EURUSD trade ideas

EURUSD 4H AnalysisAfter a strong bearish move, EURUSD has now tapped into the PD Low and shown a reaction. Structure remains bearish, but current price action near 1.1400 could lead to short-term retracement.

🔍 Key Levels:

PD High – 1.1560: Strong supply zone, key bearish continuation level

1.1500–1.1450: Broken support, may now act as resistance

PD Low – 1.1400: Demand zone, current price reacting from here

📌 Potential Scenarios:

Short-Term Bounce from PD Low:

Price reacting from 1.1400 demand.

Intraday retracement toward 1.1470–1.1500 possible.

Watch for bullish price action confirmation on lower timeframes.

Bearish Continuation if price retests 1.1500–1.1550:

Ideal area to look for fresh shorts.

Continuation move could target 1.1350 or lower.

🎯 Bias: Still bearish unless we break and hold above 1.1560 (PD High).

Patience is key. Let price test zone and wait for clear reaction before committing.

EURUSD BUY SET UPI'm looking to go long on EURUSD if price pulls back to the 1.14249 level — a key zone of interest backed by previous market structure.

🔹 Entry: Buy Limit @ 1.14249

🔹 Rationale:

Previous support/resistance flip

Confluence with market structure

Clean retracement zone with potential bullish reaction

📉 No impulse buying — I’m letting price come to me.

📊 Chart attached for visual clarity.

Trade safe. Plan your trade, and trade your plan.

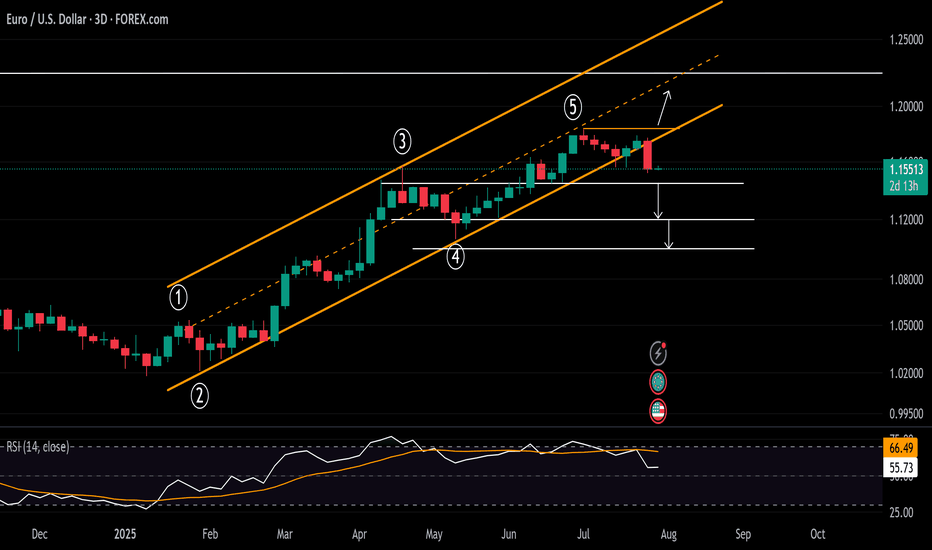

EURUSD Wave Analysis – 30 July 2025- EURUSD falling inside accelerated impulse wave c

- Likely fall to support level 1.1200

EURUSD currency pair recently broke the support trendline from February, coinciding with the 38.2% Fibonacci correction of the upward impulse 1 from May.

The breakout of these support levels accelerated the active impulse wave c, which then broke the support at 1.1460.

EURUSD currency pair can be expected to fall further to the next support level 1.1200 (former strong support from May).

