CAC40 Pivotal trading zone at 7730The CAC remains in a neutral trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 7520 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 7520 would confirm ongoing ups

Related indices

CAC40 Bullish breakout retestThe CAC 40 index continues to display a bullish bias, underpinned by a well-established rising trend. Recent intraday price action indicates a breakout from consolidation, suggesting renewed upward momentum.

Key Technical Levels:

Support:

7770 – This level marks the prior consolidation zone and n

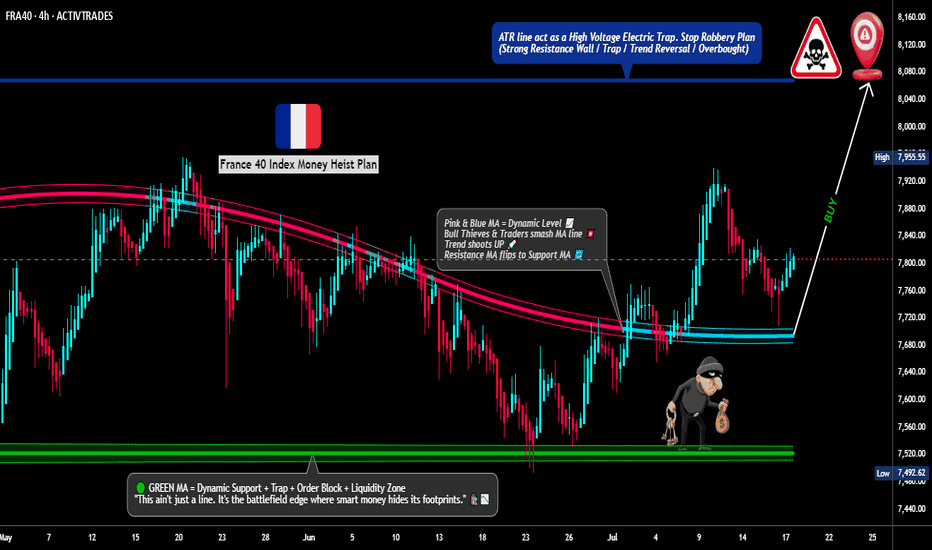

"FRA40/CAC40 HEIST! Bullish Loot Before Bear Trap – Act Fast!"💰 FRA40/CAC40 "FRANCE40" INDEX HEIST – THIEF TRADING STYLE MASTER PLAN 🏴☠️🚀

🔥 Steal the Market Like a Pro – Bullish Loot & Escape Before the Trap! 🔥

🤑 GREETINGS, FELLOW MONEY MAKERS & MARKET ROBBERS!

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

This is your VIP invite to the ultimate FRA40/CAC40 he

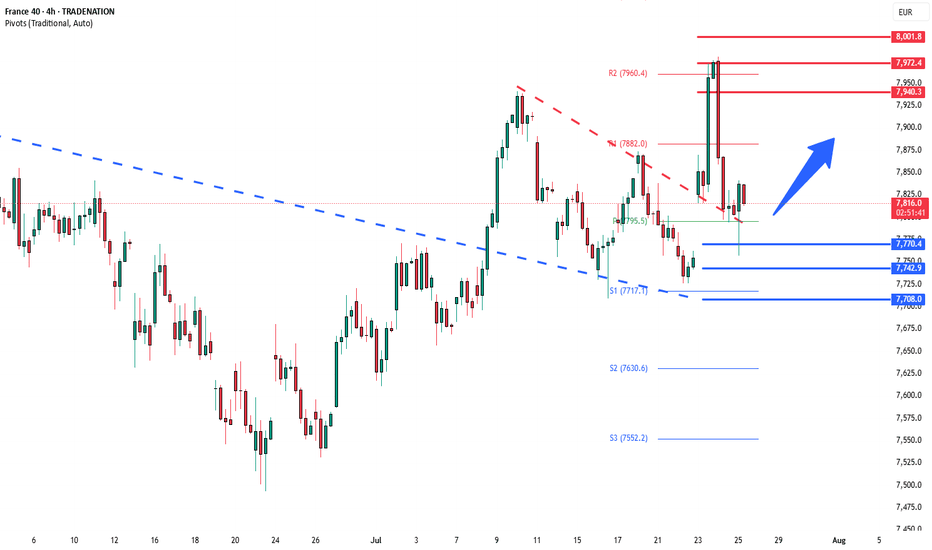

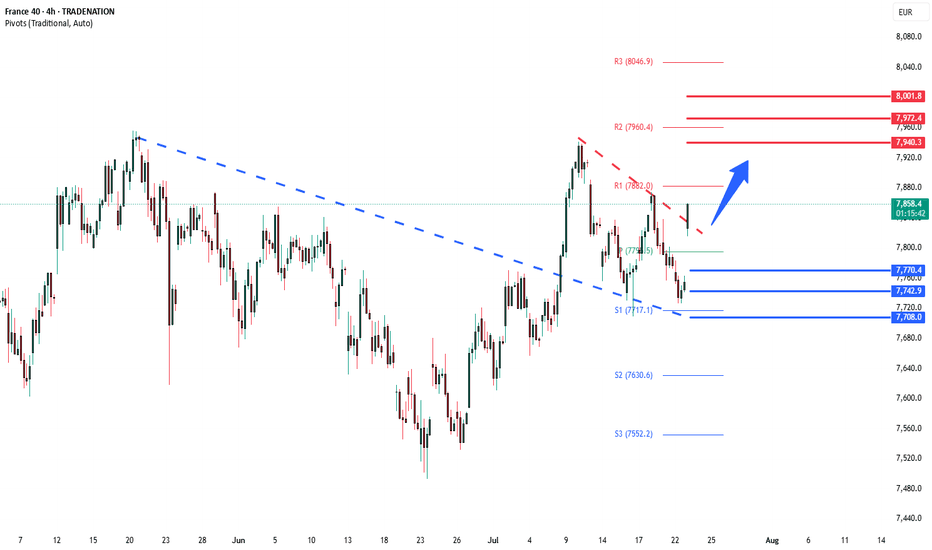

CAC breakout retest support at 7770The CAC 40 index continues to display a bullish bias, underpinned by a well-established rising trend. Recent intraday price action indicates a breakout from consolidation, suggesting renewed upward momentum.

