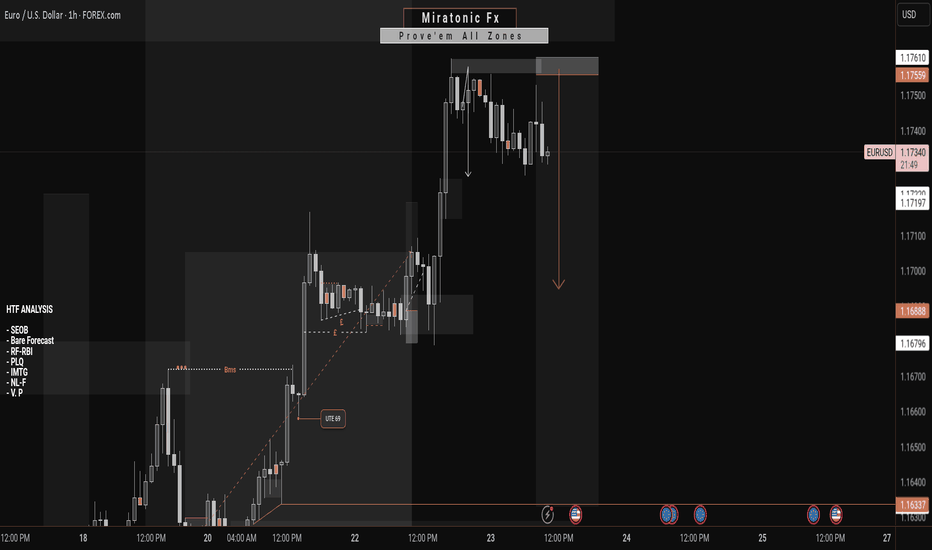

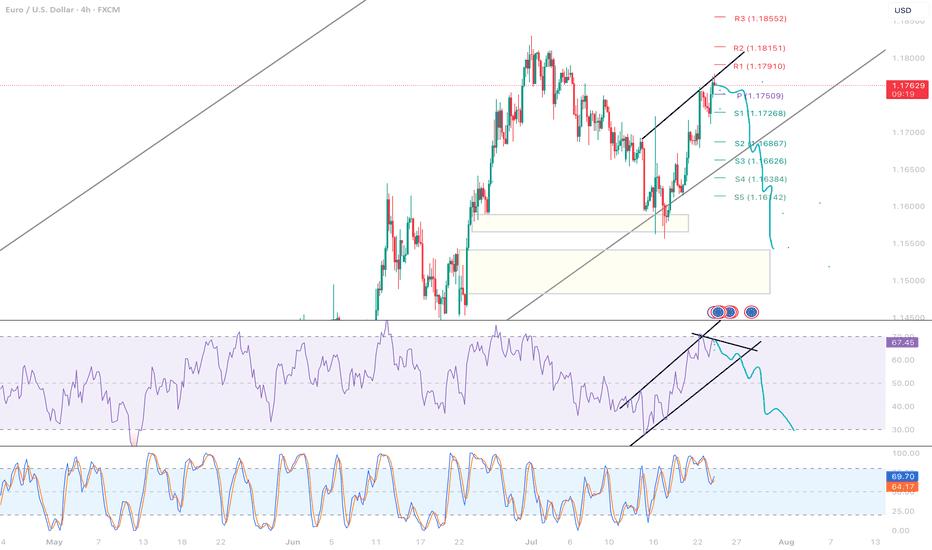

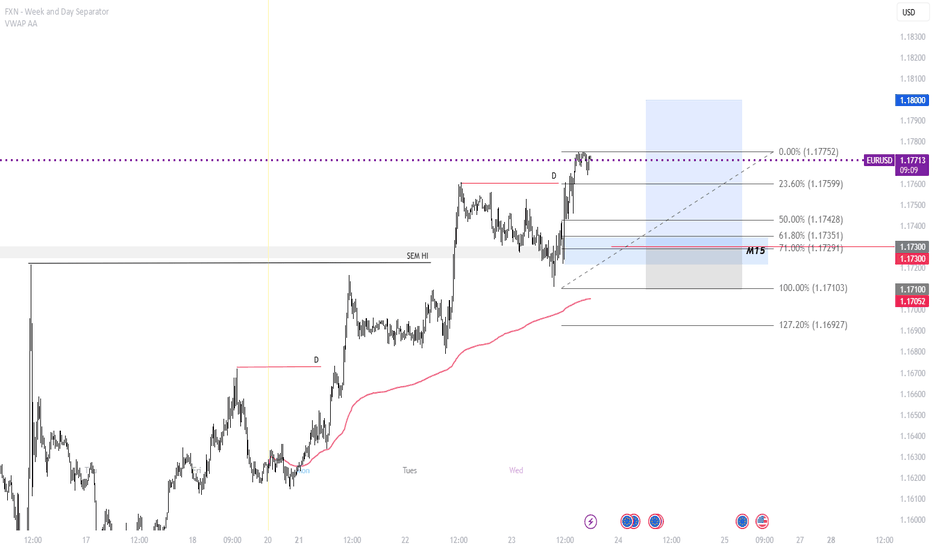

What's Next On EURUSDPrice currently leans toward a bearish pullback after a series of impulsive bullish moves. So far, we haven’t seen any significant retracement since the rally began. As we anticipate a potential correction, could this be the awaited moment for the bears to step in—especially with only weaker structures left behind and bearish pressure building?