EURUSD - quickly getting to major supportIn my view EUR reversed and will continue downtrend for few weeks. However the price is quickly getting to significant support at 1.13500. The cluster is created by FR 0.618 and One to One with previous correction. I expect the price to make correction from the support and go up even to 1.15500

EUR/USD SHORT — FRACTAL RENKO TRAP REVERSAL

🔻 EUR/USD SHORT — FRACTAL RENKO TRAP REVERSAL

Codex Execution | Tier 2 Rejection | Macro Gravity | TP1–TP10 Ladder Active

⸻

📍 TRADE SNAPSHOT

• Entry: 1.1665

• Stop Loss (SL): 1.1800 ✅ (Tier 2 pivot)

• Macro Direction (T1): 📉 Down

• Tier 2 Structure: 🔻 Bearish Flip Confirmed

• Execution Tier: Tier 2 rejection → continuation active

• Risk Size: ✅ Full position (SL = 135 pips)

• Trade State: ⚔️ Armed

• Trail SL: Activated post-TP1 → using Tier 3 pivots

⸻

🎯 TP LADDER MAP (Fixed Tier 2 Grid)

Level Price Status

🥇 TP1 1.1600 ✅ Hit

🥈 TP2 1.1500 ✅ Hit

🥉 TP3 1.1400 ⏳ Pending

🎯 TP4 1.1300 ⏳ Pending

🧨 TP5 1.1200 ⏳ Pending

💎 TP6 1.1100 ⏳ Pending

🔓 TP7 1.1000 ⏳ Pending

🔻 TP8 1.0900 ⏳ Pending

🔻 TP9 1.0800 ⏳ Pending

💀 TP10 1.0700 ⏳ Pending

🧠 TP ladder is mapped to Tier 2 (100 pip) round-number bricks — not floating from entry — per Codex IV structure logic.

⸻

🧠 STRUCTURAL RATIONALE

• Tier 2 Fib trap rejection confirmed @ 1.1665 (within 127.2–161.8% extension)

• Downtrend continuation brick confirmed below trap zone

• Tier 1 macro trend = bearish

• TP1 + TP2 already hit

• Trade now approaching TP3 zone (1.1400)

⸻

⚔️ TRADE MANAGEMENT PLAN

• ✅ SL trailed to breakeven after TP1

• ✅ Partial scale-out at TP1 / TP2

• 🔁 Add-on only allowed if:

• Retest rejection near 1.1500–1.1540

• OR clean body close below 1.1440

• ❌ No re-entry inside 1.1440–1.1500 dead zone

⸻

✅ EXECUTION FILTER STATUS

Condition Status

T1–T2 Alignment ✅

Trap Rejection Confirmed ✅

SL outside structure ✅

TP1–TP2 Reached ✅

Entry Trigger: Brick Close ✅

Macro Compression ❌

Time Cutoff (Pre-3PM EST) ⚠️ Confirmed OK

⸻

#EURUSD #FractalRenko #Tier2Trap #TP1toTP10 #CodexExecution #RenkoTrading #ShortSetup #InstitutionalFilter #TradingViewIdea #TrailLogic #RewardLadder

⸻

EUR/USD Analysis:🔹 Performance Overview:

The short-term trend is bearish after breaking the recent low. A temporary price correction is likely before the downtrend continues.

1️⃣ Holding above 1.151 USD may lead to a correction toward 1.160 USD.

2️⃣ However, a break and close below 1.145 USD could push the price down to retest 1.140 USD, followed by 1.135 USD.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

Getting short on EUR/USD!The dollar has looked set for a reversal and coming into the week it didn't hang around at all. I had a bit of a short bias on EUR/USD and was looking for confirmation signal which pretty much came at market open.

Price pushed higher back into the key level taking out a short term high, but was unable to follow through to form a new higher high. Heading into Monday London session, momentum immediately took hold with a clear bearish change of character and price didn't look back > breaking structure and key levels with minimal effort.

I was waiting for a pull back to get short early which didn't occur. But no need to chase price, waiting and patience is part of the game.

Price has now broken another key support level and is set to retest it as resistance. This will be my entry point (see screenshot) > using the 70.5%-78.6% fib retracement level and my stop above Tuesdays high. Keep it simple.

s3.tradingview.com

Market Analysis: EUR/USD Dips FurtherMarket Analysis: EUR/USD Dips Further

EUR/USD extended losses and traded below the 1.1600 support.

Important Takeaways for EUR/USD Analysis Today

- The Euro struggled to clear the 1.1800 resistance and declined against the US Dollar.

- There is a key downward channel forming with resistance at 1.1575 on the hourly chart of EUR/USD.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair failed to clear the 1.1800 resistance. The Euro started a fresh decline below the 1.1720 support against the US Dollar.

