Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

13.05 EUR

14.29 B EUR

154.01 B EUR

994.25 M

About Home Depot, Inc. (The)

Sector

Industry

CEO

Edward P. Decker

Website

Headquarters

Atlanta

Founded

1978

FIGI

BBG000QFTXB1

The Home Depot, Inc. engages in the sale of building materials and home improvement products. Its products include building materials, home improvement products, lawn and garden products and decor products. The firm operates through the following geographical segments: U.S., Canada and Mexico. It offers home improvement installation services, and tool and rental equipment. The company was founded by Bernard Marcus, Arthur M. Blank, Kenneth Gerald Langone and Pat Farrah on June 29, 1978 and is headquartered at Atlanta, GA.

Related stocks

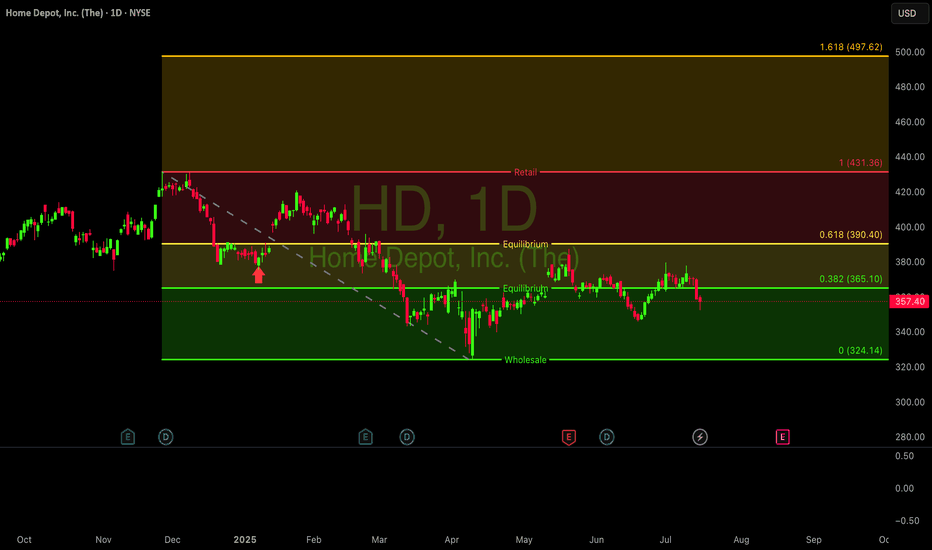

$HD - Cookie long hold this is bread and butterNYSE:HD hold a bullish position could see over $505 long term... <3

NYSE:HD breaking out with conviction! Up 5.2% this week on increasing volume. 12 analysts maintain BUY ratings with targets up to $455 (23% upside). Technical pattern shows higher lows since April. Strong revenue growth despite

Check 350.47 support (HA-MS indicator interpretation method)

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(HD 1D chart)

Can the HA-MS indicator be applied to stock charts?!!!

The conclusion is that it can be applied to all charts.

However, since the stock marke

Home Depot Wave Analysis – 18 June 2025

- Home Depot broke support zone

- Likely to fall to support level at 340.00

Home Depot recently broke the support zone located between the support level 352.00 (low of wave A from April) and the 61.8% Fibonacci correction of the ABC correction (2) from April.

The breakout of this support zone acc

Long Setup: Home Depot ($HD) | Bullish Continuation Above Cloud 📈 Technical Setup:

Home Depot ( NYSE:HD ) is setting up for a potential bullish continuation after retesting the top of the Ichimoku Cloud and holding key support.

Ichimoku Cloud: Price is consolidating above the Kumo, with the Conversion Line (Tenkan) and Base Line (Kijun) flatlining — signaling p

Home Depot – Pattern Suggests C Wave Toward $315 from $367 LevelHome Depot appears to be inside a pattern that fits either an Ending Diagonal or Skewed Triangle structure. From the $367 area, a potential C wave may begin targeting the $315 zone.

Investors should be cautious, as diagonal or skewed triangle formations often involve significant uncertainty. The wh

Home Depot Stock Chart Fibonacci Analysis 060325Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 372/61.80%

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

HD BULLISH POTENTIALHere's a professional and engaging English version of your summary, ideal for a social media or blog post:

---

🔨 Home Depot (HD) — Is the Bottom In?

