4GPN trade ideas

Global Payments Inc. Hits 52-Week Low Amid Analysts DowngradeGlobal Payments Inc. (NYSE:GPN) dropped to a new 52-week low of $66.90 on Monday after Wells Fargo slashed its price target from $105.00 to $77.00. The firm issued an "equal weight" rating. Shares last traded at $67.22, down from the prior close of $69.46, with over 1.25 million shares changing hands.

Several other analysts also revised their targets. Barclays reduced its price from $125.00 to $110.00 and maintained an "overweight" rating. Citigroup cut its target slightly from $138.00 to $135.00 while retaining a “buy” recommendation. Morgan Stanley followed suit with a target cut from $166.00 to $163.00 and kept an “overweight” stance.

Evercore ISI began coverage with an “in-line” rating and set its target at $85.00. Meanwhile, Robert W. Baird lowered its price objective significantly from $145.00 to $100.00 while keeping an “outperform” rating.

MarketBeat data shows that 15 analysts currently rate the stock as a hold. Eleven analysts recommend buying, and one has issued a sell rating. The average consensus price target now stands at $117.36.

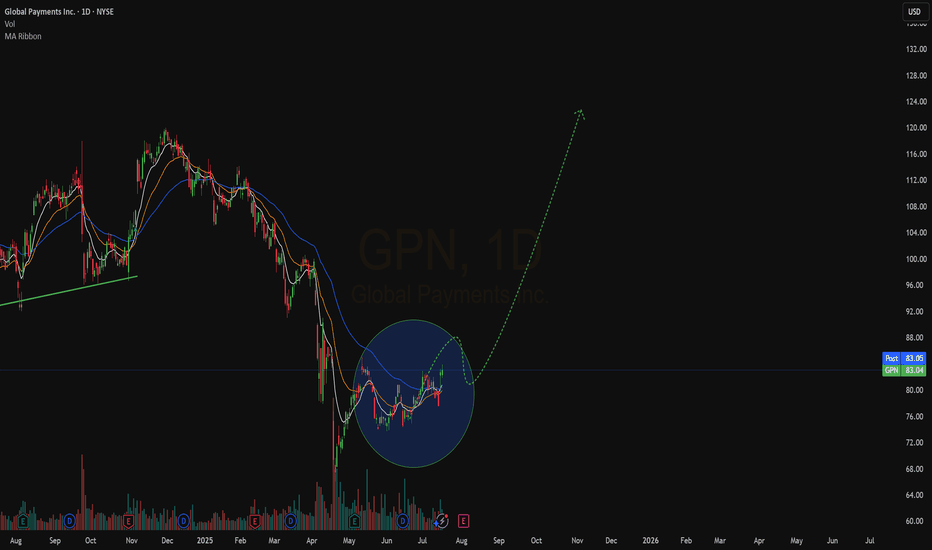

Technical Analysis

The daily chart highlights a sharp sell-off with high volume in April, pushing GPN below critical support. The price failed to hold the $92 level, breaking down with a gap and falling into oversold territory. Moving averages point to downward momentum. The 50-day, 100-day, and 200-day moving averages all hover above the current price.

RSI currently sits at 32.27, close to the oversold threshold. A minor bounce has occurred from the low, but resistance near $92 could cap gains. If selling pressure resumes, the price may revisit $66 or break lower towards $60.

Global Payments | GPN | Long at $110.67Global Payments NYSE:GPN

Pros:

4.6 million companies use the payment service, operate in over 100 countries, and execute over 50 billion transactions per year

Has aggressively repurchased shares and plans to return $7.5 billion to shareholders over the next three years

Revenue rise from $4.9 billion in fiscal year 2019 to $10 billion in Q3 of 2024 (increasing every year)

EPS anticipated to grow to $16.40 by 2027 (2023 it was $10.41)

Has a dividend (0.9%)

Debt to equity = 0.77x (low)

Price is within my selected historical moving average area (often leading to a rise) and overall downward trend may be reversing or flattening

Cons:

Large insider selling, but only a little buying in comparison

Price gap near $95 may get closed prior to a move up

Unstable dividend

While the price may dip in the near-term, NYSE:GPN is in a personal buy zone at $110.67.

Targets:

$122.00

$130.00

$155.00

$210.00 (very long-term outlook)

Wave of the day: $GPN5 good reasons for NYSE:GPN

1. Break out from the corrective channel

2. Rising MACD histogram

3. Buying Volume coming in

4. Pocket Pivot on the last day

5. Analysts have set a mean price target forecast of 160.17. This target is 20.33% above the current price.

What's your take on Global Payments? Comment below

Legal Disclaimer: The information presented in this analysis is solely for informational and educational purposes only and does not serve as financial advice.

Risking 4 To Make 10 On Global Payments (GPN)Prices have traded back above the lower end of the ORANGE zone at 123.99, re-tested it and now look poised to move higher towards 137.37+

----------------------------

In Trading, Objectivity Trumps Subjectivity

“Every trader is a steaming hot bowl of bias stew and must maintain self-awareness and lucidity behind the screens as the trading day oscillates between boredom and terror.”

The above quote is from a good friend of mine and veteran FX trader Brent Donnelly. It completely nails the biggest challenge for new and even experienced traders: being as objective as possible when making trading decisions.

Yes, as you become more experienced, subjectivity, market feel and experience are part of one’s decision-making matrix, but early on you do not have that luxury.

If you start each day knowing that price action in the market is random it will remind you to think objectively. There are, however, repeatable patterns that occur again and again…..it’s your job to identify them.

That’s where Support & Resistance levels come in.

