4GPRO trade ideas

Is there an Incoming Short Squeeze on GOPRO?Is a Short Squeeze Coming?

-GoPro carries a high short interest—around 10–11% of its float, with about 3.8 days to cover.

-Such metrics suggest potential for a short squeeze—especially if a positive catalyst appears (earnings beat, new product, etc.) .

-That said, no guaranteed squeeze is imminent. Many stocks carry high short interest without the price explosion typical of meme-stock squeezes.

Pros of Investing in GoPro

Strong Brand & Community

-Iconic in action cameras, with a dedicated user base and powerful user-generated marketing.

Turnaround Momentum

-The CEO recently waived his salary, aiming to cut operating costs and signal commitment; the company has also taken steps to reduce expenses and workforce.

Diversifying Revenue Streams

-Beyond hardware, GoPro has a subscription model (cloud storage and editing), and is exploring media/content avenues.

Cons & Risks of GoPro

High Volatility & Declining Fundamentals

-Lost ~20% of revenue in 2024 with a €432 million net loss; stock down about 90% from its highs.

-The consumer electronics industry is challenging—smartphones often cannibalize its market.

Intense Competition

-Companies like Sony, DJI, Garmin and mobile devices erode GoPro’s competitive moat.

High Beta & Speculative

-Shares have a beta ~1.98 (nearly double the market), making it highly sensitive to broader market swings.

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

GoPro | GPRO | Long at $1.35NASDAQ:GPRO is a strong brand name, but with a dying userbase / lack of growth. The company has no major turnaround planned, but the chart is interesting. The stock seems to be currently consolidating as the historical simple moving average (white line) is working its way down toward the price - which often leads to a jump. Another candidate for the Santa Claus rally? Or, will the "value" lead to an acquisition? Nothing is guaranteed, but something may be brewing. While not a long-term "buy and hold" candidate for me (personally, unless the business changes or growth seems relevant), it looks very intriguing from a technical analysis perspective. Thus, at $1.35, NASDAQ:GPRO is in a personal buy zone.

Target #1: $1.70

Target #2: $2.00

Target #3: $2.50

Target #4: $2.88 (if some good news emerges...)

Meme Camera CrazeThe meme stock phenomenon has erupted several times in recent years: in the 2021 wave, the share prices of GameStop (GME), AMC Entertainment, and other small-cap companies nearly exploded almost unexpectedly due to the coordinated buying by the Reddit / r/WallStreetBets communities. A March 2025 analysis finds that the essence of meme stocks is that retail investors’ “viral” popularity on social media drives sudden surges in trading volume and explosive price spikes—often independently of the companies’ fundamental metrics. One hallmark of these firms is extreme volatility: dramatic price swings over short periods, driven more by social-media sentiment and coordinated buying pressure than by classic financial analysis.

GoPro (GPRO)—known for its action cameras—has exhibited large price swings without any fundamental corporate events. Analysts note that GoPro has become a “Robinhood favorite” and is increasingly treated as a new “play” on Reddit forums. This study examines GoPro from four angles: the impact of social media on its stock movement, its price volatility and speculative waves, the role of high short interest, and the activity of retail-investor forums (e.g., Reddit WSB).

Social Media Impact on Stock Movement

Social media and online forums are critical for meme stocks: TradingSim highlights that these stocks’ prices and volumes are strongly shaped by retail-investor social-media activity, resulting in highly volatile, sudden price jumps. GoPro is no exception. A Nasdaq/Motley Fool analysis reports that in the first week of March 2021, GoPro shares rose 13%, then jumped another 10.3% in a single day—even though no material company-specific news was released. This spike was attributed to high (~10.5%) short interest and WallStreetBets attention.

Retail day traders are thus hunting new names, and GoPro often tops their lists: “retail investors are on the lookout for fresh picks, and GoPro seems to fit the bill,” one WSB comment noted. A MarketBeat/Entrepreneur article emphasizes that meme stocks are frequently discovered through social-media buzz, triggering swift volume surges and price explosions regardless of fundamentals. Clearly, GoPro’s price can be moved at any time by unexpected social-media waves.

Price Volatility and Speculative Waves

GoPro’s share price shows sharp swings—“roller-coaster” moves with double-digit daily gains and pullbacks. For example, the Nasdaq article above notes the stock climbed 13% within a week and jumped another double digit in one day. This is typical of meme stocks: one day, FOMO drives the price up; the next, profit-taking or short selling unleashes a crash. TradingSim also points out that meme-stock volatility often detaches from traditional factors and instead hinges on social-media sentiment.

Furthermore, GoPro’s fundamentals rarely explain short-term moves. In March 2021 there was no significant operational news, yet a major rally occurred. On the other hand, the long-term trend has been weak: in 2024 the stock fell nearly 65% by year-end, reflecting broader market headwinds and underscoring that speculative waves alone can’t sustain growth. (Worth noting, some analysts expect improved sales in 2025.) Overall, GoPro’s short-term price action mirrors retail-investor sentiment swings more than corporate performance.

