FIL – Asymmetric Move SetupEMA50 (green) and EMA100 (red) still sloping down.

Price reclaiming EMA50 after recent bounce.

MACD turning up, but still under zero = early momentum.

Bull case: Break and close above EMA100 could trigger fast move toward 3.15.

Bear case: Rejection at EMA50/EMA100 zone risks drop back to 2.10–2.20.

Risk/reward favors breakout traders watching EMA100.

FILUSD.P trade ideas

FIL 1W – Triple Bottom, Structure Aligns for ReversalTriple bottom confirmed on weekly.

All three lows hold ~$2.20 — strong base.

EMA50 flattening. EMA100 still declining but compressing.

MACD histogram decreasing in downside momentum.

Signal lines curling toward crossover.

RSI pushing off 40 — strength emerging from oversold zone.

Volume uptick confirms interest at structural lows.

Market structure turning asymmetrical — downside tight, upside open.

Quant thesis: probabilistic edge shifting long. DCA zone remains active.

FIL 1D – Triple Bottom, Ready for Lift-offTriple bottom confirmed at ~$2.20 — strong structural base.

Price testing neckline near $2.47 with rising momentum.

MACD curling for bullish cross; histogram momentum diverging.

RSI pushing above 50 — strength rebuilding.

EMA50 flattening, EMA100 compressing = volatility coil.

Asymmetric move potential: small risk, large upside.

Smart money accumulates quietly before breakout.

Quant outlook: structurally bullish with risk-defined edge.

FIL/USDT 1W$5.48 is an almost guaranteed target — it has been reached every single time.

What happens next depends entirely on the strength of the trend.

If we break out above the triangle and hold above it, there’s a real shot at $20.

And if that level gets broken and confirmed — then we might even see a retest of previous ATH.

But those are already "moon targets", and by that point, it’ll be smart to secure profits and just let the rest ride — and see what happens. 🚀

FIL 1D – Signal Compression Before ExpansionPrice pushed above the 9 EMA with strong volume.

MACD momentum is flattening near zero.

RSI just under 50 zone – fresh strength incoming.

EMA50 still under EMA100, but slope is compressing.

Daily structure shifting from distribution to early markup.

Risk-defined DCA zone still active.

Bull Load 100% – system primed.

FIL 1D – Strategic DCA OpportunityPrice bounced off the $2.20 level with rising volume.

Momentum slowdown shows in narrowing MACD histogram.

We see potential bottom formation after a heavy flush.

EMA50 and EMA100 remain overhead but flattening.

Early signs of seller exhaustion below the $2.30 mark.

Perfect zone for strategic DCA – asymmetry is shifting.

Quant view: reward/risk skew turning favorable for long exposure.

Patience now = positioning for upside convexity.

Stay tactical. Stay data-driven.

FIL 1W – Compression Ending, Expansion AheadFilecoin on the weekly is coiling.

Multiple weeks of low volatility.

MACD histogram losing bearish pressure.

Bullish cross still active.

Price printed a higher low.

First green candle after 5 weeks.

Volume remains stable.

Downtrend resistance is weakening.

Break above $2.80 opens room to $3.45.

Key resistance remains 50 EMA around $5.

As long as $2.25 holds,

the structure remains bullish-reversal inclined.

Compression leads to expansion.

Watch this zone.

#FIL #CryptoTA #Altcoins #WeeklyChart #TrendReversal #TradingView #FILUSDT

FIL 1D – Momentum Building Toward the 100 EMAFIL shows strong momentum.

Three green candles. Volume is rising.

MACD just flipped bullish.

Price is now above the 50 EMA.

Next test is the 100 EMA near $2.95.

Break above it targets $3.20 and $3.45.

Bull Load sits at 75%.

Trend, volume and momentum align.

Buyers are stepping in.

As long as FIL stays above $2.55, bulls are in control.

#FIL #Crypto #TradingView #Altcoins #Breakout #MACD #EMA #Bullish

FIL 1D – Quant Alert: Trend Exhaustion Nears, Upside Risk BuildsAnalysis:

Filecoin consolidates above the $2.50 mark after absorbing aggressive supply-side pressure.

Bear Load drops to 50% – signaling a weakening grip from short-side momentum.

Technical Structure:

• EMA50 ($2.75) and EMA100 ($2.97) remain overhead – yet flattening slope suggests trend inflection.

• MACD histogram flips neutral with positive delta widening – early sign of cyclical shift.

• Bullish divergence emerging on volume and MACD cross.

Quant Perspective:

• Volatility compression post-selloff = breakout conditions.

• Trend models estimate upside expansion toward $2.85–$3.05 on volume confirmation.

• Risk is defined. Reward asymmetric.

Positioning Insight:

• Smart money begins scaling exposure sub $2.60.

• Break and hold above $2.78 likely triggers model reallocation.

No hype, just quant edge.

#FIL #Filecoin #QuantTA #HedgeFundLens #CryptoTA #DeFi #FILUSD #TrendReversal #VolumeAnalysis

FIL 8H – Bull Load Rising | Momentum BrewingFilecoin flashing strength on the 8H.

Bull Load at 75% and climbing.

EMA50 reclaim — golden lift-off zone.

MACD crossed above signal, histogram flips green.

Volume build on breakout candle supports the push.

Red EMA100 overhead is next target.

Above $2.78, shorts begin to cover.

Next zones: $2.88 → $3.10

Let them sell. We accumulate.

#FIL #Filecoin #Altcoins #CryptoTA #QuantTrading #8HBreakout #CryptoMomentum #DeFi

FIL 1D – Bear Load Hits 75% as Bulls Face Critical SupportFilecoin trades below both EMA 50 ($2.82) and EMA 100 ($3.03), signaling trend weakness.

Heikin Ashi structure confirms continuous downside pressure.

Bear Load at 75% — trend intensity tilted short.

MACD still below zero line with no crossover in sight.

Last defense sits at $2.50 zone — a break could trigger liquidity sweep into $2.30s.

Reclaim of $2.82 (EMA50) flips short-term bias.

Volume increasing on red — smart money may be prepping the trap or acceleration.

Let price speak — stay tactical.

#FILUSD #Filecoin #CryptoTA #TrendAnalysis #HeikinAshi #EMAStack #BearLoad

FIL/USDT: Possible Movement ScenarioFIL — Fractal Repetition? Third Wedge Formation Under Long-Term Pressure

FIL is forming its third wedge pattern within a broader downtrend that has lasted for over 2.5 years. The chart reveals a clear fractal symmetry, where each previous wedge was followed by a strong upward breakout.

Currently, the price shows signs of a local uptrend and accumulation near the lower boundary of the channel — increasing the probability of a rebound. Immediate targets are $4.38–$4.81, with potential for further upside.

FIL 1D – Compression Build-Up Below ResistancePrice consolidates just below the 50 EMA.

Support holding tight at $2.86 — bulls defending the base.

MACD flatlining but with bullish divergence on histogram lows.

Volume thinning during pullbacks — classic bullish continuation structure.

Higher low structure still intact from April base.

Daily close above $2.94 opens momentum window to $3.30–$3.45.

Patience favors the bid. Smart money waits for the breakout.

#FILUSD #Filecoin #TechnicalAnalysis #EMAStack #Quant #CryptoTA #FILBreakout

FIL 1W – Compression Building at Multi-Year SupportFIL is trading near multi-year support between $2.50–$2.90.

Downtrend persists, but momentum is flattening.

MACD on 1W nearing a bullish cross after long suppression.

Volume is gradually increasing — early accumulation signals.

Price is compressing under 50/100 EMA on both daily and weekly.

Funding rate remains negative → crowd is still short.

Risk-reward is asymmetric.

If price reclaims $3.35, breakout structure is confirmed.

First targets: $4.00, then $6.50 (macro lower high).

Stop invalidation below $2.40.

Setup favors patient positioning.

FIL 1D – Compression Before DecisionPrice testing confluence zone at $2.78–$2.86 (50 EMA + prior support shelf).

Bear Load 75% but fading momentum — low volume on red candles.

MACD histogram printing higher lows. Signal lines coiling.

100 EMA still overhead, but bulls defended 50 EMA with conviction.

Shorts pressed, but no follow-through — market indecisive.

Holding above $2.74 keeps structure intact.

Break back above $2.93 reactivates bullish bias toward $3.20+.

#FILUSD #Filecoin #TechnicalAnalysis #CryptoMarkets #Quant #SwingTrade #EMA

FIL: X Wave Flat - Trendline Break & Bullish DivergenceFilecoin (FIL) Elliott Wave Analysis: Decoding the X Wave for Potential Upside (May 2025)

exprwebdev | Date of Analysis: May 24, 2025

Introduction: Navigating FIL's Corrective Structure

Filecoin (FIL), the decentralized storage powerhouse, has experienced significant price movements since its All-Time High (ATH). This analysis delves into FIL's price action using Elliott Wave Theory, complemented by crucial support/resistance levels and trendline breaks, to project its near-term and long-term trajectory. Our current focus is on identifying a potential long opportunity within a larger corrective pattern.

Higher Timeframe Perspective: The WXY Correction

Following its ATH, FIL underwent a sharp and extended decline. Based on our Elliott Wave count, this initial significant drop is interpreted as a Double Zigzag (labeled as the W wave) within a much larger corrective structure.

Currently, the market is in the process of forming the X wave of this overarching WXY corrective pattern. This X wave is a critical juncture, as it often acts as a bridge between two larger corrective or impulsive moves.

Decoding the X Wave: A Flat Correction (abc)

Upon closer inspection, we are identifying the internal structure of this major X wave as a Flat corrective pattern (labeled as abc).

Completion of 'a' and 'b' waves: We observe that the 'a' and 'b' sub-waves of this flat correction appear to be complete. The 'b' wave typically retests or slightly exceeds the start of the 'a' wave, and in a flat, it can be quite deep.

Anticipating the 'c' wave: Our analysis suggests that FIL is now poised to embark on the 'c' wave of this flat correction. Crucially, in a flat, the 'c' wave is often an impulsive wave, indicating a strong, directional move.

Technical Confluence for the 'c' Wave (Potential Long Setup)

The conviction for the impending 'c' wave to the upside is strengthened by key technical signals:

Trendline Breakout: We've observed a significant breakout of a key trendline, which has been acting as resistance. This break provides strong confirmation that the bullish momentum required for the 'c' wave is building.

Bullish Divergence Confirmation: Furthermore, a bullish divergence has been confirmed on relevant indicators (RSI) when comparing the low of the 'b' wave with previous lows. This divergence signals a weakening of bearish momentum and a potential reversal to the upside.

Support & Resistance Alignment: The low of the 'b' wave has found strong support, potentially aligning with historical price levels or Fibonacci retracement levels from prior moves. This confluence reinforces the validity of this area as a strong demand zone.

Invalidation & Risk Management

For this specific long trade setup targeting the 'c' wave, our invalidation point is the low of the 'b' wave.

Crucial Level: If the price falls below and sustains a break of the 'b' wave low, our current Elliott Wave count and bullish bias for the 'c' wave would be invalidated.

Alternative Plan: Should this invalidation level be breached, it would necessitate a re-evaluation of the wave count and potentially lead to an alternative, more bearish scenario.

Risk Management: This invalidation point serves as a critical stop-loss level for any long positions taken based on this analysis, emphasizing the importance of disciplined risk management.

Future Outlook: The Impending Y Wave

While we anticipate a strong impulsive 'c' wave to complete the X wave correction, it's vital to maintain a broader perspective.

Post-X Wave Downtrend: After the completion of this major X wave (the flat correction), our Elliott Wave projection indicates that a major Y wave will likely run to the downside. This suggests that while there may be significant upside in the near to medium term, the overall higher-timeframe corrective structure points towards a continuation of the downtrend afterward.

Conclusion: Positioning for the 'c' Wave

Filecoin (FIL) presents an intriguing technical setup. The confluence of a trendline break, bullish divergence, and the Elliott Wave count pointing to an impulsive 'c' wave within a flat X wave suggests a potential long opportunity. Traders should carefully monitor the price action around the 'b' wave low for invalidation and plan their trades accordingly, keeping the larger corrective structure and the eventual Y wave in mind.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Elliott Wave Theory is a subjective form of technical analysis, and interpretations can vary. Cryptocurrency investments are highly speculative and carry significant risk. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

FILECOIN - A less risky bet to make $$$FILUSD shows to be a good bet for the below reasons.

a. All time low reached on 07th Apr 2025 and will support the price.

b. Started showing Higher High and Higher Low on daily charts.

c. It is still the #1 decentralised storage network.

d. A huge potential for upside movement with current marketcap of $2B when compared to $12B at all time high.

e. Organisation adoption is significant. For example - The Internet Archive, a non-profit digital library, uses Filecoin for archival data storage (1000TiB). OpenSea, an NFT marketplace, uses it for NFT storage. Shoah project Starling Labs, an academic research lab, uses it for archival data (6000TiB)

FIL 1D – Structure Retained, Momentum RebuildingFIL defends key structural zone above 2.87 (50 EMA) with a decisive reclaim of the $3 handle.

The Bull Load prints 75%, confirming momentum shift.

MACD converging, signaling potential bullish inflection.

Recent bid-side volume suggests controlled accumulation post-pullback.

Setup remains constructive while holding above 2.87.

A clean break through 3.15–3.20 opens up 3.45 and beyond.

Risk defined. Opportunity clear. Execution critical.

#FIL #CryptoTA #QuantitativeStrategy #DigitalAssets #PriceAction

FIL 1D – Holding the LinePrice holding under 50 EMA after testing downside.

MACD bearish, but histogram compression suggests exhaustion.

Bear Load 50% – pressure persists, but structure not broken.

Key zone: $2.8–$2.9. Holding = accumulation.

Watch volume. Tactical long if bulls defend.

#FIL #CryptoTA #QuantTrading #Filecoin #DePIN

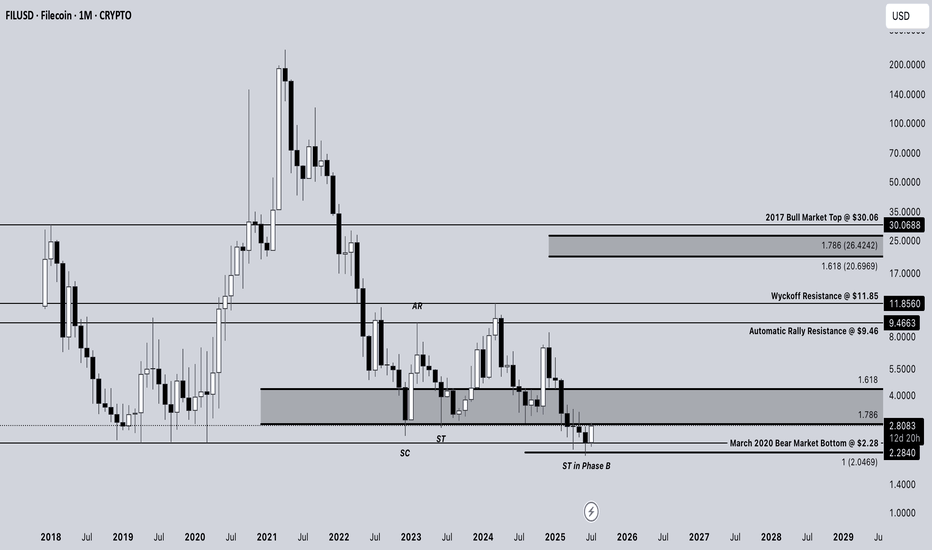

Filecoin - Still in accumulationHello everyone, as you know if you follow me, one of the coins I’ve been accumulating for years is FIL. From both a technical and fundamental analysis perspective, I believe it’s the bet with the absolute highest potential in the crypto world. Speaking of my analysis, as you can see, we’re still in an accumulation phase for about 2-3 years now, with a range between $2.3 and $7-10. In recent weeks, we’ve seen a retest of the all-time low, and right now it’s testing the lowest monthly close of the previous cycle. That said, I expect a fairly rapid rise toward $7 soon, with the possibility that it finally breaks out of the range and starts running toward the previous ATH at $230. In any case, the risk/reward is truly excellent, probably the best in the entire crypto market. Thanks to everyone for your attention, and I hope the video is helpful for your analyses.

FIL 1D – EMA Test, Compression Phase LoadingPrice tests 100 EMA from above.

Volatility compressing post-spike.

MACD still bearish, but flattening.

Volume tapering = potential reload zone.

$2.75–$2.85 = structural defense zone.

A bounce here could set up the next leg.

Let the algo do the work. Patience is positioning.