EURPLN trade ideas

EUR/PLN SHORT Investment Opportunity 4HHello, I am Trader Andrea Russo and today I want to show you a SHORT investment opportunity on EUR/PLN. We are currently on a 4-hour (4H) chart, and some technical indicators suggest increasing bearish pressure. The overbought signals and the loss of momentum suggest that we could be facing a possible bearish reversal, making this configuration particularly interesting.

Here is the Investment Setup:

The entry price for the trade is set at 4.2854.

There is a SELL signal with a target price set at 4.2066, corresponding to a TP of 1.85%.

The stop loss is set at 4.2593, corresponding to a SL of 0.61%.

This short position offers a favorable risk/reward ratio, taking advantage of the current bearish pressure and the possible confirmation of a bearish trend on EUR/PLN.

As always, I encourage you to monitor this setup carefully and apply strategic and conscious risk management to your trading plan. Happy trading! 📉

Zloty vs Euro 5.20 - timespan boundariesTwo years ago, I found the probability with the current zloty price of 4.15 PLN; and forecasted new extremum terminal point >6.5 zloty per single euro. The first part of the prediction has worked out, 4.15 was reached.

How i received the 6.50 PLN value? I got the value by applying the Elliott Wave Principle: this is the height of the first wave, primary degree. At the moment the chart is at the second wave end. I think so because there is an exit outside the channel, it is an indicator. According to the principle - the third wave cannot be the shortest in the impulse, so the target is above 6.5+.

Today, the time boundaries became obvious to me.

I think 5.20 PLN target per single EUR may be reached by the end of Trump presidency. Thus, by the end of 2028. This target will coincide with the upper trend channel and may match with the end of the first sub-wave of the minor degree of the primary third wave.

In 2024 December i also made forecast for DXY dollar index: ~112% and ~85%. The first part of that prediction has already worked out at 110.217%. The second part of the probability may be more swift, thus we may see 94-85% DXY values during 2025. Which could lead to 5.20 at PLN already in 2025. We will know this soon...

Good luck with your investing strategy, have fat profits and remember - there are no guaranties on the markets, only probabilities.

EUR/PLN 4H SHORT Selling Opportunity

Hello, I am Trader Andrea Russo and today I want to show you a SHORT investment opportunity on EUR/PLN. We are currently in a 4-hour chart (4H) and my indicator "WaveTrend + Multi-Timeframe Alerts", published in the SCRIPT section of my TradingView profile, signals an overbought situation both at 4H and 8H. In addition, we are also in a downtrend phase, so we have more signals that support this opportunity.

In the attached chart we can observe the following details:

The current price is around 4.62400.

There is a SELL signal with a target price set at 4.61400, corresponding to a TP of 1.06%.

The stop loss is set at 4.63400, corresponding to a SL of 0.32%.

The suggested short position has a favorable risk/reward ratio.

These combined signals indicate a potential downtrend reversal, making this setup particularly interesting for investors looking for short selling opportunities on EUR/PLN.

I encourage you to monitor this setup closely and act prudently, always considering risk management in your trading plan. Happy trading!

Zloty Long Trade SetupCurrent Position:

FPMARKETS:EURPLN recently approached the lower bound of its trading range for the past year, presenting an attractive entry point for a long trade.

Supporting Factors:

NBP Hawkishness: The National Bank of Poland's hawkish guidance at its December meeting has supported the zloty, but risks of an earlier-than-expected rate cut may weaken it.

External Risks: Potential trade frictions under the incoming US administration could hurt the European outlook and indirectly weigh on Poland's economy.

Technical Setup:

The technical backdrop supports a higher FPMARKETS:EURPLN , suggesting bullish potential.

Risks:

A swift resolution to the Ukraine war, as indicated by President-elect Trump’s intentions, could strengthen the zloty and pose downside risks to the trade.

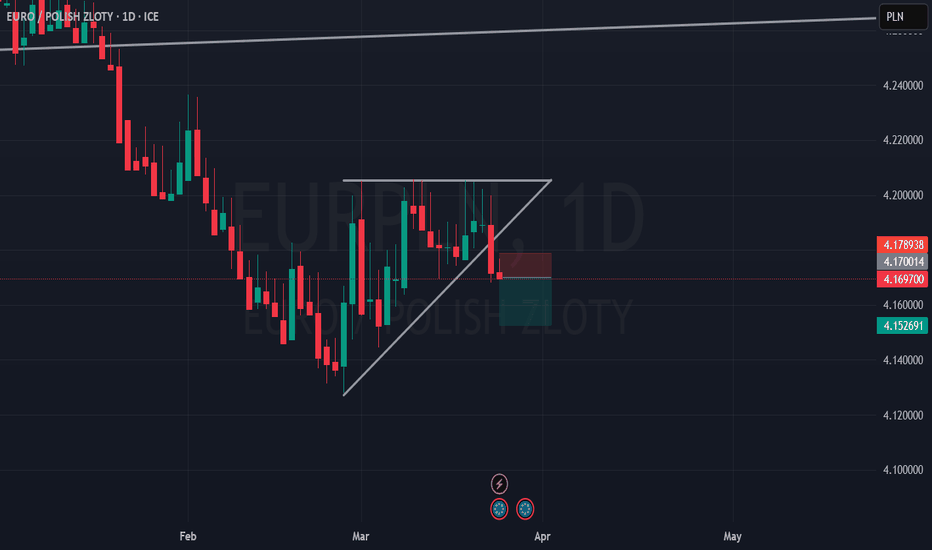

EURPLAN MARKET ANALYSIS AND PRICE PREDICTIONEURPLAN has started consolidating at the renegotiation zone. I think the final decision will favor the Bull. In few days if there is an order in favor of the Bulls, the it will retrace a little to retest the order block and give the Bulls a good entry position. Lets watch and see what will happen!

