EURUSD I Its re-accumulation. COT Overview Hey what up traders welcome to the COT data and Liquidity report. It's always good to go with those who move the market here is what I see in their cards. I share my COT - order flow views every weekend.

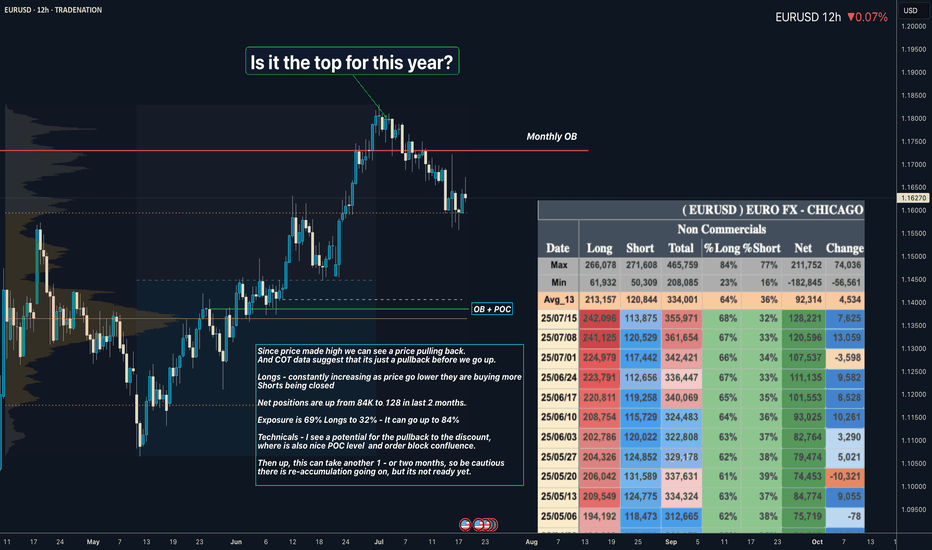

🎯 Non Commercials added significant longs and closed shorts at the same time. So for that reason I see the highs as a liquidity for their longs profits taking.

📍Please be aware that institutions report data to the SEC on Tuesdays and data are reported on Fridays - so again we as retail traders have disadvantage, but there is possibility to read between the lines. Remember in the report is what they want you to see, that's why mostly price reverse on Wednesday after the report so their cards are hidden as long as possible. However if the trend is running you can read it and use for your advantage.

💊 Tip

if the level has confluence with the high volume on COT it can be strong support / Resistance.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

EURUSD trade ideas

EUR/USD Elliott Wave Count Signals Downside TargetsThe EUR/USD chart is displaying a completed 5-wave Elliott impulse structure, suggesting the potential start of a larger corrective move to the downside. Wave 5 appears to have finished after a classic ending diagonal pattern, with price now breaking below the wave 4 support trendline — a strong confirmation of trend exhaustion.

Currently, price is retracing upward towards the 0.5–0.618 Fibonacci retracement zone of the last impulsive leg, around 1.15912–1.16383, which may serve as the final rejection zone for bears to re-enter. This area aligns perfectly with prior support-turned-resistance and is considered the potential reversal pocket.

If price holds below the 1.17869 invalidation level, the structure supports the beginning of an ABC correction or a larger bearish impulse.

Target 1 (T1): 1.14800

Target 2 (T2): 1.13915

Stop Loss (SL): 1.17869

This scenario remains valid as long as the price does not break above 1.17869. A clean break and close above this level would invalidate the bearish setup and suggest a possible wave extension.

EUR-USD Will Fall! Sell!

Hello,Traders!

EUR-USD will hit the

Horizontal resistance of 1.1620

On Monday after making a

Powerful move up on Friday

And as the pair is locally

Overbought a local bearish

Correction is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

My Trading Journal on EU 01.08.2025On the first day of August 2025, I am entering a new month filled with opportunities. I am eager to see how the EU performs today, as it has influenced my last two trades. I hope that today marks either a strong or weak start to the month. Let's see how the market reacts in New York.

