#007: LONG EUR/MXN Investment OpportunityHi, I'm Andrea Russo and today I want to talk to you about this long investment opportunity on EUR/MXN.

After a careful analysis of institutional flows, market sentiment and macroeconomic dynamics between Europe and Mexico, I have identified a potential medium-term long opportunity on this currency pair, often overlooked by retail traders but closely followed by professional operators for its hybrid technical-fundamental structure. I would like to thank in advance the Official Partner Broker PEPPERSTONE who supported us in creating this technical analysis.

🔍 Technical and strategic context

In recent days, EUR/MXN has shown typical institutional accumulation behavior: prolonged congestion on key levels, progressive decrease in volatility, increase in volume anomalies on bearish spikes and presence of clear defenses on strategic support areas.

All this while retail positioning remains strongly unbalanced short, with over 75% of retail operators selling this pair in the current area. Historically, when such extreme levels of imbalance are reached, the likelihood of an institutional-driven reversal increases significantly.

🧠 Expected Behavior and Institutional Dynamics

Large financial institutions – including global banks and hedge funds – never enter “on cue”: they enter when the market is ready for them to win. This often happens after retail has positioned itself heavily against the upcoming move, and that is exactly what we are seeing these hours.

EUR/MXN is a high-yielding pair: the Mexican peso often benefits from favorable carry trades, but is also highly exposed to geopolitical tensions (such as the current US-Iran turmoil) and the overall direction of the US dollar and the euro. In this environment, with a stable euro and rising systemic risk, the natural flow tends to move away from the Mexican peso, making long EUR/MXN particularly attractive.

🎯 Operational positioning and objectives

My entry occurred on a well-defined compression zone, with a protected technical stop loss and a target calculated on structure, volumes and previous similar breakouts. The target is an area around 22.73, where institutional profit taking is likely to arrive.

It should be noted that the entire current structure is built on protection zones generated by passive orders: we know that in EUR/MXN these levels have historically caused strong rebounds when reached.

📊 Conclusion

This trade is not simply a directional bet. It is the thoughtful execution of a model based on the behavior of large operators, market psychology and advanced analysis of capital flows. It is not about "predicting the future", but positioning yourself at the same time as the strong hands do, exploiting their own rules.

My goal is to operate like a hedge fund does, and in this trade on EUR/MXN I see all the conditions for this to happen.

EURMXN trade ideas

#005: LONG Opportunity on EUR/MXN

Hello, I am Forex Trader Andrea Russo and today I want to talk to you about a LONG opportunity on EUR/MXN.

Remember to look at my website to discover all my channels and also find exclusive Benefits reserved for my readers.

On EUR/MXN I opened a long position, following an operational logic identical to that of a hedge fund desk:

intermarket analysis, retail positioning, options, institutional behavior and verification of the manipulative entry already completed.

This operation does not arise from a random pattern, but from a structured reading of the market that takes into account real flows, institutional timing and manipulations visible on the chart.

🔍 Synthetic Technical Analysis (8H Timeframe)

Key Support: 21.75 (PRZ of a Bat Harmonic Pattern)

Breakout Occurred: Above 22.08 with a full candle

Next Resistance: 22.40 and Final Target 22.72

Protected Stop: Below 21.47 → Out of Any Technical Noise

The price compressed for over 20 8H candles in a lateral base. The breakout occurred exactly above the flat MA200, signaling the start of a directional phase.

📊 Institutional flows and behavior

This long operation is based on signals that typically anticipate the entry of banks and funds:

Previous manipulation already occurred below the lows (typical stop hunter behavior)

Retail completely short (83–100%) → contrarian pressure in favor

Break above resistance with increasing OI → confirms real flows

FX options with strike at 22.70–22.80 → targets expected by the derivative market

Those who operate as funds do not enter after the breakout, but accumulate first in areas where the risk is lower and the structural reward is maximum.

🌐 Geopolitical scenario in favor

The current escalation between the US and Iran is generating:

📉 Flight from emerging currencies (such as MXN)

🛡️ Seeking refuge in stable currencies (EUR included)

🛢️ Rising oil price → penalization for Mexico (more expensive imports)

All this creates a favorable macro push context for EUR/MXN long.

EUR MXN LONG Investment Opportunity

The EUR/MXN pair is showing signs of recovery, with an interesting possibility of appreciation of the Euro against the Mexican Peso. In this analysis, we will explore a LONG strategy, with an entry point at 21.80, based on technical and fundamental considerations.

Position parameters:

Take Profit (TP): 22.80

Stop Loss (SL): 21.46

Trend analysis and motivations for LONG:

The Euro is showing a certain degree of stability thanks to the monetary policy of the ECB and the improving economic outlook in the Eurozone. On the other hand, the Mexican Peso could be pressured by the volatility of emerging markets and the decisions of Banxico on interest rates.

Graphically, the 21.80 level has acted as a key support, suggesting a favorable area for the opening of a LONG position. The 22.80 target represents a significant resistance, tested in previous market phases. If the bullish momentum is maintained, this level could be reached with a gradual progression.