Regardless, every market scenario demands discipline and proper risk management.

Thinking of taking this outlook? Be sure to wait for strong confirmation before jumping in.

Good luck, traders, as we watch price unfold.

👉 Follow for more updates. See you in the next one 😉.

EURUSD trade ideas

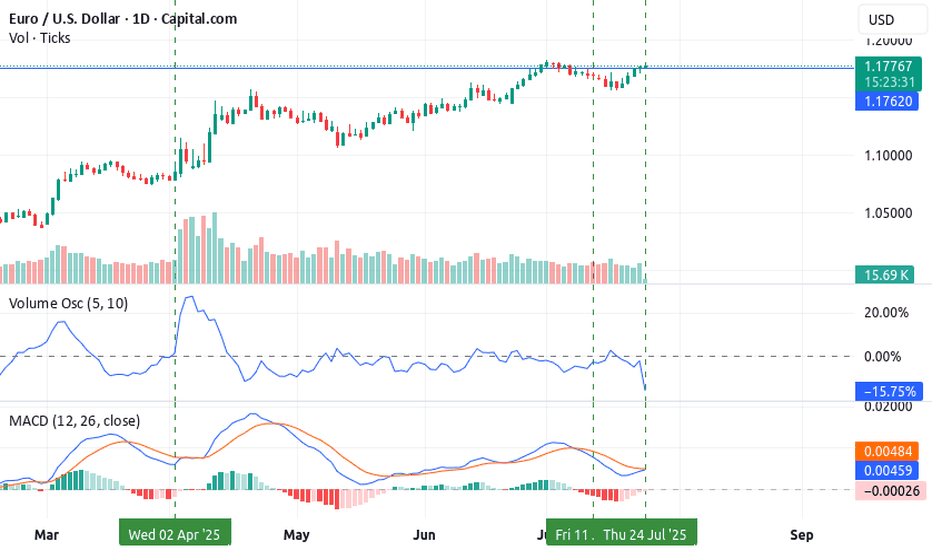

Top 3 Steps to Trading EUR/USD Long-Term✅ Top 3 Steps to Trading EUR/USD Long-Term – Rocket Booster Buy Setup 🚀

Pair: EUR/USD

Timeframe: Daily

Trade Type: Long-Term Swing / Investment

Direction: BUY

Looking for a high-confidence swing trade? EUR/USD has triggered all 3 key steps for a long-term bullish entry using the proven Rocket Booster Strategy.

Here’s the breakdown:

🔑 Step 1: Volume Oscillator – Buy Rating

Volume is trending above the zero line, showing signs of accumulation and increasing demand. This suggests smart money may be entering quietly.

🔑 Step 2: MACD – Bullish Momentum

A bullish MACD crossover above the zero line on the daily timeframe confirms that momentum has shifted in favor of the bulls. Histogram bars are expanding—classic trend continuation behavior.

🔑 Step 3: Rocket Booster Strategy – Fully Aligned

All three pillars of the strategy are locked in:

✅ Price is above the 50 EMA

✅ Price is above the 200 EMA

✅ Volume spike confirms momentum ignition

This setup shows strong potential for trend continuation on the higher timeframe.

🧠 Trade Perspective:

This is a long-term investment-grade signal, not a short-term scalp. Patience and disciplined trade management are key.

🛑 Disclaimer:

This post is for educational and informational purposes only. It does not constitute financial advice. Always do your own research and manage risk appropriately. Use a simulation trading account before you trade with real money

