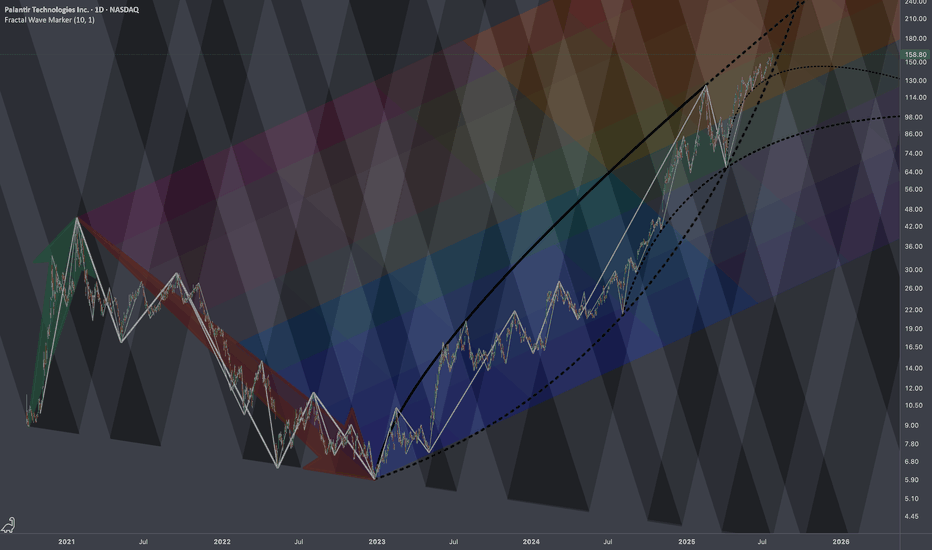

$PLTR: Regressive Heatmap🏛️ Research Notes

Technically this looks overbought, but fundamentally we know that under current administration this company is clear beneficiary (new contracts). Seems to explain why chart's dips were bought off extending bullish phases of cycle. However, there is still always a limit (as price

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.24 EUR

446.47 M EUR

2.77 B EUR

2.16 B

About Palantir Technologies Inc.

Sector

Industry

CEO

Alexander Caedmon Karp

Website

Headquarters

Denver

Founded

2003

FIGI

BBG01HQ1RVC9

Palantir Technologies, Inc. engages in the business of building and deploying software platforms that serve as the central operating systems for its customers. It operates through the Commercial and Government segments. The Commercial segment focuses on customers working in non-government industries. The Government segment is involved in providing services to customers that are the United States government and non-United States government agencies. Its platforms are widely used in areas such as defense, intelligence, healthcare, energy, and financial services, supporting data integration, large-scale analytics, and operational decision-making. The company was founded by Alexander Ceadmon Karp, Peter Andreas Thiel, Stephen Cohen, Joseph Lonsdale, and Nathan Dale Gettings in 2003 and is headquartered in Denver, CO.

Related stocks

Palantir Technologies (PLTR) Shares Surpass $160Palantir Technologies (PLTR) Shares Surpass $160 for the First Time

Shares of Palantir Technologies (PLTR), a company specialising in big data analytics software, have continued their impressive performance. Following an extraordinary rally of approximately 340% in 2024, the stock remains among th

Hot Take, PLTR is a BubbleHello I am the Cafe Trader.

Price Action suggest we haven't had a proper buyer since $90.

Now I know that this can sound a bit off putting (especially if you bought above $90).

Even if this crashed, I am not suggesting you sell your long term position. I would instead look into hedging your posi

