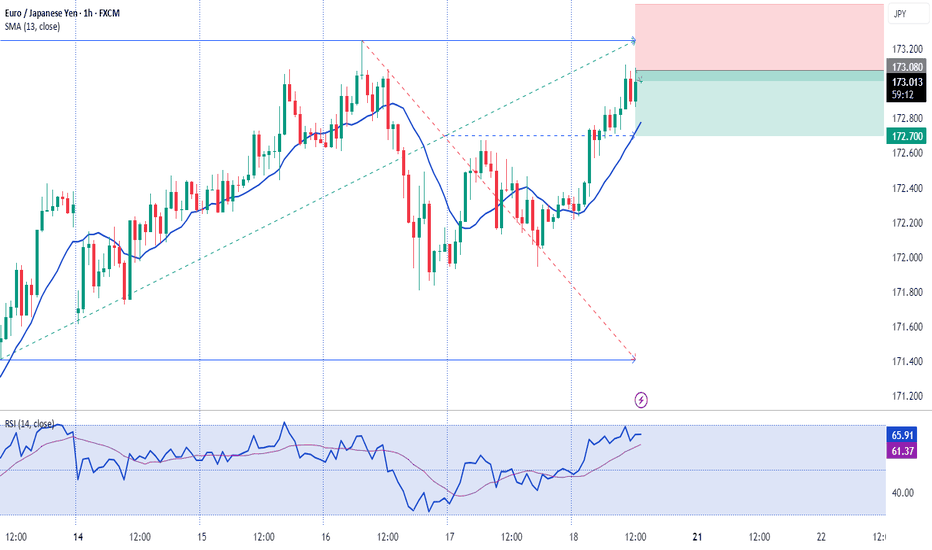

EUR/JPY: Bullish Thesis on Policy DivergenceOur primary thesis is built on a powerful confluence of compelling fundamental drivers and a clear technical structure. We are taking a long position in EUR/JPY with high conviction, anticipating significant upside fueled by a stark monetary policy divergence confirmed by a constructive chart formation.

📰 Fundamental Analysis: The core of this trade is the widening policy gap between the European Central Bank (ECB) and the Bank of Japan (BoJ). While the BoJ is only just beginning to exit its ultra-loose monetary policy, the global environment points toward continued JPY weakness. The upcoming high-impact US news will act as a major catalyst. A "risk-on" reaction to the data would significantly weaken the JPY, providing a strong tailwind for this trade.

📊 Technical Analysis: The chart structure for EUR/JPY is decidedly bullish. The pair has established a clear uptrend, and recent price action indicates a period of healthy consolidation above key support levels. This presents a strategic entry point, as the market appears to be gathering momentum for the next leg higher. The current setup suggests a low-risk entry into a well-defined upward trend.

🧠 The Trade Plan: Based on this synthesis, we are executing a precise trade with a favorable risk profile.