Risk management and operational outlook:

The Stop Loss is positioned at 21.46, a point that could indicate a bearish breakout if reached. The risk/reward ratio appears balanced, allowing a prudent management of the position without exposing the capital to excessive risks.

Conclusion:

The LONG strategy on EUR/MXN is supported by technical and macroeconomic factors that indicate a possible revaluation of the Euro in the short-medium term. Monitoring global economic developments and central bank decisions will be essential to confirm the validity of this approach.

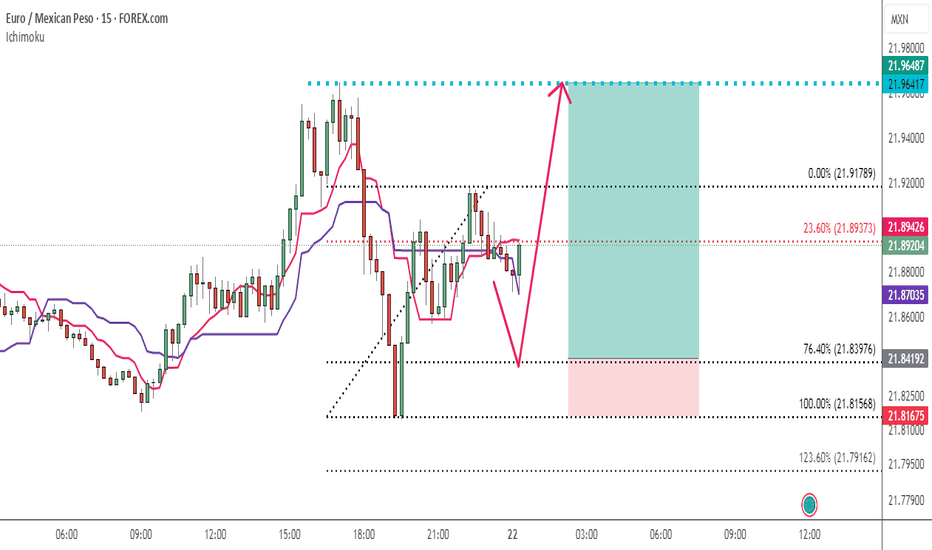

eurmxn is bearish for a whilea price action pattern depicted on the chart

we are noticing that price tried several times for breaking upward its level but failed and left a pattern with a temporary pullback before its unseccessful failing upward leg

after failing to break the level it started going south toward 76.4% fibo level

please see what the market will play out

The Arrest of South Korean President Yoon and the MarketDear readers,

My name is Andrea Russo and today I want to talk to you about an event that has profoundly shaken the international political and financial scene: the arrest of South Korean President Yoon Suk Yeol. News of this caliber cannot leave us indifferent, especially considering the economic importance of South Korea on the global stage. With you, I want to analyze the consequences of this story, both for the stock market and for the currency market.

An unexpected political turning point

The arrest of Yoon Suk Yeol came like a bolt from the blue, fueling doubts about the political stability of South Korea. In recent months, his government had been at the center of controversy for its authoritarian management of power, culminating in the announcement of martial law last December. This act had already sparked negative reactions both nationally and internationally, with consequent repercussions on the financial markets.

Now, with his arrest, the unknowns increase. South Korea is one of Asia's major economies, with a strong presence in the technology and manufacturing sectors. Any political instability could undermine investor confidence, with knock-on effects on the markets.

The impact on the South Korean stock market

Despite the initial alarm, the KOSPI index, the main benchmark of the Seoul stock exchange, recorded only slight fluctuations, closing with an increase of 0.2% the day after the news. This moderate behavior suggests that investors are still assessing the extent of the political crisis before making drastic decisions.

However, it should be considered that some South Korean companies, especially technology exporters such as Samsung and LG, could come under pressure in the short term. The perception of instability could push foreign investors to diversify their positions, penalizing the South Korean market.

The dynamics of the forex market

The currency market, notoriously more reactive to geopolitical events, has shown signs of nervousness. The South Korean won (KRW) lost ground against the US dollar, with USD/KRW moving from 1,200 to 1,205 in the hours following the news. This slight depreciation reflects investor uncertainty about the country’s economic outlook.

The announcement of martial law has previously caused the won to depreciate significantly, falling 2% against major currencies. Forex is therefore likely to continue to be a key indicator of traders’ sentiment towards South Korea.

Looking ahead

Looking ahead, it is essential to monitor the South Korean government’s response to this crisis. If institutions can ensure an orderly transition of power, the negative impact on markets could be limited. Conversely, further signs of political instability could lead to capital flight and increased market volatility.

In addition, it remains to be seen how the world’s major economies react to the situation. South Korea has strong trade ties with the United States, China and the European Union, and any deterioration in international relations could amplify the economic repercussions.

