SAP: Macro PotentialPolitical uncertainty and questionable economic policies from the U.S. administration are eroding investor confidence globally, prompting a search for more reliable investment opportunities outside the U.S.

Currently, the performance of European stock markets is outpacing that of the U.S. markets. For example, the ETF tracking major German stocks (ETF DAX) has been trading at historical highs for the second consecutive week, while

U.S. markets have merely recovered from their initial tariff-related declines.

One of the most promising medium-term investment ideas in the European equity market right now, in my opinion, is SAP ( XETR:SAP )

• Quarterly revenue and profit growth dynamics and forecasts

• Relative price strength

• Signs of accumulation by major funds

The macro trend structure of SAP also shows interesting potential

Weekly chart:

Monthly chart:

Thank you for your attention and I wish you successful trading decisions!

4SAP trade ideas

Should You Buy SAP After Its Price Drop?

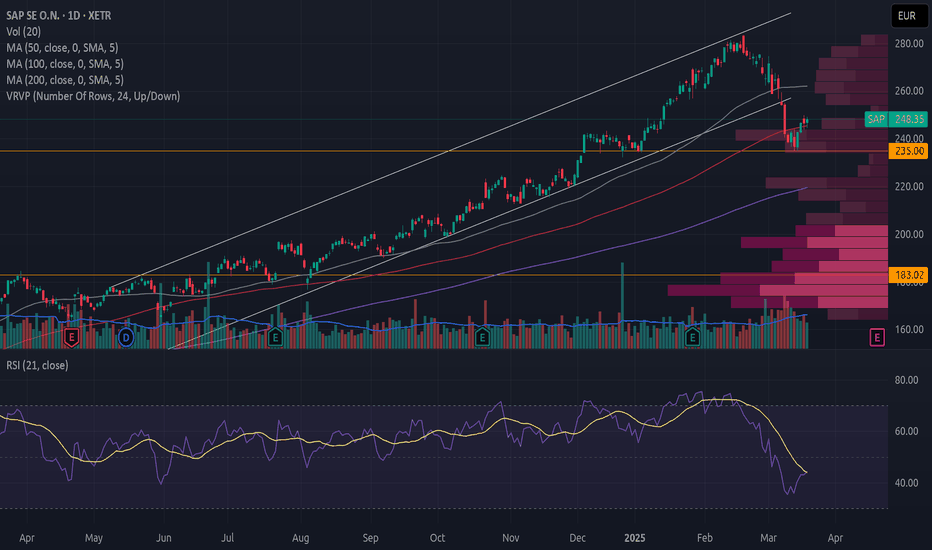

SAP has broken down from an upward trend with high volume.

The price decline has stalled around the resistance level at 235. The volume profile shows a sharp drop in trading activity at this level when prices approach from both below and above, making this a significant resistance zone.

There are no reversal formations as the price exits the trend.

The price is recovering, but without strong volume. Moreover, the negative volume balance further weakens the stock. The same applies when prices are just below a green cloud in Ichimoku.

From a fundamental perspective, the decline likely stems from concerns that SAP was overbought, combined with weakness in U.S. tech stocks. However, SAP is a European company poised to benefit from increased defense spending. These funds are not only for weapons and ammunition but also for innovation, data security, cyber warfare, infrastructure, and more.

I have chosen to reallocate some of my U.S. tech holdings into European investments and have bought SAP.

Always conduct your own research and assessment before making buy or sell decisions.

SAP - could this be the top for the main driver of the DAX ?SAP has the highest market cap in the DAX (315 billion €) and has had an impressive run since the 2022 lows. Price shot up from 80 to 280 in one steep channel.

Looking at the chart since the IPO, you can see a five wave structure that might have come to an end at the upper trendline of the channel.

The DAX has dropped by 700 points this week and if SAP starts correcting to a conservative 0.764 retracement of this move, we are looking at a drop to 236.

The MACD and RSI could certainly use a cooldown.

SAPSAP - Monthly from the beginning year 94 - Strong uptrend since '22.

