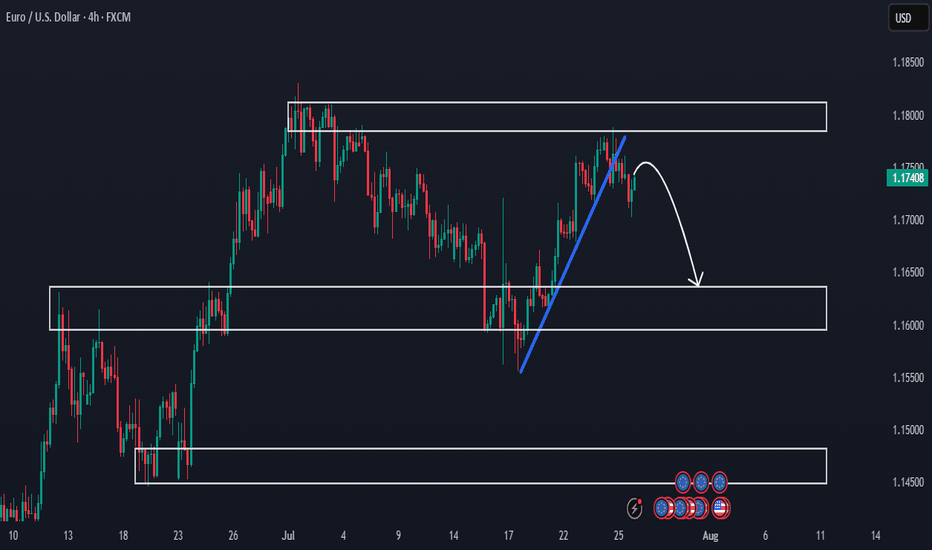

EURUSD may fall, but it's all about the FOMC DecisionEURUSD may fall, but it's all about the FOMC Decision

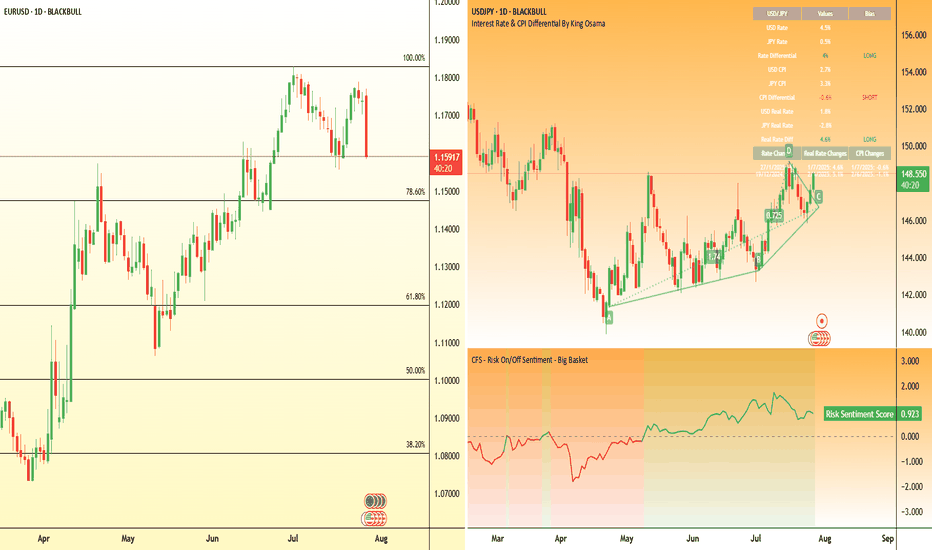

During the first 2 weeks of July, EURUSD fell from 1.18000 to 1.1550 and then the price rose again due to renewed tariffs.

Trump's comments regarding Powell and tariffs, according to which the EU and the US may reach an agreement soon, renewed the strength of EURUSD.

However, this time it is more related to the FOMC. If the FED cuts rates, EURUSD can drop further. When they didn't cut rates, the USD was weak or didn't move at all.

Let's see.

