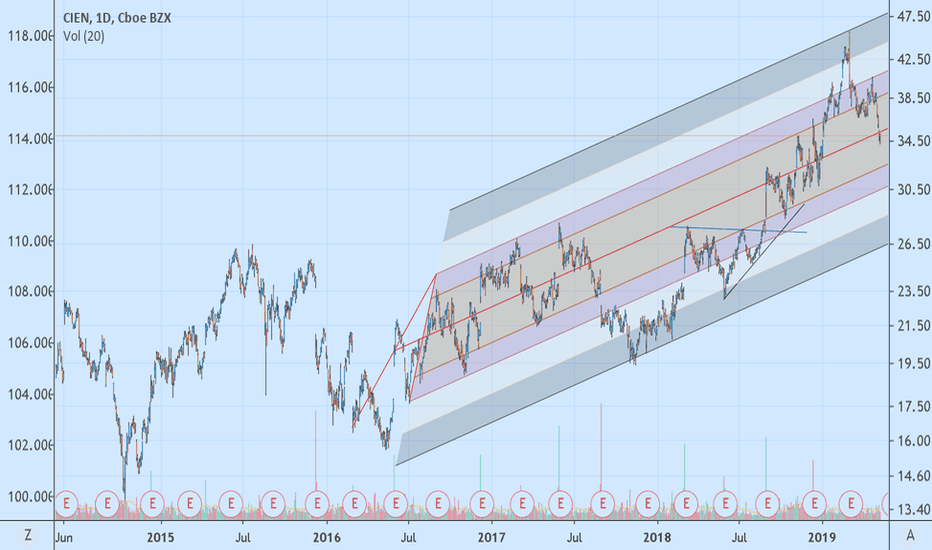

Cien — busting after after closing gapTesting a previous low— cien recently busting out with nice volume purchase as it shot upwards— now some room to grow within the channel is still visible. Will it continue up? I think so... for now. It has a 17% upside to go to the $50 average target rating it received. Strong buy rating —Given from 11 analysts. (It has seen a rocky past... so be careful as it can fall quickly on neg news if any).

4CIEN trade ideas

Ciena. Low latency ahead but..........In life there is always a but and although Ciena is a downtrending stock on the lower timeframe, the weekly larger timeframe suggest otherwise. First, the uptrend line is still intact and the demand zone level confluence with the 88.6% Fib retracement level of the immediate range. Therefore have patient and wait for the market to unfold itself =)

CIEN - a telco playSee chart for explanation

As you have seen, it did not touch the support at 32.79 and this gap down between 35.07 and 35.92 and end with a bullish hammer candle could signify a possible trend reversal.

If the gap is closed next week, then it confirms a trend reversal else it might goes further south.

Let's see how it plays out next week.

CIEN Earnings Next WeekThey beat last quarter and got hammered because they said margins were going down slightly this quarter. What's 1% margin on an expanding company with 25 trailing P/E?

Expecting CIEN to beat again, using this market tank to start a position, next week's calls.

If the market continues to tank, there is a chance it goes to $33 support. Leave some room to add.

Nearing the shoulder line --- CROSS OVER waiting to happen!THERE IS A SHOULDER LINE TO CROSS UP OVER SEE HERE !!!! may happen very soon --- if it does it will stay bullish I believe for a decent ride. My thoughts on it...anyway. It has been riding a channel for the past few trades this week. UPWARD. There is a fair bit of upside potential here on a larger DAILY chart.

Mid-day follows pattern.... NEEDS to climb above shoulder soon.Channel is being followed by the stock... What we are waiting to see if it will continue above the shoulder at approx. 38.00 - 38.08 for further confirmation of a continued uptrend. There may be resistance and stop rising. May need a couple of days to get there to break through that zone. Possibly. ==== So far nice profits.. to take off, as it predicts staying in the channel. Moving Up and down ---- Buy it back on the lows. You buy and sell accordingly - day trade.

a positive chart looking to move upward for the near future...A gap was closed on the YTD chart. Lots of downward pressure coming to a close soon perhaps... and showing the potential to possibly change direction. Positive day so far.

Channelling and Parallel lines looking good it appears. Let's see how it progresses and builds...

Ciena Reversal trade setup.Gap fill has been completed and price has bounced perfectly.

Break above 7 & 12 MA would be very bullish.

