EUXJPY trade ideas

Trading Academy - Alex Morris - Project A

Select EUR/JPY to start with on Tradingview and focus on a two-month period between the 8th of May and the 8th of July 2024.

Identify the market structure on the HTF (Weekly and Daily).

Identify the market structure on the LTF (1HR timeframe).

If possible, identify a narrow consolidation of price on the 1HR timeframe.

Identify an aggressive bullish or bearish imbalance in price.

Draw your supply or demand zone.

Identify whether there is a gradual or impulsive retracement.

Identify whether a confirmation candle is present.

Set your stop loss, take profit, and execute.

Follow the same process as above for and EUR/CHF (if you have the paid version), focusing on the two-month period between the 8th of June and the 8th of August 2022.

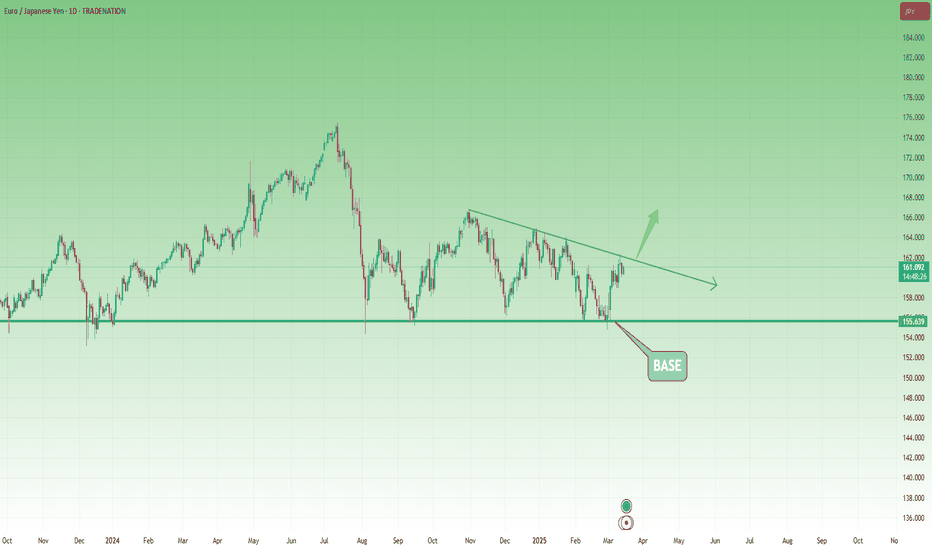

EUR/JPY Trade Setup: Buying the Dip Toward 160 for a 1:2.5 R/RSince reaching a low around 155 at the beginning of August, EUR/JPY has been trading within a defined range.

Earlier this March, the pair once again tested the lower boundary of this range and, as before, rebounded strongly. A higher low was established at the start of this week, suggesting that 159 may now serve as a new base of support.

In my view, EUR/JPY is likely to continue its upward trajectory, and a move toward 165 could materialize in the near future.

Conclusion:

Pullbacks toward the 160 area should be considered potential buying opportunities. With a stop-loss set around 158 and a target at 165, this setup offers an attractive risk-to-reward ratio of approximately 1:2.5.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EURJPY forming a top?EURJPY - 24h expiry

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

There is no sign that this bullish momentum is faltering but the pair has stalled close to a previous swing high of 162.36.

This is negative for short term sentiment and we look to set shorts at good risk/reward levels for a further correction lower.

Preferred trade is to sell into rallies.

Although the anticipated move lower is corrective, it does offer ample risk/reward today.

We look to Sell at 162.30 (stop at 163.22)

Our profit targets will be 159.68 and 157.60

Resistance: 164.15 / 166.70 / 169.90

Support: 160.75 / 159.35 / 157.60

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

CHECK EURJPY ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

EURJPY trading signals technical analysis satup👇🏼

I think now EURJPY ready for SEEL trade EURJPY SEEL zone

( TRADE SATUP) 👇🏼

ENTER POINT (162.200) to (162.100) 📊

First tp (161.800)📊

2nd tp (161.300)📊

Last target (160.800) 📊

stop loss (162.800)❌

Tachincal analysis satup

Fallow risk management

CHECK EURJPY ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

EURJPY trading signals technical analysis satup👇🏼

I think now EURJPY ready for SEEL trade EURJPY SEEL zone

( TRADE SATUP) 👇🏼

ENTER POINT (161.800) to (161.700) 📊

First tp (161.400)📊

2nd tp (161.000)📊

Last target (160.500) 📊

stop loss (162.300)❌

Tachincal analysis satup

Fallow risk management

EUR/JPY "YUPPY" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "YUPPY" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (157.700) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout MA (or) placing the Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 156.000 (swing Trade Basis) Using the 4H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 160.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

╰┈➤EUR/JPY "YUPPY" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

🟠Fundamental Analysis

1. Interest Rates: The European Central Bank (ECB) has maintained a hawkish stance, with interest rates expected to remain around 3.25%. The Bank of Japan (BOJ) has also maintained a dovish stance, with interest rates expected to remain around -0.10%

2. Inflation: Eurozone inflation is expected to be around 2.2% in 2025, while Japan's inflation is expected to be around 1.5%

3. GDP Growth: Eurozone GDP growth is expected to be around 1.2% in 2025, while Japan's GDP growth is expected to be around 1.1%

4. Trade Balance: The Eurozone has a significant trade surplus, while Japan has a trade deficit.

🟡Macroeconomic Factors

1. Monetary Policy: The ECB and BOJ's monetary policies have a significant impact on EUR/JPY.

2. Fiscal Policy: Government spending and taxation policies in the Eurozone and Japan can impact the economy and currency.