A few companies determine the performance of the German DAX. One of these "tanks" is SAP. The chart seems to be on its way to 310.80 EUR per share, a Fibonacci-Extension in green. This level represents the end of Cycle wave III in green. After that the chart should form in three waves a 23.6-% correction in total as a flat.

In the chart you see the volume which is decreasing over a long time period. So the actually reached higher highs are formed with lower and lower volume.

Furthermore, the MACD is mentioned. This index forms typical negative values within a wave 2 which is an ABC-correction of the direction of the trend wave.

Its extreme value reaches the MACD always in the C-wave of the ABC-correction. Look in the chart, please. There are two results.

SAP’s Cloud & AI MomentumSAP’s Cloud and AI Momentum: Why This Tech Giant Remains a Top Buy in 2024

SAP is a Germany based company specializing in enterprise application software

It operates through three key segments:

1.Applications, Technology & Services: This segment focuses on selling software licenses, subscriptions to SAP’s cloud applications, and related services. It encompasses support services, various professional services, implementation services for SAP’s software products, and educational services to help customers effectively use SAP solutions

2.SAP Business Network:This segment includes SAP’s cloud-based collaborative business networks and related services. It covers cloud applications and professional and educational services related to the SAP Business Network. This segment also encompasses cloud offerings developed by SAP Ariba, SAP Fieldglass, and Concur, which facilitate supplier collaboration, workforce management, and expense management.

3.Customer Experience:This segment offers both on-premise and cloud-based products designed to manage front-office functions, focusing on customer experience management. It provides solutions that help businesses enhance and streamline interactions with customers.

These segments enable SAP to offer a wide range of solutions, addressing enterprise needs from back-office functions to collaborative networks and customer-facing operations.

SAP remains a top pick, with clear growth momentum that could accelerate further and potential for margin improvements. My buy rating remains unchanged.

SAP reported its Q3 2024 earnings, showing a 10% year-over-year revenue increase in constant currency (CC) to €8.5 billion, maintaining the same growth momentum as Q2 2024. The highlight is the cloud segment’s revenue growth, reaching €4.35 billion, with a y/y CC growth rate accelerating from 25% in Q2 2024 to 27% in Q3 2024. This aligns well with my expectations, as the current cloud backlog (CCB) grew by 29% y/y CC, improving 100 basis points from Q2 2024. By product category, the Cloud ERP Suite showed 36% y/y CC growth, a 300bps sequential improvement. License revenue, though still declining, saw a slower drop from -27% in Q2 to -14% in Q3, and maintenance revenue declines also eased from -3% to -2%. This solid revenue performance contributed to a strong profit outcome, with adjusted EBIT beating estimates by approximately 9% at €2.24 billion, and a major free cash flow (FCF) beat of €1.25 billion, far surpassing the consensus of -€676 million.

Given this strong performance, it wasn’t surprising that management raised guidance, which is certainly encouraging. They now forecast adjusted EBIT in the range of €7.8 to €8 billion, a €150 million increase at the midpoint, implying y/y growth of 20% to 23% CC, up from the previous 17% to 21%. Cloud and software revenue guidance also increased by €400 million at the midpoint, with a new range of €29.5 to €29.8 billion, reflecting 10% to 11% y/y CC growth versus the previous 8% to 10%. Additionally, adjusted FCF is now projected between €3.5 to €4 billion, compared to the prior €3.5 billion.

I am confident that SAP can meet these targets for several reasons. First, the S/4HANA migration remains strong, as indicated by 29% y/y CC CCB growth and 36% y/y CC growth in the Cloud ERP Suite, which accounts for approximately 84% of total cloud revenue. Second, nearly one-third of deals signed in the quarter involved AI, highlighting increased demand for embedded AI solutions. This reinforces my previous view that AI adoption is driving SAP’s cloud migration efforts, as customers must utilize the cloud to fully leverage these AI capabilities. Notably, SAP is moving to the “expand” phase of its strategy by adding generative AI (GenAI) capabilities.