Conclusion

Dear readers, the arrest of President Yoon Suk Yeol represents a crucial moment for South Korea. As always happens in cases of political uncertainty, the markets react quickly, but it is the medium and long term that will determine the true consequences of this event.

I will continue to follow the developments of this story closely, sharing my analyses and reflections with you. In the meantime, I invite you to stay informed and carefully consider every investment decision. Prudence, especially in times like this, is always a good advisor.

Best regards,

Andrea Russo

Los Angeles Fires: The Impact on Financial MarketsHello readers, I'm Andrea Russo and today I'm talking to you about the effects that a natural disaster, such as the devastating fires that are hitting Los Angeles, can have on financial markets.

The news is dramatic: 16 dead, 153,000 people evacuated and a city under siege by flames. In addition to the human and environmental impact, events like these can also profoundly affect the economy and, consequently, the financial markets. In this article I will explain how a trader like me analyzes these situations and which sectors are most affected.

The impact on local markets

Fires of this magnitude can put pressure on various economic sectors. Insurance companies, for example, are among the first to suffer: with the increase in claims for compensation for damage to properties, their profit margins are eroded, often causing a decline in stock prices.

On the other hand, there are sectors that could see an increase. Companies related to construction, building materials and reconstruction could see an increase in demand, especially in the medium term, when the restoration work begins. Monitoring stocks of companies that produce cement, steel or lumber can offer interesting insights for those who operate in the market.

Commodities under pressure

Natural disasters like these can also have an impact on the commodities market. In the case of fires, one of the most exposed sectors is the lumber sector. The destruction of forest resources in California could lead to an increase in lumber prices, creating speculative opportunities for those who operate in this market.

Another important aspect concerns agriculture: California is one of the most productive agricultural states in the United States. If the fires affect agricultural land or interrupt supply chains, we could see a rise in the prices of certain crops, such as fruits, vegetables or almonds, typical products of the region.

Impact on Market Indices and Investor Sentiment

Natural disasters such as fires generally tend to have little impact on major indices, such as the S&P 500, unless they affect strategic sectors or regions of global economic importance. However, it is important to keep an eye on volatility: the market could react with temporary downward movements, especially if investors perceive a broader risk to the local economy.

Furthermore, market psychology should never be underestimated. In situations of great uncertainty, investors tend to move towards assets considered "safe havens", such as gold or the US dollar. This could represent an opportunity for those who trade in these asset classes.

Conclusion

The Los Angeles fires are a tragedy that will leave both human and economic impacts. For a trader, monitoring the aftermath of events such as these is essential to identify potential opportunities or manage risks. Personally, I always try to carefully analyze the affected sectors and adapt my strategies based on market conditions.

I hope this analysis has been useful to you in understanding how a natural event can have an impact on financial markets and what dynamics to consider to make informed decisions.

Thanks for reading, I'll see you in the next article!

Andrea Russo

Trump and the Impact on the Forex MarketTrump and the Impact on the Forex Market: Which Currencies Are Affected?

Donald Trump's election as President of the United States has often had a significant impact on global financial markets, including the forex market, which is particularly sensitive to political, economic and geopolitical developments. Forex is the largest and most liquid market in the world, where currencies are traded in real time, and any global event, such as a presidential election, can generate volatility.

In this article, we will analyze the impact that Trump's return to the White House could have on the forex market and which currency pairs could see the most movement.

The Context of Trump's Election

Donald Trump is known for his economic approach focused on economic nationalism and expansionary fiscal policy. During his previous administration, the focus on tax cuts, deregulation and a trade war with China had a profound impact on global currencies. Trump has also repeatedly expressed his willingness to keep the dollar weak to boost US exports, often criticizing the Federal Reserve for its monetary policies.

With his return to the presidency, one could expect a further push towards aggressive economic policies, such as tax cuts, fiscal stimulus and a greater emphasis on protectionism. This could have a knock-on effect on the US dollar and other related currencies.

Most Affected Currency Pairs

Below, we analyze the major forex pairs that could be most affected by Trump's inauguration:

1. EUR/USD (Euro/US Dollar)

The EUR/USD, the most traded pair in the world, is likely to be one of the most volatile.

Trump Effect: If Trump continues to push for expansionary fiscal policies, the dollar could weaken in the short term due to expectations of rising government debt. However, in the event of a more hawkish agenda from the Fed, the dollar could strengthen.

Geopolitical Focus: Any tensions between the United States and the European Union (related to trade tariffs or regulatory policies) could lead to a depreciation of the euro against the dollar.

2. USD/JPY (US Dollar/Japanese Yen)

The Japanese yen, considered a safe haven currency, will be strongly affected.

Trump Effect: An increase in global uncertainty or geopolitical tensions could strengthen the yen against the dollar. However, a rise in US Treasury yields could push the dollar higher.

Likely Scenario: Trump's aggressive pro-growth policies could initially weaken the dollar against the yen, but a rise in US interest rates could reverse the trend.

3. USD/CNY (US Dollar/Chinese Yuan)

The trade war between the United States and China has been a central focus of the Trump administration.