Definitions: “Support” and “Resistance” Levels

Many technical indicators and tools can be subjective and challenging to learn. This is not the case with support and resistance levels.

Support and resistance are terms for two price levels on a chart that appear to limit the security’s range of movement.

The “support level” is where the price regularly stops falling and bounces up.

The “resistance level” is where the price normally stops rising and dips back down.

The more frequently a price hits either level, the more reliable that level is likely to be in predicting future price movements.

Understanding Support and Resistance Levels

Remember, the more informed and objective we can be with numbers, the more confident we can be with our trades. That’s important because, although price action is random (a fact that has been proven time and time again), there are repeatable patterns we can use to get an edge.

Two of those objective data points we can use to gain an edge are support and resistance levels. These are two of the best tools we have when it comes to swing trading. Why? Because they give us strong data points that suggest where an instrument is likely (and unlikely) to go.

But this is really key: Arbitrarily cataloging each price level that appears to be relevant as a support or resistance level isn’t going to get you far. That’s why Aspen Trading takes a unique approach to support and resistance levels.

With Aspen’s Support & Resistance Levels, we measure where trades (prices) occur in terms of frequency. This gives us a sense of where market participants are wagering prices may go.

That’s about as raw and unfiltered as you can get in terms of displaying what has taken place. There’s no room for interpretation - this is raw data that can be used to get a sense of where prices may be heading.

Learning The “Four Sets” of Support and Resistance Levels

There are four sets of support and resistance levels that are part of Aspen Trading’s S/R framework.

Each set of support and resistance levels is unique to a specified period of time. We display each of them in different colors on our charts when we analyze trades to make it easy for us to understand the data as we get comfortable reading charts.

You’ll see each of these levels on display in the charts that follow below. The four sets of support and resistance levels are classified as follows:

There are four sets of support and resistance levels that are displayed by Aspen Trading’s S/R Analysis Tool. Each one is unique to a specified period of time that we then display directly on the chart. The levels are classified as follows

- Intra-day & short-term traders love the GREEN levels

- Swing traders gravitate towards the ORANGE levels

- Medium-term traders like to see RED

- And those longer-term folks dig PURPLE

IMPORTANT:

These lines will change/adjust until the end of the specified observation period is complete.

Once the observation period is complete, that range will then be displayed on the chart as a set of dotted lines that is shaded in to serve as a reference point for traders to know the key levels from the prior lookback period. This can often be very helpful.

What’s the distinction between the 4 color levels?

Essentially think of these levels on a rising scale of importance. While GREEN levels are certainly key, they do not hold the same level of significance as the PURPLE levels.

GPN Weekly Options PlayDescription

This is essentially a "buy the dip" index play intending to ride a retracement as GPN tags and bounces off of a major support level @ 119.

Sort-of Hedge for heavy short account.

Using a call debit spread to bring the price down and reduce risk.

Call Debit Spread

Levels on Chart

SL < 119

PT : 135

*Stops based off underlying stock price, not mark to market loss

The Trade

BUY

12/17 125C

SELL

12/17 135C

R/R & Breakevens vary on fill.

Manage Risk

Only invest what you are willing to lose

GPN - More Upside VS Downside Potential#GPN i recently made and uploaded a video on GPN discussing how this company has had solid earnings and even established a partnership with PYPL to start accepting crypto currencies as payment, aside from the fact it's a global processor for credit and debit cards it has a SAAS service it provides for business owners as well. All in All i feel this play has been dramatically run down looking at the chart you can see a long standing support line which dates back years it has recently broken through potentially being a false break, i would never advocate anyone buying into a falling knife nor would i give anyone that kind of financial advice but i do see that when this play starts to get some volume and interest will be a great opportunity to make some nice profits i am bullish on this play long term it's literally all about finding a floor and it starting to climb out of this downtrend still makes for a good one to add to a watch list.

Bottom FishingHow low will she go?

Other payment processors are following GPN down, but if I remember correctly, this one started plummeting first.

The top is ugly, and GPN has fallen to the 100% of the complicated multiple top pattern. You can get a guesstimate by drawing a trendline from the head to the neckline then projecting it downward. The neckline can be found by looking at the shoulders and where the leg up and then the leg down that form that peaks of the top. Often it is clear and is a level of support until broken. This one was not so clear and finding a neckline can be subjective.

Unfortunately, a bad, ugly top can go further than 100% and hit lower fib levels like the 1.27% etc. You can look for a point of confluence where price may gel and stop falling due to support at that level. It may be a gap, a long legged doji or a consolidation zone that you see to your left. When a security has fallen this much, sometimes it is easier to find a support zone on the weekly timeframe.

A bottom may form, or a zone of consolidation, but do beware as it can fall again. An inverse head and shoulders can be a good bottom, but these can fail as well during a strong downtrend.

Sometimes I use William's alligator which consists of short term moving averages and when it starts turning up, and the shorter moving average (5/red) starts crossing through the other 2 (8/white/ and 13/blue). William does not look good right now )o:

Oversold but oversold conditions can last for extended periods of time just as overbought levels can.

The longer term SMAs look terrible right now and price is under the 50, 100 and the 200 SMA. They are sloping down. Negative volume remains high. Short interest is 1.83%

No recommendation

Is Global Payments $GPN oversold?Stigmatized with legacy payment concerns?

Non-participant in recent market rally.

Arguably oversold ...

Can we might anticipate a bounce:

• to the mid $170s (see green line) or perhaps

• low $180s (see anchored VWAP, yellow line)

Does OBV ever really act as a coiled spring?

Consider as candidate for accumulation on further weakness, in long-term investment portfolios.