With SAP introducing more AI features, the company is well-positioned to continue capitalizing on this growth driver. For example, its AI-based assistant, Joule, now offers collaborative agent capabilities, allowing it to manage multiple AI agents for complex tasks—resulting in significant productivity gains. Additionally, the Knowledge Graph, a part of SAP’s GenAI suite, connects language and data to help users navigate SAP systems more efficiently. SAP has over 100 GenAI use cases and has added more than 500 skills to Joule so far, suggesting substantial growth potential.

AI adoption remains robust, as evidenced by AI’s central role in SAP’s sales strategy. Around 20% of deals now include premium AI features, and all ERP and LoB deals involve discussions around AI, signaling that AI is a key growth driver for SAP, especially considering that AI integration was minimal a few years ago.

I reaffirm my model assumptions and see continued attractive upside potential, even after SAP’s strong year-to-date share price rally. SAP is increasingly likely to achieve 10% growth for FY24, with further acceleration expected in FY25/26, driven by strong cloud migration and rising AI demand. Management’s upward revision of FY24 adjusted EBIT indicates that earnings margins will improve. Year-to-date, the adjusted earnings margin stands at around 21.1%, making my full-year target of 21.5% feasible. As growth accelerates and SAP completes its restructuring (which impacts 9,000 to 10,000 positions as announced in January 2024), margins should rise to the mid-20% range. I’ve added 300 basis points based on trends from FY22 to FY24. Additionally, with no visible slowdown in growth momentum, I expect the market to continue valuing SAP at a premium, at 36x forward PE compared to the three-year average of 23x.

The macroeconomic environment poses risks, especially if supply chain challenges persist or interest rates rise. Political uncertainties, such as the upcoming U.S. election, could lead to reduced business investment, impacting corporate IT budgets and SAP’s sales. Additionally, if SAP’s S/4HANA and cloud products underperform, or if there are delays in product development or launches, investor expectations may be disappointed, particularly regarding S/4HANA.

To conclude, I maintain my buy rating on SAP. The company’s strong Q3 2024 performance and revised guidance have reinforced my positive view. The accelerating growth in cloud revenue, driven by solid S/4 HANA migration and increased AI adoption, is highly encouraging. While macro risks remain, SAP’s robust fundamentals and favorable growth outlook support a buy rating.

SAP eyes on $230.59: Genesis fib support for possible longsSAP earnings report caused a return trip.

If sentiment remains positive this will bounce.

If it fails, stop losses can be placed very close.

$ 230.59 is key support to count on.

$ 231.85 would add a layer of support.

$ 244.96 would be first target and re-calc.

========================================

.

SAP SE Reported Positive Increase in Expected RevenueSAP SE ( XETR:SAP ), the largest software company in Europe, has reported a significant expected revenue increase from cloud services in the next year. SAP's current cloud backlog, which is an indicator of revenue to be booked within the next 12 months, has increased by 28% at constant currencies to €14.2 billion ($15.2 billion). This represents the fastest growth on record for the Walldorf-based software giant, resulting in a surge in the company's stock price.

XETR:SAP has been focused on migrating its customers from legacy on-premise software to the cloud, where it offers business AI services to sweeten the deal. The company's cloud offering has generated growth in excess of 30% for nine quarters in a row, thanks in part to the growing trend of incorporating AI tools into virtually all of its products. The company has invested in startups Aleph Alpha GmbH, Anthropic PBC, and Cohere as part of its efforts to incorporate AI into its portfolio.

SAP's success in cloud technology and AI has put it ahead of its US software peers, which are experiencing slowing trends. The company's accelerating growth in the current cloud backlog highlights good demand across its cloud portfolio and demonstrates that the advent of AI has propelled the story of the transformation of the cloud, according to the company's Chief Financial Officer, Dominik Asam.