Entry, take profit and Stop loss are all well stated on the chat.

Good Luck Guys!

Polish Zloty target and trend channel supportFacts:

1) This is a third time price is testing the trend channel support.

2) We see on MACD oscillator is the reversal is started.

There is a possibility that the support will be broken, but the previous Global financial crisis, the EURPLN pair acted in the opposite direction. If this time mechanics will work out the same way, price may hit 6.4 PLN per single EUR.

As per time span, according to previous GFC's stats, once it started it may last whiting 10-15 months

EURPLN Trade Signal: SellWe are issuing a Sell signal for the EURPLN currency pair. The entry price is set at 4.28464 , with a Take Profit target at 4.26977667 and a Stop Loss at 4.30147667 . This prediction is made using the EASY Quantum Ai strategy.

Trade Parameters:

Direction: Sell

Enter Price: 4.28464

Take Profit: 4.26977667

Stop Loss: 4.30147667

Rationale:

1. Technical Analysis: Our analysis shows significant resistance around the 4.3000 level. The currency pair has struggled to break this barrier, indicating a potential downside move.

2. Economic Indicators: Recent economic data from the Eurozone suggests weakening fundamentals, which could negatively impact the EUR and lead to a decrease in EURPLN.

3. Momentum Indicators: RSI and MACD indicators are signaling overbought conditions, suggesting a downward correction is imminent.

4. Polish Central Bank Policy: The National Bank of Poland has shown signs of potential intervention to support the PLN, adding fundamental pressure on EURPLN.

Please Note:

Trading carries risk, and it is crucial to follow risk management practices. This signal should be used alongside your own analysis and judgment.

Use this information wisely and trade safely!

EURPLN Short Trade SetupAfter conducting an analysis on EURPLN, we are excited to present our trade setup.

This opportunity boasts a favorable risk/reward ratio, although it does require patience due to a longer waiting period.

Nevertheless, swing traders may find this setup intriguing and worth considering.

EUR/PLN Bearish Momentum Building Below 200 EMA

⚫Back in April 2024, the EUR/PLN pair tested the 4.2500 support zone, where a triple bottom was established. Over the past five months, the price has consistently failed to break below this level. Simultaneously, we can identify a resistance area near 4.3750, where a double top was formed, indicating a clear trading range between 4.2500 support and 4.3750 resistance—a classic example of range trading.

⚫Looking at the broader picture, in January 2024, the 4.4100 area, previously a support level, flipped to become resistance, confirming the continuation of a long-term bearish trend. Additionally, EUR/PLN remains below the 200 Exponential Moving Average, further reinforcing the likelihood of continued downward movement.

⚫Recent price action, particularly from an Elliott Wave perspective, suggests the formation of an ABC corrective pattern, which was halted at the 4.3311 resistance level, precisely aligning with the Volume Profile. (For those unfamiliar, the Volume Profile highlights the price level where the most trading volume occurred.)

⚫Analyzing the potential Elliott Wave count, EUR/PLN appears to be progressing into the strongest downward wave—wave 3. Overall, the technical outlook remains exceptionally bearish for the long term. As a downside target and potential final support for the 5-wave decline, we can consider the double 227.2% Fibonacci support, located around the 4.1425 area.

⚫While the odds strongly favor the downtrend, it's crucial for traders to remain vigilant. In the event that the price breaks above the 4.3750 resistance, it could signal the beginning of a shift from a bearish to a bullish trend.

EURPLN Trade Signal: BuyWe have identified a trading opportunity for the EURPLN currency pair based on a thorough analysis using the EASY Quantum Ai strategy. The market indicators suggest a potential upward movement. Here are the details:

Direction: Buy

Enter Price: 4.29711

Take Profit: 4.30743

Stop Loss: 4.27908

The rationale behind this signal is several key factors, analyzed through our advanced algorithm:

1. Economic Indicators: Recent economic data from the Eurozone shows positive momentum, with GDP growth and employment figures beating expectations. Poland's economic indicators are also solid, but the Eurozone's strength appears to outweigh current resistance levels.

2. Technical Analysis: Technical indicators, including moving averages and trend lines, show a strong buy signal. The EURPLN pair is trading above its 50-day moving average, indicating a sustained upward trend.

3. Market Sentiment: Market sentiment and investor confidence in the Eurozone have increased recently due to improved geopolitical conditions and successful monetary policies.

4. Relative Strength Index (RSI): The RSI is indicating that the pair is not yet in an overbought state, leaving room for upward movement.

5. Interest Rate Differential: The interest rate differential between the Eurozone and Poland is currently favoring the Euro, providing additional support for the bullish outlook on the EURPLN pair.

Please monitor the price levels closely and adjust your risk management strategies accordingly. As always, ensure that you stay updated with any economic news that might impact the currency pair.

Happy Trading!