👉 Entry: 172.422

⛔️ Stop Loss: 171.292

🎯 Take Profit: 174.684

⚖️ Risk/Reward: 1:2

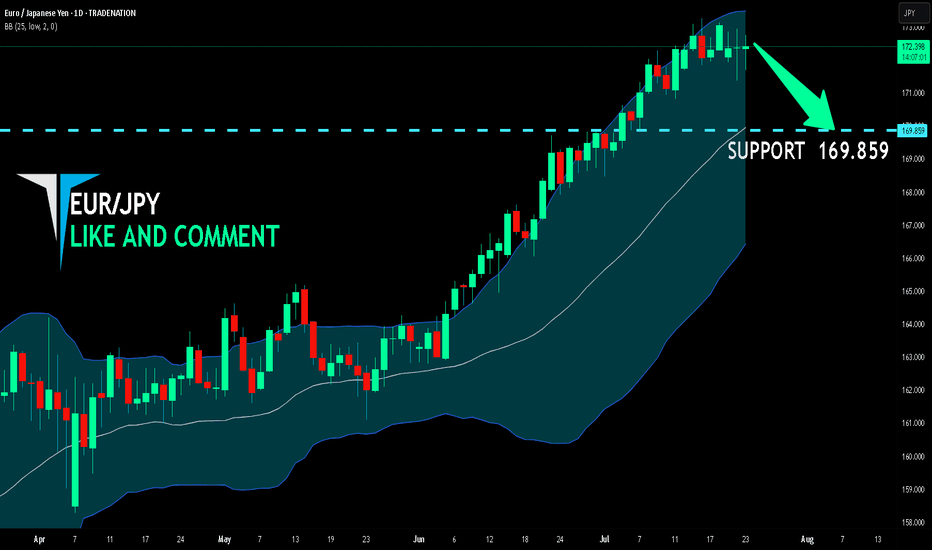

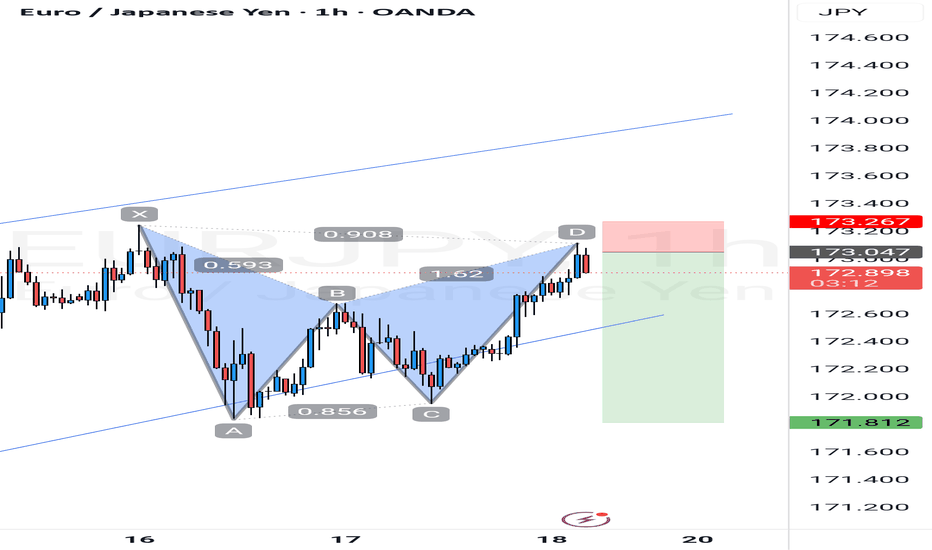

EUR/JPY BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

EUR-JPY uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 169.859 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the EUR/JPY pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

