EURNZD BUY 4H

Hello, I am Forex Trader Andrea Russo and today I want to talk to you about a promising strategy for the EURNZD currency cross.

The EURNZD is showing interesting signals for an upward movement. I decided to open a long position at 1.87460, with a stop loss (SL) at 1.861, which represents a potential loss of 0.50%. The profit target (TP) is set at 1.913, aiming for a consistent uptrend.

Technical Analysis

The EURNZD is going through a consolidation phase, offering a breakout opportunity to the upside. Technical indicators such as the MACD and the RSI indicate a growing bullish momentum. Furthermore, the price is positioning itself above the key moving averages, a sign of strength that supports my buy strategy.

Fundamental Analysis

On a fundamental level, the euro is benefiting from an improved economic environment in the Eurozone, along with a relatively stable monetary policy from the ECB. Conversely, the New Zealand dollar could be negatively affected by the recent volatility in the commodity markets, given the New Zealand economy's link to this sector.

Trading Strategy

Entry: 1.87460

Stop Loss: 1.861 (-0.50%)

Take Profit: 1.913

This setup offers a favorable risk/reward ratio and aligns with the current technical and fundamental environment. I recommend closely monitoring any changes in fundamentals or key technical levels that could impact the trade.

EURNZD trade ideas

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD ANALYSIS elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD Wave Analysis – 17 March 2025

- EURNZD reversed from long-term resistance level 1.9160

- Likely to fall to support level 1.8640

EURNZD currency pair recently reversed down from the long-term resistance level 1.9160, which stopped the sharp weekly uptrend at the start of 2020, as can be seen below.

The downward reversal from the resistance level 1.9160 created the weekly Japanese candlesticks reversal pattern Shooting Star.

Given the strength of the resistance level 1.9160 and the bearish divergence on the weekly Stochastic indicator, EURNZD currency pair can be expected to fall to the next support level 1.8640.

EURNZD sell set up- Bears taking control?We’re seeing selling pressure build up on EURNZD as price struggles to hold above resistance. A break below 1.8990 could open the doors for further downside.

🔍 Why I’m Watching This Trade:

✅ Price rejecting key resistance, signaling exhaustion

✅ Bearish structure forming, aligning with moving averages

✅ Potential liquidity grab before continuation lower

🔹 First Target: 1.8910

🔹 Final Target: 1.8805

If price confirms a breakdown, we could see sellers step in aggressively. Keeping an eye on momentum before entering!

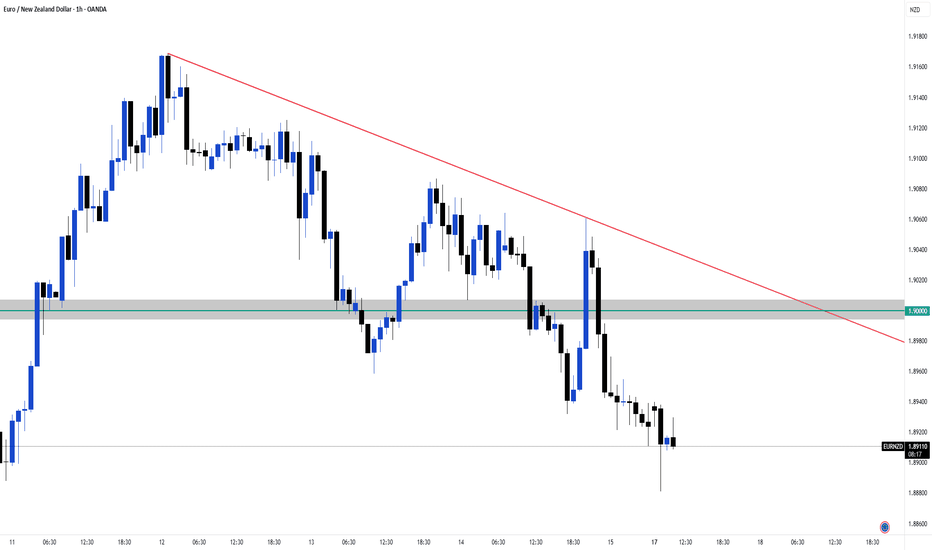

EUR/NZD 1HR // 17 March 2025 AnalysisEUR/NZD has been in an uptrend for quite a while now and we can see a small downtrend form on the 1HR timeframe.