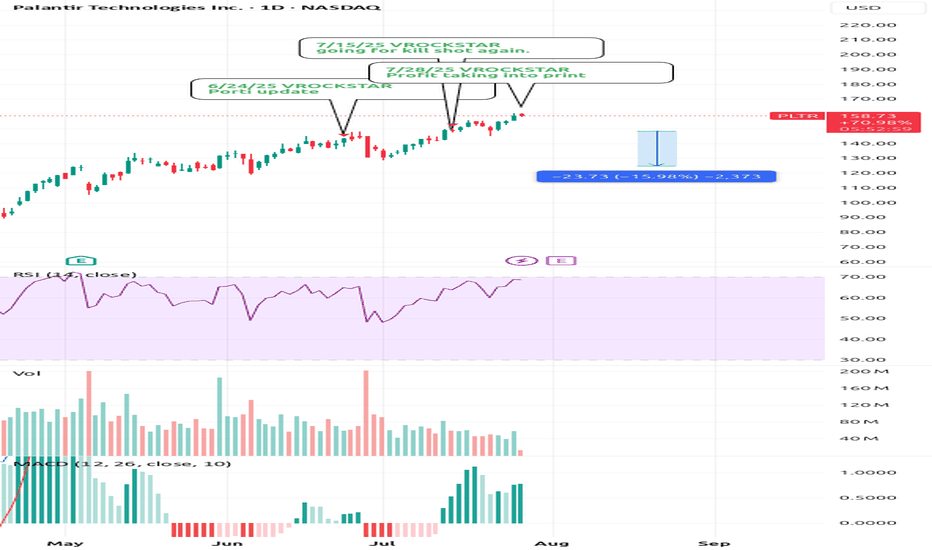

7/28/25 - $pltr - Profit taking into print7/28/25 :: VROCKSTAR :: NASDAQ:PLTR

Profit taking into print

- no idea what print brings

- but mgmt have been sell-only

- valuation is what it is... inexplicable by anyone

- i'd not be surprised to see anything happen on the result

- but into result, big holders (read: not you) are likely going t

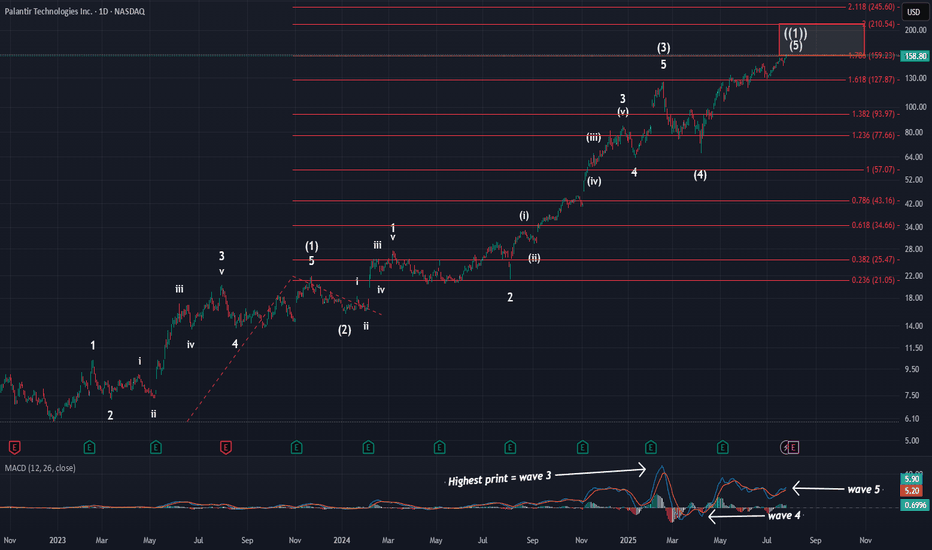

PalantirOn Friday, price hit the 1.236 extension and the larger red 1.786 extension @ $159. Tonight, I wanted to zoom out to show you where price is in the grand scheme of things. As you can see, we have all of the needed waves in place to consider this larger pattern complete. We have finally hit the stand

PLTR is doing it... pullback honeyThis video has my thoughts about PLTR and a trading view tip... the data window!!! Who knew?

Hope the talk inspires you as you decide on future investments; especially when it's stalling or pulling back.

My short term bias is bearish for a pullback on PLTR. Not sure when it will happen, but <155 i

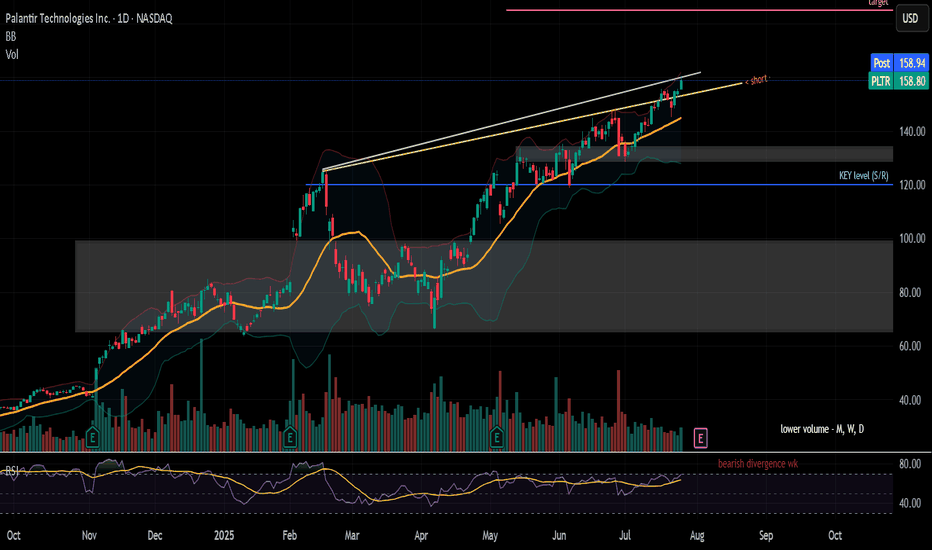

PLTR - Rising wedge formation leads to potentially larger move🧠 PLTR WEEKLY TECH+FUNDAMENTAL BRIEF