Possible entry level $38

Golden pocket target $43

Stop loss $36

Average analysts price target $50.21

Average analysts recommendation Overweight

P/E ratio 26

Short interest 3%

Company profile

Ciena Corp. engages in the provision of network and communication infrastructure. It operates through the following segments: Converged Packet Optical; Packet Networking; Optical Transport; and Software and Services. The Converged Packet Optical segment develops and sells optical processors, switching systems, and operating system software. The Packet Networking segment includes service delivery switches, services aggregation switches, and ethernet packet configurations. The Optical Transport segment manufactures and trades optical transport systems, common photonic layer, data networking products, data center interconnection, and virtual networks. The Software and Services segment provides wide are network controller, network functions virtualization platform, and software applications. The company was founded by Patrick H. Nettles in November 1992 and is headquartered in Hanover, MD.

CIEN 1D t.a. and set up 9.16.19CIEN is a long term uptrend pattern. It continues to make higher highs and higher lows throughout & the price currently trades above the 200SMA, signaling a bullish trend may continue.

Based on it's history, the price reacts well with the EMA50, as that moving average is a known major support/resistance level. However, price action has "broken below" and "closed below" the EMA50 line during the current pullback.

Also, the RSI(14) history shows a common oversold level that bottoms out in the low 30's before recovering. RSI(14) was just at this level, overextended and consolidating in the low 30's during pullback. Now a series a bullish reversal candlesticks have formed following the oversold RSI levels, signaling a potential price reversal back into an uptrend.

A potential buy signal would be to go LONG when the price "breaks above" and "closes above" both the EMA10 and the EMA50 levels.

Stay LONG with the price action on the upside of the EMA10

Hold LONG position until RSI becomes overbought near the 70 level on the daily chart.

Stop loss= if price breaks back below and closes below the EMA50 &EMA10 @ -3%

Target Exit set at known previous resistance near 45.26 level @ +9%

3:1 Risk/reward optimal

CIEN Trend Analysis with Modified Pitch ForkAlthough the short term signal is SHORT, look for a reversal to LONG around $31.

When using Modified Pitchforks, it's important that the projected lines provide multi-sigma coverage of the linear regression slope. In the case of CIEN, a Modified Pitchfork from the 2017 lows provides almost perfect symmetry and gives the trader several levels to trade Ciena. It's important to note CIEN had been in a flat range since 2002, however, it's a very wide range from $10 to $40, with two outliers that extend the range to $50 (1/03-1/04) on the high-end of the range and $5 on the low-end of the range (11/08-02/09).

Once a leader in networking hardware, Ciena lost tremendous market share to Motorola Solutions (MSI) , Arista ANET and Cisco CSCO by not recognizing the importance of 4G early enough. That mistake led them to invest heavily in 5G and the company is benefiting from this as it emerges as a potential leader in the crucial migration to 5G. With US sanctions pressuring their lead international competitor, Huwei, Ciena is poised for a massive repricing of its market cap, which at $5.5B ranks it amongst the smallest amongst its peer group: MSI: $25B, ANET: $20B, CSCO: $232B. CIEN's market cap is roughly equal to Lumentum LITE ($4.9B) but the latter trades at a PE of 130 compared to CIEN's PE of 23. If CIEN was priced at the same earnings multiple as LITE, the stock would be trading around $200/sh.

For a long position, look for a convergence of technical zones. Looking at a monthly chart, you'll see that the high end of 2010-2018 range is $30. The 50p EMA is crossing above the 100p EMA and the 24p EMA crossed above both slower EMA's last October.

On the weekly scale, the 100p EMA is at $30 with the 200p EMA just below around $27.

On the daily scale, a Fibonacci fan of the May 2018 to March 2019 move projects the 3rd fan line around $32, with prices presently hugging the 2nd fan line at $35, which also coincides with the 200p EMA. RSI is close to penetrating the lower band, confirming the stock is getting oversold, but there is still downside left before CIEN finds a floor. When it does, load the boat.

I also use a proprietary short term price predictor overlaid against a linear regression slope. When the predicted price forecast moves above the linear regression slope, it's generally a good time to step in. To create a similar 'indicator', you can use a Time Series Forecast (similar to a MA) with a periodicity of 9 overlaid against a Linear Regression Indicator with a periodicity of 18. When the TSF crosses above or below the LRI, it's a powerful buy/sell signal, but use the slope itself as a filter to avoid chop in sideways markets and this technique will help you capture very large moves. As of this writing, this method is in a sell signal with the linear regression slope pointing down. Look for when the slope levels off, and the TSF crosses above/below the LRI, as happened in early February just before the move from $38 to $46 for a buy signal, and in late February for a sell signal as the slope leveled off and the crossover occurred near $45 for a short trade that remains open. Using the linear regression slope as a filter for the TSF/LRI crossover would have avoided the chop from March to late April, and then the current short trade would have been validated at the end of April at $40.