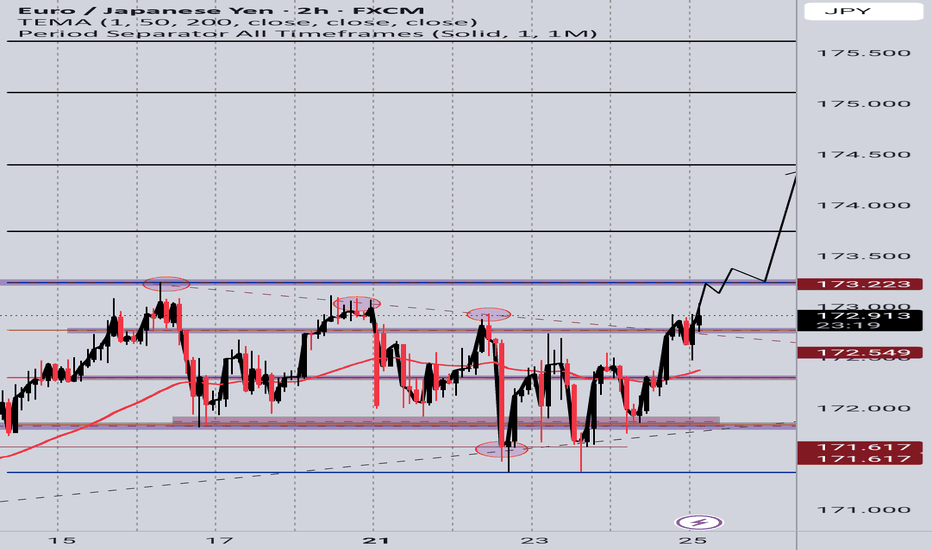

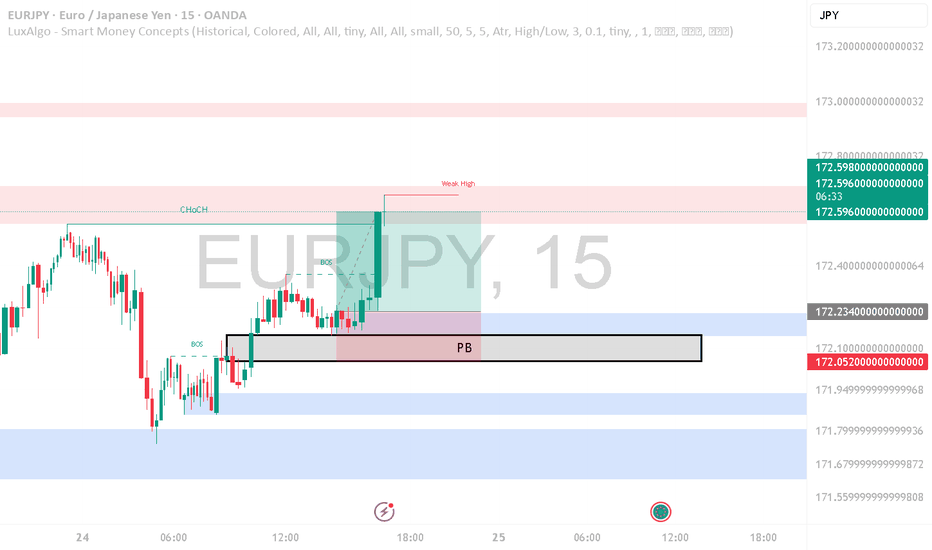

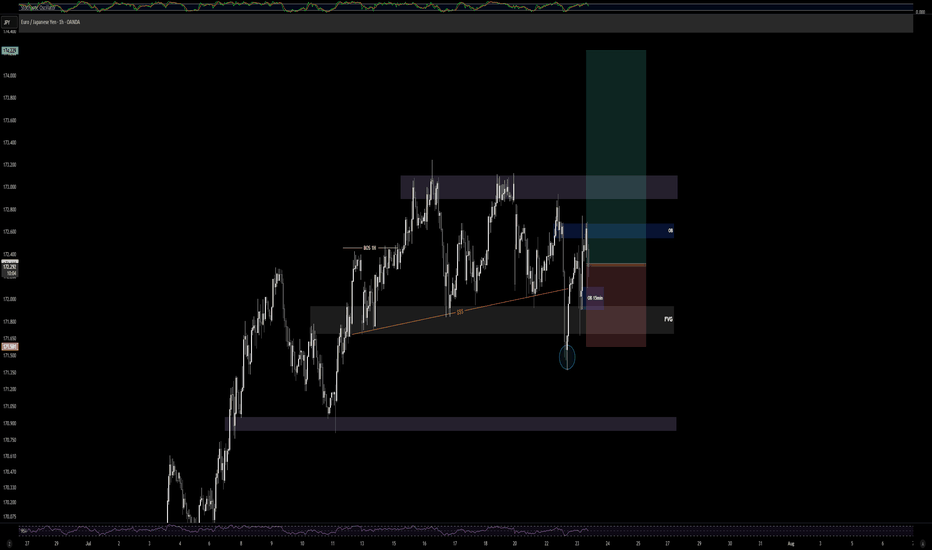

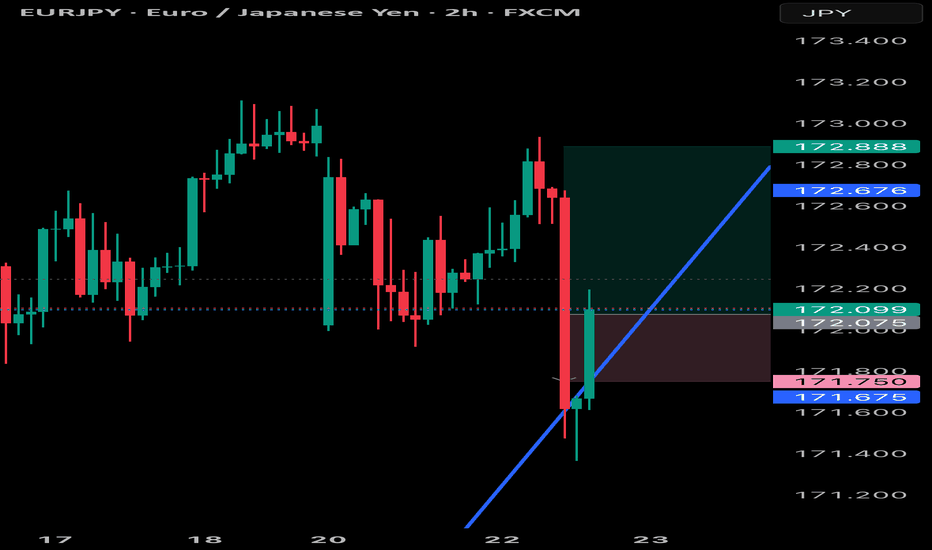