The pair declined below the 1.1660 support and the 50-hour simple moving average. Finally, it tested the 1.1520 level. A low was formed at 1.1519 and the pair is now consolidating losses. The market is showing bearish signs, and the upsides might remain capped.

There was a minor increase toward the 23.6% Fib retracement level of the downward move from the 1.1770 swing high to the 1.1519 low. Immediate resistance on the upside is near the 1.1575 level.

There is also a key downward channel forming with resistance at 1.1575. The next major resistance is near the 1.1665 zone and the 50-hour simple moving average or the 50% Fib retracement level.

The main resistance sits near the 1.1770 level. An upside break above the 1.1770 level might send the pair towards 1.1800. Any more gains might open the doors for a move towards 1.1850.

On the downside, immediate support on the EUR/USD chart is seen near 1.1520. The next major support is near the 1.1465 level. A downside break below 1.1465 could send the pair towards 1.1350.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Fundamental Market Analysis for July 30, 2025 EURUSDEvents to watch today:

30.07 15:30 EET. USD - Gross Domestic Product

30.07 21:30 EET. USD - FOMC Rate Decision

EURUSD:

Exclusive for our readers – a 202% bonus on deposits of $202 or more! Give the promo code PROFIT202 to customer support and start trading with TRIPLED capital.

EUR/USD remains under pressure amid stronger demand for the US Dollar ahead of the Federal Reserve decision (July 30, 2025). Market sentiment reflects the perception that the recent US–EU trade arrangements are relatively more favorable for the US economy, reinforcing expectations for stronger corporate earnings and a more supportive external balance in the coming months. Capital flows are skewed toward dollar-denominated assets, also because investors prefer to wait out key central‑bank communications in “quality” instruments.

A further driver is the divergence in macro momentum: the US economy shows greater resilience in consumption and labor markets, while the euro area faces constrained growth and a cautious ECB tone. With little reason for ECB tightening and with lingering risks for European industry and exports after tariff headlines, the euro’s fundamental support looks softer. Persisting uncertainty around the inflation path in the euro area adds to the preference for the USD.

Given these factors, the near‑term fundamental tilt remains to the downside for EURUSD. Risks to this view include unexpectedly dovish Fed communication, a pullback in US Treasury yields, and/or positive euro‑area data surprises that could improve growth expectations and support the euro.

Trading recommendation: SELL 1.15650, SL 1.16000, TP 1.15150

EURUSD – DAILY FORECAST Q3 | W31 | D30 | Y25📊 EURUSD – DAILY FORECAST

Q3 | W31 | D30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURUSD

DXY Rebound Pulls EURUSD Below 1.16Following the DXY’s significant rebound off a 17-year trendline, the EURUSD has broken below a trendline that connected all consecutive lows of 2025. This opens the door to further bearish risks, with key support levels now in sight.

If the pair closes cleanly below 1.15, 1.1440 and 1.1380, downside extensions could reach 1.12 and 1.11, respectively.

On the upside, a close back above the 2025 trendline and the 1.18 mark could reinstate bullish momentum, potentially lifting the pair toward the 2021 highs between 1.20 and 1.23.

Written by Razan Hilal, CMT

#AN022: Geopolitical Tensions and Forex Pressure

Hello, I'm Forex Trader Andrea Russo, and today I want to talk to you about this week's latest geopolitical tensions.

1. The Russian ruble in crisis, weakening against the USD and CNY

The ruble fell 1.5% against the dollar and 0.8% against the yuan, following a US ultimatum to Moscow for an immediate truce in Ukraine.

FX Impact: The ruble remains vulnerable, fueling demand for safe-haven currencies such as the USD, EUR, and CHF. Crosses against the RUB show potential technical short reversals.

2. Oil Rises: First Impacts on Energy Costs

Brent prices rose 3.5% to $72.50 a barrel following the announcement of possible US sanctions on buyers of Russian oil.

FX Impact: Oil-related currencies such as the CAD and NOK benefit; USD risks weakness if importing countries experience inflationary pressures.

3. Euro falls monthly for the first time, dollar strengthens

The euro is in the red on a monthly basis for the first time in 2025, while the dollar benefits from cautious Fed rate expectations and the EU-US trade deal perceived as biased toward Washington.