Trump Effect: A return of protectionist policies, such as tariffs on Chinese goods, could lead to a devaluation of the yuan. This could push the USD/CNY pair to new highs, increasing tensions in the Asian markets.

Trader Focus: Traders will need to closely monitor Trump’s statements regarding trade relations with China.

4. GBP/USD (British Pound/US Dollar)

The British pound will be influenced mainly by post-Brexit trade relations.

Trump Effect: If Trump takes a more hawkish approach in relations with the UK, a devaluation of the pound could occur. However, an improvement in Anglo-American trade relations could support a strengthening of the GBP against the dollar.

5. AUD/USD (Australian Dollar/US Dollar)

The AUD is often considered a proxy for global growth, given Australia’s dependence on exporting raw materials.

Trump Effect: Trade tensions between the US and China could hurt the Australian dollar. However, higher US infrastructure spending could support commodity prices and strengthen the AUD.

6. USD/CHF (US Dollar/Swiss Franc)

The Swiss Franc, another safe haven currency, is sensitive to global uncertainties.

Trump Effect: If Trump’s inauguration leads to political or economic instability, the CHF could appreciate against the dollar.

Thanks for reading this article, as always, if you have any questions, please feel free.

Sincerely,

Andrea Russo

Artificial Intelligence in Forex Trading: the Future

Hello readers, my name is Andrea Russo, and I’m a passionate Forex trader with years of experience in the financial markets. Today, I want to talk to you about a topic that has recently captured the attention of many traders: the integration of Artificial Intelligence (AI) into Forex trading.

AI isn’t just a trend; it’s a transformative technology that is changing how we analyze markets and make trading decisions. In this article, I’ll walk you through the benefits, challenges, and future potential of AI in the Forex market, based on my own experiences.

The Benefits of Artificial Intelligence in Forex Trading

1. Real-Time Data Analysis

One of the most powerful aspects of AI is its ability to process and analyze massive amounts of data in real time. In the Forex market, where every second matters, this speed can make the difference between profit and loss.

For example, advanced algorithms can analyze economic news, price movements, and technical indicators simultaneously, identifying trading opportunities instantly. Personally, I’ve used AI-powered tools to monitor currency pairs like EUR/USD and GBP/USD, gaining reliable and rapid trading signals.

2. Eliminating Human Error

How many times have you made emotional decisions while trading? It’s happened to me too, but AI has significantly reduced this issue. Algorithms don’t get influenced by fear or greed—they execute trades based purely on predefined logic and concrete data.

3. Adapting to Market Conditions

Another advantage I’ve noticed is AI’s ability to adapt quickly. For instance, a machine learning system can adjust strategies according to market changes, shifting from trend-following techniques to range-bound strategies without any human intervention.

4. Detecting Advanced Patterns

We all know how crucial it is to spot technical patterns on charts. Thanks to neural networks, AI can identify complex signals that even the most experienced traders might miss. I’ve tested a deep learning system that recognizes divergences between RSI and price action, delivering impressive results.

The Challenges of Artificial Intelligence

1. Data Quality

The effectiveness of an AI system depends on the quality of the data used to train it. I’ve encountered algorithms that delivered inconsistent results because they were based on incomplete or outdated historical data. It’s essential to ensure that your data is accurate and representative of current market conditions.

2. Overfitting Issues

Overfitting is a problem I’ve faced personally: during backtesting, a system performed exceptionally well on historical data but failed in live markets. This happens when a model is too tailored to past data and can’t handle new scenarios effectively.

3. Technical Complexity

Not every trader has the technical skills to develop an AI system from scratch. Initially, I had to rely on specialized software providers. It’s crucial to choose reliable tools and at least understand the basics of how they work.

4. Dependence on Technology

Lastly, over-reliance on technology can become a risk. I always recommend maintaining human oversight over automated systems to avoid surprises caused by bugs or unforeseen market events.

The Future of Artificial Intelligence in Forex Trading

Looking ahead, I’m convinced that AI will become an even more integral part of Forex trading. Among the most exciting innovations, I believe we’ll see:

Multimodal Learning: Systems that integrate numerical data, textual information, and charts to deliver comprehensive analyses.

Integration with Blockchain: To enhance the security and transparency of transactions.

Advanced Personalization: Algorithms will be able to create tailor-made strategies for each trader, based on their goals and risk tolerance.

Conclusion

As a trader and technology enthusiast, I’m excited about the possibilities AI offers. However, I firmly believe that the key to success lies in finding a balance between automation and human oversight.

If you’re considering integrating AI into your trading strategies, I recommend starting with simple tools, testing the results, and most importantly, continuing to develop your skills.

Thank you for reading this article! I hope my experiences and insights prove useful to you. If you have any questions or want to share your opinions, feel free to leave a comment below.

Best regards,

Andrea Russo

#1 Provisional Balance 2025: A Promising Start with +5%!