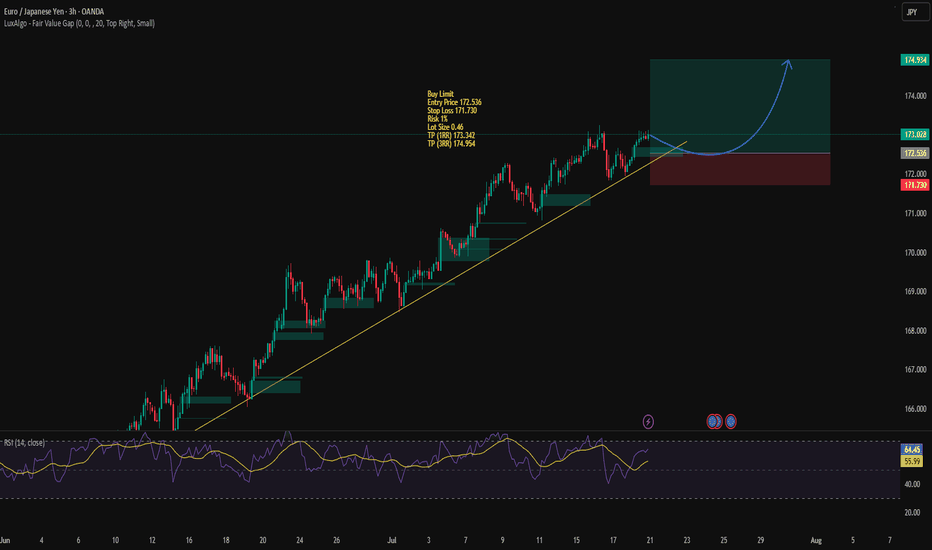

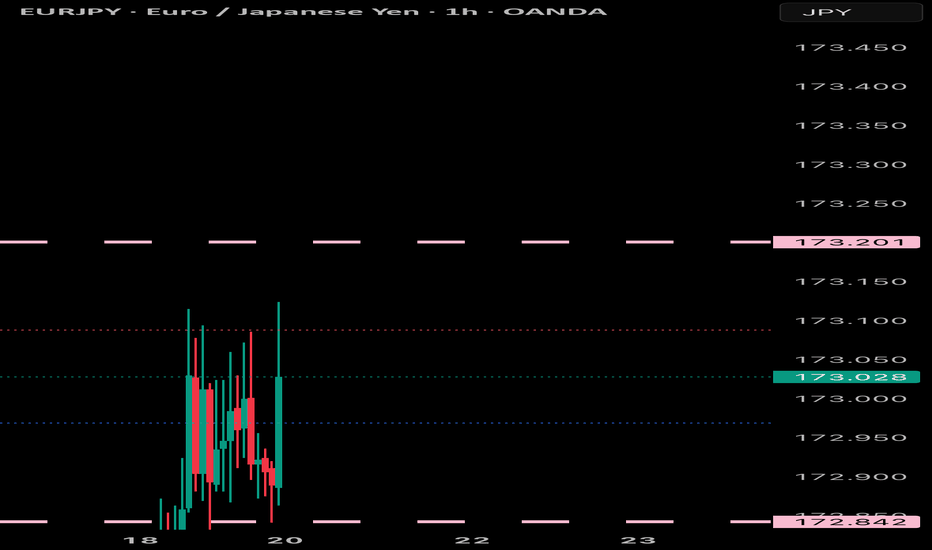

EURJPY

📍 Strategy: BoS + Retest Sniper Entry

🔍 Market Context:

