Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.74 EUR

1.52 B EUR

9.76 B EUR

241.58 M

About Global Payments Inc.

Sector

CEO

Cameron M. Bready

Website

Headquarters

Atlanta

Founded

1967

FIGI

BBG00NW9CCD0

Global Payments, Inc. engages in the provision of payment technology and software solutions. It operates through the Merchant Solutions and Issuer Solutions segments. The Merchant Solutions segment offers payments technology and software solutions globally to primarily small- and-medium sized businesses and select mid-market and enterprise customers. The Issuer Solutions segment is involved in comprehensive commerce solutions supporting the payment ecosystem for issuers. The company was founded by George W. Thorpe in 1967 and is headquartered in Atlanta, GA.

Related stocks

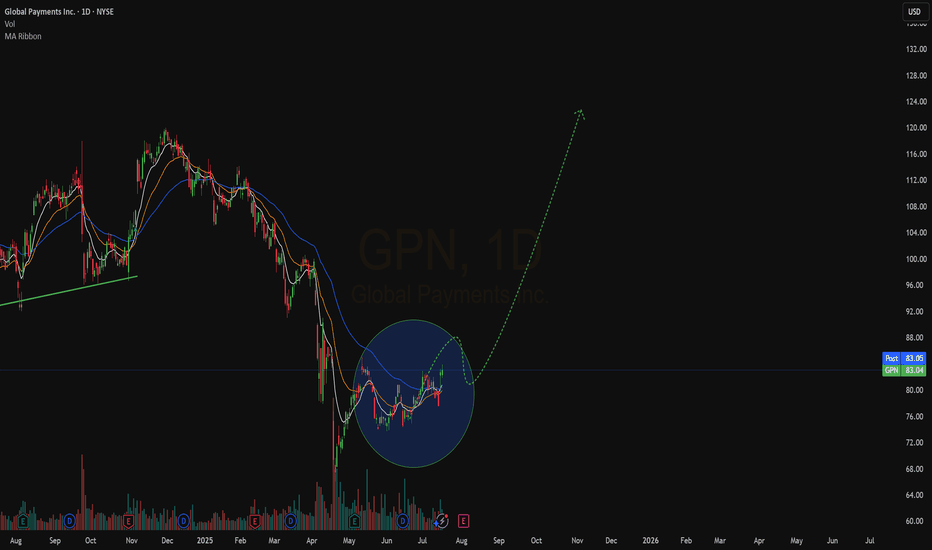

Global Payments Inc. Hits 52-Week Low Amid Analysts DowngradeGlobal Payments Inc. (NYSE:GPN) dropped to a new 52-week low of $66.90 on Monday after Wells Fargo slashed its price target from $105.00 to $77.00. The firm issued an "equal weight" rating. Shares last traded at $67.22, down from the prior close of $69.46, with over 1.25 million shares changing hand

Global Payments | GPN | Long at $110.67Global Payments NYSE:GPN

Pros:

4.6 million companies use the payment service, operate in over 100 countries, and execute over 50 billion transactions per year

Has aggressively repurchased shares and plans to return $7.5 billion to shareholders over the next three years