Forex Impact: EUR/USD is under structural pressure. Euro-commodity correlates (EUR/CAD, EUR/AUD) are showing signs of weakness.

4. IMF warns of US tariffs and rising global inflation

In its latest report, the IMF emphasized that US tariffs are slowing global growth and fueling persistent inflationary pressures.

FX Impact: Increased uncertainty favors the USD and CHF. Emerging economies and commodity-linked economies (MXN, ZAR, BRL) could weaken further.

5. India Strengthens: Growing Exports and Solid Reserves

India recorded a 7.2% increase in merchandise exports and maintains stable foreign exchange reserves, demonstrating macroeconomic resilience and the resilience of the rupee.

Forex Impact: The INR could strengthen or consolidate at robust levels, while USD/INR pairs signal potential support.

6. Global Digital Projects and Fragmentation of Payment Systems

The adoption of alternative systems to SWIFT such as mBridge or Project Agorá reflects a push toward global financial independence.

Forex Impact: The euro and dollar remain dominant, but the RMB is gaining ground in Asia-Pacific countries. RMB crosses (USD/CNH, EUR/CNH) require attention, especially from a long-term perspective.

EUR USD long As the EUR treaty yesterday gave strength to the USD and "made America great again," today we’re seeing a correction. This setup is based on a value gap—if price breaks through this gap, there's a strong chance it will reach the next zone quickly. A buy setup could be effective in this scenario.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research before making any trading decisions.

EUR/USD: ECB Pauses Amid UncertaintyBy Ion Jauregui – Analyst at ActivTrades

The European Central Bank has decided to pause its rate-cutting cycle after seven consecutive reductions over the past twelve months, leaving the deposit rate at 2%, the refinancing rate at 2.15%, and the marginal lending facility at 2.4%. This move, largely priced in by the markets, reflects the ECB’s growing caution in the face of inflation that has officially reached its 2% target but may rebound if certain fiscal and geopolitical risks materialize.

Christine Lagarde’s message has been interpreted with a hawkish tone. Although both headline and core inflation have eased — the latter standing at 2.3% — the ECB warns that surprises may still occur. Massive defense spending, fiscal imbalances, and international trade tensions (such as tariffs recently signed by Trump with Japan) could disrupt the current equilibrium.

Markets have reacted calmly: the EUR/USD barely moved a tenth of a percent after the decision, while implied interest rates in the money markets have lowered the odds of another rate cut in September. Now, only a symbolic 5 basis point cut is priced in at most.

Technical Analysis

Overall trend: Sideways to bearish in the short term; bullish in the long term.

Key support levels:

1.1488: technical and psychological reference level

1.1275: recent July low

Key resistance levels:

1.8291: short-term high

1.2278: next resistance level

The pair attempted to break higher last week but failed, starting this week with a bearish tone. As long as the price holds above key support, the bullish trend may continue. A daily close below the first support could trigger a move toward the point of control (POC) zone at 1.0419. The daily RSI is in oversold territory at 38.95%, while the MACD shows signs of turning lower, indicating a loss of bullish momentum.

There is growing speculation that the ECB's rate-cutting cycle may be over. Within the ECB, figures like Isabel Schnabel are calling for patience, while others, such as Philip Lane and Luis de Guindos, still don’t rule out a final adjustment if September projections show economic weakness.

In this context, the price range that began from the point of control zone toward recent highs appears to be losing steam. Going forward, the evolution of the EUR/USD will depend on inflation trends, European fiscal policy, and the ECB’s response to tariff tensions with the United States and other global challenges as summer draws to a close.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

EURUSD(20250730) Today's AnalysisMarket News:

According to a Reuters/Ipsos poll, Trump's approval rating has fallen to 40%, the lowest level since his second term.

Technical Analysis:

Today's Buy/Sell Levels:

1.1554

Support and Resistance Levels:

1.1634

1.1604

1.1584

1.1523

1.1504

1.1474

Trading Strategy:

If the price breaks above 1.1584, consider entering a buy position, with the first target price at 1.1604. If the price breaks below 1.1554, consider entering a sell position, with the first target price at 1.1523.