EURNZD trade ideas

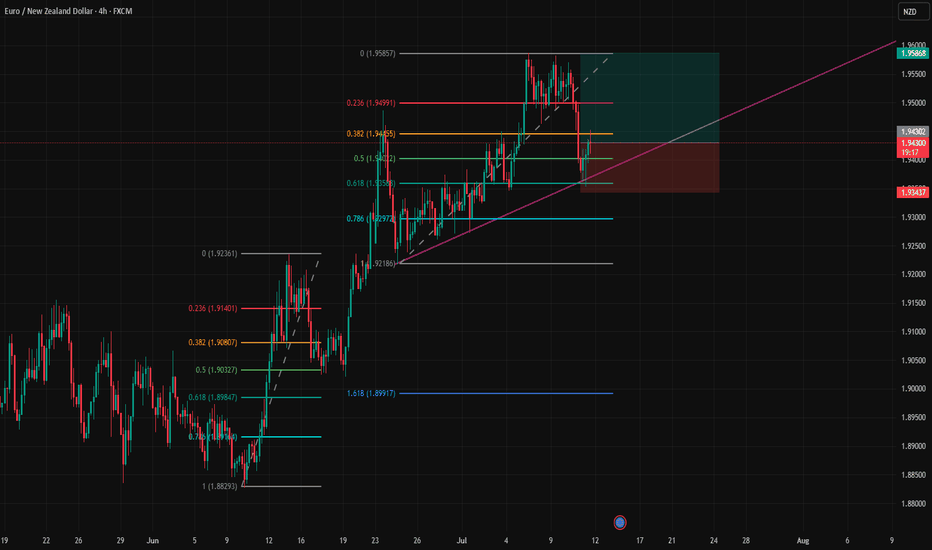

EURNZD Wave Analysis – 18 July 2025

- EURNZD reversed from the resistance area

- Likely to fall to support level 1.9400

EURNZD currency pair recently reversed down from the resistance area between the major long-term resistance level 1.9655 (which has been reversing the price from the start of 2020) and the upper weekly Bollinger Band.

The downward reversal from this resistance area stopped the previous medium-term impulse wave (5).

Given the strength of the resistance level 1.9655, EURNZD currency pair can be expected to fall to the next support level 1.9400.