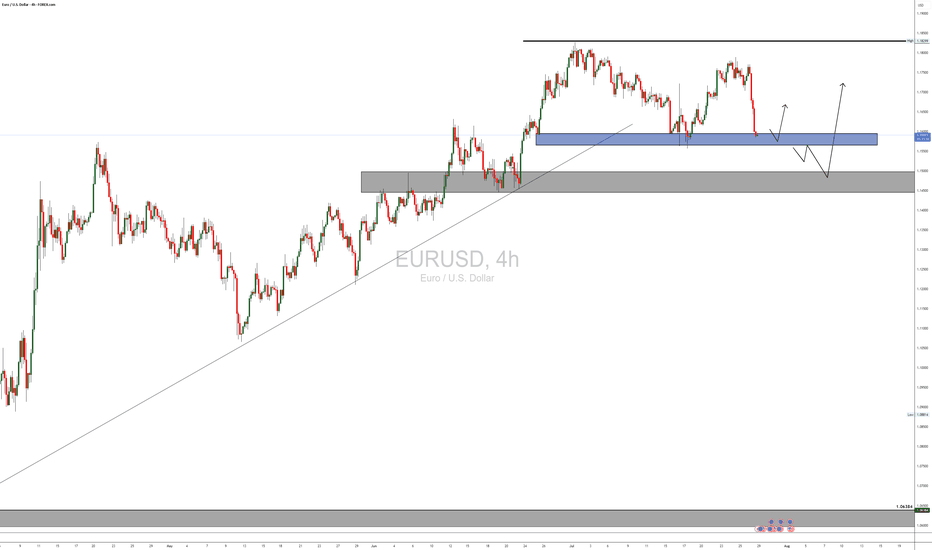

If Powell makes any surprises this time, EURUSD could fall, as shown in the chart, from 1.1800 to 1.1550, which is almost 250 pips lower.