Ticker: NASDAQ:PLTR | Sector: AI / Big Data / Defense Tech

Date: July 27, 2025

🔍 Chart Watch: Rising Wedge Risk

Palantir is trading within a rising wedge formation, a pattern often signaling bearish reversal if upward momentum fades. Recent price action has ti

PLTR Pressured at Key Support — Can $155 Hold? 8/1PLTR Pressured at Key Support — Can $155 Hold or Is a Break to $150 Next?

🔍 GEX & Options Flow Insight (1st Image Analysis)

PLTR has been sliding after failing to hold its $160+ range and is now testing the $155–156 gamma support. The GEX profile still shows moderate call dominance, but support is

PLTR at Resistance Brink — Will It Break or Fade? Jul 28🔍 1-Hour GEX & Options Outlook

Palantir (PLTR) has reclaimed strength, now consolidating just below $160.38, which aligns with the Highest Positive GEX / Gamma Wall. The GEX stack gives us a powerful framework for potential options setups:

* $160.38 = Gamma Magnet – This is the wall where large call

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 4PLTR is 133.74 EUR — it has decreased by −3.19% in the past 24 hours. Watch PALANTIR TECHNOLOGIES stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange PALANTIR TECHNOLOGIES stocks are traded under the ticker 4PLTR.

4PLTR stock has fallen by −1.43% compared to the previous week, the month change is a 19.82% rise, over the last year PALANTIR TECHNOLOGIES has showed a 434.64% increase.

We've gathered analysts' opinions on PALANTIR TECHNOLOGIES future price: according to them, 4PLTR price has a max estimate of 156.06 EUR and a min estimate of 35.07 EUR. Watch 4PLTR chart and read a more detailed PALANTIR TECHNOLOGIES stock forecast: see what analysts think of PALANTIR TECHNOLOGIES and suggest that you do with its stocks.

4PLTR reached its all-time high on Jul 25, 2025 with the price of 135.68 EUR, and its all-time low was 5.66 EUR and was reached on Dec 28, 2022. View more price dynamics on 4PLTR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4PLTR stock is 3.29% volatile and has beta coefficient of 2.29. Track PALANTIR TECHNOLOGIES stock price on the chart and check out the list of the most volatile stocks — is PALANTIR TECHNOLOGIES there?

Today PALANTIR TECHNOLOGIES has the market capitalization of 318.90 B, it has increased by 6.52% over the last week.

Yes, you can track PALANTIR TECHNOLOGIES financials in yearly and quarterly reports right on TradingView.

PALANTIR TECHNOLOGIES is going to release the next earnings report on Aug 4, 2025. Keep track of upcoming events with our Earnings Calendar.

4PLTR earnings for the last quarter are 0.12 EUR per share, whereas the estimation was 0.12 EUR resulting in a 1.05% surprise. The estimated earnings for the next quarter are 0.12 EUR per share. See more details about PALANTIR TECHNOLOGIES earnings.

PALANTIR TECHNOLOGIES revenue for the last quarter amounts to 816.98 M EUR, despite the estimated figure of 796.94 M EUR. In the next quarter, revenue is expected to reach 797.40 M EUR.

4PLTR net income for the last quarter is 197.84 M EUR, while the quarter before that showed 76.32 M EUR of net income which accounts for 159.22% change. Track more PALANTIR TECHNOLOGIES financial stats to get the full picture.

No, 4PLTR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 3.94 K employees. See our rating of the largest employees — is PALANTIR TECHNOLOGIES on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PALANTIR TECHNOLOGIES EBITDA is 402.40 M EUR, and current EBITDA margin is 11.93%. See more stats in PALANTIR TECHNOLOGIES financial statements.

Like other stocks, 4PLTR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PALANTIR TECHNOLOGIES stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PALANTIR TECHNOLOGIES technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PALANTIR TECHNOLOGIES stock shows the buy signal. See more of PALANTIR TECHNOLOGIES technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.