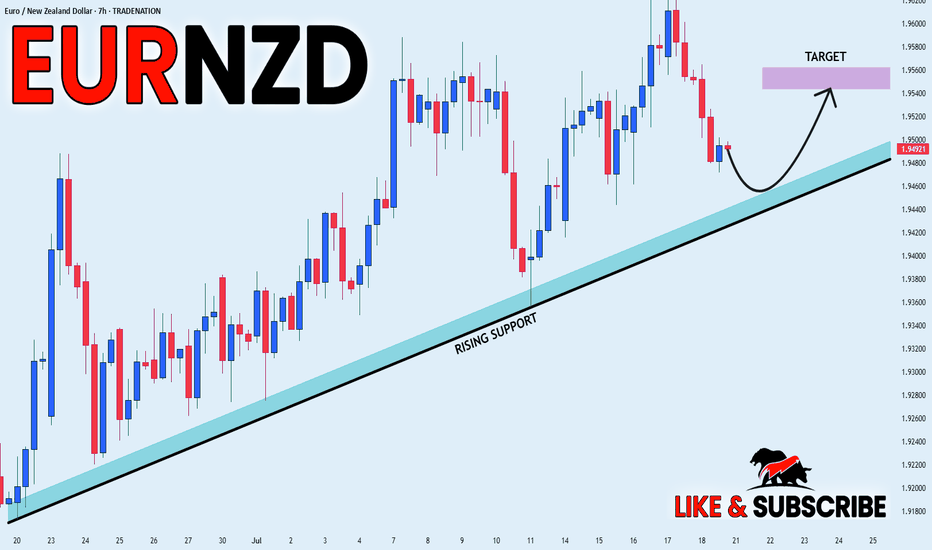

EUR_NZD LONG FROM RISING SUPPORT|

✅EUR_NZD is trading in an uptrend

Along the rising support line

Which makes me bullish biased

And the pair is about to retest the rising support

Thus, a rebound and a move up is expected

With the target of retesting the level above at 1.9544

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

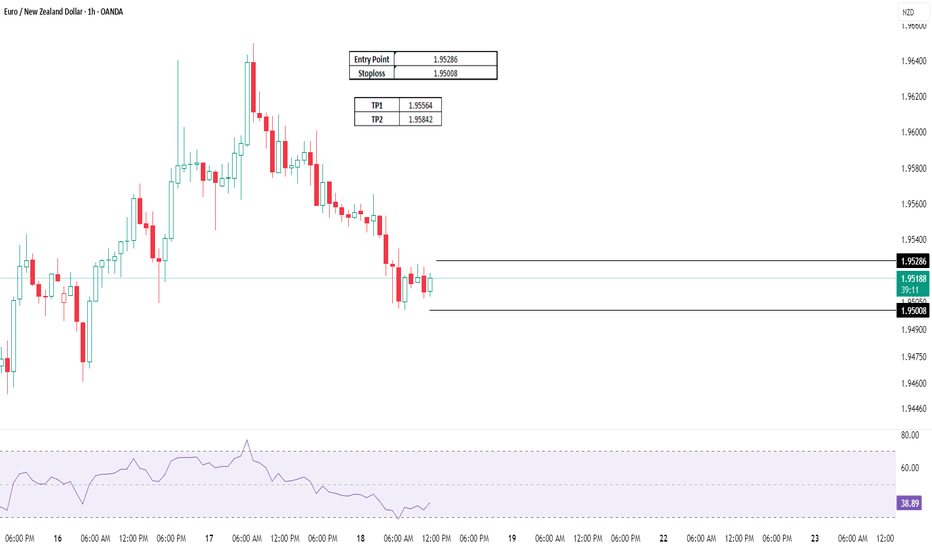

EURNZD On The Rise! BUY!

My dear friends,

EURNZD looks like it will make a good move, and here are the details:

The market is trading on 1.9481 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.9535

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

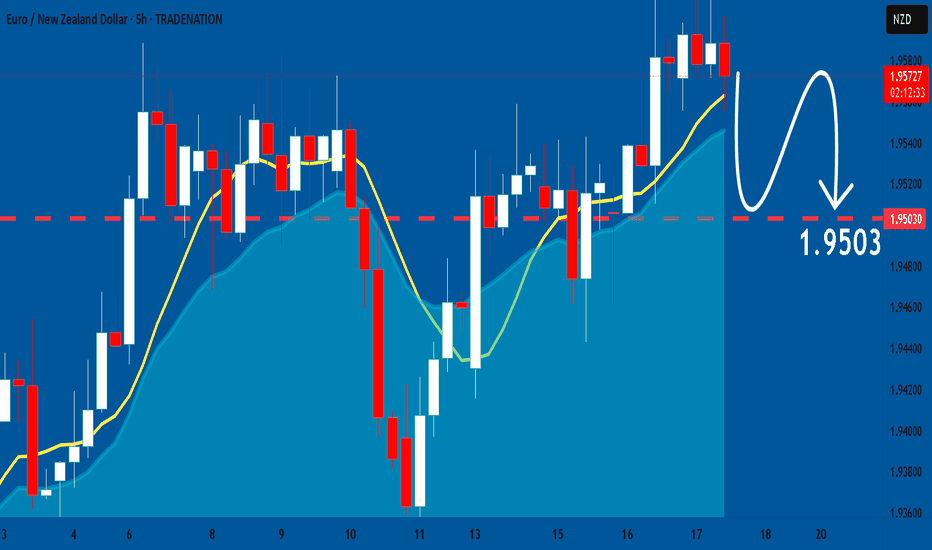

EURNZD: Bearish Forecast & Bearish Scenario

The analysis of the EURNZD chart clearly shows us that the pair is finally about to tank due to the rising pressure from the sellers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EUR NZD SHORT RESULT Price reached the resistance zone and rejected at first and I was impatient to wait for a second confirmation before entering the short trade which was a big error and price continued to the upside, because price was in an overall bullish trend.

Better TA and more patient setups to come. _THE_KLASSIC_TRADER_.

