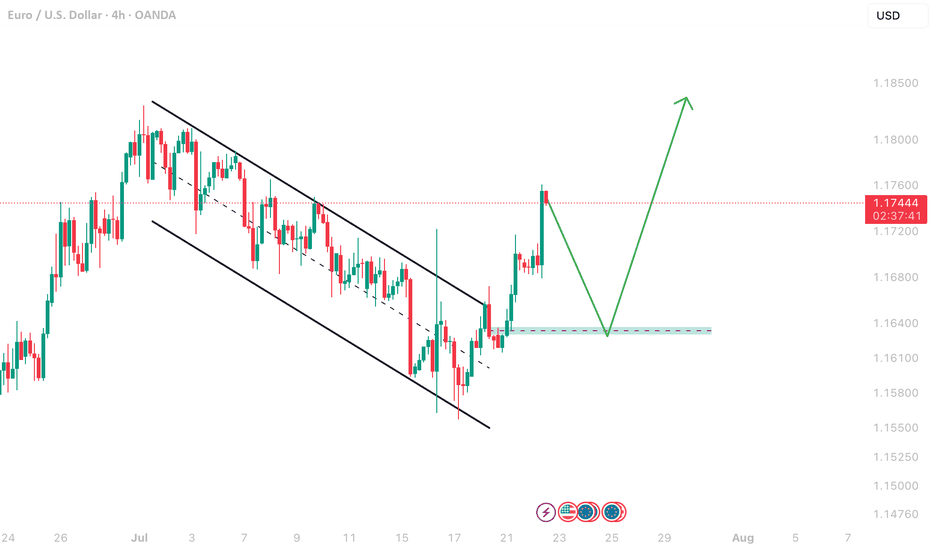

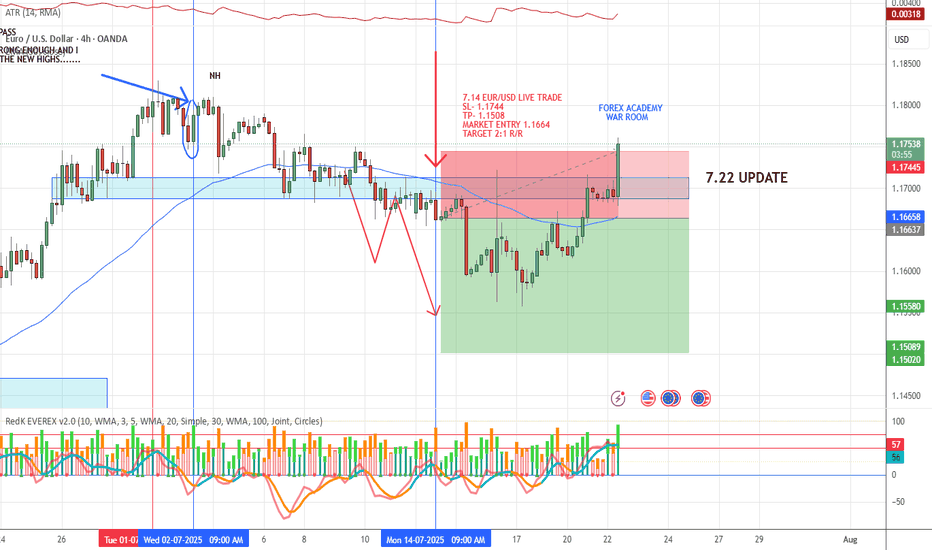

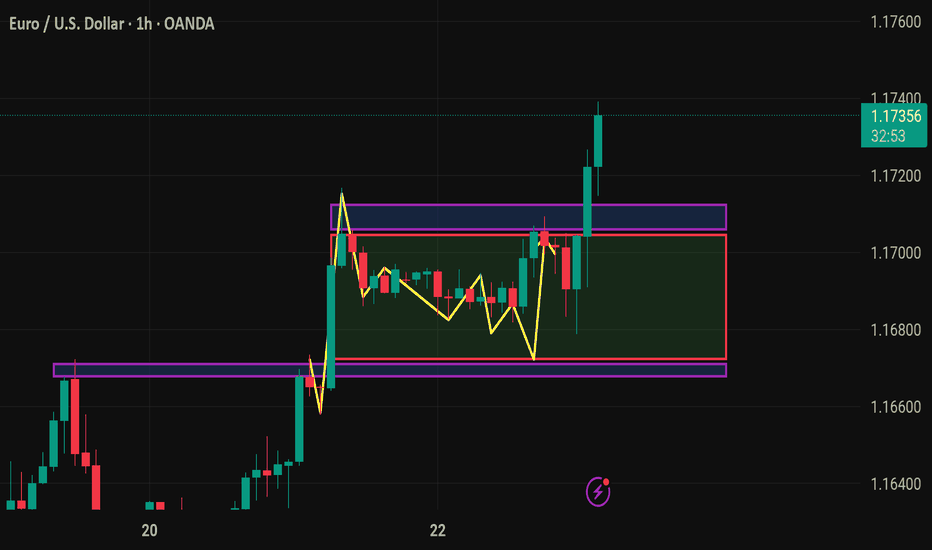

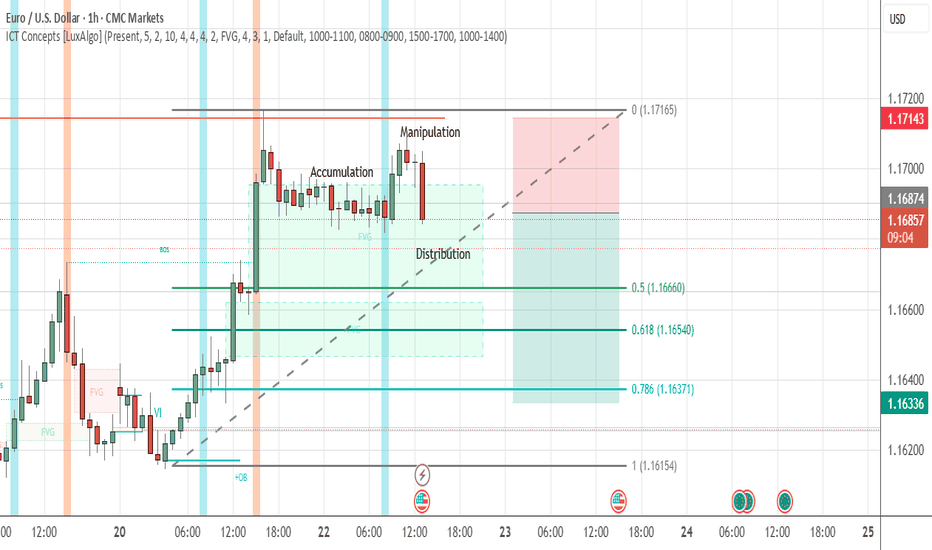

2025.07.22 LONG EURUSDThis is a long trade on EURUSD utilizing smart money concepts.

There are multiple areas of liquidity pooling above, and now that trendline liquidity has been broken, trade management parameters are in place.

Orders have been transmitted, and this is a swing trade potentially lasting 4-8 weeks.

happy trading all

-kevin

EURUSD trade ideas

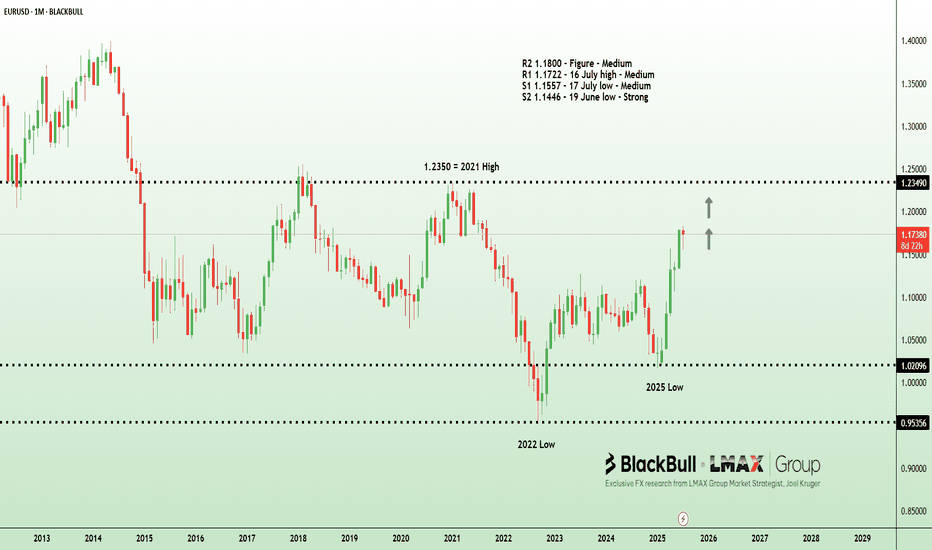

Dollar dips as politics cloud Fed picture | FX ResearchThe dollar extended its slide on Tuesday, weighed down by soft US regional data and renewed political pressure on the Fed, reinforcing the market's dovish bias. The Richmond Fed manufacturing index plunged to -20, far below expectations, while business conditions and the Philly Fed survey showed slight improvements but remained in contractionary territory.

Treasury Secretary Bessant added to the day's drama with mixed messaging, praising Fed Chair Powell's capabilities while simultaneously calling for an internal review and pressing for rate cuts, aligning with President Trump's stance that rates should be 300 basis points lower.

Trade headlines added to the noise with Bessant signaling a hard August 1 deadline for trade talks and Trump announcing a new deal with Indonesia, albeit one that still includes steep tariffs.

With the Fed in blackout mode ahead of its next meeting, markets are left to navigate a fog of political theatrics and economic uncertainty. The euro climbed to near one-month highs as the dollar softened. And traders now turn to upcoming US data and a heavy Treasury supply schedule for further direction.

Exclusive FX research from LMAX Group Market Strategist, Joel Kruger

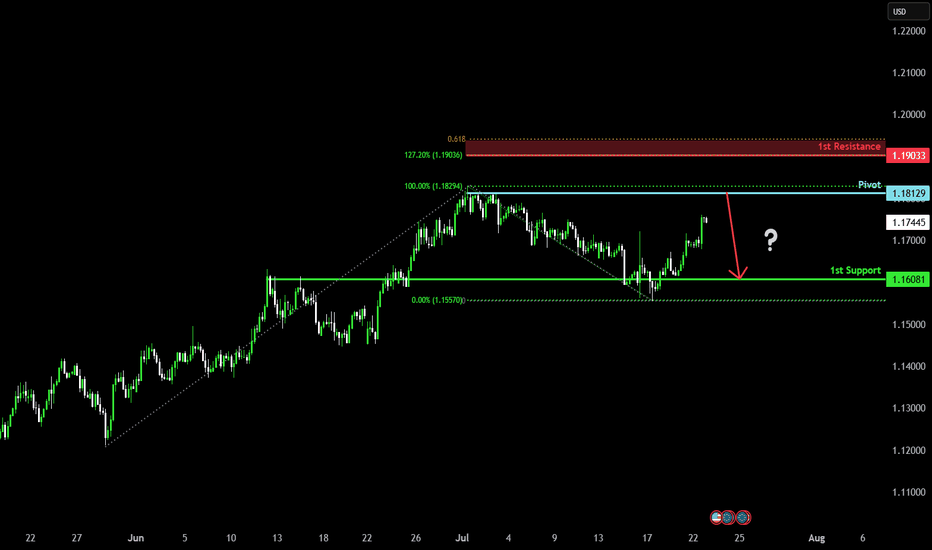

Could the Fiber reverse from here?The price is rising towards the pivot which is a pullback resistance and could reverse to the 1st support.

Pivot: 1.1812

1st Support: 1.1608

1st Resistance: 1.1903

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

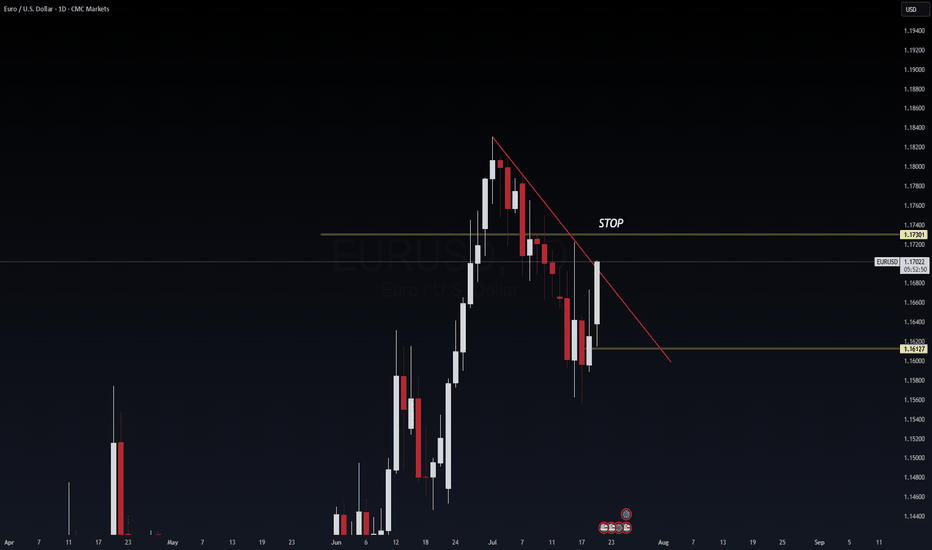

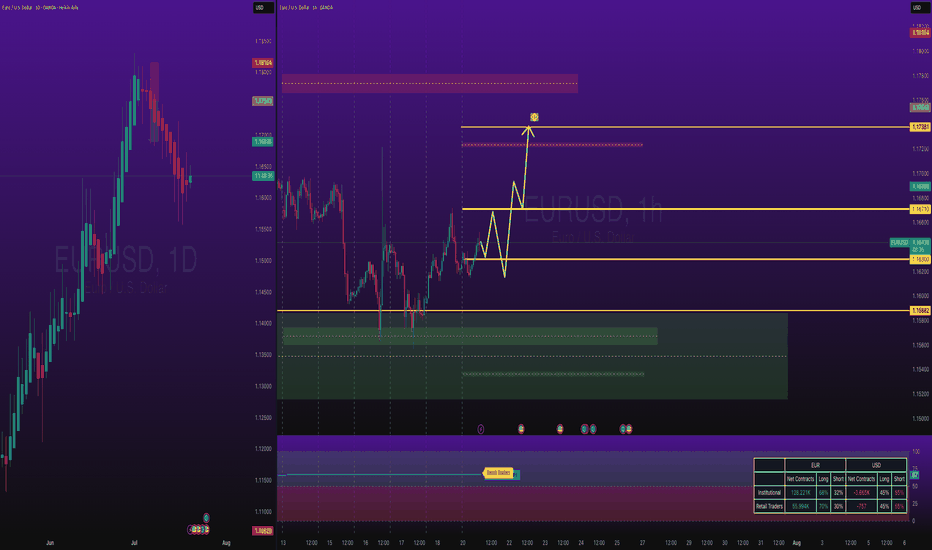

EUR/USD 6E Futures Risk Management: Navigating Macro Divergence As Risk Manager at WaverVanir International, I’m constantly evaluating asymmetrical setups where macroeconomic divergence aligns with technical structure. The current EUR/USD trade is one such instance—an evolving case of volatility compression within a descending triangle, positioned beneath key resistance at 1.1730.

🔻 Bias: Bearish

🧮 Structure: Daily lower highs + descending triangle

📉 Key Break Level: 1.1612 (horizontal support)

⚠️ Invalidation: Daily close above 1.1730

📊 Probability: 65% likelihood of downside continuation into August, driven by USD real yield strength and ECB rate path lag

We’re managing this trade with dynamic risk protocols:

🔐 Option hedge overlay for tail protection

🎛️ Exposure throttle post-FOMC volatility

💡 VolanX protocol flags 1.1530 and 1.1360 as likely liquidity pools if 1.1612 gives out

🧠 Remember: It's not about being right—it's about being protected when wrong.

—

This post is part of our ongoing commitment to transparency, system-level discipline, and volatility-aware macro execution.

#WaverVanir #VolanXProtocol #MacroTrading #RiskManagement #6EFutures #EURUSD #OptionsFlow #InstitutionalTrading #ForexStrategy

EURUSD: Mid-Term Analysis💶 EURUSD Analysis

The blue boxes under liquidity look good.

📍 The Plan

If price moves into these blue boxes:

✅ Watch for footprint absorption (buyers stepping in)

✅ Look for CDV support or bullish divergence

✅ Wait for a structure reclaim to confirm entry

⚡ Why This Matters

No chasing. No guessing.

These zones are where I’m interested if the market wants to give an opportunity.

🎯 Action Point

If signals align, I will consider a risk-managed long.

If not, I am fine waiting.

Patience and clarity. The right price, or no trade.

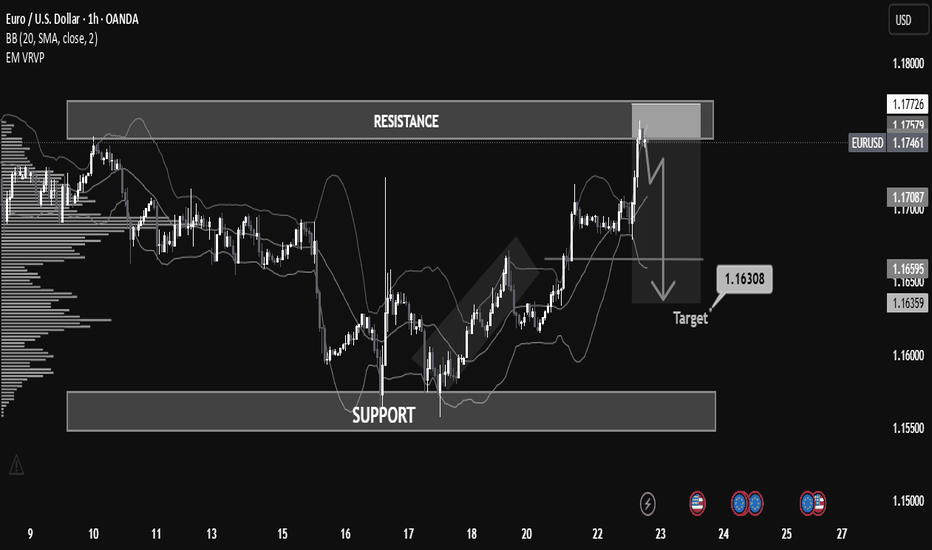

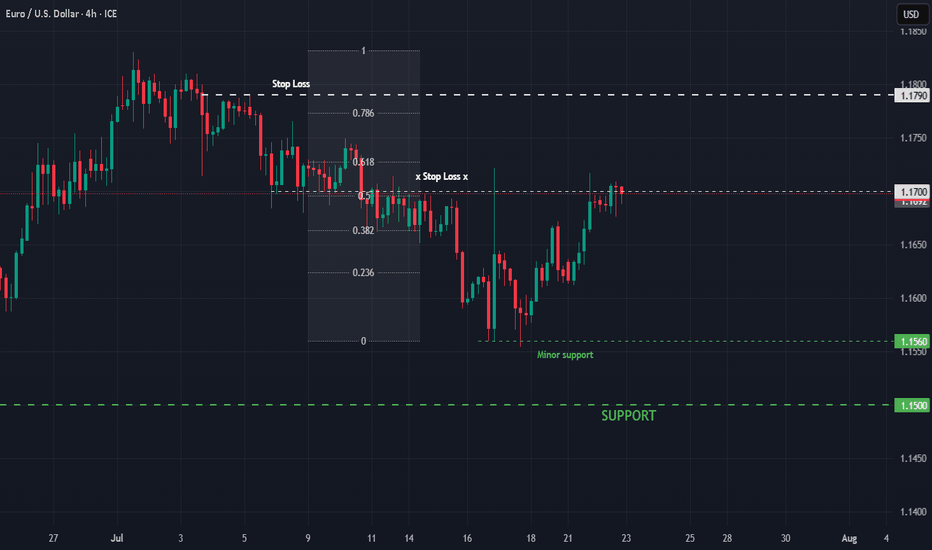

Why EUR/USD Dropped: A Step-by-Step Breakdown for Learners📉 Overview:

The EUR/USD has recently approached a key resistance zone near 1.17726, showing signs of a potential rejection after a bullish rally. The price is currently hovering around 1.17468, forming a short-term bearish setup that could lead to a retracement or reversal.

⸻

⚙ Key Technical Zones:

• 🔼 Resistance: 1.17500 – 1.17726

Price was strongly rejected after testing this area. This level has historically acted as a supply zone.

• 🔽 Support: 1.15500 – 1.16000

This is a historically significant demand zone, where price previously consolidated and reversed.

• 🎯 Target Zone: 1.16308

Marked as a potential take-profit level based on prior price structure and volume profile imbalance.

⸻

🧠 Indicators & Tools:

• Bollinger Bands: Price touched the upper band in overbought conditions, suggesting a possible mean reversion.

• Volume Profile (VRVP): Indicates declining volume near resistance, pointing to weak buyer momentum.

• Price Action: Bearish engulfing candle and strong rejection wick at resistance, confirming selling pressure.

⸻

🧭 Market Bias:

📌 Short-Term Bearish

A short opportunity is forming based on the rejection from resistance and overextension of price.

⸻

🧩 Possible Scenario:

1. Breakdown below 1.17061 (mid-level support) could trigger acceleration to the downside.

2. 1.16500 and 1.16308 are ideal short targets before reevaluation for continuation or bounce.

⸻

🛑 Risk Management Tips:

• Consider SL above 1.17800 (previous high).

• Monitor for confirmation before entry (e.g., bearish candle close below 1.17000).

• Adjust size and risk-reward ratio appropriately.

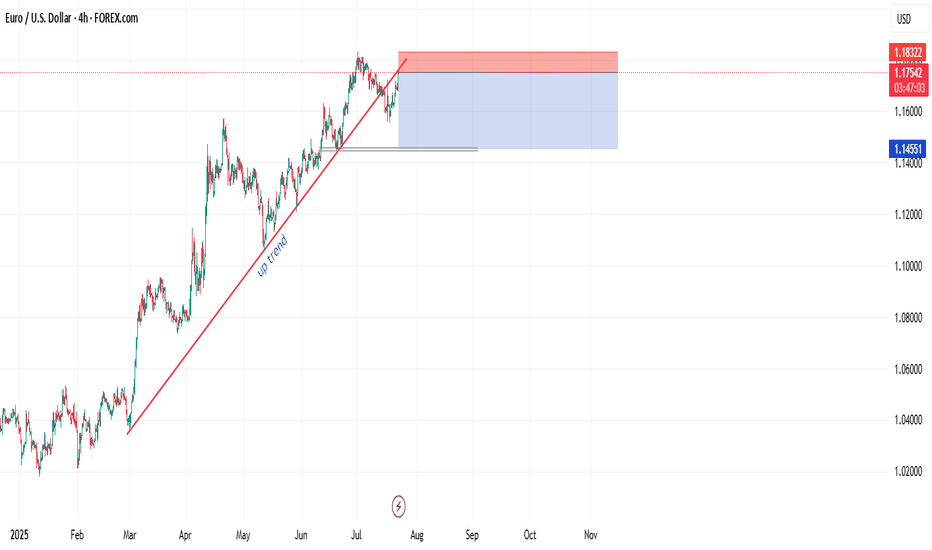

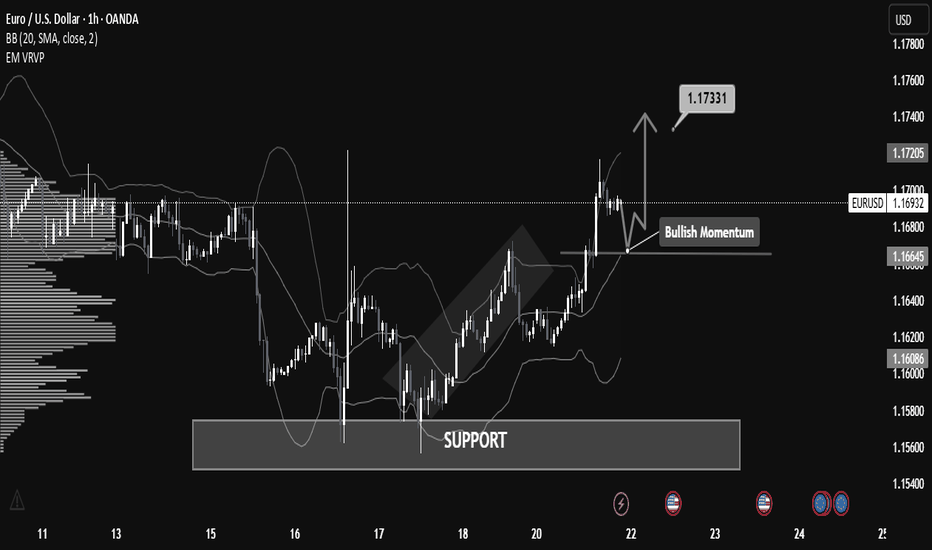

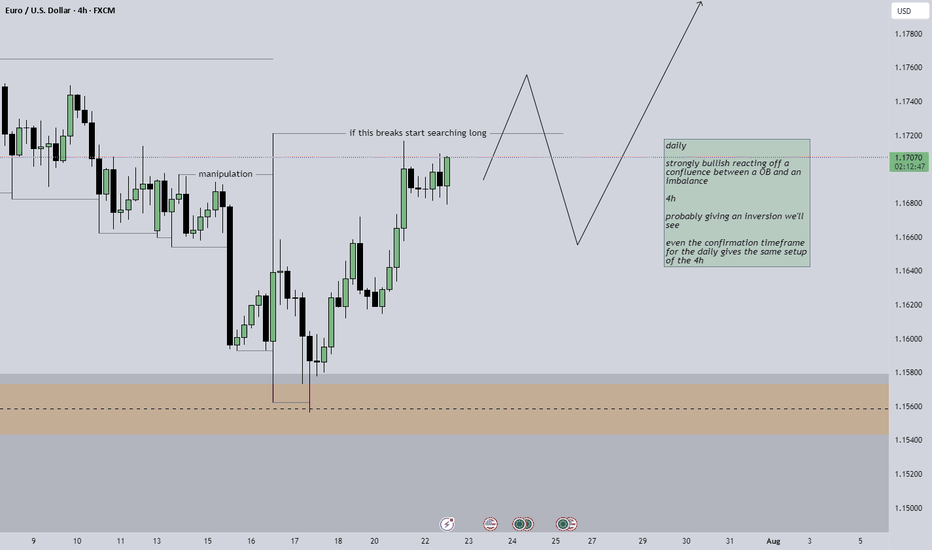

"EUR/USD Technical Blueprint: Bullish Continuation EUR/USD Technical Blueprint: Bullish Continuation Patterns and Strategic Price Zones Explained

🔹 Market Structure & Trend

The chart shows a clear shift from a ranging phase into a bullish breakout:

Price previously consolidated in a broad horizontal channel, with a strong demand zone (support) established between 1.16000 – 1.16600.

Following a deep liquidity grab on July 17-18, the price bounced sharply from support, creating higher highs and higher lows – a classic bullish structure.

Current momentum shows bullish continuation, as the price broke above local resistance around 1.16645 and is now forming a potential bull flag or bullish pennant pattern.

🟢 Bullish Momentum Confirmation

Price is currently retesting the broken resistance (now acting as support at 1.16645).

If the support holds and bullish momentum continues, the measured move target projects a price move toward 1.17331, the next significant resistance level.

This is also supported by increased volume activity in the breakout zone, as seen on the VPVR.

📊 Key Technical Levels

Level Type Description

1.16000 Major Support Historical demand zone + liquidity grab

1.16645 Support Zone Previous resistance, now retest area

1.16926 Current Price Bullish consolidation forming

1.17331 Resistance Bullish target based on breakout projection

1.17700+ Extension Potential continuation level if momentum persists

🧠 Volume & Volatility Insight

Bollinger Bands are expanding post-breakout, indicating increasing volatility and a potential trend continuation.

VPVR shows a high-volume node around 1.166, confirming it as a strong demand zone.

🔎 Outlook & Strategy

✅ Bullish Bias

As long as the price remains above 1.16645, buying dips could be a favorable strategy.

A break above 1.17000 with strong volume could open a path toward 1.1733 and higher.

❌ Invalidation Level

A strong close below 1.16600 would invalidate the bullish setup and could return price to the lower support around 1.16000.

📌 Conclusion

EUR/USD is displaying strong bullish momentum after breaking a key resistance level and forming a solid support base. A breakout above 1.17000 may lead to a continuation toward 1.17331 and potentially higher. This setup favors bullish positioning with tight risk management.

EURUSD Long Swing FX:EURUSD price had stopped falling and I was waiting for bullish volume to kick inn, initial bullish volume started jumping inn, so taking long now.

With my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

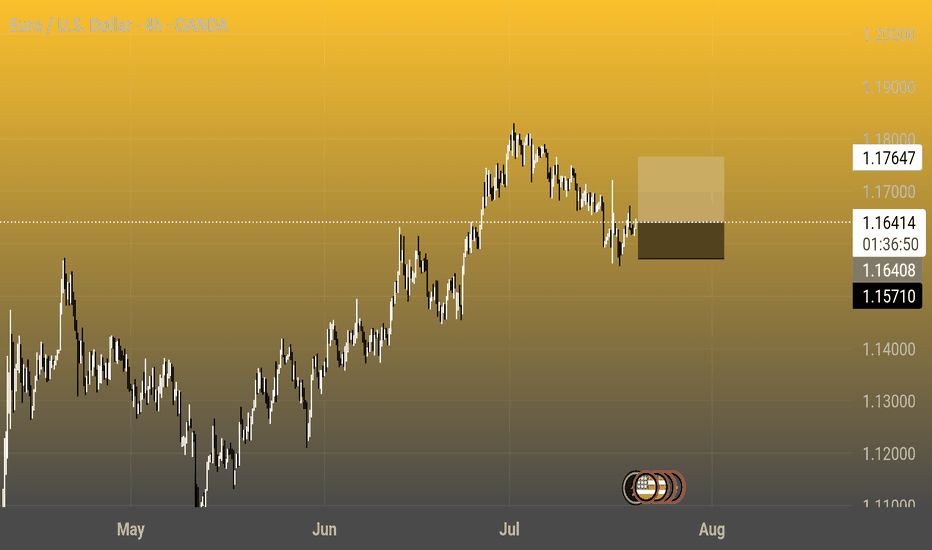

Euro / U.S. Dollar 4h Chart - OANDA4-hour candlestick chart showing the exchange rate between the Euro (EUR) and the U.S. Dollar (USD) from May to August 2025. The current rate is 1.16416, with a 0.14% increase (+0.00161). The chart highlights a peak around late June to early July, followed by a decline, with notable support and resistance levels marked at 1.17647 and 1.16416, respectively.

EURUSD| Back Aligned Bullish - Still in Analysis ModePair: EURUSD

Bias: Bullish

Following price closely and adapting to the market’s rhythm.

Recent structure showed that price is still respecting last week’s key zones — so I’ve realigned with the bullish bias accordingly.

No entries yet — still in analysis mode, which honestly is the best part 😉

Watching for clean LTF confirmations before engaging. No guessing. No forcing.

Price always tells the truth — you just gotta stay patient enough to listen.

#EURUSD #SMC #bullishbias #marketstructure #inducementking #smartmoneyflow

Bless Trading!

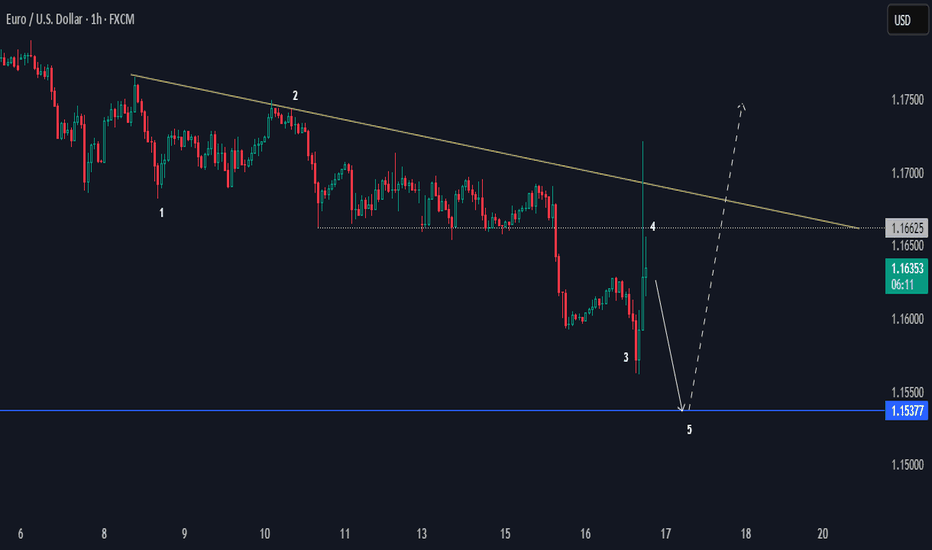

EURUSD Bearish Sentiments Below LowEURUSD looks bearish at H1 for a bias of 1.15377. It's an unusual price action; the overall trend in a higher time frame is bullish, but the 1.1700 had strong bearish pressure.

The current momentum is bearish below 1.16625, making that level a key area zone.

Happy Trading,

K.

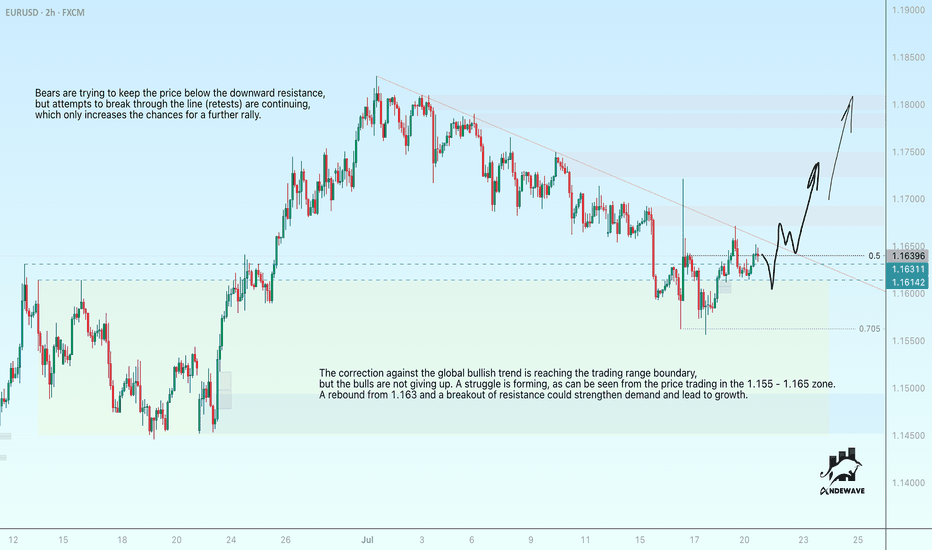

EURUSD may rally after breaking through resistanceThe correction against the global bullish trend is reaching the trading range boundary, but the bulls are not giving up. A struggle is forming, as can be seen from the price trading in the 1.155 - 1.165 zone. A rebound from 1.163 and a breakout of resistance could strengthen demand and lead to growth.

Bears are trying to keep the price below the downward resistance, but attempts to break through the line (retests) are continuing, which only increases the chances for a further rally.

The following fundamental nuances are equally important: prices are rising amid preparations by the EU for possible retaliatory measures in response to Trump's threat to impose 30% tariffs. Tomorrow, Fed Chairman Powell will speak (hints on interest rates), and on Thursday, the ECB will announce its decision (interest rates are likely to remain unchanged).

EUR/USD LOSS❌ EUR/USD Loss – Part of the Process

We were in this trade for 4 days before price made a sharp move against us, taking out our stop.

No strategy wins every time—and this is one of those times.

But losses like this are easier to handle when you have a rules-based system like the VMS strategy behind you. It’s built to:

Filter only high-probability setups

Keep emotions out of decision-making

Win more than it loses over time

📌 This wasn’t a bad trade—it was a trade that didn’t work this time. Big difference.

We stay focused. We stay patient. And we keep showing up.

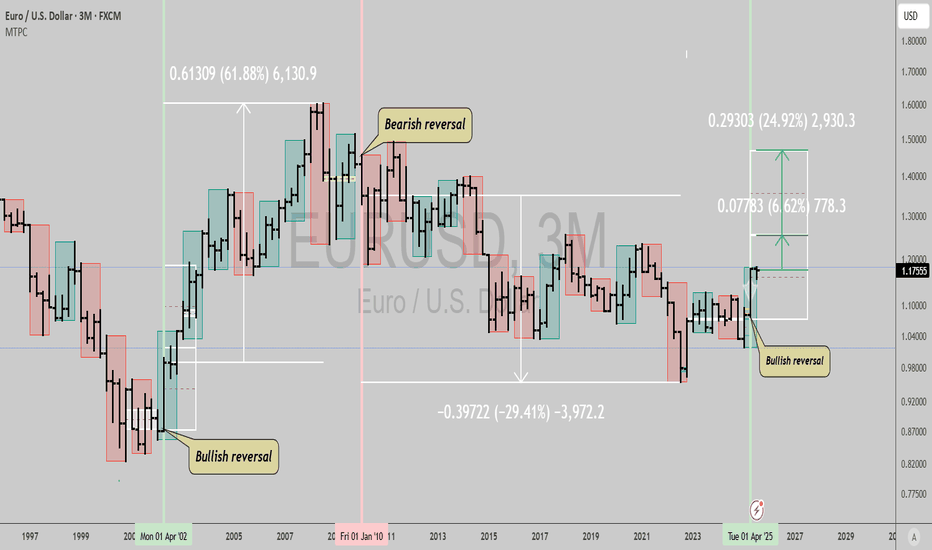

$EURUSD: Massive signal not seen since 2002...GM gents, wanted to bring your attention to the Euro here. This type of signal hasn't happened since 2002, which makes it a very big deal and a very real risk if you're in Europe and holding USD exposure.

We could see a 7% to 25% rally in the coming 2 years from this spot, with pretty high probability, and maybe even a series of similar signals in the same direction for longer like from 2002 to 2010 when the quarterly trend turned bearish decisively.

It's wise to find some way to generate enough returns to cover this currency risk, if you're invested in US stocks, crypto (stables mostly denominated in USD), etc.

Best of luck!

Cheers,

Ivan Labrie.

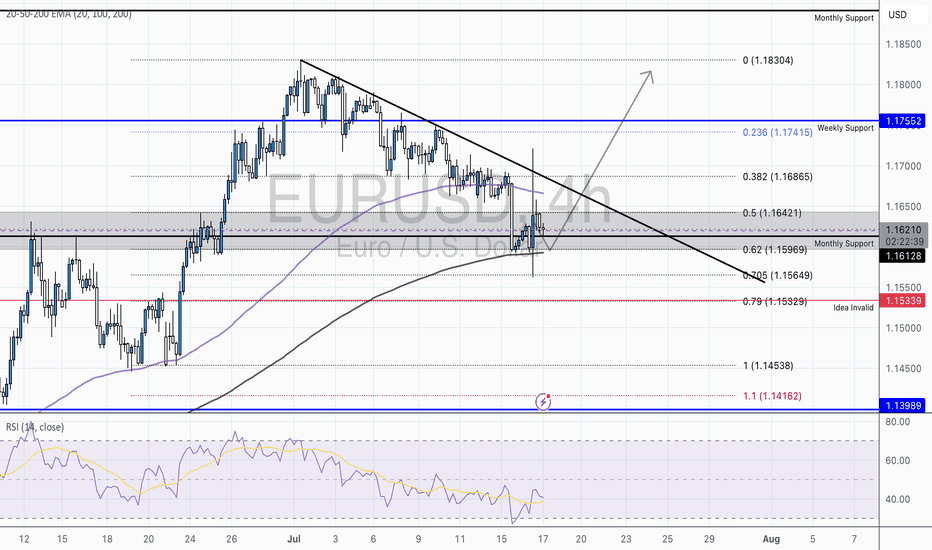

EUR/USD – Falling Wedge at Major Fibonacci Zone | Bullish ReversAfter a strong mid-June rally, EUR/USD has pulled back into a key fib cluster, showing early signs of reversal from a classic falling wedge pattern — often a precursor to bullish breakouts.

Technical Breakdown:

📉 Descending Trendline

🔍 Fibonacci Confluence:

Price is reacting from the 0.5-0.618 – 0.705 zone (1.16421-1.15969), aligning perfectly with historical demand and the golden zone of the fib retracement.

Just below sits the 0.79 fib (1.15339), which also marks our invalidity level for this idea — a deep but powerful retracement if tested.

💡 RSI:

While still below 50, it has created a hidden bullish divergence between July 12–17, hinting that momentum is flipping back to bulls.

🧠 Educational Insight:

This setup combines Trendlines, Fibonacci retracement theory, and EMA dynamics to build a multi-layered trade thesis — the type of confluence we look for at Wright Way Investments.

Price doesn’t just reverse because it hits a fib level. But when structure, EMAs, and RSI align — the odds increase significantly.

📈 Trade Setup (Idea-Based, Not Financial Advice):

Long Entry Zone: Current area (1.159–1.161), with confirmation above 1.1626

Invalidation: Clean break & close below 1.15339

Target Zones:

🎯 TP1 – 1.1642 (50 fib & retest zone)

🎯 TP2 – 1.1686 (38.2 fib)

🎯 TP3 – 1.1755 (Weekly Resistance)

📌 Summary:

EUR/USD is forming a textbook reversal setup, supported by fib precision and EMA alignment. Patience is key — but the ingredients are here for a strong bullish continuation.

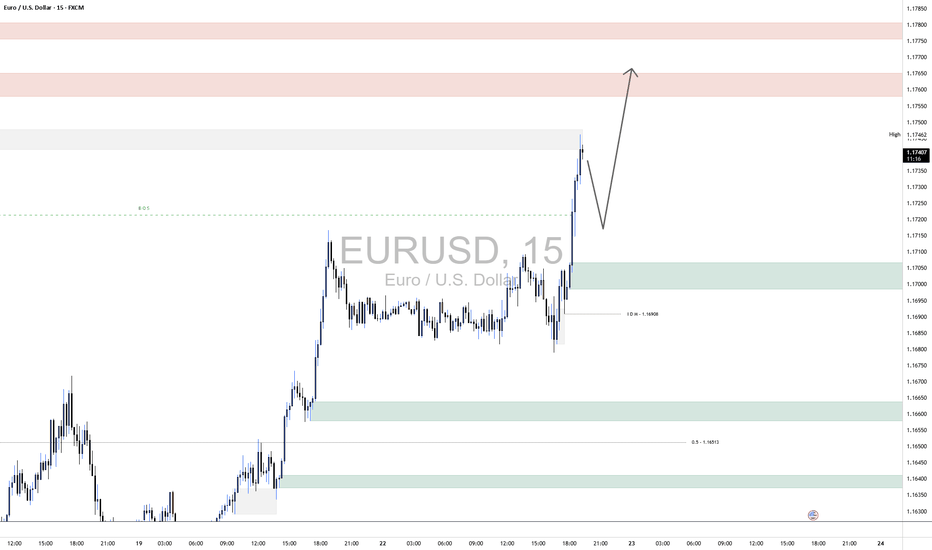

EURUSD LongEURUSD 15-Minute Technical Analysis

EURUSD has broken through a key intraday structure level with strong bullish momentum, indicating continued institutional interest on the buy side. The market is now approaching a higher-timeframe supply region while leaving behind a well-defined demand zone that could serve as a launchpad for further upside.

🔍 Market Structure & Momentum:

Break of Structure (BOS) was confirmed after the recent surge above the previous high, validating the current bullish trend.

Price has rallied aggressively from the IDM low at 1.16908, sweeping short-term liquidity and suggesting smart money involvement.

We are now trading inside a minor supply zone and approaching a broader liquidity cluster between 1.17550 – 1.17800.

🟩 Key Demand Zone

Level: 1.16980 – 1.17100

This zone marks a significant accumulation area where the market built up momentum before the breakout. It's also in line with the IDM (Internal Drawdown Marker), serving as a technical retracement level.

A retracement into this demand zone would align with a classic bullish continuation pattern, offering a potential re-entry area for long positions.

The imbalance left behind further supports this zone’s potential to hold.

🟥 Overhead Supply Zones (Resistance Clusters):

First Zone: 1.17550 – 1.17700

Second Zone (Stronger): 1.17750 – 1.17900

These zones represent unmitigated supply levels from previous sell-offs and may act as profit-taking or short-term reversal points for intraday traders. These areas are where we expect higher levels of volatility and potential bearish reaction before continuation or reversal.

📈 Expectations & Trade Setup:

Anticipation of a retracement into the 1.16980–1.17100 demand zone for price to establish a higher low before pushing toward unfilled liquidity above 1.17550.

If demand holds, a bullish continuation could aim for 1.17750–1.17900, where confluence with past supply suggests caution.

Should price fail to hold the demand, bearish momentum could pull price back toward the lower demand block at 1.16500 (aligned with the 0.5 fib level of the prior impulse).

EURUSD : Not yetBut I think it will be coming soon.

The battle between buyer and seller has been ongoing for more than 30 hours now.

If I SELL too soon (without confirmation), then it is risky, as we have seen that the price still creeps upwards. Wait for Buyer exhaustion.

We will know the winner soon. I will definitely let you know when it happens. Let's make $$$$$

Good luck.