Key support zones: 1.1660 and 1.1580

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD trade ideas

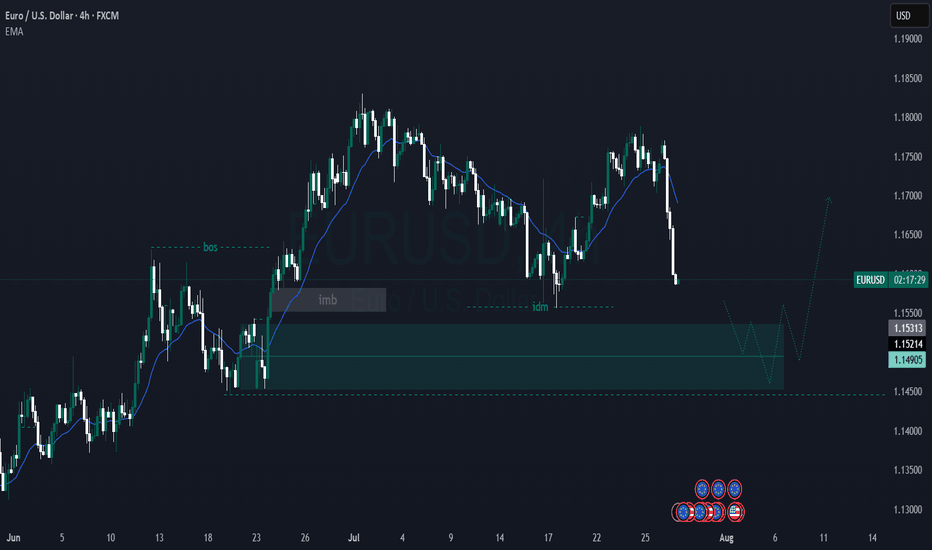

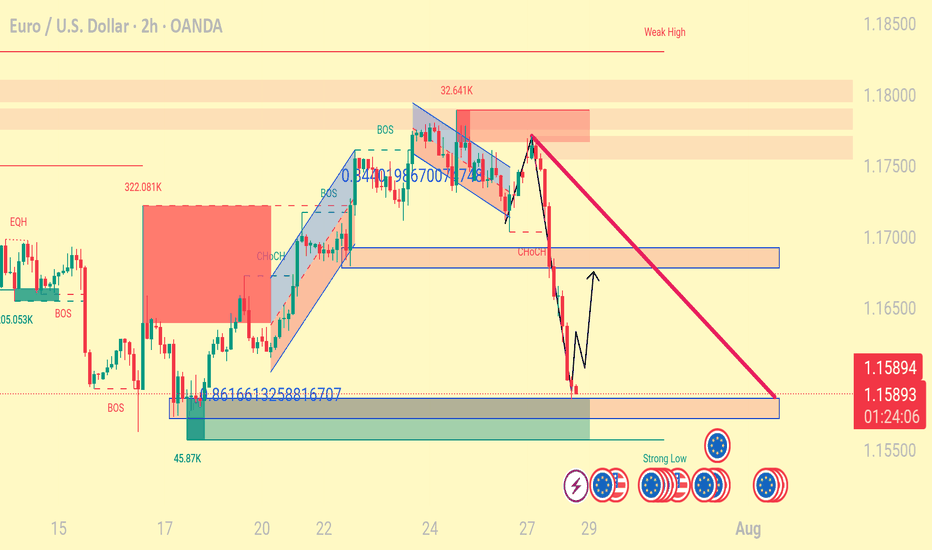

Elliott Wave Update: EURUSD Favors Weakness In To Support ZoneThe EURUSD favors upside in 3 swings from September-2022 low & should extend towards 1.1929 or higher against 1.13.2025 low. In 4-hour, it favors double correction lower from 7.01.2025 high to correct 5.12.2025 low. It favors short term pullback into 1.1512 – 1.1340 area in 7 swing pullbacks before continue rally in cycle from 1.13.2025 low. Above January-2025 low, it ended (1) at 1.0533 high, (2) at 1.0210 low, (3) at 1.1573 high, (4) at 1.1065 low & favors higher in (5). Within 4-hour, it placed 1 at 1.1830 high & correcting in 2 as double three correction before two more highs. It placed ((w)) at 1.1559 low in 3 swings zigzag correction. In ((w)), it ended (a) at 1.1659 low, (b) at 1.1714 high & (c) at 1.1559 low of 7.16.2025. Later, it unfolded expanded flat correction in ((x)) that ended at 1.1788 high of 7.24.2025. Within ((x)), it placed (a) at 1.1721 high, (b) at 1.1554 low & (c) in 5 swings at 1.1788 high.

Currently, it favors downside in ((y)) of 2 & expect sideways to lower in to support zone. It favors zigzag correction lower in ((y)) to finish 2 into extreme area before resume rally. Short term, it favors downside in (a) of ((y)) since 7.24.2025 high. In (a), it placed i at 1.1700 low, ii at 1.1771 high & favors downside in iii of (a) towards 1.1576 – 1.1569 area before bounce in iv. It expects a bounce soon in iv followed by one more push lower in v to finish (a) in 5 swings. Wave (a) of ((w)) should end near 1.1578 before bounce in (b) in 3 or 7 swings connector. The bounce in (b) should fail below 1.1788 high to extend lower in (c) into 1.1512 – 1.1340 area to finish correction. It should find next support into that area to rally higher as the part of daily sequence targeting 1.1929 or higher. We like to buy in to that area for next leg higher or at least 3 swings bounce. If it breaks above 7.01.2025 high, it expects two more highs to finish cycle from January-2025 before next pullback start.

Hold off on EURUSD for nowYesterday, EURUSD dropped over 150 pips following the trade agreement between the US and the European Union.

Tomorrow, the Fed is expected to announce interest rates, which could bring further volatility.

Avoid entering new positions at the moment and don’t overdo it with your lot sizes.

Once the news is out, there will be clearer and more confirmed trade opportunities.

Awaiting for bullish signal - EURUSDSo my EURUSD pair was stopped out with a profit. Now, at this price level, it looks like the selling pressure is not finished so I will be waiting.......

As I want to LONG ONLY so I will not be shorting this pair for now.

Let's check back later to see how the price movement is

Bullish bounce off pullback support?The Fiber (EUR/USD) is falling towards the pivot, which is a pullback support and could bounce to the 1st resistance.

