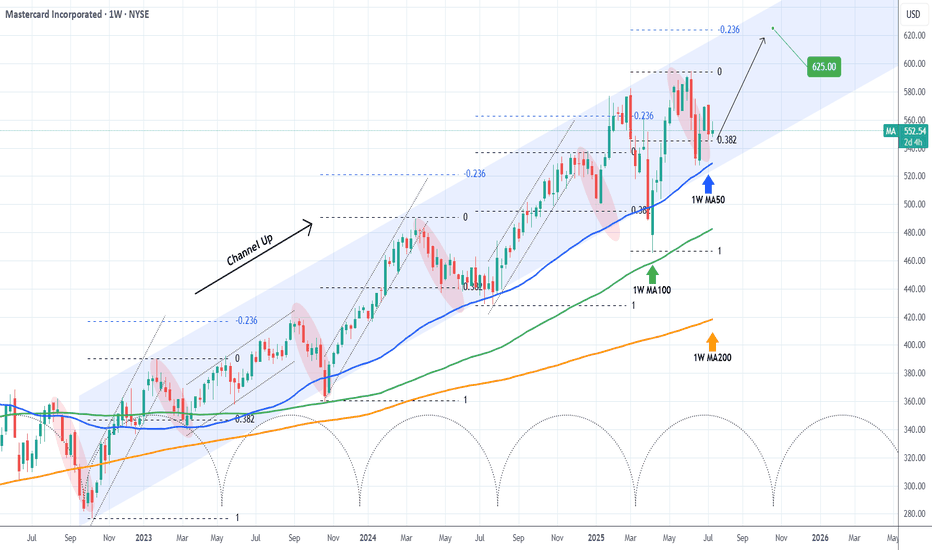

MASTERCARD Best buy entry now. Target $625.Mastercard (MA) has been trading within almost a 3-year Channel Up that only broke (but recovered naturally) during Trump's trade war. Still, the 1W MA100 (green trend-line) contained the downfall, as it always had.

Normally the Bearish Legs of this pattern tend to find Support on the 1W MA50 (blue

Key facts today

BNP Paribas Exane has raised its price target on Mastercard to $625 from $575 while keeping a neutral rating.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

13.20 EUR

12.44 B EUR

27.20 B EUR

820.28 M

About Mastercard Incorporated

Sector

Industry

CEO

Michael E. Miebach

Website

Headquarters

Purchase

Founded

1966

FIGI

BBG00LXXK1V5

Mastercard, Inc. is a technology company, which engages in the provision of payment solutions for the development and implementation of credit, debit, prepaid, commercial, and payment programs through its brands including Mastercard, Maestro, and Cirrus. It also offers cyber and intelligence solutions. The company was founded in November 1966 and is headquartered in Purchase, NY.

Related stocks

Mastercard Could Face ResistanceMastercard fell hard in June on the threat of stablecoin competition. Now, after a rebound, some traders may expect another push to the downside.

The first pattern on today’s chart is the selloff that began on June 13 when the Wall Street Journal reported that major retailers were considering sta

Who will win? Crypto or Dollar?How Stablecoin Payments Can Hurt Visa & Mastercard

Bypassing the Interchange System

-Stablecoins allow peer-to-peer or business-to-consumer payments without using credit/debit card rails.

-Visa & Mastercard earn billions from interchange fees (0.1%–3% per transaction). If people pay directly vi

Mastercard and Visa Shares Decline Due to Stablecoin BillMastercard (MA) and Visa (V) Shares Decline Due to Stablecoin Bill

Yesterday, we reported that the US Senate had passed the GENIUS stablecoin bill, which establishes a legal framework for regulating the stablecoin market. This development led to a sharp rise in the share price of cryptocurrency ex

A whole new type of cash back offer - LONG at 562.03I've posted ideas about MA before. I will continue posting buy ideas about MA until the final breath leaves my body. The average credit card APR is 24.3% - I think this trade can do better. Around 60% APR on average, with a good chance at 270%+ APR.

