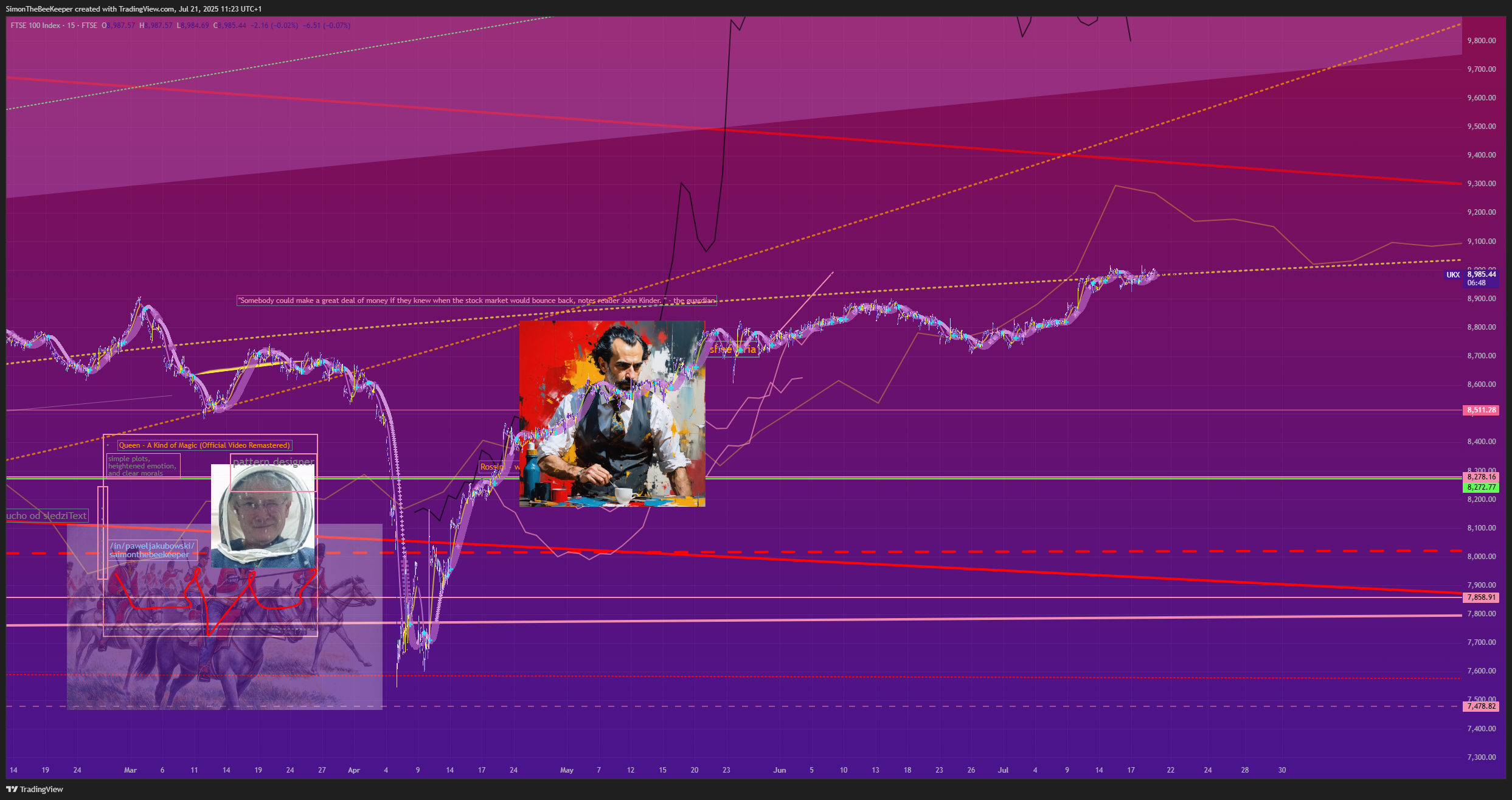

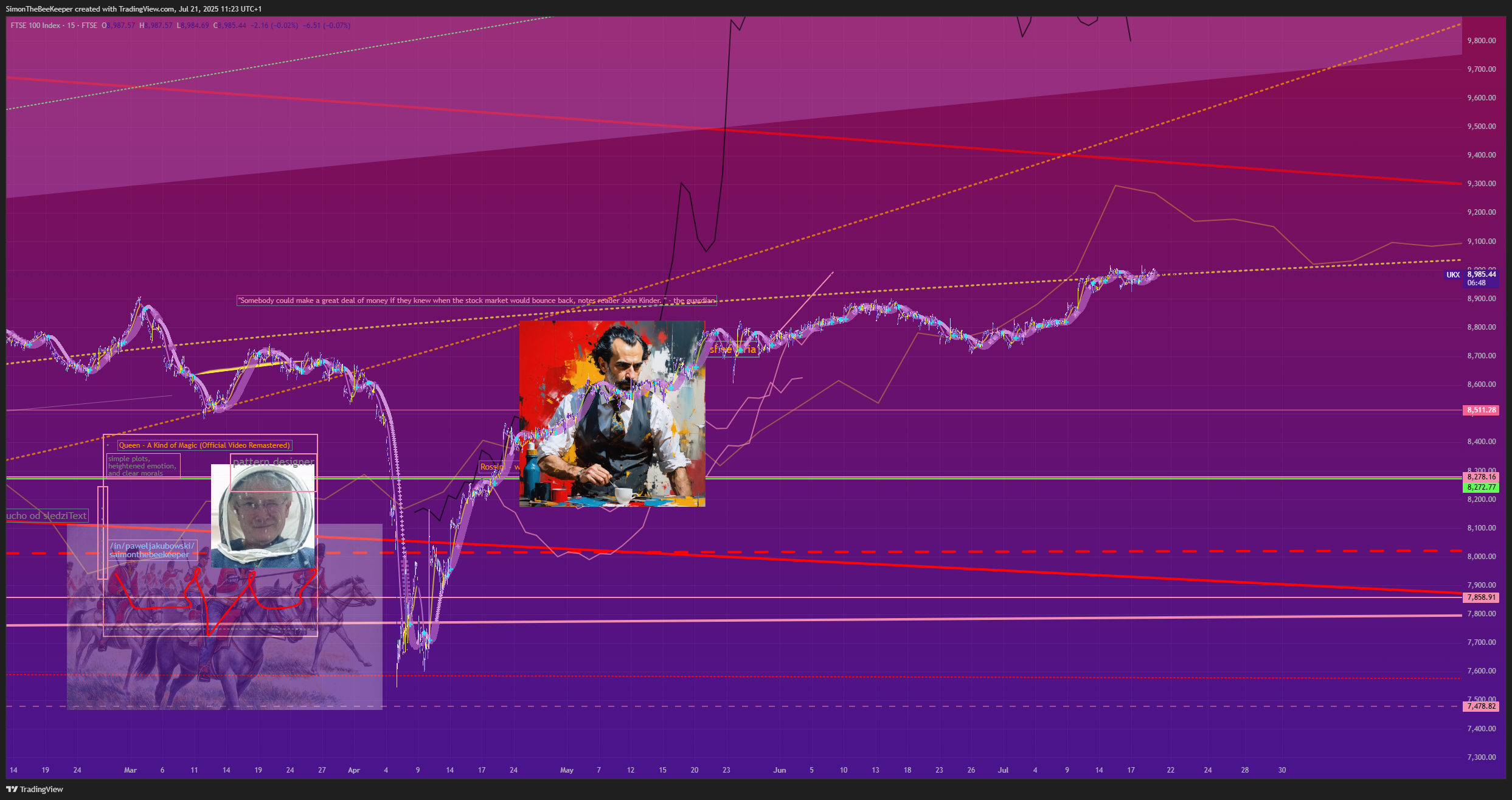

FTSE 100 Index forum

Was an easy 1:4 R this morning, as per the early smart money post, will be looking for another reload opportunity. All 3 indices  UK100GBP

UK100GBP  NAS100USD

NAS100USD  SPX500USD offered the same trade.

SPX500USD offered the same trade.

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

🌊 Flow with Intelligence, Not Noise.

⚙️ Views are Personal & Educational

🎯 Summary posts only. Full context via DM

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

🌊 Flow with Intelligence, Not Noise.

⚙️ Views are Personal & Educational

🎯 Summary posts only. Full context via DM

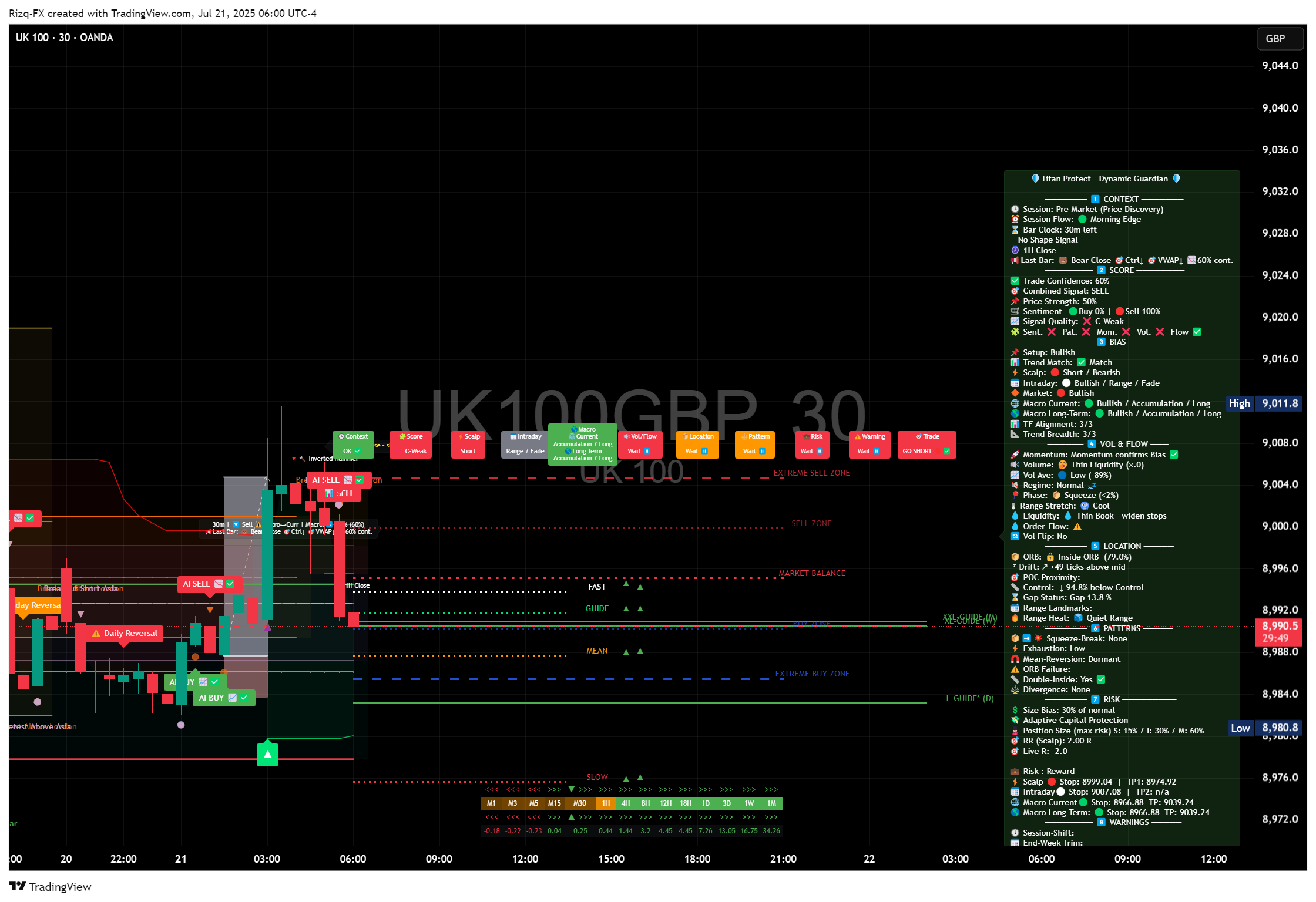

To all the Market Robbers, Smart Thieves, and Strategic Money Makers — welcome to another Thief Trading Heist Plan™.

Ready your gear and charts — the UK100 / FTSE100 index is our next vault.

🔥Heist Objective: Swipe the Bullish Loot Before the Police Trap Hits! 🔥

Based on sharp Thief-style technical and macro-fundamental analysis, the market is showing bullish exhaustion and early signs of trap reversal zones. Our goal is clear: extract max value from the bulls and escape before the heat catches on.

🚨The current price action is nearing a Red Zone — high-risk area filled with potential police traps (supply zones, resistance, and bear setups). Timing and smart entries are key.

🎯 Strategy Overview (Day/Swing Trade)

Entry Plan:

🟢 “The Vault’s Open!” – Start accumulating long positions now or set buy limits near recent 15m/30m swing lows. Layer your entries (DCA method) for better control and efficiency.

Stop Loss (SL):

🔐 SL below recent swing low on 4H timeframe (~8900.0)

Adjust based on your risk appetite, position size, and how many layered orders you've got lined up.

Target Zone (TP):

🏁 Primary Target: 9220.0

Always be ready to exit early if market signals shift. He who escapes lives to rob another day.