Pivot: 1.1537

1st Support: 1.1456

1st Resistance: 1.1655

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURUSD POSSIBLE TRADE SETUP💶 Potential Trade Setup on EURUSD

Overview:

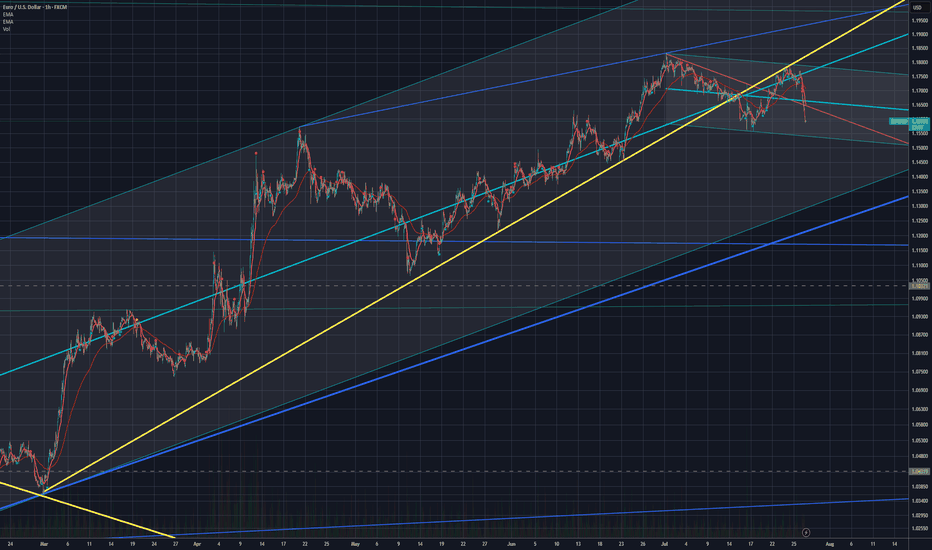

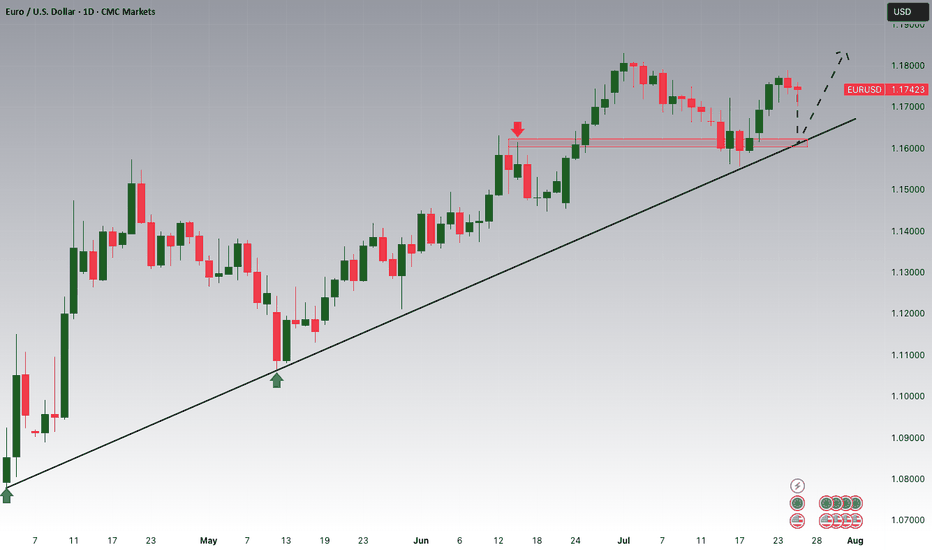

Since March, EURUSD has shown consistent bullish momentum, especially after breaking through the key 1.0600 supply zone.

The pair has maintained higher highs and higher lows, suggesting continued strength in the medium term.

That said, I am still quite anticipating for a possible continuation of the bullish momentum that started a long time ago, and moving forward, I will anticipate for a clear retest of the 50% fib at the 1.1425 region, then I go in for the kill.

Alternatively, there is a clear short opportunity, provided that, the bullish trendline is broken and the 1.1370 region is broken to the downside, this is a bit far a stretch, but it is in play. "IF" the DXY keeps the bullish momentum going.