MA is in a multi-year uptrend, only 2 days re

Mastercard: Approaching the Top of Wave BMastercard has rebounded after a brief cooling period, and we now expect turquoise wave B to complete just below resistance at $620. Once that top is in, wave C should drive a meaningful retracement, ending with the low of magenta wave (4). Alternatively, if turquoise wave alt.(4) has already bottom

Market sentiment remains bullish**Direction:** **LONG**

**LONG Targets:**

- **T1 = $562.00**

- **T2 = $572.00**

**Stop Levels:**

- **S1 = $540.00**

- **S2 = $525.00**

---

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MA5142291

Mastercard Incorporated 2.95% 15-MAR-2051Yield to maturity

6.80%

Maturity date

Mar 15, 2051

US57636QAL8

MASTERCARD 19/49Yield to maturity

6.37%

Maturity date

Jun 1, 2049

US57636QAH7

MASTERCARD 2046Yield to maturity

6.28%

Maturity date

Nov 21, 2046

MA4970638

Mastercard Incorporated 3.85% 26-MAR-2050Yield to maturity

6.27%

Maturity date

Mar 26, 2050

MA4602133

Mastercard Incorporated 3.95% 26-FEB-2048Yield to maturity

6.24%

Maturity date

Feb 26, 2048

MA5885400

Mastercard Incorporated 4.55% 15-JAN-2035Yield to maturity

4.99%

Maturity date

Jan 15, 2035

MA5808459

Mastercard Incorporated 4.875% 09-MAY-2034Yield to maturity

4.83%

Maturity date

May 9, 2034

MA5302962

Mastercard Incorporated 2.0% 18-NOV-2031Yield to maturity

4.77%

Maturity date

Nov 18, 2031

MA6009559

Mastercard Incorporated FRN 15-MAR-2028Yield to maturity

4.70%

Maturity date

Mar 15, 2028

MA5552138

Mastercard Incorporated 4.85% 09-MAR-2033Yield to maturity

4.69%

Maturity date

Mar 9, 2033

MA5142474

Mastercard Incorporated 1.9% 15-MAR-2031Yield to maturity

4.64%

Maturity date

Mar 15, 2031

See all 4MA bonds

Curated watchlists where 4MA is featured.

Frequently Asked Questions

The current price of 4MA is 473.80 EUR — it has increased by 0.93% in the past 24 hours. Watch MASTERCARD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange MASTERCARD stocks are traded under the ticker 4MA.

4MA stock has risen by 1.06% compared to the previous week, the month change is a −2.05% fall, over the last year MASTERCARD has showed a 14.24% increase.

We've gathered analysts' opinions on MASTERCARD future price: according to them, 4MA price has a max estimate of 595.02 EUR and a min estimate of 484.64 EUR. Watch 4MA chart and read a more detailed MASTERCARD stock forecast: see what analysts think of MASTERCARD and suggest that you do with its stocks.

4MA stock is 0.70% volatile and has beta coefficient of 0.77. Track MASTERCARD stock price on the chart and check out the list of the most volatile stocks — is MASTERCARD there?

Today MASTERCARD has the market capitalization of 435.07 B, it has increased by 1.78% over the last week.

Yes, you can track MASTERCARD financials in yearly and quarterly reports right on TradingView.

MASTERCARD is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

4MA earnings for the last quarter are 3.45 EUR per share, whereas the estimation was 3.31 EUR resulting in a 4.27% surprise. The estimated earnings for the next quarter are 3.42 EUR per share. See more details about MASTERCARD earnings.

MASTERCARD revenue for the last quarter amounts to 6.75 B EUR, despite the estimated figure of 6.59 B EUR. In the next quarter, revenue is expected to reach 6.73 B EUR.

4MA net income for the last quarter is 3.03 B EUR, while the quarter before that showed 3.23 B EUR of net income which accounts for −6.09% change. Track more MASTERCARD financial stats to get the full picture.

Yes, 4MA dividends are paid quarterly. The last dividend per share was 0.65 EUR. As of today, Dividend Yield (TTM)% is 0.51%. Tracking MASTERCARD dividends might help you take more informed decisions.

MASTERCARD dividend yield was 0.52% in 2024, and payout ratio reached 19.73%. The year before the numbers were 0.56% and 20.03% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 19, 2025, the company has 35.3 K employees. See our rating of the largest employees — is MASTERCARD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MASTERCARD EBITDA is 16.38 B EUR, and current EBITDA margin is 60.68%. See more stats in MASTERCARD financial statements.

Like other stocks, 4MA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MASTERCARD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MASTERCARD technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MASTERCARD stock shows the neutral signal. See more of MASTERCARD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.