High Short Interest and Its Role

Meme stocks typically feature notably high short interest, amplifying speculative risk and setting the stage for short squeezes. TradingSim explains that high short interest in such names often primes them for squeezes if buying momentum builds. GoPro carried around a 10–14% short float in early 2021—comparable to Bed Bath & Beyond at the time—and as of spring 2025 still sits at roughly 8.1% short float, which is high (many blue-chip stocks run only 1–3%).

These figures imply that sudden retail buying can force shorts to cover, generating further upward pressure. Nasdaq’s analysis underlines that GoPro’s 10.5%+ short float in March 2021 likely fueled its rally as shorts rushed to close positions. SEC reports caution that high short-interest stocks are prime targets for coordinated retail actions aiming for squeezes. Thus, GoPro’s relatively high short interest joins it to the classic meme-stock hallmarks.

Retail Investor Community Activity (Reddit, WallStreetBets)

Online retail-investor forums remain central to GoPro’s hype. Reddit’s r/WallStreetBets community regularly seeks new “meme plays,” and GoPro often surfaces in their discussions. Analyses find that these groups can mobilize rapidly, generating massive buying pressure that produces market-disrupting moves, including repeated short squeezes. Experts argue that successful meme-stock trading almost requires active monitoring of Reddit/WSB and similar channels.

GoPro’s coverage on these forums—through posts and user-generated analyses—keeps it in retail traders’ sights. While the tone is often ironic and slang-laden (“hold,” “ape,” etc.), their impact is real: TradeSim notes that social-media sentiment drives meme markets more than financial fundamentals. Whether the GoPro hype continues is uncertain, but retail attention remains high and the potential for coordinated actions endures.

Conclusions

Our analysis shows that GoPro exhibits multiple characteristics of famous meme stocks like GameStop and AMC:

Social Media Impact: GoPro’s price often reacts sharply to retail communities’ buzz. It features as a Robinhood favorite and is increasingly discussed on Reddit, meaning a single WSB post or media mention can trigger broad buying waves.

High Volatility: GoPro shares can swing 10–15% in a single day, despite stable corporate metrics—mirroring the dramatic moves typical of meme stocks.

Elevated Short Interest: With past floats above 10% and current levels near 8%, GoPro’s short interest is high enough to enable potential short squeezes—one of the core traits identified during the GameStop–AMC saga.

Active Retail Forums: Beyond WSB, other investor groups actively discuss GoPro. Research shows that following Reddit and similar channels is crucial for participating in meme-stock rallies, and GoPro remains a popular target for these coordinated efforts.

In sum, GoPro’s price behavior aligns closely with the speculative patterns of top meme stocks: it is highly susceptible to social-media hype, shows extreme volatility, carries high short interest, and enjoys active retail-investor coordination. Investors attracted to GoPro for its meme-stock profile should be aware that they are betting on sentiment-driven swings, which can yield rapid gains or steep losses. Nonetheless, by these metrics, GoPro can justifiably be regarded as a meme stock in its own right.

Sources Used:

This study draws on key analyses showing that meme stocks’ prices and volumes are driven by social-media activity. GoPro’s specific examples are supported by financial reports from Nasdaq, Motley Fool, and other outlets.

GoPro (GPRO) Long Idea – Target: $1GoPro (GPRO) Long Idea – Target: $1

GoPro CEO Nicholas Woodman has waived his salary for the remainder of 2025, reinforcing the company’s aggressive cost-cutting plan aimed at reducing operating expenses by 30% and returning to profitability by 2026. This symbolic gesture highlights leadership accountability and strengthens investor confidence in the turnaround strategy, including operational efficiencies and supply chain diversification beyond China.

Technically, the stock has stabilized and is showing signs of reversal from oversold levels. With strong support holding and volume gradually increasing, a move back toward the $1.00 psychological level is likely, making this a compelling long setup.

Many will say GoPro is dead. But… Now is your chance to obtain a future meme stock before the masses.

Gen x and millennials have adored this company over the years. The extreme sports will never stop using and promoting GoPro. It’s not going anywhere!

Possibility to be acquired in the future. Show all good qualities of becoming a future meme stock.