🧭 Trading Plan:

✅ BUY Bias (Primary Plan):

Look for a retest of the 50% Fibonacci retracement zone around 1.1425. This aligns with the ongoing momentum on the 4H timeframe.

🔻 SELL Bias (Alternative Scenario):

If price breaks the bullish trendline and the 1.1370 support zone, a short opportunity opens up.

This is only valid if DXY continues to strengthen, shifting sentiment.

🎯 Targets & Risk Management: Targeting 1:2 R:R on both setups.

Ensure entries are backed by price action signals and confluences.

EUR/USD – 4H Technical Analysis AnticipatingPrice is currently in a bullish structure, printing consecutive Breaks of Structure (BOS) to the upside, confirming strong bullish momentum FX:EURUSD FX:EURUSD

On the 4H timeframe, price has:

Left behind an imbalance, signaling inefficiency in price delivery

Formed an unmitigated demand zone (internal OB) that aligns with bullish order flow

We now wait for price to return to this zone for a potential mitigation

📍 Plan of Action:

Monitor the mitigation area

Drop down to the 15-minute timeframe

Look for LTF (lower timeframe) confirmation: CHoCH, BOS, and internal structure shift before entering

EURUSD Wave Analysis – 28 July 2025- EURUSD reversed from the resistance level 1.1775

- Likely to fall to support levels 1.1555 and 1.1460

EURUSD recently reversed down from the resistance zone between the resistance level 1.1775 (which stopped the previous impulse wave 3 at the start of July, as can be seen below) and the upper daily Bollinger Band.

This resistance zone was further strengthened by the lower trendline of the recently broken up channel from May (acting as resistance after it was broken earlier).

Given the strongly bullish US dollar sentiment, EURUSD can be expected to fall to the next support levels 1.1555 and 1.1460 – the low of waves 4 and iv.

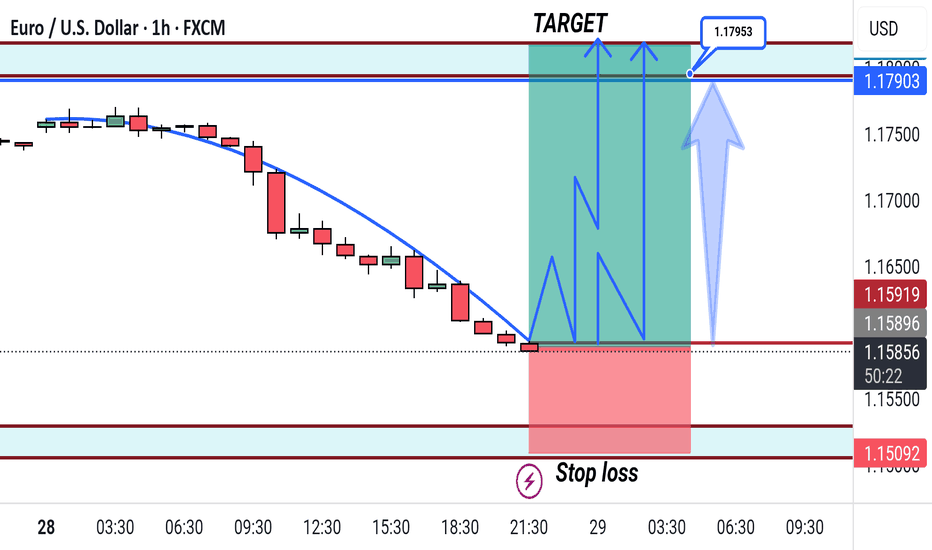

EURUSD BUYThe US Dollar (USD) gapped lower at the weekly opening amid optimism fueling demand for high-yielding assets, following news that the United States (US) and the European Union (EU) reached a trade deal.

The US and the EU agreed a 15% tariff on most European goods entering the US, much higher than the average 4.8% exporters face these days. No rates will apply to EU exports in important sectors, including aircraft parts, some chemicals, semiconductor equipment and some agricultural products.