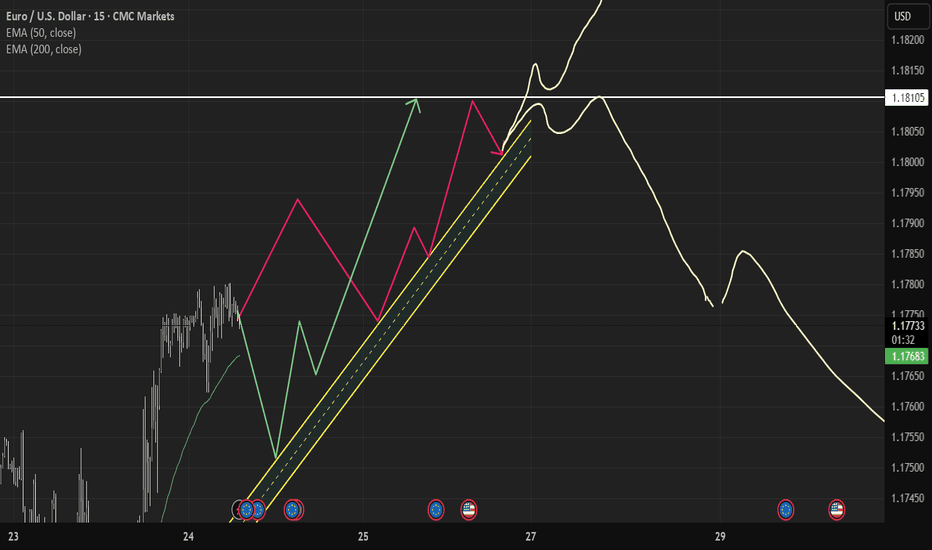

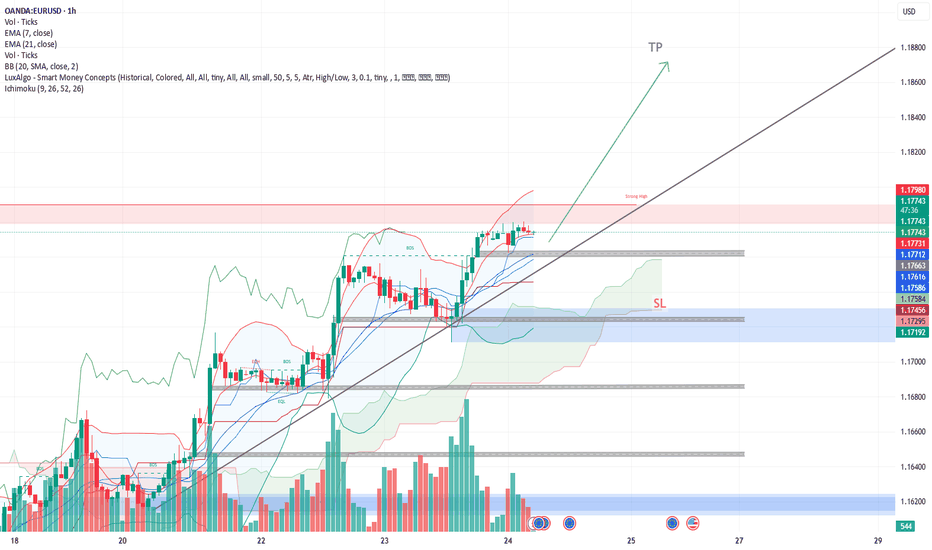

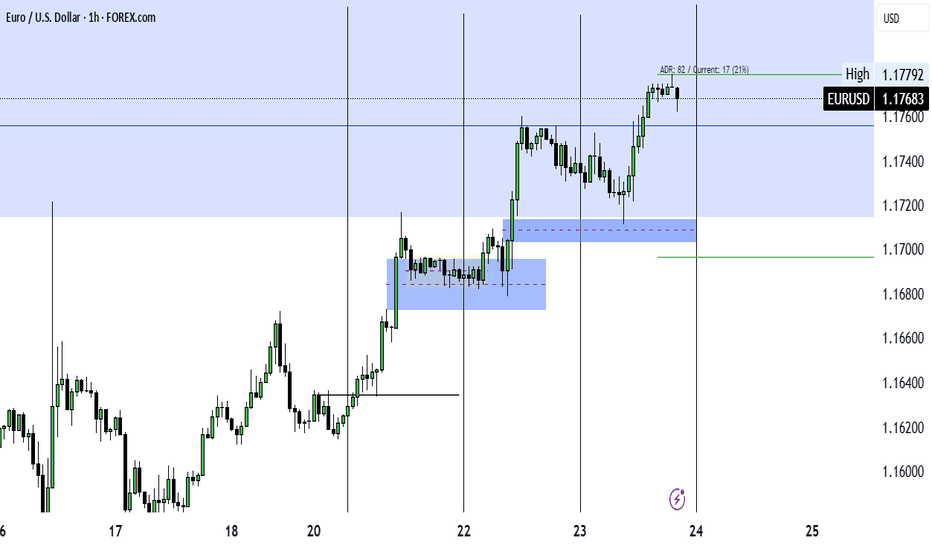

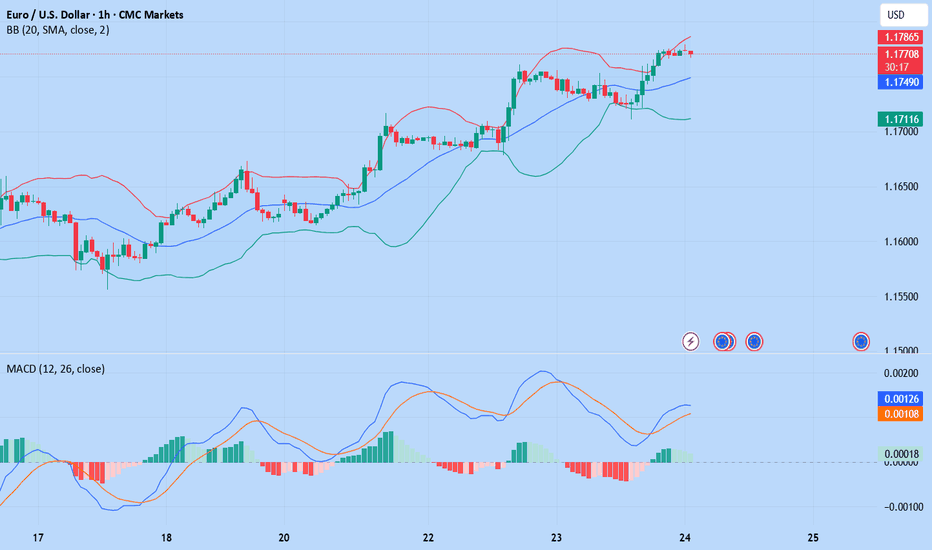

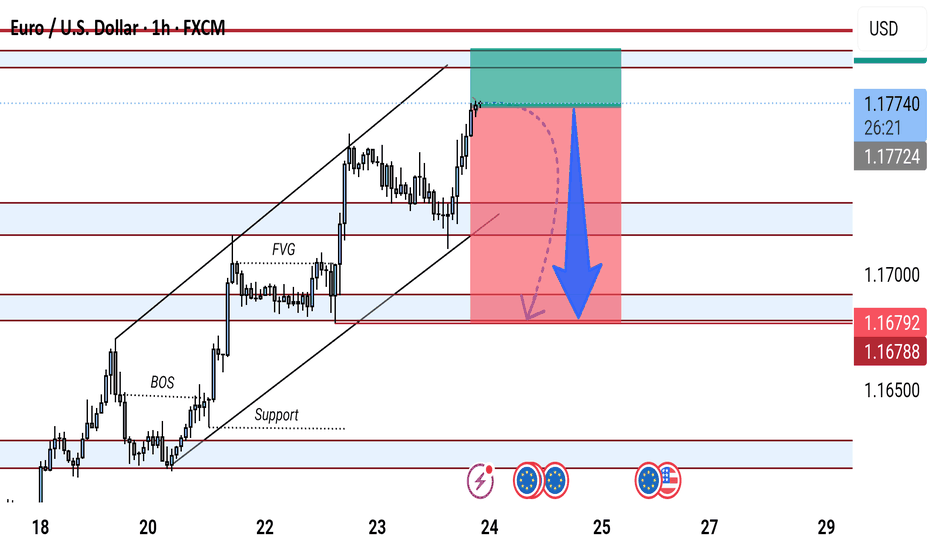

EUR/USD – Buy Setup Analysis (1H Chart)EUR/USD – Buy Setup Analysis (1H Chart)

📈 **Trend**: Uptrend

The pair is respecting the ascending trendline and is trading above both the EMA 7 and EMA 21, indicating bullish momentum.

**🔹 Long Setup**

* **Entry:** Around 1.1774 (current price)

* **Stop-Loss (SL):** 1.1731 (below trendline & EMAs)

* **Take-Profit (TP):** 1.1872 (based on recent swing high)

**🔎 Technical Signals**

* Price is forming higher highs and higher lows.

* Strong volume surge on bullish candles.

* EMA crossover (7 > 21) supports continuation.