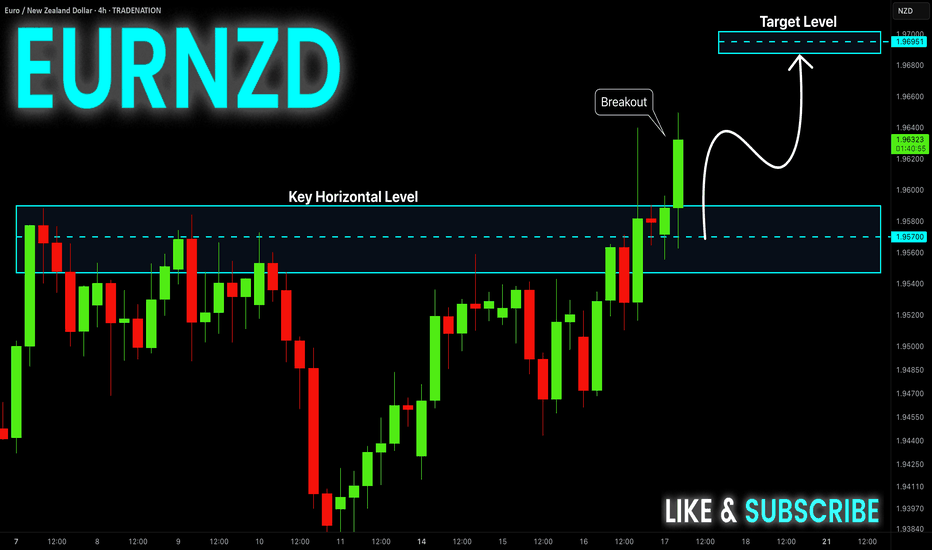

EUR-NZD Will Keep Growing! Buy!

Hello,Traders!

EUR-NZD is trading in a

Strong uptrend and the

Pair made a bullish breakout

Of the key horizontal level

Of 1.9580 so we are bullish

Biased and we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

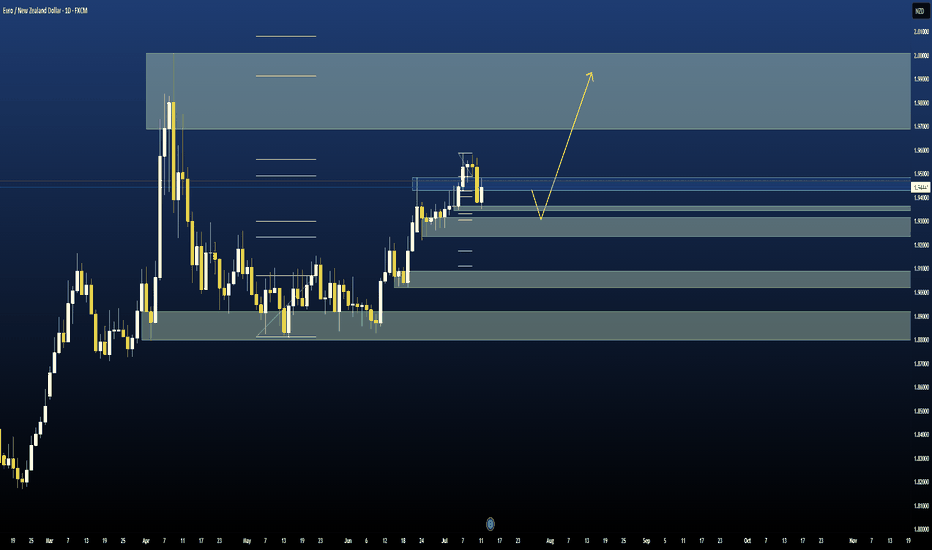

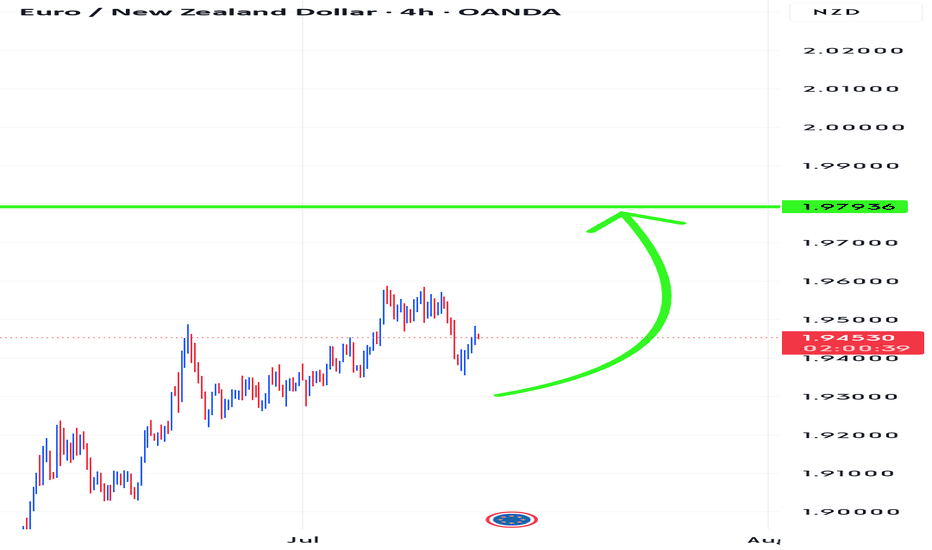

EURNZD: Bullish Setup Targeting Engineered Highs!Greetings Traders,

In today’s analysis of EURNZD, we observe that the market is currently operating within bullish institutional order flow. It is therefore essential that we align our bias with this narrative by focusing on buying opportunities.

