EURSGD trade ideas

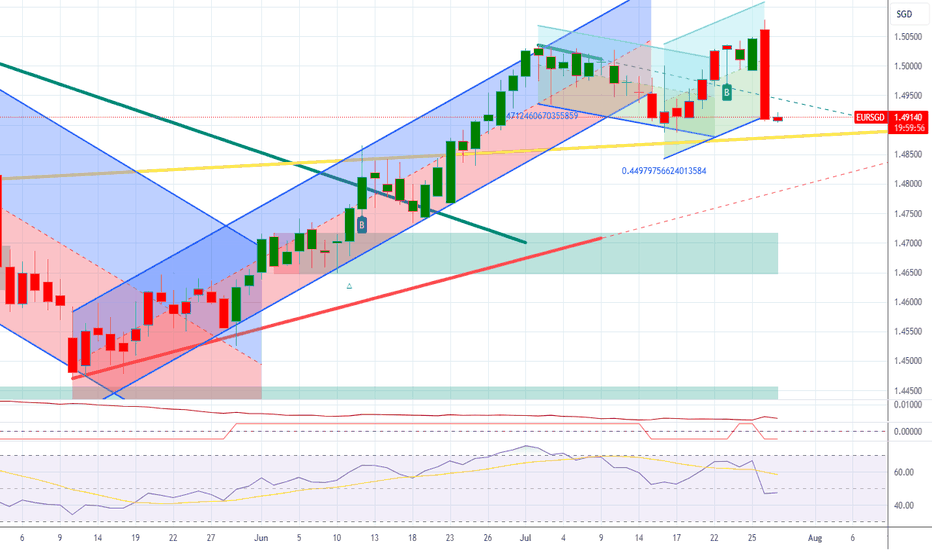

LONG EUR/SGD Investment Opportunity

Entry: 1.46708 Take Profit (TP): +1.33% Stop Loss (SL): -0.86%

📊 Market Overview

EUR/SGD is in a strategic zone, with an entry level set at 1.46708, an area that could act as a key support. The idea of this LONG trade is based on a possible resumption of the trend, taking advantage of a bullish movement in case of confirmation of the momentum.

🔍 Technical Analysis

Key Support: The price has tested the entry level several times, suggesting a potential base for a restart.

Resistance: The TP target implies a movement of +1.33%, indicating a possible breakout to new highs.

Stop Loss: The protection set at -0.86% helps manage the risk and minimize any losses.

📈 Risk Management

Capital management is crucial. With a Stop Loss of 0.86%, the risk is well calibrated against the potential gain of 1.33%, maintaining a positive risk/reward ratio.

🔥 Conclusion

If the price confirms the support and shows signs of strength, this LONG strategy on EUR/SGD could generate a favorable opportunity. However, it is always essential to monitor the market conditions and adjust the strategy if necessary.

EURSGD Trading Signal - EASY Quantum AI StrategyDirection: Buy

Enter Price: 1.41305

Take Profit: 1.41667667

Stop Loss: 1.40751667

This trading signal for the EURSGD pair is generated using the EASY Quantum AI Strategy. The decision to buy is based on strong historical patterns identified through extensive analysis. Our AI system continuously evaluates market conditions, recognizing optimal entry points with a high probability of upward movement.

Rationale:

1. Volatility Analysis: Recent market behavior has shown a stable increase in volatility, typically indicative of potential bullish trends.

2. Support Level Testing: The current support levels around the entry price have been consistently retested, suggesting potential upward momentum.

3. Technical Indicators: Momentum indicators point towards buyer dominance, reinforcing the likelihood of success at the set take profit level.

This signal is designed to optimize risk-reward ratios. Ensure effective risk management by adhering strictly to the indicated stop loss and take profit thresholds.

This analysis demonstrates the power of the EASY Quantum AI Strategy, focusing on precision and adaptive market response.