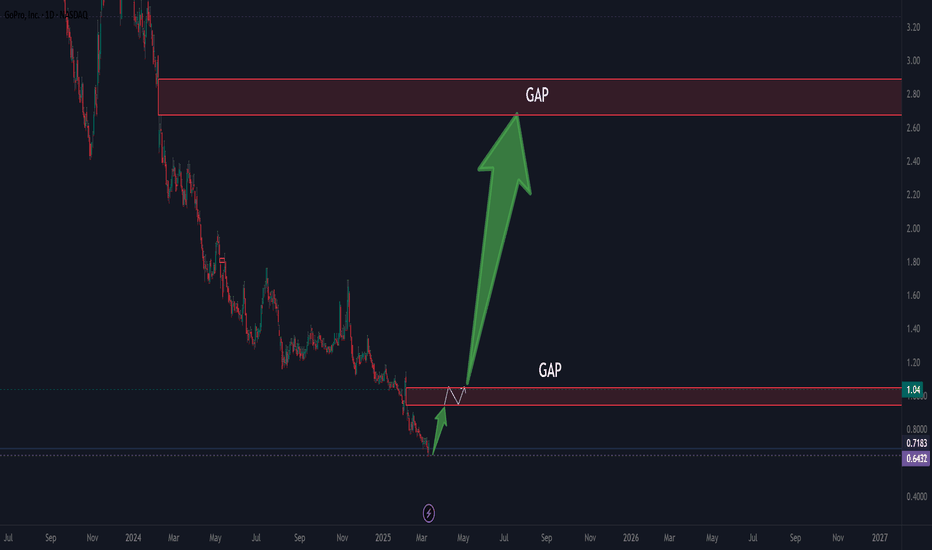

GOPRO faces a significant rise.GoPro Poised for a Strong 2025: Tariff Impact, Cost-Cutting Measures, and Market Dynamics

Summary:

GoPro (NASDAQ: GPRO) is set to emerge as the biggest beneficiary of the new U.S. tariffs on imported electronics. With key competitors such as DJI and Insta360 facing significant cost increases, GoPro’s pricing advantage could lead to market share gains. Additionally, the company's aggressive 30% cost reduction and 15% workforce reduction in late 2024 have positioned it for a return to profitability after a challenging year. With demand stabilizing and a more favorable competitive landscape, GoPro appears well-positioned for a strong 2025.

Tariffs Reshape the Action Camera Market

The U.S. government's new 20-25% import tariffs on Chinese electronics, including action cameras, are expected to have a profound impact on the market. Key GoPro rivals such as DJI, Insta360, and AKASO—who manufacture in China—will be forced to raise prices to offset higher import costs.

DJI's Osmo Action cameras, previously priced around $350, could see retail prices rise to $430 or more.

Insta360's flagship models, once positioned as a mid-tier alternative at $300, may now enter the $375-$400 range.

Budget brands like AKASO and Campark, which used to sell for $90-$100, could now be priced between $110-$125, significantly reducing their appeal to cost-conscious consumers.

Meanwhile, GoPro, despite relying on Asian manufacturing, will face a smaller 10-15% impact. This keeps its HERO lineup competitive, with an estimated post-tariff price increase from $400 to $460—still within reach of its target customer base.

With the pricing gap between GoPro and its competitors shrinking, the company is positioned to reclaim lost market share and drive revenue growth.

Cost-Cutting Measures Pave the Way for Profitability

2024 was a challenging year for GoPro, with declining sales leading to an annual net loss. The company responded with aggressive cost-cutting measures, including:

A 30% reduction in operating expenses, achieved through supply chain optimizations and streamlined marketing spend.

A 15% reduction in workforce, aimed at improving efficiency while maintaining innovation.

These measures are already yielding results, improving the company’s operating margins and reducing the breakeven threshold for profitability.

As a result, 2025 is expected to be the first profitable year for GoPro since 2022, reversing the losses incurred in 2024.

GoPro’s Competitive Edge Strengthens

With the action camera market becoming more favorable for GoPro, the company enjoys multiple tailwinds heading into 2025:

Tariff-Driven Market Share Gains – Competitors like DJI and Insta360 face steeper price hikes, making GoPro a more attractive choice for consumers.

Stabilized Demand – After a post-pandemic slowdown in 2023-2024, action camera demand is expected to rebound in 2025, fueled by travel, content creation, and extreme sports markets.

Subscription Growth – GoPro’s recurring revenue model, driven by its cloud storage and editing services, continues to provide a stable revenue stream.

Restructured Cost Base – The company’s leaner operating model ensures improved profitability, even if revenue growth remains modest.

Valuation and Outlook

GoPro’s stock has underperformed in recent years, but 2025 presents a turning point. With tariffs reshaping the competitive landscape in its favor and cost-cutting initiatives delivering tangible results, investors should expect improved financials and a potential stock price recovery.

Key Metrics to Watch in 2025:

Gross margin expansion as cost reductions take full effect.

Subscription revenue growth, providing a hedge against hardware sales volatility.

Potential market share gains as GoPro strengthens its position against tariff-impacted competitors.

Final Takeaway:

After a challenging 2024, GoPro is on track for a profitable 2025, benefiting from both external market changes and internal restructuring efforts. Investors looking for a turnaround story in consumer electronics should keep a close eye on GoPro as it reclaims its leadership position in the action camera space.