Market Context:

Higher Timeframe Alignment:

The weekly timeframe is showing a bullish draw on liquidity, and this is confirmed by the H4 (intermediate) timeframe, which is also structurally bullish. This alignment between higher and intermediate timeframes provides strong confluence for long positions.

Mitigation Block Support:

Price has recently retraced into an H4 Mitigation Block—a key institutional support zone. This area represents a region where previous sell-side activity was initiated. Now that price has broken above it, institutions are likely using this retracement to mitigate prior sell positions and establish new buy orders.

Trade Idea:

Entry Strategy:

Look for confirmation on the lower timeframes within the H4 mitigation block to initiate long positions in alignment with institutional order flow.

Target Objective:

The primary target is the relatively equal highs residing in premium pricing. These levels coincide with engineered trendline liquidity and failure swings, making them highly attractive profit-taking zones for institutions—where significant buy-side liquidity is expected to be absorbed.

Stay patient and execute only upon clear confirmation signals.

Kind Regards,

The Architect 🏛️📊

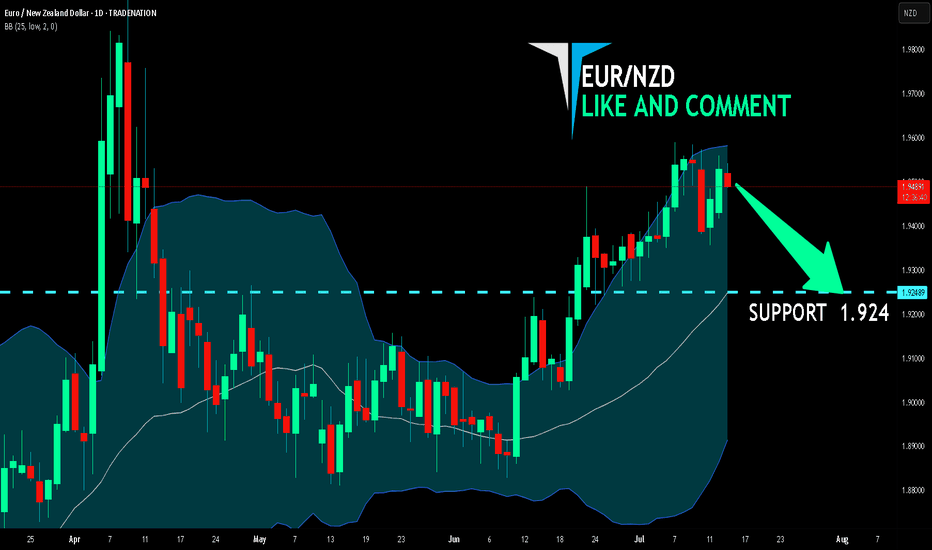

EUR/NZD BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

EUR/NZD pair is in the uptrend because previous week’s candle is green, while the price is evidently rising on the 1D timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 1.924 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

#EURNZD: Wait For Price Breakthrough,Swing Buy With ConfirmationEURNZD is trading at a critical level where the price has previously rejected multiple times. If the price breaks through this region, we could see a swing move and touch the previous higher high. The main question is to wait for a proper breakthrough. When the price does that, we can enter with confirmation. Remember, patience is key!

Good luck and trade safely. Do your own due diligence.

Team Setupsfx_

#EURNZD: Price Is Almost At The Buying Area! The EURNZD approaching buying zone will determine the future trend of the pair. We recommend waiting for the price to reach this area for strong confirmation. Using a smaller timeframe can provide a secondary perspective.

Good luck and trade safely!