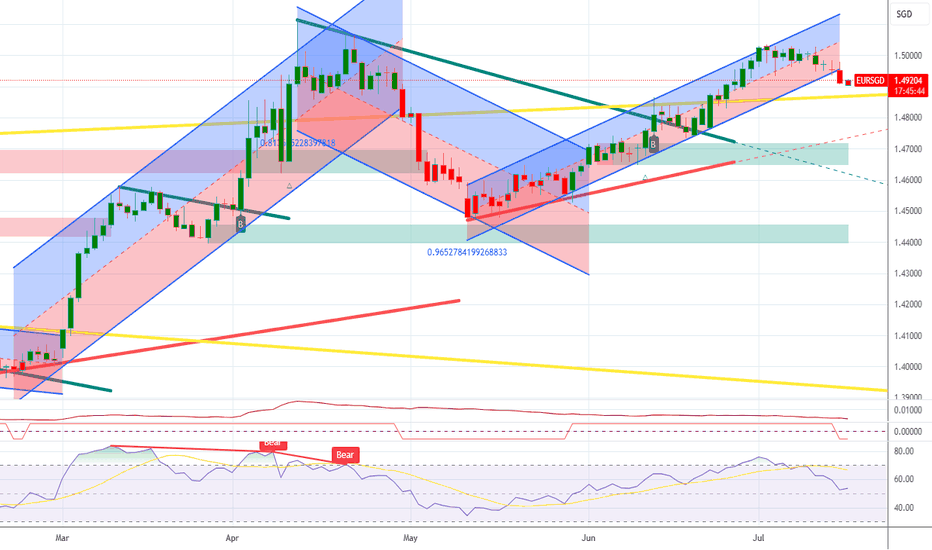

EUR/SGD - soon to begin move downAfter having completed 5 waves up from Sep'22 to Jul'23, EUR/SGD is coming down in what is likely a corrective ABC move, in which the A wave and B wave (in the form of an ABCDE correction) are already complete. A C wave is now due which would ideally take the rate down to the 0.618 retracement of the 5-wave move up at 1.416 SGD per Euro.

EURSGD Trading Signal: SellTraders, we have identified a promising opportunity in the EURSGD currency pair.

Direction: Sell

Enter Price: 1.44119

Take Profit: 1.43900333

Stop Loss: 1.44277333

Justification:

This signal is based on the analysis executed by the EASY Quantum Ai strategy. The following factors were taken into consideration:

1. Trend Analysis: Recent charts indicate a downtrend in the EURSGD pair, showing consistent lower highs and lower lows.

2. Moving Averages: A cross-over of short-term moving averages below long-term moving averages confirms bearish momentum.

3. Resistance Levels: EURSGD has faced strong resistance near the enter price, 1.44119, suggesting it is less likely to see an upward breakout in the short term.

4. Market Sentiment: Overall sentiment analysis points towards a bearish outlook owing to Eurozone's economic data contrasted with the stable performance of the Singaporean Dollar.

This trade setup suggests selling at 1.44119, targeting a profit at 1.43900333 while placing a conservative stop loss at 1.44277333.

As always, ensure you apply appropriate risk management strategies when entering this trade. Happy Trading!

Exploring Long Positions in EUR/SGD: A Probabilistic ApproachThe Euro to Singapore Dollar (EUR/SGD) pair is showing potential for a bullish trend, supported by several key fundamentals.

The European Central Bank's recent hawkish stance on monetary policy, coupled with expectations of further interest rate hikes, is strengthening the Euro against many currencies, including the Singapore Dollar.

Additionally, the improving economic outlook in the Eurozone, with signs of resilience in manufacturing and services sectors, is contributing to the Euro's positive momentum. On the other hand, Singapore's export-dependent economy is facing headwinds due to global trade tensions and a slowdown in China, which may put pressure on the Singapore Dollar.

I'm looking to capitalize on this bullish bias for EUR/SGD by utilizing probabilities to enter long positions.

12M:

1W:

1H:

Please feel free to share your ideas.

EURSGD - Making a Complete 180Similar structure to the AUDSGD trade idea I just published, but I have a few more points to add here.

I was originally short this pair.

I attempted to make another attempt to enter short and ended up taking out a loss.

Since price broke to the upside of this range, my directional bias has changed from bearish to bullish.

Momentum picked up nearing last Friday's close and the moving average crossover is an indication of potential price acceleration for the week ahead.

Continuation Trade On EURSGDEURSGD started consolidating at the beginning of September and then broke below this range 14 days later. Price retraced back to the lower boundary of the previous range and is currently holding below.

This is a good indication that selling pressure remains strong. As long as price is holding below this range, a swing trade potential is possible.