Dear readers,

My name is Andrea Russo, and today, January 9, 2025, I want to share with you the first provisional balance (#1) of the new year. After completing three trades, my initial capital has increased by +5%. Not bad as a starting point, right? But what really matters is not just the result, but the strategy behind these numbers.

My Strategy: Win Big and Lose Small

My investment approach is simple but effective:

Every winning trade increases the current capital by +30%.

Every losing trade results in a -10% loss of the current capital.

This strategy is based on disciplined risk management and maximizing market opportunities. It’s a system that allows me to move forward gradually, protecting my capital from significant shocks.

What Has Happened So Far?

Here are the results of the three trades closed so far, all verifiable on my Trading View profile:

EUR/MXN: Profit of +30% on the invested capital.

EUR/JPY: Loss of -10% on the invested capital.

EUR/ZAR: Loss of -10% on invested capital.

Additionally, I have a trade on EUR/NOK, which is currently under evaluation.

With this combination of results, my total balance so far shows an encouraging +5% increase in the initial capital. A small step, but in the right direction.

Why Share This Journey?

Documenting and sharing my journey helps me stay accountable and disciplined. Moreover, I want to show that a clear and verifiable strategy can lead to concrete results, even in a complex and unpredictable market.

Looking Ahead

This is just the beginning of 2025. I will continue to provide balance updates at regular intervals and publish my trades on Trading View, where you can verify them personally. The road is long, but every step is an opportunity to grow and learn.

Thank you for your support.

How Leverage Works in Forex TradingDear readers, my name is Andrea Russo, and today I want to talk to you about one of the most discussed topics in trading: leverage in Forex. This tool, both powerful and delicate, allows traders to amplify their gains with small investments but also carries significant risks if not used prudently. In this article, I will guide you step by step, explaining how leverage works, its advantages and risks, and how you can start trading safely.

What is leverage in Forex?

Leverage is a tool that allows traders to control much larger positions than the capital actually invested. For example, with a leverage of 1:100, you can open a $100,000 position with an initial investment of just $1,000.

Here’s a simple example:

You invest $1,000 with a leverage of 1:100.

Your market exposure will be $100,000.

If the market moves 1% in your favor, you will earn $1,000 (equal to 100% of your capital).

If the market moves 1% against you, you will lose your entire capital.

As you can see, leverage amplifies both gains and losses, which is why it’s essential to understand how it works before using it.

Advantages of leverage

Leverage offers several advantages that make it an attractive tool for those who want to invest in Forex:

Access to the market with small capital: You can start trading even with modest sums, thanks to leverage.

Diversification: With limited capital, you can open multiple positions on different currency pairs.

Maximization of profits: Even small price movements can translate into significant gains.

The risks of leverage

Despite its advantages, leverage carries important risks:

High losses: The same amplification that generates profits can multiply losses.

Margin Call: If losses exceed the available margin, the broker may automatically close your positions.

Emotional stress: High leverage can lead to impulsive decisions, often driven by anxiety.

How to start trading in Forex with leverage

If you want to use leverage effectively and safely in Forex, follow these steps:

1. Educate yourself and learn the basics

First of all, study how the Forex market works. It’s important to understand what influences exchange rates and which strategies to adopt. Dive into key concepts such as:

Major currency pairs

Spread and commissions

Technical and fundamental analysis

2. Choose a reliable broker

The broker is your trading partner, so ensure that it is regulated and offers transparent conditions. Look for brokers with:

Competitive spreads

Flexible leverage options

User-friendly platforms

3. Start with a demo account

To practice, use a demo account. You can test your strategies without risking real money and gain confidence with the platform.

4. Set up a trading strategy

A good trader doesn’t leave anything to chance. Define a trading plan that includes:

Realistic goals

Percentage of risk per trade (1-2% of capital)

Risk management tools like stop-loss and take-profit

5. Start with low leverage

If you’re a beginner, use moderate leverage, such as 1:10 or 1:20. This will allow you to limit losses while learning to manage risk.

6. Monitor positions and manage risk

Risk management is the key to successful trading. Invest only what you can afford to lose and constantly monitor your positions.

Conclusion

Leverage is an incredible tool, but it must be used cautiously. It can open the doors of the Forex market even to those with limited capital, but it requires discipline, education, and good risk management.

Thank you for reading this article. If you have any questions or want to share your experiences in Forex, feel free to write in the comments.

And remember: trading is a marathon, not a sprint! Happy trading!

EUR/MXN BUYI opened a BUY on EUR/MXN based on a solid multi-timeframe analysis. The entry price is 21.07455, with a target of 21.41824 (potential profit 1.48%) and a stop loss of 20.96655 (risk 0.66%). The risk/reward ratio of 2.23 convinced me to proceed.

I analyzed the situation using not only the Alligator indicator, which highlights a well-defined bullish trend, but also the WaveTrend, which confirms a possible continuation of the upward movement. For greater security, I checked the higher timeframes (4H and 1D), and these also strengthen my trading idea: the price seems to respect a long-term bullish pattern.