Home Depot, often considered the U.S. equivalent of IKEA in the home improvement sector, just posted **strong Q4 2024 earnings**, signaling potenti

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US437076CG5

HOME DEPOT 21/51Yield to maturity

7.32%

Maturity date

Mar 15, 2051

US437076CK6

HOME DEPOT 21/51Yield to maturity

7.08%

Maturity date

Sep 15, 2051

HD4933111

Home Depot, Inc. 3.125% 15-DEC-2049Yield to maturity

6.62%

Maturity date

Dec 15, 2049

HD4401003

Home Depot, Inc. 3.5% 15-SEP-2056Yield to maturity

6.52%

Maturity date

Sep 15, 2056

HD4971789

Home Depot, Inc. 3.35% 15-APR-2050Yield to maturity

6.45%

Maturity date

Apr 15, 2050

HD5386726

Home Depot, Inc. 3.625% 15-APR-2052Yield to maturity

6.43%

Maturity date

Apr 15, 2052

US437076BS0

HOME DEPOT 17/47Yield to maturity

6.23%

Maturity date

Jun 15, 2047

US437076BX9

HOME DEPOT 18/48Yield to maturity

5.98%

Maturity date

Dec 6, 2048

HD4253641

Home Depot, Inc. 4.25% 01-APR-2046Yield to maturity

5.96%

Maturity date

Apr 1, 2046

HD4134022

Home Depot, Inc. 4.4% 15-MAR-2045Yield to maturity

5.92%

Maturity date

Mar 15, 2045

HD5475098

Home Depot, Inc. 4.95% 15-SEP-2052Yield to maturity

5.87%

Maturity date

Sep 15, 2052

See all 4HD bonds

Curated watchlists where 4HD is featured.

Frequently Asked Questions

The current price of 4HD is 322.15 EUR — it has decreased by −0.15% in the past 24 hours. Watch HOME DEPOT stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange HOME DEPOT stocks are traded under the ticker 4HD.

4HD stock has risen by 0.96% compared to the previous week, the month change is a 1.67% rise, over the last year HOME DEPOT has showed a −3.69% decrease.

We've gathered analysts' opinions on HOME DEPOT future price: according to them, 4HD price has a max estimate of 404.61 EUR and a min estimate of 279.40 EUR. Watch 4HD chart and read a more detailed HOME DEPOT stock forecast: see what analysts think of HOME DEPOT and suggest that you do with its stocks.

4HD stock is 0.16% volatile and has beta coefficient of 0.72. Track HOME DEPOT stock price on the chart and check out the list of the most volatile stocks — is HOME DEPOT there?

Today HOME DEPOT has the market capitalization of 325.65 B, it has decreased by −3.70% over the last week.

Yes, you can track HOME DEPOT financials in yearly and quarterly reports right on TradingView.

HOME DEPOT is going to release the next earnings report on Aug 19, 2025. Keep track of upcoming events with our Earnings Calendar.

4HD earnings for the last quarter are 3.14 EUR per share, whereas the estimation was 3.17 EUR resulting in a −0.99% surprise. The estimated earnings for the next quarter are 4.14 EUR per share. See more details about HOME DEPOT earnings.

HOME DEPOT revenue for the last quarter amounts to 35.19 B EUR, despite the estimated figure of 34.70 B EUR. In the next quarter, revenue is expected to reach 39.89 B EUR.

4HD net income for the last quarter is 3.03 B EUR, while the quarter before that showed 2.89 B EUR of net income which accounts for 4.76% change. Track more HOME DEPOT financial stats to get the full picture.

Yes, 4HD dividends are paid quarterly. The last dividend per share was 2.01 EUR. As of today, Dividend Yield (TTM)% is 2.44%. Tracking HOME DEPOT dividends might help you take more informed decisions.

HOME DEPOT dividend yield was 2.15% in 2024, and payout ratio reached 60.36%. The year before the numbers were 2.35% and 55.32% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 470.1 K employees. See our rating of the largest employees — is HOME DEPOT on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HOME DEPOT EBITDA is 22.47 B EUR, and current EBITDA margin is 15.82%. See more stats in HOME DEPOT financial statements.

Like other stocks, 4HD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HOME DEPOT stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HOME DEPOT technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HOME DEPOT stock shows the neutral signal. See more of HOME DEPOT technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.