Buy opportunity on the EURZARHello,

A potential buying opportunity is emerging on the EUR/ZAR weekly chart. The pair is trading within a well-defined rising channel, where it has completed a strong impulse wave (April 2022 – May 2023) and is currently in a corrective phase.

With the correction seemingly reaching exhaustion, w

Related currencies

I wish I was wrong with this but now it's looking better EUR/ZAROk so this was painful.

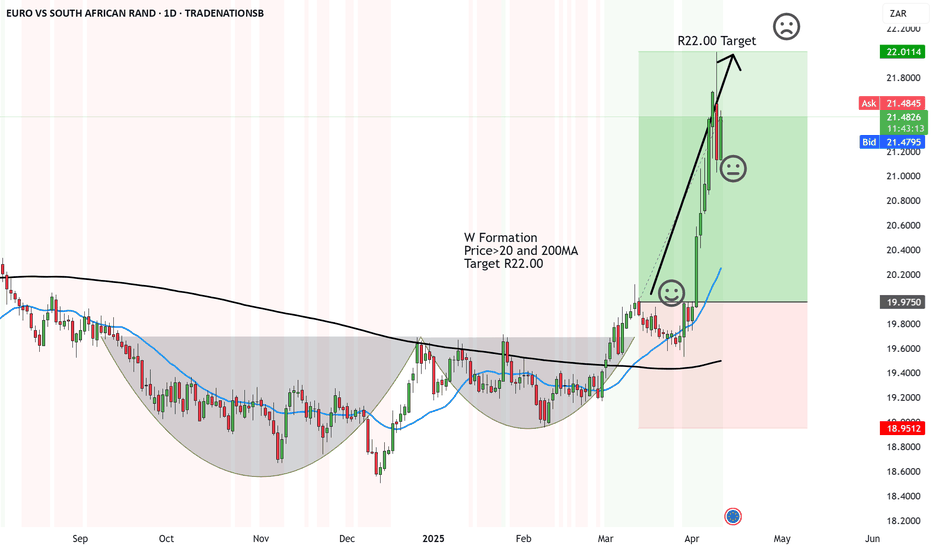

The W Formation neckline broke above and since then headed to the target at R22.00 a EURO!

For someone who travels to Europe a lot, it's not easy on the rands.

But since it hit the target, it turned down and hopefully will stay down for now.

We are currently at R20.34

EURZAR-SELL strategy 2D chart GANNIncorporating ZAR crosses makes sense on this occasion. We like to understand cross behavior, and especially ZAR is within a wider range, and using the combo whereby EURUSD is very overbought, the ZAR combo makes sense. i see a reasonable move/correction for this cross possible.

Strategy SELL @ 21

UPDATE Target Reached EURZAR - R22.00 - Next R25?Nothing to celebrate here.

It was one analysis I wish I was wrong and yet, here we are.

The Cup and Handle was text book, the Tarrifs hit SA hard.

And the sad thing out of all of this is that South African rand will probably hurt more than what will happen to the US Dollar.

So what now? Now I

EUR/ZAR is going up to R22.00 and I hate to tell you this! Here's an analysis I really don't want to do.

The EUR/ZAR is showing strong upside to come. Great for the EURO, great for Europe, Great for South African exports.

Not great for the South AFrican consumer who was planning on sailing to Mykonos this year.

Anyways, here are some reasons for the E

EURZAR MARKET ANALYSIS AND PRICE PREDICTIONEURZAR , has finished consolidating at the Institutional renegotiation zone, decision has been taken in favor of the Bulls because price has broken the Bullish structure already. Price is currently Retracing downward to mitigate an order Block, fill up an imbalance and then Give the Bulls a Perfect

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of EURZAR is 20.80064 ZAR — it has increased by 0.49% in the past 24 hours. See more of EURZAR rate dynamics on the detailed chart.

The value of the EURZAR pair is quoted as 1 EUR per x ZAR. For example, if the pair is trading at 1.50, it means it takes 1.5 ZAR to buy 1 EUR.

The term volatility describes the risk related to the changes in an asset's value. EURZAR has the volatility rating of 1.32%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The EURZAR showed a 0.70% rise over the past week, the month change is a 0.60% rise, and over the last year it has increased by 4.54%. Track live rate changes on the EURZAR chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade EURZAR right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with EURZAR technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the EURZAR shows the buy signal, and 1 month rating is strong buy. See more of EURZAR technicals for a more comprehensive analysis.