This setup gives me confidence because it combines a well-calculated entry with limited risk and confirmation on multiple timeframes. Now it only remains to follow the market and see if my analysis will be rewarded.

Common Mistakes in Forex Trading: How to Avoid ThemForex trading is the largest and most liquid market in the world, but precisely because of this, it is also one of the most complex and challenging. Many traders, especially beginners, often make mistakes that can jeopardize their profits or even wipe out their capital. However, with proper planning and greater awareness, it is possible to avoid the most common pitfalls and build a successful trading career.

In this guide, we will explore the 10 most frequent mistakes in Forex trading and provide concrete strategies to overcome them.

1. Not Having a Trading Plan

A trading plan is essential for any trader. Without a clear plan, it is easy to get carried away by emotions, make impulsive decisions, and lose money.

An effective trading plan should include:

Trading goals: Decide how much you want to earn and within what timeframe.

Risk tolerance: How much are you willing to lose in a single trade?

Entry and exit rules: Set criteria for opening and closing a position.

Capital management strategy: Determine how much of your capital to invest in each trade.

Practical example: if your goal is to earn 10% in a month, the plan should specify how many trades to make, which currency pairs to monitor, and the risk levels for each trade.

2. Inadequate Risk Management

A common mistake is risking too much capital in a single trade. This is a fast way to lose all your money. A good rule of thumb is to follow the 1-2% rule, meaning you should not risk more than 1-2% of your capital on a single trade.

For example, if you have a capital of €10,000, the maximum risk per trade should be between €100 and €200. This approach allows you to survive a series of consecutive losses without jeopardizing your account.

Additionally, it is essential to diversify your trades. Avoid focusing on a single currency pair or a specific strategy to reduce overall risk.

3. Not Setting Stop-Loss Orders

Stop-loss is an essential tool to protect your capital. It allows you to limit losses by automatically closing a position when the market moves against you.

Many traders, out of fear of closing at a loss, avoid setting stop-loss orders or adjust them incorrectly. This behavior can lead to losses much larger than expected.

Effective strategy: Set the stop-loss level based on your trading plan and never change this setting during a trade. For example, if you are trading EUR/USD and your risk level is 50 pips, set the stop-loss 50 pips away from the entry price.

4. Excessive Trading (Overtrading)

Overtrading is a common mistake, especially among beginner traders. The desire to "make money quickly" leads many to execute too many trades, often without a clear strategy.

Each trade comes with costs, such as spreads or commissions, which can quickly add up and reduce profits. Furthermore, excessive trading increases the risk of making impulsive decisions.

How to avoid it:

Stick to your trading plan.

Take a break after a series of trades, especially if they have been losing trades.

Set a daily or weekly limit on the number of trades.

5. Using Too Many Indicators

Many traders rely on a multitude of technical indicators, hoping that more information will lead to better decisions. In reality, excessive use of indicators can create confusion and conflicting signals.

It is better to choose 2-3 indicators that complement each other. For example:

Moving Average to identify trends.

RSI (Relative Strength Index) to measure market strength.

MACD (Moving Average Convergence Divergence) to identify entry and exit points.

6. Not Understanding Leverage

Leverage is a powerful tool that allows traders to control large positions with relatively small capital. However, it can amplify both profits and losses.

Many beginner traders use excessive leverage, underestimating the risks. For example, with 1:100 leverage, a small market fluctuation can result in significant losses.

Practical advice: Use low leverage, especially if you are a beginner. Start with leverage of 1:10 or 1:20 to limit your risk exposure.

7. Ignoring Economic News

Economic and political events have a profound impact on the Forex market. Ignoring the economic calendar is a serious mistake that can lead to unexpected surprises.

For example, interest rate decisions, employment data, or monetary policy announcements can cause significant market movements.

Strategy:

Regularly check an economic calendar.

Avoid trading during high-volatility events unless you have a specific strategy for these scenarios.

8. Not Backtesting Strategies

Backtesting is the process of testing a strategy on historical data to verify its effectiveness. Many traders skip this step, entering the market with untested strategies.

Backtesting allows you to:

Identify strengths and weaknesses in your strategy.

Build confidence in your trading decisions.

There are numerous software and platforms that allow you to perform backtesting. Be sure to test your strategy over a long period and under different market conditions.

9. Uncontrolled Emotions

Fear and greed are a trader's worst enemies. Fear can lead you to close a position too early, while greed can make you ignore exit signals.

To manage emotions:

Establish clear rules for each trade.

Take regular breaks from trading.

Consider using a trading journal to analyze your decisions and improve emotional control.

10. Not Staying Updated

The Forex market is constantly evolving. Strategies that worked in the past may no longer be effective. Not staying updated means falling behind other traders.

Tips to stay updated:

Read books and articles about Forex.

Attend webinars and online courses.

Follow experienced traders on social media and trading platforms.