The EU response to the headline was uneven. European Central Bank (ECB) policymaker Peter Kazimir said on Monday that the trade deal reduces uncertainty, but it is unclear for now how it impacts inflation. However, the French prime minister, François Bayrou, said the EU has capitulated to Donald Trump’s threats, adding it is a “dark day” for the EU. The trade focus now shifts to the US-China as officials from both countries resume talks in Stockholm.

The EUR/USD pair peaked at 1.1771 during Asian trading hours, but changed course early in Europe, with the USD surging across the FX board, resulting in the pair shedding over 100 pips.

The macroeconomic calendar had nothing relevant to offer at the beginning of the week, but will be flooded with first-tier releases, including US employment-related data ahead of the Nonfarm Payrolls report on Friday, the preliminary estimates of the Q2 Gross Domestic Product (GDP) for the US and the EU, and inflation updates. On top of that, the Federal Reserve (Fed) will announce its decision on monetary policy on Wednesday.

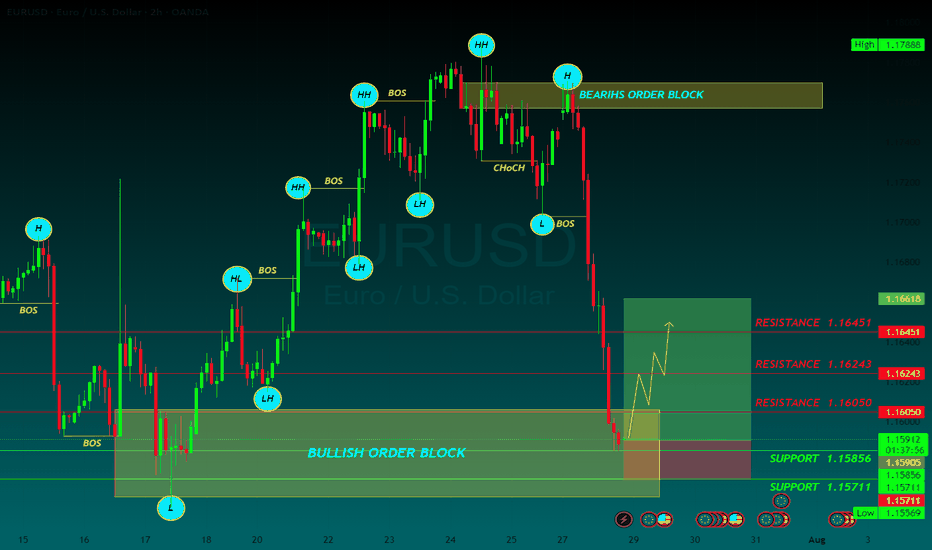

RESISTANCE 1.16050

RESISTANCE 1.16243

RESISTANCE 1.16451

SUPPORT 1.15856

SUPPORT 1.15711

EU faces new tariffs, Euro slides | FX ResearchThe euro surged in early Asian trade following the US–EU trade agreement announced over the weekend, but has since faced consistent selling pressure, eventually triggering stop-loss orders below 1.17, reflecting a classic buy-the-rumour, sell-the-fact market reaction.

The deal imposes 15% tariffs on most EU exports to the US, down from 25% for automobiles, while excluding pharmaceuticals and medical metals, with semiconductors still under review. The EU committed to buying $750 billion in US energy products over three years, investing further in the US, opening markets with zero tariffs, and purchasing significant US military equipment.

The EU trade commissioner noted the deal provides business predictability despite higher tariffs than the previous 4.8% average. German automakers, including Mercedes-Benz, acknowledged some relief but highlighted ongoing costs, while Spain's PM offered lukewarm support.

Meanwhile, South Korea is preparing a trade package focusing on shipbuilding cooperation, and US–China tariff talks resume in Stockholm. The US dollar's trajectory may shift with this week's FOMC updates, Q2 GDP, core PCE, inflation, and non-farm payrolls data. While a light-data Monday features only the Dallas Fed manufacturing survey.

Exclusive FX research from LMAX Group Market Strategist, Joel Kruger

Countdown to Powell’s rate decision: What to watch WednesdayFederal Reserve Chair Jerome Powell is under mounting pressure from President Donald Trump to begin cutting interest rates.

