eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD trade ideas

EURNZD: Bearish Continuation is Expected! Here is Why:

The price of EURNZD will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD BUY TRADE PLAN🔥 EUR/NZD TRADE PLAN

📅 Date: April 2, 2025

🔖 Plan Type:

✅ Main Swing Trade Plan

📈 Bias & Trade Type:

Bullish Continuation – Trend Following Buy Setup

⭐ Confidence:

⭐⭐⭐⭐ (80%)

Structure + OB alignment + D1 trend + H4 impulse leg retracement

📌 Status:

🕒 Waiting for entry

Price currently retracing toward valid HTF discount zones; clean structure intact.

📍 ENTRY ZONES:

Primary Buy Zone: 1.8865 – 1.8885

(H4 OB + FVG + 50% of bullish impulse leg)

Secondary Buy Zone (Deeper Tap): 1.8825 – 1.8840

(D1 OB midpoint + LTF sweep + unfilled imbalance)

❗ STOP LOSS:

SL: 1.8785

(Below OB structure + liquidity pocket invalidation)

🎯 TAKE PROFIT TARGETS:

🥉 TP1: 1.8965 (Recent H1 minor structure high)

🥈 TP2: 1.9040 (Clean H4 wick imbalance target)

🏆 TP3: 1.9125 (D1 supply & equal highs liquidity)

📏 RISK:REWARD:

Minimum 1:3 R:R optimized for swing continuation

🧠 MANAGEMENT STRATEGY:

Risk 1–2% only

Move SL to BE after TP1 hit

Secure partials at TP2, trail SL above OB

Let remaining lot run toward TP3

Invalidate if D1 CHoCH or HTF trend flip occurs

⚠️ CONFIRMATION CRITERIA (REQUIRED):

H1 bullish engulfing or pin bar inside OB zone

Volume breakout spike at OB level

Optional: M15–M30 bullish divergence at zone

⏳ VALIDITY:

Valid for 1–3 days (HTF swing setup); expires if unfilled post 72 hours or structure breaks

🌐 FUNDAMENTAL & SENTIMENT FACTORS:

✅ EUR sentiment moderately bullish (COT net long building)

✅ NZD under pressure (RBNZ dovish bias + weak milk auctions)

✅ No high-impact news in next 24h = Clean window

✅ Risk sentiment slightly tilted Risk-On → favors EUR flows

📋 FINAL SUMMARY:

EUR/NZD remains in bullish structure on D1 & H4. Waiting for price to retrace into OB + FVG overlap inside discount range. High confluence trade with confirmation required. Do not enter blindly — wait for H1 signal inside zone.

EURNZD SELL IDEA i love how the zones on eurnzd have been super clear and with the recent bos a pullback has occurred and on the lower time frame we can see that price is starting to close back under support and for me once price did that the probability of at least going back into half of that zone makes this trade idea worth one me taking.

EURNZD Wave Analysis – 2 April 2025

- EURNZD reversed from resistance area

- Likely to fall to support level 1.8700

EURNZD currency pair recently reversed down from the resistance area located between the resistance level 1.9100 (which stopped the earlier sharp upward impulse wave I at the start of March) and the upper daily Bollinger Band.

The downward reversal from this resistance area stopped the earlier short-term impulse wave iii of the upward impulse wave 3 from the end of February.

Given the strength of the resistance level 1.9100, EURNZD currency pair can be expected to fall to the next support level 1.8700.

EURNZD SELLThe market here has previously tested a significant swing level as resistance and has just don’t the same on the daily chart printing a strong body bearish rejection candle.

I have chosen my entry to be a 50% retracement of the bearish signal candle.

My stop loss will be the previous swing level to account for spreads with my profit being 3x my risk.

Best of luck on the charts traders

EUR/NZD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

EUR-NZD uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 1.885 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the EUR/NZD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

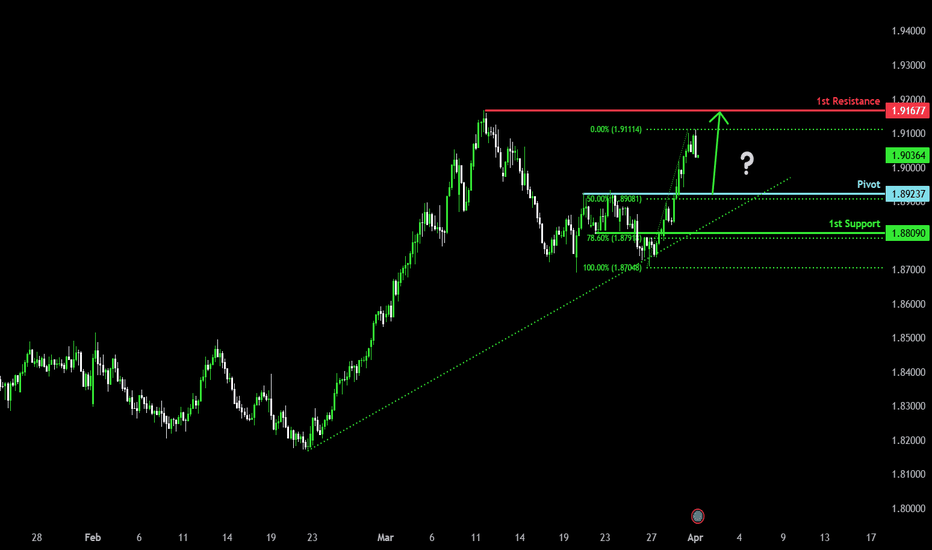

Falling towards 50% Fibonacci support?EUR/NZD is falling towards the pivot which has been identified as a pullback support and could bounce to the pullback resistance.

Pivot: 1.89237

1st Support: 1.88090

1st Resistance: 1.91677

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR-NZD Strong Resistance Ahead! Sell!

Hello,Traders!

EUR-NZD keeps growing

In a strong uptrend but a

Wide horizontal supply

Area is above around 1.9170

So after the pair retests

This level we will be expecting

A local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.