Break of Structure (BoS) confirmed

Price returned to retest broken structure zone

RSI showing overbought divergence (above 70)

Perfect rejection from AREA OF INTEREST near 172.90–173.00

🔻 TRADE DETAILS

🟣 Sell Entry: 172.349

🔺 Stop Loss: 172.948 (Above structure high)

🎯 Take Profit: 169.146

🧮 Risk/Reward: ~1:5.6

🧠 Confidence: 75% setup based on structure + RSI + fakeout wick

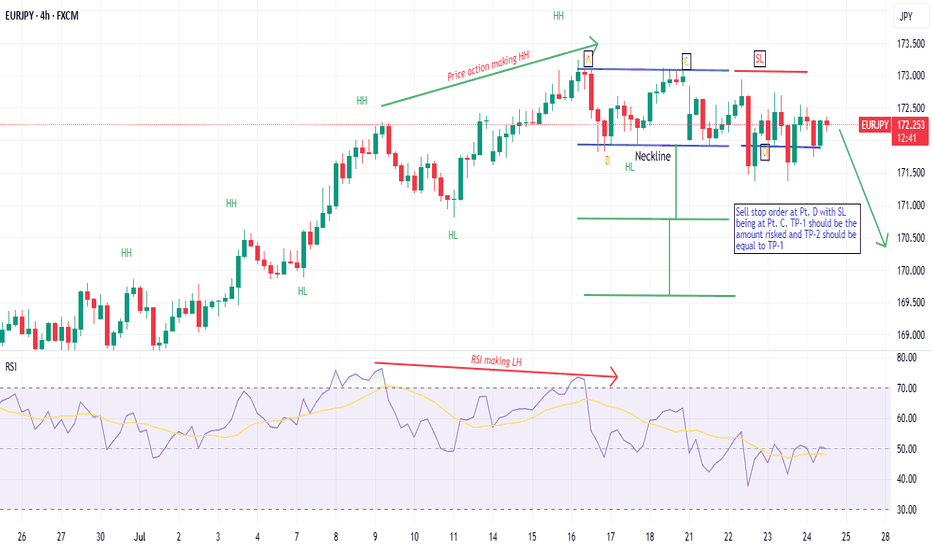

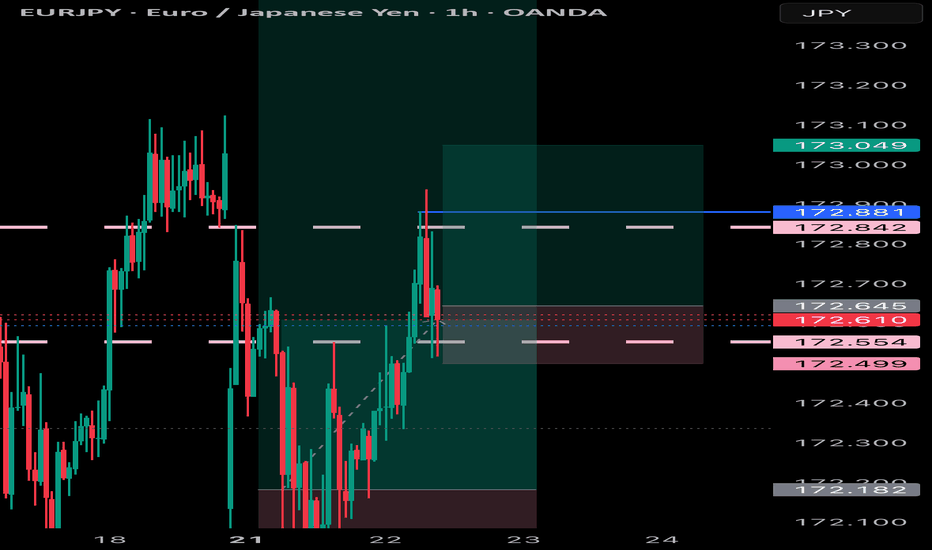

EUR/JPY – Double Top with RSI Divergence (Bearish Setup)Technical Analysis (Short Trade Idea)