Waiting to see how price reacts to the trendline and the support/resistance zone drawn around the 1.9000 psychological price area.

Looking for potential sells if we get a good rejection from the area as well as the trend line and could look for potential long term swing targets.

DISCLAIMER: This analysis is purely for personal reference and record keeping and should be taken as educational material only, NOT FINANCIAL ADVISE. I will not be responsible for profits or loses due to this analysis.

EUR-NZD Risky Long! Buy!

Hello,Traders!

EUR-NZD is approaching a

Horizontal support level

Of 1.8868 so after the

Retest of the support

A long trade with the

Target Level of 1.8947

And Stop Loss of 1.8851

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_NZD LONG SIGNAL|

✅EUR_NZD is going down now

But a strong support level is ahead at 1.8902

So after the retest on Monday we can

Enter a long trade with the target of 189640

And a Stop Loss of 1.8866

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/NZD WeeklyThe bullish weekly trend for EUR/NZD continues but have the buyers run out of steam for now?

Examining the weekly price action. we see that after 2 weeks of strong buying, the last week ended in a Shooting Star candle (also known as a pin candle).

This may be a sign that buying pressure has decreased and a natural pullback/correction is now in play.

Watch for changes in cycle/sentiment changes on the smaller time frames.

This may lead to sell setups if they meet your strategy rules.

EURNZD What Next? BUY!

My dear subscribers,

My technical analysis for EURNZD is below:

The price is coiling around a solid key level - 1.8988

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.9024

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

EUR/NZD "Euro vs Kiwi" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/NZD "Euro vs Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 1.84000 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.80400 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

EUR/NZD "Euro vs Kiwi" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

🔱 Fundamental Analysis

New Zealand Trade Balance: July trade balance: -NZ$963M monthly, -NZ$9,290M annualized.

Chinese Loan Prime Rates: August 1-Year Loan Prime Rate: 3.35%, 5-Year Loan Prime Rate: 3.85%.

German PPI: July PPI: +0.2% monthly, -0.8% annualized.

🔱 Macroeconomic Trends

Current Macroeconomic Trends

- GDP Growth Rate: Eurozone's GDP growth rate is expected to slow down in the coming months, while New Zealand's economy is anticipated to remain stable.

- Inflation Rate: Eurozone's inflation rate is currently at 1.0% annualized, while New Zealand's inflation rate is at 1.5% annualized.

- Unemployment Rate: Eurozone's unemployment rate stands at 7.5%, whereas New Zealand's unemployment rate is at 3.9%.

- Interest Rates: European Central Bank's (ECB) main refinancing rate is 0.0%, and Reserve Bank of New Zealand's (RBNZ) official cash rate is 1.5%.

Upcoming Macroeconomic Events

- Federal Reserve Rate Decision: The upcoming Federal Reserve rate decision may impact EUR/NZD.

- European Central Bank Rate Decision: ECB's rate decision will also influence the pair.

- New Zealand GDP Growth Rate: Q3 GDP growth rate announcement may affect NZD.

🔱 COT Report

The latest COT report shows that speculative traders are net short on the EUR/NZD pair, indicating a bearish sentiment

🔱 Technical Analysis

Trend Lines: Descending Tenkan-sen, ascending Kijun-sen.

Chart Patterns: Bearish harmonic pattern.

Moving Averages:

50-Day SMA: 1.7945

100-Day SMA: 1.8051

200-Day SMA: 1.8335

Relative Strength Index (RSI): 42.12 (neutral).

Bollinger Bands: Upper: 1.8232, Lower: 1.7632.

MACD: Bearish crossover.

Stochastic Oscillator: Oversold region.

Fibonacci Levels: 23.6% retracement at 1.8115.

🔱 Positioning Data

Institutional Traders: 55% long, 45% short.

Retail Traders: 70% short, 30% long.

Market Sentiment: Bearish (60%).