3. Global Events: Events like the COVID-19 pandemic, Brexit, and trade wars can impact EUR/JPY.

🔴COT Data

1. Non-Commercial Traders: These traders hold a net long position in EUR/JPY futures, with 55.1% of open interest.

2. Commercial Traders: Commercial traders hold a net short position in EUR/JPY futures, with 44.9% of open interest.

3. Open Interest: The total number of outstanding contracts is 233,111.

🟤Market Sentimental Analysis

1. Bullish Sentiment: 53.5% of investors are bullish on EUR/JPY.

2. Bearish Sentiment: 46.5% of investors are bearish on EUR/JPY.

3. Sentiment Index: The sentiment index is at 54.2, indicating a neutral market sentiment.

🟣Positioning Analysis

1. Long Positions: 56.3% of investors are holding long positions in EUR/JPY.

2. Short Positions: 43.7% of investors are holding short positions in EUR/JPY.

3. Retail Trader Sentiment: Retail traders are net long EUR/JPY, with a sentiment index of 57.1%.

4. Institutional Trader Sentiment: Institutional traders are net short EUR/JPY, with a sentiment index of 45.6%.

🔵Quantitative Analysis

1. Moving Averages: The 50-day moving average is above the 200-day moving average, indicating a bullish trend.

2. Relative Strength Index (RSI): The RSI is at 55.9, indicating a neutral market sentiment.

3. Bollinger Bands: The price is trading near the upper band, indicating a potential overbought condition.

🟢Intermarket Analysis

1. Correlation with Other Markets: EUR/JPY has a positive correlation with EUR/USD and a negative correlation with USD/JPY.

2. Commodity Prices: EUR/JPY has a positive correlation with gold prices and a negative correlation with oil prices.

⚫News and Events Analysis

1. ECB Meetings: The ECB's monetary policy decisions can significantly impact EUR/JPY.

2. BOJ Meetings: The BOJ's monetary policy decisions can also impact EUR/JPY.

3. Economic Data Releases: Releases of economic data, such as GDP growth and inflation, can influence EUR/JPY.

⚪Next Trend Move

Based on the analysis, the next trend move for EUR/JPY is likely to be bullish, with a potential target of 160.000.

🟡Future Prediction

Based on the analysis, the future prediction for EUR/JPY is bullish, with a potential target of 165.000 in the next 6-12 months.

🔴Overall Summary Outlook

EUR/JPY is expected to remain in a bullish trend, driven by the ECB's hawkish stance and the BOJ's dovish stance. However, investors should remain cautious of potential market volatility and economic uncertainties.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURJPY: A Large Corrective Pattern in DevelopmentEURJPY: A Large Corrective Pattern in Development

The EURJPY currency pair recently encountered a significant resistance zone from above. Historically, the price has repeatedly declined after testing this dynamic zone, increasing the likelihood of another bearish movement.

Adding to the downward pressure is the Bank of Japan's (BOJ) influence. The BOJ's recent comments have created uncertainty and are driving down the value of currencies, including the yen.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/JPY Rejection at Trendline – Bearish Move Ahead?EUR/JPY 4-hour chart is respecting a long-term descending trendline, acting as dynamic resistance. Price recently tested this trendline near 162.018 - 164.073 and is now rejecting it, indicating a potential bearish move.

Bearish Confirmation & Entry:

Price failed to break above the 162.018 - 164.073 resistance zone, confirming a potential sell opportunity.

A downward movement is expected, targeting key support levels as marked.

Target Levels:

First Take Profit (TP1): 158.753 (Minor support zone)

Second Take Profit (TP2): 157.319 (Stronger support)

Third Take Profit (TP3): 156.202 (Significant demand area)

Final Take Profit (TP4): 154.786 (Major support and previous low)

Risk Management:

Stop-loss: Above 162.018 to protect against a potential breakout.

The trade setup offers a high risk-to-reward ratio, making it a strong candidate for a short position.

Buy idsaDescending wedge indicating a possible short term bullish run on the hourly/30m time frame. Price seemed to have a faked a breakout earlier today, if all goes as planned, I expect a breakout on the upside and continuation to the price I have marked as a target on the chart!

Let me know what you think! Comments and/or suggestions highly appreciated! :)