Markets and analysts overwhelmingly expect the Fed to hold rates steady this Wednesday.

But what if the political heat is becoming too much to bear, and Powell and the Fed board advocate for a cut this week? Some Fed governors, Chris Waller and Michelle Bowman , have already signaled support for an early cut.

FX pairs to watch

USD/JPY:

This pair remains highly sensitive to yield differentials and broader risk sentiment. However, any hawkish resistance or emphasis on data dependency may keep the pair supported, especially if risk appetite holds.

EUR/USD:

The euro has shown relative strength in recent sessions, but the pair has been hit by the announcement of the trade deal struck between the EU and US. If the Fed clearly signals it's not ready to ease, the USD could regain even ground.

EUR-USD Support Ahead! Buy!

Hello,Traders!

EUR-USD is making a massive

Bearish correction and the pair

Is already locally oversold

So after it hits a horizontal

Support level below at 1.1568

We will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/USD Holds Lower-High ResistancePerhaps it's a buy the rumor sell the news event, or maybe it's just squaring up ahead of a really big week of U.S. drivers, but so far this week EUR/USD is putting in a sizable sell-off.

Notably, the rally last week ran through the ECB rate decision and price held at a lower-high as bulls suddenly got shy around tests of resistance. This retains bearish potential given the breach of the rising wedge and the lower-lows that printed a couple of weeks ago, which led into the bounce of lower-highs last week.

Also notable is where that resistance held - right around the 78.6% Fibonacci retracement of the 2021-2022 major move, as that held the highs on Friday ahead of today's sell-off. If looking for USD-weakness, I think there could be more amenable pastures elsewhere, such as GBP/USD. But for USD-strength, EUR/USD makes a compelling argument given the current technical structure. - js

Excitement or Euro sell-off?Today is Monday. After the market opened, the dollar suddenly surged while the euro dropped — even though there was no scheduled news on Forex Factory. Personally, I searched everywhere but couldn't find any fundamental reason behind this move. We’ll have to wait and see whether this trend continues or reverses.

EURUSD Will the 1D MA50 hold?The EURUSD pair has been trading within a Channel Up pattern since the April 21 2025 High. The price is right now on a strong pull-back and is about to test the 1D MA50 (blue trend-line) for the first time since May 12.

As long as the 1D candle closes above the 1D MA50, it will be a buy signal, targeting 1.19250 (a standard +3.20% rise).

If the candle closes below the 1D MA50, the buy will be invalidated and we will switch to a sell, targeting the 1D MA100 (green trend-line) at 1.14100.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Premarket Analysis - Will Price Head Lower?Hello everybody!

We’re looking at three key areas on the chart.

Price has been rejected from a supply zone.

The clean upward trendline has been broken, and we expect the price to move lower this week.

If the drop continues, we’ll look to sell and aim for the more likely target around 1.16400.

Then we’ll see whether this first demand/support area holds or not.

Have a good trading week ahead!

EUR/USD Analysis: Potential Reversal at Key Support📉 Day 3 of 100: EUR/USD Breaks Structure!

Today’s market gave us a lesson! 📚

✅ SL Hit due to news

✅ 61% order block broken

✅ NY session may go bullish after Asia+London trap

.

Are you seeing the pattern unfold?

👇 Comment “Wave Watcher 🌊” if you use Elliott Wave!

Day 3/100 - EUR/USD Breakdown! | Forex Analysis | Elliott Wave | Order Block Strategy

In today’s update: 📌 SL hit due to major fundamental shift

📌 Break of 61% order block; heading to 78% zone

📌 Similar pattern in Tokyo/London sessions—bullish setup possible for NY session

.

💬 Drop a comment if you're also using Elliott Wave price action!

👍 Like | 🔁 Share | 🔔 Subscribe for more daily updates!

🚀 Join the 100-Day EUR/USD Challenge — Let’s decode the market together!

#forex #eurusd #elliottwave #orderblock #forextrader #forexeducation #smartmoneyconcepts #priceaction #forexchallenge #newyorksession #technicalanalysis #forexstrategy

---