Team Setupsfx_

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

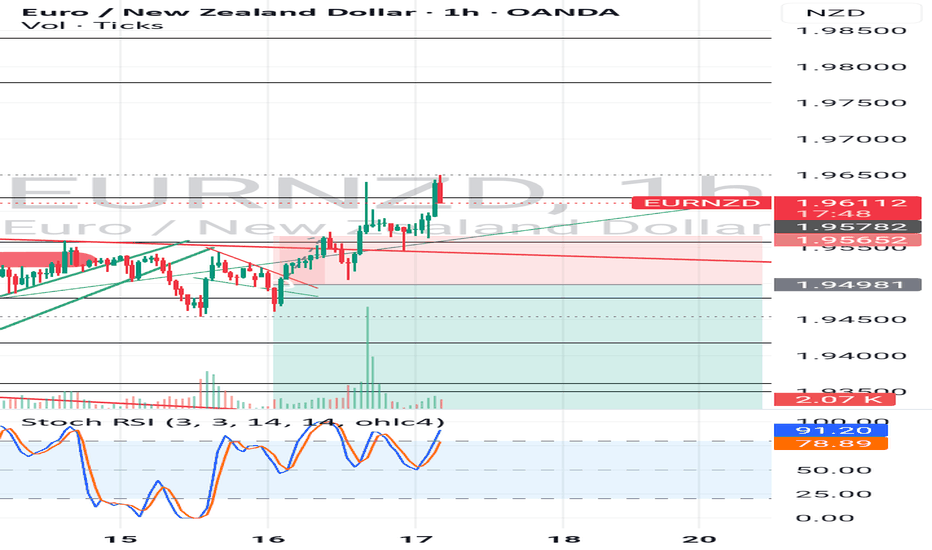

EURNZD Short Swing TradeOANDA:EURNZD Short trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

EUR-NZD Will Fall! Sell!

Hello,Traders!

EUR-NZD made a retest

Of the horizontal resistance

Of 1.9480 from where we

Will be expecting a local

Pullback and a move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_NZD RESISTANCE AHEAD|SHORT|

✅EUR_NZD has been growing recently

And the pair seems locally overbought

So as the pair is approaching a horizontal resistance of 1.9500

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bullish reevrsal?EUR/NZD has bounced off the pivot and could rise to the 61.8% Fibonacci resistance.

Pivot: 1.93667

1st Support: 1.93001

1st Resistance: 1.94871

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURNZD is in the downtrend after breaking TrendlineHello Traders

In This Chart EURNZD 4 HOURLY Forex Forecast By FOREX PLANET

today EURNZD analysis 👆

🟢This Chart includes EURNZD market update)

🟢What is The Next Opportunity on EURNZD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURNZD – Bearish Reversal Expected from Channel Top ResistanceEURNZD has reached the upper boundary of a well-defined ascending channel on the 2H chart and printed a rejection wick, suggesting exhaustion and potential for a pullback. The pair is likely to retrace toward the channel midline or base, with downside targets near 1.9423 and 1.9264, assuming confirmation follows.

🧠 Fundamentals:

EUR Drivers:

ECB remains cautious with weak Eurozone inflation and rising recession risks.

Recent German and Eurozone data (retail sales, factory orders) disappointed.

Political instability in France and ECB’s dovish tone are capping upside momentum in the euro.

NZD Drivers:

RBNZ remains one of the more hawkish central banks, reiterating restrictive stance despite slowing inflation.

Dairy auctions improved recently, adding strength to NZD fundamentals.

China exposure is a double-edged sword — optimism helps, but slowdown risk remains.

🔍 Technical Structure:

Clear ascending channel from mid-June remains intact.

Price rejected perfectly at the upper trendline near 1.9585.

Strong bearish divergence may form if rejection persists.

Bearish scenario targets the 1.9423 zone first (support + midline), then 1.9264 (bottom of channel).

Invalid if price breaks and closes above 1.9600 on strong volume.

⚠️ Risk Factors:

A sudden euro bid from safe-haven demand or ECB surprise could break the channel.

NZD weakness could emerge if China disappoints or RBNZ shifts tone unexpectedly.

🔁 Leader/Lagger Dynamics:

EURNZD often lags risk-sensitive NZD pairs (like NZDJPY, NZDCAD), especially during Asia session moves. However, during European hours, EUR’s tone can dominate due to ECB speeches or EU data.

✅ Trade Bias: Bearish

TP1: 1.9423

TP2: 1.9264

SL: Above 1.9600

Event to Watch:

ECB speakers this week

China CPI/PPI (affects NZD)

US CPI (indirect cross-pressure on both currencies)

📌 Look for bearish confirmation on the 2H/4H candle close below 1.9540. Risk-reward favors a tactical short if the channel structure holds.