SAP's restructuring program, which was announced in January, has had a significant impact on the company's operating profit to International Financial Reporting Standards. The program resulted in a loss of €787 million for the period due to a €2.2 billion provision related to the restructuring program. The results are the company's first to include share-based compensation expenses in its non-IFRS report, which weighed on non-IFRS operating profit, resulting in €1.53 billion in the period, compared to estimates of €1.7 billion.

SAP's CEO, Christian Klein, expressed confidence that the company would achieve its goals for the year, citing the powerful growth drivers in place, which include business AI, cross-selling across the cloud portfolio, and winning new customers, particularly in the midmarket. Overall, the first quarter results show that SAP is off to a great start in 2024.

a weekly price action market recap and outlook - SAPGood Morning and I hope you are well.

Let's do some SAP today because they just reported earnings.

current market cycle: Strong bull trend is done after 3 pushes up and market is now correcting. Earnings were utter garbage and W1 could go much deeper and so will the targets below. I will update this, once market found bigger support.

key levels: 170-185 - below is 150 next

bull case: Bulls need to keep it above 170 or much more stop losses will be triggered to take profits of the last months. Not much more magic to it.

bear case: 170 will fall and the selling will continue at least to 150 where bulls have to pray for support. My base case is 130 over the next months.

short term: Strong bearish

medium-long term: Strong bearish to 130 or lower.

SAP's Bold Move: Restructuring for AI DominanceGerman Software Giant XETR:SAP Soars to New Heights as it Pivots Towards Artificial Intelligence

German software company ( XETR:SAP ) has announced plans to restructure 8,000 jobs as part of a bold push toward artificial intelligence (AI) dominance. The move comes on the heels of the company's stellar quarterly and full-year results, propelling XETR:SAP shares to an all-time high and signaling a transformative year for the technology stalwart.

XETR:SAP 's Chief Financial Officer, Dominik Asam, revealed to CNBC that the restructuring initiative is a crucial step in fully capitalizing on the burgeoning opportunities presented by the next wave of fast-moving technology. "The next big opportunity is artificial intelligence, and we want to be well prepared for that," Asam emphasized, setting the stage for a comprehensive overhaul to position SAP at the forefront of the AI revolution.

Shares of SAP skyrocketed by 7% in early London trading, a testament to the market's resounding approval of the company's strategic vision. The financial results for the fourth quarter of 2023 showcased a remarkable 5% year-over-year revenue increase, capping off a stellar year where the stock surged by an impressive 50%—its best performance since 2012.

As part of the 2024 restructuring plan, XETR:SAP aims to facilitate voluntary buyouts or support job changes for 8,000 staff, impacting over 7% of its 108,000 full-time workforce. However, the company is keen on maintaining its overall headcount, signaling a shift in focus rather than a downsizing move. The restructuring is strategically aligned with XETR:SAP 's vision to intensify its focus on key strategic growth areas, particularly in Business AI.

XETR:SAP 's commitment to the future is highlighted by a substantial investment of around $2 billion over the next two years, primarily earmarked for reskilling its workforce and preparing for the AI-driven landscape. Chief Financial Officer Dominik Asam emphasized the importance of reskilling employees, stating, "The majority of these people we either want to reskill and transfer to new positions, or offer voluntary measures." However, Asam acknowledged the possibility of non-voluntary departures as the company adapts to the evolving technological landscape.

While XETR:SAP 's cloud computing business continues to thrive, Asam acknowledged a noticeable deceleration in demand for software services. Despite this, he expressed confidence in the company's transformation into a cloud and growth-centric entity, emphasizing the accelerated momentum in SAP's cloud computing endeavors.

As XETR:SAP positions itself at the vanguard of AI innovation, the restructuring signals not only a commitment to staying ahead of technological trends but also a dedication to nurturing and empowering its workforce for the challenges and opportunities that lie ahead. The bold move is a testament to XETR:SAP 's resilience and adaptability, setting the stage for a new chapter of growth and leadership in the dynamic realm of artificial intelligence.

SAP vs. MSFTXETR:SAP shows a strong correlation to NASDAQ:MSFT , which on the surface is not very surprising. But comparing fundamental data and the general company profile can lead to some raised eyebrows.