Be cautious with your trades and remember to pay attention to the high-impact news today: the Non-Farm Payrolls (NFP) and Employment Change reports.

Fiber (EurUsd) Short Idea. Aug 4-8 This Idea wont be precise as my Last Euro Analysis, You can check that out on my Profile.

Now the what do i mean by it not being precise? it means that there is room for upside Movement But it should break that high (Fib high) and the target is Sell-Side Liquidity for this week Key Things in this charts are Liquidity gap, Breaker block IFVG weekly Inverse rejection block.

EURUSD The Week AheadKey Support and Resistance Levels

Resistance Level 1: 1.1716

Resistance Level 2: 1.1817

Resistance Level 3: 1.1885

Support Level 1: 1.1466

Support Level 2: 1.1390

Support Level 3: 1.1338

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Will EURUSD dump on Tuesday?Overall EU is quite bullish, but on Monday price sold creating an imbalance. Which we anticipate before price to continue high we need to retrace and fill the imbalance to push price high.

We take advantage of the retracement back to the imbalance and look for our entry during the London Open time range. Obvious it will be a sell-off.

EURUSD: The Market Is Looking Up! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.14350 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1.14588.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

“Exactly What I Saw” promises value and transparency.

In today's analysis, I’ve identified a clear completion of Wave D, securing a 3% ROI across just two trades – all before the move unfolded.

🔍 What’s inside this breakdown?

• Multi-timeframe analysis: Weekly ➝ Daily ➝ 4H ➝ 1H

• Elliott Wave structure with confluence zones

• Trade psychology at key turning points

• Exact entry & exit insights explained

• Risk management for consistent returns

---

⚡ Highlights:

Precise reversal spotted before it was obvious

No indicator clutter – just clean, confident price action

Part of my 100-day breakdown series: real, raw, and repeatable setups

---

👣 Day 7 of 100 is just the beginning.

Tap Follow to stay ahead of the market – one wave at a time.

#EURUSD #ForexAnalysis #ElliottWave #Forex #TradingViewUK #SwingTrading #PriceAction #RiskReward #FXMindset #ForexTradersIndia #ForexEducation

EURUSD short to 1.121Hello Traders,

Factoring in the fundamentals such as US EUR trade deal, $600 billion of investment into US, $350 billion investment from South Korea.

4hr chart, trading under 1 day up trendline.

Was strong sell signal from 1.177 last Thursday.

200ema starting to turn downwards

Still close to upper regression channel that began July 1st, believe it is still in play.

6 hr and 12 hr block still support, strong rejection at 4h bearish block. not expecting much else today since it's Friday. Still targeting 1.121 in August

Originally entered trade at 1.172 area, added 3 times on the way down, originally targeting 1.143 but with the ever evolving trade deal news that I believe to be bullish for the USD I moved target to 1.121.

Goodluck to you all.

My Trading Journal on EURUSD 04.08.2025The first week of the month presents a new opportunity for everyone—don't give up on your dreams!

Last week was fantastic, especially with the Non-Farm Payroll (NFP) report, which had a significant impact on the market. We hope this week will also be a great one, especially since there are no major red folder news events today.

Let's keep an eye on how the GBPUSD, EURUSD, and XAUUSD perform.

EUR/USD Setup Is Ready This is a bullish EUR/USD (Euro/US Dollar) 1-hour chart analysis. The setup indicates a potential upward reversal after a downtrend, supported by a series of higher lows.

Key elements:

Entry Point: Around 1.14044–1.14376.

Stop Loss: Placed below the recent low at 1.12770 to manage risk.

Targets:

First Target: 1.15034

Second Target: 1.15892

Third Target: 1.17238

The chart suggests a buy setup with a risk-reward strategy, aiming for a breakout and continuation towards higher resistance levels. The large upward arrow emphasizes bullish momentum expectations.

EURUSD – DAILY FORECAST Q3 | W32 | D4 | Y25📊 EURUSD – DAILY FORECAST

Q3 | W32 | D4 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURUSD