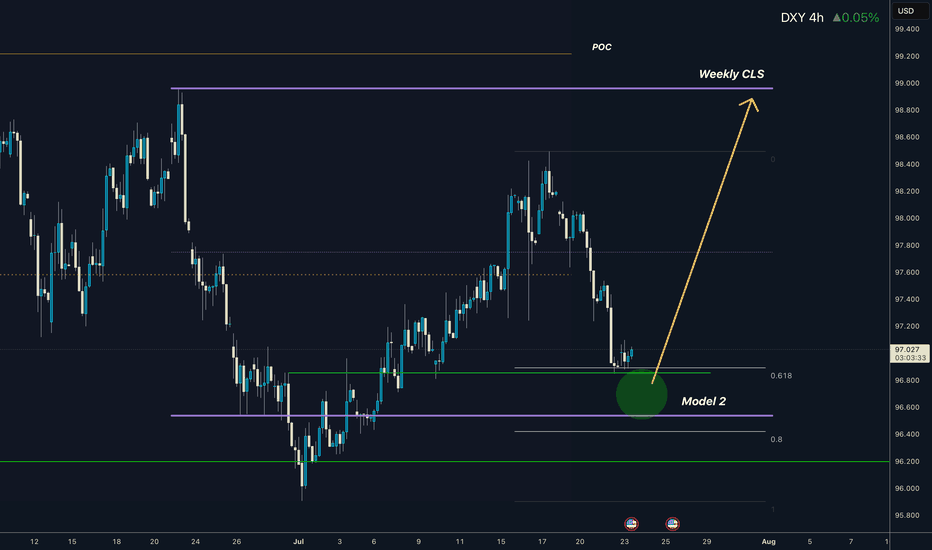

Dollar I Weekly CLS I Model 2 I Ready for pullbackYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/d

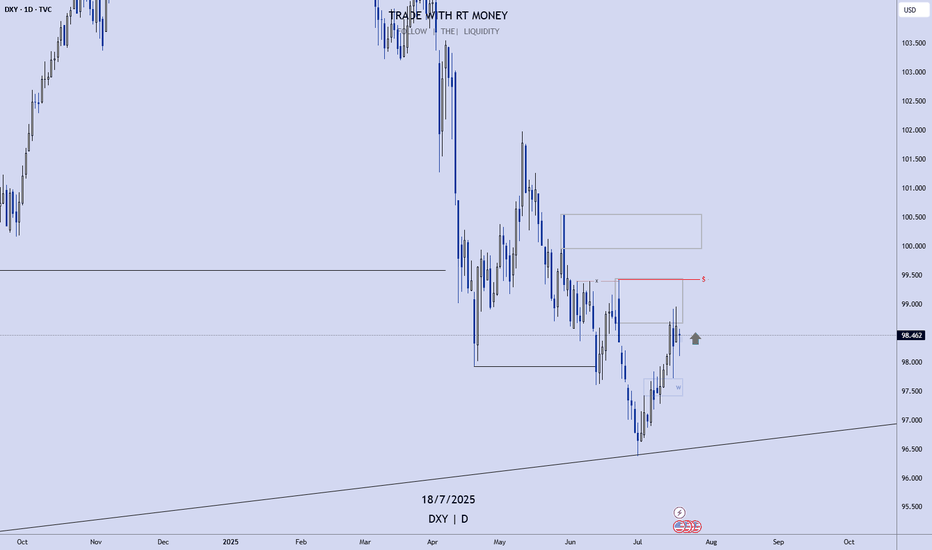

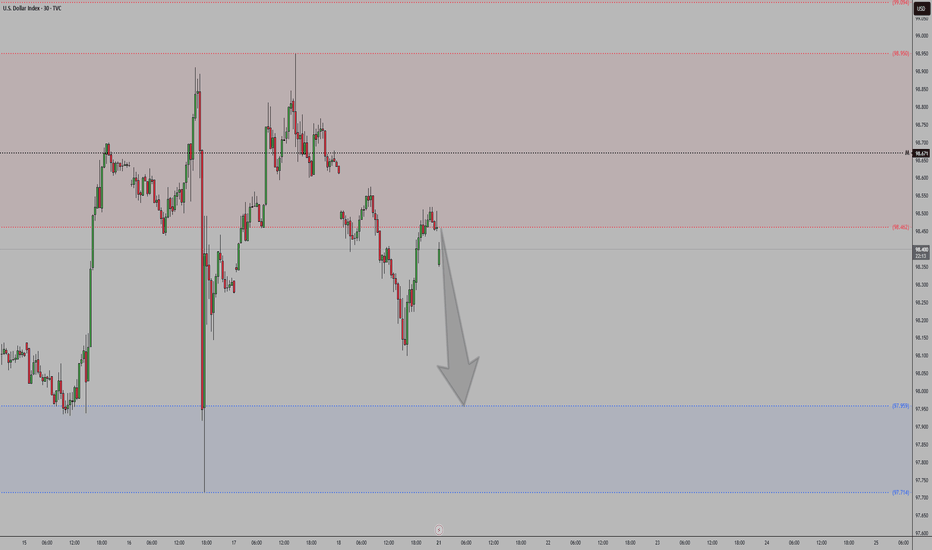

USD Is Still Bullish! Wait For Buys!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

USD

The DXY has run bullish last week, up into an area of Supply, where the momentum hesitates now. Next week may pull back a bit... before continuing higher to the buy

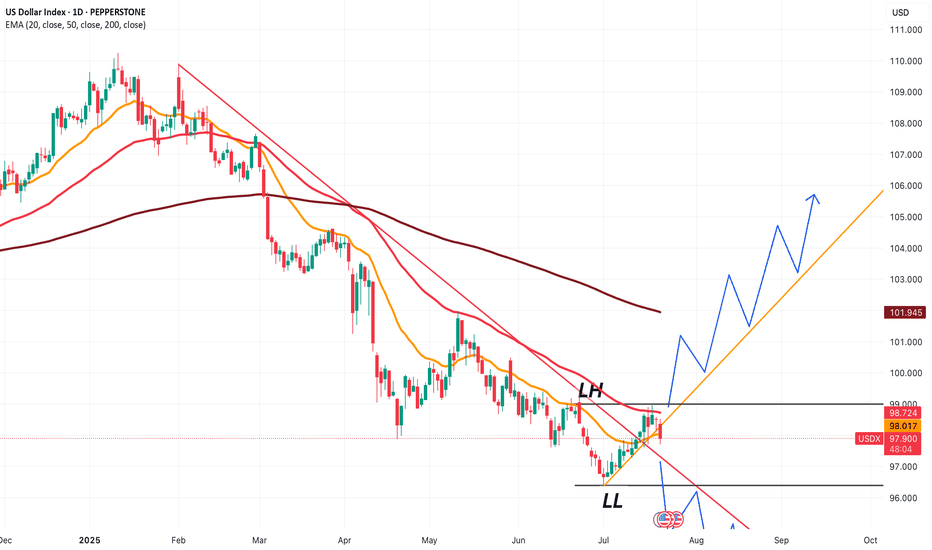

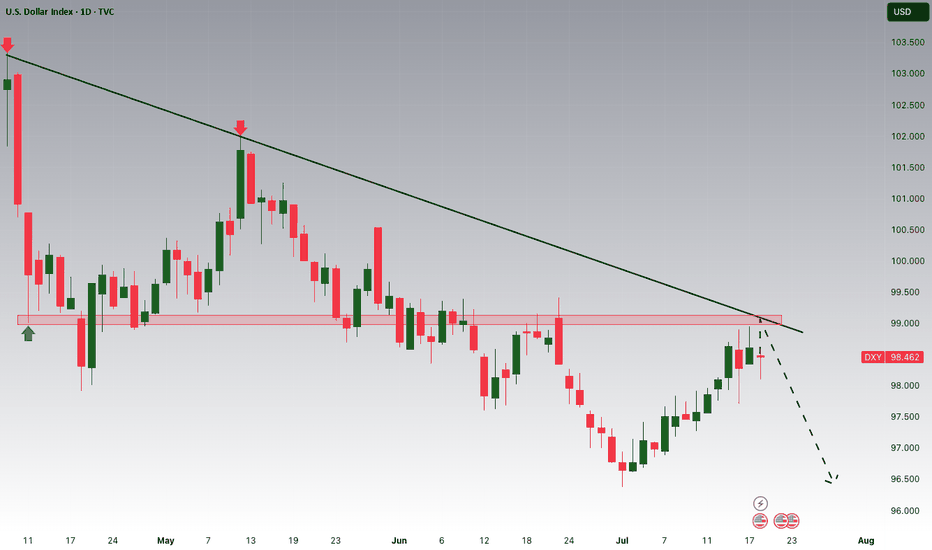

USDX at a crucial price point, which will decide trendThe next few candles for USDX price will be extremely important to understand where the dollar index is headed.

Based on that, we'll be able to choose 'which' Forex pairs we can trade, and more importantly 'how' we can trade them.

If price starts to follow the green line, and takes out 99.000, we'

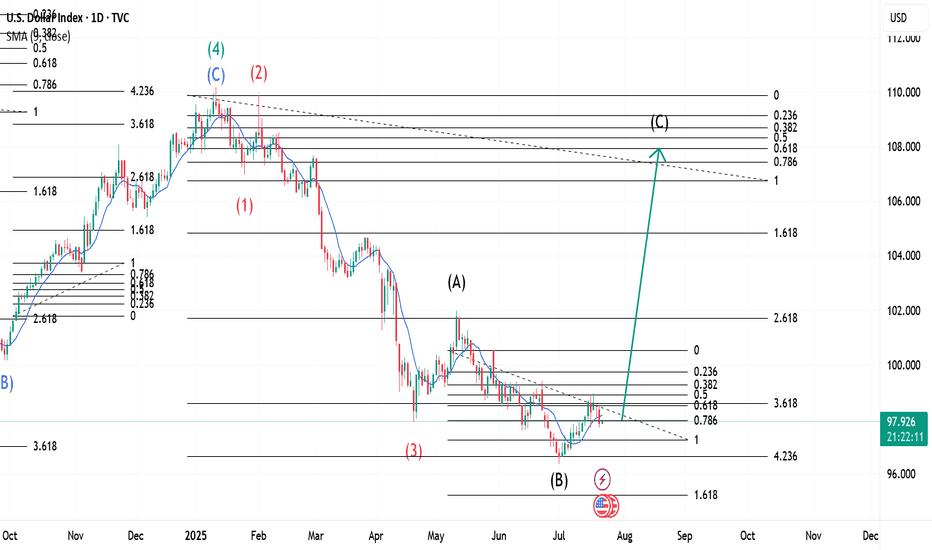

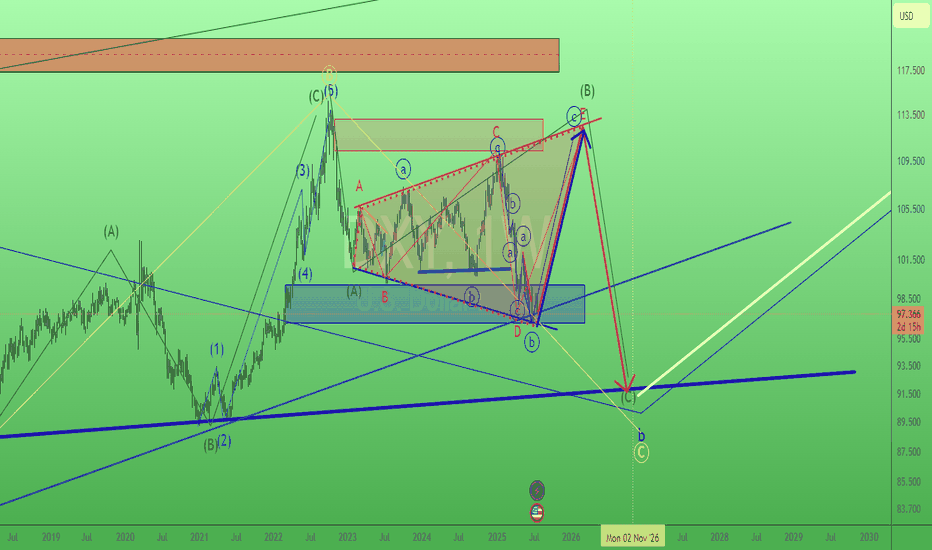

The $ Index ~ Elliott Wave Theory in real time.This is an update of a previously uploaded Dollar index Chart. Analysis remains the same and a confirmation at its current location would trigger continuation of the upward move as analysed on the first chart I had posted. Theoretically, the pullback on Monday, 21st July 2025 could be our Wave 2 wit

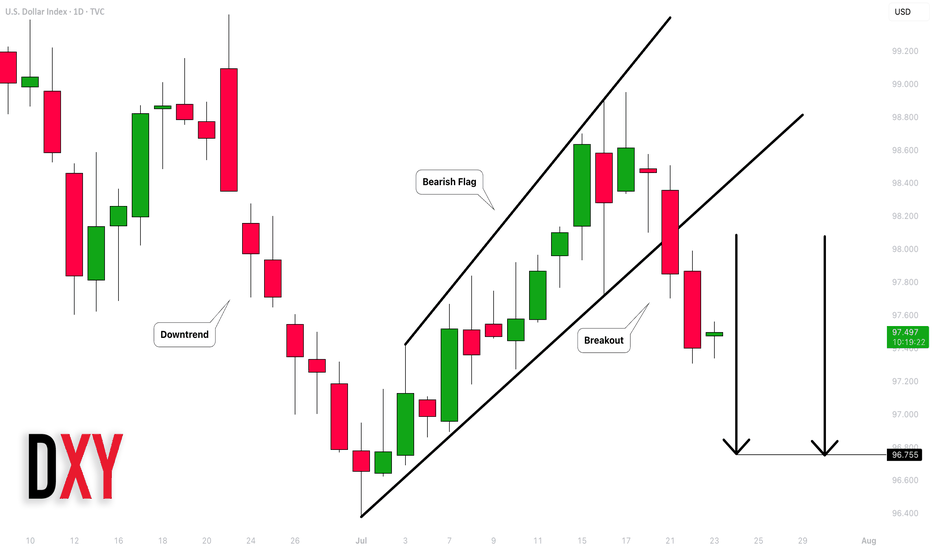

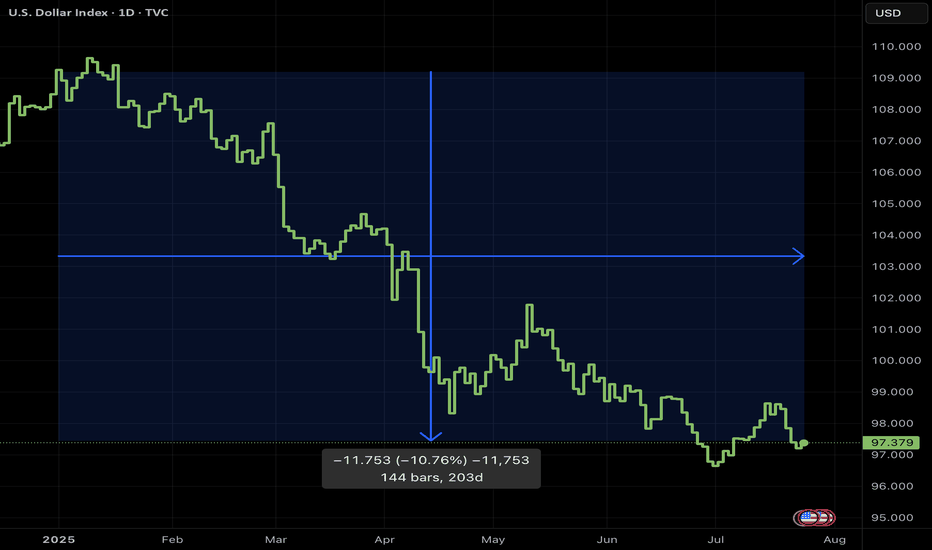

Dollar Index (DXY): Strong Bearish Price Action

Dollar Index broke and closed below a support line

of a bullish flag pattern on a daily.

Because the market is trading in a bearish trend,

this violation provides a strong bearish signal.

I expect a bearish movement to 96.75

❤️Please, support my work with like, thank you!❤️

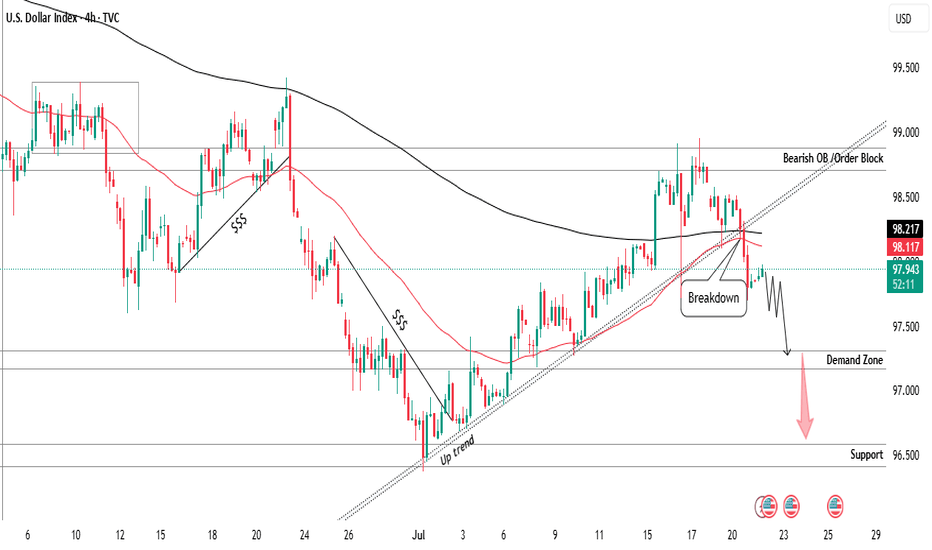

DXY Sell breakdown from bullish trend selling pressure 📊DXY – US Dollar Index Analysis – 4H Timeframe

The US Dollar Index has broken its bullish trend with a strong bearish candle, signaling a possible shift in momentum to the downside

📍 Sell Position Active:

Entry taken at 98.000 following the trendline break and bearish confirmation candle

🎯 Tech

Why a USD Bounce Could Trigger a Stock PullbackThe US Dollar has faced brutal selling during the first half of 2025. Some are even questioning whether the Dollar’s global hegemony is at risk. Early in the year the US stock market AMEX:SPY sold off aggressively, falling 19% from mid‑March to early April. Since then stocks have more than regaine

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

USDX Dollar Basket Index DXU5 Exp 03/09/2025 23:59 reached its highest quote on Jan 13, 2025 — 109.991 USD. See more data on the USDX Dollar Basket Index DXU5 Exp 03/09/2025 23:59 chart.

The lowest ever quote of USDX Dollar Basket Index DXU5 Exp 03/09/2025 23:59 is 95.974 USD. It was reached on Jul 1, 2025. See more data on the USDX Dollar Basket Index DXU5 Exp 03/09/2025 23:59 chart.

USDX Dollar Basket Index DXU5 Exp 03/09/2025 23:59 is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy USDX Dollar Basket Index DXU5 Exp 03/09/2025 23:59 futures or funds or invest in its components.