Conclusion

Avoiding these mistakes is the first step to improving your performance in Forex trading. Remember that success requires time, discipline, and continuous learning. Be patient, learn from your mistakes, and keep refining your skills.

Happy trading!

Why I Invest Exclusively in Forex: A Strategic ChoiceInvesting in the currency market (forex) has gained popularity among investors worldwide due to its liquidity, accessibility, and profit potential. If you're wondering why I prefer to focus solely on forex and not diversify into other markets like stocks or cryptocurrencies, here are some reasons explaining my choice to concentrate exclusively on the currency market.

Unmatched Liquidity

Forex is the largest and most liquid financial market in the world, with a daily trading volume exceeding 6 trillion dollars. This extraordinary liquidity means I can enter and exit positions at any time without worrying about slippage or difficulty finding a buyer or seller for my trades. The high liquidity also makes the market more stable, reducing the risk of price manipulation and increasing transparency.

24/7 Accessibility

Forex is a global market that operates 24 hours a day, five days a week. This provides a flexibility that few other markets can match. I can decide to trade at any time of the day, fitting it into my schedule and routine without worrying about the fixed hours of other markets, like stock exchanges. This constant accessibility makes forex perfect for those with busy lives or those who prefer to trade during specific sessions, such as the Asian, European, or American sessions.

Low Barrier to Entry

Another significant advantage of forex is the low barrier to entry. You don’t need a large capital to start trading forex. Thanks to leverage, I can control a much larger position than my initial investment, potentially increasing returns. Additionally, many trading platforms offer free demo accounts, allowing me to learn and refine my skills without risking real money. The ability to start with modest amounts makes forex accessible to a wide range of investors, even those with limited budgets.

Less Volatility Than Cryptocurrencies

While cryptocurrencies promise high returns, they are notoriously volatile and risky. In comparison, forex tends to be more stable, especially when dealing with the most traded currencies like the US dollar, the euro, or the Japanese yen. While cryptocurrencies can experience price fluctuations of 10% or more in a single day, forex, though influenced by economic and political events, tends to move more predictably and in a controlled manner. For those seeking a less speculative and more regulated market, forex is a preferred choice over cryptocurrencies.

Predictability and Fundamental Analysis

In forex, currency movements are mainly influenced by economic factors such as interest rates, central bank monetary policies, inflation, and macroeconomic data. This predictability makes it easier to anticipate price movements compared to other markets. With a solid understanding of fundamental analysis, it’s possible to develop trading strategies based on economic events and government policies, providing a relatively clear basis for forecasting. On the other hand, the cryptocurrency market is influenced by unpredictable factors, including technological adoption, regulation, and speculation, making it harder to analyze.

International Diversification

Investing in forex gives access to a wide range of currencies from different countries and regions. This geographic diversification can protect the portfolio from risks related to individual stock markets or local economic crises. Furthermore, currencies behave differently based on global economic and political developments, offering multiple investment opportunities in different macroeconomic environments.

Less Dependence on Companies or Sectors

In stock trading, results are heavily dependent on the performance of individual companies or sectors. For instance, a corporate crisis or regulatory change can significantly affect stock values. In forex, however, performance depends on global macroeconomic factors, not individual entities. More stable currencies are influenced by monetary policies and economic data, making them easier to analyze and predict.

Risk Management

In forex, there are several risk management tools such as stop-loss and take-profit orders that help limit losses and protect gains. Furthermore, the ability to use leverage allows for higher returns but must be managed with caution. Risk management in forex is well-developed and allows for safer trading compared to other markets like cryptocurrencies, where volatility can lead to larger losses in a short amount of time.

Conclusion

Investing in forex offers numerous advantages, including liquidity, accessibility, relative stability, and the ability to trade 24/7. While every market has its risks, forex seems to be the most balanced for those seeking an investment that combines stability with profit opportunities. Though not without risks, forex offers greater predictability compared to cryptocurrencies and flexibility that allows for adaptation to changing market conditions. For these reasons, I’ve decided to focus my portfolio exclusively on this asset class.

Mexican carry tradeWe would like to buy the Mexican peso selling the euro at the same time so the idea to sell the euro against the M3xican peso.

There is a positive Jerry trade from borrowing the euro and buying the Mexican peso so because they have a higher interest rate than both the euro and the American dollar there is a positive carry to buying the MXN.

There should be greater strength as well as we seen that strong holders of the queso of $50. What essentially would’ve been the holders and there is reason to believe that positive care is worth it where you have an economics of supplied showing that we’re only trading the house’s money.

Can You Use Math to Elevate Your Trading Strategy?In the world of trading, understanding market movements is crucial for success. One of the most effective frameworks for interpreting these movements is Wave Theory, a concept that helps traders identify price trends and potential reversals. By incorporating mathematical projections, traders can enhance their analysis and make informed decisions. In this article, we’ll explore the fundamentals of Wave Theory and demonstrate how to project price movements using wave measurements—specifically, measuring Wave 1 to project the size of Wave 3.