**Conclusion**

As long as EUR/USD holds above the trendline and the EMAs, the bullish setup remains valid. A break below 1.1730 would invalidate this outlook.

EURUSD ahead of the ECBYesterday, EURUSD continued its bullish movement, reaching 1,1780.

Today, the ECB will announce its decision on interest rates.

The news is scheduled for 1:15 PM, followed by a press conference 30 minutes later.

Expect possible sharp and misleading price movements — reduce your risk and avoid rushing into new positions!

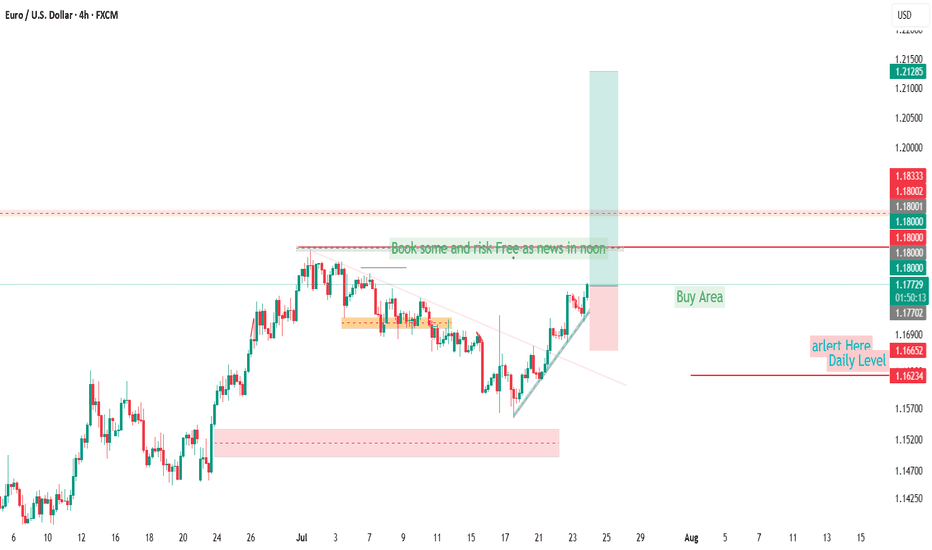

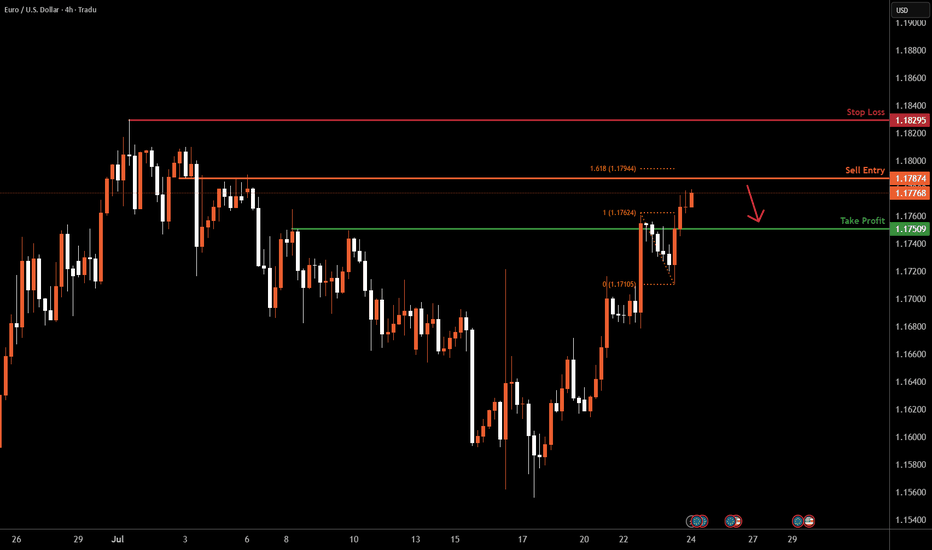

EURUSD H4 I Bearish Reversal Based on the H4 chart analysis, we can see that the price is rising toward our sell entry at 1.1787, which is a pullback resistance aligning close to the 161.8% Fibo extension.

Our take profit will be at 1.1750, a pullback support level.

The stop loss will be placed at 1.1829, a swing-high resistance level.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

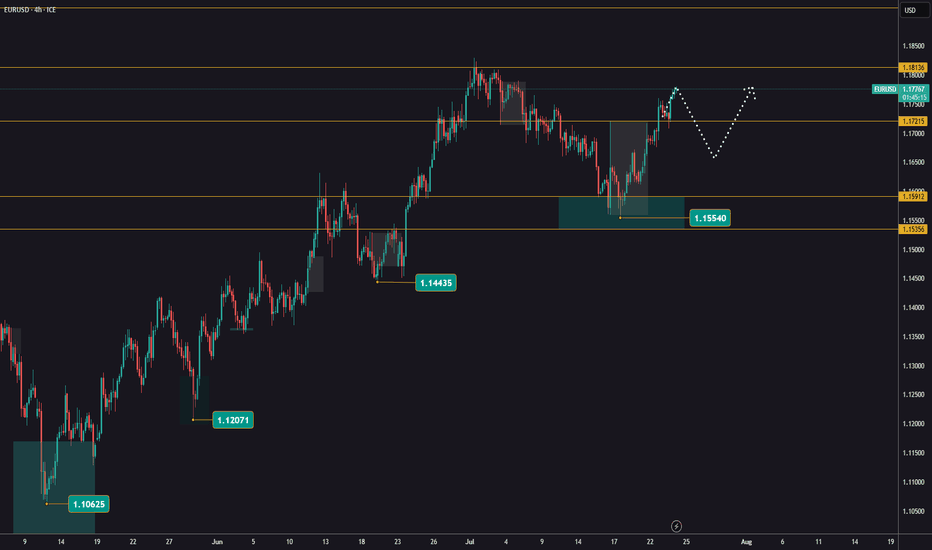

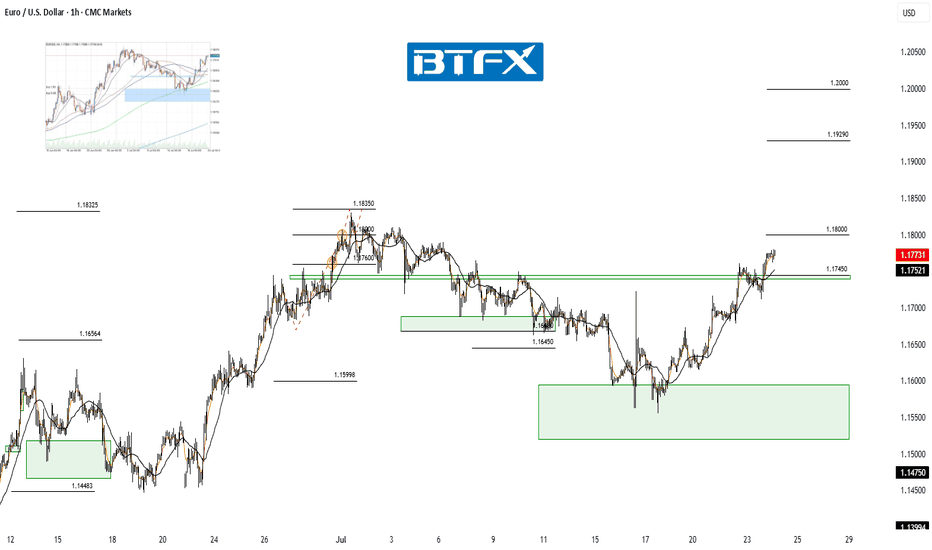

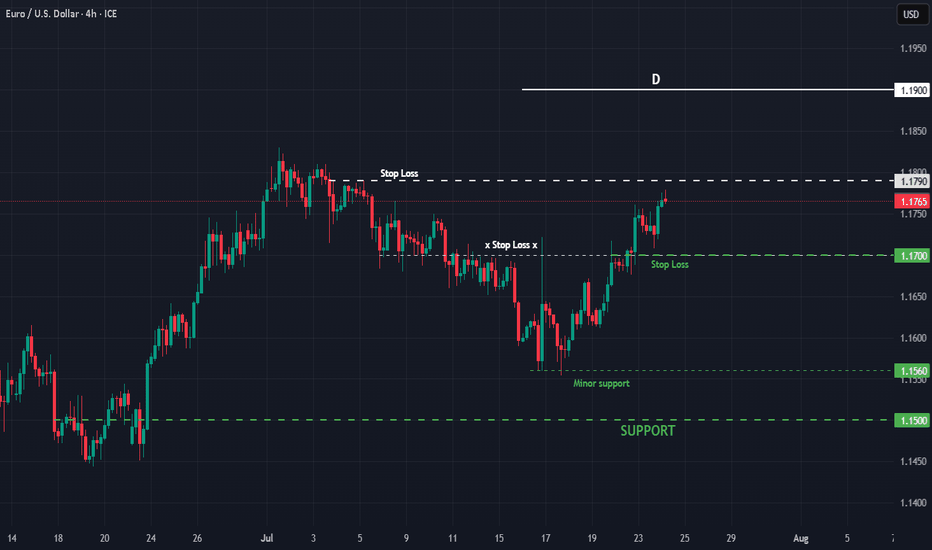

EUR/USD Recovery in Play — Eyes on ResistanceHi Everyone,

Since our last update, EUR/USD briefly dipped below the 1.16000 level but quickly reclaimed the key 1.16450 zone — a level that continues to serve as an important structural pivot.

Price has since stabilised above this support and is now moving back toward the highlighted resistance area around 1.17450. A sustained push toward 1.18000 in the coming sessions would further reinforce the presence of renewed buying interest.

Our broader outlook remains unchanged: we continue to anticipate the pair building momentum for another move higher. A decisive break above 1.18350 could open the path toward the 1.19290 area and ultimately the 1.20000 handle.

We’ll be watching closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term view remains bullish, as long as price continues to hold above the key support zone.

We’ll continue to provide updates throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — we really appreciate the support!

All the best for the rest of the week.

Trade safe.

BluetonaFX

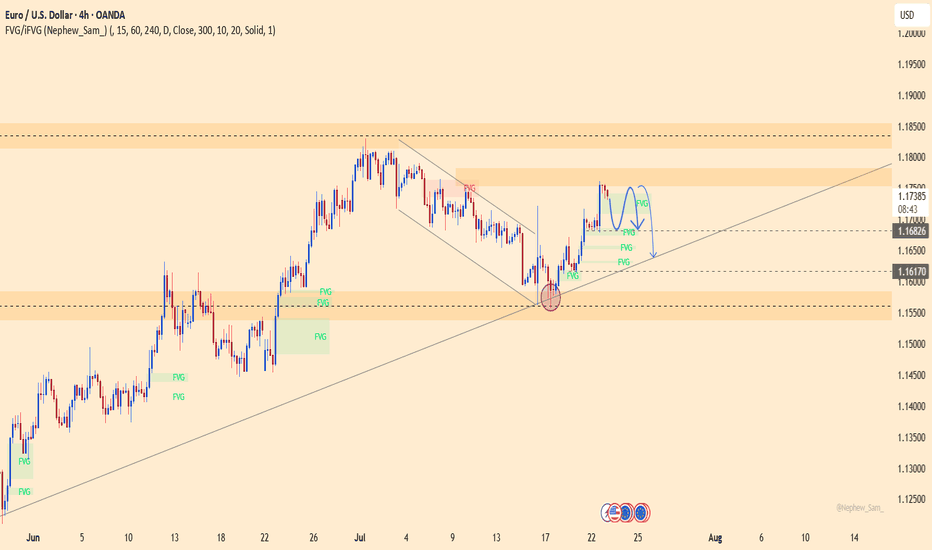

EURUSD – Recovery losing steam, correction risk is risingAfter rebounding from the trendline support, EURUSD is now approaching the key resistance area around 1.17500 — a zone that has historically triggered multiple rejections. However, with French and German PMI figures coming in below expectations and the ECB holding rates steady without providing any fresh policy guidance, the euro lacks the momentum for a sustained move higher.

On the H4 chart, price action is showing signs of exhaustion as it tests resistance. If buyers fail to break through convincingly, a pullback toward the 1.16800 support zone — or even deeper toward 1.16400 — becomes increasingly likely.

Preferred strategy: Watch for bearish rejection patterns near 1.17500. If confirmed, this could be a favorable opportunity to initiate short positions in anticipation of a correction.

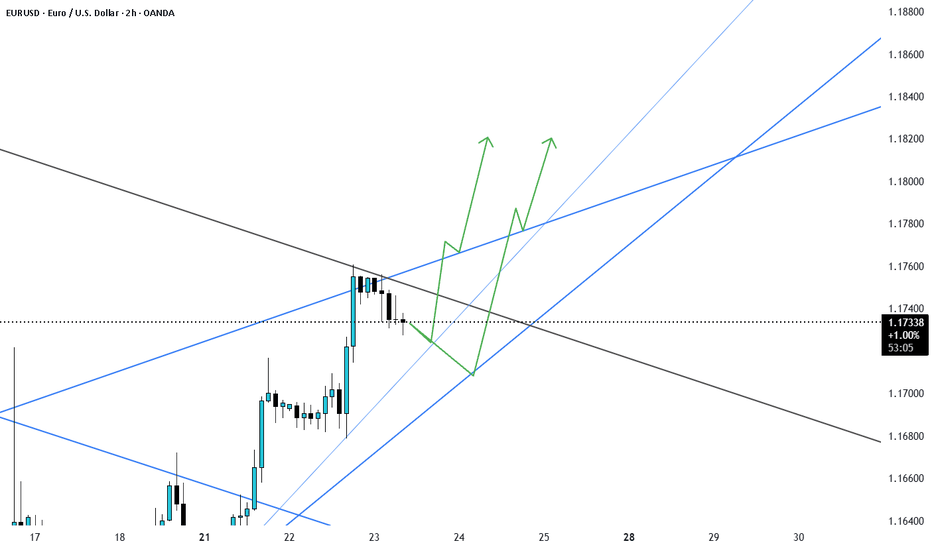

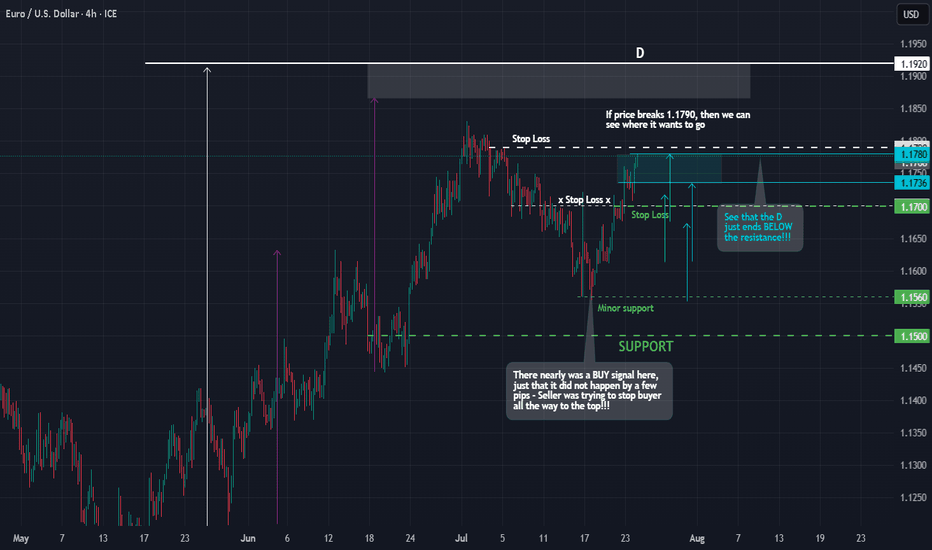

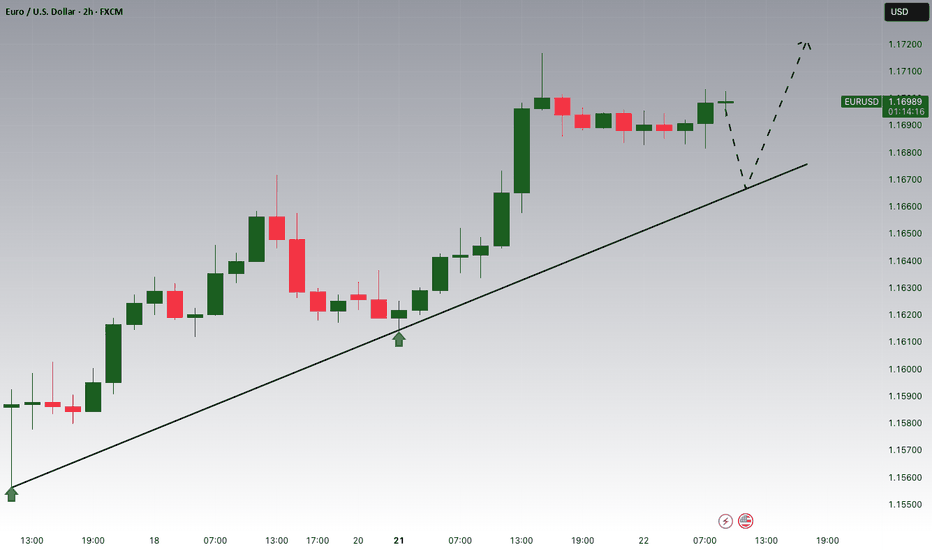

EURUSD : Status @ 23/7Direction: Buy

Signal triggered: 23/7/2025

Stop when:

a) Stop Loss @ 1.1700 ; or if

b) Sell signal triggered

Action:

Buy the dip

Good luck.

P/S: Note that the Buyer finally won the battle. But it did so, fighting the Seller all the way to the top. Now, they are at 1.1790 resistance with a potential to reach the long-term D @ 1.1900/30. My preference is not to buy. Instead, wait for a SELL as it is a bit late now to buy.

EURUSD(20250724) Today's AnalysisMarket news:

U.S. President Trump continued to lash out at the Federal Reserve on Tuesday, but seemed to back off from the remaining plan to fire Chairman Powell. "I think he's doing a bad job, but he's going to be out of office soon anyway," Trump said in an exchange with reporters at the White House. "In eight months, he'll be out of office."

Technical analysis:

Today's buying and selling boundaries:

1.1751

Support and resistance levels:

1.1814

1.1791

1.1775

1.1726

1.1711

1.1687

Trading strategy:

If the price breaks through 1.1775, consider buying in, with the first target price at 1.1791

If the price breaks through 1.1751, consider selling in, with the first target price at 1.1726

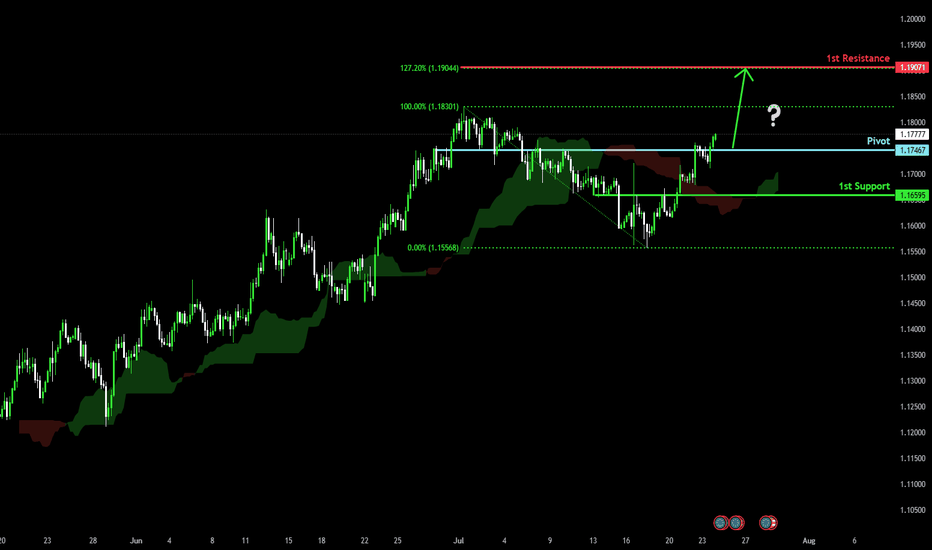

Bullish momentum to extend?The Fiber (EUR/USD) is reacting off the pivot and could rise to the 127.2% Fibonacci resistance.

Pivot: 1.1746

1st Support: 1.1659

1st Resistance: 1.1907

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR/USD BREAKS ABOVE RESISTANCE APPROACHING JULY HIGH! Hey Traders so looking at the EUR/USD still looking bullish if you took the buy zone at 1.571 consider moving stop now to Break Even.

IMO taking the risk out of a trade is the first step before locking in a profit. So now we approach July high at 1.833.

I always say markets can do 3 things as they approach significant support or resistance.

1. Consolidate

2. Breakthrough

3. Reverse

However you want to give the market room to breathe so I would start to lock in profit by staying 3 days behind market. So if you want to try this profit taking wait until tommorows candle finishes and then move the stop 3 days behind the market at 1.1670. Then just manually let the market decide when to stop you out. Just say behind 3 days behind market.

So if bullish consider protecting stops or small profit taking.

However if Bearish I don't think now is the time to short unless a significant reversal takes place and support is broken.

Good Luck & Always use Risk Management!

(Just in we are wrong in our analysis most experts recommend never to risk more than 2% of your account equity on any given trade.)

Hope This Helps Your Trading 😃

Clifford

"EUR/USD Bearish Reversal Setup from Key Resistance Zone"This EUR/USD 1-hour chart suggests a potential bearish reversal from the 1.17730 resistance level. The price has reached a key supply zone, with a marked fair value gap (FVG) and previous break of structure (BOS). The chart anticipates a drop toward the 1.16500–1.16788 support zone, supported by a highlighted short setup.

EURUSD Bearish Ahead as US Resilience Meets Eurozone FragilityEURUSD has shifted into bearish territory, pressured by growing divergence between a resilient US economy and a struggling Eurozone. The pair recently rejected the 1.1700 zone, forming multiple bearish structures on the 4H chart. With sticky US inflation, Trump’s renewed tariff agenda, and a dovish ECB, EUR/USD appears poised for a deeper move toward 1.1527 and possibly 1.1445 in the coming sessions. This setup is both technically and fundamentally aligned, but key event risk remains.

🔸 Technical Structure (4H)

Clear rejection from the 1.1700–1.1710 zone.

Bearish pennants and wedge patterns confirm continuation lower.

Downside targets:

🔹 First: 1.1637

🔹 Second: 1.1527

🔹 Final: 1.1445

Risk zone: Above 1.1785 (invalidates short bias if broken cleanly).

🧭 Key Fundamentals

🇺🇸 Dollar Strength: Sticky inflation, stable labor market, and geopolitical risk all favor USD demand.

🇪🇺 Euro Weakness: ECB dovish tone persists amid weak data, soft PMIs, and stagnating growth.

Yield Spread: US-Euro real yield spread supports further EUR/USD downside.

Tariff Pressure: Trump’s 50% tariff plan and tensions with the EU weigh on EUR.

⚠️ Risks to Watch

A surprise dovish pivot from the Fed.

Weak US CPI or disappointing retail sales.

Major risk-on flows that trigger broad USD weakness.

New EU fiscal stimulus or Germany/France recovery surprises.

📆 Key Events Ahead

🇺🇸 US Core CPI – A hot print supports USD strength.

🇺🇸 Retail Sales & Powell testimony – Watch tone on rate cuts.

🇪🇺 German ZEW Sentiment, Eurozone HICP inflation – Weak readings would further drag EUR.

🔄 Leader or Lagger?

EUR/USD is a lagger to GBP/USD, often following UK-driven USD moves.

Acts as a leader for EUR/JPY, EUR/AUD, EUR/CHF – weakness here cascades across EUR crosses.

Tracks broad USD sentiment – dovish Fed pricing boosts EURUSD, while rate hike fears drag it.

✅ Summary: Bias and Watchpoints

EUR/USD is bearish below 1.1700 as economic divergence, sticky US inflation, and rising geopolitical tensions favor the dollar. ECB policy remains soft, offering little support to the euro. Key risk lies in a dovish Fed pivot or softer US data. Watch US CPI and Powell for clues. This pair is likely to lag GBP/USD moves, but will lead EUR crosses lower if the downside momentum continues.