EURTRY trade ideas

EURTRY - 240 - Ready to pop?Trade Alert

We are trying to slightly jump ahead of ourselves here, but it could work out.

What are waiting for a break above the 6.165 barrier, before we could examine higher areas, as such a move would confirm a forthcoming higher high.

Be cautious and keep your eyes on the price action.

Don't forget your stop-loss.

I am affraid it is time to short the Turkish LiraThis trade is not part of my usual price action trading strategy. It is longer-term play based on the Ichimokucloud technicals (kumo turning bullish on eurtry and chikou broke past prices), but also the fundamentals. As the new year has come, prices of essential things like energy and water have doubled for my family living in Turkey. Other bills for the new year still need to come in but are expected to show the same increases. This was to be expected as Turkey has financed almost all energy infrastructure with foreign (USD) debt and USD interest rates are rising. It is mathematically impossible to keep energy rates as low as they were, as total national energy revenues hardly covered interest payments on these foreign loans. As energy prices will rise all other prices will have to rise eventually. If Turkey is to remain competitive as an exporter then in the short term (next half year to year) the TRY will need to depreciate. The down-side is that it will make foreign debt even heavier. It is a tough choice, but I think the powers that be rather have higher inflation of which they can control the reporting of the numbers to the people. Inflation will erode purchasing power, but also all the consumer debt Turkish people have taken on in the form of Taksit (paying in installments). The subsequent devaluation of the TRY will keep the economy going keeping nominal growth figures presentable. There will be no actual growth, but this will not be visible immediately to the man in the street. The devaluation of the Turkish Lira can also be explained as a plot by the West to stop Turkey in its growth. Rich Turks move out of cash into hard assets such as land and real estate fulling the bubble even more. Smart Turks will buy Gold and Silver as holding other currencies then the Turkish Lira has already been frowned upon.

So, as it turns out the same is happening in Turkey as is happening all over the world. The rich will get richer as they move into real assets, the poor will get poorer as everything gets more expensive.

OK, this has been a pretty negative few on the situation. Honestly, I hope it will not play out.

For a more positive outlook, I suggest the following reports by the state-owned TRT World news channel: www.youtube.com

www.youtube.com

I am hopeful for the long-term outlook for Turkey, knowing the resilience of the Turks (something we have lost here in the west i.m.h.o.) and the fact that Turkey and the Turks have always have had an appreciation for and understanding of real Money in the form of Gold and Silver.

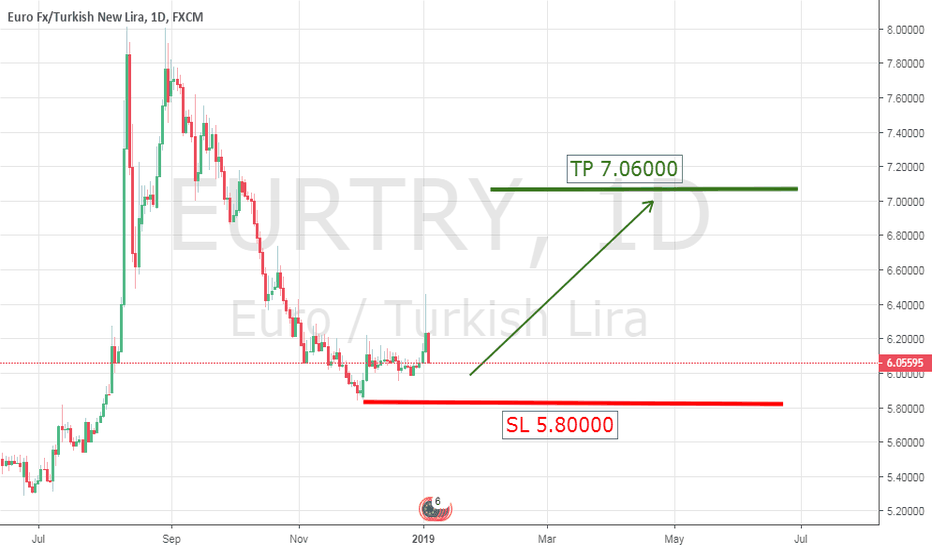

EUR/TRY LONG IDEA. History can and does repeat itself!Refer to my USD/TRY idea linked to this idea. When I trade one pair, I also like to study the market structure of correlating pairs. USD/TRY and EUR/TRY correlating pairs. In my high level analysis we see that both pairs experienced the nicest nice bounce off the 61.8 fib level and would have been a perfect entry point, as we can see price action was swift to the upside. Also, I used the bars tool simulator, taking a snipped from this pair's history to predict future movement. If history repeats itself, could this move be the future of this pair as well as that of USD/TRY since they correlate? Note, price is still respecting the trendline as well with this idea. Now we know that although in Forex history tends to repeat itself, the market is also dynamic. Many factors can impact price action. Be sure to watch the direction of the Turkish Lira. This idea is for demonstration and educational purposes only. Trade at your own risk. This is not a signal. Price could very well not reach these highs.