Revenue rise fr

Wave of the day: $GPN5 good reasons for NYSE:GPN

1. Break out from the corrective channel

2. Rising MACD histogram

3. Buying Volume coming in

4. Pocket Pivot on the last day

5. Analysts have set a mean price target forecast of 160.17. This target is 20.33% above the current price.

What's your take on Global Paym

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US37940XAC6

GLOBAL PAYM. 19/49Yield to maturity

7.56%

Maturity date

Aug 15, 2049

GPN5459742

Global Payments Inc. 5.95% 15-AUG-2052Yield to maturity

6.46%

Maturity date

Aug 15, 2052

GPN5303816

Global Payments Inc. 2.9% 15-NOV-2031Yield to maturity

5.41%

Maturity date

Nov 15, 2031

US37940XAQ5

GLOBAL PAYM. 22/32Yield to maturity

5.19%

Maturity date

Aug 15, 2032

US37940XAB8

GLOBAL PAYM. 19/29Yield to maturity

5.14%

Maturity date

Aug 15, 2029

US37940XAN2

GLOBAL PAYM. 22/29Yield to maturity

4.90%

Maturity date

Aug 15, 2029

US37940XAD4

GLOBAL PAYM. 20/30Yield to maturity

4.83%

Maturity date

May 15, 2030

TSS4344610

Total System Services LLC 4.8% 01-APR-2026Yield to maturity

4.65%

Maturity date

Apr 1, 2026

US37940XAP7

GLOBAL PAYM. 22/27Yield to maturity

4.62%

Maturity date

Aug 15, 2027

GPN5303815

Global Payments Inc. 2.15% 15-JAN-2027Yield to maturity

4.56%

Maturity date

Jan 15, 2027

TSS4631848

Global Payments Inc. 4.45% 01-JUN-2028Yield to maturity

4.54%

Maturity date

Jun 1, 2028

See all 4GPN bonds

Curated watchlists where 4GPN is featured.

Frequently Asked Questions

The current price of 4GPN is 72.26 EUR — it has increased by 1.86% in the past 24 hours. Watch GLOBAL PAYMENTS stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange GLOBAL PAYMENTS stocks are traded under the ticker 4GPN.

4GPN stock has risen by 3.14% compared to the previous week, the month change is a 8.17% rise, over the last year GLOBAL PAYMENTS has showed a −21.29% decrease.

We've gathered analysts' opinions on GLOBAL PAYMENTS future price: according to them, 4GPN price has a max estimate of 110.67 EUR and a min estimate of 54.48 EUR. Watch 4GPN chart and read a more detailed GLOBAL PAYMENTS stock forecast: see what analysts think of GLOBAL PAYMENTS and suggest that you do with its stocks.

4GPN reached its all-time high on Feb 19, 2020 with the price of 193.98 EUR, and its all-time low was 59.88 EUR and was reached on Apr 22, 2025. View more price dynamics on 4GPN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4GPN stock is 1.83% volatile and has beta coefficient of 1.15. Track GLOBAL PAYMENTS stock price on the chart and check out the list of the most volatile stocks — is GLOBAL PAYMENTS there?

Today GLOBAL PAYMENTS has the market capitalization of 17.81 B, it has increased by 2.37% over the last week.

Yes, you can track GLOBAL PAYMENTS financials in yearly and quarterly reports right on TradingView.

GLOBAL PAYMENTS is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

4GPN earnings for the last quarter are 2.49 EUR per share, whereas the estimation was 2.48 EUR resulting in a 0.22% surprise. The estimated earnings for the next quarter are 2.59 EUR per share. See more details about GLOBAL PAYMENTS earnings.

GLOBAL PAYMENTS revenue for the last quarter amounts to 2.04 B EUR, despite the estimated figure of 2.03 B EUR. In the next quarter, revenue is expected to reach 2.00 B EUR.

4GPN net income for the last quarter is 282.60 M EUR, while the quarter before that showed 547.88 M EUR of net income which accounts for −48.42% change. Track more GLOBAL PAYMENTS financial stats to get the full picture.

Yes, 4GPN dividends are paid quarterly. The last dividend per share was 0.22 EUR. As of today, Dividend Yield (TTM)% is 1.17%. Tracking GLOBAL PAYMENTS dividends might help you take more informed decisions.

GLOBAL PAYMENTS dividend yield was 0.89% in 2024, and payout ratio reached 16.23%. The year before the numbers were 0.79% and 26.54% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 27 K employees. See our rating of the largest employees — is GLOBAL PAYMENTS on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GLOBAL PAYMENTS EBITDA is 3.93 B EUR, and current EBITDA margin is 42.48%. See more stats in GLOBAL PAYMENTS financial statements.

Like other stocks, 4GPN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GLOBAL PAYMENTS stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GLOBAL PAYMENTS technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GLOBAL PAYMENTS stock shows the sell signal. See more of GLOBAL PAYMENTS technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.