GOPRO: $1.22 | An Opportunity for the Few HOLDERS at all time HIGHS

meet you halfway

Fresh investors

WAIT WAIT WAIT under $1.0 and place bids towaerds $0.20 cents

a humbling experience in progress

for the CEO FOUNDER to reflect

when to flip and make whole for LONG TERM INVESTORS

Adventure Gadgets are making all time highs

from Redbull Oakley Applewatch health apps to Gatorade unstoppable demand

perhaps Nick Woodman after a decade of running the business

may want to relax and hand over management to PROFESSIONALS

a Founder can only do so much

as reflected to new generation like META GOOGLE etc...

Capitulation in progress

6/27/24 - $gpro - 2 cheap 2 ignore at $1.3/shr6/27/24 :: VROCKSTAR :: NASDAQ:GPRO

2 cheap 2 ignore at $1.3/shr

wtf is V writing about gpro. lol. yuh fam i look at it all.

This thing is basically worth the equivalent of it's annual R&D budget which is pretty large at $170 mm (and the all in company is worth $200 ish).

- google trends still look like suck for the hardware biz BUT they're not really getting substantially worse. 2nd deriv stuff, but we're not red anymore k.

- services growing in the mix and helping gross mgn, to be sure

- so wtf is that R&D worth, bc if it's actually legit and not purely bloated, the IP they've built in the last years is an Ez take out by someone like NASDAQ:AMZN , among many others.

- and if NYSE:RDDT is selling ur data to openAI to train their models (lol pleb crusher move) and NASDAQ:ADBE is attempting the same... surely the video footage is super helpful to a mega-corp-pseudo-state-co like NASDAQ:MSFT , NASDAQ:AMZN , $googl... u know em.

- so basically i think this thing has some floor value probably below $1.5 and we're at $1.3 today. does it go to $1? idk. if enough time passes everything goes to zero. enen u and me.

- so it's one of those pretty cheap call options that doesn't expire. the biggest cash burn happend last Q (seasonally) so they have enough to not dunk/ raise on our butts. so that's key for something that has a loser chart.

i took a peanut 25 bps position as a cheap call option. if in this tape the beaten up stuff gonna get a bid into 4th of july and opex tmr, i like playing stuff like this. if u r buying $irbt... you're better off buying NASDAQ:GPRO IMVHO. lower downside, more upside, optionality.

risky. but wanted to flag.

it's too cheap to ignore.

V

Shorting Strategy for GoPro, Inc. (GPRO)Entry Point:

Suggested Entry Point: $1.60

This entry point is slightly above the current price of $1.59, anticipating a minor pullback or consolidation before the downward trend continues.

Target:

Target Price: $1.00

This target is based on the stock's downward momentum and technical support levels. A $0.60 drop from the entry point aligns with a significant percentage decline and likely support levels observed in past price action.

Stop Loss:

Stop Loss Level: $1.80

This stop loss is set above recent resistance levels and moving averages, allowing some room for short-term volatility while protecting against significant losses if the trend reverses unexpectedly.

GOPRO Set To Possibly Explode Off Of Current Price?I'll admit right up front, my analysis here is super simple chart reading, key levels, support/resistance and taking a quick look at options. On the daily/weekly charts, this stock looks like it is setting up for a double or triple bottom, basically at current price of $2.39 USD, and could easily be a $4-5 stock two years from now.

But you tell me in the comments.

GOPRO or Go Home 📸🏆Hello TradingView Family / Fellow Traders,

After rejecting the 2.0 demand zone, NASDAQ:GPRO has been bullish from a short-term perspective.

📈 For the bulls to maintain control and take over from a medium-term perspective, we need a daily candle close above the 4.1 resistance marked in gray.

In this case, a movement toward the 6.5 resistance would be expected.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GPRO goes to earnings LONGFrom the 2H chart GPrRO is in early reversal two days before earnings

sitting at a bottom on the POC line of the volume profile. The MAC profile

shows a line cross under a small histogram. Right now momentum is subtle

and sluggish but could accelerate quickly in the approach to that earnings

report. Based on the chart, I will target the July 18th pivot high and set the

stop-loss under that POC line.

GOPRO Stock Chart Fibonacci Analysis 073123 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 4.19/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provide these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

GOPRO Stock Chart Fibonacci Analysis 070423Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 4.2/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provide these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

GO PRO or Go Home 📷 Analysis #25/50Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

on DAILY: Left Chart

GPRO is stuck inside a range around support in the shape of a rising broadening wedge, and it is currently around the lower bound so we will be looking for buy setups on lower timeframes.

on H4: Right Chart

🏹 For the bulls to take over, we need a momentum candle close above the last major high in gray.

Meanwhile, until the buy is activated, GPRO can still trade lower till the 4.7 support or even break it downward.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich