FILBTC trade ideas

Filecoin is choppy and consolidating. How do we approach this ?

I think the chart should be stretched out a bit longer. But i'm quite impatient, and the charts I make are to illustrate what I would like to see ofcourse. Besides that, normally I don't include multiple pivots in my forecasting and generally think it looks amateurish to do so. As I think that requires constant adjustment on every new candle, which is not possible in a tradingview idea. Causing the analysis to outdate itself right away. However I am feeling adventurous tonight and think these pivots I expect based on this chart are realistic.

In the bottom chart, there is the trend visualized as overlapping, transparant bars. Green represent the bullish trend, red represents the bearish trend. Both can be present at the same time, and the art of analyzing trends is to predict which one of the two will become dominant enough so the other will starve.

Trends move in cycles, and a way to recognize the end of a trend cycle is when both the bullish trend and the bearish trend is below 20. That's an anchor point which is used by many screeners and bots. However lower values are also used such as 15 or 16. But generally speaking, 20 is a good treshold value to determine a trend has ended if you do chart analysis by yourself.

So without further ado, here's my analysis. (tl;dr: no-trade zone. Go spend time with friends and family coming week).

On the bottom chart red columns are bearish trend and green columns are bullish trend. Both are stable but also decreasing steadily. When the trend drops below 20 it starts to cycle into a new one. Which means volatility and momemtum have reached their lowest point and will start to increase from then on. However, the direction of the trend is something we have yet to estimate.

But there is an exception to this though. Because there is a consolidative squeeze happening (I marked the starting point with two black dots on the crossover of the bands with the channels). It is hard to estimate when squeezes like this finish, configuring an alert when the bands and channels cross again is something you'd like to do. Once this happens, an indicator such as the parabolic SAR can be used to estimate the trend direction.

So we have two possible catalysts right now, and this squeeze is the most unpredictable. The chance is high it happens before the current trend can actually 'fade out' on the bottom chart. Then the squeeze will ignite a new trend right away, causing a steady (explosive) increase of momentum and volatility. Sometimes these moments are used to setup traps as well or shake out overleveraged traders with large wicks. As it is hard to estimate the direction properly if you enter a position too early on this.

If this squeeze will develop slowly, then the bottom chart will show the trend fading out untill it drops below 20 eventually. Once that happens, the chart becomes more interesting again and things like support/resistance levels become more important. However, actually opening a position should be done once you have a clear entry. After the trend crossed over 20 again (important). I've put an extra ceiling, on 40. There's these intermediate pushes happening that can't get beyond this level. Possible "hidden" breakouts can be anticipated if the trend is actually strong enough to get passed that point.

If the consolidating squeeze ends pre-maturely the new trend could break out during one of those intermediate pushes, with price action following shortly after. I've mirrored the decreasing trend line to illustrate how that would look like. This mirror image however does not predict wether price go up or down. It predicts the price will increase in momentum and force. This is followed by an increase or decrease in price. So the price can go down, the price can go up. I don't see why it would go down, as filecoin is awesome.

Please leave a reply in the comments if you have enjoyed reading this article or have any questions. The feedback and talk is very encouraging to put in more effort in my publications. I also do livestreaming on trading view streams occasionally, but it is pretty tense talking by myself still. So if you like to talk about charting and exchange ideas with me on stream, I'm definitely open for it. I have derived my knowledge from technical indicators, book reading and backtesting (as i am a developer). But need to improve a lot on harmonic patterns. I also like to explore gann analysis or Elliot waves.

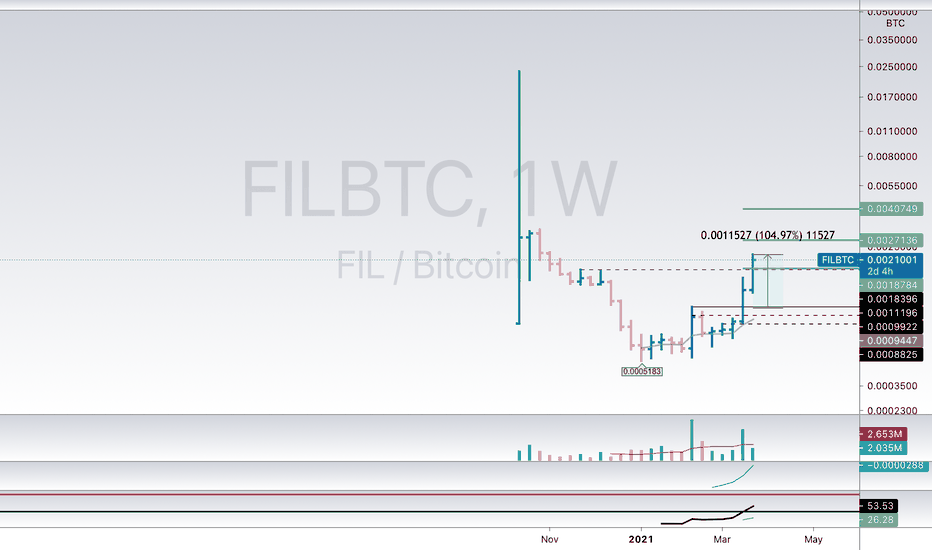

Filecoin has been unphased during the correctionFilecoin seems to be looking very strong. In the past I had mentioned FIL in one of my idea and the target got hit, but also left the possibility for more upside open. And I do believe more upside is coming. Especially if there is a reduction in the inflation rate.

FILBTC - Potential 30% From HereThis is a risky position because the bullish momentum in the 3H is not yet confirmed in the 6H. However the 12H and 24H timeframes all look like they are eager to allow bullish moves. The question is, when we should be opening our positions. I am likely going to go for a close Stop Loss, and conservative Take Profit locations in this case. Would rather wait for the breakout, or confirmation in the upper time frames.

FILBTC (Filecoin) - Coin of the WeekFilecoin is a decentralized storage mechanism with the aim of storing "humanity's most valuable information." In 2017, the project raised $205 million from an initial coin offering (ICO), with a target launch date of mid-2019. The project was first defined in 2014 as an incentive layer for the peer-to-peer storage network Interplanetary File System (IPFS). Filecoin is an open protocol with a blockchain that tracks the network's members' commitments and transactions in FIL, the blockchain's native currency. Proof-of-replication and proof-of-spacetime are both used in the blockchain.

Technically, we are seeing a big consolidation for this pair in its way to new highs. The higher probability scenario is a short term down move to reach the support area and then continue the uptrend. The price might continue to go higher from here, although we consider this to be a lower probability scenario. If the price breaks the red trendline and consolidates above it, it will probably continue the uptrend.

Trade with care.

Best regards,

Financial Flagship

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. Remember that you need a plan before you start trading; so, take this knowledge and use it as a guidebook that will ultimately help you understand the market and easily predict your next move.

Crypto|FIL/BTC|Long and shortLong and short FIL/BTC

Activation of the transaction only when the blue zone is fixed/broken.

The author recommends the use of anchoring fixed the blue zone, this variation is less risky.

If there is increased volatility in the market and the price is held for more than 2-3 minutes behind the activation zone after the breakdown, then the activation of the idea occurs at the prices behind the activation zone.

Working out the support and resistance levels of the consolidation zone.

* Possible closing of a trade before reaching the take/stop zone. The author can close the deal for subjective reasons, this does not completely cancel the idea and is not a call to the same action, you can continue working out the idea according to your data, but without the support of the author.

+ ! - zone highlighted by the ellipse is a zone of increased resistance, in this area there is a possible reversal for a correction, please take this factor into account in this transaction.

The "forecast" tool is used for more noticeable display of % (for the place of the usual % scale) of the price change, I do not put the date and time of the transaction, only %.

The breakdown of the upper blue zone - long.

Breakdown of the lower blue zone - short.

Working out the stop when the price returns to the level after activation + fixing in the red zone.

Blue zones - activation zones.

Green zone - take zone.

Red zone - stop zone.

Orange arrows indicate the direction of the take.

Red arrows indicate the direction of the stop.

Priority - The value of the priority parameter implies the author's subjective opinion about the more likely activation zone on this idea, this does not mean that this idea will be 80% activated by this parameter, the purpose of the parameter is to provide for the risk of the inverse of the zone parameter.

Example: "Priority Long: So the author inclines more in the direction of the activation zone open long trades, in this case, when reaching the activation zone in short you should be very careful, because this area may be highly likely to be punched about the breakdown/do not get to take/activate transaction from go to stop."

Please consider this parameter if you use my ideas.

SUM PNL: This parameter displays the total % of all closed ideas of the "new" format (according to the author) for this sector at the time of publication of the idea. The calculation is very "clumsy" just the sum of the profits of all the ideas, based on this indicator, you can more accurately assess the risks when working with my ideas of this sector. I present you the construction of the idea, you can use it yourself as you like based on your subjective view and risks, the calculation of the PNL indicator is carried out only on transactions that the author closed on TV in manual mode or by take.

P.S Please use RM (risk management) and MM (money management) if you decide to use my ideas, there will always be unprofitable ideas, this will definitely happen, the goal of the system is that there will be more profitable ideas at a distance.

FIL BTC Rising Wedge, Possible move to the downsideStrong resistance at the 30,000 mark.

Could power through to the upside or act with downward bias

Rising wedge against the downward sloping trend line.

two key levels of support on the downside.

at both 24k and 20k

If a fall back to support levels, watch and wait for consolidation and buy the breakout on the re-test of the downward sloping trendline.

TP at previous highs (22 and 43)

FIL/BTC Range Reaction off DemandBounce off of daily demand, clear S/R flip of the blue region, and volume increase on price increase.

If you did not buy at demand, then I would look to enter on a successful flip of the Orange Region (0.003). This is extra confirmation as bearish Market Structure will officially have been broken with the creation of a Higher high and eventually a Higher Low on the retest.

FilecoinSalve

miss me?

let's talk about another cool project, Filecoin is a decentralized storage network based on the Interplanetary File Storage (IPFS) protocol. It is designed to utilized unused storage globally into an efficient storage market for users to pay for low cost storage. The objective is to ensure file storage is permanent and distributed across the web. Contrast this with centralized cloud storage solution such as Amazon Web Services, Google Cloud, or Dropbox, where data are stored in servers owned by these private corporations

and I bet you don't care about FIL and you here for money eh

tg 212-215-220 sl 200-195

have fun, stay rich

peace