🔱 Market Outlook

- Market Sentiment: Bearish

- Institutional Traders: 42% bullish, 30% bearish, 28% neutral

- Banks: 40% bullish, 32% bearish, 28% neutral

- Hedge Funds: 45% bullish, 27% bearish, 28% neutral

- Corporate Traders: 38% bullish, 35% bearish, 27% neutral

- Retail Traders: 48% bearish, 25% bullish, 27% neutral

🔱 Overall Outlook

The overall outlook for the EUR/NZD pair is bearish. The pair has broken out of a triangle pattern, and speculative traders are net short. Institutional traders are positioning themselves for a potential drop, and retail traders are also bearish.

EUR/NZD "Euro vs Kiwi" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/NZD "Euro vs Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 1.83500 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.80000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The EUR/NZD "Euro vs Kiwi" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

⭐Fundamental Analysis

Economic Indicators: Eurozone's GDP growth rate expected to slow down to 1.2% in 2025

Monetary Policy: European Central Bank (ECB) expected to maintain dovish stance

Trade Balance: Eurozone's trade balance expected to remain in surplus

Inflation Rate: Eurozone's inflation rate expected to rise to 2.0% in 2025

⭐Macro Economics

Global Economic Trends: Ongoing global economic recovery expected to drive up demand for commodities

Commodity Prices: Commodity prices expected to rise by 5% in 2025

Interest Rates: Central banks expected to maintain low interest rates in 2025

Currency Flows: Currency flows expected to remain stable, with no significant changes in currency exchange rates

⭐Intermarket Analysis

Correlation Analysis: EUR/NZD pair positively correlated with EUR/USD pair

Commodity Analysis: EUR/NZD pair negatively correlated with gold

Equity Analysis: EUR/NZD pair positively correlated with Euro Stoxx 50 index

⭐COT Data

Non-Commercial Traders (Institutional):

Net Short Positions: 45%

Open Interest: 120,000 contracts

Commercial Traders (Companies):

Net Long Positions: 35%

Open Interest: 60,000 contracts

Non-Reportable Traders (Small Traders):

Net Short Positions: 20%

Open Interest: 30,000 contracts

⭐Technical Analysis

Trend: Bearish trend

Support Zone: 1.80000 - 1.81000

Resistance Zone: 1.84000

RSI(7): 24.55, indicating oversold conditions

STOCH(5,3,3): 20.56, indicating a potential reversal

⭐Sentimental Analysis

Institutional Sentiment: 45% bullish, 55% bearish

Retail Sentiment: 50% bullish, 50% bearish

Market Mood: Bearish, with a sentiment score of -0.5

⭐Market News and Events

Economic Indicators: Monitor economic indicators, such as GDP growth rates and inflation rates, to gauge the overall health of the economy.

Central Bank Decisions: Keep an eye on central bank decisions, such as interest rate changes, to anticipate potential market movements.

Geopolitical Events: Monitor geopolitical events, such as trade tensions and elections, to identify potential market risks.

⭐Next Move Prediction

Based on the analysis, the next move prediction is:

Short-term (1-3 days): Bearish, targeting 1.80000

Medium-term (1-2 weeks): Neutral, with a potential reversal to 1.84000

Long-term (1-3 months): Bearish, targeting 1.75000

⭐Positioning

Risk-Reward Ratio: Aim for a risk-reward ratio of 1:3 or higher

Position Sizing: Optimal position size is 2% of the trading account, based on a risk-reward ratio of 1:2

Stop-Loss: Set a stop-loss above 1.8350 for bearish trades

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURNZD Long From SupportHello Traders

In This Chart EURNZD 4 HOURLY Forex Forecast By FOREX PLANET

today EURNZD analysis 👆

🟢This Chart includes EURNZD market update)

🟢What is The Next Opportunity on EURNZD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURNZD: Bullish Trend Resumes After PullbackEURNZD is currently moving within a rising, expanding channel and has recently posted a new higher high on the 4-hour timeframe, breaking through a key horizontal resistance level.

This breakout suggests a potential continuation of the bullish trend, targeting the 1.920 resistance area.

An ideal entry would be within the demand zone aligned with the broken structure and supported by the ascending channel’s trendline.