In my view NASDAQ:MSFT appears to be a much stronger company, which should have little problems capitalizing on the current AI hype for growth and also overall has a much more ubiquitous product portfolio.

Meanwhile, the ongoing strength in the chart of XETR:SAP appears perplexing and one cannot help but wonder what are the fundamental catalysts for these moves are. My assumption is that SAP is currently simply riding the wave as perceived similarity to MSFT. While SAP has a higher dividend yield it shows much less potential for future growth. Its P/E ratio also appears quite exaggerated. I believe the similarity to MSFT is only skin deep.

Unless something fundamentally changes, my hypothesis is that we are due for a correction in $XETR:SAP. Now the RSI on the daily chart indicates overbought conditions, so we can use this opportunity to initiate a medium term short trade. It will be difficult to get the timing right for an put options trade, but we can enter in increments if the trade starts going against us.

First price target for taking profits is 120 with a expiration date before earnings in January 2024.

If you want to hedge the risk, you could also buy MSFT calls to cover the upside potential.

SAP SE: A Mid- to Long-Term InvestmentSAP SE: A Mid- to Long-Term Investment

SAP SE

SAP SE is a German multinational software corporation that develops enterprise software. It is the world's largest independent software vendor by revenue. SAP's products are used by businesses of all sizes in over 180 countries.

Capitalization SAP's market capitalization is approximately $170 billion. The company is listed on the Frankfurt Stock Exchange and the New York Stock Exchange.

Current and Future Projects SAP is currently investing heavily in cloud computing and artificial intelligence. The company's cloud revenue is growing rapidly, and it is developing new products and services that use artificial intelligence to automate business processes and improve decision-making.

Some of SAP's current and future projects include:

SAP S/4HANA Cloud: This is SAP's flagship cloud-based enterprise resource planning (ERP) system. It is designed to help businesses of all sizes transform their operations and become more agile.

SAP Leonardo: This is SAP's suite of artificial intelligence (AI) solutions. It helps businesses to automate processes, improve decision-making, and make better use of data.

SAP Business Network: This is SAP's platform for connecting businesses with their customers, suppliers, and partners. It helps businesses to collaborate more effectively and improve their supply chain efficiency.

Stock Rating

I would rate SAP shares as a Strong Buy for the mid- to long-term. The company has a strong track record of financial performance, growth opportunities, and a strong brand.

It is also well-positioned to benefit from the growth of the cloud computing and artificial intelligence markets. However, there are some risks to consider before investing in SAP shares. These include:

Competition: SAP faces competition from other large enterprise software companies, such as Oracle and Microsoft.

Technology risk: SAP's business depends on its software products. If the company is not able to keep up with the latest technologies, it could lose market share to its competitors.

Geopolitical risk: SAP operates in many countries around the world. If there is a political crisis in any of these countries, it could disrupt the company's operations and its share price.

Overall, I believe that SAP shares are a good investment for investors who are looking for a company with a strong track record of financial performance, growth opportunities, and a strong brand. However, investors should be aware of the risks associated with investing in enterprise software stocks.

Conclusion SAP is a well-established company with a strong track record of financial performance. It is also well-positioned to benefit from the growth of the cloud computing and artificial intelligence markets. I believe that SAP shares are a good investment for the mid- to long-term. However, investors should be aware of the risks associated with investing in enterprise software stocks.

Risk Warning

Trading stocks and options is a risky activity and can result in losses. You should only trade if you understand the risks involved and are comfortable with the potential for losses.

Rating: Strong Buy

Risk Disclaimer!

The article and the data is for general information use only, not advice!

The Trade Academy Team - The Professional Trader

Risk Disclaimer!

General Risk Warning: Trading on the Financial Markets, Stock Exchange and all its asset derivatives is highly speculative and may not be suitable for all investors. Only invest with money you can afford to lose and ensure that you fully understand the risks involved. It is important that you understand how Trading and Investing on the stock exchange works and that you consider whether you can afford the high risk of loss.