Key Technical Levels:

Support:

7770 – This level marks the prior consolidation zone and n

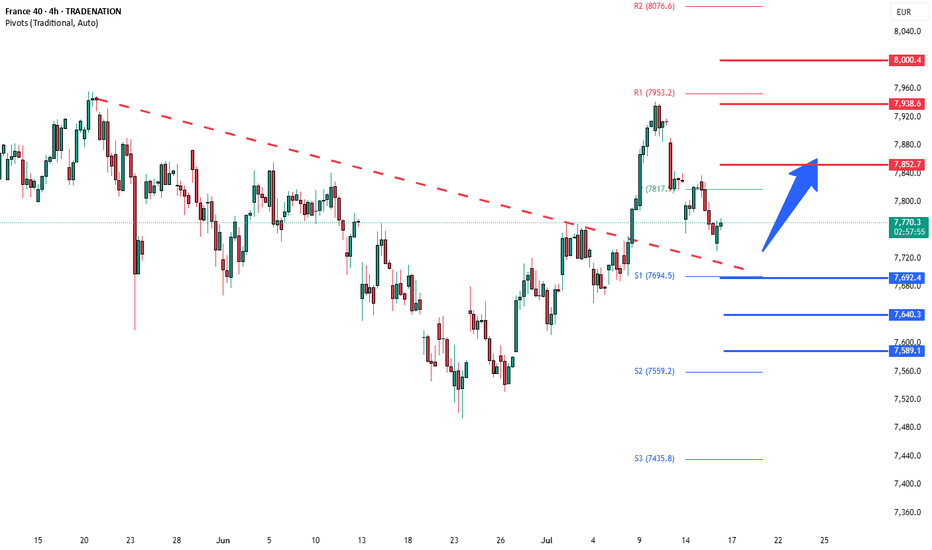

CAC40 Bullish consolidation breakout The CAC40 price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a consolidation breakout.

The key trading level is at the 7770 level, the previous consolidation price range. A corrective pullback from current levels and a bulli

CAC40 Bullish breakout retest support at 7770The CAC40 price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a consolidation breakout.

The key trading level is at the 7770 level, the previous consolidation price range. A corrective pullback from current levels and a bul

CAC40 Bullish breakout retest support at 7690The CAC40 remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 7960 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 7690 would confirm ongoing up

FRANCE 40 Heist in Progress | Bullish Reversal Zone Spotted.💼 CAC40 Market Heist: Thief Trading Blueprint for Smart Traders (Swing/Day Trade Edition) 💼

🌍 Bonjour, Hola, Hallo, Marhaba, Ola, Hello! 🌍

Welcome to all Market Hustlers, Silent Snipers, and Profit Seekers! 🤑💸🎯

We're back with a precision-built Thief Trading Plan — this time targeting the FRANCE40

France 40 is priming up for strong upside to 8,673France is definitely setting itself for upside to come.

We have positive data from the love country including:

📈 Oversold Conditions

The CAC 40 was heavily sold off — now it’s ripe for a bounce.

🏦 ECB Rate Cuts

Lower interest rates fuel investor appetite for European equities.

💼 Strong Cor

CAC40 Bullish breakout supported at 7560Key Support and Resistance Levels

Resistance Level 1: 7850

Resistance Level 2: 7930

Resistance Level 3: 7995

Support Level 1: 7560

Support Level 2: 7490

Support Level 3: 7410

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a p

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of CAC 40 Index is 7,743.00 EUR — it has risen by 0.44% in the past 24 hours. Track the index more closely on the CAC 40 Index chart.

CAC 40 Index reached its highest quote on May 10, 2024 — 8,259.19 EUR. See more data on the CAC 40 Index chart.

The lowest ever quote of CAC 40 Index is 893.82 EUR. It was reached on Jan 29, 1988. See more data on the CAC 40 Index chart.

CAC 40 Index value has increased by 0.87% in the past week, since last month it has shown a −0.72% decrease, and over the year it's increased by 7.20%. Keep track of all changes on the CAC 40 Index chart.

The top companies of CAC 40 Index are EURONEXT:MC, EURONEXT:RMS, and EURONEXT:OR — they can boast market cap of 268.82 B EUR, 258.03 B EUR, and 238.30 B EUR accordingly.

The highest-priced instruments on CAC 40 Index are EURONEXT:RMS, EURONEXT:MC, and EURONEXT:OR — they'll cost you 2,114.00 EUR, 461.35 EUR, and 384.35 EUR accordingly.

The champion of CAC 40 Index is EURONEXT:GLE — it's gained 182.92% over the year.

The weakest component of CAC 40 Index is EURONEXT:STLAP — it's lost −42.70% over the year.

CAC 40 Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy CAC 40 Index futures or funds or invest in its components.

The CAC 40 Index is comprised of 39 instruments including EURONEXT:MC, EURONEXT:RMS, EURONEXT:OR and others. See the full list of CAC 40 Index components to find more opportunities.