EUR/JPY is forming a textbook double top pattern with notable bearish signals:

First top: 173.242

S econd top: 173.111 (lower high, indicating weakening bullish pressure)

Neckline: 171.650 – key support level, potential breakdown trigger

RSI divergence: Bearish divergence observed as RSI prints lower highs while price forms nearly equal tops, signaling momentum loss

This structure suggests a potential reversal from recent highs. A short opportunity may arise if price breaks below the neckline at 171.650 with confirmation.

Trade Setup

Sell Stop: 171.650

Stop Loss: 173.148

Take Profit 1: 170.180

Take Profit 2: 168.642

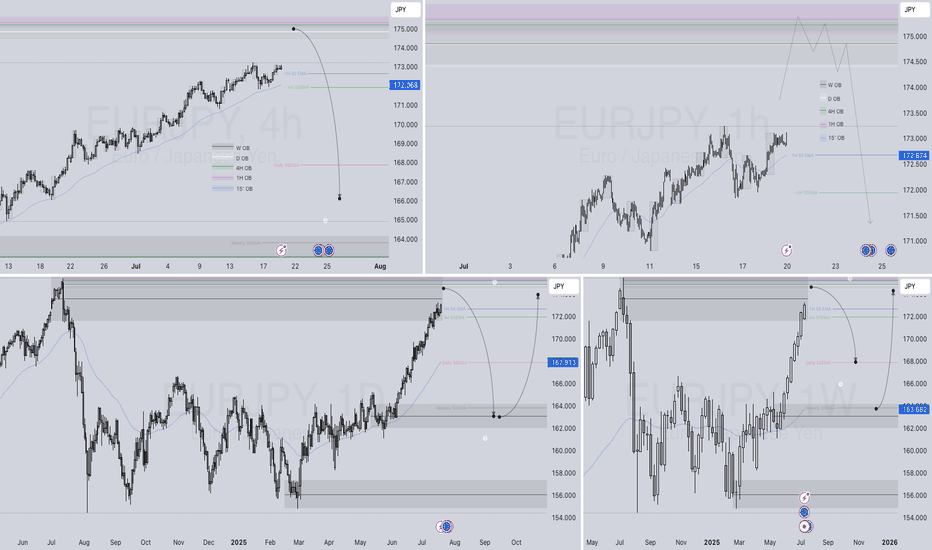

EURJPY Hits Major Weekly Supply | Is the Bull Run Over?EUR/JPY – Institutional Macro Context (COT)

EUR (Euro)

Non-commercials net longs increased by +16,146 → strong buying.

Commercials added +25,799 long positions.

✅ Bias: Moderately bullish.

JPY (Japanese Yen)

Non-commercials decreased longs by -4,432.

Commercials cut -20,405 long contracts.

❌ Bias: Bearish pressure remains on JPY.

Conclusion (COT): EUR remains fundamentally strong, JPY structurally weak. Institutional flows favor long EUR/JPY, but positioning is stretched.

Seasonality (July)

EURJPY shows strong bullish seasonality in July, especially over the 2Y and 5Y averages (+1.03% and +0.66% respectively).

✅ Seasonality bias: Bullish.

Retail Sentiment

89% of traders are short on EUR/JPY.

Contrarian bias = bullish confirmation.

Technical Analysis (Weekly View)

Price is pushing into a major weekly supply zone around 172.50–173.00.

RSI still elevated but showing signs of weakening momentum.

Potential double top structure forming in confluence with liquidity grab.

First downside target sits around 169.50 (daily demand zone).

Awaiting a reaction in supply and confirmation for short.

Trading Plan (Top-Down)

Wait for price to reject the 172.50–173.00 area

Watch for bearish confirmation on Daily (engulfing or lower high)

Target: 169.50 zone

Risk: tight above 173.20 (invalidating supply zone)

EURJPY – WEEKLY FORECAST Q3 | W30 | Y25📊 EURJPY – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