Understanding Wave Theory

Wave Theory, popularized by Ralph Nelson Elliott, posits that financial markets move in repetitive cycles or waves, driven by collective investor psychology. Elliott identified two primary types of waves:

Impulse Waves: These are the waves that move in the direction of the prevailing trend, typically comprising five waves (labeled 1, 2, 3, 4, and 5).

Corrective Waves: These waves move against the prevailing trend and consist of three waves (labeled A, B, and C).

In a typical bullish market, you will observe a series of impulse waves followed by corrective waves. Understanding these waves allows traders to identify potential entry and exit points based on price patterns.

The Mathematics Behind Wave Projections

One of the key aspects of Wave Theory is using mathematical relationships to predict future price movements. A common approach is to measure the length of Wave 1 and use that measurement to project the size of Wave 3. Research indicates that Wave 3 often ranges between 1.0 to 1.68 times the length of Wave 1.

Steps to Project Wave 3:

Identify Wave 1: Begin by determining the starting point of Wave 1 and measuring its length. This can be done by noting the price levels at the start and end of Wave 1.

Calculate the Length of Wave 1:

Length of Wave 1 = End Price of Wave 1 - Start Price of Wave 1.

Project Wave 3:

To project Wave 3, multiply the length of Wave 1 by the desired factor (1.0 to 1.68).

Projected Length of Wave 3 = Length of Wave 1 × (1.0 to 1.68).

Determine the Target Price:

Add the projected length of Wave 3 to the endpoint of Wave 2 to determine the target price for Wave 3.

Target Price = End Price of Wave 2 + Projected Length of Wave 3.

Example: Applying Wave Theory in a Trading Scenario

Let’s say we’re analyzing a stock and identify Wave 1 as follows:

Start of Wave 1: $50

End of Wave 1: $70

Step 1: Measure Wave 1:

Length of Wave 1 = $70 - $50 = $20

Step 2: Project Wave 3:

Using the range of 1.0 to 1.68:

Minimum Projection = $20 × 1.0 = $20

Maximum Projection = $20 × 1.68 = $33.60

Step 3: Determine the Target Price: Assuming Wave 2 has an endpoint of $80:

Minimum Target Price = $80 + $20 = $100

Maximum Target Price = $80 + $33.60 = $113.60

Thus, based on Wave Theory, we would anticipate that Wave 3 could reach between $100 and $113.60.

Wave Theory, combined with mathematical projections, provides traders with a structured approach to understanding market dynamics and predicting future price movements. By accurately measuring Wave 1 and projecting Wave 3, traders can make informed decisions based on calculated price targets, improving their chances of success in the financial markets.

As you incorporate Wave Theory into your trading strategy, remember that no system is foolproof. Always combine technical analysis with sound risk management practices to protect your capital. With patience, discipline, and a strong mathematical foundation, you can leverage Wave Theory to enhance your trading prowess and navigate the markets with greater confidence.

How can you see yourself incorporating mathematical projections like Wave Theory into your trading strategy, and what has been your experience with predicting market movements using these techniques? Let me know in the comments.

Happy trading!

EURMXN Trading Signal: Buy Opportunity DetectedWe have identified a trading opportunity for the EURMXN currency pair based on our analysis using the EASY Quantum Ai strategy. Here are the specifics for this trade:

Direction: Buy

Enter Price: 21.6228

Take Profit: 21.85480333

Stop Loss: 21.43738333

Our analysis indicates the potential for a bullish movement in the EURMXN pair due to several factors:

1. Technical Indicators: Our algorithm detected strong bullish signals from multiple technical indicators, including moving averages and momentum oscillators. These indicators suggest an upward trend in the pair.

2. Macro-Economic Factors: Recent economic data from the Eurozone indicates stronger-than-expected economic performance, which tends to boost the Euro against other currencies, including the Mexican Peso.

3. Market Sentiment: Current market sentiment is leaning towards a risk-on environment, with investors showing a preference for assets with better return prospects. This sentiment is likely to support a stronger Euro.

4. Support and Resistance Levels: Our analysis identified strong support at lower price levels, reinforcing the likelihood of a move upward from our enter price point.

Based on these factors, our EASY Quantum Ai strategy signals to buy EURMXN at 21.6228, targeting a Take Profit at 21.85480333, and setting a Stop Loss at 21.43738333. This strategy aims to capture the anticipated bullish movement while minimizing potential risks.

Stay vigilant and monitor your trade according to the specified parameters. Happy trading!

eurmxn is bullishThe high volatility of EUR/MXN makes it possible to trade the pair in short-term and medium-term strategies with high profitability. However, when analyzing the euro exchange rate against the Mexican peso, traders need to independently monitor the main macroeconomic data affecting the dynamics of EURMXN quotes due to the lack of professional analytical materials on this pair.

EUR/MXN prices are influenced by such factors as changes in monetary policy and interest rates, data on trade balances and inflation, GDP levels and labor market data in the EU, Mexico and the USA.