EURPLN trade ideas

The euro doesn’t stand a chance against the Polish zlotyDespite the strength of the euro against other major currencies such as the US dollar, it, unfortunately, doesn’t stand a chance against the Polish zloty. In fact, bears have been slowly and steadily dragging the pair, and now it’s heading towards its support level. It’s believed that prices will go down to its lowest ranges in nearly five months as the Polish zloty works to recover the euro’s major gains from the beginning of the pandemic. What’s slowing down the Polish zloty now is the fears of another wave of coronavirus infections in the nation. That would further harm the economy and do more damage to the zloty. The reopening of economies in the region has benefited almost all of the currencies there, and the zloty is no exemption. One of the main factors that have affected the Polish zloty is the recent election in the country. Just recently, Poland’s top court ruled that the results of the presidential elections were valid, closing the argument for now.

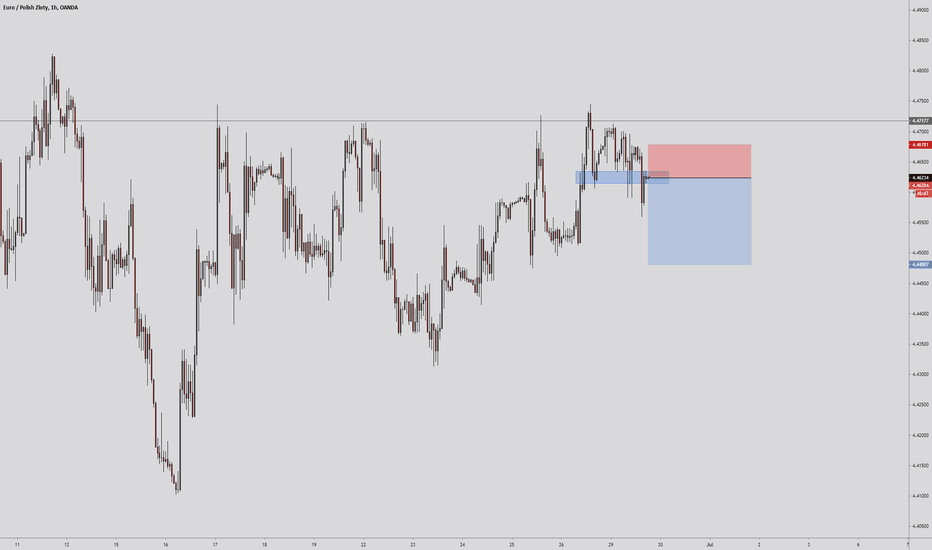

EURPLN double top on the 0.618 🦐The market has retraced in a inside a channel till the 0.618 fib level and created a double top.

Now the price is moving down and if the price will manage to break the channel and consequently will break the 4h structure we can look for a nice short order according with our strategy.

–––––

Follow the Shrimp 🦐

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

EUR/PLN - still within a trend channelThe EUR/PLN currency pair has been moving within a trend channel since the end of March. The pair has tested the lower limit of the channel as a potential support area and also has tested the upper limit as potential resistance.

Last week it has been defended so the market may move to the next potential support at 4,36 or at the line drawn through the bottoms.

It seems that only a breakout of the upper limit of the channel may change the sentiment from bearish to bullish.

________

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

EURPLN triangle range 🦐 The market has been retracing till the 0.5 fib level and price is moving inside a triangle pattern.

If the market will manage to break the triangle and break also the lower yellow structure we can set a nice short order according with our strategy.

–––––

Follow the Shrimp! 🦐

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

Update idea

Polish central bank is concerned about the strength of the PLNEarlier this month, the Polish central bank signaled that it’s highly concerned about the strength of the Polish zloty. According to the central bank, it prefers the zloty to be weaker to help the economy recover much more efficiently amid the coronavirus pandemic. This paved the way for the euro bulls to force the pair higher towards its resistance level in the sessions. Looking at it, both the zloty and the euro are relatively weak, but the tides are still in favor of bulls. Moreover, investors of the exchange rate are focusing their attention on the presidential elections in Poland. Conservative President Andrzej Duda is facing the current mayor of Warsaw and Liberal party candidate Rafal Trzaskowski in the upcoming second round of voting in the country due in two weeks’ time. The results would have a significant impact on the direction of the Polish zloty as it would determine the approach of the government’s coronavirus rescue and recovery plan.

EURPLN FLAT correction 🦐EURPLN is in a FLAT correction (ELLIOTT's Waves) and broke a wedge. We will aspect a impulsive wave in order to reach the 'C' Point

According to Plancton strategy, we can set a nice order

–––––

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

EURPLN A Great Buying OpportunityTrade Proposal:

There is a probability of first tp to the proposed (4.51700) Direction line. So, Traders can set orders based on Price Action and expect to reach short-term goals.

Technical analysis:

EURPLN Waiting for the Range Bound and the beginning of the Ascension Trend.

TP1= 4.51700

TP2= 4.57272

EURPLN the price continues to falling downEURPLN the price continues to falling down, after a little bounce to upside, the price wants to fill the weekly bear candle.

According to Plancton strategy, we can set a nice order

–––––

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.